| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| 3D Printed Prosthetics Market Size 2024 |

USD 1,776.29 million |

| 3D Printed Prosthetics Market, CAGR |

7.52% |

| 3D Printed Prosthetics Market Size 2032 |

USD 3,306.53 million |

Market Overview:

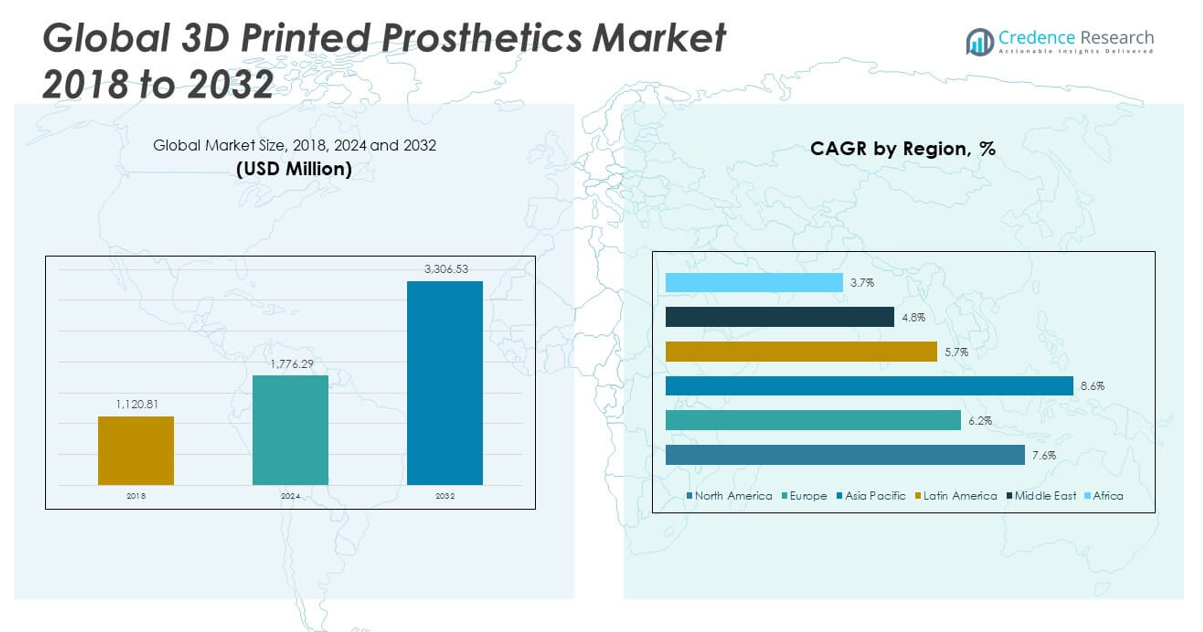

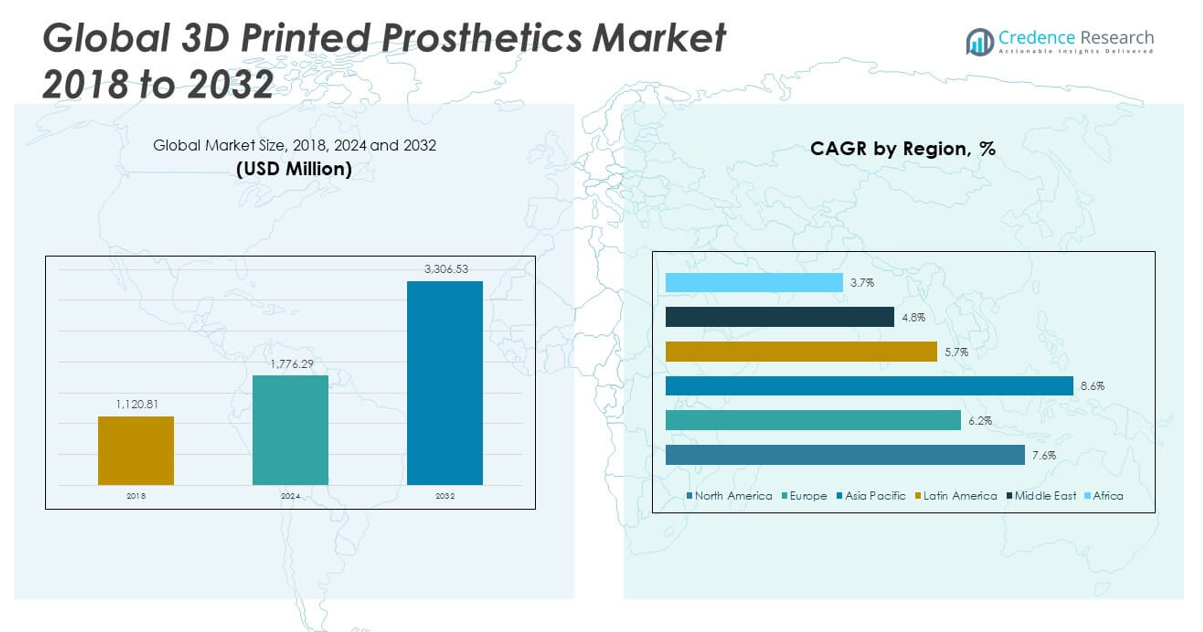

The Global 3D Printed Prosthetics Market size was valued at USD 1,120.81 million in 2018 to USD 1,776.29 million in 2024 and is anticipated to reach USD 3,306.53 million by 2032, at a CAGR of 7.52% during the forecast period.

The growth of the global 3D printed prosthetics market is driven by several key factors. First, the ability to customize and personalize prosthetics through 3D printing has been a major catalyst, allowing devices to be tailored to the specific anatomical and functional needs of individual patients, thereby improving comfort and usability. Additionally, 3D printed prosthetics offer a more affordable solution compared to traditional prosthetic devices, making them more accessible to a broader population. Technological advancements in 3D printing have further enhanced the durability, lightweight nature, and overall functionality of prosthetics. Another significant driver is the rising incidence of limb loss due to factors like diabetes, vascular diseases, and accidents, which has led to an increased demand for prosthetic solutions. These factors, combined with the growing awareness and adoption of 3D printing in healthcare, continue to propel the market forward.

Regionally, North America holds the largest share of the global 3D printed prosthetics market, driven by its advanced healthcare infrastructure, high adoption rates of new technologies, and significant healthcare expenditure. The United States plays a central role in this growth, with both private and public healthcare initiatives supporting the development and accessibility of 3D printed prosthetics. Europe follows closely, with countries such as Germany and the UK leading in the adoption of 3D printing in healthcare. This region benefits from strong research and development activities and government policies that support technological innovations in medical devices. The Asia-Pacific region is expected to witness the highest growth during the forecast period, due to the increasing demand for healthcare solutions, technological advancements, and rising awareness. Meanwhile, the Latin American and Middle East & Africa regions are also seeing gradual adoption of 3D printed prosthetics, with market growth driven by the need for affordable and accessible medical solutions.

Market Insights:

- The global 3D printed prosthetics market is projected to grow from USD 1,120.81 million in 2018 to USD 1,776.29 million in 2024, with an expected reach of USD 3,306.53 million by 2032, growing at a CAGR of 7.52%.

- Customization is a key factor driving the market, with 3D printing offering highly personalized prosthetics tailored to the individual’s anatomical needs. This enhances comfort, functionality, and mobility, making it increasingly popular among patients with specific needs.

- The market benefits from the affordability of 3D printed prosthetics. By reducing manufacturing costs through efficient production and material use, 3D printing makes prosthetics more accessible, especially to patients in low- and middle-income regions.

- Technological advancements continue to improve the quality of prosthetics, making them more durable, lightweight, and functional. Enhanced 3D printing methods and advanced biocompatible materials are further driving growth in the market.

- The rise in limb loss due to conditions such as diabetes, vascular diseases, and accidents is fueling the demand for prosthetics. With an aging population and increasing amputations, the need for customized prosthetic devices is steadily growing.

- High initial investment and production costs for 3D printing technologies remain a challenge, especially for smaller companies. The capital-intensive nature of 3D printing limits entry into the market and adoption in areas with limited access to advanced healthcare.

- Regulatory and standardization challenges, including varying global regulations and the lack of universal guidelines for 3D printed prosthetics, slow market expansion. Manufacturers must navigate complex approval processes, adding to costs and delaying product launches.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers:

Customization and Personalization Enhances Functionality in the Global 3D Printed Prosthetics Market

One of the primary drivers of the global 3D printed prosthetics market is the ability to offer highly customized and personalized prosthetic devices. Traditional prosthetics often require extensive adjustments and may not perfectly fit the patient’s unique anatomical structure. In contrast, 3D printing enables the creation of prosthetics that are tailored to an individual’s exact specifications. This customization enhances the comfort, functionality, and aesthetic appeal of the device, ensuring better user satisfaction and improved mobility. Customization also allows for prosthetics to be designed for specific activities or lifestyles, increasing their versatility and effectiveness. These personalized solutions contribute to the growing demand for 3D printed prosthetics among patients with specific needs and preferences.

Cost-Effectiveness and Affordability Expand Market Reach

Cost plays a significant role in the adoption of 3D printed prosthetics, as traditional prosthetic devices can be prohibitively expensive. The global 3D printed prosthetics market benefits from the affordability of 3D printing technology, which reduces the overall cost of manufacturing prosthetics. By streamlining the production process, 3D printing lowers material waste and labor costs, making the final product more affordable for patients. This reduction in cost makes high-quality prosthetics accessible to a wider population, including individuals in low- and middle-income countries who might otherwise be unable to afford traditional devices. The affordability of 3D printed prosthetics is crucial in addressing the global need for cost-effective healthcare solutions.

- For instance, the HK Maker Club reported a cost reduction of over 90%when producing 3D printed prosthetic hands using the Raise3D N2 printer, enabling the distribution of more than 100 devices in Hong Kong and Africa.

Technological Advancements Propel the Development of High-Quality Prosthetics

Technological innovations in 3D printing technology and materials continue to drive advancements in the global 3D printed prosthetics market. New developments in 3D printing methods, such as the use of advanced biocompatible materials, enhance the strength, flexibility, and durability of prosthetics. These improvements make it possible to create prosthetics that are not only functional but also lightweight and long-lasting. Advances in 3D scanning technologies have also improved the accuracy of prosthetic design, ensuring a better fit and more precise functionality. With ongoing research and development in this field, 3D printed prosthetics are expected to become even more efficient and effective in meeting the diverse needs of patients.

- For example, recent research on prosthetic leg sockets fabricated with PLA+ and reinforced with carbon fiber, carbon-Kevlar, fiberglass, or cement showed that cement-reinforced sockets exhibited up to 89.57% higher yield strength and 76.15% greater Young’s modulusthan other materials, significantly improving mechanical performance.

Rising Incidence of Limb Loss Drives Increased Demand for Prosthetics

The global 3D printed prosthetics market is also being fueled by the increasing incidence of limb loss due to factors such as diabetes, vascular diseases, and traumatic accidents. According to healthcare statistics, the number of amputations is steadily rising worldwide, which creates a growing need for prosthetic devices. 3D printed prosthetics offer an alternative to traditional devices by providing cost-effective and customizable solutions to those affected by limb loss. This rising prevalence of amputations, combined with an aging population, is contributing to the expansion of the market. The demand for prosthetics will continue to grow as more individuals require these devices for rehabilitation and enhanced mobility.

Market Trends:

Adoption of Biocompatible and Advanced Materials in the Global 3D Printed Prosthetics Market

A notable trend in the global 3D printed prosthetics market is the increasing use of biocompatible materials in prosthetic production. Manufacturers are turning to advanced materials, such as medical-grade titanium, carbon fiber, and flexible polymers, to improve the performance and comfort of 3D printed prosthetics. These materials offer greater durability and strength, while being lightweight, which enhances the overall functionality of the devices. The integration of biocompatible materials also reduces the risk of skin irritation or allergic reactions, making the prosthetics more suitable for long-term wear. As material science progresses, new materials that better mimic the natural properties of human bone and tissue are being developed, creating more realistic and functional prosthetics. This trend reflects the industry’s commitment to providing high-quality and safer prosthetic solutions.

Integration of 3D Scanning and Imaging Technologies Enhances Prosthetic Design

The integration of advanced 3D scanning and imaging technologies is transforming the design process in the global 3D printed prosthetics market. These technologies allow for highly detailed and accurate measurements of a patient’s residual limb, ensuring a perfect fit for the prosthetic. The use of 3D scanners improves the precision of prosthetic designs, resulting in enhanced comfort and functionality. This technology also speeds up the production process, as prosthetic designs can be easily modified based on individual patient data. The ability to create accurate digital models of a patient’s limb allows for faster and more cost-effective manufacturing. This trend supports the growing demand for personalized and well-fitting prosthetic devices.

- For instance, the EINScan Pro 2X Plus 3D Scanner (SHINING 3D Tech. Co., Ltd.) demonstrated a mean radial error of 0.1 mm, mean angular error of 2.5°, and root mean square error of 0.52 mm, all well below clinically relevant thresholds for prosthetic fit and comfort.

Increasing Adoption of Prosthetics in Emerging Markets

Emerging markets are seeing a rise in the adoption of 3D printed prosthetics, driven by both affordability and increasing healthcare access. In regions such as Asia-Pacific, Latin America, and Africa, the cost-effectiveness of 3D printed prosthetics makes them a viable option for patients who might not otherwise afford traditional prosthetic devices. As healthcare infrastructure improves and awareness of 3D printing technologies increases, these regions are experiencing a surge in the demand for personalized and cost-effective prosthetic solutions. This shift is particularly evident in countries where the need for affordable healthcare solutions is high, but access to high-quality medical devices has been limited. The growth of 3D printed prosthetics in emerging markets highlights the industry’s global reach and ability to cater to diverse patient needs.

Rise of Digital Prosthetic Solutions for Enhanced Mobility and Functionality

Another emerging trend in the global 3D printed prosthetics market is the rise of digital prosthetic solutions that enhance mobility and functionality. The development of prosthetics with embedded sensors and microelectronics allows for real-time monitoring and performance tracking. These prosthetics can provide feedback on a user’s movement, helping adjust for optimal comfort and function. Digital prosthetics also enable users to track progress during rehabilitation, providing valuable data to healthcare providers. The integration of smart technologies into prosthetics marks a shift toward more sophisticated and user-friendly device, providing an improved user experience. This trend is particularly significant as the demand for prosthetics that offer greater mobility and advanced functionality continues to rise.

- For instance, companies like Hanger Clinic have implemented the PLUS-M™ (Prosthetic Limb Users Survey of Mobility), collecting data from over 1,100 patientsto objectively track mobility outcomes and guide individualized care pathways.

Market Challenges Analysis:

High Initial Investment and Production Costs in the Global 3D Printed Prosthetics Market

One of the key challenges facing the global 3D printed prosthetics market is the high initial investment required for 3D printing technology and production facilities. Setting up 3D printing operations demands substantial capital for purchasing advanced printers, acquiring specialized materials, and establishing quality control systems. These high upfront costs make it difficult for smaller companies or startups to enter the market and compete with established players. Furthermore, despite the cost-effectiveness of 3D printed prosthetics in the long run, the production of high-quality, customized devices remains expensive. This financial barrier limits the widespread adoption of 3D printed prosthetics, particularly in regions with limited access to advanced healthcare technologies or insufficient insurance coverage. The challenge of balancing cost and quality continues to hinder the growth potential of the market.

Regulatory and Standardization Challenges Impacting Market Expansion

The global 3D printed prosthetics market also faces significant regulatory and standardization challenges. Different regions have varying regulations concerning medical devices, and 3D printed prosthetics fall under stringent medical device standards that differ by country. This lack of universal standards complicates the approval process, leading to delays and increased costs for manufacturers looking to expand globally. In some cases, the absence of clear guidelines on the safety and efficacy of 3D printed materials in prosthetics further complicates market growth. Manufacturers must navigate complex regulatory landscapes and ensure that their products meet the necessary certifications to be sold across different markets. These challenges create hurdles for companies trying to introduce new products or enter new regions, limiting their market reach.

Market Opportunities:

Expansion into Emerging Markets Presents Growth Potential in the Global 3D Printed Prosthetics Market

The global 3D printed prosthetics market has significant growth opportunities in emerging markets, where there is a rising demand for affordable healthcare solutions. In regions such as Asia-Pacific, Latin America, and Africa, the cost-effectiveness and accessibility of 3D printed prosthetics present an attractive alternative to traditional prosthetic devices. As healthcare infrastructure continues to improve and the awareness of advanced technologies increases, these regions offer substantial growth potential. Manufacturers can tap into these markets by offering tailored solutions that meet the needs of diverse populations, improving access to quality prosthetic care.

Integration of Smart Technologies in Prosthetics Opens New Avenues

The integration of smart technologies in 3D printed prosthetics presents a promising opportunity for market expansion. By incorporating sensors, microelectronics, and real-time data tracking, prosthetic devices can offer enhanced functionality and performance. These advancements provide patients with better mobility and the ability to monitor their progress during rehabilitation. As digital prosthetics gain popularity, manufacturers can explore new opportunities for innovation, such as developing prosthetics with improved user interfaces or more intuitive control systems. This trend could further drive the adoption of 3D printed prosthetics globally, particularly among tech-savvy users seeking advanced solutions.

Market Segmentation Analysis:

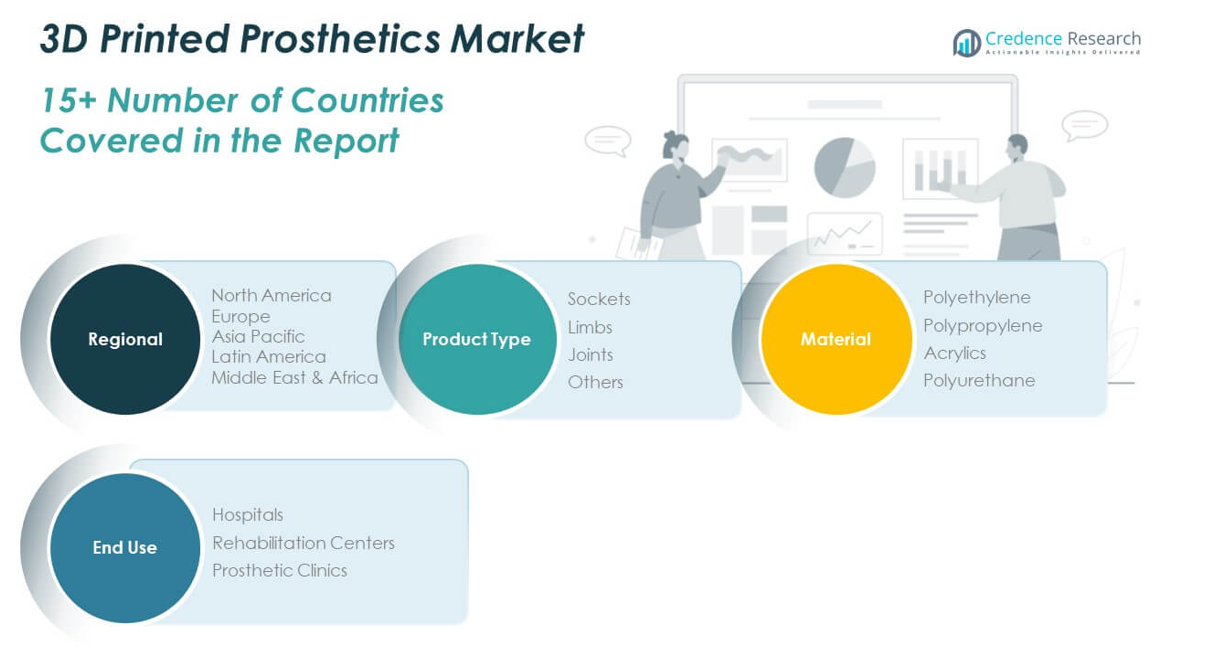

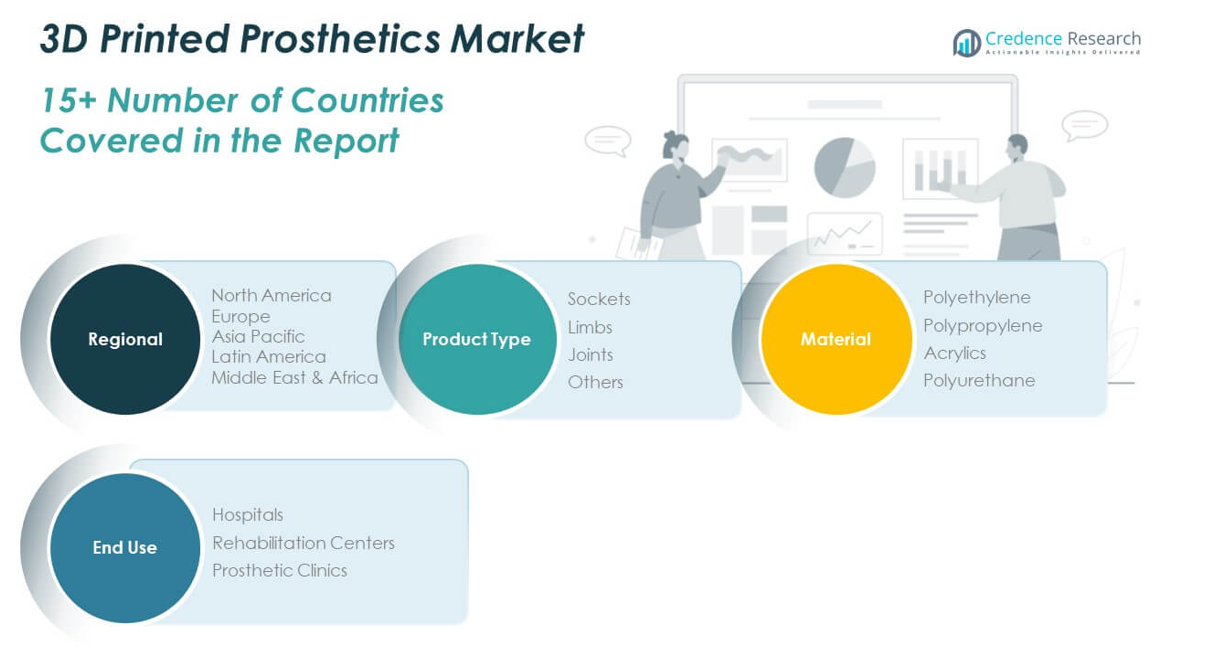

The global 3D printed prosthetics market is segmented into product types, materials, and end-use categories, each playing a critical role in market expansion.

By Product Type, the market includes sockets, limbs, joints, and others. Limbs hold the largest share due to the high demand for full prosthetic replacements, while sockets are essential for the comfort and fitting of prosthetics. Joints are gaining traction for their ability to enhance mobility and functionality, particularly in lower limb prosthetics.

- For example, Sockets: MIT’s digital transtibial prosthetic pipeline uses MRI and digital image correlation (DIC) to generate subject-specific pressure maps and socket geometries, validated by clinical trials measuring gait, pressure, and thermal metrics.

By Material segment comprises polyethylene, polypropylene, acrylics, and polyurethane. Polyethylene is favored for its lightweight properties and durability, while polypropylene is known for its flexibility. Acrylics and polyurethane are used for their strength and aesthetic appeal, providing a balance between functionality and comfort.

- For example, Peke Waihangain New Zealand utilizes 3D-printed polyethylene components in their prosthetic devices, which has enabled them to nearly double their output of custom prosthetics in the past year, improving accessibility and patient comfort.

By End Use, the market is divided into hospitals, rehabilitation centers, and prosthetic clinics. Hospitals lead in the adoption of 3D printed prosthetics due to their access to advanced technologies and large patient volumes. Rehabilitation centers are increasingly integrating 3D printed prosthetics as part of their treatment programs, offering customized solutions to patients. Prosthetic clinics cater to individual patient needs, emphasizing personalized and affordable prosthetic devices. Each of these segments contributes to the overall growth of the global 3D printed prosthetics market, with continuous innovations and improvements in customization and cost-efficiency.

Segmentation:

By Product Type:

- Sockets

- Limbs

- Joints

- Others

By Material:

- Polyethylene

- Polypropylene

- Acrylics

- Polyurethane

By End Use:

- Hospitals

- Rehabilitation Centers

- Prosthetic Clinics

By Region:

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis:

North America 3D Printed Prosthetics Market

The North America 3D printed prosthetics market size was valued at USD 467.88 million in 2018, and it is anticipated to reach USD 1,369.28 million by 2032, growing at a CAGR of 7.6% during the forecast period. North America holds the largest market share in the global 3D printed prosthetics market, primarily due to the region’s advanced healthcare infrastructure and early adoption of new technologies. The United States leads the market, driven by significant healthcare investments and a large number of prosthetic device manufacturers. The demand for personalized prosthetics and advancements in 3D printing technologies further fuel growth in this region. The growing prevalence of limb loss, coupled with increasing awareness of 3D printed prosthetics, supports market expansion. Healthcare initiatives in the region promote research and development, offering a conducive environment for growth. North America’s market share is expected to remain dominant as demand for affordable, high-quality prosthetics continues to rise.

Europe 3D Printed Prosthetics Market

The Europe 3D printed prosthetics market size was valued at USD 203.25 million in 2018, and it is anticipated to reach USD 512.90 million by 2032, growing at a CAGR of 6.2% during the forecast period. Europe holds a significant share of the global market, driven by strong healthcare systems, innovation in prosthetic technology, and growing adoption of 3D printing in the medical field. Countries like Germany, the UK, and France lead the market, with robust research and development activities supporting advancements in prosthetics. The demand for custom-made and cost-effective solutions is increasing, further contributing to the market’s growth. European regulatory frameworks also support the development and commercialization of 3D printed medical devices, facilitating market growth. The region’s market share is expected to grow as digital technologies, including 3D printing, gain more traction in the healthcare sector.

Asia Pacific 3D Printed Prosthetics Market

The Asia Pacific 3D printed prosthetics market size was valued at USD 360.04 million in 2018, and it is anticipated to reach USD 1,206.90 million by 2032, growing at a CAGR of 8.6% during the forecast period. The Asia Pacific region is expected to experience the highest growth rate in the global 3D printed prosthetics market. Countries like China, India, and Japan are witnessing an increase in the adoption of 3D printed prosthetics due to growing healthcare needs, technological advancements, and rising awareness. The region’s large population, coupled with a rising incidence of limb loss, drives demand for affordable prosthetics. Improvements in healthcare infrastructure and government support for innovative healthcare solutions further propel market growth. The Asia Pacific market share is expanding as the demand for customized, cost-effective prosthetic solutions grows.

Latin America 3D Printed Prosthetics Market

The Latin America 3D printed prosthetics market size was valued at USD 48.45 million in 2018, and it is anticipated to reach USD 123.28 million by 2032, growing at a CAGR of 5.7% during the forecast period. The Latin American market is expanding gradually as healthcare access improves, and demand for affordable prosthetic solutions increases. Countries such as Brazil and Mexico are driving the growth of the market in this region. The need for low-cost, high-quality prosthetics is becoming more evident as the prevalence of limb loss rises, particularly in emerging economies. Rising awareness and adoption of 3D printing technologies also support market expansion. The Latin America market share is expected to increase as more patients gain access to personalized prosthetics that offer cost-effective solutions for rehabilitation and mobility.

Middle East 3D Printed Prosthetics Market

The Middle East 3D printed prosthetics market size was valued at USD 27.16 million in 2018, and it is anticipated to reach USD 58.93 million by 2032, growing at a CAGR of 4.8% during the forecast period. The Middle East region is seeing steady growth in the adoption of 3D printed prosthetics, driven by advancements in healthcare infrastructure and increasing demand for affordable prosthetic solutions. Countries like the UAE and Saudi Arabia are investing heavily in medical technology, including 3D printing, to improve healthcare delivery. The market is also supported by a rising number of patients requiring prosthetic devices due to accidents and medical conditions. The Middle East market share will continue to expand as awareness of the benefits of 3D printed prosthetics increases, further improving patient access to cutting-edge solutions.

Africa 3D Printed Prosthetics Market

The Africa 3D printed prosthetics market size was valued at USD 14.03 million in 2018, and it is anticipated to reach USD 35.23 million by 2032, growing at a CAGR of 3.7% during the forecast period. The African market is experiencing gradual growth, driven by the need for affordable, accessible prosthetic devices. Countries like South Africa and Kenya are leading the adoption of 3D printed prosthetics, where the technology is seen as a cost-effective solution to address the lack of prosthetic access in underserved areas. The rising incidence of limb loss, combined with improved healthcare infrastructure, supports market growth. As awareness of 3D printing in healthcare increases, the demand for customized and affordable prosthetics is expected to grow, further expanding the African market share. The market will continue to evolve as more healthcare providers recognize the potential of 3D printing in improving patient care and access to prosthetics.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- 3D Systems Corporation

- EnvisionTEC

- Stratasys Ltd.

- Bionicohand

- YouBionic

- Mecuris

- LimbForge, Inc.

- Open Bionics

- Create Prosthetics

- Bio3D Technologies

Competitive Analysis:

The competitive landscape of the global 3D printed prosthetics market is marked by the presence of both established players and emerging startups focused on technological innovation and cost-effective solutions. Key players include companies like Össur, 3D Systems, and Stratasys, which leverage their expertise in 3D printing and medical devices to offer advanced prosthetic solutions. These companies focus on improving product functionality, customization, and user experience, thus gaining a competitive edge. Smaller companies are capitalizing on the affordability and customization offered by 3D printing, providing tailored prosthetics for specific patient needs. Competitive strategies include partnerships with healthcare providers, investments in research and development, and expanding product portfolios to meet diverse customer demands. As the market continues to grow, companies are expected to focus on enhancing material quality, user comfort, and expanding accessibility to capture a larger market share.

Recent Developments:

- In April 2025, 3D Systems unveiled several new solutions at RAPID+TCT 2025, including the Figure 4® 135 3D printer and the Figure 4 Tough 75C FR Black material, both aimed at cost-effective, high-precision additive manufacturing for applications like prosthetics, motorsports, and electrical connectors.

- In April 2025, Stratasys launched the Neo®800+, a high-speed, large-format stereolithography (SLA) 3D printer. The Neo800+ features ScanControl+™ technology, which increases printing speeds by up to 50% and delivers high part yield and low production costs. This new printer is designed for industries requiring large, accurate, and repeatable high-fidelity parts, including applications in prosthetics, wind tunnel testing, and tooling. The Neo800+ will be showcased at the RAPID+TCT conference in Detroit.

- In March 2025, Open Bionics launched the Hero Pro and Hero RGD prosthetic hands.These new models are wireless, waterproof, and operate independently of the wearer, offering improved functionality and user experience.The Hero Arm, known for its affordability and advanced features, continues to be a significant product in the 3D printed prosthetics market.

Market Concentration & Characteristics:

The global 3D printed prosthetics market is characterized by a moderately concentrated competitive landscape, with a few major players holding significant market share, while several smaller companies focus on niche segments. Leading companies, such as Össur, 3D Systems, and Stratasys, dominate the market by leveraging their advanced technologies, strong distribution networks, and established brand recognition. Smaller players are focusing on providing affordable and customizable solutions, often targeting emerging markets with specific regional needs. The market is highly innovative, with continuous advancements in 3D printing technologies and materials driving product differentiation. Companies also emphasize collaborations with healthcare providers and research institutions to expand their product offerings. The market’s competitive environment is dynamic, with players vying for dominance through technological innovations, cost-effective solutions, and strategic partnerships to capture a larger share of the growing demand for personalized prosthetic devices.

Report Coverage:

The research report offers an in-depth analysis based on product types, materials, and end-use. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- The global 3D printed prosthetics market is projected to grow from USD 1.79 billion in 2024 to USD 3.84 billion by 2034, at a CAGR of 7.9%.

- Technological advancements in 3D printing are enabling the production of highly customized, lightweight, and aesthetically pleasing prosthetic limbs at potentially lower costs than traditional methods.

- The increasing prevalence of limb loss due to accidents, diabetes, and vascular diseases is driving demand for personalized medical solutions, contributing to market growth.

- The growing focus on pediatric prosthetics is contributing to market growth, with lightweight and adaptable designs catering to children’s unique needs.

- Advances in materials and design technologies are expanding the range of available prosthetics, making them more durable and versatile.

- Government initiatives and non-profit programs aimed at improving healthcare access in underserved regions are accelerating the adoption of 3D printed prosthetics.

- The integration of artificial intelligence and machine learning in prosthetic design is enhancing personalization and functionality, leading to improved patient outcomes.

- The rise of open-source platforms and community-driven initiatives is democratizing access to prosthetic designs, fostering innovation and reducing costs.

- Strategic partnerships and collaborations among key players are expanding market reach and accelerating the development of advanced prosthetic solutions.

- The increasing awareness and acceptance of 3D printed prosthetics among healthcare professionals and patients are driving wider adoption and market expansion.