Market Overview

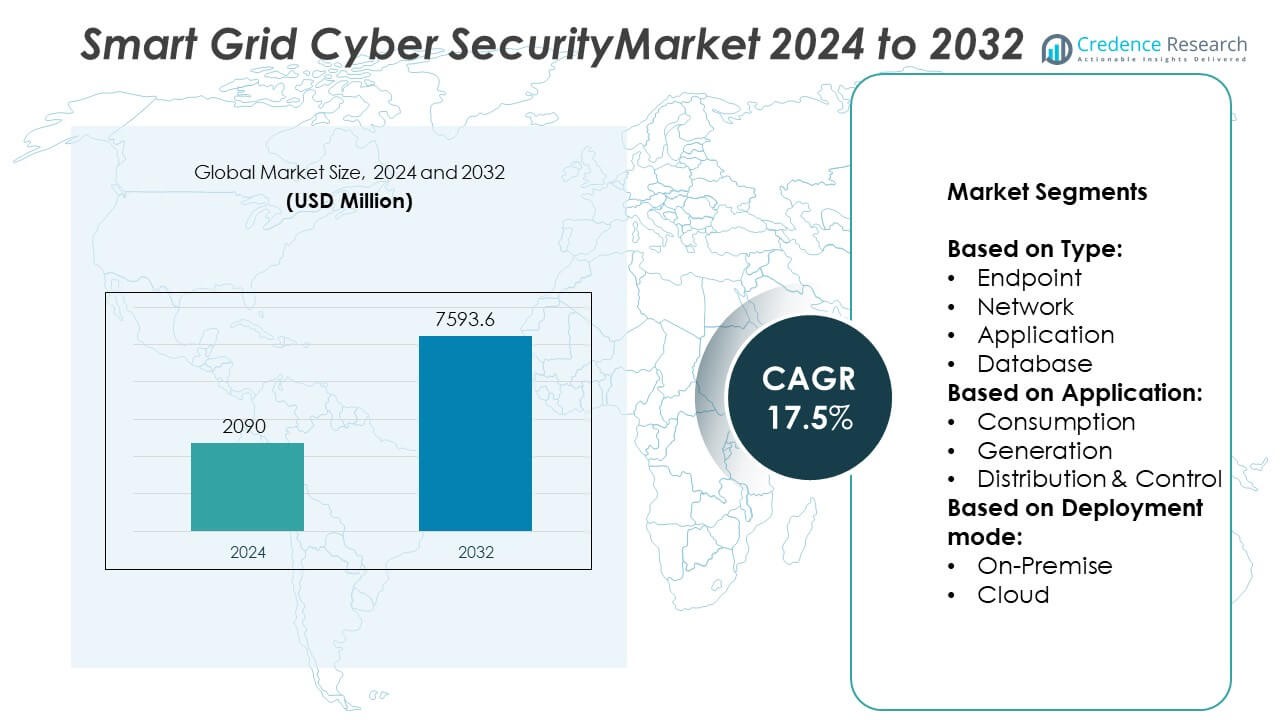

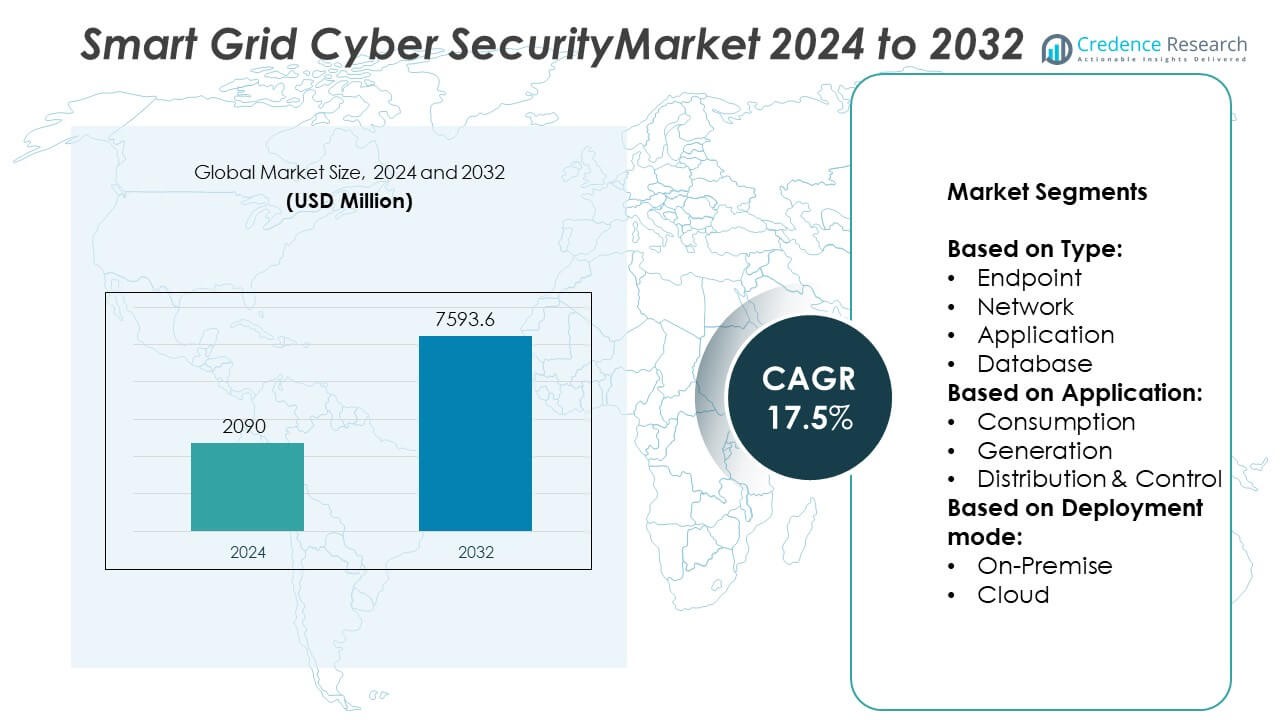

Smart Grid Cyber Security Market size was valued at USD 2090 million in 2024 and is anticipated to reach USD 7593.6 million by 2032, at a CAGR of 17.5% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2024 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Smart Grid Cyber Security Market Size 2024 |

USD 2090 Million |

| Smart Grid Cyber Security Market, CAGR |

17.5% |

| Smart Grid Cyber Security Market Size 2032 |

USD 7593.6 Million |

The Smart Grid Cyber Security market advances through a rising threat landscape, regulatory enforcement, and the widespread integration of distributed energy resources. Utilities prioritize real-time intrusion detection, compliance automation, and secure IT-OT convergence to safeguard grid infrastructure. The market also reflects strong momentum in adopting AI-driven analytics, Zero Trust architectures, and cloud-based security platforms. Demand increases for secure metering systems and scalable defense solutions that support grid modernization. innovation across cyber defense technologies.

North America leads the Smart Grid Cyber Security market due to early adoption of smart grid technologies, strong regulatory frameworks, and high utility investments in cyber defense. Europe follows with robust compliance mandates and grid modernization efforts across Germany, France, and the U.K., while Asia-Pacific grows steadily with national programs driving grid digitalization in China, Japan, and India. Latin America and the Middle East & Africa show emerging potential as infrastructure investments and cyber awareness increase. Across these regions, demand rises for integrated security platforms that protect operational assets, consumer data, and distributed energy systems. Key players shaping the competitive landscape include Cisco Systems Inc.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Smart Grid Cyber Security market was valued at USD 2,090 million in 2024 and is projected to reach USD 7,593.6 million by 2032, growing at a CAGR of 17.5% during the forecast period.

- Increasing cyberattacks on critical energy infrastructure drive utilities to adopt real-time threat detection, endpoint security, and incident response systems to ensure grid reliability.

- The market trends include rapid integration of AI, machine learning, and Zero Trust architectures, enabling utilities to detect and mitigate advanced threats with greater speed and precision.

- Leading players such as IBM, Cisco Systems Inc., and Lockheed Martin Corporation are enhancing product capabilities through strategic partnerships, AI integration, and managed security services tailored to smart grids.

- A major restraint lies in the high complexity of securing legacy infrastructure and the shortage of skilled cybersecurity professionals, which slows implementation and weakens overall grid resilience.

- North America dominates the market with strong regulatory enforcement and high adoption of smart grid technologies, while Asia-Pacific is expanding due to government-led modernization programs and increased digital grid investments.

- The market reflects a growing need for scalable, cloud-native, and cost-effective cybersecurity frameworks to protect smart metering, distributed energy resources, and control systems across diverse utility environments.

Market Drivers

Escalating Threat Landscape Necessitates Advanced Cyber Defense Mechanisms

The Smart Grid Cyber Security market gains traction due to a surge in sophisticated cyber threats targeting critical infrastructure. Nation-state actors and cybercriminals increasingly exploit vulnerabilities in grid communication protocols, remote access points, and IoT-enabled components. Power grids face growing risks of operational disruption, financial losses, and data breaches. It demands real-time intrusion detection, threat intelligence, and incident response systems tailored to grid operations. Utilities invest in security orchestration platforms to counter ransomware, DDoS, and APT attacks. The continuous evolution of adversarial tactics compels stakeholders to prioritize proactive security investments.

- For instance, Cisco Systems deployed over 1,500 AI-enabled threat detection nodes across North American utilities, significantly reducing average breach detection time to under 7 minutes.

Integration of Distributed Energy Resources Increases Attack Surface

The rapid deployment of distributed energy resources (DERs), including solar panels, wind farms, and battery storage, introduces new entry points into grid networks. These assets often connect via unsecured or minimally protected endpoints, expanding the attack surface. The Smart Grid Cyber Security market responds with tailored solutions to secure bidirectional data flow and maintain grid stability. It supports secure data exchange across decentralized assets while enforcing access control and device authentication. The integration of DERs necessitates robust cybersecurity frameworks to protect grid reliability. Utility providers seek vendor-agnostic solutions that scale with DER adoption.

- For instance, Honeywell (Elster) integrated Quantinuum quantum encryption into over 200,000 smart meters, enhancing endpoint protection in distributed solar grids.

Regulatory Mandates Drive Adoption of Security Standards and Compliance Tools

Government and regulatory agencies enforce strict cybersecurity mandates for utilities to ensure national energy resilience. Frameworks such as NERC CIP in North America, ENISA guidelines in Europe, and India’s CERT-In directives compel utilities to implement baseline and advanced security controls. The Smart Grid Cyber Security market expands through growing demand for compliance automation, audit readiness, and security posture assessments. It promotes alignment with evolving standards and improves incident response preparedness. Cybersecurity vendors offer specialized tools that streamline regulatory adherence while reducing operational burden. These mandates strengthen organizational accountability across transmission and distribution systems.

Growing IT-OT Convergence Demands Unified Cybersecurity Architectures

The convergence of Information Technology (IT) and Operational Technology (OT) environments in smart grid ecosystems introduces complex security challenges. Interconnected platforms enable real-time monitoring, grid automation, and predictive maintenance but also increase exposure to cyber risks. The Smart Grid Cyber Security market supports unified architectures that monitor IT and OT assets under a centralized visibility framework. It enables behavioral analytics, anomaly detection, and zero-trust access controls across legacy and modern systems. Utilities adopt converged security platforms to ensure consistent policy enforcement and threat management. Unified cybersecurity strategies reduce blind spots and enhance resilience across the digital grid.

Market Trends

Expansion of AI and ML Integration Enhances Threat Detection Capabilities

Artificial Intelligence (AI) and Machine Learning (ML) are transforming cyber defense strategies in the energy sector. These technologies enable real-time anomaly detection, behavioral analysis, and predictive threat modeling. The Smart Grid Cyber Security market incorporates AI-driven tools to identify zero-day vulnerabilities and unauthorized access patterns. It helps reduce response time and improves threat containment across distributed grid components. Vendors develop self-learning systems that adapt to evolving cyberattack vectors without manual intervention. Utilities prefer AI-based solutions for their scalability and minimal false-positive rates.

- For instance, IBM deployed its Security QRadar SIEM across 36 European transmission operators, automating compliance workflows for over 190 individual regulatory controls.

Adoption of Zero Trust Architecture Strengthens Grid-Wide Access Control

The shift toward Zero Trust security models reflects the growing emphasis on identity verification and access restriction across all digital assets. Smart grid environments involve diverse stakeholders and multiple access layers, making perimeter-based defense inadequate. The Smart Grid Cyber Security market supports Zero Trust frameworks that verify each user and device before granting access to sensitive systems. It reinforces segmentation policies, multi-factor authentication, and dynamic privilege management. Utilities deploy micro-segmentation and software-defined perimeters to reduce lateral threat movement. This approach improves network isolation and operational control.

- For instance, Fortinet Inc. secured a contract with a European transmission operator to deploy FortiSIEM and FortiEDR across 3,200 endpoints.

Cloud-Based Security Solutions Gain Momentum Across Utility Providers

Cloud platforms offer flexibility, scalability, and faster deployment for cybersecurity applications. Utilities increasingly migrate their security operations centers (SOCs), SIEM tools, and data analytics to secure cloud environments. The Smart Grid Cyber Security market reflects this trend with cloud-native products designed for utility-grade compliance and reliability. It supports hybrid cloud models that integrate legacy infrastructure with modern cloud services. Vendors offer managed detection and response (MDR) capabilities through cloud to optimize resource utilization. This migration reduces capital expenditure and enhances real-time threat intelligence sharing.

Focus on Secure Smart Metering Infrastructure and Consumer Privacy

Smart meters represent critical endpoints within grid networks, collecting consumption data and enabling demand-side management. Their connectivity introduces vulnerabilities that require tailored protection mechanisms. The Smart Grid Cyber Security market responds by embedding encryption, tamper detection, and secure firmware updates into meter systems. It ensures data privacy and system integrity while complying with consumer protection regulations. Utilities implement end-to-end encryption and key management frameworks to secure communications. Emphasis on secure metering aligns with broader goals of building consumer trust and regulatory compliance.

Market Challenges Analysis

High Complexity of Securing Legacy Infrastructure Across Operational Layers

Many utilities operate with legacy infrastructure that was not designed with cybersecurity in mind. These systems often lack encryption, remote access control, and patch management capabilities, making them vulnerable to exploitation. The Smart Grid Cyber Security market faces challenges in integrating modern security solutions without disrupting operational continuity. It requires extensive customization and compatibility testing to secure outdated supervisory control and data acquisition (SCADA) systems and remote terminal units (RTUs). Budget limitations further hinder the replacement or retrofitting of legacy assets. The complexity of hybrid environments increases security gaps and delays incident response.

Shortage of Skilled Cybersecurity Workforce and Rising Cost Pressures

A persistent talent gap in critical infrastructure cybersecurity limits the deployment of advanced defense strategies. Utilities struggle to attract and retain professionals with specialized knowledge in OT security, compliance management, and threat hunting. The Smart Grid Cyber Security market contends with rising training costs and a limited pool of experienced personnel. It impacts the effective use of threat intelligence platforms, anomaly detection systems, and forensic tools. Smaller utilities often lack in-house expertise, relying on costly external support. The shortage slows the pace of security modernization and weakens resilience across the grid ecosystem.

Market Opportunities

Digital Grid Modernization Opens Demand for Scalable Cybersecurity Frameworks

Utilities are investing in grid digitization projects that rely on interconnected sensors, control systems, and automation platforms. These digital upgrades require advanced cybersecurity solutions that scale across substations, distribution networks, and end-user interfaces. The Smart Grid Cyber Security market finds opportunity in providing modular security architectures tailored to evolving grid configurations. It enables centralized visibility, adaptive risk scoring, and threat intelligence integration across diverse grid components. Vendors can differentiate by offering plug-and-play security tools that minimize implementation time. Demand grows for scalable platforms that align with utility modernization roadmaps.

Emerging Economies Accelerate Adoption of Smart Infrastructure Protection

Countries in Asia, Africa, and Latin America are rapidly expanding their smart grid infrastructure to meet rising energy demand and improve distribution efficiency. These regions represent untapped markets for cybersecurity solutions tailored to budget-conscious deployments. The Smart Grid Cyber Security market can leverage this trend by offering lightweight, cloud-enabled, and compliance-ready products. It supports localized partnerships and capacity-building initiatives to address regulatory gaps and skills shortages. Vendors focusing on cost-effective, resilient solutions can gain early-mover advantage. Growing interest in energy transition policies amplifies the need for secure and future-ready grid ecosystems.

Market Segmentation Analysis:

By Type:

The Smart Grid Cyber Security market segments by type into endpoint, network, application, and database security. Endpoint security leads due to its role in protecting smart meters, remote terminals, and operator consoles from malware and unauthorized access. It supports device integrity and ensures secure communication across distributed energy assets. Network security holds significant share, driven by the need to safeguard data-in-transit across substations, SCADA systems, and control centers. Application security gains traction with the increasing integration of software-driven grid management platforms. Database security addresses risks related to energy consumption records, customer profiles, and operational data stored across grid environments.

By Application:

The Smart Grid Cyber Security market includes consumption, generation, and distribution & control. Consumption-related security focuses on securing smart meters, billing systems, and consumer-facing platforms. It prevents data tampering and protects customer privacy. Generation segment emphasizes cybersecurity for renewable and conventional power generation assets that require real-time monitoring and control. It supports continuous power delivery and shields assets from intrusion. Distribution and control emerge as the most critical application due to the need for resilient substation automation, fault isolation, and command system integrity. This segment benefits from layered security approaches, including intrusion detection and micro-segmentation.

- For instance, Siemens rolled out its Electrification X IoT suite—built on cloud services—to manage 350 digital substations for Aral’s charging infrastructure, ensuring interoperable electrification with embedded cybersecurity for industrial and utility clients.

By Deployment mode:

The Smart Grid Cyber Security market divides into on-premise and cloud-based models. On-premise deployment remains prominent in utility environments with strict regulatory requirements and sensitive operational data. It allows full control over cybersecurity infrastructure, meeting internal governance standards. Cloud deployment gains momentum due to its scalability, cost efficiency, and real-time threat analytics capabilities. It supports hybrid utility models and allows integration of advanced security analytics without large capital investment. Cloud platforms help utilities extend protection to remote endpoints and facilitate collaboration with managed security service providers. Each deployment mode addresses distinct operational and compliance needs.

Segments:

Based on Type:

- Endpoint

- Network

- Application

- Database

Based on Application:

- Consumption

- Generation

- Distribution & Control

Based on Deployment mode:

Based on the Geography:

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis

North America

North America accounted for the largest share in the Smart Grid Cyber Security market, contributing approximately 34.8% of the global revenue in 2024. The region benefits from early adoption of smart grid technologies and strong regulatory mandates, including NERC CIP standards in the U.S. Utilities in the U.S. and Canada invest heavily in threat detection, network segmentation, and identity access management systems to protect critical grid infrastructure. High-profile cyberattacks on energy infrastructure have accelerated the adoption of real-time monitoring and threat intelligence platforms. The presence of major cybersecurity vendors and federal support for grid modernization further strengthen the regional ecosystem. Investments in advanced metering infrastructure (AMI) and distributed energy resources require continuous security enhancements, driving sustained demand.

Europe

Europe held a market share of around 26.1% in the Smart Grid Cyber Security market in 2024. The region emphasizes grid stability and cyber resilience through strict regulatory frameworks such as the EU NIS2 Directive and ENISA’s cybersecurity guidelines. Countries like Germany, France, and the U.K. lead in smart grid deployments supported by secure communication and data management systems. Utilities implement Zero Trust architectures and encryption protocols to comply with GDPR and local privacy regulations. The increasing penetration of renewable energy sources requires cybersecurity frameworks to manage decentralized assets. Collaborative initiatives between public agencies and private technology firms foster a robust cybersecurity environment across the continent.

Asia-Pacific

Asia-Pacific captured a market share of 22.4% in 2024, supported by rapid urbanization, grid digitalization, and energy transition efforts across emerging economies. Countries such as China, Japan, South Korea, and India are investing in smart grid infrastructure and cyber defense capabilities to address grid vulnerabilities. National programs like Japan’s Energy System Reform and India’s Revamped Distribution Sector Scheme (RDSS) integrate cybersecurity mandates into grid modernization. The Smart Grid Cyber Security market benefits from large-scale rollouts of smart meters and automation systems, which demand endpoint and network protection. The growing presence of domestic cybersecurity providers and international partnerships supports capacity-building across utility operations.

Latin America

Latin America contributed around 9.1% to the global Smart Grid Cyber Security market in 2024. The region shows growing awareness of the need for cybersecurity in modern grid systems, especially in Brazil, Mexico, and Chile. Governments emphasize regulatory alignment and public-private collaboration to strengthen cyber defense. Investment in cloud-based security services grows as utilities seek affordable and scalable solutions. Limited local expertise remains a challenge, but cross-border cooperation and digitalization incentives help bridge capability gaps. Vendors offering cost-effective solutions tailored to local constraints find expanding opportunities in this developing market.

Middle East & Africa

The Middle East & Africa accounted for a 7.6% share in 2024, driven by ongoing investments in smart grid projects and energy diversification programs. Countries like the UAE, Saudi Arabia, and South Africa lead regional initiatives with national cybersecurity strategies embedded into utility reforms. The region focuses on securing grid automation, transmission lines, and energy management systems. It adopts cloud-native platforms and AI-based threat detection to enhance operational security. Despite limited penetration compared to mature markets, rising government funding and regional digital transformation create long-term growth prospects. International collaborations play a critical role in strengthening cyber resilience frameworks.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Cisco Systems Inc. (United States)

- IOActive (United States)

- Honeywell (Elster) (United States)

- N-Dimension Solutions (Canada)

- AlertEnterprise (United States)

- Entergy (United States)

- BAE Systems Plc (United Kingdom)

- IBM (United States)

- HP (United States)

- McAfee-Intel (United States)

- Lockheed Martin Corporation (United States)

- Black and Veatch (United States)

- AlienVault Inc. (United States)

Competitive Analysis

The competitive landscape of the Smart Grid Cyber Security market features key players such as IBM, Cisco Systems Inc., Lockheed Martin Corporation, Honeywell (Elster), McAfee-Intel, IOActive, AlertEnterprise, and BAE Systems Plc. These companies compete by delivering specialized cybersecurity solutions tailored for utility-scale grid operations, focusing on real-time monitoring, endpoint protection, and threat intelligence. The market favors vendors that offer integrated platforms capable of protecting both IT and OT environments under a unified security framework. Leading providers invest in AI-driven threat detection, Zero Trust architecture, and compliance automation to meet regulatory standards and operational demands. Strategic collaborations with utility companies, government bodies, and grid technology providers enhance their market positioning. Players that offer scalable cloud-native tools and managed services gain preference among utilities with limited in-house expertise. Continuous product innovation, vertical-specific customization, and global deployment capabilities define the competitive edge. The market remains dynamic, with emphasis on resilience, interoperability, and rapid incident response.

Recent Developments

- In 2025, Cisco expanded its strategy to support clean energy initiatives—highlighting smart grid integration—by signing long-term Power Purchase Agreements in India, Texas, and Spain innovative Power Purchase Agreements contribute to Cisco’s net-zero goals while helping drive wind and solar development.

- In July 2025, Honeywell launched advanced AI initiatives—Cyber Proactive Defense and Digital Prime—that leverage behavioral analytics and real-time monitoring to elevate energy infrastructure security.

- In March 2024, IOActive verified significant security issues across multiple smart grid platforms, exposing vulnerabilities such as protocol tampering and rootkits within modern smart grid deployments.

Market Concentration & Characteristics

The Smart Grid Cyber Security market exhibits moderate to high concentration, with a few dominant players controlling a significant share of the global landscape. It is characterized by the presence of multinational defense contractors, cybersecurity firms, and grid technology specialists that offer end-to-end solutions tailored for utility applications. The market emphasizes real-time threat detection, IT-OT convergence, compliance with national security standards, and adaptive risk management. It favors vendors that can integrate scalable platforms across legacy systems and modern digital assets without disrupting operations. Product differentiation revolves around AI capabilities, cloud-native deployment, and response automation. The market values long-term vendor partnerships supported by technical consulting, incident response, and regulatory alignment. Utilities seek solutions that address both physical and cyber risks across transmission, distribution, and consumption networks. It continues to evolve with shifting attack vectors, policy changes, and grid modernization programs, prompting continuous innovation in architecture, scalability, and resilience. Regional variation in adoption patterns creates distinct demand profiles across advanced and emerging economies.

Report Coverage

The research report offers an in-depth analysis based on Type, Application, Deployment Mode and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for AI-powered threat detection systems will grow as utilities seek faster identification of cyber intrusions.

- Adoption of Zero Trust architecture will become standard across grid infrastructure to strengthen access control.

- Utilities will increase investment in cloud-based cybersecurity platforms for scalability and cost efficiency.

- Governments will enforce stricter compliance mandates, driving adoption of audit-ready security frameworks.

- Integration of distributed energy resources will require enhanced endpoint protection and secure data transmission.

- Utilities will partner more with managed security service providers to overcome workforce and skill shortages.

- Cybersecurity solutions tailored for OT environments will see higher adoption in substation and control system protection.

- The rise in smart metering infrastructure will boost demand for secure communication and firmware update protocols.

- Emerging economies will accelerate cyber defense initiatives to secure expanding digital grid infrastructure.

- Cross-border information sharing and public-private partnerships will shape regional cybersecurity strategies.