| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| 3D Printed Gas Turbine Market Size 2024 |

USD 1,630.41 million |

| 3D Printed Gas Turbine Market, CAGR |

13.74% |

| 3D Printed Gas Turbine Market Size 2032 |

USD 4,900.36 million |

Market Overview:

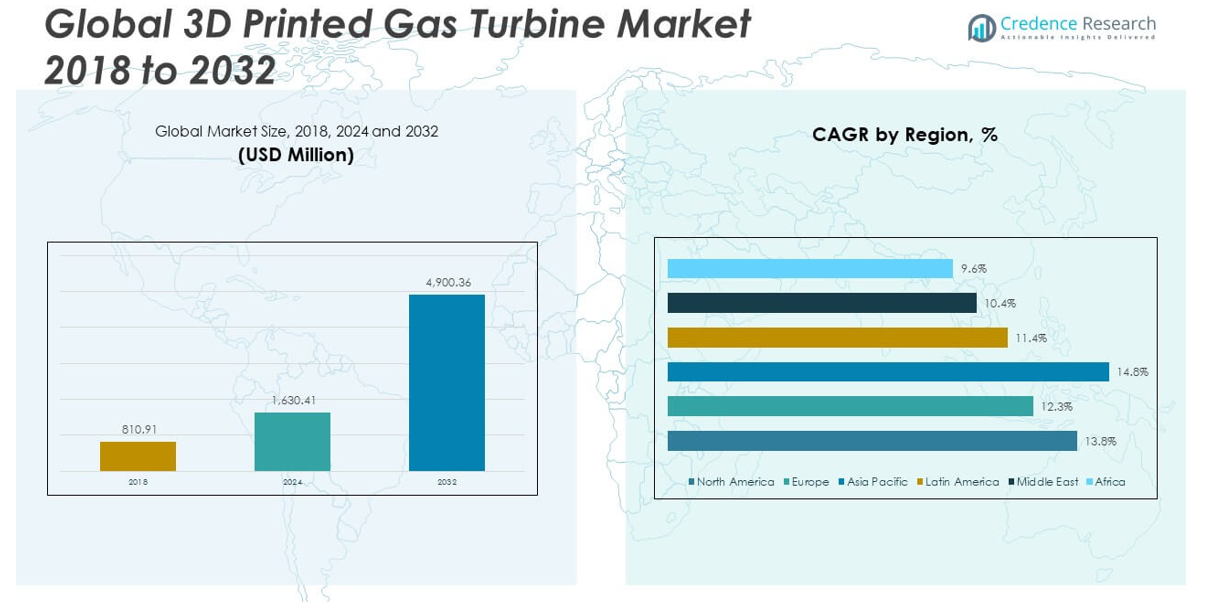

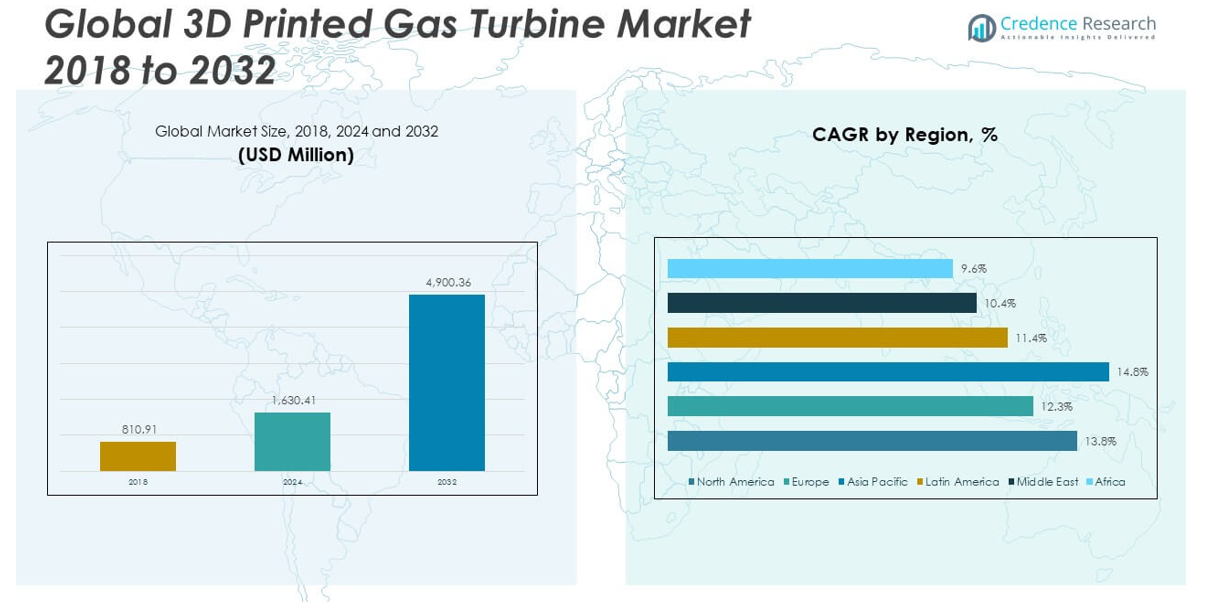

The Global 3D Printed Gas Turbine Market size was valued at USD 810.91 million in 2018 to USD 1,630.41 million in 2024 and is anticipated to reach USD 4,900.36 million by 2032, at a CAGR of 13.74% during the forecast period.

The primary drivers of growth in the 3D printed gas turbine market include the need for improved operational efficiency, performance reliability, and cost optimization. Additive manufacturing allows for the production of highly complex and lightweight turbine parts, such as fuel injectors and turbine blades, which contribute to enhanced thermal management and reduced fuel consumption. These benefits are particularly crucial for the aerospace and power generation sectors, which are under continuous pressure to meet stringent emission and fuel efficiency standards. Moreover, 3D printing enables rapid prototyping and reduced lead times, giving manufacturers the flexibility to innovate faster and respond quickly to design changes. Technological advancements in materials—especially in high-strength metals like titanium, nickel alloys, and ceramic composites—are also boosting the durability and heat resistance of printed components. As companies increase investments in digital manufacturing and automation, the integration of 3D printing into turbine production lines is becoming more mainstream, supporting long-term scalability and sustainability goals.

Regionally, North America dominates the global market due to its strong aerospace and defense manufacturing base, early adoption of additive manufacturing, and the presence of leading companies such as GE Aviation and Honeywell. The region benefits from significant R&D funding, a skilled workforce, and a mature industrial infrastructure. Europe follows closely, with countries like Germany, the United Kingdom, and France actively promoting 3D printing through industrial partnerships and government-led innovation initiatives. The European market is further supported by the region’s commitment to decarbonization, which encourages the development of efficient turbine technologies. Meanwhile, the Asia-Pacific region is expected to witness the fastest growth during the forecast period. Rapid industrialization, increased investments in energy infrastructure, and supportive government policies in countries such as China, India, Japan, and South Korea are driving regional demand. China, in particular, is investing heavily in domestic 3D printing capabilities to reduce reliance on imported turbine components. Latin America and the Middle East & Africa are emerging markets, showing gradual adoption due to expanding energy projects and growing awareness of additive manufacturing benefits. As global manufacturing continues to evolve, regional dynamics will play a critical role in shaping the future of the 3D printed gas turbine market.

Market Insights:

- The Global 3D Printed Gas Turbine Market is projected to grow from USD 810.91 million in 2018 to USD 4,900.36 million by 2032, at a CAGR of 13.74%.

- Improved fuel efficiency and reduced emissions are key drivers, as 3D printing produces complex, lightweight components that enhance turbine performance.

- The technology helps reduce costs and production times, offering faster prototyping and greater flexibility in design, making it an attractive solution for aerospace and power generation sectors.

- Technological advancements in materials like titanium, nickel alloys, and ceramics improve turbine durability, enhancing their heat resistance and longevity.

- Digital manufacturing and automation are accelerating the integration of 3D printing, enhancing design precision, reducing errors, and optimizing production processes.

- The North American market dominates, driven by strong aerospace and defense industries, with significant investments in R&D and additive manufacturing infrastructure.

- Despite growth, challenges such as high initial investments and regulatory hurdles related to certification of 3D printed turbine components continue to pose barriers to widespread adoption.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers:

Enhanced Fuel Efficiency and Reduced Emissions

The Global 3D Printed Gas Turbine Market benefits from the growing demand for improved fuel efficiency and lower emissions in turbine manufacturing. 3D printing allows for the production of complex, lightweight components, such as turbine blades and fuel injectors, that enhance the thermal management and efficiency of gas turbines. These components help reduce fuel consumption and improve overall turbine performance. Industries like aerospace and power generation are increasingly turning to additive manufacturing as a way to meet stringent environmental standards and evolving energy demands, making it a key driver for the market. The ability to create customized, high-performance parts further supports the demand for 3D printing in reducing the carbon footprint of turbine operations.

- For instance, Siemens Energy and EON Energy Projects installed 3D-printed guiding vanes and heat shields in a gas turbine at a German combined cycle power station, resulting in a 25% reduction in cooling air consumption and a 0.5% improvement in turbine efficiency.

Cost Reduction and Faster Production Times

Cost efficiency and shortened production times significantly contribute to the growth of the Global 3D Printed Gas Turbine Market. Traditional turbine manufacturing methods often incur high costs and long lead times, particularly when producing intricate parts. 3D printing reduces material waste, streamlines production processes, and allows for faster prototyping. Manufacturers can quickly test and refine designs, reducing the time to market for new turbine models. This increased speed and cost-efficiency make 3D printing an attractive solution in competitive and cost-sensitive sectors like aerospace and power generation. As companies look to optimize their production cycles, 3D printing offers an attractive alternative to traditional methods, ensuring greater operational agility.

- For instance, EOS introduced NickelAlloy IN738, a superalloy specifically engineered for additive manufacturing in gas turbine applications. In stress rupture tests, IN738 demonstrated a 50% increase in rupture life compared to conventional compositions, and its enhanced creep resistance allows for the production of turbine blades that require less cooling and offer greater durability under high-temperature, high-stress conditions.

Advancements in Materials Science

Technological innovations in materials science are key drivers of the Global 3D Printed Gas Turbine Market. The development of high-performance alloys and ceramics tailored for additive manufacturing has enabled the creation of stronger, more durable turbine components. Materials like titanium and nickel-based alloys are now compatible with 3D printing, offering resistance to high temperatures and extreme environments. These advancements improve the operational longevity and reliability of gas turbines. Continued material research will expand the potential of 3D printing, providing manufacturers with more robust solutions for turbine component production. As these materials continue to evolve, they will enable even more specialized turbine designs, boosting market adoption.

Integration of Digital Manufacturing and Automation

The integration of digital manufacturing and automation is accelerating the adoption of 3D printing in the gas turbine industry. Digital technologies such as 3D scanning, modeling, and simulation enhance the design and precision of turbine components. These technologies enable manufacturers to produce customized parts that meet specific performance requirements while maintaining high quality. The increasing use of automation in manufacturing processes ensures faster, more consistent production, reducing errors and improving overall efficiency. This synergy between digital tools and 3D printing is a critical driver of growth in the market. As automation systems become more advanced, they will further optimize production flows, reducing costs and enhancing turbine performance.

Market Trends:

Increasing Adoption of Hybrid Turbine Systems

One notable trend in the Global 3D Printed Gas Turbine Market is the growing adoption of hybrid turbine systems that combine gas turbines with other energy sources, such as solar or wind power. Hybrid systems offer greater flexibility and efficiency in power generation by optimizing fuel use and reducing emissions. These systems leverage 3D printed components to enhance performance, particularly in terms of fuel efficiency and operational lifespan. As the demand for sustainable energy solutions continues to rise, hybrid turbine systems are becoming a preferred choice for both the aerospace and energy sectors. 3D printing plays a crucial role in enabling the customization of components required for these hybrid systems, leading to enhanced efficiency.

Focus on Aerospace and Power Generation Applications

The Global 3D Printed Gas Turbine Market is increasingly seeing a focus on aerospace and power generation applications. Both sectors are actively seeking ways to enhance turbine performance through additive manufacturing, which offers design flexibility and the ability to produce lightweight, high-performance components. In aerospace, for example, 3D printing enables the production of highly complex and efficient parts that reduce fuel consumption and increase engine reliability. In the power generation sector, turbines with 3D printed components help meet environmental regulations by improving energy efficiency and reducing harmful emissions. These trends are reshaping how turbines are used in both industries, accelerating the shift toward additive manufacturing.

- For example, Aurora Labs Limitedhas demonstrated the impact of 3D printing in aerospace propulsion with its 200N Class 3D printed micro gas turbine, which achieved 22 kg of thrust during its maiden flight in July 2024.

Customization of Gas Turbine Components for Specific Use Cases

Customization of gas turbine components for specific use cases is another emerging trend in the Global 3D Printed Gas Turbine Market. The ability to tailor parts to meet the specific needs of different industries, operating conditions, and performance goals has gained significant traction. 3D printing allows for the creation of bespoke components that are not possible with traditional manufacturing techniques. By producing customized turbine blades, nozzles, and other critical components, manufacturers can optimize turbine performance and durability in ways that were previously unattainable. This level of customization improves both the efficiency and reliability of turbines, driving further growth in the market.

- For example, Oak Ridge National Laboratory and Solar Turbines have demonstrated the ability to print entire blade sets with defect-free geometries, leveraging the EBM process’s 1,000°C heated powder bedto suppress thermal gradients and eliminate cracks. This enables the production of bespoke turbine blades and nozzles with complex internal cooling channels, tailored to specific thermal and mechanical requirements.

Expansion of 3D Printing Capabilities in Material Innovation

The expansion of 3D printing capabilities in material innovation is a crucial trend influencing the Global 3D Printed Gas Turbine Market. As new, advanced materials are developed specifically for additive manufacturing, turbine components are becoming more durable, efficient, and capable of withstanding extreme operating conditions. High-performance materials such as superalloys, ceramics, and metal composites are increasingly being used in the production of turbine components. These materials enable the creation of parts that offer improved heat resistance, strength, and wear properties, making turbines more efficient and long-lasting. This trend highlights the continuous evolution of additive manufacturing technology and its impact on turbine production.

Market Challenges Analysis:

High Initial Investment and Infrastructure Costs

One of the major challenges facing the Global 3D Printed Gas Turbine Market is the high initial investment and infrastructure costs associated with adopting 3D printing technology. While additive manufacturing offers long-term cost savings through reduced material waste and faster production times, the initial setup costs for 3D printing systems and specialized equipment can be prohibitively expensive. Smaller manufacturers, in particular, may struggle to justify these investments, especially without guaranteed returns in the short term. Furthermore, the integration of 3D printing technology into existing turbine production lines requires significant upgrades to manufacturing facilities, which adds to the overall financial burden. These high costs can slow down the widespread adoption of 3D printing in turbine manufacturing, especially in cost-sensitive industries.

Certification and Regulatory Hurdles

Another significant challenge in the Global 3D Printed Gas Turbine Market is the complexity of certification and regulatory compliance. Gas turbines, especially those used in aerospace and energy generation, must meet strict safety and performance standards. The use of 3D printed components in turbine systems introduces uncertainty in terms of certification, as these parts need to undergo extensive testing and validation before they can be deemed safe and reliable for commercial use. Regulatory bodies are still developing standards for additive manufacturing, which leads to delays in approval and complicates the certification process for new turbine designs. The uncertainty surrounding regulatory requirements can hinder the speed at which 3D printing technology is adopted, particularly in industries with stringent safety requirements.

Market Opportunities:

Expanding Demand for Sustainable Energy Solutions

The Global 3D Printed Gas Turbine Market stands to benefit from the increasing global focus on sustainable energy solutions. As industries and governments push for cleaner energy alternatives, there is a growing demand for more efficient turbines that minimize environmental impact. 3D printing technology enables the production of advanced, lightweight components that can significantly improve turbine performance, leading to reduced fuel consumption and lower emissions. This shift towards sustainable energy presents a substantial opportunity for 3D printed turbines to play a central role in meeting global energy efficiency targets, especially in sectors like aerospace and power generation.

Growth in Aerospace and Industrial Applications

There is also a significant opportunity in the expanding aerospace and industrial sectors, where the demand for high-performance, cost-efficient turbine components continues to rise. 3D printing offers unparalleled design flexibility, allowing for the production of complex turbine components that are lighter, stronger, and more durable. This capability opens doors for new applications in both commercial and military aviation, where turbine performance is critical. Additionally, the increasing adoption of 3D printed turbines in industrial power generation and transportation sectors further enhances market growth potential. The ability to customize parts for specific use cases makes 3D printing a valuable solution for these industries.

Market Segmentation Analysis:

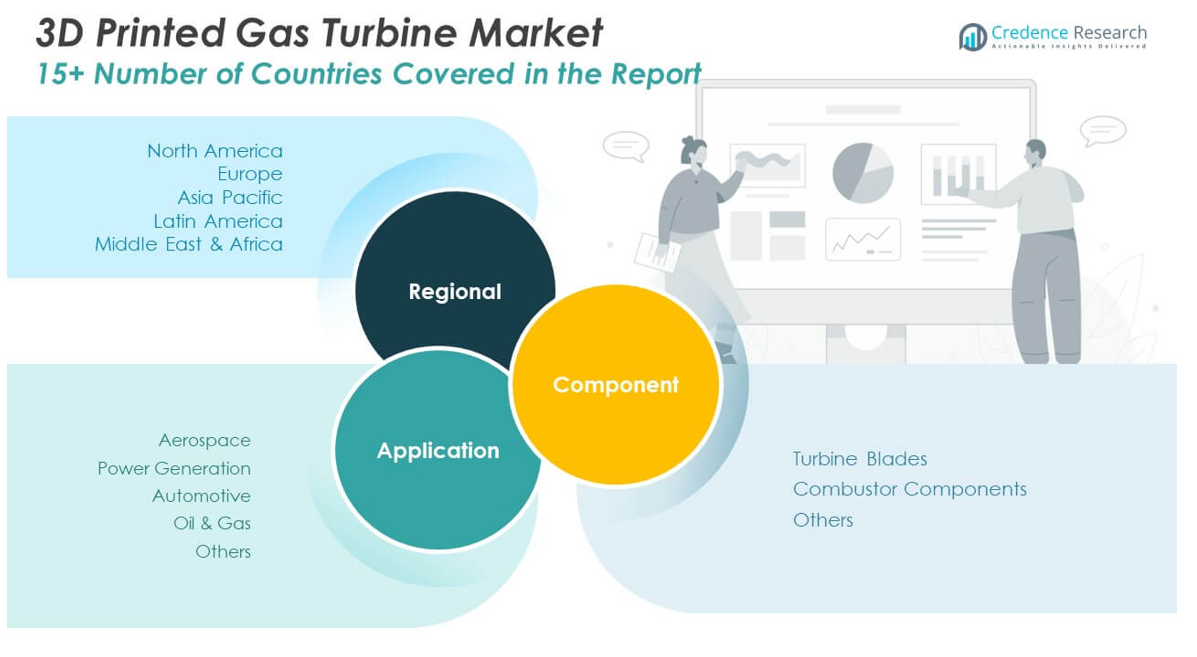

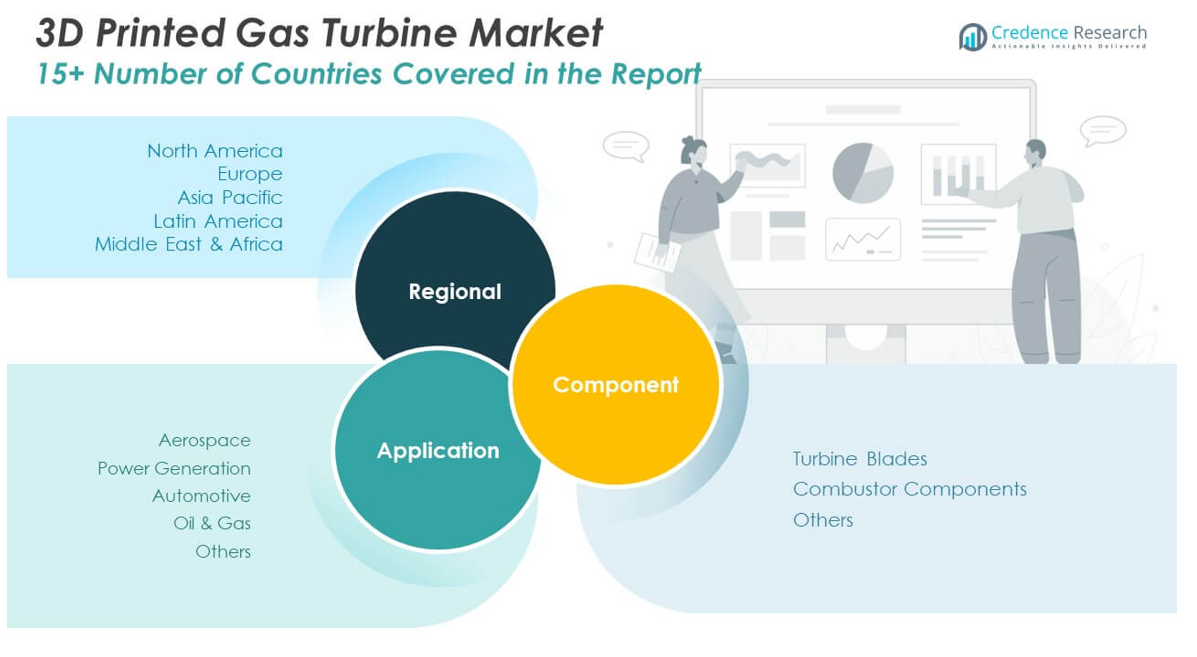

The Global 3D Printed Gas Turbine Market is segmented by component and application, each of which contributes significantly to its growth.

By component segment, turbine blades dominate the market due to their critical role in turbine efficiency and performance. 3D printing enables the production of lightweight, complex turbine blades that improve fuel efficiency and reduce emissions. Combustor components also hold a substantial share as 3D printing allows for the creation of intricate designs that optimize combustion processes, contributing to higher performance and lower operational costs. Other components such as nozzles, seals, and bearings are also increasingly manufactured using 3D printing, benefiting from the flexibility and precision that additive manufacturing offers.

- For instance, GE Aviation’s LEAP engine utilizes 3D-printed turbine blades manufactured using laser powder bed fusion technology, resulting in a 15% improvement in fuel efficiency and a 5% reduction in overall engine weight, as documented in GE’s official technical releases.

By application segment is led by aerospace, where 3D printed gas turbines significantly enhance engine performance by reducing weight and increasing fuel efficiency. In the power generation sector, the demand for more sustainable and efficient turbines drives the adoption of 3D printing. Automotive applications are emerging as another key area, with hybrid and electric vehicle manufacturers using 3D printed turbines to improve fuel efficiency and performance. The oil & gas industry also adopts 3D printed turbine components to withstand harsh environments and improve reliability. Other sectors, including marine and industrial applications, are seeing gradual adoption of 3D printed turbines, driven by the need for customized, high-performance solutions.

- For example, BMW has been utilizing 3D printing since 1991 for various components, including parts for special models, concept cars, prototypes, and race cars. The company’s Additive Manufacturing Campus in Oberschleissheim has been instrumental in advancing 3D printing within BMW, producing over 300,000 parts in 2023 alone.

Segmentation:

By Component

- Turbine Blades

- Combustor Components

- Others

By Application

- Aerospace

- Power Generation

- Automotive

- Oil & Gas

- Others

By Region

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis:

North America 3D Printed Gas Turbine Market

The North America 3D Printed Gas Turbine Market size was valued at USD 346.54 million in 2018, reaching USD 689.35 million in 2024, and is anticipated to reach USD 2,077.80 million by 2032, at a CAGR of 13.8% during the forecast period. North America holds the largest market share in the global 3D printed gas turbine sector. The region benefits from a strong aerospace and defense industry, as well as significant investments in additive manufacturing technologies. The United States, in particular, is a key contributor, with major players such as GE Aviation and Honeywell leading innovation in turbine production. Increased demand for energy-efficient solutions and the region’s emphasis on sustainable power generation further supports market growth. North America’s established infrastructure and technological leadership make it a dominant player in the development and adoption of 3D printed gas turbines.

Europe 3D Printed Gas Turbine Market

The Europe 3D Printed Gas Turbine Market size was valued at USD 141.37 million in 2018, reaching USD 267.57 million in 2024, and is anticipated to reach USD 725.81 million by 2032, at a CAGR of 12.3% during the forecast period. Europe holds a significant share in the global market due to its strong presence in aerospace and power generation industries. Countries like Germany, the UK, and France are investing heavily in additive manufacturing to improve turbine efficiency and reduce emissions. Europe’s regulatory push towards cleaner energy solutions, including increased adoption of renewable energy and decarbonization policies, drives the demand for advanced gas turbine technologies. The region’s strong R&D infrastructure and emphasis on industrial innovation contribute to its leadership in adopting 3D printed gas turbine solutions.

Asia Pacific 3D Printed Gas Turbine Market

The Asia Pacific 3D Printed Gas Turbine Market size was valued at USD 266.34 million in 2018, reaching USD 561.81 million in 2024, and is anticipated to reach USD 1,824.04 million by 2032, at a CAGR of 14.8% during the forecast period. Asia Pacific is expected to experience the highest growth rate in the global market. This is due to rapid industrialization, expanding energy needs, and growing investments in renewable energy. Countries like China, Japan, and India are at the forefront of adopting 3D printing in turbine manufacturing to improve energy efficiency and reduce operational costs. The region’s governments are increasingly supporting the transition towards cleaner energy solutions, which contributes to the increasing demand for advanced turbine technologies. As the region focuses on infrastructure modernization and power generation, it presents significant growth opportunities for 3D printed turbines.

Latin America 3D Printed Gas Turbine Market

The Latin America 3D Printed Gas Turbine Market size was valued at USD 29.47 million in 2018, reaching USD 58.29 million in 2024, and is anticipated to reach USD 148.94 million by 2032, at a CAGR of 11.4% during the forecast period. Latin America is an emerging market for 3D printed gas turbines, with increasing interest in modernizing the energy and aerospace sectors. Brazil, Mexico, and Argentina are seeing significant growth in the adoption of additive manufacturing for turbine applications. The region’s energy needs are expanding, and governments are looking for sustainable energy solutions to meet growing demand. As infrastructure investments increase, Latin America’s market for 3D printed gas turbines is projected to experience steady growth.

Middle East 3D Printed Gas Turbine Market

The Middle East 3D Printed Gas Turbine Market size was valued at USD 17.35 million in 2018, reaching USD 30.97 million in 2024, and is anticipated to reach USD 73.47 million by 2032, at a CAGR of 10.4% during the forecast period. The Middle East is increasingly investing in 3D printed gas turbines to modernize its energy infrastructure and diversify away from traditional fossil fuels. Countries like the UAE and Saudi Arabia are focusing on energy efficiency and sustainability, which encourages the adoption of advanced turbine technologies. The region’s focus on reducing carbon emissions and improving energy efficiency supports the growth of additive manufacturing in turbine production. Despite its smaller market share, the Middle East offers significant opportunities due to its strategic investments in sustainable energy.

Africa 3D Printed Gas Turbine Market

The Africa 3D Printed Gas Turbine Market size was valued at USD 9.83 million in 2018, reaching USD 22.41 million in 2024, and is anticipated to reach USD 50.31 million by 2032, at a CAGR of 9.6% during the forecast period. Africa’s 3D printed gas turbine market is in its nascent stages, but growing energy demand and infrastructure development present significant opportunities for growth. The region is increasingly adopting advanced technologies to improve energy efficiency and meet power generation needs. Countries like South Africa and Nigeria are investing in renewable energy and modernizing their energy grids, creating demand for more efficient turbine solutions. The market’s steady growth reflects the region’s commitment to infrastructure development and sustainable energy solutions.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- General Electric (GE)

- Siemens Energy

- Mitsubishi Heavy Industries

- Ansaldo Energia

- Baker Hughes

- MAN Energy Solutions

- Solar Turbines

- Rolls-Royce

- Kawasaki Heavy Industries

- Capstone Turbine Corporation

Competitive Analysis:

The Global 3D Printed Gas Turbine Market is highly competitive, with key players focusing on innovation, cost reduction, and efficiency improvements. Leading companies like General Electric, Siemens, and Mitsubishi Heavy Industries invest heavily in research and development to integrate 3D printing into turbine manufacturing, aiming to improve performance and reduce operational costs. These companies leverage advanced materials and additive manufacturing technologies to produce complex turbine components that offer superior efficiency, durability, and reduced environmental impact. Smaller players and startups also contribute to the market by offering specialized solutions tailored to niche sectors such as aerospace and oil & gas. Competition intensifies as companies expand their portfolios and explore new applications, including automotive and power generation. Strategic partnerships, acquisitions, and investments in 3D printing technologies allow companies to maintain a competitive edge in this rapidly evolving market.

Recent Developments:

- In May 2025, Ansaldo Energia announced it would supply four leading-edge AE94.3A gas turbines for the new Al Dhafra power plant in Abu Dhabi, commissioned by TAQA. While the announcement focuses on the deployment of advanced gas turbines, Ansaldo Energia has emphasized the integration of digital and remote diagnostics systems for continuous monitoring.

- GE Aerospace announced a $650 million investment plan in 2024 to scale production of its 3D printing-enabled LEAP engines and GE9X engines, featuring over 300 3D-printed parts. This investment aims to enhance production capabilities at facilities across the U.S. and internationally.

Market Concentration & Characteristics:

The Global 3D Printed Gas Turbine Market is moderately concentrated, with a few dominant players leading the way in innovation and market share. Major companies such as General Electric, Siemens, and Mitsubishi Heavy Industries control a significant portion of the market by investing in advanced 3D printing technologies and forming strategic partnerships. These players focus on high-performance applications in aerospace, power generation, and oil & gas sectors. While large companies maintain a competitive advantage through robust R&D and established infrastructure, smaller players and startups also contribute by offering specialized products and services, particularly in niche markets. The market is characterized by rapid technological advancements, with companies continuously improving the efficiency, sustainability, and cost-effectiveness of 3D printed turbine components. Collaboration between manufacturers and technology providers is a key factor in maintaining a competitive edge in this evolving market.

Report Coverage:

The research report offers an in-depth analysis based on component and application. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- The Global 3D Printed Gas Turbine Market will continue to grow as industries demand more fuel-efficient and environmentally friendly turbine solutions.

- Advances in additive manufacturing technologies will lead to further improvements in the performance and durability of turbine components.

- The aerospace sector will remain a key driver, with 3D printing enabling lighter and more efficient turbine parts for aircraft engines.

- Power generation applications will increasingly adopt 3D printed turbines to reduce costs and enhance operational efficiency.

- The automotive sector will explore the potential of 3D printed turbines for hybrid and electric vehicles, boosting market demand.

- Growing investments in renewable energy sources will drive the need for more efficient and cost-effective turbines.

- Emerging markets in Asia Pacific, Latin America, and Africa will see significant growth due to industrialization and increasing energy demands.

- The trend towards customized turbine components will expand, as 3D printing allows for highly specialized solutions.

- Strategic partnerships and acquisitions will increase as companies look to expand their technological capabilities and market reach.

- Regulatory pressures for sustainability will push further adoption of 3D printing to meet stricter environmental standards in turbine manufacturing.