Market Overview

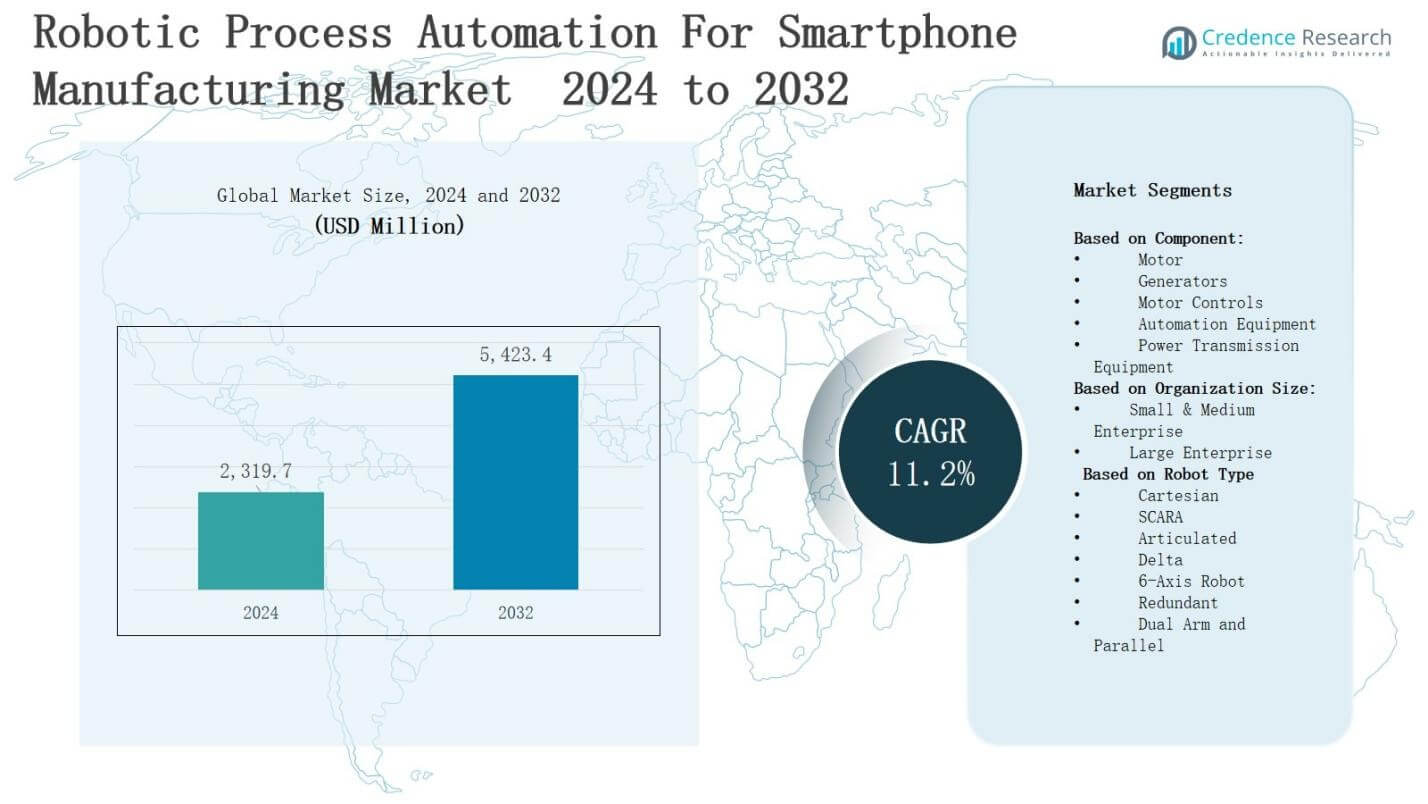

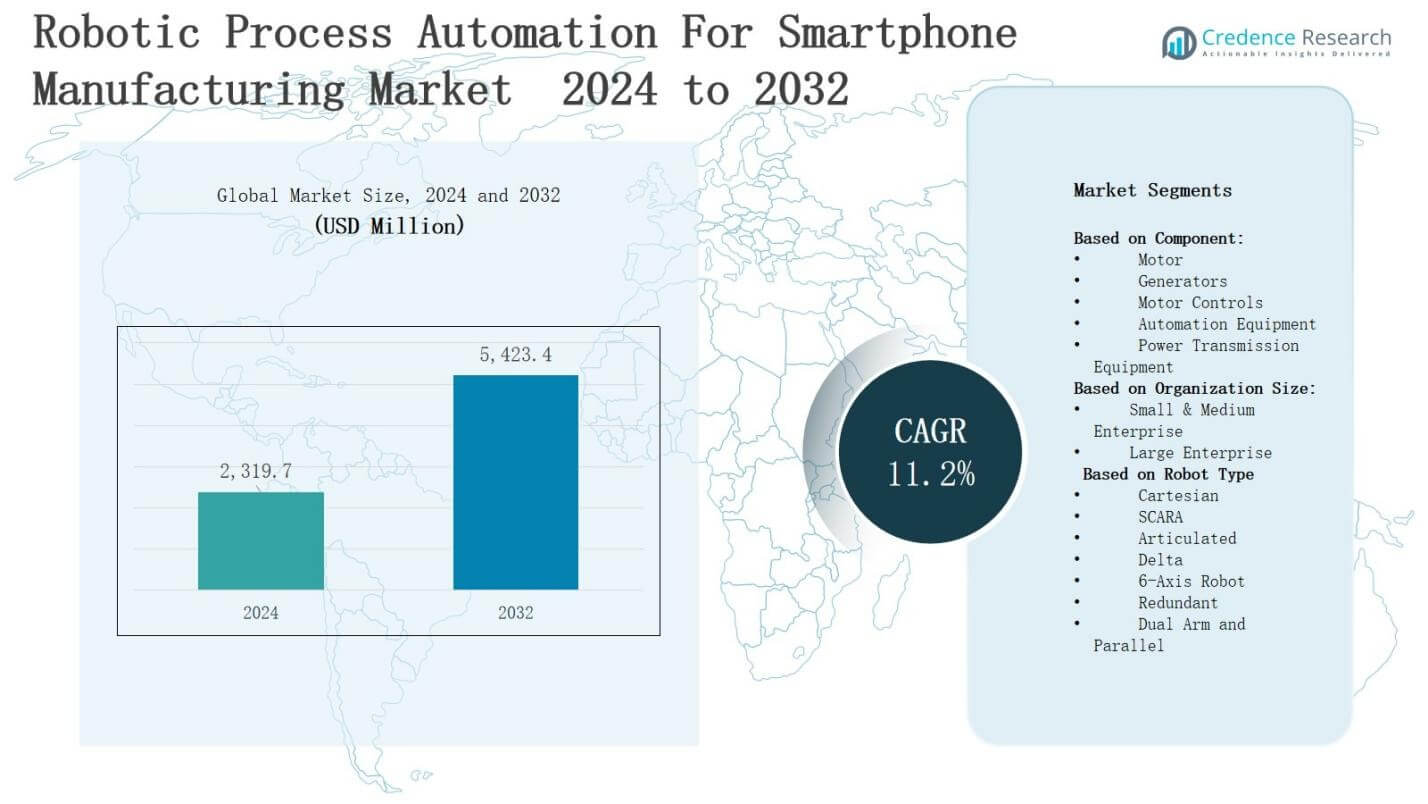

The Robotic process automation for smartphone manufacturing market is projected to grow from USD 2,319.7 million in 2024 to USD 5,423.4 million by 2032, registering a CAGR of 11.2% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2024 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Robotic process automation for smartphone manufacturing market Size 2024 |

USD 2,319.7 Million |

| Robotic process automation for smartphone manufacturing market, CAGR |

11.2% |

| Robotic process automation for smartphone manufacturing market Size 2032 |

USD 5,423.4 Million |

The robotic process automation for smartphone manufacturing market grows due to rising demand for high production efficiency, reduced operational costs, and enhanced quality control in complex assembly processes. Manufacturers adopt RPA to streamline repetitive tasks, minimize human error, and accelerate time-to-market amid increasing smartphone model variations. The shift toward Industry 4.0, integration of AI-driven automation, and expansion of flexible manufacturing lines drive adoption. Trends include collaborative robots for precision assembly, predictive maintenance systems, and real-time data analytics to optimize workflows. Growing investment in smart factories and advanced robotics further strengthens market growth and competitive differentiation in the global smartphone sector.

The robotic process automation for smartphone manufacturing market spans North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa, with Asia-Pacific holding the largest share due to high production volumes and technological adoption. North America and Europe benefit from advanced manufacturing infrastructure and strong R&D capabilities, while Latin America and the Middle East & Africa show growth through emerging manufacturing hubs. Key players include Mitsubishi Electric Corporation, ABB Ltd., Nachi-Fujikoshi Corporation, Yaskawa Electric Corporation, Comau S.p.A., Denso Corporation, Kawasaki Heavy Industries Ltd., Fanuc Corporation, Suzhou Elite Robot Co., Ltd., and KUKA AG.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The robotic process automation for smartphone manufacturing market is projected to grow from USD 2,319.7 million in 2024 to USD 5,423.4 million by 2032, at a CAGR of 11.2%.

- Growth is fueled by the need for higher production efficiency, cost reduction, and improved quality control in complex smartphone assembly processes.

- Industry 4.0 adoption, AI integration, collaborative robots, predictive maintenance, and real-time analytics are driving technological advancements.

- Key challenges include high initial investment, complex integration into existing lines, skilled workforce shortages, and cybersecurity risks.

- Asia-Pacific leads with 42% share, followed by North America at 22%, Europe at 20%, Latin America at 8%, and the Middle East & Africa at 8%.

- Major players include Mitsubishi Electric Corporation, ABB Ltd., Nachi-Fujikoshi Corporation, Yaskawa Electric Corporation, Comau S.p.A., Denso Corporation, Kawasaki Heavy Industries Ltd., Fanuc Corporation, Suzhou Elite Robot Co., Ltd., and KUKA AG.

- Rising investments in smart factories, flexible manufacturing lines, and premium smartphone customization present strong growth opportunities.

Market Drivers

Rising Demand for Production Efficiency and Cost Optimization

The robotic process automation for smartphone manufacturing market benefits from the industry’s drive to achieve higher productivity and lower operational costs. It enables manufacturers to automate repetitive, labor-intensive tasks, reducing cycle times and minimizing errors. Automation optimizes resource utilization and ensures consistent output quality across large-scale production lines. It helps address the challenges of high-volume demand without proportionally increasing labor costs. The integration of RPA into assembly processes supports lean manufacturing goals. It also allows companies to maintain competitive pricing while safeguarding margins.

- For instance, British American Tobacco, which automates its Bill of Materials processing using RPA, significantly improving accuracy and reducing errors by precisely transferring production recipes and material costs into their system.

Enhanced Quality Control and Precision in Manufacturing

The market grows due to the need for exceptional quality standards in smartphone production, where even minor defects can impact brand reputation. It enables precise component placement, accurate soldering, and consistent inspection processes. Automated systems identify defects in real time, ensuring rapid corrective actions. This minimizes waste and improves yield rates. It supports compliance with stringent quality regulations in global markets. Enhanced accuracy reduces the likelihood of costly product recalls. It strengthens trust between manufacturers and end consumers.

- For instance, Siemens employs AI-driven computer vision systems in its assembly lines for real-time detection of tiny flaws like dents and misalignments, significantly reducing faulty products.

Adoption of Industry 4.0 and Advanced Robotics Integration

The robotic process automation for smartphone manufacturing market expands with the adoption of Industry 4.0 technologies, enabling connected, data-driven production environments. It facilitates the integration of AI, machine vision, and predictive analytics into manufacturing workflows. Smart robots adjust operations based on real-time data, improving adaptability. This enables flexible production lines capable of managing multiple product models. It supports mass customization without compromising efficiency. The convergence of robotics and digital technologies accelerates innovation in manufacturing processes.

Growing Investment in Smart Factories and Workforce Optimization

The market gains momentum from rising investments in smart factories that combine robotics, IoT, and advanced control systems. It enables manufacturers to create highly automated, interconnected production ecosystems. Automation reallocates human resources from repetitive assembly to high-value tasks like process optimization and innovation. This shift improves workforce productivity and operational agility. It reduces dependency on manual labor amid skilled labor shortages. Enhanced automation capabilities also support scalability in response to market demand fluctuations. It ensures sustainable long-term growth.

Market Trends

Integration of Artificial Intelligence and Machine Vision

The robotic process automation for smartphone manufacturing market is witnessing a strong shift toward AI and machine vision integration to enhance automation capabilities. It enables real-time defect detection, adaptive decision-making, and predictive process adjustments. AI-driven robots can recognize complex patterns, improve accuracy in component assembly, and optimize inspection processes. This trend supports the production of high-precision devices with minimal human intervention. It reduces quality variability, improves yield rates, and enhances operational efficiency across manufacturing stages. Manufacturers gain a competitive advantage through consistent, high-quality output.

Rise of Collaborative Robots in Assembly Lines

The market is experiencing increased deployment of collaborative robots (cobots) designed to work alongside human operators safely. It allows flexible task allocation, combining human dexterity with robotic precision. Cobots improve productivity in intricate assembly processes, such as smartphone camera module installation or micro-soldering. They require minimal reprogramming, enabling rapid adaptation to new models. This flexibility shortens production changeover times. Cobots also reduce operator fatigue, lower workplace injuries, and enable scalable automation strategies without fully replacing human labor.

- For instance, Universal Robots’ UR10e cobots have been deployed by Siemens Gerätewerk Erlangen for handling diverse tasks including assembly, palletizing, and quality inspection, helping overcome labor shortages and increasing flexibility in mid-volume production.

Adoption of Predictive Maintenance and IoT-Enabled Monitoring

The robotic process automation for smartphone manufacturing market is embracing predictive maintenance solutions powered by IoT sensors. It allows real-time equipment health tracking, early fault detection, and optimized maintenance scheduling. This approach reduces unplanned downtime, lowers repair costs, and extends equipment lifespan. IoT-enabled robots transmit performance data for continuous process improvement. Predictive analytics support proactive adjustments, ensuring uninterrupted production flow. This trend aligns with the industry’s push toward operational resilience and higher overall equipment effectiveness.

- For instance, Tenaris, a major manufacturer, implemented IoT sensors on motors in its pipe production lines to detect failures early, allowing maintenance teams to address issues proactively and ensure uninterrupted operations.

Focus on Flexible Manufacturing and Product Customization

The market is shifting toward flexible manufacturing systems that can adapt to diverse smartphone designs and features. It enables quick reconfiguration of production lines to accommodate varying models and customer-specific requirements. Flexible RPA solutions streamline product customization without sacrificing efficiency. This approach supports brands offering limited-edition models or region-specific designs. It reduces the lead time between product design and market launch. Manufacturers leveraging flexible automation gain agility, faster response to trends, and improved customer satisfaction.

Market Challenges Analysis

High Initial Investment and Integration Complexity

The robotic process automation for smartphone manufacturing market faces challenges due to the substantial capital expenditure required for advanced automation systems. It involves costs for robotics hardware, AI-enabled software, integration services, and operator training. Many small and mid-sized manufacturers find it difficult to justify such investments without clear short-term returns. Integration into existing production lines can be complex, requiring customization to match unique workflows. Downtime during installation may disrupt ongoing operations. These factors slow adoption among cost-sensitive industry players, particularly in emerging markets with tighter budgets.

Skilled Workforce Shortage and Technological Adaptation Barriers

The market also contends with a shortage of skilled personnel capable of operating, maintaining, and programming advanced robotic systems. It demands expertise in robotics, AI, and industrial automation, which is often scarce in certain manufacturing regions. Resistance to change from traditional production teams can delay implementation. Continuous technological advancements require frequent updates to systems, creating adaptation challenges. Cybersecurity concerns linked to connected manufacturing environments further complicate adoption. Addressing these issues requires strategic investment in workforce development and robust security frameworks.

Market Opportunities

Expansion of Smart Manufacturing and Industry 4.0 Adoption

The robotic process automation for smartphone manufacturing market holds significant potential through the expansion of smart manufacturing initiatives. It benefits from increasing adoption of Industry 4.0 technologies, where robotics, AI, IoT, and data analytics converge to create fully connected production environments. Manufacturers can leverage automation to achieve greater efficiency, flexibility, and precision in high-volume smartphone assembly. Growth opportunities arise in retrofitting existing facilities with RPA capabilities to enhance output quality. This integration supports rapid adaptation to new models and features, enabling faster product launches. Emerging economies investing in advanced manufacturing infrastructure further amplify market prospects.

Rising Demand for Customized and Premium Smartphone Models

The market gains new opportunities from the growing consumer preference for customized and premium smartphone designs. It enables manufacturers to handle complex assembly processes for limited-edition devices, multi-camera configurations, and innovative form factors. Flexible robotic systems allow rapid line reconfiguration, reducing time-to-market for differentiated products. The demand for premium quality and aesthetic precision creates space for advanced automation solutions. Manufacturers adopting scalable RPA systems can respond quickly to shifting design trends. This adaptability strengthens competitive positioning in the global smartphone industry.

Market Segmentation Analysis:

By Component

The robotic process automation for smartphone manufacturing market is segmented into motors, generators, motor controls, automation equipment, and power transmission equipment. Motors and motor controls hold a critical role in ensuring precise robotic movement and positioning during assembly. Automation equipment, including sensors and controllers, drives operational efficiency and process accuracy. Power transmission equipment supports seamless motion transfer, while generators provide stable energy supply in advanced manufacturing setups. Demand for high-performance components is rising with the shift toward high-speed, precision-driven smartphone production lines.

By Organization Size

The market caters to both small & medium enterprises and large enterprises. Large enterprises lead adoption due to higher capital availability and the ability to integrate advanced robotics across multiple production facilities. It offers scalability, speed, and efficiency benefits that align with mass production requirements. Small & medium enterprises are gradually adopting RPA solutions to remain competitive and improve output quality. Supportive financing options and modular automation systems are making entry easier for smaller players. This adoption trend expands the market’s reach across diverse manufacturing scales.

- For instance, Reckitt, a leading global manufacturer, uses over 80 bots to automate about 20% of IT processes, resulting in 10,000 saved working hours monthly and a 20% reduction in operational costs.

By Robot Type

The robotic process automation for smartphone manufacturing market includes Cartesian, SCARA, articulated, delta, 6-axis, redundant, dual-arm, and parallel robots. Articulated and 6-axis robots dominate high-precision assembly, enabling complex maneuvers for intricate smartphone components. SCARA robots are preferred for high-speed pick-and-place tasks, while delta robots excel in lightweight part handling. Dual-arm and parallel robots offer simultaneous multi-tasking capabilities, boosting throughput. Redundant robots enhance safety and flexibility in constrained spaces. The variety of robot types supports customized automation strategies tailored to production needs.

- For instance, companies like Epson have implemented dual-arm robots to increase production line efficiency by performing coordinated assembly actions concurrently.

Segments:

Based on Component:

- Motor

- Generators

- Motor Controls

- Automation Equipment

- Power Transmission Equipment

Based on Organization Size:

- Small & Medium Enterprise

- Large Enterprise

Based on Robot Type

- Cartesian

- SCARA

- Articulated

- Delta

- 6-Axis Robot

- Redundant

- Dual Arm and Parallel

Based on the Geography:

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis

North America

North America holds 22% share of the robotic process automation for smartphone manufacturing market, driven by strong technological infrastructure and early adoption of advanced manufacturing solutions. It benefits from the presence of leading robotics and automation companies, as well as established smartphone assembly plants. Manufacturers in the region prioritize automation to offset high labor costs and maintain competitiveness. The demand for AI-integrated robotics and predictive maintenance tools is increasing. It also gains from government incentives supporting smart manufacturing initiatives. Strong R&D capabilities and collaboration between tech firms and manufacturers enhance innovation in automation processes.

Europe

Europe accounts for 20% of the market share, supported by a mature manufacturing ecosystem and stringent quality standards in smartphone production. Countries like Germany, France, and the UK lead investments in robotics and Industry 4.0 integration. It focuses on enhancing precision, reducing waste, and improving energy efficiency in production lines. European firms leverage automation to maintain high competitiveness in a global market. The region also benefits from skilled engineering talent and robust supply chain networks. Adoption of flexible automation systems aligns with the growing demand for customized smartphone models.

Asia-Pacific

Asia-Pacific dominates the robotic process automation for smartphone manufacturing market with a 42% share, led by China, Japan, South Korea, and India. It thrives due to high smartphone production volumes, low-cost manufacturing advantages, and rapid technological adoption. Governments in the region support industrial automation through policy incentives and infrastructure investments. Leading smartphone brands operate large-scale automated facilities to meet global demand. The region’s competitive advantage is strengthened by a strong supplier base for robotics components. Continuous investment in AI-driven automation ensures sustained leadership in production efficiency.

Latin America

Latin America holds 8% share of the market, with growth driven by expanding electronics manufacturing hubs in Brazil and Mexico. It is witnessing increased adoption of automation to improve quality control and reduce dependency on imports. Manufacturers are investing in robotics to cater to regional smartphone demand and export opportunities. The focus on operational efficiency is encouraging partnerships with international automation providers. It also benefits from gradual improvements in manufacturing infrastructure. Skilled workforce development programs are supporting broader RPA adoption in the sector.

Middle East & Africa

The Middle East & Africa represent 8% of the market share, with emerging opportunities in countries investing in diversified manufacturing. It is adopting automation in smartphone assembly to reduce reliance on imports and enhance local production capabilities. Governments are encouraging industrial modernization through technology-driven initiatives. The market growth is supported by increasing consumer demand for smartphones and rising investments in electronics manufacturing zones. International robotics firms are exploring partnerships in the region to establish a stronger foothold. It is gradually building a skilled labor base to operate advanced automation systems.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Competitive Analysis

The robotic process automation for smartphone manufacturing market is characterized by intense competition among global and regional players focusing on innovation, scalability, and precision engineering. It features established companies such as Mitsubishi Electric Corporation, ABB Ltd., Nachi-Fujikoshi Corporation, Yaskawa Electric Corporation, Comau S.p.A., Denso Corporation, Kawasaki Heavy Industries Ltd., Fanuc Corporation, Suzhou Elite Robot Co., Ltd., and KUKA AG. These players invest heavily in R&D to integrate AI, machine vision, and IoT into automation systems, enhancing production flexibility and efficiency. Strategic partnerships with smartphone manufacturers strengthen market positioning and enable customized automation solutions tailored to evolving product designs. Companies compete by offering modular, energy-efficient robotics capable of high-speed, high-accuracy operations. Expansion into emerging markets with cost-optimized solutions and localized support networks is a key growth strategy. Continuous advancements in collaborative robots, predictive maintenance, and data-driven process optimization are shaping competitive dynamics. Players are also aligning portfolios with Industry 4.0 requirements to meet the demand for smart, connected manufacturing ecosystems.

Recent Developments

- On June 24, 2025, Comau S.p.A. launched smart, mobile, and collaborative automation solutions at Automatica 2025, targeting enhanced flexibility and precision in smartphone manufacturing.

- In March 2025, Mitsubishi Electric launched its MELFA RH-10CRH and RH-20CRH SCARA robots. These new robots offer enhanced flexibility for digital manufacturing, addressing skilled workforce shortages.

- In June 2025, KUKA AG introduced the KMR iisy CR, a cleanroom-certified autonomous mobile robot for semiconductor and electronics manufacturing, offering advanced mobility and precision in sensitive production environments.

- In July 2025, Comau S.p.A. completed the acquisition of Italian warehouse automation specialist Automha, expanding its expertise in logistics automation and intralogistics solutions.

Market Concentration & Characteristics

The robotic process automation for smartphone manufacturing market demonstrates a moderately concentrated structure, with a mix of global leaders and specialized regional players competing on technology, customization, and service capabilities. It is characterized by high entry barriers due to significant capital requirements, advanced technical expertise, and the need for integration with complex manufacturing lines. Leading companies focus on innovation in AI integration, machine vision, and predictive maintenance to enhance precision and efficiency. The market exhibits strong alignment with Industry 4.0 principles, emphasizing connected, data-driven production environments. Demand for collaborative robots and flexible automation solutions drives competition, while partnerships between automation providers and smartphone manufacturers strengthen market presence. The competitive landscape also reflects regional specialization, with Asia-Pacific dominating high-volume production and North America and Europe focusing on advanced, high-precision solutions. Continuous R&D investment, product differentiation, and scalability remain critical factors shaping competitive positioning.

Report Coverage

The research report offers an in-depth analysis based on Component, Organization Size, Robot Type and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for automation in smartphone manufacturing will increase to meet faster production cycles and complex design requirements.

- Integration of AI and machine vision will enhance precision and reduce defects in assembly processes.

- Collaborative robots will gain wider adoption to improve flexibility and human-robot interaction on production lines.

- Predictive maintenance will become a standard feature to minimize downtime and optimize equipment life.

- Flexible manufacturing systems will enable faster adaptation to new smartphone models and customization trends.

- Smart factory investments will expand, creating more interconnected and data-driven production environments.

- Workforce training in robotics and automation will grow to address skill gaps in operating advanced systems.

- Emerging markets will increase adoption as infrastructure and technology access improve.

- Partnerships between robotics firms and smartphone manufacturers will drive tailored automation solutions.

- Sustainability initiatives will encourage the development of energy-efficient and eco-friendly automation technologies.