| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Oil Storage Terminal Market Size 2024 |

USD 34,554.07 Million |

| Oil Storage Terminal Market, CAGR |

3.68% |

| Oil Storage Terminal Market Size 2032 |

USD 47,141.93 Million |

Market Overview:

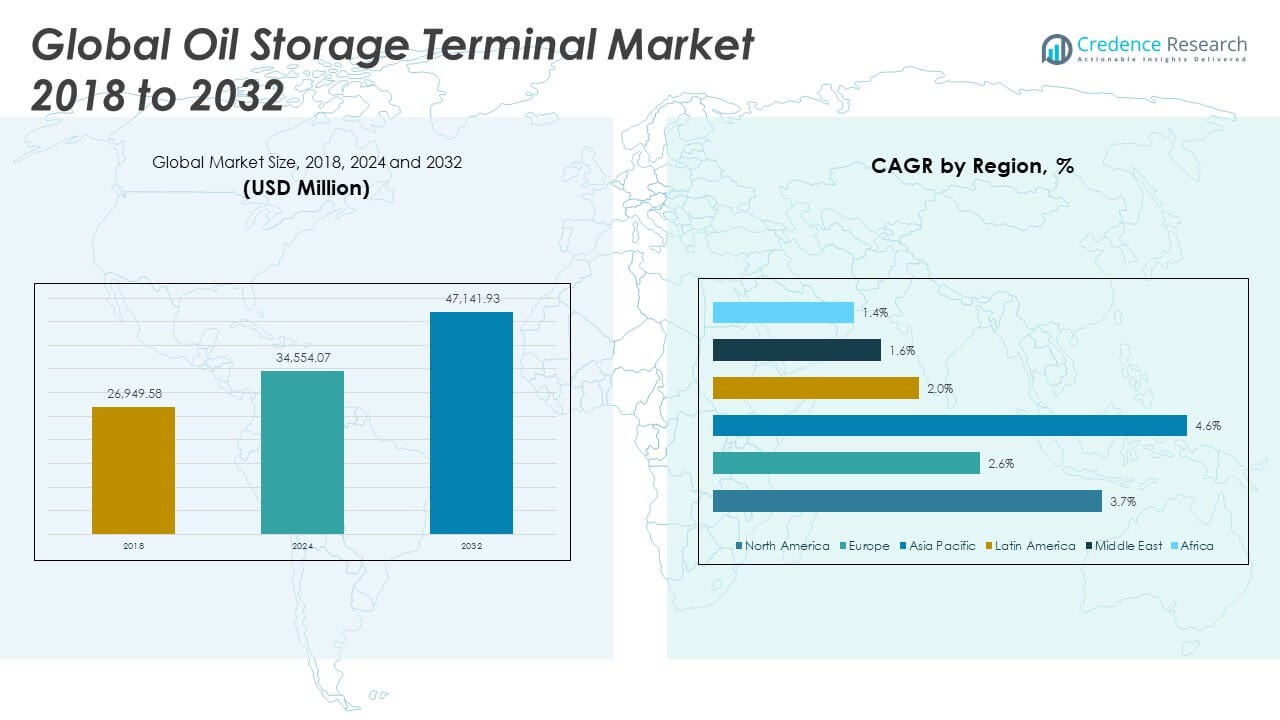

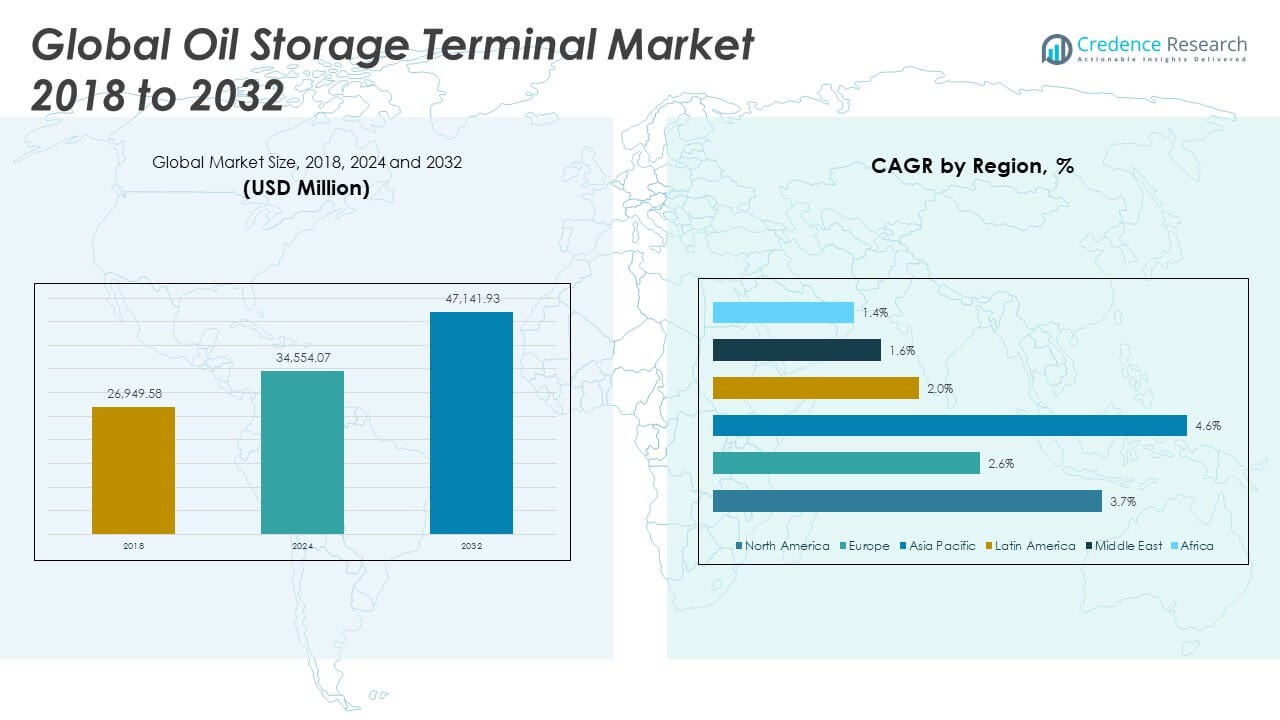

The Oil Storage Terminal Market size was valued at USD 26,949.58 million in 2018 to USD 34,554.07 million in 2024 and is anticipated to reach USD 47,141.93 million by 2032, at a CAGR of 3.68% during the forecast period.

The global oil storage terminal market is propelled by several critical factors. Rising global demand for crude oil and refined products across transportation, industrial, and residential sectors necessitates expanded storage capacities to maintain supply chain stability. Strategic petroleum reserves play a vital role as governments invest in large-scale storage infrastructure to ensure energy security and mitigate risks associated with supply disruptions. Furthermore, significant infrastructure development projects, especially in emerging economies, contribute to market growth by enhancing storage and distribution capabilities. Technological advancements, including the adoption of automation, digital monitoring, and safety systems, improve operational efficiency and reduce risks, attracting further investment and facilitating the modernization of existing terminals.

Regionally, the oil storage terminal market shows marked variations driven by production volumes, consumption patterns, and government policies. North America, led by the United States, holds substantial storage capacity, particularly along the Gulf Coast, with ongoing projects aiming to boost export capabilities. The Middle East and Africa dominate due to their large oil production and strategic reserves initiatives, with the market in this region expected to grow steadily as countries invest in expanding storage infrastructure. In the Asia-Pacific, rapidly growing economies such as China and India are significantly increasing storage capacity to meet rising domestic demand and support international trade flows. China has also developed alternative oil terminals to manage sanctioned shipments, ensuring continuity of supply. These regional dynamics reflect a combination of strategic priorities and economic growth that continue to drive market expansion worldwide.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- The Global Oil Storage Terminal Market grew from USD 26,949.58 million in 2018 to USD 34,554.07 million in 2024 and is projected to reach USD 47,141.93 million by 2032, with a CAGR of 3.68%.

- Rising global demand for crude oil and refined products across transportation, industrial, and residential sectors drives the need for expanded storage capacity to maintain supply chain stability.

- Strategic petroleum reserves play a key role as governments invest in large-scale storage infrastructure to ensure energy security and manage supply disruptions.

- Infrastructure modernization and capacity expansion in emerging economies, particularly in Asia Pacific and the Middle East, propel market growth by enhancing storage and distribution capabilities.

- Technological advancements, including automation, digital monitoring, and safety systems, improve operational efficiency, reduce risks, and attract further investments.

- Stringent regulatory compliance and growing environmental concerns impose operational challenges and require substantial capital for upgrades and pollution control.

- High capital expenditure and market volatility from fluctuating oil prices and geopolitical tensions affect project viability and slow new terminal development.

Market Drivers:

Growing Global Demand for Crude Oil and Refined Petroleum Products Drives Expansion

The rising consumption of crude oil and refined petroleum products worldwide significantly fuels the growth of the Global Oil Storage Terminal Market. Expanding industrial activities, increasing transportation needs, and growing energy consumption in residential and commercial sectors create constant pressure to secure adequate storage capacity. It plays a critical role in balancing supply and demand fluctuations, preventing disruptions in the energy supply chain. Countries with rapidly growing economies invest heavily in building new storage terminals to accommodate expanding fuel requirements. The rise in offshore oil exploration and production further amplifies the need for enhanced storage infrastructure. This steady demand growth ensures sustained investment and development in oil storage terminals globally.

Strategic Petroleum Reserves and National Energy Security Initiatives Strengthen Market Growth

Strategic petroleum reserves remain a fundamental driver in this market by enabling countries to safeguard against geopolitical tensions, supply interruptions, and price volatility. Governments increasingly recognize the importance of maintaining robust reserves to stabilize their domestic markets during crises. It encourages the establishment and expansion of large-scale storage facilities dedicated to these reserves. National policies and regulations support investment in advanced storage infrastructure, improving resilience and operational readiness. The Global Oil Storage Terminal Market benefits from these initiatives as governments prioritize energy security in their strategic agendas. Enhanced storage capabilities enable countries to manage emergencies more effectively while supporting long-term energy planning.

For example, the U.S. Department of Energy reported in 2024 that the Strategic Petroleum Reserve (SPR) maintained a capacity of over 350 million barrels, with recent releases and replenishments directly impacting domestic market stability.

Infrastructure Modernization and Capacity Expansion in Emerging Economies Propel Market Demand

Emerging economies demonstrate significant growth potential through ongoing infrastructure modernization and capacity expansion projects. Investments in refining, petrochemical, and distribution sectors drive demand for reliable storage terminals capable of handling increased volumes. It facilitates smoother supply chain management by reducing bottlenecks and improving turnaround times for oil handling and transportation. Governments and private enterprises collaborate to upgrade existing facilities and construct new terminals equipped with state-of-the-art technology. This development ensures compliance with environmental and safety standards while optimizing operational efficiency. The rapid industrialization and urbanization in regions like Asia-Pacific and the Middle East continue to create lucrative opportunities for market participants.

For instance, in 2023, Indian Oil Corporation announced the commissioning of a new 2.5 million metric ton storage terminal in Paradip, India, designed to improve supply chain efficiency and reduce bottlenecks for both crude and refined products.

Technological Advancements Enhance Operational Efficiency and Safety, Attracting Investments

Technological progress in automation, digital monitoring, and safety systems plays a pivotal role in transforming the oil storage terminal industry. It enables operators to monitor tank conditions, detect leaks promptly, and control inventory more accurately, thereby minimizing risks and operational costs. Integration of IoT, AI, and real-time data analytics improves predictive maintenance and resource management. These innovations increase the reliability and longevity of storage infrastructure while ensuring compliance with stringent environmental regulations. Investors show strong interest in terminals that adopt advanced technology, recognizing the potential for improved returns through enhanced productivity and reduced downtime. The Global Oil Storage Terminal Market reflects this trend toward modernization, supporting sustainable growth and competitive advantage.

Market Trends:

Increased Adoption of Digitalization and Automation Transforms Operational Practices

The Global Oil Storage Terminal Market witnesses a significant shift toward digitalization and automation across storage facilities worldwide. Operators implement advanced control systems, IoT-enabled sensors, and automated safety protocols to optimize performance and reduce human error. It improves real-time monitoring of inventory levels, tank integrity, and environmental conditions, enhancing operational transparency. Automation accelerates routine processes such as filling, draining, and maintenance, which boosts efficiency and lowers operational costs. The adoption of smart technologies also supports regulatory compliance by providing detailed data logs and audit trails. This trend reflects a broader industry movement toward leveraging technology for safer, more reliable, and cost-effective oil storage operations.

For instance, Vopak implemented IoT-enabled sensors and digital control systems for real-time inventory and safety monitoring, including digital twin technology and automation pilots in Singapore.

Rising Focus on Environmental Sustainability and Regulatory Compliance Drives Infrastructure Upgrades

Environmental concerns and stringent regulatory frameworks shape the development trajectory of oil storage terminals. It compels operators to invest in eco-friendly technologies, such as vapor recovery systems, spill containment measures, and corrosion-resistant materials. The Global Oil Storage Terminal Market responds to increasing pressure from governments and environmental agencies to minimize emissions and reduce the risk of contamination. Implementation of stricter safety standards drives modernization of aging infrastructure to align with global best practices. Sustainable practices also include the integration of renewable energy sources for powering terminal operations. This growing emphasis on environmental responsibility encourages innovation and fosters long-term market resilience.

Expansion of Storage Capacities Supports Growing Trade Volumes and Strategic Stockpiling

Market participants continue to expand storage capacities to accommodate increasing crude oil production and refined product trade. It enables better management of supply chain volatility and enhances the ability to respond quickly to market fluctuations. The Global Oil Storage Terminal Market benefits from growing global oil trade, including rising exports from major producing regions. Countries focus on strategic stockpiling to buffer against geopolitical uncertainties and market disruptions. Investment in large-scale terminals and multi-purpose facilities allows for flexibility in handling various petroleum products. This trend aligns with broader efforts to strengthen energy security and maintain steady supply in a dynamic global market.

For instance, in 2024, Abu Dhabi National Oil Company (ADNOC) completed the first phase of its Fujairah underground oil storage facility, adding 14 million barrels of new capacity to support the UAE’s strategic reserves and export flexibility, as detailed in ADNOC’s official press releases.

Integration of Advanced Safety Systems Enhances Risk Management and Operational Reliability

Safety remains a top priority within the oil storage terminal sector, driving the adoption of advanced risk management technologies. It incorporates fire detection and suppression systems, remote monitoring, and automated emergency response mechanisms. The Global Oil Storage Terminal Market recognizes that enhanced safety protocols reduce downtime and prevent costly incidents. Operators employ predictive analytics to identify potential failures before they occur, enabling proactive maintenance. Safety training programs combined with technology deployment foster a culture of vigilance and responsibility. These developments contribute to higher operational reliability and protect both assets and personnel in increasingly complex storage environments.

Market Challenges Analysis:

Stringent Regulatory Compliance and Environmental Concerns Present Operational and Financial Hurdles

The Global Oil Storage Terminal Market faces considerable challenges due to increasingly strict regulatory frameworks focused on environmental protection and safety. It demands substantial investments to upgrade existing infrastructure and implement advanced pollution control technologies. Compliance with international and local regulations requires continuous monitoring and adaptation, which increases operational complexity and costs. Operators must manage risks related to leaks, spills, and emissions to avoid penalties and reputational damage. Environmental concerns also push companies to adopt sustainable practices, which can delay project timelines and increase capital expenditure. Navigating diverse regulatory environments across different regions further complicates operations for multinational stakeholders. These factors create significant barriers to entry and affect profitability for market participants.

- For instance, in September 2023, Southern California air regulators adopted new rules requiring oil storage tanks to implement stricter vapor controls, including the installation of domes on floating-roof tanks and weekly leak detection monitoring using infrared cameras.

High Capital Expenditure and Market Volatility Impact Project Viability and Investment Decisions

Significant upfront capital investment represents a major challenge within the oil storage terminal sector. It involves costs related to land acquisition, construction, technology integration, and safety compliance. The Global Oil Storage Terminal Market experiences uncertainty driven by fluctuating oil prices and geopolitical tensions, which affect demand forecasts and project feasibility. Investors often hesitate to commit large funds amid volatile market conditions and shifting energy transition policies. It complicates long-term planning and delays expansion initiatives. Operational risks, including maintenance requirements and potential downtime, further strain financial resources. This environment forces companies to balance risk management with growth objectives, limiting the pace of new terminal development and modernization.

Market Opportunities:

The Global Oil Storage Terminal Market presents significant opportunities through the growing emphasis on strategic petroleum reserves by governments worldwide. It encourages investment in large-scale storage facilities to enhance energy security and manage supply disruptions. Emerging economies exhibit strong potential for infrastructure development, driven by increasing energy consumption and expanding industrial sectors. These markets require modern, high-capacity terminals to support refining, import-export activities, and domestic distribution. Investments in such projects offer long-term growth prospects for terminal operators and service providers. The shift toward diversified storage solutions tailored to regional needs further expands market reach and competitiveness.

Technological advancements create opportunities for the Global Oil Storage Terminal Market to improve operational efficiency and safety standards. It enables the adoption of digital monitoring, automation, and predictive maintenance systems that optimize asset utilization and reduce costs. Diversifying storage capabilities to handle alternative fuels, petrochemicals, and renewable energy carriers supports market expansion beyond traditional crude oil and refined products. Integration of environmentally sustainable technologies enhances compliance and aligns with global climate goals, attracting eco-conscious investors. These developments allow market players to differentiate their offerings and capitalize on evolving energy trends while strengthening resilience against industry disruptions.

Market Segmentation Analysis:

The Global Oil Storage Terminal Market segments

By type include Strategic Reserve and Commercial Reserve. The Strategic Reserve segment holds significance for national energy security, ensuring a steady supply during emergencies or disruptions. Commercial Reserve caters to market demand fluctuations, supporting refineries, distributors, and end-users. The balance between these reserves influences market dynamics and investment priorities.

By tank type, the market divides into Fixed Roof, Floating Roof, Bullet Tank, and Spherical Tank categories. Fixed Roof tanks offer a cost-effective solution for storing non-volatile liquids but face limitations due to vapor losses. Floating Roof tanks reduce evaporation losses and are preferred for volatile products, enhancing environmental compliance. Bullet and Spherical tanks primarily serve pressurized storage needs for gases and liquids, ensuring safety and efficiency in handling hazardous materials.

By Product segmentation covers Diesel, Petrol, Aviation Fuel, Crude Oil, Kerosene, and Others. Diesel dominates storage requirements given its extensive use in transportation and industrial applications. Petrol follows due to its high consumption in the automotive sector. Aviation Fuel storage grows with expanding air travel demands. Crude Oil storage remains vital for upstream and downstream operations, while Kerosene and other products maintain niche roles in specific regions or applications.

Segmentation:

By Type Segment Analysis

- Strategic Reserve

- Commercial Reserve

By Tank Type Segment Analysis

- Fixed Roof

- Floating Roof

- Bullet Tank

- Spherical Tank

By Product Segment Analysis

- Diesel

- Petrol

- Aviation Fuel

- Crude Oil

- Kerosene

- Others

By Regional Analysis

- North America

- Europe

- Asia-Pacific

- Middle East and Africa

- Latin America

Regional Analysis:

The North America Oil Storage Terminal Market size was valued at USD 8,623.86 million in 2018, rising to USD 10,900.60 million in 2024 and is anticipated to reach USD 14,928.20 million by 2032, growing at a CAGR of 3.7% during the forecast period. North America holds a significant market share in the Global Oil Storage Terminal Market, supported by advanced infrastructure and high energy consumption. The United States leads the region with extensive storage capacity and ongoing investments in upgrading terminal facilities. Rising demand for commercial and strategic reserves drives expansion, supported by regulatory frameworks ensuring energy security. The region emphasizes technology adoption for safety and environmental compliance. Growing exploration and production activities also sustain storage terminal growth. North America’s market reflects steady growth aligned with increasing oil consumption and strategic stockpiling.

The Europe Oil Storage Terminal Market size was valued at USD 5,508.47 million in 2018, increasing to USD 6,709.43 million in 2024 and is projected to reach USD 8,399.36 million by 2032, with a CAGR of 2.6%. Europe contributes a moderate share to the Global Oil Storage Terminal Market, influenced by diverse energy policies and a transition towards cleaner fuels. The market benefits from strategic reserves managed by governments to stabilize supply during disruptions. Western European countries maintain significant storage infrastructure, while Eastern Europe shows gradual growth. The regulatory environment prioritizes safety and emissions reduction, shaping storage terminal operations. Market growth faces constraints from fluctuating oil demand and renewable energy adoption. Investment in modernization and automation improves operational efficiency, maintaining Europe’s position in the global market.

The Asia Pacific Oil Storage Terminal Market size was valued at USD 10,308.83 million in 2018, expanding to USD 13,775.25 million in 2024 and expected to reach USD 20,096.51 million by 2032, at a CAGR of 4.6%. Asia Pacific dominates the Global Oil Storage Terminal Market with the largest regional share. Rapid industrialization, urbanization, and growing energy consumption fuel demand for storage capacity. China, India, and Southeast Asia lead market growth through significant infrastructure development and government initiatives supporting energy security. Increasing refinery capacity and expanding commercial reserves drive terminal construction. The region prioritizes building flexible and efficient storage solutions to meet diverse product needs. Market players focus on capacity expansion and technology integration to enhance safety and reduce environmental impact.

The Latin America Oil Storage Terminal Market size was valued at USD 1,187.85 million in 2018, rising to USD 1,502.74 million in 2024 and expected to reach USD 1,797.50 million by 2032, growing at a CAGR of 2.0%. Latin America holds a smaller share in the Global Oil Storage Terminal Market, with Brazil and Argentina as key contributors. The region’s market growth depends on oil production activities and increasing consumption. Storage terminals support both strategic reserves and commercial distribution networks. Infrastructure development remains a focus to improve efficiency and capacity. Political and economic factors influence investment decisions. Efforts to modernize facilities and comply with environmental standards impact market dynamics.

The Middle East Oil Storage Terminal Market size was valued at USD 795.01 million in 2018, increasing to USD 936.19 million in 2024 and projected to reach USD 1,088.67 million by 2032, at a CAGR of 1.6%. The Middle East contributes to the Global Oil Storage Terminal Market with strategic reserves and commercial storage supporting its role as a major oil producer. Storage terminals enable efficient supply management and export logistics. The region focuses on upgrading infrastructure to maintain competitive advantage in global markets. Geopolitical factors and oil price volatility affect market stability. Investments in safety and environmental compliance remain priorities. The market experiences moderate growth driven by steady oil production and export demands.

The Africa Oil Storage Terminal Market size was valued at USD 525.55 million in 2018, increasing to USD 729.86 million in 2024 and is anticipated to reach USD 831.69 million by 2032, growing at a CAGR of 1.4%. Africa holds a minor share in the Global Oil Storage Terminal Market with South Africa and Egypt as leading countries. The market growth hinges on expanding oil production and increasing regional demand. Infrastructure development lags behind other regions but shows gradual improvement. Strategic reserves and commercial storage are essential to address supply volatility. Market challenges include political instability and limited investment. Emphasis on capacity enhancement and modernization aims to boost market potential.

Key Player Analysis:

- Vopak (Royal Vopak N.V.)

- VTTI (Vitol Tank Terminals International)

- Oiltanking GmbH

- Stolt-Nielsen Limited (Stolthaven Terminals)

- Exolum (formerly CLH Group)

- NuStar Energy L.P.

- Odfjell SE

- McDermott International Inc.

- China National Petroleum Corporation (CNPC)

- China National Offshore Oil Corporation (CNOOC)

Competitive Analysis:

The Global Oil Storage Terminal Market features a competitive landscape dominated by key players such as Vopak, VTTI, Oiltanking GmbH, and Stolt-Nielsen Limited. These companies leverage extensive infrastructure, strategic geographic locations, and diversified service portfolios to maintain market leadership. It emphasizes innovation and operational efficiency to optimize storage capacity and safety standards. Collaborations and acquisitions remain common strategies to expand global reach and enhance service offerings. Market players invest in advanced technologies for environmental compliance and risk management to meet stringent regulations. Regional competitors focus on local market needs, creating a dynamic environment that fosters continuous improvement. The market demands adaptability to fluctuating oil prices and shifting energy policies, challenging companies to balance growth with sustainability. It requires a proactive approach to address geopolitical uncertainties and supply chain disruptions. This competitive environment drives efficiency and expansion, shaping the future of the global oil storage terminal sector.

Recent Developments:

- In April 2025, Royal Vopak entered into a strategic partnership with OQ, Oman’s integrated energy company, to accelerate the development of the Duqm Special Economic Zone as a global hub for hydrocarbons, chemicals, and low-carbon products. This partnership aims to leverage Vopak’s expertise in terminal infrastructure to support Oman’s ambitions for Duqm, focusing on industrial and energy terminal infrastructure that aligns with the global energy transition.

- In January 2025, VTTI launched VIDA bioenergy, a wholly owned subsidiary focused on transforming biomass into renewable energy, positioning itself as a leading biomethane producer in Europe. Additionally, in December 2024, VTTI, alongside Snam, finalized the acquisition of Terminale GNL Adriatico S.r.l. (Adriatic LNG), Italy’s largest LNG regasification terminal, with VTTI holding a 70% stake

Market Concentration & Characteristics:

The Global Oil Storage Terminal Market exhibits a moderately concentrated structure, with a few large multinational corporations such as Vopak, VTTI, and Oiltanking commanding significant market shares. It features high entry barriers due to the substantial capital investment and stringent regulatory requirements involved in terminal operations. The market characteristics include a strategic focus on geographic diversification to serve key oil-producing and consuming regions. It prioritizes operational efficiency, safety, and environmental compliance to maintain competitiveness. The presence of both state-owned and private players creates a balanced competitive environment, encouraging innovation and service differentiation. Market dynamics reflect sensitivity to global oil demand fluctuations and geopolitical influences. It demands continuous capacity expansion and technology upgrades to address evolving storage needs and regulatory standards. These characteristics define the operational landscape and competitive behavior within the global oil storage terminal sector.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage:

The research report offers an in-depth analysis based on Type, Tank Type and Product It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Increasing global oil demand will drive expansion of storage terminal capacities worldwide.

- Emerging economies in Asia Pacific and Africa will present significant growth opportunities.

- Investment in advanced storage technologies will enhance operational efficiency and safety.

- Regulatory focus on environmental sustainability will push adoption of eco-friendly infrastructure.

- Strategic reserves will gain importance amid geopolitical uncertainties and supply disruptions.

- Integration of digital solutions and automation will optimize terminal management and reduce costs.

- Diversification into storing alternative fuels and petrochemicals will broaden market scope.

- Collaborations and mergers will continue to consolidate market positions among key players.

- Infrastructure modernization will address aging assets and improve storage reliability.

- Growing demand for flexible and modular storage solutions will support evolving energy transition needs.