| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| North America Single Use Assemblies Market Size 2023 |

USD 870.80 Million |

| North America Single Use Assemblies Market, CAGR |

12.1% |

| North America Single Use Assemblies Market Size 2032 |

USD 2,438.15 Million |

Market Overview:

North America Single Use Assemblies Market size was valued at USD 870.80 million in 2023 and is anticipated to reach USD 2,438.15 million by 2032, at a CAGR of 12.1% during the forecast period (2023-2032).

Key drivers propelling this market include the increasing adoption of single-use systems across various bioprocessing stages, such as filtration, cell culture, and mixing. These systems offer significant advantages, including reduced risk of cross-contamination, lower capital expenditures, and shorter turnaround times compared to traditional stainless-steel systems. Additionally, the rising prevalence of chronic diseases and the growing demand for biologics and biosimilars are fueling the need for advanced manufacturing solutions. Technological advancements, such as the development of 2D and 3D bag assemblies, further enhance the versatility and efficiency of single-use systems, making them attractive to both large pharmaceutical companies and emerging biotech firms.

Regionally, North America maintains a dominant position in the global single-use assemblies market, accounting for over 36% of the market share in 2023. The United States leads this segment, benefiting from a well-established biopharmaceutical infrastructure, substantial government investments in biomanufacturing, and a favorable regulatory environment that supports the adoption of innovative technologies. Canada, while smaller in market share, is emerging as the fastest-growing country in the region, with projections indicating a significant increase in market size by 2030. This growth is attributed to increased expenditure in biopharmaceutical research and development, government initiatives, and the development of single-use assembly products tailored to local needs. Collectively, these factors position North America as a central hub for the advancement and implementation of single-use assembly technologies in biopharmaceutical manufacturing.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- The North America Single Use Assemblies Market is expected to grow significantly, reaching USD 2,438.15 million by 2032, from a valuation of USD 870.80 million in 2023, driven by a CAGR of 12.1%.

- The Global Single-Use Assemblies Market was valued at USD 2,480.91 million in 2023 and is expected to reach USD 6,991.12 million by 2032, growing at a CAGR of 12.2% from 2023 to 2032.

- Increasing adoption of single-use systems in bioprocessing stages such as filtration, cell culture, and mixing is one of the primary drivers of market growth, offering advantages like reduced cross-contamination risks and shorter turnaround times.

- The growing demand for biologics and biosimilars is fueling the need for scalable and flexible production solutions, particularly in the U.S. and Canada, with an increasing focus on efficient manufacturing systems.

- Technological advancements, such as 2D and 3D bag assemblies, continue to enhance the versatility and efficiency of single-use systems, attracting large pharmaceutical companies and biotech firms.

- The regulatory environment in North America, with clear guidelines from the FDA and Health Canada, supports the growth of single-use technologies, ensuring compliance with manufacturing standards.

- The U.S. holds a dominant share of the market, accounting for over 36%, benefiting from a strong biopharmaceutical infrastructure and government investments in biomanufacturing.

- Canada is rapidly emerging as a growth hub, with projections showing a significant market size increase by 2030, driven by government initiatives and advancements in single-use assembly products tailored to local needs.

Market Drivers:

Increasing Demand for Biologics and Biosimilars

The growing demand for biologics and biosimilars is one of the primary drivers fueling the North American single-use assemblies market. Biologics, such as monoclonal antibodies and gene therapies, are increasingly becoming the treatment of choice for various diseases, including cancer, autoimmune disorders, and rare diseases. As the production of these complex products requires specialized manufacturing techniques, the need for scalable and flexible production systems is paramount. Single-use assemblies provide the flexibility to handle high-volume manufacturing of biologics without the need for extensive cleaning and validation procedures associated with traditional stainless-steel systems. This shift to biologics production is driving the adoption of single-use technologies across North America.

Cost Efficiency and Operational Flexibility

Cost efficiency is a critical factor influencing the adoption of single-use assemblies in the biopharmaceutical sector. These systems are inherently more cost-effective than traditional stainless-steel systems due to reduced capital investment, less maintenance, and shorter production cycles. Single-use technologies eliminate the need for dedicated cleaning systems and sterilization equipment, reducing both operational costs and downtime. Additionally, their modular design allows for greater flexibility in scaling production volumes up or down based on demand, making them particularly attractive for contract manufacturers and smaller biotech firms. For example, Cytiva’s launch of X-platform bioreactors in April 2023 streamlined upstream bioprocessing by boosting process efficiency and supply chain operations, demonstrating how these technologies can optimize time efficiency and resource utilization. The ability to reduce manufacturing costs while maintaining high standards of quality is a key advantage that single-use assemblies offer over traditional biomanufacturing systems.

Technological Advancements in Single-Use Systems

Technological advancements in single-use assemblies continue to drive innovation in the North American market. The development of advanced single-use systems, such as 2D and 3D bioreactor bags, filtration units, and mixing technologies, is enhancing the performance and efficiency of single-use systems. These advancements enable more precise control over critical manufacturing processes, such as temperature, pH, and oxygen levels, improving the consistency and yield of biopharmaceutical products. For instance, in March 2022, Cellexus International launched a single-use mixing system airlift bioreactor, enabling efficient and gentle mixing for delicate cell cultures while maintaining sterility, which is crucial for product purity and regulatory compliance. Additionally, the integration of sensors, automation, and data analytics into single-use systems has further optimized process monitoring and control, enabling manufacturers to enhance product quality and meet stringent regulatory standards. These technological developments are expanding the range of applications for single-use systems and driving their increased adoption in North America.

Regulatory Support and Favorable Manufacturing Environment

North America’s favorable regulatory environment plays a significant role in driving the growth of the single-use assemblies market. The U.S. Food and Drug Administration (FDA) and Health Canada have established clear guidelines for the use of single-use technologies in biopharmaceutical manufacturing, providing manufacturers with the assurance needed to invest in these systems. The regulatory frameworks support the use of single-use systems for both clinical and commercial-scale manufacturing of biologics and biosimilars, promoting confidence in the technology’s safety and efficacy. Additionally, the U.S. government’s ongoing investments in biotechnology research and development, coupled with favorable policies that encourage innovation in the life sciences sector, create an ideal environment for the adoption of single-use technologies. The combination of regulatory clarity, government support, and a strong manufacturing infrastructure further accelerates the growth of the single-use assemblies market in North America.

Market Trends:

Customization and Modular Solutions

A significant trend in the North American single-use assemblies market is the increasing demand for customized and modular solutions. Biopharmaceutical companies are seeking tailored assemblies that align with specific production requirements, enhancing process efficiency and reducing the risk of contamination. This shift towards personalized solutions allows for more flexible and scalable manufacturing processes, accommodating the diverse needs of biologics, vaccines, and cell and gene therapies. The ability to customize assemblies ensures that manufacturers can maintain high standards of quality while optimizing operational workflows.

Integration of Automation and Digital Technologies

The integration of automation and digital technologies into single-use assemblies is transforming biomanufacturing processes in North America. For instance, automation in single-use assemblies has facilitated the incorporation of big data-based machine learning, allowing for increased production efficiency and real-time process control. The adoption of automated systems, including robotics and real-time data analytics, enables more precise control over production parameters, such as temperature, pH, and oxygen levels. These advancements facilitate continuous monitoring and adjustment, leading to improved product consistency and yield. The incorporation of digital technologies also supports predictive maintenance and process optimization, reducing downtime and enhancing overall operational efficiency. This trend reflects the industry’s commitment to innovation and the pursuit of more intelligent and responsive manufacturing systems.

Sustainability Initiatives and Eco-Friendly Materials

Environmental sustainability is becoming an increasingly important consideration in the North American single-use assemblies market. Manufacturers are exploring the use of eco-friendly materials and recyclable components to reduce the environmental impact of disposable systems. For example, Thermo Fisher Scientific’s new facility is designed to support the production of single-use assemblies that can reduce or eliminate the need for traditional stainless-steel equipment, thereby minimizing water and energy consumption associated with cleaning and sterilization. This includes the development of biodegradable polymers and the implementation of recycling programs for used assemblies. Regulatory pressures and consumer demand for sustainable practices are driving these initiatives, prompting companies to invest in research and development of greener alternatives. The focus on sustainability aligns with broader industry efforts to minimize waste and promote responsible manufacturing practices.

Expansion of Contract Manufacturing Organizations (CMOs)

The growth of Contract Manufacturing Organizations (CMOs) is influencing trends in the single-use assemblies market. CMOs are increasingly adopting single-use technologies to offer flexible and cost-effective manufacturing solutions to their clients. This trend is particularly evident in the production of biologics and biosimilars, where the scalability and efficiency of single-use systems are highly beneficial. The expansion of CMOs contributes to the broader adoption of single-use assemblies, as these organizations provide access to advanced manufacturing capabilities for a wide range of biopharmaceutical companies. This trend underscores the growing reliance on outsourcing in the biomanufacturing sector and the pivotal role of CMOs in the industry’s evolution.

Market Challenges Analysis:

High Costs of Initial Investment

One of the primary challenges in the North American single-use assemblies market is the high initial investment required for the adoption of these technologies. Although single-use systems offer long-term cost savings by reducing maintenance, cleaning, and validation costs, the upfront costs associated with purchasing, installing, and validating single-use systems can be significant. For example, the price per single-use assembly can range from $100 to $500 depending on complexity and customization, which can add up quickly for facilities needing large numbers of assemblies for different processes. Smaller biopharmaceutical companies or contract manufacturing organizations (CMOs) may find it difficult to justify these costs, especially when they are competing against larger players with established capital resources. This financial barrier can slow the broader adoption of single-use technologies, particularly among smaller entities that could benefit most from their flexibility.

Limited Availability of Skilled Workforce

Another constraint affecting the growth of the North American single-use assemblies market is the shortage of a skilled workforce. The complexity of single-use systems, coupled with the rapid advancements in technology, requires a workforce with specialized knowledge in bioprocessing and system integration. However, there is a gap in the availability of adequately trained professionals who are capable of designing, maintaining, and troubleshooting these systems. This shortage of skilled labor could hinder the efficient implementation of single-use technologies, particularly as demand continues to rise in the region. Companies may need to invest in extensive training programs to bridge this gap, which could further add to operational costs.

Regulatory and Compliance Concerns

Regulatory and compliance challenges also represent a significant restraint for the North American single-use assemblies market. While regulatory bodies like the FDA have provided guidelines for the use of single-use technologies, there are still concerns regarding the long-term safety and performance of these systems. Issues related to the traceability of materials, validation of systems, and the potential for leachable from plastic components remain under scrutiny. These concerns can lead to delays in product approvals and additional investments in testing and documentation to ensure compliance with stringent regulatory standards. These obstacles can impede market growth, especially when regulatory requirements become more stringent over time.

Market Opportunities:

The North American single-use assemblies market presents significant opportunities driven by the expansion of emerging biopharmaceutical markets. As the demand for biologics, biosimilars, and cell and gene therapies continues to rise, there is a growing need for scalable, flexible manufacturing solutions. Single-use assemblies provide a cost-effective, efficient alternative to traditional stainless-steel systems, offering the ability to quickly adapt to varying production volumes. This flexibility is particularly beneficial in the production of novel therapeutics, where smaller batch sizes and rapid scale-up are often required. As biotechnology firms and contract manufacturers seek to enhance their production capabilities, the adoption of single-use technologies presents a valuable opportunity for companies within the market to capitalize on this growing demand.

Another notable opportunity in the North American market is the increasing focus on sustainability and eco-friendly technologies. As environmental concerns become more pressing, there is an industry-wide push towards reducing the environmental impact of manufacturing processes. Single-use systems are being developed with recyclable and biodegradable materials, allowing biopharmaceutical manufacturers to maintain high levels of production efficiency while minimizing waste. This shift toward sustainable solutions is creating new avenues for innovation and differentiation within the market. Companies that invest in developing more environmentally friendly single-use assemblies will be well-positioned to meet the growing demand for sustainable biomanufacturing practices, potentially gaining a competitive edge in an increasingly eco-conscious market.

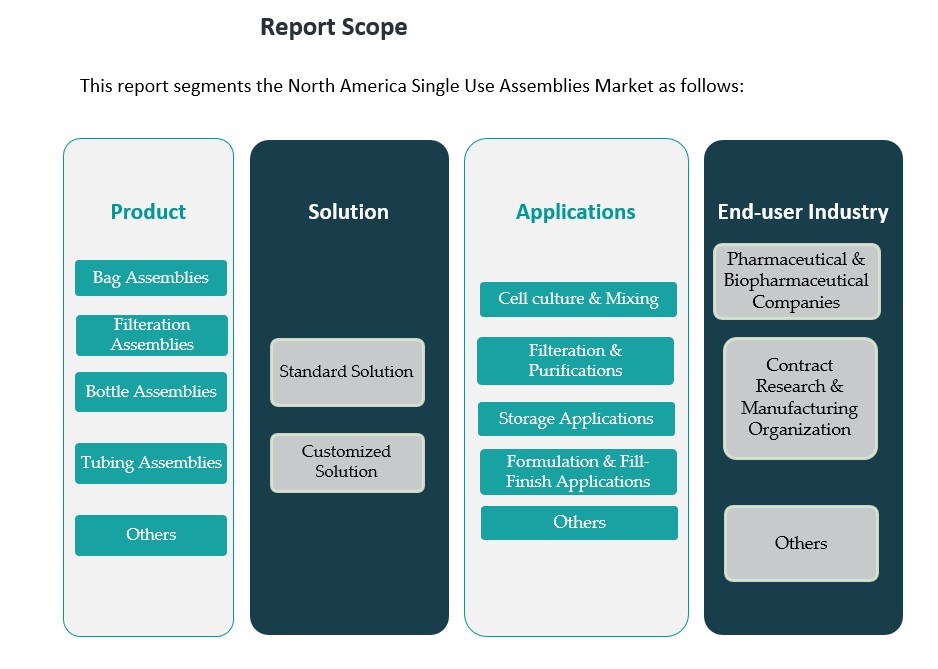

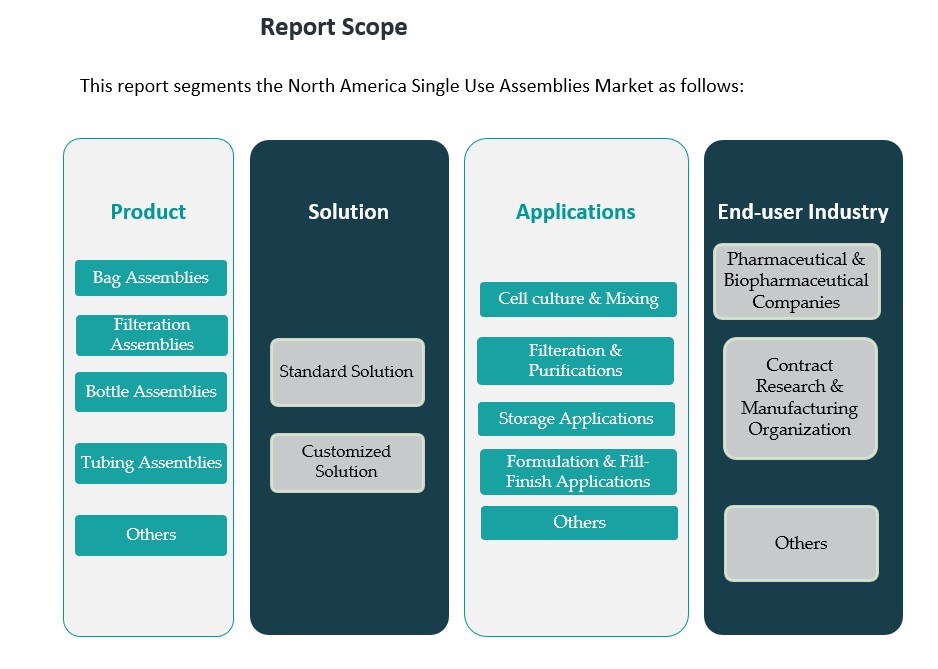

Market Segmentation Analysis:

The North American single-use assemblies market is segmented across multiple dimensions, including product, solution, application, and end-user segments, each with distinct growth drivers.

By Product Segment: The product segment is primarily divided into bag assemblies, filtration assemblies, bottle assemblies, tubing assemblies, and others. Bag assemblies dominate this segment, driven by their extensive use in cell culture, mixing, and storage applications. Filtration assemblies are also a key contributor, owing to their crucial role in downstream processing. Tubing and bottle assemblies, while smaller in market share, continue to gain traction due to their versatility in biomanufacturing processes.

By Solution Segment: Single-use systems are available in both standard and customized solutions. The standard solutions segment is widely adopted due to its cost-effectiveness and ease of implementation, offering pre-designed components for common applications. However, the demand for customized solutions is steadily increasing as companies require tailored systems for specific production needs, particularly in high-precision biopharmaceutical manufacturing.

By Applications Segment: The market is also segmented by applications such as cell culture and mixing, filtration and purifications, storage applications, and formulation and fill-finish applications. Cell culture and mixing applications lead the market due to their central role in biologics production. Filtration and purification are closely following, driven by the need for high-quality, contaminant-free products.

By End-User Segment: The major end-users of single-use assemblies include pharmaceutical and biopharmaceutical companies, contract research and contract manufacturing organizations, and academic and research institutes. Pharmaceutical and biopharmaceutical companies hold the largest share, spurred by their increasing adoption of single-use technologies to enhance production efficiency and scalability in biologics manufacturing.

Segmentation:

By Product Segment:

- Bag Assemblies

- Filtration Assemblies

- Bottle Assemblies

- Tubing Assemblies

- Others

By Solution Segment:

- Standard Solutions

- Customized Solutions

By Applications Segment:

- Cell Culture & Mixing

- Filtration & Purifications

- Storage Applications

- Formulation and Fill-Finish Application

- Others

By End-User Segment:

- Pharmaceutical & Biopharmaceutical Companies

- Contract Research & Contract Manufacturing Organizations

- Academics & Research Institutes

Regional Analysis:

The North American single-use assemblies market is a dynamic and rapidly expanding segment, driven by the presence of established pharmaceutical companies, biomanufacturers, and robust technological advancements. Within this region, the United States holds the largest market share, accounting for over 80% of the total market in 2023. This dominance can be attributed to the country’s leading position in biopharmaceutical research, development, and manufacturing. The U.S. boasts a highly advanced biotechnology infrastructure, supported by strong regulatory frameworks and significant government investments in healthcare and biotechnology sectors. Additionally, the presence of large-scale pharmaceutical companies and Contract Manufacturing Organizations (CMOs) has further fueled the adoption of single-use technologies for flexible and scalable biomanufacturing processes.

Canada represents a smaller, yet rapidly growing segment of the North American market, contributing approximately 10-15% to the total market share. The country is witnessing an increased demand for single-use assemblies, particularly in biologics manufacturing, driven by growing investments in the pharmaceutical and biotechnology sectors. Canadian companies are increasingly adopting single-use technologies to improve production efficiency and reduce operational costs, particularly as the government continues to support the sector with favorable policies and research grants. While Canada’s market size is smaller compared to the U.S., its growth potential is significant, especially with rising biopharmaceutical production and clinical trials.

Mexico’s share of the North American single-use assemblies market is relatively small, accounting for about 5% in 2023. However, the market in Mexico is expected to grow steadily due to the country’s expanding role in contract manufacturing and the increasing number of biopharmaceutical companies setting up production facilities. The shift towards more cost-effective production solutions, such as single-use technologies, is driving adoption in Mexico, particularly within the biosimilars and generics sectors.

Key Player Analysis:

- Thermo Fisher Scientific Inc.

- Sartorius AG

- Danaher Corporation

- Merck KGaA

- Avantor, Inc.

- Parker-Hannifin Corporation

- Saint-Gobain S.A.

- Repligen Corporation

- Corning Incorporated

- Entegris

- L. Gore & Associates, Inc.

- NewAge Industries

- Antylia Scientific

- Intellitech Inc.

Competitive Analysis:

The North American single-use assemblies market is dominated by several key players that drive innovation and market growth. Thermo Fisher Scientific, Danaher Corporation, Merck KGaA, Sartorius AG, Avantor, and Lonza are among the leading companies in this sector. These firms leverage their extensive product portfolios, technological expertise, and strong distribution networks to maintain market leadership. For instance, Thermo Fisher Scientific opened a new single-use technology site in Tennessee, becoming the company’s largest SUT site in its growing network. The market is characterized by a moderate to high concentration, with a few dominant players leading the industry. In 2023, the United States held approximately 89% of the regional market share. This concentration is primarily due to the advanced biopharmaceutical infrastructure and significant investments in biotechnology research and development in the United States. Key players in the market continue to invest in research and development, strategic partnerships, and facility expansions to enhance their competitive positions and meet the growing demand for single-use technologies in biopharmaceutical manufacturing.

Recent Developments:

- In April 2025, Sartorius AG announced the acquisition of MatTek Corp, including Visikol Inc. This acquisition is significant for the single-use assemblies market because MatTek is a leading developer and manufacturer of advanced 3D microtissue models, which are widely used in cell culture and drug discovery.

- Thermo Fisher Scientific Inc.’s February 2025 agreement to acquire Solventum’s Purification & Filtration business is relevant to the single-use assemblies market. The acquisition will expand Thermo Fisher’s capabilities in purification and filtration, which are core components of single-use assembly systems for biomanufacturing. By broadening its bioproduction portfolio, Thermo Fisher is positioned to meet the increasing demand for modular, flexible, and contamination-reducing single-use solutions in biologics manufacturing.

Market Concentration & Characteristics:

The North American single-use assemblies market is characterized by a moderate to high concentration, with a few dominant players leading the industry. In 2023, the market share distribution was as follows: the United States held approximately 89%, Canada accounted for about 10%, and Mexico contributed around 1%. This concentration is primarily due to the advanced biopharmaceutical infrastructure and significant investments in biotechnology research and development in the United States. Key players in the market include Thermo Fisher Scientific, Danaher Corporation, Merck KGaA, Sartorius AG, Avantor, Lonza, Saint-Gobain, Corning Incorporated, Entegris, and KUHNER AG. These companies leverage their extensive product portfolios, technological expertise, and strong distribution networks to maintain market leadership. The market is further shaped by collaborations and partnerships among these companies and contract manufacturing organizations (CMOs), facilitating the development and deployment of innovative single-use technologies. The market’s characteristics include a strong emphasis on innovation, with continuous advancements in single-use technologies to meet the evolving needs of the biopharmaceutical industry. Additionally, there is a growing trend towards sustainability, with companies exploring eco-friendly materials and practices to reduce the environmental impact of single-use systems. Regulatory support and favorable manufacturing environments in the United States and Canada further contribute to the market’s growth and development.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage:

The research report offers an in-depth analysis based on Product Segment, Solution Segment, Applications Segment and End User Segment. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- The North American single-use assemblies market is expected to grow at a robust pace, driven by increasing demand for biologics and biosimilars.

- Technological advancements in single-use systems, such as the integration of automation and real-time monitoring, will enhance process efficiency.

- The shift toward sustainable manufacturing practices will drive innovation in eco-friendly and recyclable single-use materials.

- Expansion in Contract Manufacturing Organizations (CMOs) will increase the adoption of single-use systems for flexible, cost-efficient production.

- Regulatory support from the FDA and Health Canada will continue to facilitate the widespread use of single-use technologies in biopharmaceutical manufacturing.

- The growing trend of modular and customizable single-use assemblies will enable companies to meet specific production needs more efficiently.

- Increased investment in research and development will lead to the development of next-generation single-use technologies.

- Market penetration will rise in Canada and Mexico, with these regions seeing increased demand for single-use systems in the biotechnology sector.

- The proliferation of cell and gene therapy manufacturing will drive the need for scalable, flexible production solutions.

- Strategic partnerships and collaborations will remain crucial for market players to maintain competitive advantages and meet the evolving demands of the industry.