Market Overview

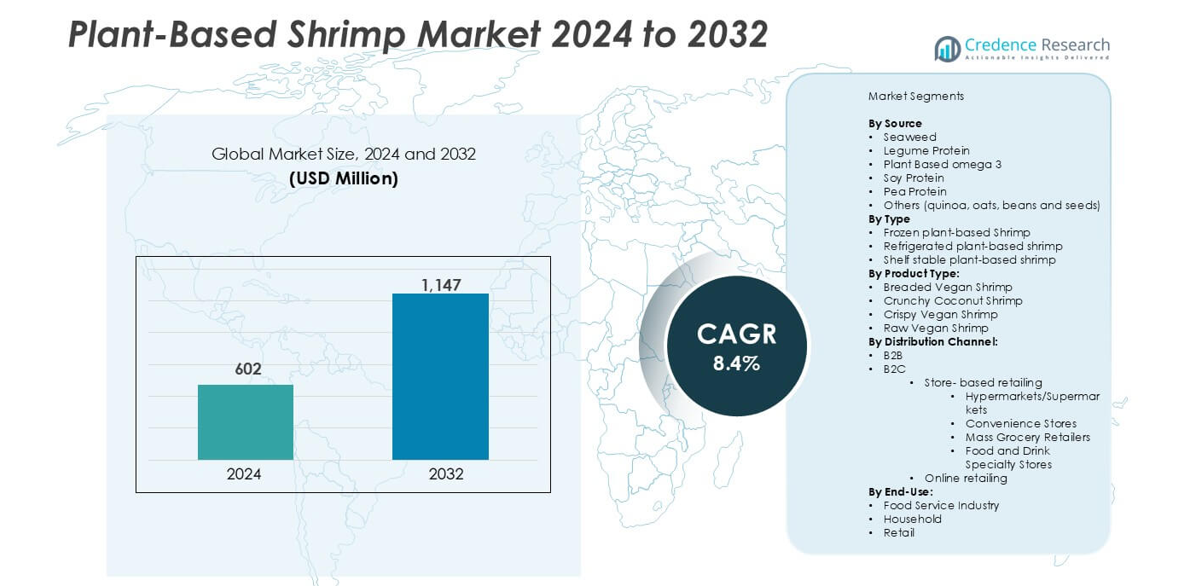

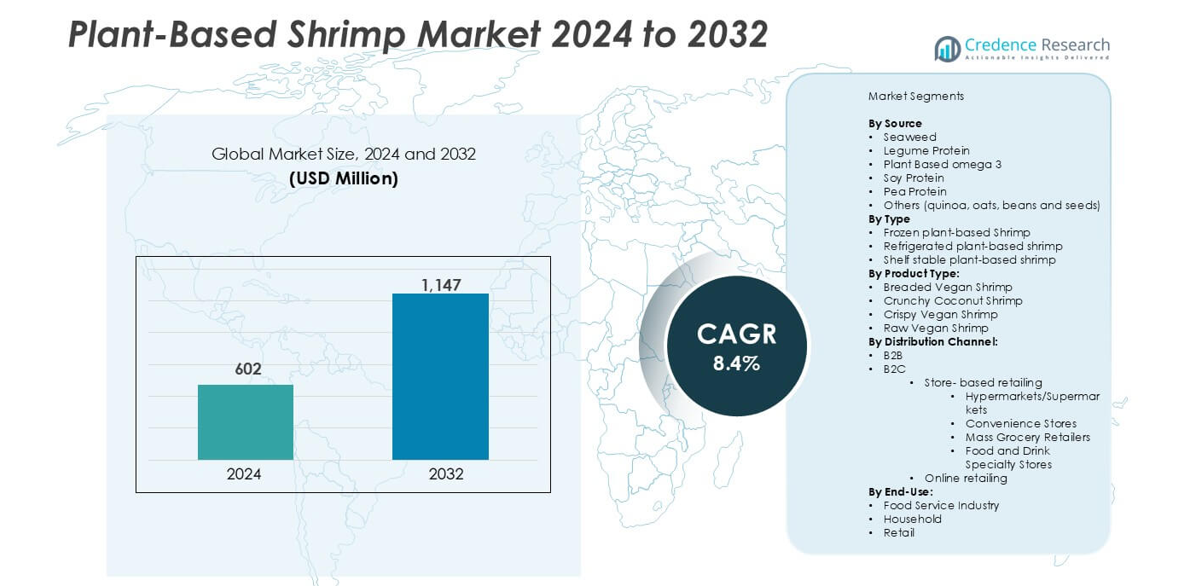

The Plant-Based Shrimp market size was valued at USD 602 million in 2024 and is anticipated to reach USD 1,147 million by 2032, registering a CAGR of 8.4% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Plant-Based Shrimp Market Size 2024 |

USD 602 million |

| Plant-Based Shrimp Market, CAGR |

8.4% |

| Plant-Based Shrimp Market Size 2032 |

USD 1,147 million |

The plant-based shrimp market is led by companies such as Thai Union, ProExpo, Omarsa, Zhanjiang Guolian, Quoc Viet, Nekkanti Sea Foods, The Liberty Group, Devi Fisheries, Royal Greenland A/S, and Pescanova. These players focus on developing sustainable and high-protein shrimp alternatives using seaweed, soy, and pea protein bases. North America holds the largest regional share of 38%, supported by strong consumer awareness, retail expansion, and advanced R&D capabilities. Europe follows with 30% share, driven by clean-label trends and eco-friendly food regulations, while Asia-Pacific accounts for 24%, benefiting from growing vegan populations and seafood innovation hubs.

Market Insights

- The plant-based shrimp market was valued at USD 602 million in 2024 and is projected to reach USD 1,147 million by 2032, registering a CAGR of 8.4%.

- Rising environmental concerns, overfishing, and demand for sustainable protein sources are driving market growth across foodservice and retail channels.

- Key trends include innovation in seaweed and pea protein formulations, clean-label ingredient development, and expanding vegan seafood portfolios by global brands.

- Major players such as Thai Union, Omarsa, and The Plant-Based Seafood Co. focus on R&D, partnerships, and product differentiation to strengthen market positions.

- North America leads with 38% share, followed by Europe at 30% and Asia-Pacific at 24%; seaweed-based shrimp dominates by source, while frozen plant-based shrimp holds the largest type share globally.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Source

Seaweed dominates the plant-based shrimp market with over 34% share in 2024 due to its rich umami flavor and sustainable cultivation. Seaweed-based shrimp analogs replicate authentic taste and texture while offering high nutritional value and low environmental impact. Producers such as New Wave Foods and Sophie’s Kitchen utilize seaweed extract and algal proteins to enhance product quality. Rising consumer preference for ocean-friendly and allergen-free seafood alternatives drives the segment growth, supported by innovation in algae-derived proteins and plant-based omega-3 fortification technologies.

- For instance, New Wave Foods developed shrimp alternatives using seaweed extract and mung bean protein in formulations of up to 20 % algae content per batch.

By Type

Frozen plant-based shrimp holds the largest share of about 52% in 2024, owing to its longer shelf life and convenient storage for retail and foodservice channels. Manufacturers focus on improving freezing technology to preserve moisture and texture comparable to real shrimp. Frozen variants are gaining traction across supermarkets and quick-service restaurants due to consistent product quality. Increasing adoption of frozen vegan seafood in global supply chains and e-commerce platforms further supports this segment’s expansion, while refrigerated and shelf-stable types cater to niche urban consumers.

- For instance, several manufacturers maintain internal product temperatures at –18 °C and achieve thaw drip losses under 5 g per 100 g after freezing.

By Product Type

Breaded vegan shrimp leads the product type segment with nearly 45% market share in 2024. Its crunchy coating and ready-to-cook format appeal to flexitarian and fast-food consumers. Companies such as Beleaf and The Plant-Based Seafood Co. invest in advanced breading formulations using pea protein and rice flour to mimic traditional shrimp. The rising demand for quick-preparation plant-based meals and snack-friendly seafood alternatives accelerates this segment’s growth, supported by the launch of innovative coconut- and crispy-style variants targeting global retail and restaurant chains.

Key Growth Drivers

Growing Flexitarian and Vegan Population

The global shift toward plant-forward diets is significantly boosting the demand for vegan seafood alternatives. Flexitarians, who occasionally consume animal products, represent a large share of this growth. They are motivated by health consciousness, animal welfare, and environmental concerns. Plant-based shrimp appeals to this group due to its high protein and low cholesterol content. Major retail chains and quick-service restaurants are expanding vegan menu options to meet this growing consumer base. Marketing campaigns emphasizing “cruelty-free seafood” and “ocean-safe nutrition” are further fueling adoption. This consumer-driven transition is expected to continue strengthening plant-based shrimp sales worldwide.

- For instance, over 40 % of consumers globally identified as flexitarian by 2025, supporting uptake of plant-based shrimp products.

Advancements in Food Technology and Product Innovation

Technological improvements in texture enhancement, extrusion, and flavor replication are transforming the plant-based shrimp market. New formulations use seaweed extracts, pea protein isolates, and fermentation-based oils to deliver the elasticity and mouthfeel of traditional shrimp. Companies like New Wave Foods and OmniFoods are investing heavily in R&D to achieve higher sensory parity and cleaner ingredient lists. These innovations are expanding applications in ready-to-eat, frozen, and restaurant menus. Continuous developments in encapsulated flavor systems and plant-based omega-3 integration further improve product quality. The advancement of scalable production and improved freezing technologies will sustain market competitiveness.

- For instance, New Wave Foods uses seaweed and soy protein in formulations that retain springy texture and protein levels comparable to conventional shrimp.

Rising Demand for Sustainable Seafood Alternatives

The growing awareness of overfishing, ocean pollution, and the carbon footprint of traditional seafood production is driving the adoption of plant-based shrimp. Consumers are increasingly choosing sustainable protein sources that protect marine ecosystems while offering comparable nutrition and flavor. Companies are responding by developing algae- and seaweed-based shrimp that replicate real shrimp texture without environmental harm. Governments and NGOs are also promoting alternative proteins through awareness campaigns and clean-label certifications. As sustainability becomes a key purchase factor, plant-based shrimp manufacturers gain strong traction in retail and foodservice channels, especially across North America and Europe.

Key Trends & Opportunities

Expansion Across Foodservice and Retail Channels

Plant-based shrimp is rapidly expanding into mainstream retail and restaurant networks as global brands partner with alternative seafood producers. Foodservice chains and frozen food brands are adding plant-based shrimp to sushi rolls, tacos, and pasta dishes to attract flexitarian consumers. Retail visibility through supermarkets and online grocery platforms has surged, supported by improved cold chain logistics. Collaborations between manufacturers and food distributors are enhancing availability in North America, Europe, and Asia-Pacific. The ongoing integration of vegan shrimp into diverse cuisines and meal formats presents a major opportunity for sustained market penetration.

- For instance, in March 2021, New Wave Foods announced a partnership with Dot Foods, a major U.S. food redistributor, to distribute its plant-based shrimp. This deal gave New Wave Foods access to thousands of foodservice operations across the country.

Innovation in Ingredient Sourcing and Clean Label Formulations

Manufacturers are shifting toward clean-label, allergen-free, and non-GMO ingredients to meet evolving consumer expectations. Seaweed, mung beans, and chickpeas are emerging as preferred raw materials for their nutritional and sustainability benefits. Companies are also exploring fermentation and enzymatic processing to enhance flavor and texture naturally. The demand for simple ingredient lists and functional nutrients, such as omega-3 fatty acids and fiber, continues to grow. Brands emphasizing transparency and natural sourcing are gaining stronger consumer trust, particularly among health-conscious buyers and premium vegan product lines.

Key Challenges

High Production Costs and Limited Economies of Scale

Despite increasing demand, production costs for plant-based shrimp remain high due to complex formulations and limited manufacturing infrastructure. The use of specialty ingredients such as algal oil and textured proteins raises operational expenses. Scaling production while maintaining quality and sensory appeal poses a challenge for emerging brands. Moreover, limited processing facilities for alternative seafood create supply bottlenecks. Manufacturers must invest in process optimization and ingredient innovation to achieve cost parity with traditional shrimp. Achieving affordability without compromising quality will be crucial for large-scale market penetration.

Consumer Skepticism and Taste Acceptance

Taste and texture remain key barriers to broader adoption of plant-based shrimp. Many consumers still perceive vegan seafood as inferior in flavor or authenticity compared to real shrimp. Overcoming this perception requires continuous R&D to replicate the complex chewiness and oceanic flavor profile of shrimp. Brands are conducting sensory testing and collaborating with chefs to refine formulations. Marketing strategies emphasizing taste parity and environmental benefits are helping shift perceptions, but overcoming ingrained seafood preferences remains a gradual process. Building consumer trust through sampling and education is essential for long-term success.

Regional Analysis

North America

North America dominates the plant-based shrimp market with nearly 38% share in 2024. The region’s strong demand stems from rising vegan seafood adoption and environmental awareness. Consumers are shifting toward sustainable protein options, supported by advanced retail distribution and high purchasing power. Companies like New Wave Foods and The Plant-Based Seafood Co. lead with large-scale retail and foodservice collaborations. Expanding plant-based menus across restaurants and supermarkets in the U.S. and Canada continues to drive steady growth, while ongoing product innovation and marketing around sustainability strengthen market leadership.

Europe

Europe accounts for about 30% of the global market, driven by stringent sustainability regulations and growing flexitarian lifestyles. Consumers in countries such as Germany, the U.K., and the Netherlands increasingly prefer ocean-friendly protein substitutes. The region benefits from advanced R&D and widespread availability of vegan seafood through major retail chains. European manufacturers emphasize non-GMO, allergen-free, and clean-label ingredients. The EU’s focus on reducing seafood imports and supporting alternative proteins further boosts local production. Innovation in flavor development and texture enhancement ensures a strong competitive position for European brands.

Asia-Pacific

Asia-Pacific holds nearly 24% of the market, supported by rapid urbanization, dietary diversification, and seafood dependency. Countries such as China, Japan, and Singapore are witnessing fast adoption of plant-based seafood due to health and sustainability concerns. Local startups and global brands are investing in algae-based shrimp production and distribution partnerships. Government initiatives promoting sustainable aquaculture alternatives further enhance growth prospects. Rising disposable income and growing vegan populations across key economies are fueling demand, especially in frozen and ready-to-eat product segments distributed through online retail and supermarkets.

Latin America

Latin America captures about 5% market share, with Brazil and Mexico leading adoption. The region’s growing awareness of ocean conservation and plant-based diets is driving early market expansion. Local producers are collaborating with global vegan seafood brands to introduce cost-effective shrimp alternatives in supermarkets and restaurants. Increased consumer interest in sustainable food production and plant-based protein innovation is encouraging investment in regional manufacturing. However, limited cold chain infrastructure and price sensitivity currently restrict wider market penetration, though retail presence and foodservice partnerships are steadily increasing.

Middle East & Africa

The Middle East & Africa region holds around 3% of the global share, with gradual growth fueled by rising vegan product availability and international trade partnerships. Countries like the UAE and South Africa are emerging as key markets due to increasing health consciousness and premium food imports. Global players are expanding distribution in the region’s retail and hospitality sectors. The demand for sustainable and halal-certified plant-based seafood options is increasing. Despite infrastructure challenges, expanding awareness campaigns and higher urban consumption levels are creating long-term growth opportunities.

Market Segmentations:

By Source

- Seaweed

- Legume Protein

- Plant Based omega 3

- Soy Protein

- Pea Protein

- Others (quinoa, oats, beans and seeds)

By Type

- Frozen plant-based Shrimp

- Refrigerated plant-based shrimp

- Shelf stable plant-based shrimp

By Product Type:

- Breaded Vegan Shrimp

- Crunchy Coconut Shrimp

- Crispy Vegan Shrimp

- Raw Vegan Shrimp

By Distribution Channel:

-

- Store- based retailing

- Hypermarkets/Supermarkets

- Convenience Stores

- Mass Grocery Retailers

- Food and Drink Specialty Stores

- Online retailing

By End-Use:

- Food Service Industry

- Household

- Retail

By Geography:

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the plant-based shrimp market is moderately consolidated, with leading players focusing on innovation, sustainability, and global expansion. Companies such as Thai Union, ProExpo, Omarsa, and Zhanjiang Guolian are investing in alternative seafood R&D to reduce reliance on conventional shrimp farming. Emerging plant-based specialists like The Plant-Based Seafood Co. and New Wave Foods are driving product innovation through algae- and pea protein-based formulations that replicate real shrimp texture and flavor. Strategic partnerships with retail and foodservice brands are expanding distribution networks across North America, Europe, and Asia-Pacific. Major seafood producers are diversifying into vegan shrimp to meet growing consumer demand for sustainable and allergen-free options. Continuous advancements in extrusion technology, ingredient sourcing, and clean-label production are intensifying competition, while marketing efforts centered on environmental impact and taste parity further differentiate brands in this evolving global market.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Thai Union

- ProExpo

- Omarsa

- Zhanjiang Guolian

- Quoc Viet

- Nekkanti Sea Foods

- The Liberty Group

- Devi Fisheries

- Royal Greenland A/S

- Pescanova

Recent Developments

- In July 2024, Big Idea Ventures launched Bayou Best Foods after acquiring intellectual property from New Wave Foods, with plans to bring plant-based shrimp products to market by the end of 2024.

- In January 2024, Steakholder Foods, based in Israel, unveiled the world’s first 3D-printed plant-based shrimp, crafted to closely mimic the texture and appearance of traditional shrimp.

- In July 2023, Thai Union, a Thailand-based food producer, launched plant-based shrimp dumplings and announced plans to expand its branded plant-based offerings across European markets.

- In March 2023, New Wave Foods entered a strategic distribution partnership with Dot Foods to roll out plant-based shrimp made from seaweed and plant proteins across the U.S. foodservice industry.

Report Coverage

The research report offers an in-depth analysis based on Source, Type, Product Type, Distribution Channel, End-Use and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will grow steadily as demand for sustainable seafood alternatives increases.

- Advancements in plant protein and algae-based ingredients will enhance product quality.

- Frozen and ready-to-eat formats will gain stronger consumer acceptance worldwide.

- Foodservice chains will expand vegan shrimp offerings on global menus.

- Investment in R&D will improve texture, flavor, and nutritional profiles.

- Clean-label and allergen-free formulations will attract health-conscious consumers.

- Asia-Pacific will emerge as a key production and consumption hub.

- Strategic collaborations between seafood and plant-based companies will accelerate innovation.

- Retail expansion and e-commerce growth will boost product accessibility.

- Regulatory support for sustainable food production will strengthen market adoption