Market Overview:

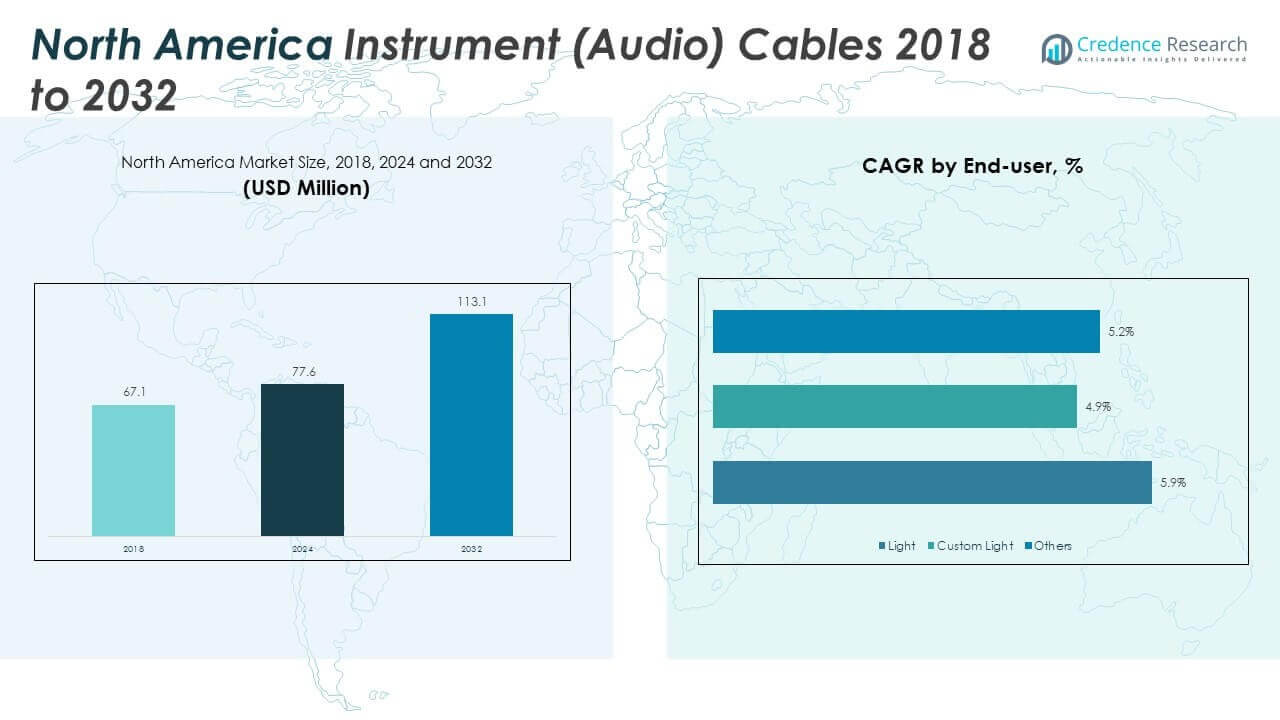

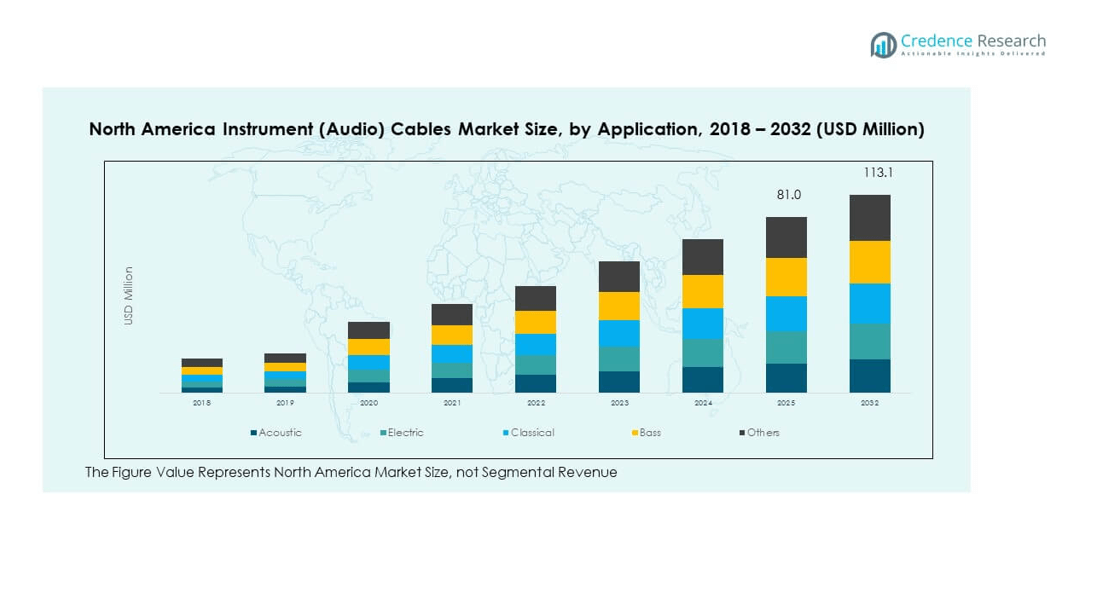

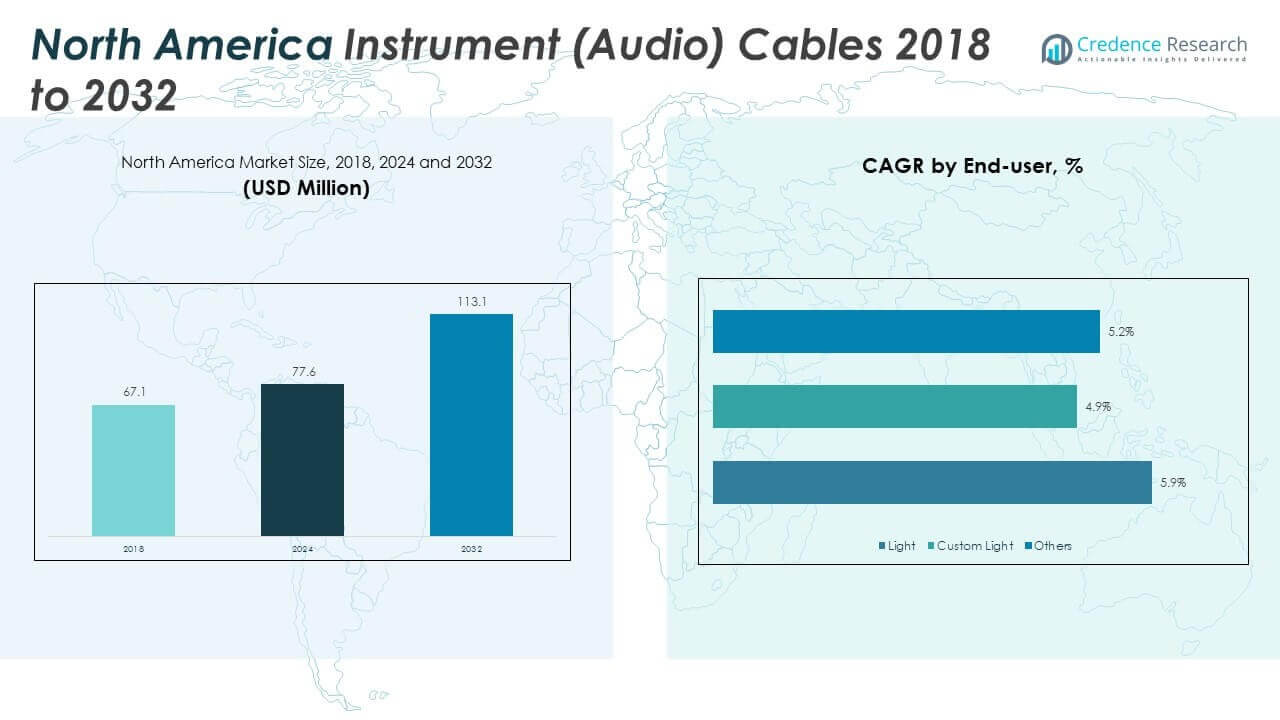

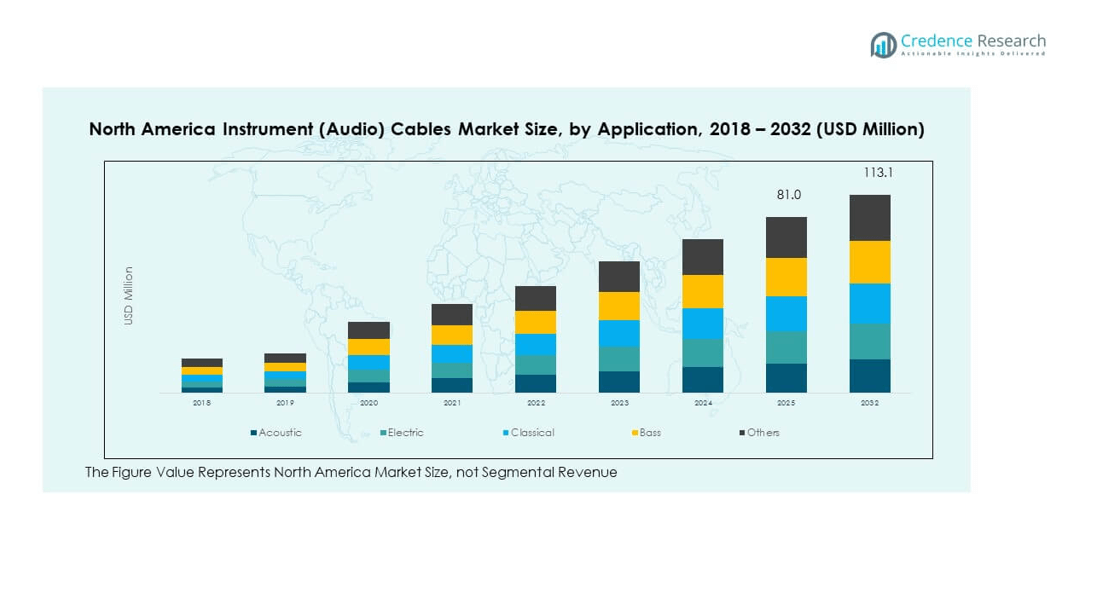

The North America Instrument (Audio) Cables Market size was valued at USD 67.1 million in 2018 to USD 77.6 million in 2024 and is anticipated to reach USD 113.1 million by 2032, at a CAGR of 4.90% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| North America Instrument (Audio) Cables Market Size 2024 |

USD 77.6 million |

| North America Instrument (Audio) Cables Market, CAGR |

4.90% |

| North America Instrument (Audio) Cables Market Size 2032 |

USD 113.1 million |

The market growth is driven by rising demand for high-quality audio transmission solutions across live performances, recording studios, and broadcasting applications. Increasing consumer preference for durable and interference-free instrument cables has further strengthened market adoption. Expanding investments in advanced audio technologies and the integration of oxygen-free copper conductors, braided shielding, and enhanced connectors are improving signal quality, thereby boosting demand. Moreover, the growing popularity of home studios and digital music production platforms continues to accelerate consumption in both professional and semi-professional segments.

Regionally, the United States dominates the market, supported by a well-established music industry, high adoption of advanced recording technologies, and significant presence of leading manufacturers. Canada is emerging as a growth market due to its expanding live entertainment sector and increasing independent music production. Meanwhile, Mexico shows promising opportunities, driven by rising investments in cultural events and growing demand for cost-effective audio equipment. Collectively, these dynamics position North America as a leading hub for instrument cable innovation and adoption.

Market Insights:

- The North America Instrument (Audio) Cables Market was valued at USD 77.6 million in 2024 and is projected to reach USD 113.1 million by 2032, growing at a CAGR of 4.90%.

- The Global Instrument (Audio) Cables Market size was valued at USD 179.3 million in 2018 to USD 210.0 million in 2024 and is anticipated to reach USD 306.5 million by 2032, at a CAGR of 4.9% during the forecast period.

- Strong demand for high-quality and interference-free audio transmission supports steady growth across live performances, studios, and digital production setups.

- Rising preference for durable cables with advanced shielding and premium connectors drives adoption among professionals and semi-professionals.

- Price competition and the presence of low-cost alternatives restrain revenue potential for premium brands in the regional market.

- The United States dominates the market with nearly 65% share, supported by a mature entertainment ecosystem and strong manufacturer presence.

- Canada is emerging as a key growth hub, backed by rising music festivals, cultural events, and investments in studio infrastructure.

- Mexico shows steady potential through expanding live events and rising adoption of cost-effective audio solutions in urban centers.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers:

Rising demand for reliable sound performance and high-quality transmission solutions

The North America Instrument (Audio) Cables Market is witnessing strong demand from live concerts, music festivals, and studio recordings that require dependable connectivity. Artists, sound engineers, and producers seek cables that guarantee consistent tonal clarity without interference or distortion. The market is supported by the rising interest in professional-grade equipment among hobbyists and semi-professional musicians. It is driven by the shift toward oxygen-free copper conductors and improved shielding, which improve signal stability. Expanding adoption of digital audio workstations and home studios has created a steady requirement for cables with high reliability. Increasing brand preference for tested and durable products reinforces market growth. It strengthens the demand for cables that offer longevity and uninterrupted performance.

- For example, Mogami Cable’s Gold Series instrument cable (model W2524) offers a capacitance of approximately 39.7 pF/ft (130 pF/m), which helps preserve signal clarity over longer runs.

Expanding entertainment sector and higher investments in advanced audio equipment

The growth of the entertainment sector in North America supports strong demand for professional instrument cables in broadcasting, film, and live sound applications. Venues invest in high-end audio systems to maintain quality standards, creating opportunities for manufacturers. The North America Instrument (Audio) Cables Market benefits from continuous innovations that meet rigorous performance needs of recording studios. It is also strengthened by replacement demand, as institutions seek to upgrade older systems with new cables offering better durability. Rising investments by rental houses and production companies drive frequent purchases. Growing acceptance of premium cables in consumer-level setups also adds to the market potential. This factor creates a bridge between professional and consumer demand. It ensures steady momentum across multiple end-use segments.

- For example, Planet Waves’ American Stage instrument cables feature D’Addario’s patented Geo-Tip plugs, designed to accommodate varying jack tolerances and provide secure, reliable connections widely appreciated in live performance settings.

Strong consumer preference for durable products with technological enhancements

Consumer behavior highlights a preference for cables that combine durability with advanced features such as braided shielding and gold-plated connectors. The North America Instrument (Audio) Cables Market benefits from heightened awareness regarding the role of cables in overall sound quality. It creates a push for premium options that ensure signal purity under intensive use. Rising adoption of noise-cancellation and low-capacitance technologies boosts the perception of quality among end users. Growing numbers of independent musicians invest in higher-grade products to support career development. Studio owners favor cables that minimize downtime and reduce the need for frequent replacements. This consumer trend secures long-term growth and keeps the market competitive. It positions durable designs at the core of product development strategies.

Expanding independent music ecosystem and rise of digital content creation platforms

The flourishing ecosystem of independent musicians and content creators accelerates cable demand across North America. The North America Instrument (Audio) Cables Market benefits from rising YouTube creators, online tutors, and podcasters who rely on professional setups. It grows further with home recording studios, where users prefer compact, high-performance cables. This development encourages manufacturers to launch affordable but reliable options for emerging artists. Strong growth in digital distribution platforms supports greater investments in recording equipment. It widens the consumer base and strengthens the secondary sales market. Demand also rises through cultural festivals and community events, which require high-quality sound reinforcement. It ensures that the market remains relevant to both professional and amateur segments.

Market Trends:

Advancements in premium cable design and enhanced shielding technologies

Technological progress is redefining the instrument cable category with the introduction of advanced materials and shielding systems. The North America Instrument (Audio) Cables Market is influenced by the adoption of double-braided shielding, flexible jackets, and connectors engineered for precision. It supports consistent sound output across longer performance sessions. High-performance designs are increasingly preferred in professional studios where clarity is critical. Brands focus on reducing interference while keeping cables lightweight and flexible. Demand rises for innovative coatings that improve durability without impacting tonal accuracy. Cable aesthetics, including color-coded designs, also emerge as a market differentiator. It sets the stage for premium cable adoption in both commercial and personal use.

- For instance, Ernie Ball’s braided instrument cables utilize dual-conductors with multiple shielding layers and offer cable options up to 25ft (7.62m) in length, ensuring low noise and maximum flexibility for professional use.

Growing role of sustainability and eco-conscious product development

The rising focus on sustainability is shaping the trajectory of cable manufacturing in North America. The North America Instrument (Audio) Cables Market sees an increase in eco-friendly packaging and recyclable materials. It aligns with industry-wide commitments to reduce environmental impact while maintaining high product performance. Musicians and institutions now value brands that integrate responsible practices. Cable makers respond with products designed using low-toxicity plastics and renewable materials. This trend enhances brand reputation and attracts environmentally aware buyers. Green certifications gain importance in purchasing decisions among institutions. Demand shifts toward suppliers that demonstrate long-term ecological responsibility. It brings sustainability into mainstream product development for the industry.

Expanding influence of e-commerce platforms and direct-to-consumer sales channels

The retail landscape has shifted with online platforms becoming a vital sales channel for instrument cables. The North America Instrument (Audio) Cables Market adapts to this shift by offering tailored digital experiences for buyers. It benefits from detailed product descriptions, technical guides, and video demonstrations available online. Consumers compare specifications and reviews before purchase, supporting transparency. E-commerce players expand access to a wide product range, boosting small and mid-level brands. Subscription-based delivery models for cable replacement gain traction among professionals. Digital channels also provide a forum for niche, high-performance cable makers to reach targeted audiences. It strengthens competition and elevates customer engagement.

Rising collaborations between cable manufacturers and audio equipment brands

Strategic partnerships between cable manufacturers and major audio equipment brands are shaping product innovation. The North America Instrument (Audio) Cables Market sees co-branded products that integrate seamlessly with amplifiers, pedals, and recording gear. It reflects the demand for end-to-end compatibility solutions across professional environments. Such collaborations create specialized product lines that deliver added value to musicians. Partnerships also extend to artist endorsements, where cables are promoted alongside instruments and accessories. These endorsements influence buying decisions, especially among hobbyists. Distribution networks expand under these collaborations, improving product availability. It highlights the growing synergy between accessory makers and core equipment manufacturers.

- For instance, WD’s Copperhead Gold Series instrument cables, produced by RapcoHorizon, use 18-gauge oxygen-free copper wire with a 95% braided shield, resulting from a collaboration that prioritizes studio-grade reliability and widespread distribution.

Market Challenges Analysis:

Rising competition and pressure of product commoditization

Intense competition within the instrument cable segment drives pricing pressure and challenges differentiation. The North America Instrument (Audio) Cables Market faces issues with commoditization, where many products appear similar to end users. It creates difficulties in sustaining premium pricing strategies for established brands. Small-scale manufacturers enter the market with low-cost options, attracting budget-conscious consumers. This competition reduces profit margins and limits scope for mid-tier brands. The market also contends with counterfeit products that undermine quality perceptions. Consumers may find it difficult to distinguish authentic products, which weakens trust. It makes brand loyalty harder to maintain in a crowded environment.

Evolving consumer preferences and rapid technological change

Consumer expectations shift rapidly, making it difficult for manufacturers to align with emerging preferences. The North America Instrument (Audio) Cables Market is affected by fast-paced developments in wireless audio and digital solutions. It creates uncertainty about the long-term demand for traditional instrument cables. Manufacturers must adapt quickly to integrate advanced shielding or hybrid designs that compete with wireless alternatives. High R&D costs pose risks for smaller players aiming to keep up with trends. It requires balancing affordability with innovation. Customers demand durability while expecting lower costs, creating tension in pricing models. The challenge intensifies as buyers prefer multifunctional products that combine convenience with reliability.

Market Opportunities:

Expanding live entertainment sector and strong rise of independent creators

Growth in the live entertainment industry presents significant opportunities for manufacturers. The North America Instrument (Audio) Cables Market benefits from increasing concerts, festivals, and theater productions. It aligns with the rising influence of independent musicians, podcasters, and digital content creators. Demand expands into smaller towns and regional markets where entertainment infrastructure is developing. Brands can capture these opportunities by offering customizable solutions for different user segments. Consumer demand for reliability and performance creates room for innovation. It positions the market for sustained growth in the coming years.

Rising acceptance of premium cables across consumer and professional segments

The adoption of premium cables is increasing, driven by rising awareness of their impact on sound quality. The North America Instrument (Audio) Cables Market benefits from consumers who prioritize professional-grade setups even in home environments. It encourages manufacturers to launch mid-priced options that combine durability with premium features. Growth of online retail platforms broadens access to these offerings, strengthening sales volumes. Cable makers have opportunities to build strong brand reputations by highlighting performance advantages. Growing replacement demand from studios ensures continued opportunities. It establishes a favorable market environment where both established and emerging brands can thrive.

Market Segmentation Analysis:

By Application, the North America Instrument (Audio) Cables Market demonstrates diverse demand patterns across application segments. Acoustic cables hold a strong share due to their extensive use by live performers and hobbyists who require reliable sound output at affordable costs. Electric instrument cables show robust growth, supported by their essential role in professional studios and concert setups where precision and clarity are critical. Classical cables maintain a smaller but steady segment, appealing to musicians who prioritize tonal accuracy and minimal interference. Bass cables sustain consistent demand due to their construction designed to handle low frequencies with durability. The “others” category includes specialized and hybrid cables that serve niche requirements in modern audio setups, reinforcing product diversity within the industry.

- For example, Tour Gear Designs’ flat pedalboard cables offer 99.9% oxygen-free copper conductors and 95% twisted shielding, enabling effective handling of frequencies critical for bass (20 Hz–250 Hz) while preserving signal clarity in pedalboard setups.

By end-user segmentation, light cables command significant adoption owing to their suitability for beginners and casual players seeking accessible and cost-effective solutions. Custom light cables record strong traction among professionals and enthusiasts who prefer balanced performance with flexibility and durability. The “others” segment captures demand from specialized users who require tailored cable solutions for unique equipment setups and unconventional sound applications. The North America Instrument (Audio) Cables Market benefits from this broad segmentation, as it allows manufacturers to address both mainstream and niche consumer groups. It supports a dynamic product mix that responds to professional standards while catering to emerging lifestyle-driven applications across the region.

- For instance, the Ernie Ball Classic Series Instrument Cable offers crisp highs, rich harmonics, and a rugged PVC jacket at an affordable price, making it a favorite among entry-level users and casual performers.

Segmentation:

By Application

- Acoustic

- Electric

- Classical

- Bass

- Others

By End-User

- Light

- Custom Light

- Others

Regional Analysis:

The United States holds the largest share of the North America Instrument (Audio) Cables Market, accounting for nearly 65% of the regional revenue. Its dominance is supported by a strong presence of established brands, advanced recording facilities, and a vibrant live entertainment sector. The demand is reinforced by both professional musicians and independent creators who prioritize premium audio quality. Growth in home studio setups and digital content creation also supports consistent sales in the U.S. It remains the core market for innovation, where manufacturers launch advanced cables with durability and noise-resistance features. It creates a competitive landscape that continues to set product standards for the wider region.

Canada contributes approximately 20% of the regional share, driven by a growing independent music culture and investments in live performance venues. The Canadian market benefits from rising numbers of music festivals, cultural events, and smaller studio setups across urban centers. Strong government support for the arts also fuels infrastructure development, creating consistent demand for reliable cables. It is gradually adopting higher-quality products as musicians and sound engineers emphasize durability and clarity. Consumer interest in mid-range and premium options is growing, which opens opportunities for global and regional players to strengthen distribution networks. It makes Canada an emerging growth hub within the regional landscape.

Mexico holds close to 15% of the market, reflecting its expanding entertainment sector and rising adoption of audio equipment across cultural and commercial applications. Growth is linked to increasing music production activities and the influence of international touring artists who create demand for professional-grade equipment. The market is price-sensitive, which encourages the adoption of cost-effective cable solutions while creating room for premium brands in urban centers. It also benefits from rising investments in theaters, concert venues, and local music production companies. The North America Instrument (Audio) Cables Market gains resilience from Mexico’s steady expansion, as it diversifies the consumer base across professional and recreational users. It highlights Mexico’s potential to evolve into a competitive market segment with sustained long-term demand.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

Competitive Analysis:

The North America Instrument (Audio) Cables Market is highly competitive, with both global and regional players focusing on performance, durability, and innovation to differentiate themselves. Established brands such as Mogami, Klotz, Fender, Ernie Ball, and Shure dominate the landscape with extensive product portfolios and strong distribution networks. These companies leverage brand loyalty and endorsements from professional musicians to strengthen their market presence. It reflects a structure where premium products gain recognition for advanced shielding, noise reduction, and superior tonal clarity. Mid-tier brands like Boss, Line 6, Lava, and Monster target diverse consumer bases by offering cables that balance affordability with performance. The market also features smaller local manufacturers that compete on price and niche customization, particularly in semi-professional and hobbyist segments. Strategic activities include mergers, product launches, and regional expansions aimed at enhancing reach and reinforcing technical leadership. The competitive intensity ensures that continuous product innovation and effective marketing remain critical for maintaining and expanding market share.

Recent Developments:

- In March 2025, Wilson Benesch a prominent British manufacturer of high-end audio systems announced an exclusive U.S. partnership with Fidelity Imports. This alliance is poised to expand Wilson Benesch’s footprint in North America, delivering its flagship Omnium Loudspeaker and IGx Infrasonic Generator via Fidelity Imports’ distribution network.

- In August 2024, Shure formed a strategic alliance with TD SYNNEX to improve market access to its premium audio solutions across the United States. This partnership leverages Shure’s audio expertise and TD SYNNEX’s distribution capabilities, ensuring broader customer reach for conferencing, presentation, and educational audio technologies.

- In January 2024, Klotz introduced a redesigned LaGrange Supreme Guitar Cable. The new edition celebrates its 45th anniversary, now with laser-engraved metal jack plugs and improved handling, while retaining its reputation for high-purity copper conductors, triple shielding, and classic performance.

Market Concentration & Characteristics:

The North America Instrument (Audio) Cables Market exhibits a moderately concentrated structure, with a few leading brands holding significant shares while several smaller players compete across specific niches. It is characterized by strong brand-driven competition, where reputation and proven reliability influence purchasing decisions. Price sensitivity exists, but professionals prioritize performance and durability, creating opportunities for premium cable manufacturers. The market reflects high replacement demand, as cables are subject to wear in live performances and studio use, supporting recurring revenue streams. Distribution through both offline retail and online platforms strengthens accessibility, while endorsements and collaborations with equipment manufacturers enhance product visibility. It demonstrates balanced growth potential across established and emerging segments, reinforcing the importance of innovation and customer trust in sustaining leadership.

Report Coverage:

The research report offers an in-depth analysis based on Application and End-User. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Growing demand for high-quality cables will strengthen opportunities across professional studios, live performances, and digital content creation.

- The shift toward premium materials and advanced shielding technologies will elevate product standards across regional markets.

- Rising consumer awareness of sound quality will encourage adoption of mid-range and premium cables even among hobbyists and independent creators.

- Expansion of e-commerce channels will provide broader accessibility, enabling smaller brands to compete effectively with established players.

- Endorsements from professional artists and partnerships with equipment manufacturers will continue to influence purchasing behavior.

- Replacement demand will remain a consistent revenue stream, driven by wear and tear in intensive usage environments.

- Customization options in design, flexibility, and connector types will attract diverse consumer groups seeking personalized solutions.

- Sustainability initiatives in packaging and materials will gain traction, aligning with rising eco-conscious preferences among buyers.

- Regional growth in Canada and Mexico will diversify revenue streams, reducing reliance on the U.S. market.

- Ongoing product innovation will define competitive advantage, positioning manufacturers that deliver durability and tonal clarity as long-term leaders.