Market Overview

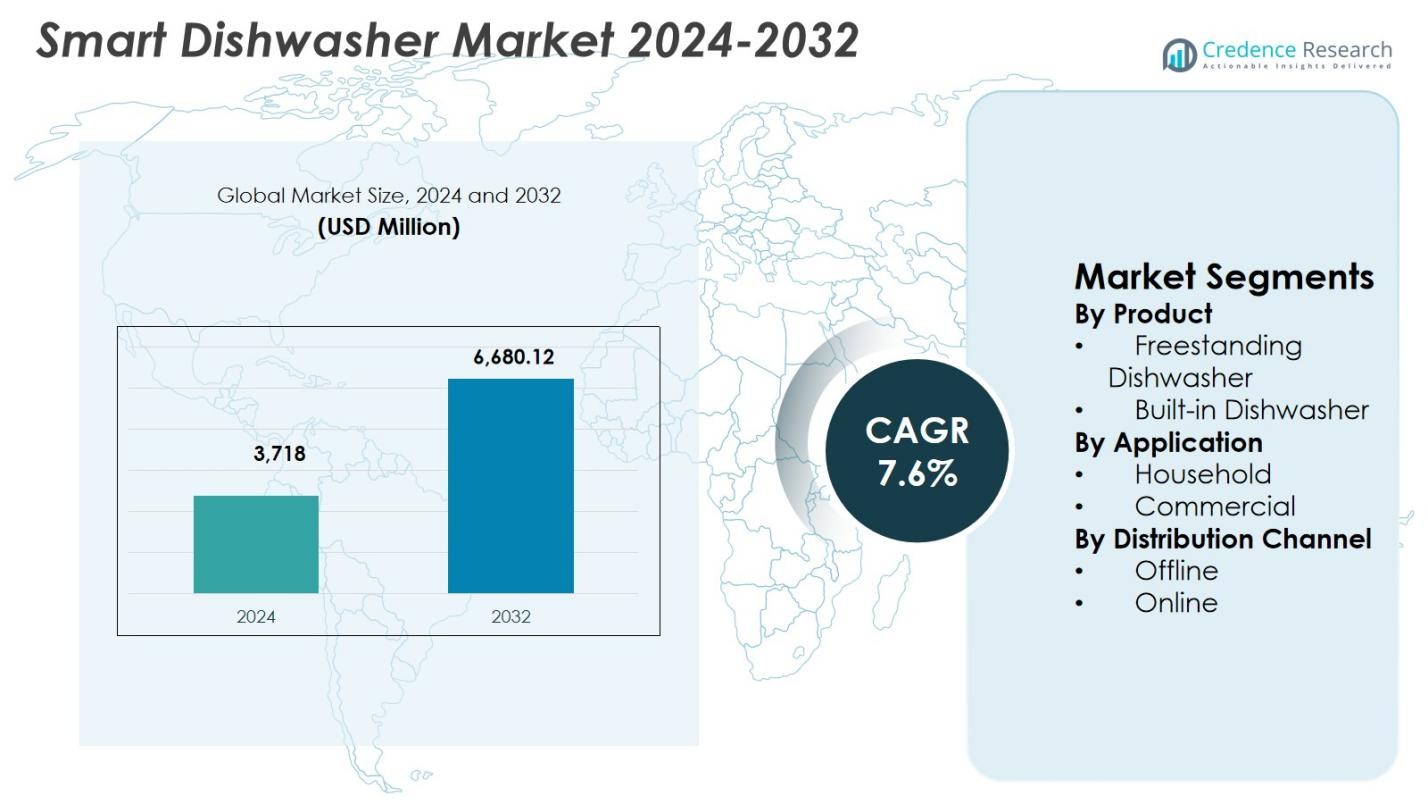

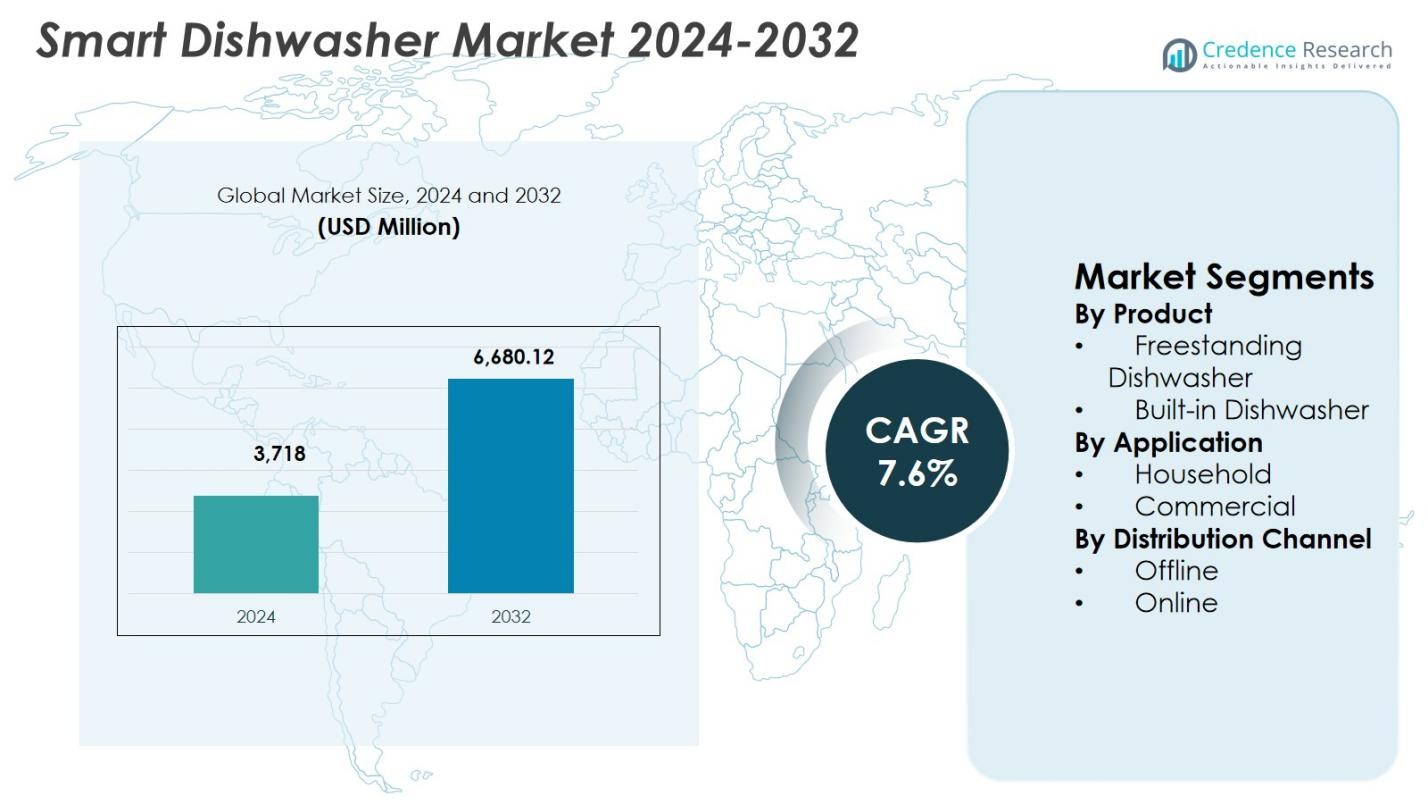

Smart Dishwasher Market size was valued at USD 3,718 Million in 2024 and is anticipated to reach USD 6,680.12 Million by 2032, growing at a CAGR of 7.6% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Smart Dishwasher Market Size 2024 |

USD 3,718 Million |

| Smart Dishwasher Market, CAGR |

7.6% |

| Smart Dishwasher Market Size 2032 |

USD 6,680.12 Million |

Smart Dishwasher Market is driven by strong participation from leading appliance manufacturers such as LG Electronics, Samsung Electronics Co., Ltd., Whirlpool Corporation, Robert Bosch GmbH, Siemens AG, Haier Group Corporation, Miele & Cie. KG, Beko, General Electric Company, and Smeg S.p.A. These companies focus on smart connectivity, AI-enabled wash technologies, and energy-efficient designs to strengthen their product portfolios and expand global reach. Continuous investments in innovation, premium built-in models, and smart home integration support brand differentiation and customer retention. Regionally, North America leads the Smart Dishwasher Market with a 34.2% share, supported by high smart home adoption and strong consumer spending on advanced appliances, followed by Europe and Asia-Pacific, which benefit from sustainability regulations and rapid urbanization, respectively.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- Smart Dishwasher Market was valued at USD 3,718 Million in 2024 and is projected to reach USD 6,680.12 Million by 2032, growing at a CAGR of 7.6% during the forecast period, driven by smart appliance adoption and premium kitchen upgrades.

- Market growth is driven by rising smart home penetration, increasing focus on water and energy efficiency, and growing demand from urban dual-income households seeking automated and time-saving appliances.

- Key market trends include integration of AI and IoT technologies, expansion of online distribution channels, and increasing preference for built-in smart dishwashers, which held 6% segment share in 2024 due to modular kitchen adoption.

- Major players focus on product innovation, smart ecosystem compatibility, premium feature expansion, and omnichannel presence to strengthen brand positioning and customer engagement across regions.

- Regionally, North America led with 34.2% share in 2024, followed by Europe at 29.6% and Asia-Pacific at 24.1%, while household applications dominated with 4% share, reflecting strong residential demand.

Market Segmentation Analysis:

By Product

By product, the Smart Dishwasher Market is led by Built-in Dishwashers, which accounted for 58.6% market share in 2024. Built-in models gain strong adoption due to their seamless integration with modular kitchens, premium aesthetics, and compatibility with smart home ecosystems. Rising urbanization, increasing penetration of smart kitchens, and higher spending on premium home appliances drive demand for built-in variants. These products also offer advanced features such as Wi-Fi connectivity, AI-based wash cycles, and energy optimization, strengthening consumer preference. Freestanding dishwashers maintain steady demand, supported by flexibility and lower installation requirements.

- For instance, Siemens built-in dishwashers incorporate the Intelligent Programme, which learns from user feedback via the Home Connect app to adjust wash settings for optimal cleaning and drying.

By Application

By application, the Household segment dominated with a 71.4% share in 2024, reflecting rising adoption of smart appliances in residential settings. Growth is driven by increasing dual-income households, time-saving preferences, and rising awareness of water and energy efficiency. Smart dishwashers offer remote monitoring, automated detergent dosing, and customized wash programs, enhancing user convenience. Expanding smart home adoption and higher disposable incomes further support household demand. The commercial segment shows consistent growth, supported by restaurants and hotels focusing on hygiene standards, operational efficiency, and reduced manual labor dependency.

- For instance, GE Profile Smart Dishwashers integrate with the SmartHQ app for remote cycle control and automatic detergent reordering based on usage tracking.

By Distribution Channel

By distribution channel, Offline retail held a 62.8% market share in 2024, driven by consumer preference for physical product inspection, in-store demonstrations, and after-sales support. Specialty appliance stores and brand-owned outlets play a key role in influencing purchase decisions for high-value smart dishwashers. Offline channels also benefit from professional installation services and bundled warranty offerings. The online segment continues to expand due to competitive pricing, wider product availability, and digital promotions, supported by increasing consumer trust in e-commerce platforms and doorstep installation services.

Key Growth Driver

Rising Adoption of Smart Home Ecosystems

The expansion of smart home ecosystems is a major growth driver for the Smart Dishwasher Market. Increasing integration of appliances with IoT platforms, voice assistants, and centralized home management systems enhances user convenience and control. Smart dishwashers offer remote operation, cycle optimization, and real-time performance monitoring, aligning with connected living trends. Growing consumer preference for automation, combined with rising penetration of smart kitchens in urban households, supports sustained demand. Manufacturers continue to enhance compatibility with major smart home platforms, strengthening product value and accelerating adoption across residential environments.

- For instance, LG’s 2018 dishwashers, equipped with ThinQ technology, allow Wi-Fi control via the ThinQ app or voice commands through Alexa and Google Assistant. Owners start, stop cycles, check remaining time, and get completion alerts remotely.

Increasing Focus on Water and Energy Efficiency

Rising awareness of water conservation and energy efficiency strongly drives the Smart Dishwasher Market. Smart dishwashers optimize water usage, adjust cycle duration, and reduce electricity consumption through sensor-based load detection and AI-driven wash programs. Regulatory emphasis on energy-efficient appliances and consumer demand for lower utility costs further reinforce adoption. These systems appeal to environmentally conscious buyers seeking sustainable household solutions. Continuous improvements in energy ratings and efficiency-focused product innovation enhance long-term market growth and support replacement demand for conventional dishwashers.

- For instance, Bosch dishwashers utilize only 7 liters of water per wash cycle through efficient rinsing technology. Their ActiveWater system enhances water circulation and quick heating to minimize overall consumption while ensuring clean results.

Urbanization and Changing Lifestyles

Rapid urbanization and evolving consumer lifestyles significantly support growth in the Smart Dishwasher Market. Increasing numbers of dual-income households and busy urban professionals prioritize time-saving and automated appliances. Smart dishwashers reduce manual effort while maintaining high hygiene standards, aligning with modern living requirements. Growth in modular kitchens and premium residential developments further accelerates adoption. Rising disposable incomes in urban regions also encourage spending on smart appliances, positioning smart dishwashers as essential components of contemporary households.

Key Trend & Opportunity

Integration of AI and Advanced Sensors

The integration of artificial intelligence and advanced sensors represents a key trend and opportunity in the Smart Dishwasher Market. AI-driven algorithms enable adaptive wash cycles, load recognition, and predictive maintenance, improving performance and durability. Sensor-based technologies enhance water efficiency and cleaning accuracy, delivering consistent results across varying load types. These innovations create differentiation opportunities for manufacturers and support premium product positioning. As AI capabilities improve, smart dishwashers can offer enhanced personalization, strengthening consumer engagement and long-term value creation.

- For instance, Hobart’s SMART VISION CONTROL uses AI to identify each item loaded onto the conveyor, adjusting wash parameters instantly based on more than 80,000 training images for optimal results and reduced water and chemical consumption.

Expansion of Online Sales Channels

The rapid expansion of online sales channels creates strong growth opportunities for the Smart Dishwasher Market. E-commerce platforms provide consumers with broader product choices, transparent pricing, and detailed feature comparisons. Digital marketing, virtual demonstrations, and easy financing options enhance purchase confidence for high-value appliances. Online channels also enable manufacturers to reach emerging urban and semi-urban consumers efficiently. Continued improvements in logistics, installation support, and after-sales service further strengthen online adoption and accelerate market penetration.

- For instance, LG offers Wi-Fi-enabled smart dishwashers with SmartThinQ technology, allowing remote monitoring and control via the LG ThinQ app on smartphones, even when users are away from home.

Key Challenge

High Initial Cost and Price Sensitivity

High initial costs remain a significant challenge for the Smart Dishwasher Market. Advanced connectivity features, AI integration, and premium components increase product pricing, limiting affordability for price-sensitive consumers. In developing regions, high upfront investment discourages adoption despite long-term efficiency benefits. Consumers often compare smart dishwashers with conventional alternatives, slowing conversion rates. Addressing this challenge requires cost optimization, flexible financing options, and stronger communication of long-term savings to improve market accessibility.

Limited Consumer Awareness and Adoption Barriers

Limited consumer awareness poses a key challenge to the Smart Dishwasher Market, particularly in emerging economies. Many potential buyers lack familiarity with smart features, usage benefits, and maintenance requirements. Concerns related to installation complexity, connectivity reliability, and data security further hinder adoption. In some regions, cultural preferences for manual dishwashing persist. Overcoming these barriers requires focused consumer education, in-store demonstrations, and improved after-sales support to build trust and accelerate acceptance of smart dishwasher solutions.

Regional Analysis

North America

North America accounted for 34.2% market share in 2024 in the Smart Dishwasher Market, supported by high smart home adoption and strong consumer spending on premium appliances. The region benefits from widespread penetration of connected home ecosystems, advanced digital infrastructure, and high awareness of energy-efficient appliances. Consumers increasingly prefer smart dishwashers with AI-based wash cycles, remote monitoring, and voice assistant compatibility. Replacement demand for conventional dishwashers remains strong, driven by lifestyle upgrades. The presence of leading appliance manufacturers and well-established distribution networks further strengthens regional market performance.

Europe

Europe held a 29.6% market share in 2024, driven by stringent energy-efficiency regulations and strong sustainability awareness. Consumers across Germany, the UK, France, and Italy prioritize water-saving and low-energy appliances, accelerating adoption of smart dishwashers. Built-in smart dishwashers are widely integrated into modular kitchens, supporting premium segment growth. Government-backed energy labeling programs and eco-design standards encourage replacement of older models. High urbanization levels, growing smart kitchen installations, and strong demand for technologically advanced home appliances continue to support steady regional expansion.

Asia-Pacific

Asia-Pacific captured 24.1% market share in 2024 and represents the fastest-growing regional market. Rapid urbanization, rising disposable incomes, and expanding middle-class populations drive adoption across China, Japan, South Korea, and India. Growth in smart home ecosystems and increasing penetration of modular kitchens support demand for smart dishwashers. Consumers increasingly seek time-saving appliances aligned with busy urban lifestyles. Expanding e-commerce penetration and competitive pricing strategies further enhance accessibility. Local manufacturing capabilities and strong innovation pipelines position Asia-Pacific as a key growth engine for the market.

Latin America

Latin America accounted for 7.1% market share in 2024, supported by gradual adoption of smart home appliances in Brazil, Mexico, and Chile. Rising urban housing development and increasing consumer exposure to connected appliances drive market growth. Demand is concentrated in premium urban households seeking convenience and improved hygiene standards. Expanding retail infrastructure and improving availability of smart appliances through online channels support adoption. However, price sensitivity remains a key factor influencing purchasing decisions, encouraging manufacturers to focus on mid-range smart dishwasher offerings.

Middle East & Africa

The Middle East & Africa region held 5.0% market share in 2024, driven by growth in premium residential construction and rising smart home adoption in the UAE, Saudi Arabia, and South Africa. High disposable incomes in Gulf countries support demand for advanced, built-in smart dishwashers integrated into luxury kitchens. Commercial adoption in hotels and hospitality facilities also contributes to growth. Increasing awareness of water efficiency is particularly relevant in water-scarce regions. Gradual improvement in retail penetration and smart infrastructure continues to support long-term market development.

Market Segmentations:

By Product

- Freestanding Dishwasher

- Built-in Dishwasher

By Application

By Distribution Channel

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

Competitive landscape in the Smart Dishwasher Market is shaped by leading players including LG Electronics, Samsung Electronics Co., Ltd., Whirlpool Corporation, Bosch (Robert Bosch GmbH), Siemens AG, Haier Group Corporation, Miele & Cie. KG, Beko, General Electric Company, and Smeg S.p.A. These companies focus on technological differentiation through IoT integration, AI-driven wash optimization, and energy-efficient designs to strengthen their market positions. Product innovation, premium feature expansion, and seamless smart home compatibility remain central strategies. Players actively invest in R&D to enhance connectivity, water efficiency, and noise reduction. Strategic partnerships with smart home platform providers and expansion of omnichannel distribution networks further support competitiveness. Strong brand recognition and after-sales service capabilities provide an advantage in high-value appliance segments. Regional customization, pricing strategies, and continuous product upgrades remain critical for sustaining market presence and capturing emerging demand.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In August 2025, Bosch Home Appliances unveiled its all-new 500 Series dishwasher line, featuring Zone Wash Spray Arm technology, AutoAir® open-door drying, and smart Home Connect® connectivity to enhance cleaning performance and user convenience in mainstream smart dishwasher offerings.

- In January 2025, LG unveiled its second-generation LG SIGNATURE Dishwasher at CES with a pop-out handle, QuadWash Pro, and ThinQ app integration for seamless smart kitchen connectivity.

- In April 2023, Xiaomi Corporation launched the Mijia N1 Smart Dishwasher, featuring advanced drying systems, a large capacity design, and flexible installation options for medium- to large-sized households.

Report Coverage

The research report offers an in-depth analysis based on Product, Application, Distribution Channel and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Smart dishwasher adoption will increase steadily as smart home ecosystems expand across urban and semi-urban households.

- Manufacturers will integrate advanced AI algorithms to enable adaptive wash cycles, predictive maintenance, and personalized usage settings.

- Energy and water efficiency improvements will remain a core focus, supporting regulatory compliance and sustainability goals.

- Built-in smart dishwashers will gain stronger preference due to rising modular kitchen installations and premium housing projects.

- Online sales channels will play a larger role, supported by virtual product demonstrations and improved installation services.

- Demand from commercial applications such as hotels and restaurants will grow with higher hygiene and automation requirements.

- Product differentiation will increasingly rely on connectivity reliability, cybersecurity features, and seamless platform compatibility.

- Emerging markets will contribute higher growth as disposable incomes rise and consumer awareness improves.

- Manufacturers will focus on mid-priced smart models to address cost sensitivity and broaden customer reach.

- Continuous innovation in sensors, noise reduction, and smart diagnostics will strengthen long-term market competitiveness.