Market Overview:

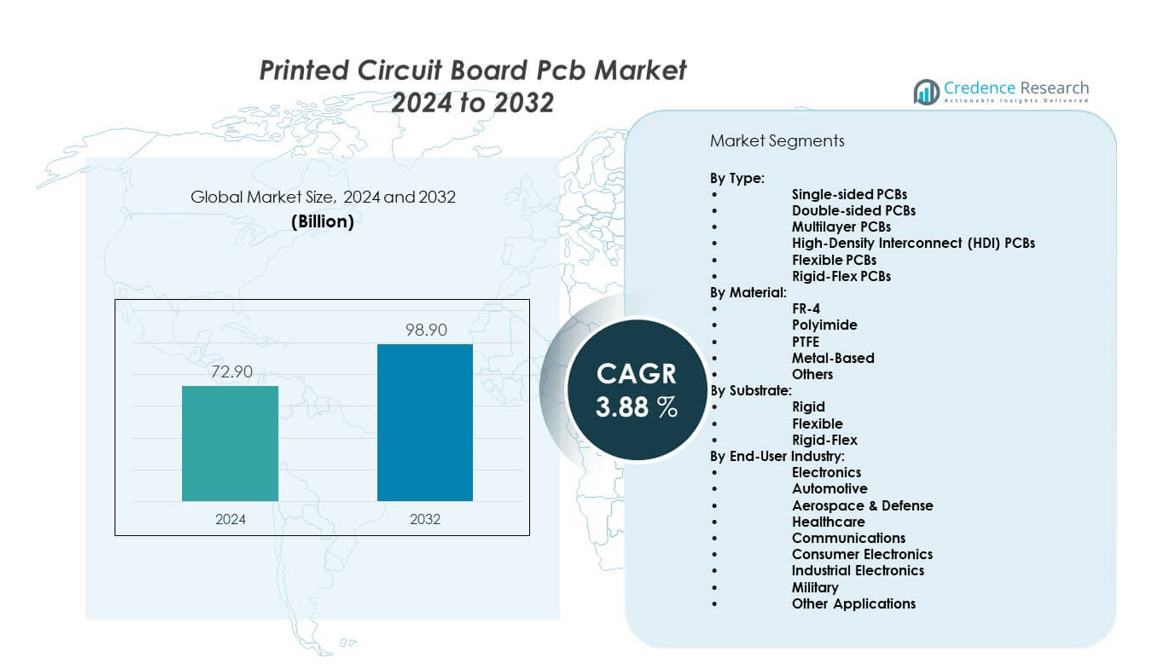

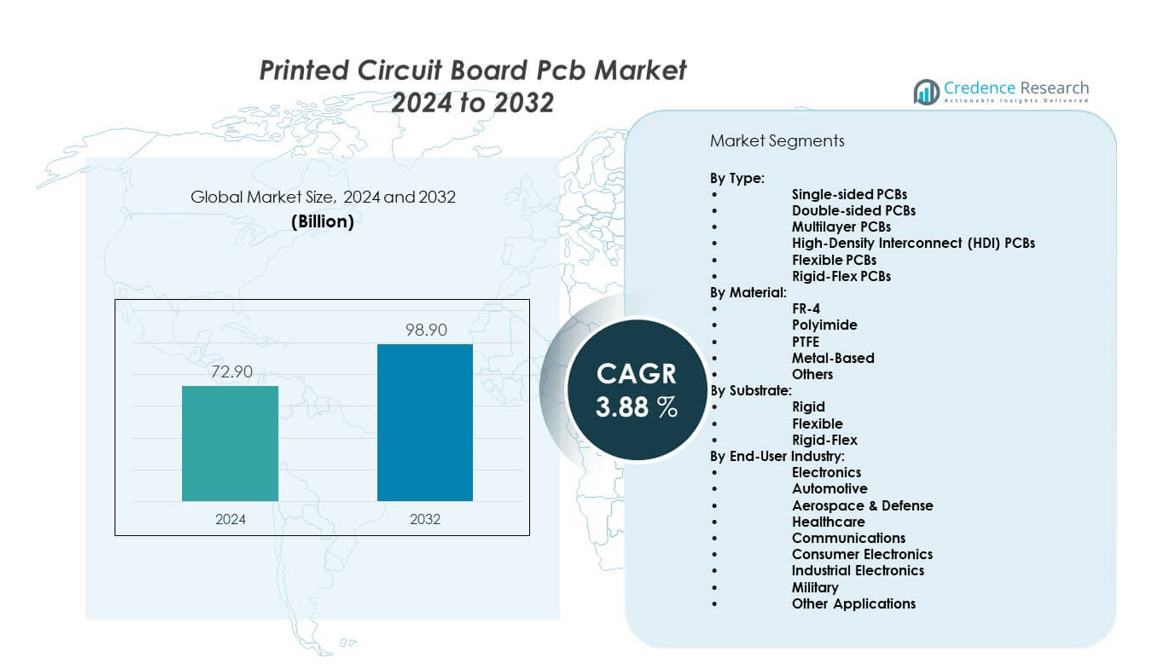

The Printed circuit board (PCB) market is projected to grow from USD 72.9 billion in 2024 to an estimated USD 98.9 billion by 2032, expanding at a CAGR of 3.88% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Printed Circuit Board (PCB) Market Size 2024 |

USD 72.9 billion |

| Printed Circuit Board (PCB) Market, CAGR |

3.88% |

| Printed Circuit Board (PCB) Market Size 2032 |

USD 98.9 billion |

The printed circuit board market is fueled by strong demand across sectors such as consumer electronics, automotive, and healthcare. Miniaturization of devices and the shift toward advanced packaging technologies are increasing reliance on multilayer and high-density interconnect PCBs. Automotive electronics, especially in electric vehicles and ADAS, drive innovation in PCB materials and designs. Expanding 5G networks and IoT applications also require high-speed, reliable boards, further boosting market adoption. These factors ensure consistent growth momentum in the years ahead.

The printed circuit board market shows strong leadership in Asia-Pacific due to robust manufacturing hubs in China, Japan, South Korea, and Taiwan. The region benefits from large-scale electronics production, cost efficiency, and strong government support for semiconductor industries. North America and Europe follow with steady demand, driven by automotive advancements, aerospace electronics, and increasing 5G deployment. Emerging markets in Latin America and the Middle East are witnessing rising adoption, supported by expanding consumer electronics and infrastructure development.

Market Insights:

- The printed circuit board pcb market is valued at USD 72.9 billion in 2024 and is projected to reach USD 98.9 billion by 2032, growing at a CAGR of 3.88%.

- Strong demand from consumer electronics, including smartphones, tablets, and wearables, drives market expansion.

- Automotive growth, especially in electric vehicles and ADAS systems, increases PCB adoption.

- Rising raw material costs and global supply chain disruptions act as significant restraints.

- Complex design requirements and stricter compliance standards challenge PCB manufacturers.

- Asia-Pacific leads the market due to large-scale production in China, Japan, and South Korea.

- North America and Europe show steady growth, while Latin America and the Middle East emerge with rising electronics adoption.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers:

Growing Demand for Consumer Electronics and Portable Devices:

The printed circuit board pcb market is strongly driven by demand for compact consumer devices such as smartphones, tablets, and wearables. Manufacturers prioritize PCBs that provide higher density and performance in smaller footprints. Growth in personal electronics creates consistent orders for multilayer boards with advanced interconnections. Rising disposable incomes and digital lifestyles push global shipments of electronic gadgets upward. Portable devices increasingly rely on high-speed PCBs to deliver efficient connectivity. Strong consumer upgrades to 5G-enabled phones amplify PCB requirements. Manufacturers invest heavily in technology to meet evolving specifications for lightweight, power-efficient designs. It strengthens the role of PCB innovations in supporting the fast-changing electronics industry.

- For instance, Nippon Mektron Ltd., a leader in flexible PCB solutions for consumer electronics, manufactures multi-layer flexible printed circuits capable of up to 38 layers, supporting high-density integration in smartphones and wearables with a strong focus on ultra-thin, lightweight designs and 97.2% on-time delivery performance.

Rapid Growth of Automotive Electronics and Electric Vehicles:

The expansion of the automotive sector significantly contributes to the growth of the printed circuit board pcb market. Electric vehicles require advanced PCBs for battery management, charging infrastructure, and motor control systems. Integration of advanced driver-assistance systems further accelerates PCB usage in vehicles. Automakers demand boards that can handle high temperature variations and remain durable. Hybrid and electric platforms create opportunities for flexible and rigid-flex PCBs in compact spaces. Enhanced safety features and digital dashboards drive higher reliance on innovative board designs. Automotive suppliers push PCB makers toward compliance with strict reliability standards. It strengthens collaboration between automakers and PCB companies for customized solutions.

- For instance, TTM Technologies Inc. prepared for the future by acquiring multiple manufacturing sites in 2025 to expand capacity for advanced PCBs used in automotive and aerospace sectors, with investments such as up to $130 million for new manufacturing plants supporting complex rigid and flexible PCB applications.

Expansion of Telecommunications Infrastructure and 5G Technology:

The telecommunications sector plays a key role in advancing the printed circuit board pcb market. The transition to 5G requires high-frequency and low-loss PCBs that can manage rapid data transfers. Telecom providers deploy advanced base stations, antennas, and routers that rely heavily on PCBs. Continuous demand for internet connectivity ensures long-term stability in orders. Cloud computing, data centers, and networking equipment expand with high-speed PCB integration. Miniaturization trends push manufacturers toward thin, multi-layered PCBs capable of handling signal integrity. The rising use of IoT devices also strengthens the demand for efficient networking boards. It provides telecom industries with advanced hardware platforms that align with rapid connectivity growth.

Rising Industrial Automation and Healthcare Technology Applications:

The industrial and healthcare industries are contributing significantly to the printed circuit board pcb market. Industrial automation systems require durable PCBs that can withstand heavy usage and harsh environments. Robotics and smart manufacturing processes integrate PCBs to control sensors and actuators. Healthcare electronics, including imaging systems and diagnostic devices, rely on advanced PCBs. The demand for reliable and miniaturized components supports innovation in medical-grade boards. PCB manufacturers focus on stringent quality and safety standards in these industries. Wearable medical monitoring devices further boost reliance on compact circuit boards. It underscores the critical role of PCBs in enabling innovation across multiple end-use industries.

Market Trends:

Growing Shift Toward Environmentally Friendly PCB Materials and Recycling Practices:

Sustainability is becoming a major trend in the printed circuit board pcb market. Companies face pressure to reduce hazardous chemicals and adopt eco-friendly materials. Regulations on electronic waste disposal drive manufacturers toward recyclable substrates and safer processes. Lead-free soldering practices are gaining strong adoption across manufacturing facilities. Recycling initiatives create closed-loop supply chains for PCB materials. Consumer preferences for green products further motivate companies to adapt. Investments in biodegradable laminates and halogen-free boards are expanding across major producers. It establishes sustainability as a competitive differentiator in global PCB markets.

Increasing Integration of Flexible and Rigid-Flex PCB Designs:

The rising demand for flexibility in design is reshaping the printed circuit board pcb market. Flexible and rigid-flex PCBs enable manufacturers to produce lightweight and compact devices. Consumer electronics, medical devices, and aerospace systems adopt these solutions widely. Design flexibility supports innovations in wearables, foldable phones, and miniaturized electronics. The growth of compact devices increases demand for bendable circuit structures. Companies invest in advanced materials that improve flexibility while maintaining durability. Manufacturing processes adapt to meet the complexity of rigid-flex board production. It marks a significant trend toward enhanced design freedom and reliability in electronics manufacturing.

- For instance, Nippon Mektron leads in rigid-flex and flexible PCB production using advanced materials that allow for ultra-thin, fine-pitch flexible circuits, contributing to innovations in foldable smartphones and medical devices with high durability.

Adoption of High-Speed and High-Frequency PCBs in Advanced Applications:

High-performance applications drive a growing trend within the printed circuit board pcb market. Industries such as aerospace, defense, and telecommunications require boards that handle high-speed signals. Demand for low-loss dielectric materials strengthens to maintain signal accuracy. High-frequency PCBs are critical in radar systems, satellite communications, and 5G infrastructure. Data centers and high-speed computing systems increasingly rely on advanced PCB designs. Miniaturization and performance requirements lead to continuous research in material science. Companies integrate advanced testing processes to ensure signal reliability under harsh conditions. It emphasizes the critical importance of high-speed PCBs in enabling next-generation technologies.

Expansion of Smart Manufacturing and Digital Twin Integration:

Digital transformation trends are reshaping the printed circuit board pcb market. Smart manufacturing integrates IoT-enabled monitoring and automated inspection systems in PCB production. Digital twin technology allows predictive maintenance and optimization of production lines. Advanced analytics improve process efficiency and reduce defects during manufacturing. AI-driven design tools support faster development of innovative PCB layouts. Real-time data collection ensures higher yield and quality in production facilities. Companies benefit from reduced operational costs while maintaining global competitiveness. It highlights the increasing adoption of Industry 4.0 practices across PCB manufacturing operations.

Market Challenges Analysis:

Rising Raw Material Costs and Supply Chain Constraints:

The printed circuit board pcb market faces major challenges due to volatile raw material prices and fragile supply chains. Copper, resins, and laminates often experience price spikes that disrupt planning and production. Manufacturers encounter difficulty maintaining profit margins when costs surge unexpectedly. Global shortages in semiconductor and electronic components intensify these pressures. Supply chain disruptions caused by geopolitical tensions or natural disasters slow manufacturing schedules. Companies must increase investments in supply resilience and sourcing strategies. Smaller firms find it harder to absorb these unexpected costs compared to larger competitors. It creates an ongoing challenge for the industry to balance affordability with growth expectations.

Complexity in Design Standards and Technological Advancements:

The growing demand for advanced boards also creates challenges for the printed circuit board pcb market. Design standards become more complex as industries demand miniaturized and multifunctional devices. Engineers must balance electrical performance with thermal management and cost efficiency. Advanced multilayer boards require significant precision during production. New materials and designs introduce manufacturing risks and demand skilled labor. Rapid shifts in customer requirements force companies to adapt quickly. Compliance with environmental and safety regulations adds further complexity. It highlights the ongoing challenge for PCB manufacturers to innovate while meeting diverse and stringent requirements.

Market Opportunities:

Expanding Applications in Artificial Intelligence and Edge Computing Devices:

Artificial intelligence and edge computing present strong opportunities in the printed circuit board pcb market. AI-powered devices require high-performance boards for data processing and connectivity. Edge devices deployed in healthcare, manufacturing, and smart homes increase demand for compact PCBs. Growth in embedded systems and AI accelerators supports market expansion. Manufacturers offering high-density designs gain a competitive advantage. Custom PCBs for AI applications align with rising demand for specialized computing. It creates opportunities for companies to capture niche, high-value market segments.

Increasing Demand for Advanced PCB Solutions in Aerospace and Defence Systems:

The aerospace and defense industries present high-value opportunities for the printed circuit board pcb market. Advanced radar, communication, and navigation systems rely on high-frequency PCBs. Defense modernization programs create consistent demand for reliable circuit solutions. Aerospace applications require boards that can perform under extreme conditions. Manufacturers investing in durable materials and advanced testing stand to benefit. Expansion of space exploration initiatives further accelerates reliance on specialized PCBs. It provides strong growth opportunities for suppliers serving high-reliability sectors worldwide.

Market Segmentation Analysis:

By Type

Single-sided PCBs dominate low-cost applications, offering simple designs for basic electronics. Double-sided PCBs provide greater flexibility by enabling components on both sides of the board. Multilayer PCBs are widely adopted in smartphones, servers, and computing devices requiring high functionality. High-Density Interconnect (HDI) PCBs are expanding in advanced consumer electronics and telecommunications equipment. Flexible PCBs find growing use in wearables, foldable devices, and automotive applications. Rigid-Flex PCBs combine durability with flexibility, enabling complex designs for aerospace and medical devices.

- For instance, Unimicron Technology Corporation specializes in high-density interconnect (HDI) PCBs and IC substrates utilized in 5G and AI computing markets, manufacturing advanced multi-layer boards to meet high-functionality device demands.

By Material

FR-4 remains the most widely used material, favored for its balance of cost and performance. Polyimide is preferred for flexible PCBs due to its heat resistance and durability. PTFE is important in high-frequency applications, especially in communications and defense systems. Metal-based PCBs support LED lighting, power electronics, and thermal management. Other materials, including ceramics, cater to specialized applications with higher reliability demands.

- For instance, Zhen Ding Technology Holding Limited focuses on diverse material use for high-end flexible PCBs and HDI PCBs, enabling AI, telecommunication, and automotive applications that demand high reliability and advanced thermal management solutions.

By Substrate

Rigid PCBs hold the largest share due to widespread adoption in consumer electronics and industrial devices. Flexible substrates are expanding with rising demand in automotive and wearable technologies. Rigid-Flex substrates, though costlier, gain traction in aerospace, defense, and medical electronics where reliability is critical.

By End-User Industry

Electronics and consumer electronics drive strong demand with smartphones, laptops, and home appliances. Automotive is growing rapidly with electric vehicles, ADAS, and infotainment systems requiring advanced PCBs. Aerospace & defense rely on high-frequency and durable boards for mission-critical systems. Healthcare applications include diagnostic devices, imaging equipment, and wearables. Communications lead with 5G base stations, routers, and data centers. Industrial electronics leverage PCBs for automation, robotics, and smart manufacturing. Military applications demand high-reliability boards with advanced protection. Other applications include energy, IoT, and smart city infrastructure.

Segmentation:

By Type:

- Single-sided PCBs

- Double-sided PCBs

- Multilayer PCBs

- High-Density Interconnect (HDI) PCBs

- Flexible PCBs

- Rigid-Flex PCBs

By Material:

- FR-4

- Polyimide

- PTFE

- Metal-Based

- Others

By Substrate:

- Rigid

- Flexible

- Rigid-Flex

By End-User Industry:

- Electronics

- Automotive

- Aerospace & Defense

- Healthcare

- Communications

- Consumer Electronics

- Industrial Electronics

- Military

- Other Applications

By Region:

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis:

Asia-Pacific: Leading Global Production and Electronics Demand

The Asia-Pacific region dominates the printed circuit board pcb market with a commanding 58 percent share. China, Japan, South Korea, and Taiwan host the largest PCB manufacturing hubs, driven by strong semiconductor and electronics industries. High-volume production and cost efficiency keep the region at the center of global supply chains. Demand rises from smartphones, consumer electronics, and expanding 5G infrastructure projects. Government support for electronics manufacturing and investment in advanced technologies strengthen regional competitiveness. It remains the primary growth engine due to large-scale exports and continuous innovation.

North America: Innovation Driven by High-Performance Applications

North America accounts for 17 percent of the printed circuit board pcb market, led by the United States. The region emphasizes high-performance applications in aerospace, defense, healthcare, and advanced communications. Demand is supported by strong adoption of electric vehicles and digital infrastructure. Local manufacturers focus on advanced technologies, including high-frequency and rigid-flex boards. Defense and aerospace programs increase reliance on reliable, high-grade PCBs. It shows steady growth driven by innovation, government contracts, and strong research capabilities.

Europe, Latin America, and Middle East & Africa: Emerging and Specialized Growth

Europe holds 15 percent of the printed circuit board pcb market, supported by strong automotive and industrial electronics sectors in Germany, France, and the UK. Latin America accounts for 5 percent, with growing demand from consumer electronics and industrial applications. The Middle East & Africa region captures 5 percent share, driven by expanding telecommunications and defense investments. European firms focus on advanced, sustainable PCB production with strict compliance standards. Emerging regions witness steady expansion due to rising electronics consumption and infrastructure development. It positions Europe as a specialized hub while Latin America and the Middle East & Africa build market presence.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- Nippon Mektron Ltd. (Japan)

- Unimicron Technology Corporation (Taiwan)

- Zhen Ding Technology Holding Limited (Taiwan)

- TTM Technologies Inc. (USA)

- Ibiden Co., Ltd. (Japan)

- Tripod Technology Corporation (Taiwan)

- Compeq Manufacturing Co., Ltd. (Taiwan)

- Shennan Circuits Co., Ltd. (China)

- AT&S Austria Technologie & Systemtechnik AG (Austria)

- Advanced Circuits Inc.

- Sumitomo Electric Industries Ltd. (Japan)

- Jabil Inc.

- Wurth Elektronik Group

- Becker & Muller Schaltungsdruck GmbH

Competitive Analysis:

The printed circuit board pcb market is highly competitive, led by Asian manufacturers and supported by strong players in North America and Europe. Major companies such as Nippon Mektron, Zhen Ding Technology, Unimicron, and TTM Technologies dominate through scale, technology, and global networks. Firms invest in research to develop flexible, multilayer, and HDI PCBs, targeting industries like automotive, telecommunications, and consumer electronics. Partnerships with device makers and telecom providers create long-term supply stability. Innovation in eco-friendly materials and advanced substrates strengthens competitive positioning. Smaller firms focus on niche applications and custom solutions. It maintains a balance between high-volume manufacturing and specialized technological advancements.

Recent Developments:

- In Unimicron Technology Corporation, the company is expanding its PCB production to Southeast Asia, with its first plant in Thailand set to begin mass production in the second half of 2025. This investment supports the growing demand for high-end chip substrates and PCBs driven by the AI boom, despite tariff and geopolitical challenges.

- In Zhen Ding Technology Holding Limited, its subsidiary Avary Holding is investing RMB 8 billion (approximately NT$33.5 billion) from the second half of 2025 to 2028 to expand high-end PCB capacity, focusing on AI applications such as servers, optical communications, and smart vehicles. The investment includes constructing two new fabs and advanced equipment procurement to meet increasing demand for high-layer-count PCBs.

- In TTM Technologies Inc., the company acquired a 750,000-square-foot facility in Eau Claire, Wisconsin, in July 2025, and land rights for a future manufacturing site in Penang, Malaysia. These investments aim to enhance their advanced technology PCB manufacturing footprint in North America and Southeast Asia, particularly for generative AI applications and data center computing.

Market Concentration & Characteristics:

The printed circuit board pcb market displays moderate to high concentration, with top players in Asia holding dominant shares of global output. Large corporations leverage economies of scale, while specialized companies in Europe and North America target aerospace, defense, and medical applications. It features intense competition, heavy capital investment requirements, and continuous innovation in design and materials. Sustainability initiatives, stringent regulations, and increasing demand for high-performance boards further define its evolving characteristics.

Report Coverage:

The research report offers an in-depth analysis based on type, material, substrate, end-user industry, and region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Expansion of flexible PCB adoption across wearable and foldable devices.

- Rising integration of PCBs in electric vehicles and charging systems.

- Strong demand for HDI boards in 5G infrastructure and telecom applications.

- Growth in aerospace and defense reliance on high-frequency PCBs.

- Increasing adoption of eco-friendly substrates and recyclable materials.

- Advanced automation and AI use in PCB design and production.

- Rising healthcare electronics applications boosting medical-grade PCB demand.

- Regional diversification of manufacturing to reduce supply risks.

- Higher investment in data center and cloud computing PCB solutions.

- Continued mergers and partnerships to enhance production scale and innovation.