Market Overview

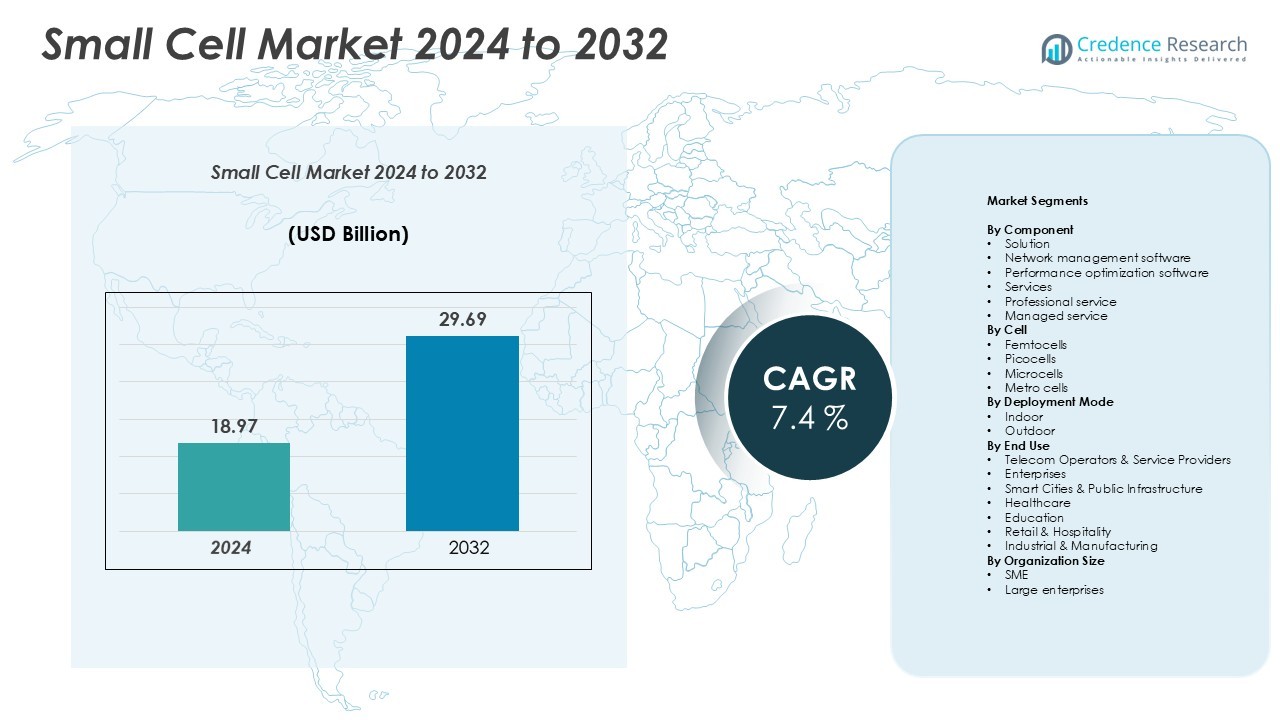

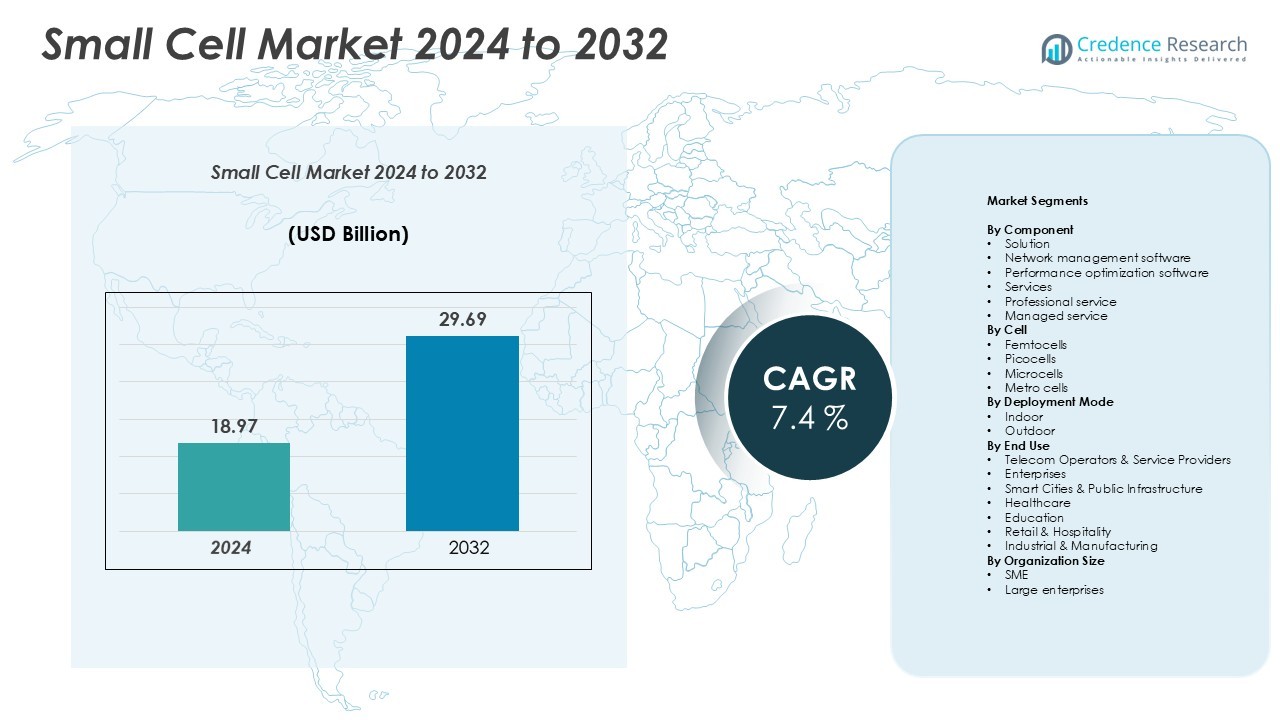

Small cell network market size was valued USD 18.97 billion in 2024 and is anticipated to reach USD 29.69 billion by 2032, at a CAGR of 7.4% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Small Cell Network Market Size 2024 |

USD 18.97 Billion |

| Small Cell Network Market, CAGR |

7.4% |

| Small Cell Network Market Size 2032 |

USD 29.69 Billion |

The small cell network market is led by major companies including CommScope, Ericsson, Samsung, Huawei, Corning, Fujitsu, Nokia, Airspan, Cisco, and ZTE. These players dominate through advanced 5G-ready solutions, strong R&D capabilities, and strategic partnerships with telecom operators. Their focus on network densification, Open RAN integration, and enterprise connectivity drives competitive strength. North America leads the market with a 36% share, supported by large-scale 5G deployments and advanced infrastructure. Asia Pacific follows with 28%, driven by rapid urbanization and strong government initiatives, while Europe holds 25%, supported by smart city and industrial network investments.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The small cell network market was valued at USD 18.97 billion in 2024 and is expected to reach USD 29.69 billion by 2032, growing at a CAGR of 7.4%.

- Strong 5G rollout and rising demand for high-speed, low-latency connectivity drive market expansion across industries.

- Increasing adoption of private 5G networks, edge integration, and Open RAN deployment is shaping market trends.

- Key players such as CommScope, Ericsson, Samsung, Huawei, Corning, Fujitsu, Nokia, Airspan, Cisco, and ZTE dominate through innovation and strategic partnerships, with solutions leading the component segment at 46% share.

- North America leads with 36% share, followed by Asia Pacific at 28% and Europe at 25%, driven by rapid network densification and infrastructure investments.

Market Segmentation Analysis:

By Component

Solution dominates the Small Cell Network Market with a 46% market share in 2024. Strong demand for network densification and advanced connectivity drives this segment. Network management and performance optimization software enhance coverage quality, reduce downtime, and support real-time traffic management. Professional and managed services strengthen operational efficiency by offering seamless deployment and maintenance. Growing 5G rollout and private network initiatives boost investments in scalable solutions. Telecom operators prioritize flexible software platforms to improve capacity and reduce congestion, which further supports strong growth in the solution sub-segment.

- For instance, Ericsson’s Intelligent RAN Automation platform automates network optimization actions across commercial 5G networks, using machine learning to improve latency and traffic handling efficiency at an industrial scale.

By Cell

Femtocells lead the market with a 41% share, supported by rapid adoption in residential and enterprise settings. Their low power and cost-effective deployment make them ideal for enhancing indoor coverage and offloading macro networks. Picocells and microcells also show strong growth due to rising demand in commercial buildings and urban zones. Metro cells gain traction in transport hubs and dense city areas to support high user traffic. Expanding 5G networks, combined with improved spectral efficiency and low-latency requirements, continue to drive the dominance of femtocells in the overall market landscape.

- For instance, in September 2020, Samsung Electronics launched the Link Cell, an indoor 5G millimeter-wave (mmWave) small cell. It provides up to 2 Gbps peak throughput and is designed to enhance 5G coverage and capacity in high-traffic indoor environments like enterprise offices, manufacturing facilities, and public venues.

By Deployment Mode

Indoor deployment holds a 63% share, driven by the surge in data traffic from homes, offices, and commercial buildings. Small cells enhance coverage in areas where macro networks face capacity challenges. Enterprises and telecom operators increasingly use indoor solutions to deliver stable, high-speed connectivity. Outdoor deployment gains momentum in stadiums, smart cities, and transportation corridors but remains secondary to indoor usage. The strong demand for low-latency applications, video streaming, and enterprise connectivity reinforces the leadership of indoor small cell deployments across both developed and emerging markets.

Key Growth Drivers

Rapid 5G Rollout and Network Densification

The global 5G expansion is a primary growth driver for the small cell network market. Telecom operators increasingly deploy small cells to enhance network capacity, coverage, and reliability in dense urban zones. Unlike macro towers, small cells enable targeted coverage, supporting high data speeds and low latency. These networks play a crucial role in meeting the demands of real-time applications, IoT devices, and smart city ecosystems. Growing mobile data consumption from video streaming, AR/VR, and connected devices further accelerates adoption. Governments and private players are investing heavily in infrastructure upgrades, pushing operators to densify their networks and maximize spectrum efficiency. This transition strengthens 5G availability and prepares networks to handle future traffic surges.

- For instance, Nokia has a long-standing partnership with T-Mobile US, providing its AirScale Radio platform to support the build-out and expansion of T-Mobile’s nationwide 5G network. The AirScale portfolio is used to expand 5G coverage, including in high-density metro areas, but the deployment of a specific number like 4,000 small cells is unverified. The latency benefits of 5G have been demonstrated in controlled test environments, with speeds as low as 1 ms achievable under ideal conditions.

Rising Demand for High-Speed Connectivity

Enterprises, industries, and consumers increasingly expect seamless, high-speed connectivity for their daily operations. Small cell networks provide localized coverage, delivering superior data speed and lower congestion compared to traditional macro networks. Their deployment supports advanced use cases such as autonomous vehicles, smart manufacturing, remote healthcare, and immersive experiences. The proliferation of cloud computing and edge applications is further amplifying the need for fast and stable connections. Enterprises across healthcare, education, and retail are adopting private networks powered by small cells to ensure uninterrupted operations. The focus on digital transformation in both developed and emerging economies continues to fuel market expansion, positioning small cells as a critical enabler of modern connectivity solutions.

- For instance, Mavenir, after acquiring ip.access in 2020, inherited and builds upon ip.access’s legacy of deploying more than 2 million small-cell units globally. The original milestone, announced by ip.access in 2017, primarily covered its residential 3G technology. The deployments also encompassed other specialized applications, such as for aviation, maritime, and rural networks.

Growing Adoption of IoT and Smart City Projects

Smart city development and IoT integration are significantly driving small cell network demand. These cells enable seamless connectivity for large volumes of interconnected devices such as sensors, wearables, and autonomous systems. Governments worldwide are launching smart infrastructure initiatives that rely on reliable, low-latency networks. Small cells are ideal for supporting these dense IoT ecosystems due to their flexibility, low power, and scalable deployment. Transportation, energy management, and public safety applications rely heavily on such networks. Their ability to offer consistent coverage across urban areas makes them indispensable for building intelligent cities. Increasing investments in digital infrastructure and real-time data systems further accelerate small cell network adoption.

Key Trends & Opportunities

Expansion of Private 5G Networks

The growing shift toward private 5G networks is creating new opportunities for small cell deployments. Enterprises are leveraging these networks to ensure secure, reliable, and low-latency communication within their facilities. Manufacturing plants, logistics hubs, hospitals, and educational institutions are adopting small cells to power industrial automation, telemedicine, and smart learning environments. These networks offer better control, improved QoS, and enhanced security compared to public networks. Vendors are also offering customizable solutions to cater to diverse enterprise needs. The trend is expected to grow stronger as more industries digitalize operations and adopt advanced automation technologies, driving sustained small cell network expansion globally.

- For instance, Small Cell Forum, private networks built with small cells already support industrial warehousing and port deployments with LTE-based solutions.

Integration with Edge Computing and Open RAN

The integration of small cells with edge computing and Open RAN architectures is shaping future network evolution. Edge computing allows data to be processed closer to users, improving response times and reducing backhaul costs. Open RAN, on the other hand, enhances network flexibility, lowers deployment costs, and promotes vendor diversity. Combining these technologies with small cells enables operators to build cost-effective, agile, and high-performance networks. This integration supports emerging applications such as industrial IoT, connected mobility, and immersive experiences. Strategic partnerships among telecom operators, cloud providers, and technology firms are driving innovation, positioning small cells at the core of next-generation connectivity ecosystems.

- For instance, a testbed named X5G Testbed deployed an eight-node multi-vendor private 5G system achieving a downlink cell rate exceeding 500 Mbps and uplink around 45 Mbps.

Key Challenges

High Deployment and Maintenance Costs

Despite their advantages, small cell networks face high initial deployment and maintenance costs. Operators must invest in site acquisition, backhaul connectivity, and power supply, which can be challenging in dense urban zones. Upgrading existing infrastructure to support 5G-ready small cells also requires significant capital. In addition, integrating thousands of small cells into existing networks demands advanced planning, skilled labor, and operational coordination. Ongoing maintenance adds further cost pressure, especially when managing large-scale deployments. These financial challenges often limit deployment speed in cost-sensitive regions, slowing network densification efforts and affecting the overall adoption rate in some markets.

Regulatory Barriers and Site Acquisition Issues

Regulatory complexity and site acquisition hurdles remain significant obstacles to small cell network growth. Local zoning laws, permit delays, and varying approval processes increase deployment timelines. Dense urban areas often face public resistance to infrastructure installation, adding to administrative burdens. Operators must navigate multiple agencies to secure rights-of-way and access utility poles or buildings. These challenges delay network rollouts and increase project costs. In some regions, inconsistent policies between municipalities and national regulators further complicate the process. Streamlined approval frameworks and standardized regulations are essential to address these issues and support rapid, wide-scale deployment of small cell networks.

Regional Analysis

North America

North America holds a 36% market share, making it the leading region in the small cell network market. The dominance stems from rapid 5G deployment, strong telecom infrastructure, and high enterprise digitalization. Major operators such as AT&T, Verizon, and T-Mobile actively invest in small cell rollouts to enhance coverage and capacity. Dense urban areas and increasing mobile traffic further drive adoption. Government support for advanced network technologies accelerates large-scale deployments. The strong presence of technology vendors and advanced edge computing infrastructure also strengthens regional growth. Enterprises across sectors leverage small cells to support high-speed, low-latency applications.

Europe

Europe accounts for a 25% market share, supported by growing 5G penetration and smart city initiatives. Countries like Germany, the U.K., and France lead deployments through strong regulatory backing and funding programs. Telecom operators are upgrading existing infrastructure to integrate small cells for improved capacity and latency performance. Industrial sectors increasingly rely on private 5G networks to enhance operational efficiency. The region benefits from well-developed fiber backhaul, enabling fast and scalable deployments. Collaboration between telecom providers and government agencies accelerates adoption, particularly in dense urban environments and industrial clusters.

Asia Pacific

Asia Pacific captures a 28% market share, driven by strong network expansion in China, Japan, South Korea, and India. Rapid urbanization, massive mobile user bases, and increasing data traffic fuel widespread adoption. Governments and operators are investing heavily in 5G infrastructure, positioning small cells as critical components of network densification strategies. Countries such as China and South Korea lead with large-scale deployments to support IoT applications, smart cities, and enterprise connectivity. Competitive pricing and high population density create strong demand for flexible, high-capacity networks. This region is expected to record the fastest growth rate through the forecast period.

Latin America

Latin America holds an 8% market share, with Brazil and Mexico driving most deployments. Telecom operators are focusing on expanding coverage in urban centers where network congestion is rising. Limited fiber infrastructure slows deployment in some areas, but government digitalization efforts are encouraging investments. Growing smartphone usage and enterprise digital adoption create strong demand for efficient small cell solutions. Infrastructure modernization projects supported by international funding also play a key role. The region is expected to gradually strengthen its share with increased investment in 5G and next-generation connectivity projects.

Middle East & Africa

The Middle East & Africa region accounts for a 6% market share, with the UAE, Saudi Arabia, and South Africa leading deployments. National digital transformation strategies and smart city projects are boosting investments in small cell networks. Telecom operators are prioritizing indoor coverage solutions to support growing mobile traffic in business districts and commercial hubs. Infrastructure limitations in rural zones remain a challenge, but urban areas show strong growth momentum. Strategic partnerships between governments and private telecom players accelerate 5G rollout, positioning the region for steady growth in small cell adoption.

Market Segmentations:

By Component

- Solution

- Network management software

- Performance optimization software

- Services

- Professional service

- Managed service

By Cell

- Femtocells

- Picocells

- Microcells

- Metro cells

By Deployment Mode

By End Use

- Telecom Operators & Service Providers

- Enterprises

- Smart Cities & Public Infrastructure

- Healthcare

- Education

- Retail & Hospitality

- Industrial & Manufacturing

By Organization Size

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The small cell network market is highly competitive, with major players focusing on technological innovation, strategic partnerships, and large-scale deployments to strengthen their market positions. Key companies include CommScope, Ericsson, Samsung, Huawei, Corning, Fujitsu, Nokia, Airspan, Cisco, and ZTE. These companies invest heavily in advanced 5G-ready small cell solutions to support network densification and low-latency applications. Many are collaborating with telecom operators to accelerate private 5G rollouts across industrial, commercial, and public infrastructure environments. Vendors are also adopting open RAN and edge integration strategies to improve flexibility and cost efficiency. Strong emphasis on product portfolios, global supply chains, and R&D capabilities helps these players maintain a competitive edge. Strategic acquisitions and joint ventures further enhance their ability to address diverse market demands.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In February 2025, Mavenir and EdgeQ introduced the next generation of indoor and outdoor small cells technology. These are industry’s first software-defined 4G and 5G small cells, which allows customers to dynamically change and scale their network without changing any hardware or reinstallation.

- In February 2025, the Small Cell Forum (SCF) introduced FAPI v9, the latest update to its 5G FAPI suite. This update aims to foster a healthy Open RAN ecosystem by providing standardized interfaces for small cell devices, enhancing interoperability and accelerating the deployment of 5G networks.

- In October 2024, Crown Castle, the premier wireless tower company, announced a cut in its small cell node growth plans. The firm opted to eliminate between 3,000 and 5,000 small cell nodes from its 2024 construction pipeline as part of a strategic review.

- In August 2024, EE announced its plan for installing over 1,000 small cells across the UK. The street-level mini masts, attached to existing buildings like phone boxes and lampposts, are intended to reduce network overload and improve mobile coverage. While 4G small cells provide download speeds of up to 300Mbps, 5G small cells provide speeds of up to 600Mbps.

Report Coverage

The research report offers an in-depth analysis based on Component, Cell, Deployment Mode, End Use, Organization Size and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Small cell networks will play a central role in expanding global 5G coverage.

- Network densification will accelerate to support increasing mobile data traffic.

- Enterprises will adopt private 5G networks to improve security and performance.

- Integration with edge computing will enhance real-time data processing capabilities.

- Open RAN adoption will lower deployment costs and increase vendor diversity.

- Smart city projects will drive demand for low-latency and reliable connectivity.

- Indoor small cell deployments will continue to dominate over outdoor installations.

- Technological innovation by leading vendors will strengthen market competition.

- Strategic partnerships between telecom operators and enterprises will expand coverage.

- Regulatory improvements and faster site approvals will support large-scale deployments.