Market Overview:

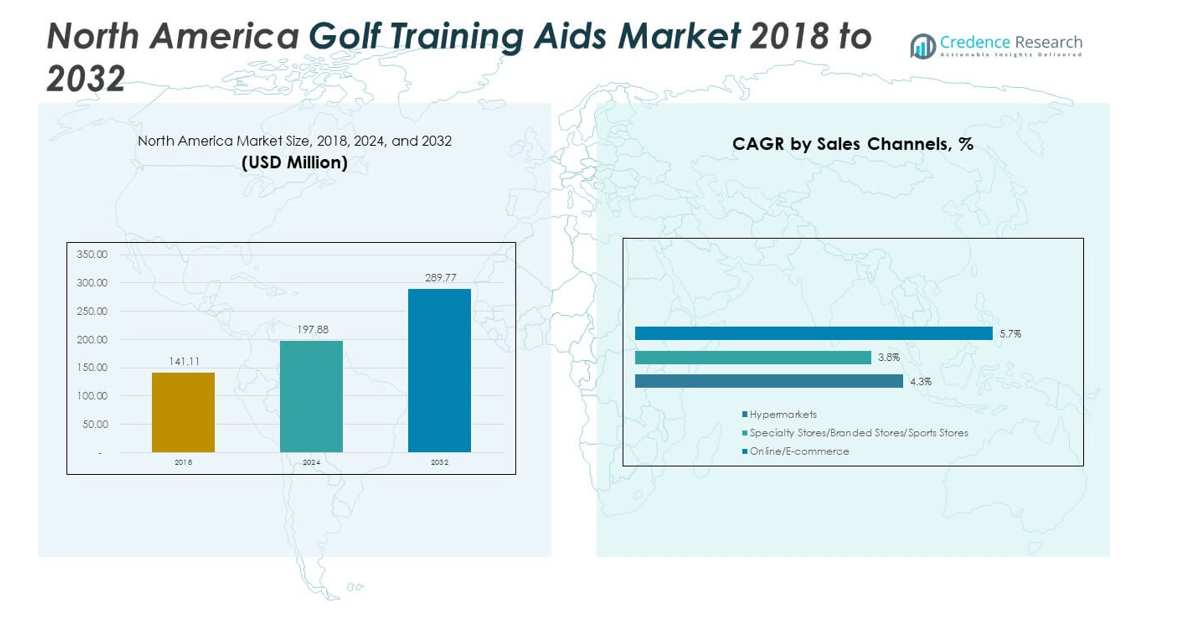

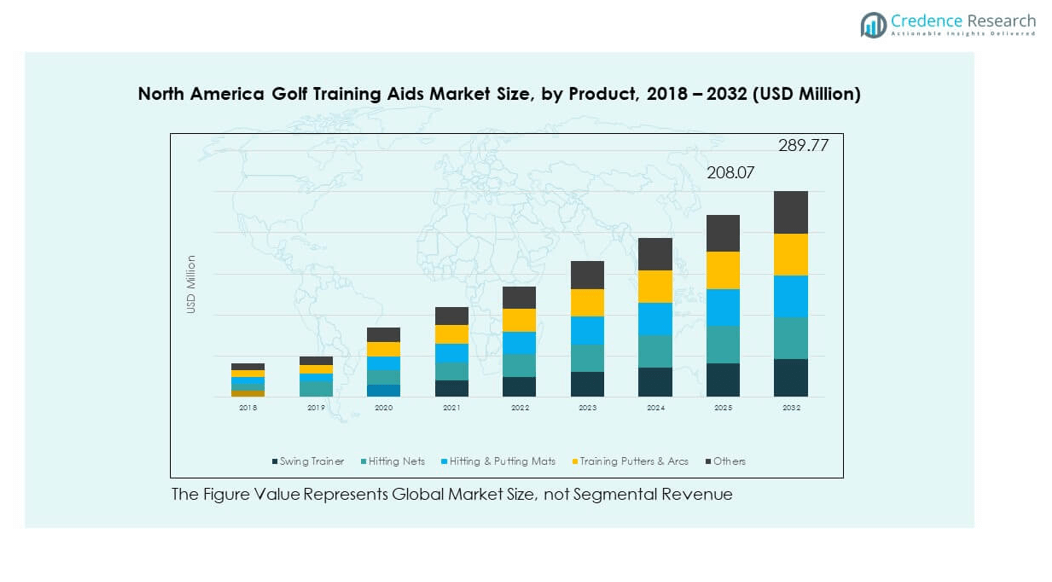

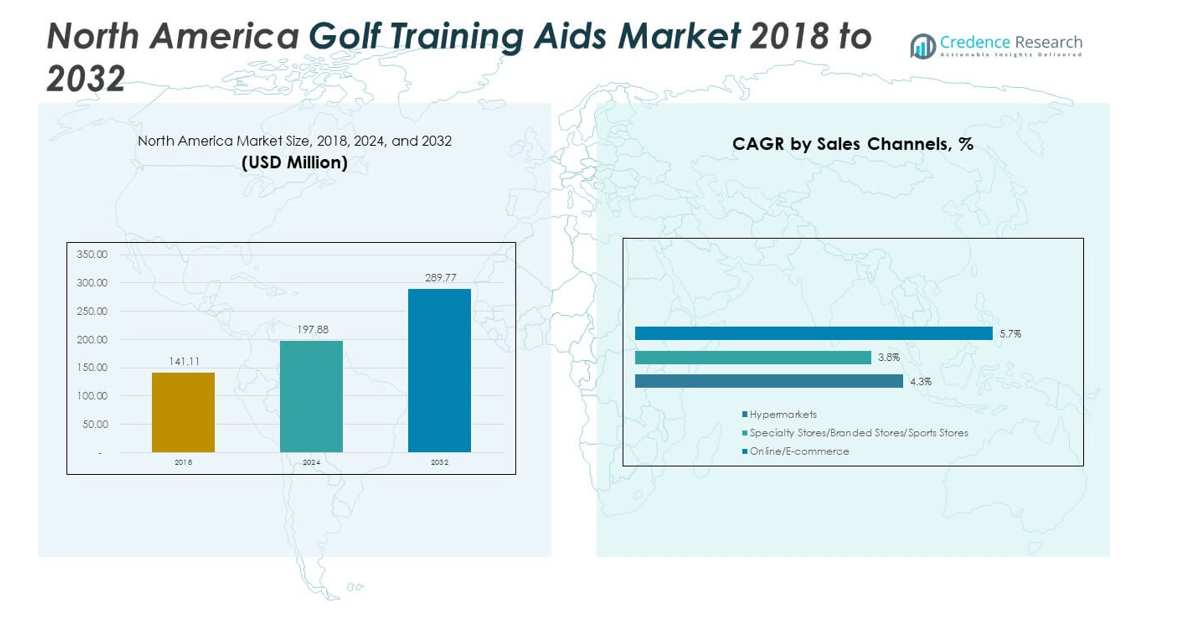

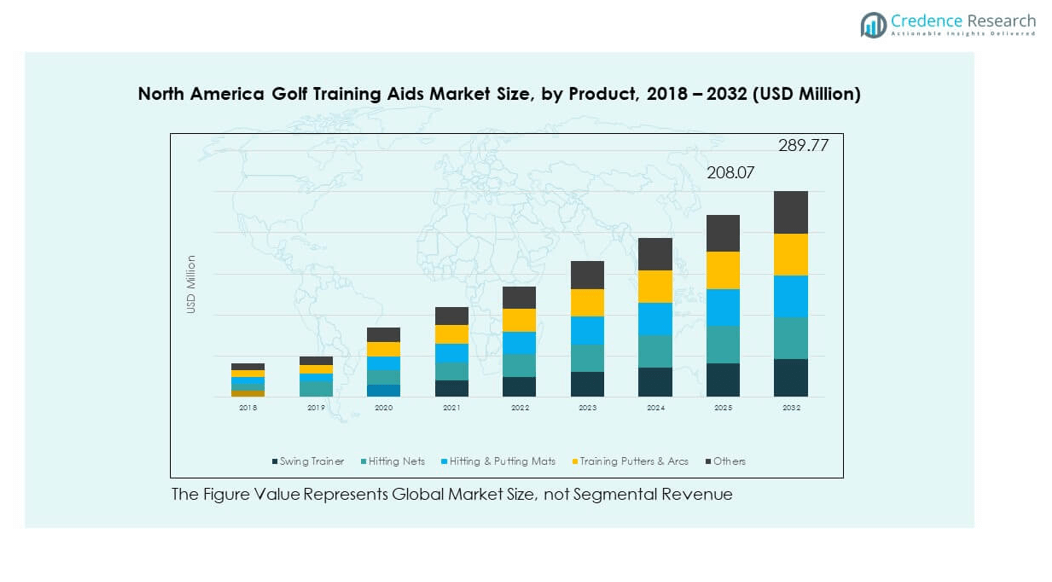

The North America Golf Training Aids Market size was valued at USD 141.11 million in 2018 to USD 197.88 million in 2024 and is anticipated to reach USD 289.77 million by 2032, at a CAGR of 4.80% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| North America Golf Training Aids Market Size 2024 |

USD 197.88 million |

| North America Golf Training Aids Market, CAGR |

4.80% |

| North America Golf Training Aids Market Size 2032 |

USD 289.77 million |

The market is witnessing steady growth driven by rising interest in golf among both professional and recreational players, supported by the expansion of golf courses and training facilities. Technological advancements in training aids, such as smart sensors, swing analyzers, and virtual simulation tools, are enhancing training efficiency and user experience. Increasing awareness of fitness and sports performance optimization, coupled with promotional initiatives by golf associations, is further fueling demand. Additionally, the growing popularity of indoor golf centers is expanding the market beyond traditional outdoor courses.

Regionally, the market benefits from a strong presence in countries such as the United States and Canada, which are home to a significant number of golf courses and active player communities. The United States leads the market due to its large golfing population, advanced sports infrastructure, and adoption of innovative training technologies. Canada is emerging as a growth market, driven by rising youth participation and seasonal indoor training demand. Growth opportunities are also expanding in urban regions, where compact training facilities are attracting new players seeking convenient access to golf practice.

Market Insights:

- The North America Golf Training Aids Market was valued at USD 197.88 million in 2024 and is projected to reach USD 289.77 million by 2032, at a CAGR of 4.80%.

- Rising participation in golf across age groups and skill levels is driving consistent demand for advanced training aids.

- Technological innovations, including AI-enabled swing analyzers and VR simulators, are enhancing product appeal.

- High costs of premium training devices are limiting adoption among casual and entry-level players.

- The United States dominates with 78% market share, supported by a large golfing population and advanced retail infrastructure.

- Canada shows steady growth driven by indoor golf facility expansion and youth engagement initiatives.

- Mexico presents emerging opportunities due to rising golf tourism and growing urban interest in the sport.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers:

Increasing Participation in Golf Across All Demographics

The North America Golf Training Aids Market benefits from a steady rise in participation across diverse age groups and skill levels. Golf organizations and academies promote the sport through community programs, junior camps, and beginner-friendly initiatives, creating a larger base of potential customers for training aids. The inclusion of golf in schools and collegiate sports is supporting early skill development. Corporate sponsorships and charity tournaments help sustain public interest in the sport. A growing middle-class population in urban and suburban areas is investing in recreational activities such as golf. Players seek tools that refine swing mechanics and improve overall game performance. Fitness-conscious consumers view golf as a low-impact sport that offers long-term engagement. The market gains further traction from endorsements by professional golfers who highlight training aids in skill improvement journeys.

- For instance, the First Tee program in the United States has involved over 10.5million young people ages 5-18 since its inception, offering in-school and after-school access to golf training aids and skill-building opportunities.

Technological Advancements in Golf Training Equipment

Rapid technological innovation is transforming the design and effectiveness of training aids in the North America Golf Training Aids Market. Smart devices integrated with AI, motion sensors, and real-time analytics offer personalized feedback to players. Virtual reality simulators replicate real course conditions, enabling users to practice year-round regardless of weather. Wearable performance trackers provide accurate data on swing speed, angle, and impact consistency. Training mats and putting systems feature enhanced durability and precision to meet professional standards. Manufacturers invest in R&D to align products with evolving golfer preferences. It helps attract both high-performance athletes and casual players seeking measurable improvement. Distribution through e-commerce platforms ensures accessibility to innovative products across the region.

- For instance, companies like HackMotion introduced wrist sensor devices that provide immediate, accurate swing feedback utilizing advanced motion sensor technology, capturing precise wrist angles and clubface control metrics for each swing.

Expansion of Indoor Golf Facilities and Year-Round Practice Options

Urban areas with limited outdoor golf course space are witnessing a rise in indoor training facilities, creating demand in the North America Golf Training Aids Market. These centers provide climate-controlled environments for year-round play and practice. Indoor simulators and swing analysis stations encourage more frequent usage of training aids. Businesses and residential complexes integrate golf practice zones, catering to both enthusiasts and beginners. The availability of portable and compact training devices allows individuals to practice in limited spaces. Rising interest in golf entertainment venues boosts market exposure. Corporate wellness programs incorporate golf as a recreational activity, increasing adoption of training aids. Seasonal variations in climate do not hinder participation, ensuring consistent revenue streams for suppliers.

Influence of Golf Tourism and Professional Tournaments

Golf tourism drives significant demand for training aids, with enthusiasts preparing for destination golf experiences in the North America Golf Training Aids Market. Professional tournaments, including PGA events, inspire amateur players to invest in improving their skills. Resorts and golf clubs enhance guest offerings by providing training sessions equipped with advanced aids. Seasonal golf packages often include access to specialized coaching tools. The sport’s visibility through televised events increases product awareness and aspiration. Retailers leverage these opportunities to launch promotional campaigns. Cross-collaboration between equipment manufacturers and golf academies strengthens consumer engagement. It reinforces the market’s growth potential by connecting aspirational value with tangible skill improvement tools.

Market Trends:

Rising Popularity of Custom-Fitted and Personalized Training Aids

Customization is emerging as a strong trend in the North America Golf Training Aids Market. Golfers increasingly seek products tailored to their swing style, grip size, and physical attributes. Manufacturers offer adjustable devices that can be fine-tuned to meet specific skill improvement goals. 3D scanning and biomechanical assessments allow for precise fitting of training tools. Consumers perceive custom-fitted aids as a way to maximize performance and reduce injury risk. Premium brands target this segment with higher-value, specialized products. Retailers incorporate personalized fitting sessions into sales strategies to enhance customer loyalty. The growing interest in precision-based training tools supports the shift toward bespoke solutions.

- For instance, Sittler Golf has custom-fitted over 25,000 golfers since 1993, leveraging PGA-certified club fitters and advanced launch monitors to optimize clubs for each player’s unique swing dynamics.

Growth of Subscription-Based and On-Demand Training Services

Subscription models are reshaping product access in the North America Golf Training Aids Market. Users can rent or lease high-end training devices for short-term use, reducing upfront investment costs. Digital platforms offer monthly access to virtual coaching, paired with hardware deliveries. Manufacturers partner with instructors to provide structured training programs that include equipment use. This model appeals to beginners who prefer trial periods before committing to purchases. On-demand rental services increase accessibility for seasonal players. It supports recurring revenue streams for businesses while keeping customers engaged. Flexible access models help bridge the gap between affordability and quality.

- For example, the PGA TOUR Golf Academy’s Complete Remote Coaching Program offers two coached video analyses per month, a monthly development call, a personalized training plan, and access to a digital locker, all designed to provide dedicated instructor feedback and ongoing improvement through its interactive platform.

Integration of Eco-Friendly Materials in Product Development

Sustainability is influencing product design in the North America Golf Training Aids Market. Brands adopt recycled plastics, biodegradable packaging, and low-carbon manufacturing processes. Eco-conscious consumers prefer training aids with minimal environmental impact. Suppliers highlight green credentials to strengthen brand appeal. Golf clubs and academies support this shift by aligning procurement policies with sustainability goals. The adoption of durable, long-lasting materials also reduces product waste. Industry events showcase innovations in eco-friendly golf accessories, further driving awareness. It positions sustainable training aids as a competitive differentiator in the premium market segment.

Increasing Cross-Industry Collaborations to Enhance Training Experience

Collaboration between sports technology companies and golf equipment manufacturers is expanding the feature set of training aids in the North America Golf Training Aids Market. Tech firms provide advanced analytics software, while golf brands supply specialized hardware. Partnerships with fitness companies integrate golf training with overall athletic performance improvement. Media platforms collaborate to create content that promotes new training technologies. Retailers and event organizers co-host interactive demonstrations to engage potential buyers. Cross-promotions between golf apparel brands and training aid producers attract style-conscious players. It enhances brand visibility while expanding market reach through multiple consumer touchpoints.

Market Challenges Analysis:

High Product Costs Limiting Adoption Among Casual Players

The North America Golf Training Aids Market faces challenges in attracting casual players due to the high costs of advanced devices. Premium products featuring smart sensors, AI integration, and virtual simulation carry significant price tags. Budget-conscious consumers often opt for basic, low-cost alternatives, reducing revenue potential for high-end manufacturers. Rental models address this issue partially but do not fully bridge the affordability gap. Economic fluctuations influence consumer spending on leisure goods, making demand unpredictable. Retailers must balance offering premium features while keeping pricing accessible. Intense competition from alternative recreational activities also impacts sales. It requires continuous innovation in cost-effective product design without compromising performance quality.

Limited Awareness and Training Accessibility in Emerging Areas

Despite strong market presence in major cities, the North America Golf Training Aids Market struggles with limited awareness in less urbanized areas. Many potential customers lack access to professional golf coaching or modern training facilities. Without direct exposure, consumers may not perceive the value of investing in training aids. Marketing campaigns often focus on established golfing hubs, leaving smaller communities untapped. Distribution channels face logistical challenges in reaching remote regions. This restricts the spread of innovative training solutions. Manufacturers must address these gaps through targeted awareness drives and partnerships with regional sports organizations. It will help unlock potential demand in underrepresented markets.

Market Opportunities:

Expansion of Digital and Hybrid Training Platforms

The North America Golf Training Aids Market has strong potential in the integration of digital and hybrid training platforms. Combining physical devices with mobile applications enhances accessibility and engagement. Players can track progress remotely and receive instant feedback through AI-enabled tools. Hybrid models support both in-person and online coaching, appealing to busy consumers. Gamified training content increases user retention rates. The shift toward blended learning environments creates scope for subscription-based revenue streams. It enables brands to reach new audiences beyond traditional retail channels.

Penetration into Youth and Amateur Segments

Growing interest in golf among youth and amateur players presents a major growth avenue for the North America Golf Training Aids Market. Schools, universities, and youth sports programs are incorporating golf into extracurricular activities. Affordable, easy-to-use training aids can attract this demographic. Partnerships with junior golf academies help strengthen brand presence early in a player’s journey. Social media engagement with younger audiences creates awareness and aspirational appeal. It opens pathways for long-term customer loyalty. Expanding into these segments supports both short-term sales and sustained market growth.

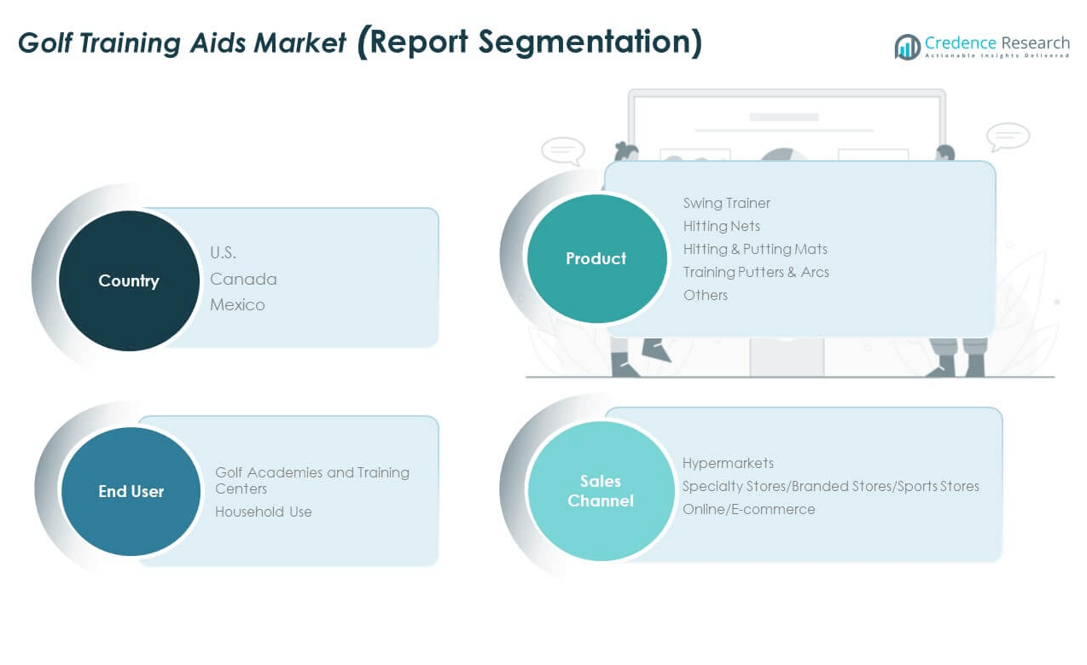

Market Segmentation Analysis:

By product, the North America Golf Training Aids Market features Swing Trainers as a dominant segment, driven by their role in improving swing mechanics for players at all levels. Hitting Nets hold strong demand among consumers seeking convenient at-home practice solutions. Hitting & Putting Mats continue to gain popularity for enabling controlled indoor and outdoor practice. Training Putters & Arcs attract players focused on precision putting techniques, while the Others category, including alignment tools and grip trainers, addresses specialized skill refinement needs.

- For example, Kavooa Pro swing training aid, developed by collegiate golfer Dylan Horowitz. Kavooa Pro utilizes a tripod-based adjustable rod system for real-time feedback, helping steady a player’s head and hips through each swing.

By end user, Golf Academies and Training Centers represent the leading segment, supported by structured coaching programs and advanced training setups. Household Use is expanding, propelled by growing interest in recreational practice and the availability of compact, portable aids for home environments.

- The International Junior Golf Academy (IJGA) in Orlando, FL, offers world-class facilities equipped with advanced golf training technology, including TrackMan Doppler radar, K-Vest 3D motion capture, and Swing Catalyst performance studios, providing detailed performance analysis and real-time feedback to enhance player development.

By sales channel, Specialty Stores / Branded Stores / Sports Stores maintain a significant share, offering expert guidance and product trials. Hypermarkets contribute through broad product visibility in high-traffic retail spaces. Online / E-commerce is experiencing rapid growth due to convenience, wider product ranges, and the appeal of direct-to-consumer sales models. It benefits from digital marketing strategies and integration with virtual coaching platforms, enabling stronger consumer engagement and repeat purchases.

Segmentation:

By Product

- Swing Trainer

- Hitting Nets

- Hitting & Putting Mats

- Training Putters & Arcs

- Others

By End User

- Golf Academies and Training Centers

- Household Use

By Sales Channel

- Hypermarkets

- Specialty Stores / Branded Stores / Sports Stores

- Online / E-commerce

Regional Analysis:

The United States holds the largest share of the North America Golf Training Aids Market, accounting for 78% of the regional revenue. Its dominance is driven by a mature golfing culture, a large number of courses, and high participation rates across both amateur and professional segments. The country hosts multiple PGA Tour events, creating aspirational demand for training equipment. Strong retail infrastructure, coupled with extensive e-commerce penetration, ensures wide product availability. It benefits from advanced sports technology adoption, with training aids incorporating sensors, data analytics, and virtual reality. The presence of leading manufacturers and golf academies further strengthens market leadership.

Canada represents 15% of the regional market share, with steady growth supported by increasing participation in recreational golf and the development of indoor training facilities. Seasonal climate variations encourage demand for simulators, putting mats, and portable training tools that support year-round practice. Canadian golf associations and youth development programs are boosting engagement among younger demographics. Specialty sports stores and online platforms play a key role in expanding product reach. It also benefits from cross-border trade with the United States, facilitating access to advanced training technologies. The country’s focus on grassroots golf initiatives supports long-term growth in training aid adoption.

Mexico accounts for 7% of the regional share, with emerging opportunities driven by expanding golf tourism and rising interest among urban consumers. The country’s coastal resort areas host premium golf courses that attract international players, stimulating demand for training aids among both locals and visitors. Investment in golf academies and sports facilities is improving accessibility to professional training resources. Specialty retail outlets in metropolitan areas are introducing global golf brands to a wider audience. It is also seeing growth in e-commerce sales, especially for compact and affordable training devices. Partnerships between resorts and equipment suppliers are helping position Mexico as a growing market for golf training products.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

Competitive Analysis:

The North America Golf Training Aids Market features a mix of established global brands and specialized niche players competing on product innovation, quality, and distribution reach. Leading companies such as Acushnet Holdings Corp., Skytrak, EyeLine Golf, and Optishot Golf focus on integrating advanced technologies like swing analytics, virtual simulation, and portable design. Emerging brands emphasize affordability and compact formats to capture household and beginner segments. Strategic partnerships with golf academies and professional players strengthen brand credibility. It benefits from a strong retail and e-commerce ecosystem, enabling wide market access. Product differentiation through customization, sustainability features, and multi-skill training capability remains a key competitive lever.

Recent Developments:

- In April 2025, GolfNow onboarded over 320 new golf properties across North America including traditional golf courses and off-course fitting, training, and entertainment venues—and integrated its technology and services into their daily operations. It reflects growing demand for golf training facilities and underscores how the North America Golf Training Aids Market connects with expanding infrastructure

- In May 2025, EyeLine Golf launched the Speed Trap 2.0, a new and highly versatile training aid designed to improve swing path and ball striking in golfers of all skill levels. This innovative product quickly became popular in North America for delivering immediate feedback, helping users correct slices and hooks while enhancing overall swing trajectory.

Market Concentration & Characteristics:

The North America Golf Training Aids Market displays moderate concentration, with a few major players holding significant market share while smaller brands compete in niche categories. It is characterized by continuous innovation, seasonal demand patterns, and a strong link to golf tourism and professional tournaments. The market rewards product quality, ease of use, and measurable performance improvement. Competitive advantage depends on technology integration, brand partnerships, and effective distribution networks across specialty retail, hypermarkets, and online channels. Consumer loyalty often aligns with brands that offer consistent product upgrades and reliable after-sales support. Companies that balance premium performance with accessible pricing are well-positioned to expand their market presence.

Report Coverage:

The research report offers an in-depth analysis based on Product, End User and Sales Channel. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Advancements in smart training aids with AI-driven analytics will enhance personalized skill improvement.

- Increased integration of virtual reality and augmented reality tools will offer immersive practice experiences.

- Expansion of indoor golf facilities will sustain year-round demand across varied climate regions.

- Rising participation among younger demographics will boost adoption of beginner-friendly training solutions.

- Growth in e-commerce will drive accessibility, supported by targeted digital marketing campaigns.

- Collaboration between professional golfers and brands will strengthen product credibility and consumer trust.

- Sustainability-focused product development will attract environmentally conscious players.

- Technological convergence with fitness tracking devices will broaden product utility beyond golf practice.

- Emerging interest from corporate wellness programs will open new distribution opportunities.

- Cross-border trade and brand partnerships within North America will expand market penetration and product diversity.