Market Overview:

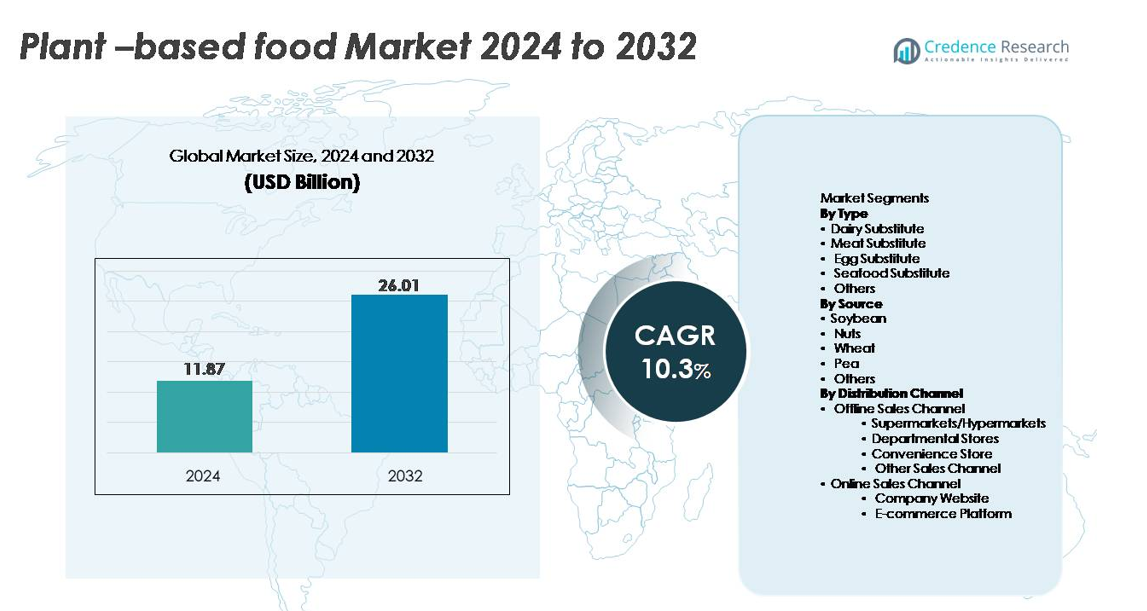

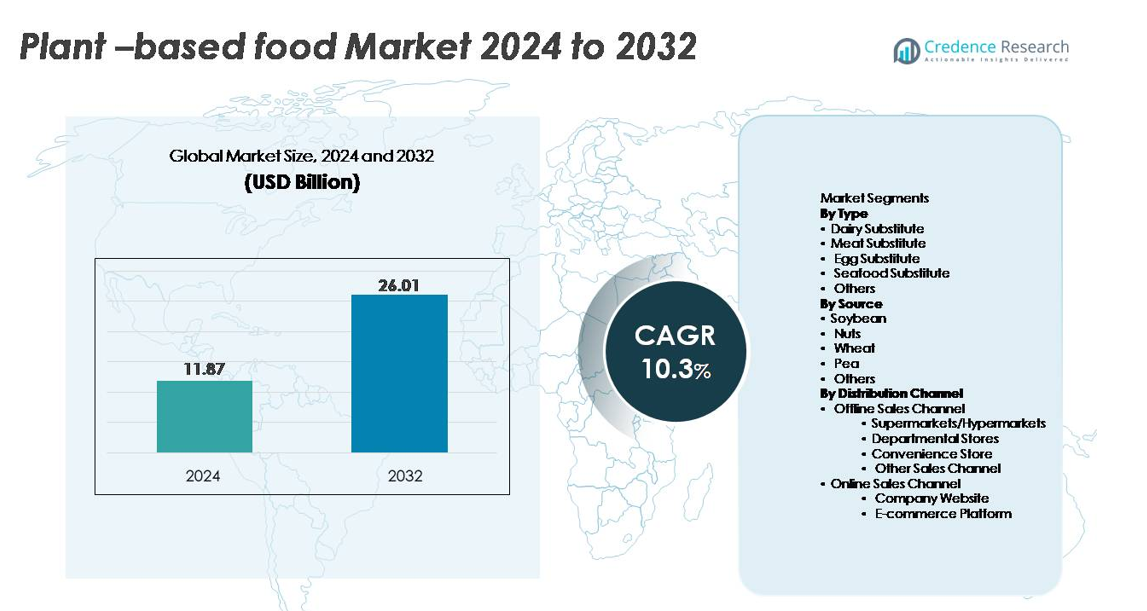

The global plant-based food market was valued at USD 11.87 billion in 2024 and is projected to reach USD 26.01 billion by 2032, reflecting a CAGR of 10.3% over the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Plant-Based Food Market Size 2024 |

USD 11.87 billion |

| Plant-Based Food Market, CAGR |

10.3% |

| Plant-Based Food Market Size 2032 |

USD 26.01 billion |

The plant-based food market is shaped by a highly competitive group of innovators and established food manufacturers. Leading players such as Good Catch Foods, Greenleaf Foods SPC, Upfield (Violife, Flora Plant), Unilever (The Vegetarian Butcher), Kellogg Company (MorningStar Farms), Tofurky Co., Inc., and Maple Leaf Foods Inc. (Lightlife, Field Roast) continue to expand portfolios through advanced protein technologies, clean-label formulations, and strategic retail partnerships. North America remains the leading region with a 38–40% global market share, driven by strong flexitarian adoption, high product availability, and robust brand visibility. Europe follows closely with 32–34%, supported by progressive sustainability policies and widespread consumer acceptance of plant-based diets.

Market Insights:

- The global plant-based food market was valued at USD 11.87 billion in 2024 and is projected to reach USD 26.01 billion by 2032, registering a CAGR of 10.3%, driven by rising mainstream adoption of dairy, meat, and egg alternatives.

- Strong market drivers include expanding flexitarian diets, growing lactose-intolerance awareness, and rapid innovation in high-moisture extrusion, clean-label formulations, and nutrient-fortified plant proteins that enhance taste and texture.

- Key trends feature the rise of sustainable sourcing, precision-fermented ingredients, hybrid protein systems, and premium plant-based dairy leading the type segment with the highest share.

- Competitive intensity increases as major players expand product portfolios, scale manufacturing, and strengthen omnichannel distribution while facing restraints such as high product pricing, raw-material volatility, and sensory-performance gaps in cheese and meat analogs.

- Regionally, North America leads with 40%, followed by Europe at 34%, while Asia-Pacific grows fastest; supermarkets/hypermarkets dominate distribution, accounting for the largest channel share.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Type

Dairy substitutes represent the dominant segment, capturing the largest share due to strong global demand for plant-based milk, yogurt, cheese, and cream alternatives. Their leadership is driven by broad retail availability, high product innovation, and widespread lactose intolerance. Continuous advancements in flavor and texture particularly in oat-, almond-, and soy-based dairy formulations support repeat purchases and category expansion. Meat substitutes follow closely, benefitting from rising flexitarian adoption, while egg and seafood substitutes are gaining traction as manufacturers improve functional properties in cooking, baking, and structured food applications.

- For instance, Oatly’s Ma’anshan facility in China can produce up to 150 million liters of oat-based beverages annually, enabling large-scale supply for retail and foodservice channels.”

By Source

Soybean remains the largest source segment, accounting for the highest market share owing to its well-established processing technology, high protein concentration, and versatile functionality across dairy, meat, and bakery alternatives. Its mature supply chain and cost-efficient production strengthen its dominance, especially in Asia-Pacific and North America. Pea protein is the fastest-growing source as brands shift toward allergen-friendly, non-GMO, and neutral-flavor ingredients suitable for clean-label positioning. Nuts and wheat-based proteins contribute steady demand from premium dairy substitutes and structured meat analogs, while emerging sources such as chickpea and fava continue to diversify formulations.

- For instance, Fuji Oil’ssoy protein ingredient business operates globally, with a leading market share in Japan and a significant presence in China and other regions, supplying a wide range of soy protein ingredients for food manufacturers worldwide.

By Distribution Channel

Supermarkets and hypermarkets hold the dominant share within offline distribution, driven by their extensive SKU variety, strong merchandising, and ability to support refrigerated and frozen plant-based assortments. Consumers prefer these channels for product comparison, access to new launches, and promotional pricing. Online sales are expanding rapidly as company-owned websites and e-commerce platforms strengthen direct-to-consumer engagement through subscription models, customization options, and improved last-mile cold chain solutions. Convenience stores and departmental stores contribute additional reach, particularly in urban areas with high adoption of ready-to-consume and single-serve plant-based offerings.

Key Growth Drivers:

Rising Health Awareness and Shift Toward Flexitarian Diets

Growing consumer preference for healthier, plant-forward diets remains a powerful driver of the plant-based food market. Consumers increasingly associate plant-derived proteins with benefits such as improved cardiovascular health, lower saturated fat intake, and better weight management. The rapid growth of flexitarianism has expanded the consumer base beyond vegans and vegetarians, encouraging mainstream adoption of dairy, meat, and egg alternatives. Food manufacturers actively reformulate products to reduce additives, enhance nutrient profiles, and incorporate whole-food ingredients, strengthening consumer trust. The surge in chronic lifestyle conditions particularly diabetes and obesity further motivates consumers to replace animal-based foods with functional plant-based options. Combined with broader government-supported nutrition education campaigns, this health-centric shift continues to expand product penetration across all demographic groups.

- For instance, Danone implemented a company-wide initiative between 2016 and 2020 to reformulate its products and improve their nutritional quality, including reducing sugars, fat, and salt. By the end of 2020, Danone successfully aligned 73% of its global dairy product volumeswith its internal sugar targets, an increase from 54% in 2016.

Innovation in Plant Protein Processing and Product Formulation

Advances in processing technologies such as high-moisture extrusion, precision fermentation, enzymatic modification, and shear-cell structuring are significantly improving the taste, texture, and nutritional profile of plant-based foods. These innovations help manufacturers replicate the fibrous structure of meat, enhance creaminess in dairy substitutes, and improve binding and whipping properties in egg alternatives. Companies increasingly adopt clean-label formulations and hybrid protein systems to enhance sensory performance while reducing reliance on single ingredients such as soy or wheat. Continuous investment in R&D enables the development of fortified products with improved amino-acid profiles, better heat stability, and reduced off-notes. This technological progress accelerates consumer acceptance by closing the sensory gap between plant-based and conventional foods, directly supporting market expansion.

- For instance, Impossible Foods’ precision-engineered heme ingredient is produced via a proprietary fermentation process that operates at commercial scale, generating thousands of liters per batch to deliver meat-like flavor and aroma.

Expansion of Retail Distribution and Strengthening Omnichannel Presence

The widening availability of plant-based products across retail shelves has been instrumental in accelerating market growth. Supermarkets, hypermarkets, and specialty health stores continue to expand shelf space and diversify assortments across refrigerated, frozen, and ambient categories. Major retailers are partnering with plant-based brands to introduce private-label lines and exclusive product placements. Simultaneously, e-commerce platforms and company-owned websites fuel rapid growth in direct-to-consumer models, supported by subscription deliveries and personalized product recommendations. Improvements in cold-chain logistics ensure safe transport of plant-based dairy and meat substitutes. As omnichannel distribution matures, consumers gain seamless access to a wide range of products, strengthening repeat purchases and regional market penetration.

Key Trends & Opportunities:

Growth of Clean-Label, Sustainable, and Regenerative Ingredient Sourcing

The plant-based food market is witnessing a strong shift toward clean-label formulations and environmentally responsible sourcing. Brands are reducing artificial additives, focusing on minimally processed ingredients, and adopting organic and non-GMO raw materials to meet consumer expectations for transparency. Sustainability-driven innovations such as regenerative agriculture, reduced water-use crop systems, and carbon-neutral manufacturing create new differentiation opportunities. Companies are integrating eco-friendly packaging solutions and improving supply-chain traceability, supported by blockchain systems and digital labeling. This emphasis on sustainability not only strengthens consumer trust but also positions plant-based foods as key contributors to climate-positive food systems, enabling brands to appeal to ethically minded and environmentally conscious consumers.

- For instance, the Danone North AmericaRegenerative Agriculture Program has expanded to nearly 150,000 acres (approximately 60,700 hectares) across the U.S. and Canada.

Rising Demand for High-Protein, Functional, and Nutrient-Fortified Plant-Based Foods

Consumers are increasingly seeking plant-based foods that deliver not just meat or dairy replacement but enhanced functional benefits such as high protein content, energy support, gut health, and immune modulation. This trend encourages manufacturers to fortify products with vitamins, minerals, omega fatty acids, prebiotics, and complete amino acid profiles. The opportunity for high-protein snacks, performance nutrition beverages, and fortified dairy alternatives is expanding rapidly. Companies are blending multiple plant proteins such as pea, chickpea, fava, and brown rice to achieve superior nutritional and sensory profiles. The integration of functional botanicals, adaptogens, and fiber-rich ingredients further widens product applications, strengthening opportunities in the wellness-driven consumption landscape.

- For instance, Nestlé’s plant-based Garden Gourmet Sensational Burger delivers approximately 15.8 grams of protein per 113-gram patty using a proprietary soy and wheat protein matrix engineered to mimic muscle fiber formation validated through extensive internal sensory panel testing across its European R&D network.

Emergence of Novel Proteins and Precision-Fermented Ingredients

The incorporation of next-generation proteins presents a major opportunity for future market expansion. Precision fermentation enables the production of animal-identical dairy proteins, enzymes, and fats without animal inputs, allowing manufacturers to create superior cheese, yogurt, and ice-cream analogs. Novel botanical proteins from lupin, canola, sorghum, and microalgae are gaining attention for their sustainability profile and improved sensory versatility. Companies are exploring hybrid formulations that combine plant proteins with fermented fats or flavor compounds to deliver enhanced creaminess and aroma. As regulatory approvals expand and production scales up, these advanced ingredients will significantly reshape the competitive landscape.

Key Challenges:

Taste, Texture, and Ingredient Authenticity Limitations

Despite significant progress, many plant-based products still face challenges in matching the sensory performance of animal-based counterparts. Off-flavors from pea, soy, or wheat proteins; textural inconsistencies in meat analogs; and meltability issues in plant-based cheeses limit repeat purchases. Achieving clean-label formulations while maintaining desirable texture and stability remains a complex technical barrier. Additionally, consumers increasingly scrutinize long ingredient lists and perceive some formulations as overly processed. These sensory and formulation limitations pose a challenge for broader mainstream adoption, particularly among non-vegan consumers who frequently compare plant-based products directly with their traditional equivalents.

Price Sensitivity, Supply-Chain Complexity, and Raw Material Volatility

Plant-based foods often carry premium price points due to cost-intensive ingredient processing, advanced technology requirements, and the need for high-quality raw materials. Price-sensitive consumers may hesitate to switch from conventional products, especially in emerging markets. Supply-chain challenges including fluctuating availability of soy, peas, and nuts, climate-related yield variations, and dependency on imported protein concentrates further elevate production costs. Manufacturers must also manage cold-chain logistics for dairy and meat substitutes, increasing operational complexity. These cost and supply constraints challenge manufacturers’ ability to scale efficiently while maintaining consistent quality and affordability.

Regional Analysis:

North America

North America commands the largest share of the plant-based food market, accounting for 40% of global revenue. Strong consumer adoption of vegan and flexitarian diets, widespread lactose intolerance awareness, and expanding availability of plant-based dairy, meat, and functional beverages drive regional growth. Major retailers continuously broaden plant-based assortments across refrigerated and frozen categories, while foodservice chains rapidly integrate plant-based menu offerings. High R&D investments in protein innovation, advanced extrusion technologies, and clean-label formulations further strengthen market penetration. Additionally, favorable marketing regulations and strong brand visibility contribute to sustained leadership.

Europe

Europe holds the second-largest share, contributing 34% of the global market due to robust regulatory support for sustainable diets and high consumer preference for environmentally responsible food choices. Countries such as Germany, the U.K., the Netherlands, and Sweden lead consumption, supported by mature retail infrastructure and strong demand for organic, non-GMO, and clean-label products. Government-backed initiatives promoting reduced animal protein intake and carbon-neutral food systems further accelerate adoption. Extensive presence of specialty vegan brands, expanded private-label offerings, and rapid retail innovation in plant-based dairy and meat alternatives position Europe as a highly progressive market.

Asia-Pacific

Asia-Pacific represents one of the fastest-growing regions, capturing 20% of global market share, driven by rising disposable incomes, urbanization, and increasing acceptance of plant-based protein as part of modern diets. Countries such as China, Japan, Australia, and South Korea are witnessing rapid expansion of plant-based dairy, RTD beverages, and meat substitutes. Traditional soy-based foods provide a strong cultural foundation, while innovative pea-, nut-, and rice-based products attract younger consumers. E-commerce penetration, health-focused marketing, and investments from regional and international brands further boost commercialization. The region’s expanding cold-chain capabilities and shifting dietary preferences support long-term growth.

Latin America

Latin America holds a developing yet expanding share of 7%, supported by growing health consciousness, demand for lactose-free foods, and wider availability of plant-based milk and meat alternatives. Brazil, Mexico, Chile, and Argentina are the primary contributors, with supermarket chains increasing shelf space for imported and local plant-based brands. Although price sensitivity remains a constraint, rising interest among young and urban consumers accelerates adoption. Regional manufacturers are incorporating native crops such as chia, quinoa, and amaranth to diversify product offerings. Strengthening distribution networks and expanding e-commerce platforms are expected to support deeper market penetration.

Middle East & Africa

The Middle East & Africa region accounts for 5% of global share, with growth driven by increasing awareness of plant-based nutrition, rising lifestyle diseases, and demand for dairy-free foods among lactose-intolerant populations. The UAE, Saudi Arabia, Israel, and South Africa lead regional consumption due to strong retail modernization and growing expatriate populations familiar with plant-based diets. Premium supermarkets and specialty health stores are expanding assortments of plant-based milks, spreads, and meat alternatives. Although affordability and limited local manufacturing remain challenges, rising investments in plant-based processing and food-tech innovation support future market expansion.

Market Segmentations:

By Type

- Dairy Substitute

- Meat Substitute

- Egg Substitute

- Seafood Substitute

- Others

By Source

- Soybean

- Nuts

- Wheat

- Pea

- Others

By Distribution Channel

- Offline Sales Channel

- Supermarkets/Hypermarkets

- Departmental Stores

- Convenience Store

- Other Sales Channel

- Online Sales Channel

- Company Website

- E-commerce Platform

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape:

The competitive landscape of the plant-based food market is characterized by rapid innovation, strong brand positioning, and expanding investments from both established food manufacturers and emerging startups. Leading players focus on developing next-generation plant proteins, improving sensory performance, and expanding clean-label product portfolios across dairy, meat, and egg alternatives. Companies such as Beyond Meat, Impossible Foods, Oatly, Nestlé, Danone, and Kraft Heinz leverage advanced processing technologies and global distribution networks to strengthen market reach. Strategic activities including mergers, acquisitions, and partnerships with retail chains and foodservice operators further accelerate market penetration. Additionally, brands are adopting sustainability-driven sourcing models, precision fermentation technologies, and proprietary protein blends to differentiate offerings. Competitive intensity continues to rise as retailers expand private-label plant-based product lines and regional manufacturers introduce cost-efficient alternatives tailored to local preferences.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- Good Catch Foods

- Greenleaf Foods SPC

- Upfield (Violife, Flora Plant)

- Unilever (The Vegetarian Butcher)

- Kellogg Company (MorningStar Farms)

- Tofurky Co., Inc.

- Maple Leaf Foods Inc. (Lightlife, Field Roast)

Recent Developments:

- In November 2025, Unilever announced a bold “Future Foods” ambition, under which it plans to expand and reposition its plant-based offerings through the brand The Vegetarian Butcher

- In February 2025, Unilever the company faced scrutiny for its plant-based meat business as shifting consumer preferences and declining valuations complicated its plan to reduce exposure to some meat-alternative products.

- In March 2024, Lightlife announced a new product launch: Tempeh Protein Crumbles (Original and Smoked Chipotle flavors), offering 16 grams of protein and 6 grams of fiber per serving to cater to demand for convenient, protein-rich, plant-based options.

Report Coverage:

The research report offers an in-depth analysis based on Type, Source, Distribution channel and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- The market will expand as consumers increasingly adopt flexitarian and health-focused eating patterns across all major regions.

- Product innovation will intensify with advancements in extrusion, enzymatic modification, and fermentation improving taste, texture, and nutritional profiles.

- Precision-fermented and novel botanical proteins will gain commercial scale, enabling more realistic dairy and meat analogs.

- Clean-label, minimally processed, and allergen-friendly formulations will become standard expectations across retail categories.

- Retailers will allocate greater shelf space to plant-based assortments, strengthening private-label penetration.

- E-commerce and direct-to-consumer channels will grow rapidly through subscription models and personalized nutrition offerings.

- Sustainability commitments will drive adoption of regenerative agriculture, low-carbon production, and recyclable packaging.

- Hybrid protein systems combining multiple plant sources will become more common to enhance amino-acid balance and functional performance.

- Manufacturers will focus on regionalized product development tailored to local cuisines and price sensitivities.

- Increased investments, partnerships, and consolidations will reshape competition as global food companies scale plant-based manufacturing and distribution.