Market Overview

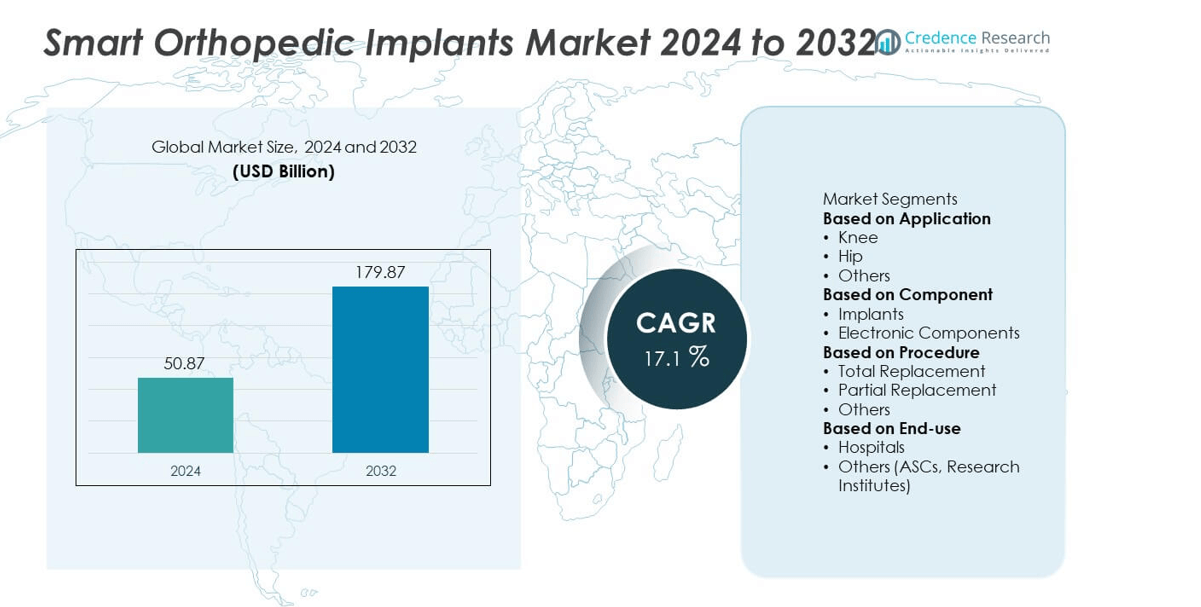

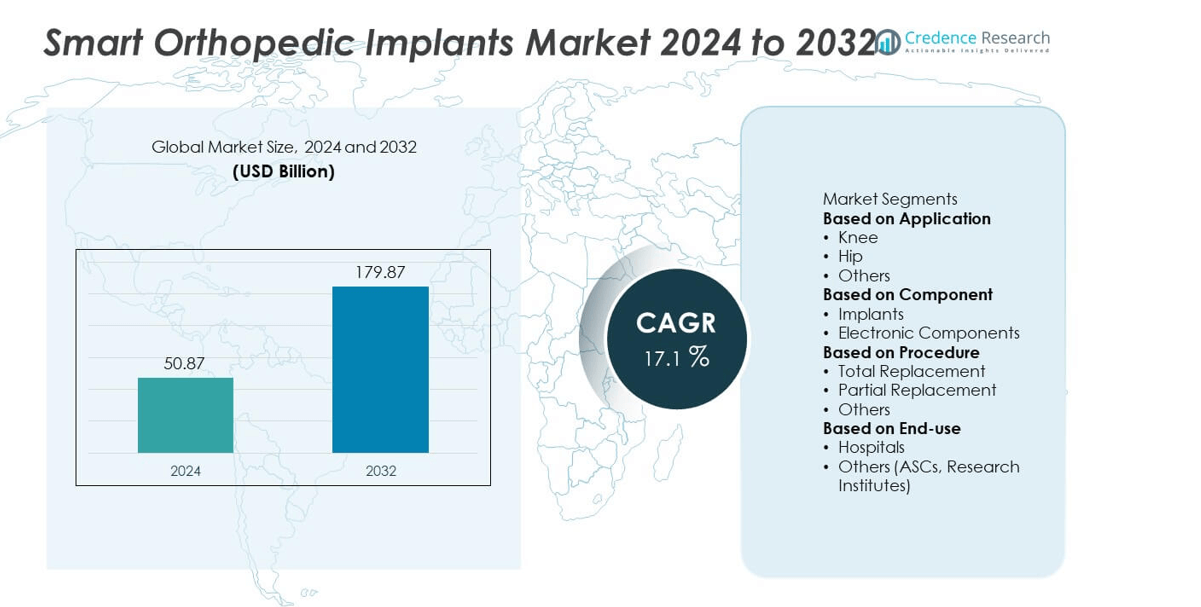

The Smart Orthopedic Implants market size was valued at USD 50.87 billion in 2024 and is projected to reach USD 179.87 billion by 2032, expanding at a CAGR of 17.1% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Smart Orthopedic Implants Market Size 2024 |

USD 50.87 billion |

| Smart Orthopedic Implants Market, CAGR |

17.1% |

| Smart Orthopedic Implants Market Size 2032 |

USD 179.87 billion |

The smart orthopedic implants market is led by key players such as Zimmer Biomet, Stryker, Medtronic, Abbott, Boston Scientific Corporation, Biotronik, Nevro Corp., Cochlear Ltd., Exactech, Inc., and CONMED Corporation. These companies are advancing innovations in sensor-enabled implants, wireless connectivity, and AI-driven platforms to improve surgical outcomes and post-operative monitoring. Regionally, North America commanded the largest share at 38% in 2024, driven by strong healthcare infrastructure and rapid adoption of smart medical technologies. Europe followed with 30% share, supported by regulatory frameworks and rising hip and knee replacement procedures. Asia-Pacific accounted for 27% share, fueled by expanding healthcare investments and increasing orthopedic surgeries, making it the fastest-growing regional market.

Market Insights

- The smart orthopedic implants market was valued at USD 50.87 billion in 2024 and is projected to reach USD 179.87 billion by 2032, growing at a CAGR of 17.1% during the forecast period.

- Rising demand for joint replacements and spine surgeries, coupled with the need for real-time patient monitoring, is a major driver for market adoption.

- Key trends include the integration of AI, IoT, and wireless technologies into orthopedic implants, enabling predictive analytics, remote monitoring, and improved patient outcomes.

- Competition is shaped by leading players such as Zimmer Biomet, Stryker, Medtronic, Abbott, and Boston Scientific Corporation, who focus on R&D, product innovation, and strategic collaborations to expand their global reach.

- Regionally, North America led with 38% share in 2024, followed by Europe at 30% and Asia-Pacific at 27%, while Latin America and the Middle East & Africa accounted for 3% and 2% respectively, showing gradual adoption with growing healthcare investments.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Application

The knee segment dominated the smart orthopedic implants market in 2024, accounting for over 45% share. Rising cases of osteoarthritis, an aging population, and higher adoption of knee replacement surgeries drive this dominance. Smart knee implants equipped with sensors provide real-time data on joint performance, helping improve rehabilitation outcomes. Increasing demand for minimally invasive procedures and technological advancements in implant design further strengthen this segment. While hip implants are growing due to rising hip fracture cases, the knee segment remains the leading contributor to market expansion.

- For instance, Zimmer Biomet’s Persona IQ smart knee implant, records in vivo kinematic data on range of motion, step count, and walking speed to provide insights into patient recovery trends that can be remotely monitored by surgeons and therapists via the mymobility app.

By Component

Implants held the largest share of over 60% in 2024, as they serve as the core element of orthopedic procedures and directly address patient mobility and pain management. The integration of smart sensors into these implants enhances post-surgical monitoring and personalized recovery. Increasing adoption of advanced materials and biocompatible coatings further supports this segment’s dominance. Electronic components are gaining traction with advancements in IoT-enabled monitoring, but implants remain the leading sub-segment, driven by their indispensable role in orthopedic surgeries worldwide.

- For instance, Stryker is actively developing implantable sensor systems for orthopedic implants to improve surgical outcomes and enable post-operative patient monitoring, leveraging its 2021 acquisition of OrthoSensor and integration into platforms like Mako SmartRobotics.

By Procedure

otal replacement procedures led the smart orthopedic implants market with over 55% share in 2024, supported by the rising prevalence of advanced joint disorders that require complete reconstruction. The demand is particularly strong in knee and hip replacements, where total procedures ensure long-term effectiveness and improved quality of life. Smart implants used in total replacements provide detailed feedback for clinicians, supporting better post-operative care. Partial replacement and other procedures are expanding gradually, but the complexity and higher efficiency of total replacements sustain their dominance in this market segment.

Market Overview

Rising Prevalence of Orthopedic Disorders

The growing prevalence of conditions such as osteoarthritis, osteoporosis, and fractures is a major driver for the smart orthopedic implants market. Aging populations across developed and emerging economies contribute significantly to rising surgical volumes, particularly in knee and hip replacements. Patients demand advanced solutions that improve long-term outcomes and mobility. Smart implants with embedded sensors enable real-time monitoring of implant performance and patient activity, ensuring better rehabilitation and reduced complication rates. This growing disease burden accelerates adoption of smart orthopedic technologies globally.

- For instance, Johnson & Johnson’s subsidiary, DePuy Synthes, is a key player in digital orthopedics, particularly with its VELYS™ Digital Surgery platform. The company has integrated technology into its procedures and developed solutions to provide data and enhance precision in surgeries like total knee replacements.

Advancements in Sensor and IoT Integration

The integration of IoT-enabled sensors in orthopedic implants is revolutionizing post-operative care. These sensors provide continuous data on parameters like load, alignment, and movement, enabling clinicians to monitor recovery remotely. This reduces hospital visits, improves rehabilitation efficiency, and helps in early detection of implant-related issues. Coupled with AI-driven analytics, the data supports personalized care and better long-term outcomes. Increasing focus on digital healthcare and connected systems strengthens this driver, making smart implants a central tool in modern orthopedic care.

- For instance, Leading medical technology companies like Medtronic are increasingly integrating IoT and AI into their devices to enable remote monitoring and personalized patient care. These technologies assist clinicians in a range of areas, including managing patient recovery and detecting implant anomalies early, and the use of such devices is expanding across the industry.

Rising Demand for Minimally Invasive and Personalized Solutions

Patients are increasingly seeking minimally invasive procedures and customized implants to improve recovery and long-term mobility. Smart orthopedic implants meet this demand by offering precise, patient-specific solutions that enhance surgical accuracy. Advanced manufacturing techniques such as 3D printing allow personalization of implant design, while smart features track performance post-surgery. This trend is especially strong in developed markets, where patients and healthcare providers prioritize comfort, reduced downtime, and improved quality of life. The shift toward patient-centric care accelerates the adoption of smart orthopedic implants worldwide.

Key Trends & Opportunities

Expansion of AI and Predictive Analytics

AI-powered predictive analytics is emerging as a transformative trend in the smart orthopedic implants market. By analyzing continuous data from embedded sensors, AI can forecast complications, detect implant failures early, and optimize rehabilitation plans. This technology improves clinical decision-making and enhances patient outcomes while reducing long-term healthcare costs. Hospitals and device manufacturers are increasingly integrating AI platforms with implant systems, creating strong opportunities for innovation. This trend positions predictive analytics as a key enabler of smarter and more efficient orthopedic care.

- For instance, Stryker’s MAKO robotic surgery system features insightful data analytics, and by the end of 2024, it had been used in more than 1.5 million procedures globally, including knee replacements

Growth of Remote Monitoring and Telehealth Integration

Remote monitoring through smart implants is creating new opportunities for connected healthcare ecosystems. Patients equipped with sensor-enabled implants can transmit data directly to healthcare providers, enabling real-time follow-ups and reduced dependency on in-person visits. The integration of these systems with telehealth platforms supports continuous patient engagement and care accessibility, especially for aging populations and rural patients. This trend not only enhances convenience but also reduces hospital readmissions, improving overall efficiency in orthopedic care delivery.

- For instance, Boston Scientific has deployed remote-monitoring-enabled smart implants, integrated with its telehealth systems, allowing clinicians to conduct virtual follow-ups. This capability enables earlier intervention for patients with implant-related complications, potentially improving patient outcomes.

Key Challenges

High Costs of Smart Orthopedic Implants

The advanced technologies embedded in smart orthopedic implants significantly increase their cost compared to traditional devices. High expenses for sensors, IoT integration, and advanced materials limit adoption in cost-sensitive markets. Patients in developing economies often face affordability barriers, while healthcare providers struggle with reimbursement complexities. Although these devices deliver long-term savings by reducing complications and hospital visits, upfront costs remain a critical challenge, slowing widespread adoption across global healthcare systems.

Data Security and Privacy Concerns

Smart orthopedic implants rely heavily on continuous data collection and cloud-based systems, raising concerns about patient privacy and cybersecurity risks. Unauthorized access to sensitive health data can compromise patient trust and expose providers to regulatory penalties. Compliance with strict frameworks such as HIPAA and GDPR adds to operational complexity for manufacturers. Ensuring secure data storage, encrypted transmission, and robust cybersecurity measures is costly and challenging. Without addressing these risks, adoption may be hindered despite the strong benefits of connected orthopedic solutions.

Regional Analysis

North America

North America accounted for 39% share of the smart orthopedic implants market in 2024, driven by high adoption of advanced medical technologies and favorable reimbursement policies. The U.S. leads with strong demand for knee and hip replacements, supported by a large elderly population and rising prevalence of osteoarthritis. Canada contributes with expanding healthcare infrastructure and growing interest in digital health integration. Robust R&D pipelines, collaborations between device manufacturers and hospitals, and early adoption of IoT-enabled implants reinforce regional dominance. High healthcare spending and patient preference for innovative treatments further strengthen North America’s leadership in this market.

Europe

Europe held 29% share of the smart orthopedic implants market in 2024, supported by an aging population and growing focus on personalized healthcare. Countries such as Germany, the U.K., and France lead adoption, with advanced hospital infrastructure and strong investments in orthopedic research. The region benefits from regulatory support through frameworks like EU MDR, ensuring device safety and reliability. Demand for minimally invasive surgeries and customized implants continues to rise. Increasing prevalence of musculoskeletal disorders and government funding for digital health accelerate growth, positioning Europe as a strong hub for innovation in orthopedic technologies.

Asia-Pacific

Asia-Pacific dominated the smart orthopedic implants market with 27% share in 2024, fueled by rising healthcare investments and expanding access to advanced treatments. China, India, and Japan are key contributors, with rapid urbanization and aging populations driving higher surgical volumes. The growing burden of osteoporosis and joint disorders boosts demand for knee and hip replacements. Local and global manufacturers are expanding production and distribution networks to meet regional demand. Increasing adoption of telehealth and IoT-enabled healthcare further supports growth, making Asia-Pacific the fastest-growing region in smart orthopedic implants during the forecast period.

Latin America

Latin America captured 3% share of the smart orthopedic implants market in 2024, with Brazil and Mexico leading regional demand. Rising prevalence of lifestyle-related disorders, such as obesity and osteoporosis, is driving demand for hip and knee replacement procedures. Healthcare modernization and expanding private sector investments are improving access to advanced orthopedic treatments. However, affordability issues and limited reimbursement policies constrain faster adoption. Growing partnerships between international implant manufacturers and local healthcare providers are expected to improve accessibility. With increasing focus on minimally invasive surgeries, the region shows steady growth potential in the forecast period.

Middle East & Africa

The Middle East and Africa accounted for 2% share of the smart orthopedic implants market in 2024, reflecting gradual adoption but increasing opportunities. Gulf countries, particularly Saudi Arabia and the UAE, are driving growth through investments in advanced healthcare infrastructure and premium orthopedic solutions. South Africa contributes with demand for joint replacements supported by rising cases of trauma and musculoskeletal disorders. Limited affordability and gaps in skilled workforce hinder widespread adoption across several African nations. However, growing government-backed healthcare initiatives and medical tourism in the Middle East are creating long-term opportunities for regional market expansion.

Market Segmentations:

By Application

By Component

- Implants

- Electronic Components

By Procedure

- Total Replacement

- Partial Replacement

- Others

By End-use

- Hospitals

- Others (ASCs, Research Institutes)

By Geography

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Competitive Landscape

Competitive landscape in the smart orthopedic implants market is shaped by leading players including Zimmer Biomet, Medtronic, Boston Scientific Corporation, Abbott, Nevro Corp., Biotronik, Cochlear Ltd., Exactech, Inc., Stryker, and CONMED Corporation. These companies drive innovation by integrating sensors, wireless connectivity, and AI-based data platforms into orthopedic implants, enabling real-time monitoring and improved patient outcomes. Their strategies focus on R&D investments, strategic acquisitions, and collaborations with healthcare providers to expand product portfolios and strengthen global reach. With rising demand for advanced knee and hip replacement solutions, manufacturers are prioritizing miniaturized sensors, battery-free devices, and cloud-enabled monitoring systems. Companies also emphasize regulatory compliance and clinical validation to build trust among surgeons and patients. Intense competition is pushing players to enhance personalization, durability, and post-surgery rehabilitation solutions. Growing adoption in developed markets like North America and Europe, combined with emerging opportunities in Asia-Pacific, ensures these players maintain a strong foothold while expanding access to next-generation orthopedic care.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Cochlear Ltd.

- Stryker

- Biotronik

- Zimmer Biomet

- Medtronic

- Nevro Corp.

- Exactech, Inc.

- Abbott

- CONMED Corporation

- Boston Scientific Corporation

Recent Developments

- In July 2025, Cochlear Ltd. launched the Nexus System (Nucleus Nexa), the first “smart” cochlear implant having upgradable firmware inside the implant itself.

- In 2025, Stryker unveiled the Mako 4 system, a single robotic platform that supports hip, knee, partial knee, and spine procedures with smart guidance.

- In September 2024, Medtronic expanded its AiBLE™ ecosystem by launching new software (O-arm 4.3) and imaging features to improve spine surgery navigation and implant guidance.

- In February 2024, Exactech, Inc. signed a partnership with Statera Medical to co-develop a smart reverse shoulder implant.

Report Coverage

The research report offers an in-depth analysis based on Application, Component, Procedure, End-use and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for smart orthopedic implants will rise with growing cases of joint disorders.

- AI and IoT integration will enhance predictive monitoring and patient care outcomes.

- Knee and hip implant procedures will continue to dominate global adoption.

- Remote monitoring solutions will gain traction with the expansion of telehealth services.

- North America will maintain leadership due to advanced healthcare infrastructure and high adoption rates.

- Asia-Pacific will emerge as the fastest-growing region with increasing surgical volumes.

- Partnerships between medtech firms and hospitals will drive innovation and accessibility.

- Miniaturization of sensors will improve implant performance and patient comfort.

- Regulatory frameworks will push manufacturers to ensure higher safety and reliability standards.

- Competition will intensify as companies invest in digital health integration and personalized implant solutions.