Market overview

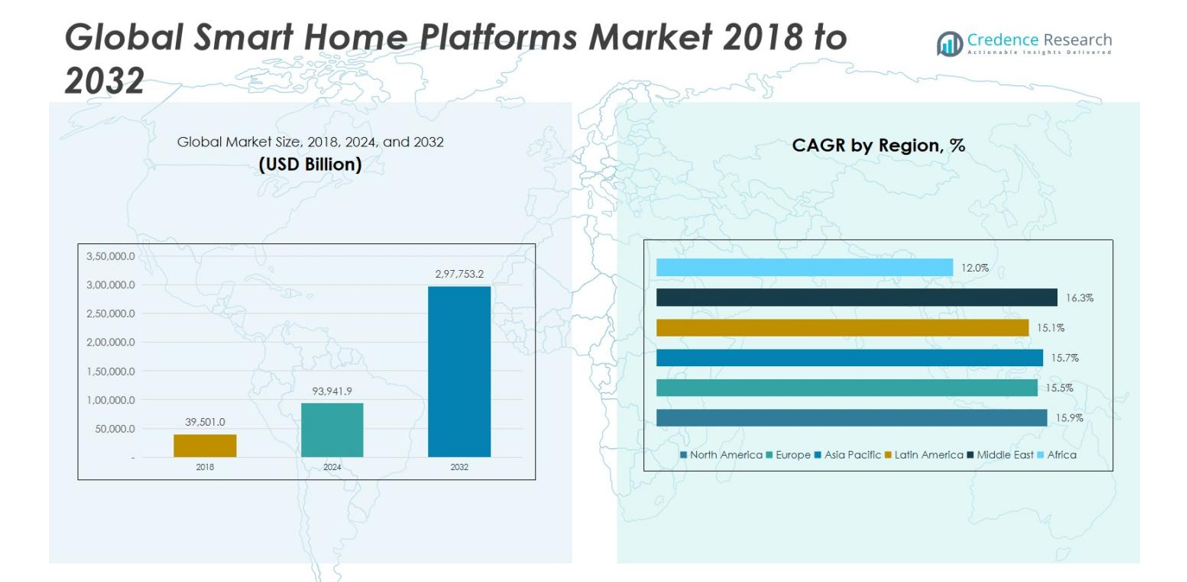

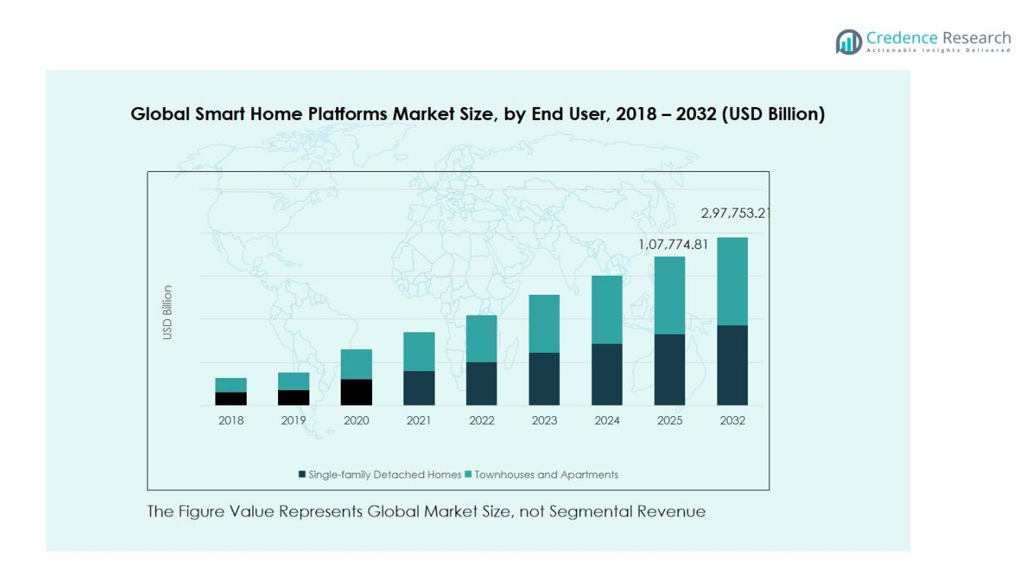

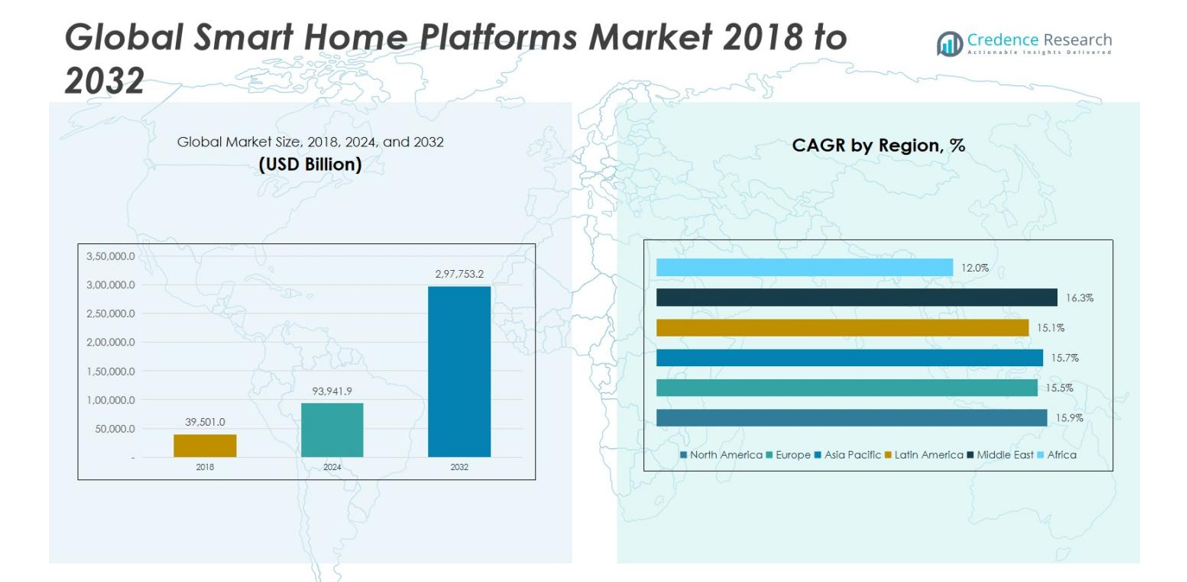

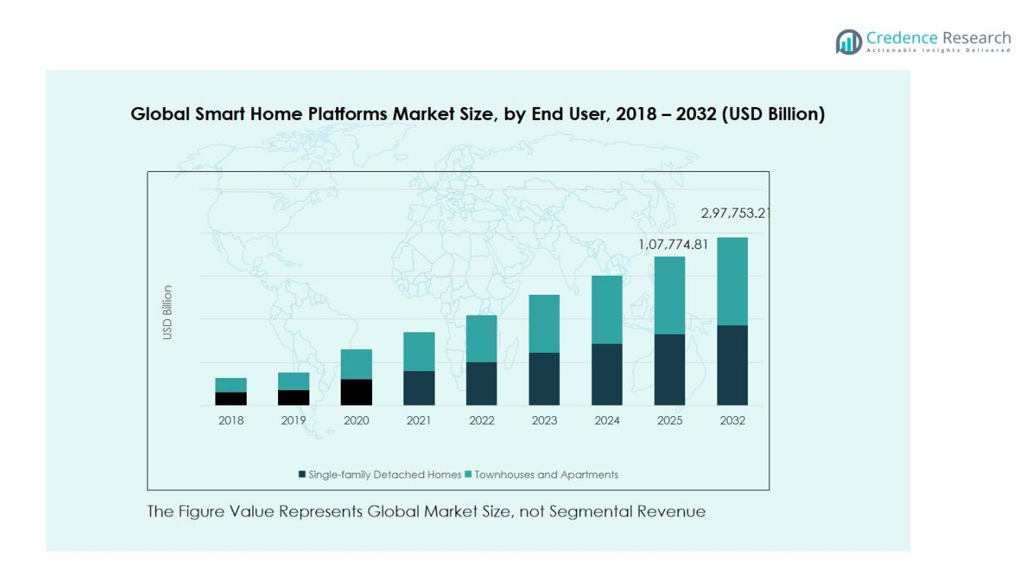

Smart Home Platforms Market size was valued at USD 39,501.0 Billion in 2018, increased to USD 93,941.9 Billion in 2024, and is anticipated to reach USD 2,97,753.2 Billion by 2032, at a CAGR of 15.62% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Smart Home Platforms Market Size 2024 |

USD 93,941.9 Billion |

| Smart Home Platforms Market, CAGR |

15.62% |

| Smart Home Platforms Market Size 2032 |

USD 2,97,753.2 Billion |

Smart Home Platforms Market features prominent players such as Amazon.com Inc., Apple Inc., Samsung Electronics Co. Ltd., Google LLC, Comcast Corp., Legrand SA, Assa Abloy AB (Yale), Resideo Technologies Inc., and Tuya Smart, all driving innovation through IoT integration, AI-enabled automation, and expanding device ecosystems. These companies focus on enhancing interoperability, cloud-based capabilities, and voice-assistant functionality to strengthen platform adoption across residential settings. North America leads the Smart Home Platforms Market with 38.7% share, supported by strong smart device penetration, advanced broadband infrastructure, and high consumer demand for security and home automation solutions. Europe follows with 27.9% share, driven by energy-efficient smart home upgrades and rapid adoption of interoperable ecosystems.

Market Insights

- The Smart Home Platforms Market reached USD 93,941.9 Billion in 2024 and will grow at a CAGR of 15.62% through 2032, driven by rising smart device penetration and expanding automation demand.

- The market grows as consumers adopt IoT-enabled appliances, smart security tools, and cloud-based automation, with the Device Centric Platform segment leading at 4% share due to strong OEM integration and seamless device control.

- Key trends include AI-driven personalization, Matter-based interoperability, and voice-assistant adoption, which enhance multi-device orchestration and strengthen long-term platform usage.

- Major technology players expand device ecosystems, enhance cybersecurity, and upgrade AI capabilities, intensifying innovation while the market faces restraints linked to data privacy risks and device fragmentation that limit cross-brand integration.

- Regionally, North America leads with 7% share, followed by Europe at 27.9%, while Asia Pacific holds 22.4% driven by rapid urbanization and rising adoption of affordable smart home solutions across China, Japan, South Korea, and India.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

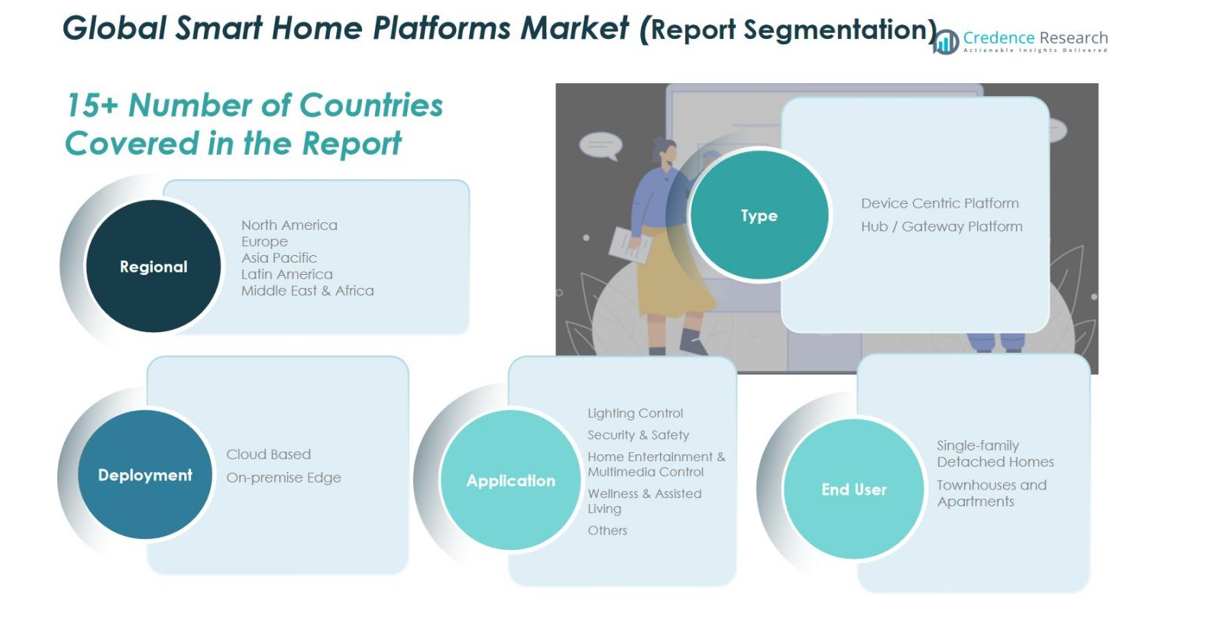

By Type

The Smart Home Platforms Market by type is dominated by the Device Centric Platform segment, accounting for 63.4% share in 2024, driven by its strong integration with proprietary ecosystems, simplified device onboarding, and expanding compatibility with connected appliances. Consumers increasingly prefer device-led ecosystems that ensure seamless control, optimized firmware updates, and stable connectivity across multiple devices. The Hub/Gateway Platform segment holds 36.6% share, supported by households adopting unified control hubs for multi-brand device interoperability, but device-centric platforms continue to lead due to vendor-specific optimization and wider OEM partnerships.

- For instance, Samsung’s SmartThings has integrated hub functionality directly into consumer devices its latest soundbar (HW-Q900C) now operates as a complete SmartThings hub with support for Zigbee, Thread, and Matter protocols, while over 140 Billion IoT devices from more than 300 providers already operate within the SmartThings network worldwide, demonstrating vendor-specific optimization at scale.

By Application

The Smart Home Platforms Market by application is led by the Security & Safety segment, contributing 41.8% share in 2024, fueled by rising adoption of smart surveillance, intrusion detection, and automated emergency response systems. Consumers prioritize real-time monitoring, AI-based alerts, and enhanced home protection, driving higher platform integration rates. Lighting Control holds 23.5% share, while Home Entertainment & Multimedia Control contributes 18.4%, supported by streaming and voice-assistant ecosystems. Wellness & Assisted Living and Others collectively hold 16.3%, but Security & Safety remains dominant due to increasing demand for connected home protection solutions.

- For instance, Signify launched the Philips Hue Bridge Pro in September 2025 at $89.99, supporting up to 150 smart lights and featuring MotionAware™ technology that transforms lights into motion sensors, automatically triggering security automations when movement is detected.

By Deployment

The Smart Home Platforms Market by deployment is dominated by the Cloud-Based segment, which captures 68.9% share in 2024, supported by continuous updates, remote accessibility, scalable storage, and AI-driven automation capabilities. Cloud integration enables seamless device control, cross-platform synchronization, and advanced analytics that enhance user experience. The On-premise Edge segment holds 31.1% share, driven by demand for low-latency processing, enhanced data privacy, and local control reliability. Despite this growth, cloud-based platforms maintain leadership due to broader ecosystem support, voice-assistant integration, and strong service provider adoption.

Key Growth Drivers

Rising Integration of IoT and Connected Devices

The rapid expansion of IoT ecosystems continues to drive the Smart Home Platforms Market as households adopt an increasing number of connected appliances, sensors, and automation tools. Seamless interoperability across devices enhances convenience, energy optimization, and remote monitoring, strengthening the value proposition of unified platforms. Manufacturers are integrating advanced connectivity protocols such as Zigbee, Z-Wave, Thread, and Wi-Fi 6 to improve real-time responsiveness. As smart homes evolve toward fully automated environments, the growing density of connected devices significantly accelerates platform adoption across residential and multi-dwelling units.

- For instance, the SmartThings platform demonstrates this integration capability by partnering with ABB’s free@home automation system, allowing residents to manage switches, dimmers, shutters, climate control, and appliances from different manufacturers through one app.

Growing Consumer Demand for Home Security and Automation

Demand for home security and automation remains a key accelerator as consumers prioritize safety, surveillance, and energy-efficient solutions. Smart security products such as AI-enabled cameras, smart locks, and motion sensors increasingly rely on central platforms for unified control and automated alerts. Enhanced awareness of remote security management, combined with rising urbanization and dual-income households, drives rapid deployment. The integration of emergency response features, real-time monitoring, and predictive analytics further boosts reliance on smart home platforms as core infrastructure for secure and efficient living.

- For instance, Arlo’s all-in-one motion sensors are designed to detect movement, water leaks, and temperature changes, triggering instant alerts and automations within the Arlo ecosystem.

Expanding Adoption of Cloud and AI-Driven Smart Home Capabilities

Cloud connectivity and AI-based automation significantly strengthen market growth by enabling remote access, adaptive learning, and personalized user experiences. Platforms leveraging cloud infrastructure deliver continuous updates, instant data synchronization, and scalable remote management features. AI-driven insights help automate routines, improve device efficiency, and enhance safety through context-aware decision-making. Voice assistants powered by AI also play a crucial role by simplifying control and increasing platform stickiness. As platform intelligence advances, cloud-AI convergence accelerates smart home upgrades and strengthens long-term adoption.

Key Trends & Opportunities

Emergence of Interoperable Ecosystems and Matter Standardization

A major industry trend is the adoption of interoperable ecosystems, driven by the global rollout of the Matter smart home standard. This development enables cross-brand compatibility and reduces fragmentation, creating a unified experience for consumers. Matter’s device certification promotes seamless integration across lighting, security, HVAC, and entertainment systems, unlocking new growth opportunities for platform vendors. As interoperability eliminates long-standing integration barriers, manufacturers benefit from wider market acceptance, lower development costs, and faster deployment cycles, positioning the market for accelerated global expansion.

- For instance, IKEA launched a range of 21 new smart home products including lighting and sensors that are fully Matter-compatible, simplifying smart home technology for consumers by ensuring seamless integration across devices.

Growth of Health Monitoring and Assisted Living Applications

Smart home platforms increasingly support wellness and assisted-living applications, creating new revenue channels for solution providers. Aging populations and rising demand for in-home health management drive the integration of fall detection, sleep monitoring, air-quality tracking, and emergency alert systems. These capabilities transform homes into proactive care environments that enhance safety and independence for elderly residents. As healthcare providers, insurers, and smart home vendors collaborate, the market sees expanding opportunities for specialized sensors, AI-driven diagnostics, and remote-care platforms embedded into daily living workflows.

Key Challenges

Data Privacy Concerns and Cybersecurity Risks

The Smart Home Platforms Market faces significant challenges related to data privacy and cybersecurity as interconnected devices generate sensitive personal information. Breaches, unauthorized access, and weak device-level security can expose users to identity theft, intrusion, or surveillance risks. Consumers increasingly expect robust encryption, secure authentication, and transparent data policies from platform providers. Regulatory frameworks continue to tighten, requiring vendors to invest heavily in compliance, secure firmware, and real-time threat detection. Failure to address these vulnerabilities can weaken user trust and slow adoption.

Fragmentation Across Devices and Lack of Standardization

Despite recent improvements, platform fragmentation remains a persistent challenge due to varying communication protocols, limited cross-brand compatibility, and inconsistent device performance. Consumers often face integration hurdles when connecting devices from different vendors, reducing the overall reliability of smart home ecosystems. Manufacturers must address these inconsistencies by supporting universal standards, expanding interoperability frameworks, and improving software synchronizations. The absence of unified device certification continues to impede market fluidity, delaying deployments and increasing support costs. Reducing fragmentation is essential for unlocking full-scale smart home automation.

Regional Analysis

North America

North America holds 38.7% share of the Smart Home Platforms Market, driven by strong penetration of IoT devices, widespread broadband access, and high consumer adoption of smart security and automation systems. The region grows at a CAGR of 15.9%, supported by rapid technological advancement. The U.S. leads regional demand with robust investments from major technology companies and strong integration of cloud-based platforms. Market size increased from USD 9,128.67 Billion in 2018 to USD 21,979.71 Billion in 2024, and is projected to reach USD 70,805.71 Billion by 2032. Canada and Mexico also experience rising smart home deployments supported by expanding smart appliance availability and increasing awareness of home energy management solutions across urban households.

Europe

Europe accounts for 27.9% share of the Smart Home Platforms Market, supported by growing adoption of interoperable ecosystems, advanced home automation standards, and strong emphasis on sustainability. The region grows at a CAGR of 15.5%, driven by energy-efficient smart home upgrades. Market size expanded from USD 10,799.56 Billion in 2018 to USD 25,458.25 Billion in 2024, and is forecasted to reach USD 79,738.31 Billion by 2032. Countries such as Germany, the UK, France, and the Netherlands lead uptake due to high smart lighting, HVAC control, and security system integration. Government initiatives promoting energy-efficient buildings and expansion of Matter-compliant devices strengthen regional growth, enhancing multi-device orchestration across European households.

Asia Pacific

Asia Pacific captures 22.4% share of the Smart Home Platforms Market, driven by rapid urbanization, increasing smart device affordability, and expanding connected living ecosystems. The region grows at a CAGR of 15.7%, supported by strong demand in China, Japan, South Korea, and India. Market size rose from USD 13,738.44 Billion in 2018 to USD 32,761.56 Billion in 2024, and is projected to reach USD 1,04,213.62 Billion by 2032. Local manufacturers and global brands aggressively expand portfolios of AI-enabled appliances, voice assistants, and cloud-based solutions, while government digitalization programs and rising residential construction further accelerate platform integration.

Latin America

Latin America represents 6.3% share of the Smart Home Platforms Market, supported by increasing demand for smart security products, gradual IoT adoption, and wider availability of affordable connected devices. The region grows at a CAGR of 15.9% driven by expanding smart automation in Brazil and Mexico. Market size increased from USD 3,424.73 Billion in 2018 to USD 8,285.67 Billion in 2024, and is expected to reach USD 26,857.34 Billion by 2032. Rising e-commerce penetration and growing smartphone usage enhance awareness and access to smart home solutions, driving adoption of energy management and convenience-based automation across urban households.

Middle East

The Middle East holds 3.8% share of the Smart Home Platforms Market, fueled by rapid smart city development, strong demand for luxury residential automation, and advanced security system adoption. The region records the highest CAGR at 16.3%, driven by premium smart home investments. Market size grew from USD 1,275.88 Billion in 2018 to USD 3,143.03 Billion in 2024, and is projected to reach USD 10,421.36 Billion by 2032. Countries such as the UAE, Saudi Arabia, and Qatar lead demand, supported by digital transformation programs, new smart-enabled residential projects, and rising interest in sustainable, energy-efficient living solutions.

Africa

Africa accounts for 0.9% share of the Smart Home Platforms Market, with growth gradually increasing as smart devices become more accessible and urbanization accelerates. The region grows at a CAGR of 12.0%, supported by rising adoption of affordable smart security and energy-management solutions. Market size expanded from USD 1,133.68 Billion in 2018 to USD 2,313.65 Billion in 2024, and is expected to reach USD 5,716.86 Billion by 2032. South Africa leads adoption, driven by demand for security monitoring, smart lighting, and IoT-powered solutions. Improving mobile internet penetration and expanding e-commerce access enable wider adoption across emerging African markets.

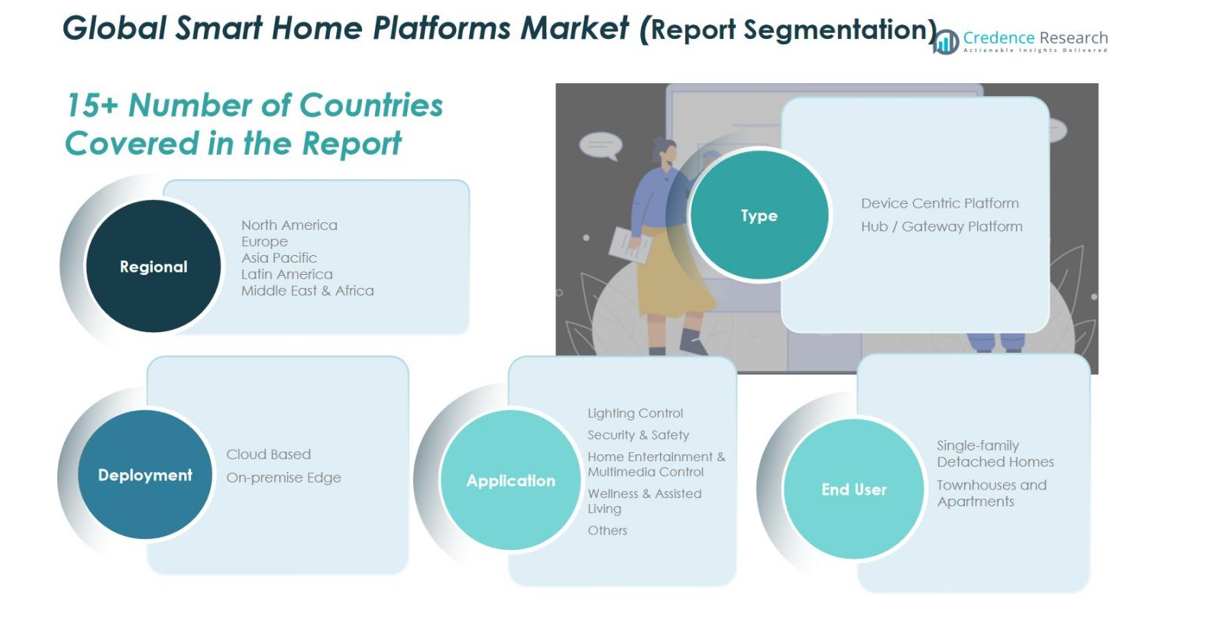

Market Segmentations:

By Type

- Device Centric Platform

- Hub / Gateway Platform

By Application

- Lighting Control

- Security & Safety

- Home Entertainment & Multimedia Control

- Wellness & Assisted Living

- Others

By Deployment

- Cloud Based

- On-premise Edge

By End User

- Single-family Detached Homes

- Townhouses and Apartments

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

Competitive landscape in the Smart Home Platforms Market is shaped by leading players such as Amazon.com Inc., Apple Inc., Samsung Electronics Co. Ltd., Google LLC, Comcast Corp., Legrand SA, Assa Abloy AB (Yale), Resideo Technologies Inc., and Tuya Smart, each driving innovation through advanced AI, IoT integration, and cloud-based automation. Companies strategically invest in expanding device ecosystems, enhancing interoperability, and strengthening voice-assistant capabilities to increase platform stickiness and user retention. The introduction of the Matter standard has intensified competition as vendors accelerate compatibility upgrades, enabling cross-brand device integration. Market players also focus on enhancing cybersecurity, improving real-time analytics, and enabling personalized automation based on behavioral data. Partnerships with home appliance manufacturers, telecom operators, and smart security companies further extend market reach, while continuous product updates and subscription-based service models contribute to sustained revenue growth. Overall, the competitive environment continues to evolve toward unified, intelligent, and adaptive smart home ecosystems.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In September 2025, Philips Hue announced a partnership with Sonos to integrate Sonos Voice Control into its lighting portfolio, enabling users to manage lights and smart plugs via voice commands.

- In November 2025, IKEA launched 21 new smart home products compatible with the Matter standard, focusing on lighting, sensors and control devices to simplify multi-brand ecosystem integration.

- In September 2025, True Corporation partnered with Tuya Smart and China Mobile International to enhance its TrueX smart-home platform in Thailand, targeting migration of over 3 Billion users to the new ecosystem.

Report Coverage

The research report offers an in-depth analysis based on Type, Application, Deployment, End User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will expand rapidly as households increasingly adopt interconnected devices for automation and security.

- AI-driven personalization will enhance user experiences and strengthen platform engagement.

- Interoperability through Matter and similar standards will accelerate multi-brand device integration.

- Cloud-based platforms will gain momentum with continuous updates and scalable remote management.

- Edge computing adoption will rise to support low-latency processing and privacy-focused applications.

- Smart home security solutions will become more advanced with real-time analytics and predictive alerts.

- Voice assistants will evolve into central control hubs for unified smart home ecosystems.

- Health, wellness, and assisted-living features will play a larger role in platform innovation.

- Telecom operators and appliance manufacturers will expand partnerships to deliver bundled smart home services.

- Growing consumer demand for sustainability will push platforms to integrate energy optimization and smart grid capabilities.