Market Overview

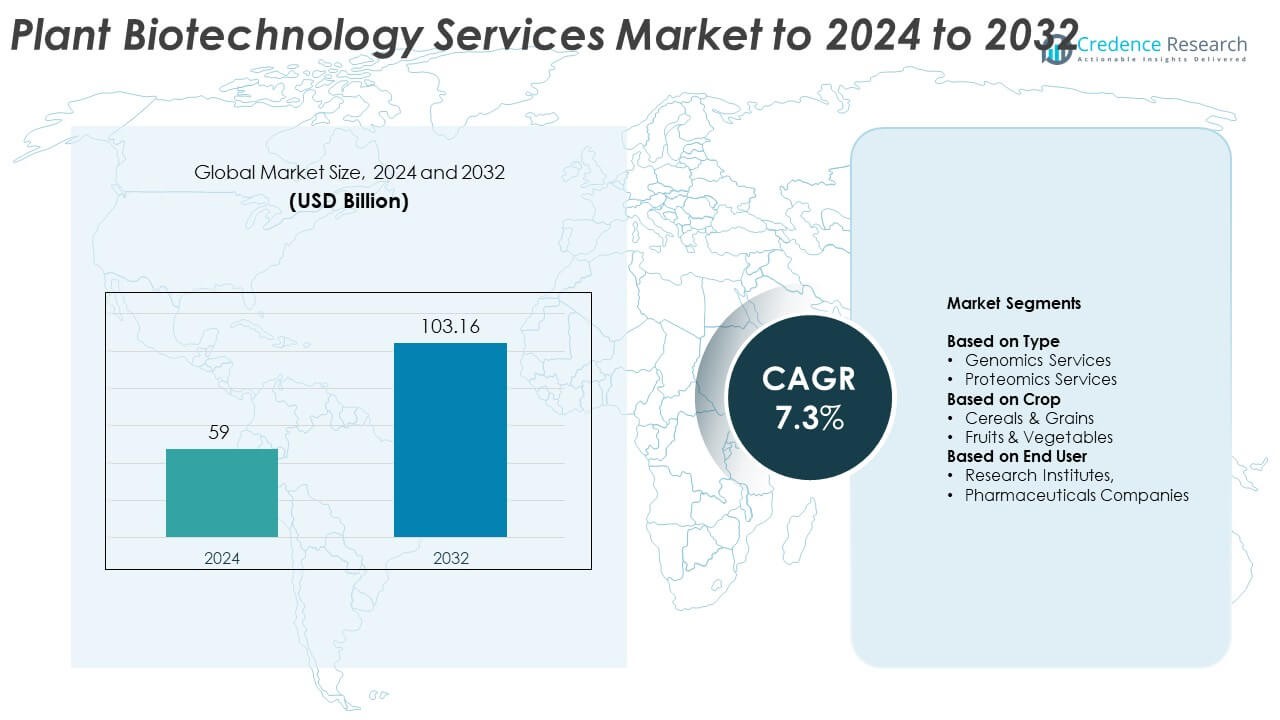

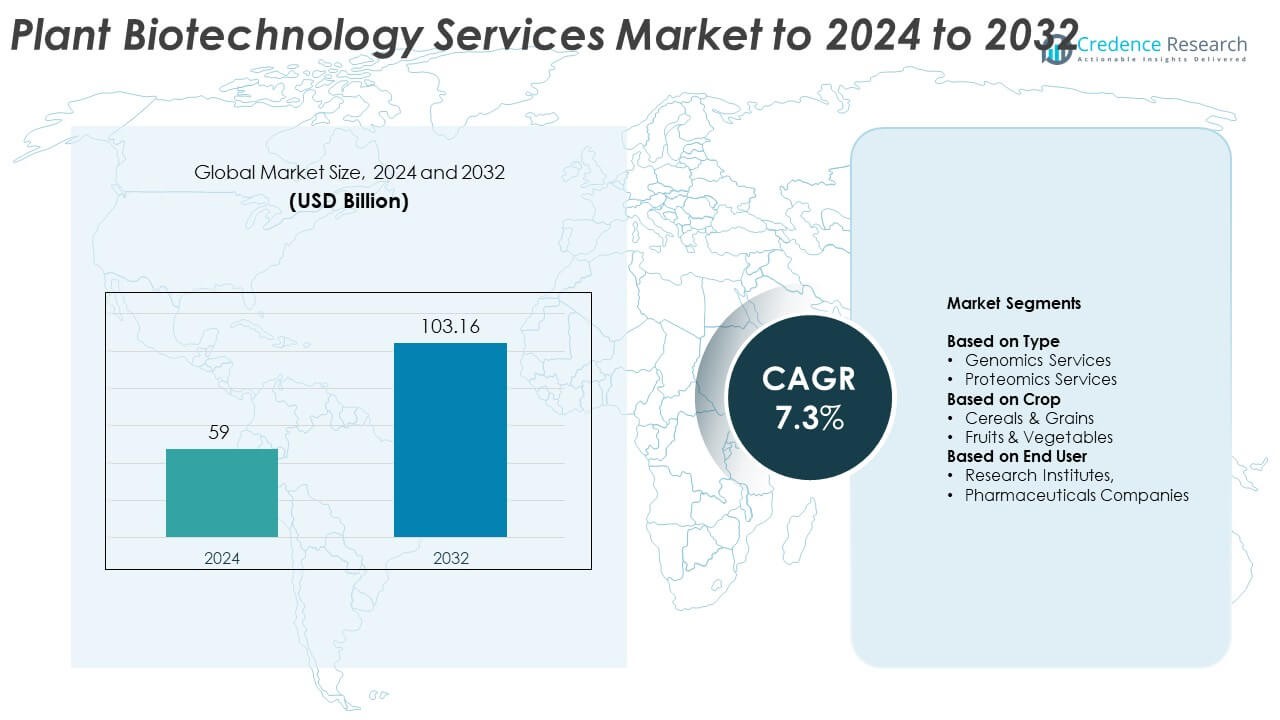

Plant Biotechnology Services Market size was valued USD 59 Billion in 2024 and is anticipated to reach USD 103.16 Billion by 2032, at a CAGR of 7.3% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Plant Biotechnology Services Market Size 2024 |

USD 59 Billion |

| Plant Biotechnology Services Market, CAGR |

7.3% |

| Plant Biotechnology Services Market Size 2032 |

USD 103.16 Billion |

The Plant Biotechnology Services Market includes leading innovators known for their strong capabilities in genomics, proteomics, and advanced crop-improvement services. These companies strengthen the market through high-throughput analysis, molecular breeding support, and multiomics integration that help research teams accelerate trait discovery. The competitive environment benefits from expanding investments in sustainable agriculture, plant-derived compounds, and stress-resilient crop development. North America leads the global market with a 38% share, supported by advanced research infrastructure, strong funding, and large-scale adoption of biotechnology tools across major crop segments. Europe and Asia Pacific follow, driven by rising demand for high-yield and climate-resilient varieties.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Plant Biotechnology Services Market was valued at USD 59 Billion in 2024 and will grow at a USD 103.16 Billion with CAGR of 7.3%.

- The Plant Biotechnology Services Market grows due to strong demand for high-yield and stress-resistant crops, which increases the use of genomics and proteomics services.

- The Plant Biotechnology Services Market benefits from rising trends such as multiomics integration, precision breeding, and digital agriculture, supporting faster and more accurate trait development.

- The Plant Biotechnology Services Market remains competitive as providers expand sequencing capacity and analytics capabilities while facing cost pressures and regulatory restraints.

- The Plant Biotechnology Services Market is led by North America with 38%, followed by Europe at 27% and Asia Pacific at 29%, while genomics services lead by type with a 46% share and cereals and grains dominate by crop with a 52% share.

Market Segmentation Analysis:

By Type

Genomics services lead the market with a 46% share due to strong demand for trait mapping, marker-assisted selection, and early disease detection. Many research teams use genomic tools to boost crop yield and stress resistance. The service model supports faster breeding cycles and reduces trial costs. Proteomics services grow as growers explore protein expression linked to plant health. Adoption rises as labs study plant responses to pests and climate stress. Expanding use of mass-spectrometry platforms strengthens service uptake across advanced research units.

- For instance, Illumina’s NovaSeq X generates up to 26 billion sequencing reads per run.

By Crop

Cereals and grains dominate the segment with a 52% share because breeders focus on yield stability and climate resilience. Rising demand for wheat, rice, and maize strengthens investment in genomic and proteomic pipelines. Research teams use these tools to screen drought-tolerant and disease-resistant varieties. Fruits and vegetables show steady growth as producers aim for improved shelf life and higher nutrient profiles. Controlled-environment farming boosts adoption in high-value horticulture. Research advances support faster evaluation of flavor, color, and stress traits.

- For instance, Syngenta’s S 6668 corn hybrid produced 46 versus 35 quintals per acre in farmer trials using its StartRight protocol.

By End User

Research institutes hold a 55% share due to strong project funding and continuous use of advanced sequencing and protein-analysis tools. Many institutes run long-term breeding and molecular biology programs that rely on outsourced service platforms. Their work covers stress biology, crop improvement, and genetic mapping. Pharmaceutical companies expand usage for plant-derived compounds and bioactive molecules. Interest rises in transgenic platforms and plant-based production systems. Growing concern for sustainable raw materials strengthens service demand in discovery programs.

Key Growth Drivers

Rising Demand for High-Yield and Stress-Resistant Crops

Growing need for stable food supply pushes farmers and research groups to adopt biotechnology services that enhance yield, drought tolerance, and disease resistance. Genomic and proteomic tools help breeders shorten development cycles and identify strong traits with higher accuracy. Climate change increases production risks, which drives faster adoption of advanced plant improvement platforms. Expanding global food consumption strengthens investments in molecular breeding programs, boosting service utilization across both public and private institutions.

- For instance, across all growing environments, Optimum AQUAmax products delivered an average 5.1 bushel-per-acre yield advantage over the competition in 2022.

Expanding Use of Molecular Tools in Crop Improvement

Modern breeding programs rely on sequencing, marker-assisted selection, and protein-expression analysis to accelerate crop enhancement. These tools support rapid screening of traits linked to growth, color, resistance, and nutrient quality. Research teams now integrate multiomics pipelines into routine workflows to improve precision and reduce trial failures. Strong adoption across cereals, grains, fruits, and vegetables pushes service providers to scale capacity. Continuous advances in data analytics strengthen the driver further.

- For instance, PacBio’s Revio system can sequence about 1,300 genomes per year at 30X coverage, supporting complex plant breeding and diversity panels.

Growing Shift Toward Sustainable Agriculture Practices

Producers and regulators favor biotechnology services that reduce chemical inputs and improve resource efficiency. Molecular testing helps identify varieties that need fewer fertilizers and have stronger natural resistance. This shift boosts demand from companies developing bio-based solutions and plant-derived compounds. Sustainability targets in major agricultural economies further accelerate adoption. As farming systems move toward eco-friendly approaches, biotechnology platforms play a central role in meeting productivity and environmental goals.

Key Trends & Opportunities

Growth of Multiomics Integration in Crop Research

Research groups adopt multiomics workflows that combine genomics, proteomics, transcriptomics, and metabolomics. This integration helps uncover complex plant responses and supports faster trait discovery. As labs aim for more accurate predictive models, multiomics platforms attract higher investment and create new service opportunities. Service providers offering combined data analysis and high-throughput tools find strong demand. This trend strengthens collaboration between research institutes and commercial agriculture programs.

- For instance, Bruker’s timsTOF Pro coupled with Evosep workflows can process 60 proteomics samples per day, enabling high-throughput plant protein profiling.

Emergence of Precision Breeding and Digital Agriculture

Precision breeding tools, supported by advanced analytics and remote sensing, create new opportunities for tailored trait selection. Digital platforms help researchers track plant behavior, growth patterns, and molecular signals more accurately. This shift accelerates high-value crop development and supports targeted biotechnology service adoption. Companies focusing on real-time data analysis and customizable breeding pipelines experience rising demand. The trend improves decision-making across modern agriculture systems.

- For instance, John Deere’s See & Spray system uses 36 boom-mounted cameras to detect weeds and guide targeted herbicide application at fine spatial resolution.

Rising Interest in Plant-Based Bioactive Compounds

Pharmaceutical and nutraceutical companies increase investment in plant-derived molecules for drug discovery and functional products. Biotechnology services support compound isolation, gene expression analysis, and pathway mapping. This rise creates strong opportunities for service providers with expertise in plant metabolic engineering. Demand grows as industries search for sustainable alternatives to synthetic ingredients. The trend strengthens long-term partnerships between biotech labs and global health companies.

Key Challenges

High Cost of Advanced Biotechnology Platforms

Sequencing, proteomic profiling, and high-throughput analysis require costly equipment and skilled personnel. Many small research units struggle to afford premium service packages, slowing adoption. Expensive data analysis tools also limit usage in developing regions. These barriers reduce market penetration and widen the gap between advanced and resource-limited labs. Service providers face pressure to balance pricing with technological upgrades, making cost management a major challenge.

Complex Regulatory and Intellectual Property Frameworks

Plant biotechnology involves strict rules governing genetically modified crops, trait ownership, and biosafety. Navigating these regulations delays research timelines and increases compliance costs. Conflicts related to patent licensing and genetic resource use add further complexity. Companies must ensure transparent documentation and compliance across multiple regions. These hurdles slow commercialization and restrict collaboration, making regulatory navigation a persistent challenge for service providers

Regional Analysis

North America

North America holds a 38% share due to strong investment in genomics, proteomics, and advanced crop-improvement research. The region benefits from well-established biotechnology infrastructure, high funding for agricultural innovation, and strong collaboration between universities and private companies. Growth accelerates as producers adopt molecular tools to enhance yield stability and climate resilience. The United States drives most service demand, supported by large-scale crop breeding programs and expanding interest in sustainable agriculture. Canada strengthens adoption through research grants and rising use of precision breeding technologies across cereals, grains, and specialty crops.

Europe

Europe captures a 27% share, driven by strict quality standards, strong public research funding, and high interest in sustainable farming. Countries such as Germany, France, and the Netherlands lead adoption through advanced genomics platforms and well-regulated biotechnology ecosystems. Demand rises as regional growers prioritize disease-resistant and low-input crops. Regulatory support for reduced chemical usage boosts reliance on molecular breeding tools. The region’s strong academic network and focus on food security further accelerate service uptake, especially across cereals, horticulture, and plant-derived compound development.

Asia Pacific

Asia Pacific holds a 29% share and continues to grow quickly as major agricultural nations invest in plant biotechnology to meet rising food demand. China and India drive large-scale adoption through national crop-improvement programs, expanding sequencing capacity, and strong government funding. Research teams rely on genomics and proteomics tools to improve yield, stress tolerance, and nutrient content. The region benefits from a large farming base and rapid modernization of breeding systems. Growing investment in plant-based pharmaceuticals further strengthens demand for specialized biotechnology services.

Latin America

Latin America accounts for an 8% share, supported by expanding crop-breeding initiatives across Brazil, Argentina, and Mexico. Regional demand rises as growers seek biotechnology services to enhance productivity in soybeans, maize, and sugarcane. Adoption grows due to climate-related stress and the need for drought-resistant traits. Research institutions collaborate with global companies to advance molecular testing and accelerate trait development. Although infrastructure gaps persist, rising investment in agricultural innovation and biotechnology education strengthens service uptake across key commercial crops.

Middle East and Africa

Middle East and Africa hold a 6% share, driven by growing interest in crop resilience, water-efficient varieties, and food-security programs. Many countries rely on biotechnology services to address soil degradation and extreme climate conditions. Research centers in South Africa, Kenya, and the Gulf region increasingly adopt genomics-based testing for staple crops. Limited local infrastructure slows faster expansion, but rising partnerships with global institutions help improve access to advanced molecular platforms. Government-led agricultural modernization efforts continue to support steady market growth.

Market Segmentations:

By Type

- Genomics Services

- Proteomics Services

By Crop

- Cereals & Grains

- Fruits & Vegetables

By End User

- Research Institutes,

- Pharmaceuticals Companies

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the Plant Biotechnology Services Market features key innovators such as LanzaTech, Novozymes, Pivot Bio, Motif FoodWorks, Ginkgo Bioworks, Kiverdi, Concentric, Indigo Ag, and Joyn Bio. The market includes a mix of advanced biotechnology platforms, specialized service providers, and research-focused firms that compete on technology depth, multiomics capability, and speed of project execution. Companies strengthen their position by expanding genomic sequencing capacity, improving proteomic workflows, and integrating AI-driven analytics to support faster trait discovery. Many players invest in sustainable crop solutions, molecular breeding tools, and high-throughput testing to address global food-security challenges. Strategic alliances with research institutes and agritech firms help accelerate technology adoption across major crop segments. Service differentiation relies on data accuracy, project turnaround, regulatory compliance, and scalable analysis platforms, which collectively shape long-term competitiveness in this growing market.

Key Player Analysis

- LanzaTech (USA)

- Novozymes (Denmark)

- Pivot Bio (USA)

- Motif FoodWorks (USA)

- Ginkgo Bioworks (USA)

- Kiverdi (USA)

- Concentric (USA)

- Indigo Ag (USA)

- Joyn Bio (USA)

Recent Developments

- In 2025, Ginkgo Bioworks extended its multi-year strategic collaboration with Bayer to advance microbial nitrogen fixation technologies aimed at reducing synthetic fertilizer use.

- In 2025, LanzaTech spun out a synthetic biology company, LanzaX, to commercialize its microbial fermentation technology for specialty chemicals, enabling scaling of biorefineries and expanding production capabilities across existing plants in the US, Belgium, China, and India.

- In 2024, Ginkgo Bioworks partnered with Sojitz Corporation to offer its synthetic biology R&D services to Japanese companies aiming to develop sustainable fermentation processes and bio-based manufacturing.

- In 2024, Indigo Ag launched CLIPS™, an innovative automatic hands-free seed treatment device that applies dry powder biological seed coatings during planting.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Type, Crop, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for trait-enhanced crops will rise as climate stress intensifies.

- Adoption of multiomics platforms will grow across research institutes and industry.

- Precision breeding tools will support faster development of improved crop varieties.

- Service providers will expand advanced sequencing and protein-analysis capacity.

- Interest in plant-based pharmaceuticals will strengthen biotechnology partnerships.

- Digital agriculture tools will integrate with molecular platforms for better decision-making.

- Sustainable farming practices will boost demand for low-input and resilient crops.

- Emerging economies will invest more in modern breeding infrastructure.

- Automation and AI will enhance data accuracy and reduce analysis time.

- Regulatory harmonization will support smoother global collaboration in crop research