Market Overview:

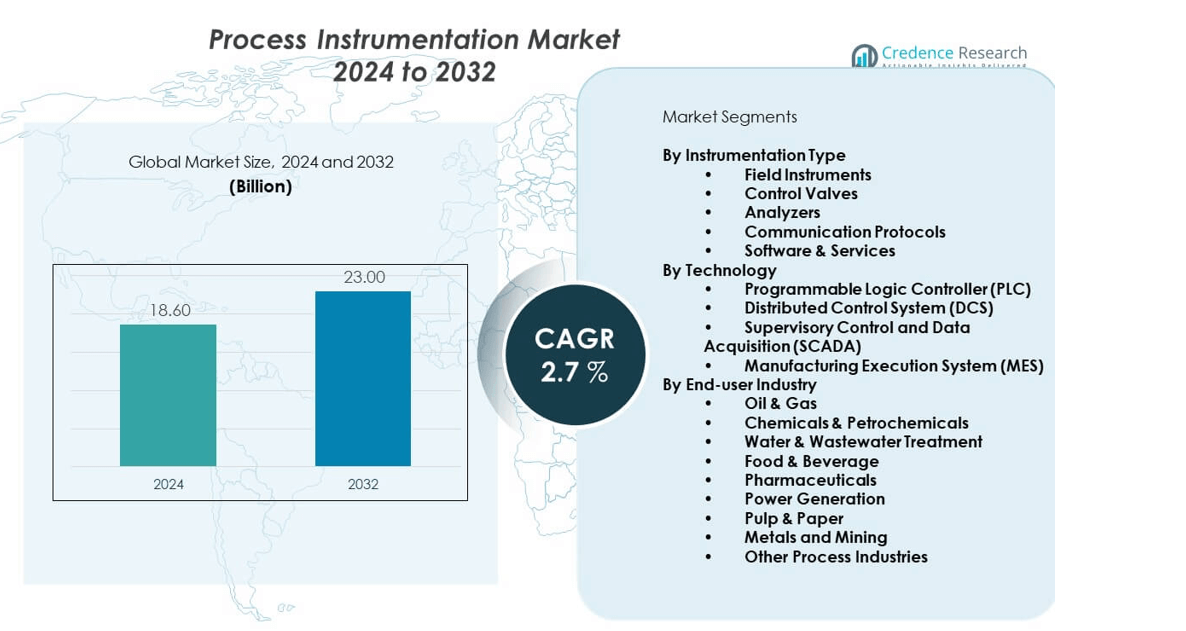

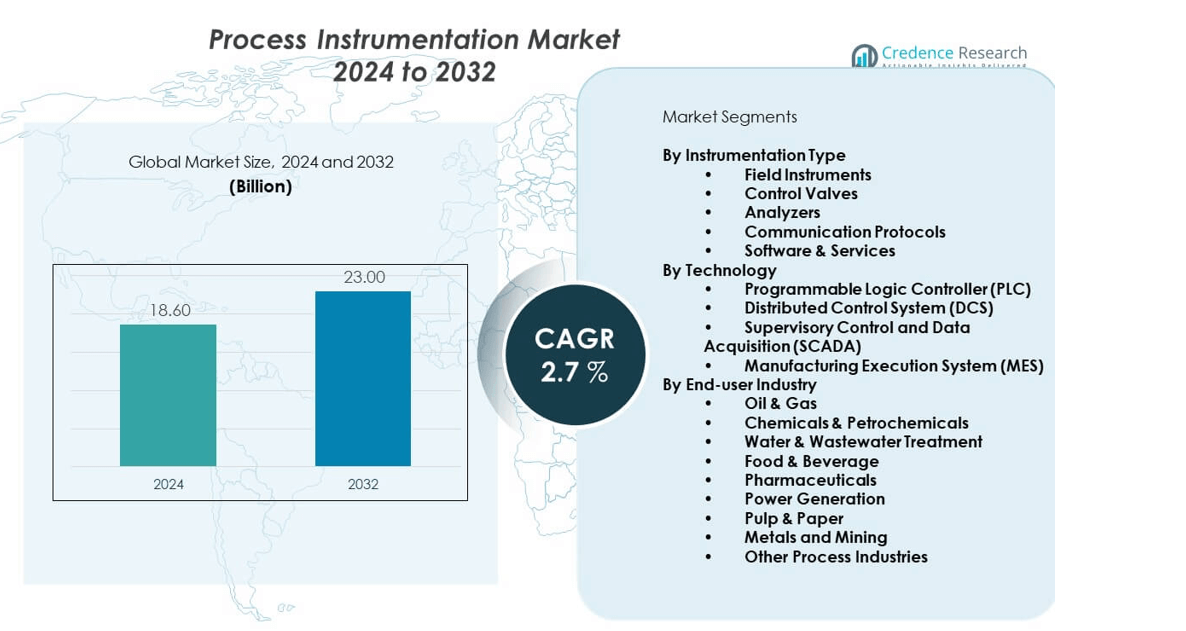

The process instrumentation market is projected to grow from USD 18.6 billion in 2024 to an estimated USD 23.0 billion by 2032, with a compound annual growth rate (CAGR) of 2.7% from 2024 to 2032.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Process Instrumentation Market Size 2024 |

USD 18.6 billion |

| Process Instrumentation Market, CAGR |

2.7% |

| Process Instrumentation Market Size 2032 |

USD 23.0 billion |

Growth is driven by industries adopting smart technologies that enhance accuracy, safety, and real-time monitoring. Companies are focusing on advanced sensors, transmitters, and analyzers to optimize operational control and reduce downtime. Expanding investments in industrial automation, coupled with the shift toward Industry 4.0, are also strengthening adoption. Rising energy demand, stricter emission norms, and the need for predictive maintenance solutions further encourage the deployment of innovative process instrumentation technologies across critical sectors.

Regional Analysis, North America leads the process instrumentation market due to strong investments in industrial automation, advanced manufacturing, and stringent compliance standards. Europe follows closely, driven by its strong focus on energy efficiency and sustainability initiatives. The Asia-Pacific region is emerging as the fastest-growing market, supported by rapid industrialization in China, India, and Southeast Asia. Growing infrastructure projects and expanding chemical and energy industries make the region a key growth hub. Meanwhile, Latin America and the Middle East & Africa are witnessing steady adoption, mainly in oil and gas, mining, and water management applications.

Market Insights:

- The process instrumentation market was valued at USD 18.6 billion in 2024 and is projected to reach USD 23.0 billion by 2032, growing at a CAGR of 2.7% during the forecast period.

- Growing demand for industrial automation and digital monitoring systems is a major driver for market expansion.

- Rising emphasis on energy efficiency and compliance with stringent environmental regulations is boosting adoption across industries.

- High initial investment and challenges in integrating advanced systems with legacy infrastructure act as restraints.

- North America leads the market due to strong adoption of automation and regulatory compliance requirements.

- Europe follows with demand driven by sustainability initiatives and energy efficiency goals.

- Asia-Pacific is emerging as the fastest-growing region, fueled by rapid industrialization and infrastructure investments in China, India, and Southeast Asia.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers:

Rising Demand for Automation and Digitalization Across Industries:

The process instrumentation market is expanding due to the surge in industrial automation. Industries are adopting advanced systems to ensure higher precision, consistency, and safety in operations. Automation reduces human error, boosts efficiency, and helps maintain compliance with strict regulations. Growing use of digital solutions for data collection and real-time monitoring is increasing the adoption of smart instrumentation devices. Industries such as oil and gas, water treatment, chemicals, and energy generation are prioritizing automated controls to manage complex processes. It supports operational continuity and strengthens safety management practices. Integration of smart transmitters, analyzers, and advanced control systems allows industries to achieve greater production efficiency.

Strong Focus on Energy Efficiency and Environmental Compliance:

Sustainability goals and stricter emission regulations are fueling demand for efficient process instruments. Companies are investing in solutions that optimize energy usage while reducing waste and emissions. Governments and regulatory bodies continue to implement stringent guidelines for environmental safety, driving higher adoption of monitoring systems. The process instrumentation market benefits from rising investments in eco-friendly and energy-efficient production facilities. It helps industries align with international standards while meeting consumer expectations for sustainable practices. Smart instrumentation devices provide accurate measurement of flow, pressure, and chemical levels, enabling optimization of resources. This trend ensures industries maintain profitability while addressing environmental concerns.

- For instance, ABB’s next-generation electromagnetic flowmeters launched recently deliver accuracy improvements up to 0.15%, helping water treatment plants optimize energy use and reduce waste effectively.

Growing Investments in Industrial Infrastructure and Smart Manufacturing:

The development of smart factories and modern infrastructure projects is accelerating the use of process instrumentation. Countries across Asia-Pacific and the Middle East are investing heavily in manufacturing hubs and energy facilities. Smart manufacturing initiatives prioritize real-time monitoring, predictive maintenance, and integrated process control. The process instrumentation market is supported by government-backed industrial modernization programs. It helps industries deploy advanced sensors, valves, and transmitters that improve productivity. Infrastructure projects in oil and gas, power, and chemicals are demanding more reliable control systems. Companies are also focusing on integrating digital twins and cloud-based platforms for enhanced process visibility.

- For instance, Honeywell’s Manufacturing Excellence Platform (MXP) offers real-time production visibility with dedicated dashboards that provide actionable insights into process timelines and equipment status, enabling accelerated batch review and release through digitized paper records and integrated quality management systems. Honeywell’s platform supports scalable and modular operations that grow with production requirements, allowing comprehensive process digitization and continuous improvement at any scale.

Expanding Adoption of Predictive Maintenance and Industrial IoT Solutions:

Industries are increasingly adopting predictive maintenance tools that rely on accurate data from advanced instrumentation. Predictive maintenance reduces downtime, prevents costly breakdowns, and extends equipment life. The process instrumentation market is witnessing strong growth from the adoption of industrial IoT solutions. It enables industries to connect devices, collect data, and analyze performance in real time. Integration of AI and analytics enhances the accuracy of predictions and supports proactive decision-making. Industries in energy, water management, and chemicals are prioritizing predictive tools to ensure process reliability. This driver supports a shift from reactive to proactive maintenance strategies across industries.

Market Trends:

Integration of Wireless and Remote Monitoring Solutions:

Wireless process instruments are transforming industrial monitoring and control. Companies are reducing reliance on wired systems to cut costs and improve flexibility. Remote monitoring solutions allow operators to track performance across geographically dispersed plants. The process instrumentation market is adopting wireless communication to streamline installation and enhance scalability. It provides faster deployment, reduces maintenance requirements, and improves system uptime. Industries are adopting wireless-enabled transmitters, flow meters, and sensors to optimize efficiency. Integration with cloud platforms further strengthens real-time decision-making.

- For instance, Emerson’s strategic collaboration with TotalEnergies in 2025 uses wireless sensor networks and cloud analytics to boost data access latency by 30%, enhancing remote operational oversight.

Advancements in Miniaturized and Portable Instrumentation Devices:

Smaller, portable instrumentation devices are gaining popularity in industries demanding mobility and flexibility. Miniaturized instruments provide accurate results while occupying less space and consuming less energy. The process instrumentation market is benefiting from rising use of compact analyzers, handheld sensors, and portable testing devices. It enables industries to perform spot checks, maintenance diagnostics, and field monitoring efficiently. Compact designs improve accessibility in remote and harsh environments. Industries such as oil and gas, pharmaceuticals, and water treatment are leveraging portable devices to strengthen operational continuity. The trend highlights a growing preference for convenience and adaptability in process monitoring.

- For instance, Honeywell’s Granit Ultra industrial scanner integrates AI to boost scanning performance by 45% compared to previous models, addressing process bottlenecks. Its SwiftDecoder™ software combines AI with optical character recognition (OCR) for highly adaptive and accurate data extraction in diverse operational environments, enhancing workflow efficiency.

Increasing Adoption of Cloud-Based and AI-Powered Platforms:

Cloud-based platforms are enabling centralized data collection, analysis, and storage for instrumentation systems. The integration of AI and machine learning enhances the accuracy of insights derived from process data. The process instrumentation market is shifting toward AI-driven platforms to enable predictive analytics and anomaly detection. It supports faster decision-making and greater flexibility in adjusting operations. Cloud-based solutions also enable remote accessibility, collaboration, and scalability for large-scale industries. Companies in chemicals, food processing, and pharmaceuticals are adopting these technologies to improve competitiveness. The trend underscores a digital transformation in process monitoring and control.

Rising Popularity of Multi-Parameter and Integrated Measurement Devices:

Industries are adopting instruments capable of measuring multiple parameters simultaneously. Multi-parameter devices combine flow, temperature, pressure, and chemical analysis into a single system. The process instrumentation market is witnessing strong demand for integrated devices that improve operational efficiency. It helps industries reduce costs, streamline workflows, and minimize downtime. Integrated solutions provide comprehensive data, enabling better process optimization and predictive insights. Industries in energy, water management, and advanced manufacturing are leveraging these devices to improve reliability. The trend reflects a preference for consolidated, cost-efficient, and smarter instrumentation systems.

Market Challenges Analysis:

High Initial Costs and Integration Barriers Across Industries:

The process instrumentation market faces challenges from the high initial investment required for advanced systems. Many small and medium-sized enterprises struggle with affordability, delaying large-scale adoption. Integration of new devices with legacy systems also poses technical difficulties. It often requires customization, skilled labor, and additional infrastructure, raising overall costs. Industries in developing regions face budget limitations that restrict modernization. Complex installation procedures and technical support needs further hinder deployment speed. Companies must address these barriers to expand adoption and sustain competitiveness in cost-sensitive markets.

Data Security Concerns and Shortage of Skilled Professionals:

Adoption of digital platforms and IoT-enabled instrumentation raises concerns about cybersecurity. Unauthorized access to critical process data poses risks to industrial safety and performance. The process instrumentation market must address data privacy regulations and security frameworks. It is also affected by the shortage of skilled technicians who can operate and maintain advanced systems. Lack of expertise slows adoption and limits the benefits of sophisticated technologies. Training and upskilling initiatives are essential for industries to utilize advanced solutions effectively. Ensuring data integrity and operational security remains a critical challenge across regions.

Market Opportunities:

Expansion of Industry 4.0 and Digital Transformation in Manufacturing:

Industry 4.0 initiatives are creating strong opportunities for advanced process instrumentation. Smart factories are deploying digital systems for real-time control and automated decision-making. The process instrumentation market is expected to benefit from integration with robotics, IoT, and AI-driven platforms. It enables predictive analytics, digital twins, and enhanced visibility into operations. Companies investing in digital transformation will require scalable instrumentation solutions. Growth is supported by industrial modernization programs across developed and emerging economies. The opportunity highlights the importance of aligning with digital innovation strategies.

Rising Investments in Renewable Energy and Water Infrastructure Projects:

Global investments in renewable energy projects and water treatment facilities are driving demand for advanced instrumentation. Wind, solar, and hydro projects require accurate monitoring systems to ensure operational efficiency. The process instrumentation market is benefiting from increased infrastructure spending on smart water and wastewater treatment. It supports resource optimization, safety monitoring, and regulatory compliance. Emerging economies are prioritizing sustainable energy and water solutions, creating growth prospects. Companies focusing on instrumentation for these sectors will capture significant opportunities. This creates long-term potential for innovation and product differentiation.

Market Segmentation Analysis:

By Instrumentation Type

The process instrumentation market is segmented into field instruments, control valves, analyzers, communication protocols, and software & services. Field instruments, including pressure transmitters, temperature sensors, flow meters, and level indicators, dominate due to their role in ensuring precision and safety. Control valves also hold strong demand as automated regulators are vital for maintaining pressure, temperature, and flow stability in complex operations. Analyzers are expanding in use as industries prioritize chemical composition, gas concentration, and pH measurement to ensure compliance and product quality. Communication protocols such as HART, Foundation Fieldbus, and Profibus enable seamless data transfer and interoperability across facilities. Software & services are gaining traction with process control platforms, data management, and consulting solutions driving efficiency and reliability.

- For instance, Mitsubishi Electric’s XB Series HVIGBT modules provide high power density in compact form factors, increasing inverter efficiency and reducing footprint by 25% in industrial applications.

By Technology

Programmable logic controllers (PLC) remain a cornerstone of automation, valued for their flexibility and durability. Distributed control systems (DCS) are widely adopted in large, continuous processing plants where operational stability is essential. Supervisory control and data acquisition (SCADA) systems are advancing industrial visibility, allowing real-time monitoring and control across dispersed assets. Manufacturing execution systems (MES) are bridging production floors with enterprise platforms, ensuring integration, productivity, and process transparency.

- For instance, Honeywell’s upcoming AI-powered Experion® distributed control system embeds explainable AI into the human-machine interface, transforming monitoring into proactive advisory functions that can predict failures and guide preventive action in complex process plants.

By End-user Industry

Oil and gas leads the adoption of advanced instrumentation due to safety, reliability, and efficiency needs. Chemicals and petrochemicals follow closely, focusing on optimization and adherence to strict standards. Water and wastewater treatment is deploying instruments for better quality control and regulatory compliance. Food and beverage and pharmaceuticals depend on instrumentation for hygiene, accuracy, and product consistency. Power generation, pulp and paper, and metals and mining represent other significant adopters, while smaller process industries steadily contribute to the market’s expansion.

Segmentation:

By Instrumentation Type

- Field Instruments (pressure transmitters, temperature sensors, flow meters, level indicators)

- Control Valves (automated regulators of flow, pressure, temperature)

- Analyzers (chemical composition, gas concentration, pH measurement)

- Communication Protocols (HART, Foundation Fieldbus, Profibus)

- Software & Services (process control software, data management, consulting)

By Technology

- Programmable Logic Controller (PLC)

- Distributed Control System (DCS)

- Supervisory Control and Data Acquisition (SCADA)

- Manufacturing Execution System (MES)

By End-user Industry

- Oil & Gas

- Chemicals & Petrochemicals

- Water & Wastewater Treatment

- Food & Beverage

- Pharmaceuticals

- Power Generation

- Pulp & Paper

- Metals and Mining

- Other Process Industries

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis:

North America

North America holds the largest share of the process instrumentation market, accounting for around 35%. Strong adoption of industrial automation and strict regulatory standards drive demand across oil and gas, power generation, and water treatment sectors. The presence of leading manufacturers such as Emerson and Rockwell Automation further strengthens the regional landscape. It benefits from advanced manufacturing facilities, higher technology adoption, and continuous investment in modernization. Expansion of shale gas projects and digital transformation initiatives create strong opportunities. The region also invests heavily in predictive maintenance and IoT-based instrumentation, supporting long-term growth.

Europe

Europe represents nearly 28% of the global process instrumentation market, supported by its strong focus on energy efficiency and sustainability. The region has a mature industrial base with advanced chemical, pharmaceutical, and automotive sectors driving steady adoption. It benefits from strict environmental regulations that require accurate monitoring of emissions and process quality. Germany, the UK, and France lead due to their developed manufacturing hubs and adoption of Industry 4.0 technologies. Companies like Siemens and ABB anchor regional innovation with advanced solutions. Growing renewable energy projects and smart water management initiatives also create consistent demand.

Asia Pacific

Asia Pacific accounts for around 30% of the process instrumentation market and is the fastest-growing region. Rapid industrialization in China, India, and Southeast Asia fuels strong adoption across chemicals, metals, and power generation. It benefits from large-scale infrastructure projects and government-backed manufacturing initiatives. The presence of expanding food and beverage and pharmaceutical industries further drives adoption. Local players and global companies are investing in cost-effective and scalable solutions for diverse applications. With ongoing industrial automation programs and rising investments in smart factories, the region is expected to maintain strong growth momentum.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- Honeywell International Inc.

- Siemens AG

- Emerson Electric Company

- ABB Ltd.

- Omron Corporation

- Rockwell Automation Inc.

- Mitsubishi Electric Corporation

- Danaher Corporation

- Metso Corporation

- Yokogawa Electric Corporation

- Endress+Hauser AG

Competitive Analysis:

The process instrumentation market is highly competitive, with global and regional players striving for technological leadership. Companies such as Honeywell, Siemens, ABB, Emerson, and Yokogawa dominate with strong product portfolios and global distribution networks. It is shaped by innovation in automation, IoT integration, and data-driven solutions. Market leaders invest in R&D to strengthen smart sensors, analyzers, and control systems. Regional players focus on cost efficiency and customized solutions to address diverse end-user demands. Strategic mergers, acquisitions, and partnerships enhance market reach and product offerings. Growing competition is pushing companies to deliver advanced, reliable, and scalable systems.

Recent Developments:

- In April 2025, Siemens AG acquired DownStream Technologies, a software company specializing in printed circuit board design data preparation tools. This acquisition enhances Siemens’ automation and AI capabilities specifically in the electronics sector for small and medium-sized enterprises and complements their digital twin technology portfolio (April 7, 2025).

- ABB Ltd. unveiled the next generation of its electromagnetic flowmeters, including the ProcessMaster and AquaMaster models, combining high accuracy, modularity, and IoT connectivity for industrial and utility applications. This launch ensures higher flexibility, connectivity, and reduced total cost of ownership for customers (reported by December 2024 but relevant to 2025 market).

- In June 2025, Rockwell Automation announced that Rotork, a global flow control and intelligent actuation leader, joined its Technology Partner Program, expanding Rotork’s visibility in the industrial automation sector and facilitating integration of Ethernet-enabled actuators in Rockwell’s system design tools (June 9, 2025).

- Mitsubishi Electric Corporation launched samples of its new XB Series high-voltage insulated-gate bipolar transistor (HVIGBT) module in April 2025, designed for large industrial equipment to improve inverter efficiency and reliability. They also received a 2025 Control Engineering Product of the Year award for a cybersecurity partnership with Dispel, offering secure remote access for manufacturing environments (April 7 and June 3, 2025).

Market Concentration & Characteristics:

The process instrumentation market is moderately consolidated, with a few multinational corporations holding significant shares. It is defined by continuous innovation, high entry barriers, and reliance on long-term industry partnerships. Companies with broad product portfolios and strong service networks maintain an advantage. Regional competition is also increasing, with local firms focusing on low-cost solutions and niche markets. The market depends on long-term contracts, regulatory compliance, and advanced automation needs. Customer preference for integrated, smart, and connected solutions is reshaping competitive strategies.

Report Coverage:

The research report offers an in-depth analysis based on instrumentation type, technology, end-user industry, and geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Rising adoption of automation will accelerate growth across industries.

- Increased focus on sustainability will drive demand for energy-efficient instruments.

- Integration of IoT and AI will enhance process visibility and predictive analytics.

- Wireless and portable instrumentation devices will gain traction in remote monitoring.

- Cloud-based platforms will strengthen data-driven decision-making.

- Investments in smart factories will expand demand for integrated solutions.

- Strong growth is expected in renewable energy and water infrastructure projects.

- Compliance with stricter safety and environmental standards will boost adoption.

- Regional expansion in Asia-Pacific will continue at a rapid pace.

- Product differentiation and service innovation will define competitive positioning.