Market Overview

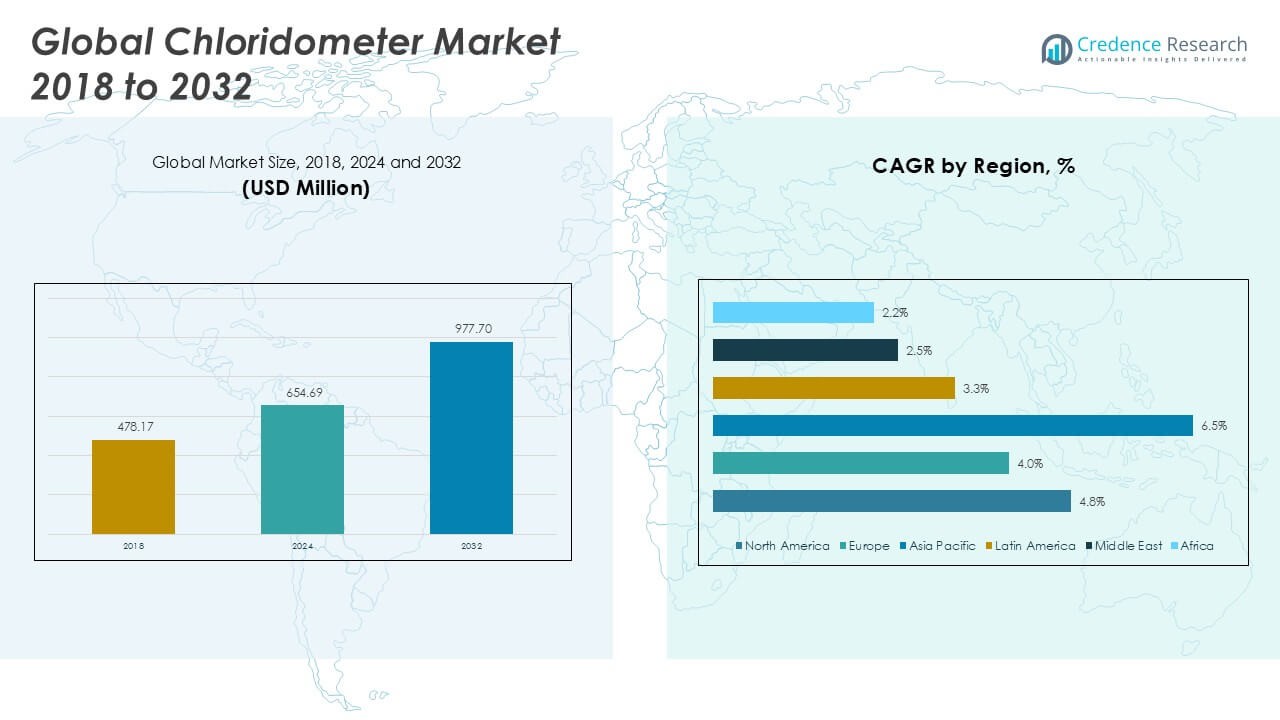

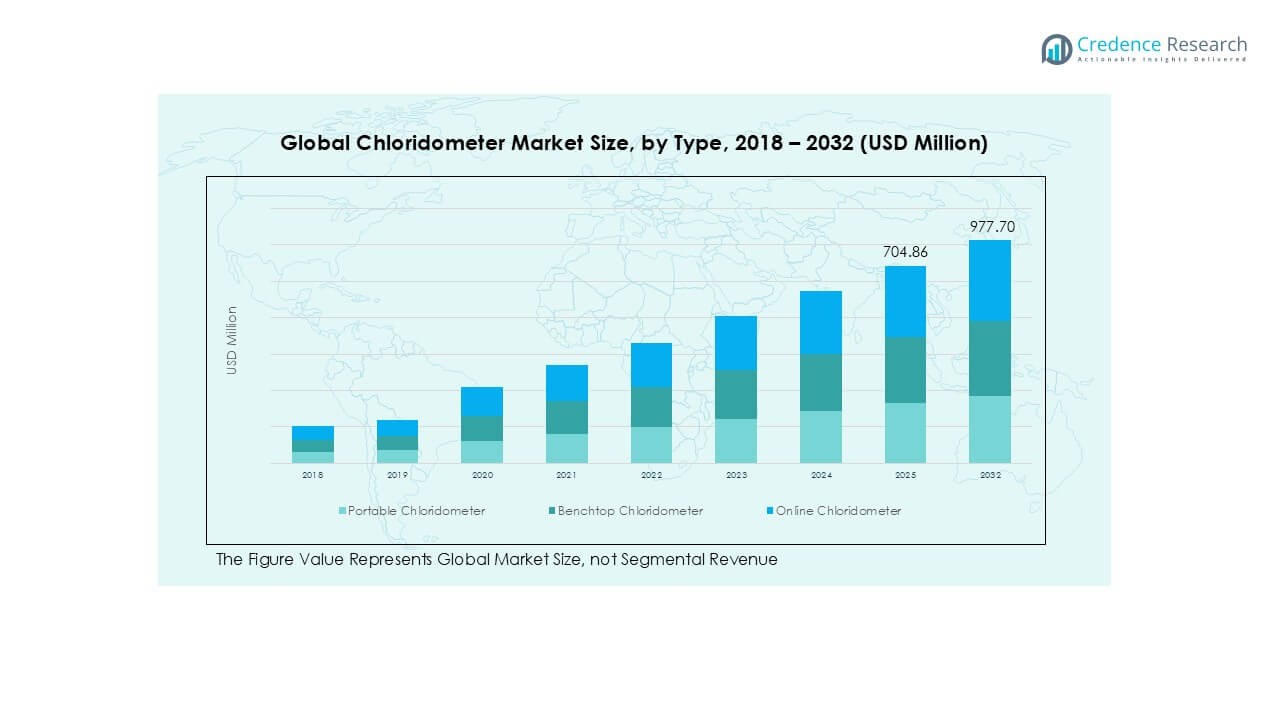

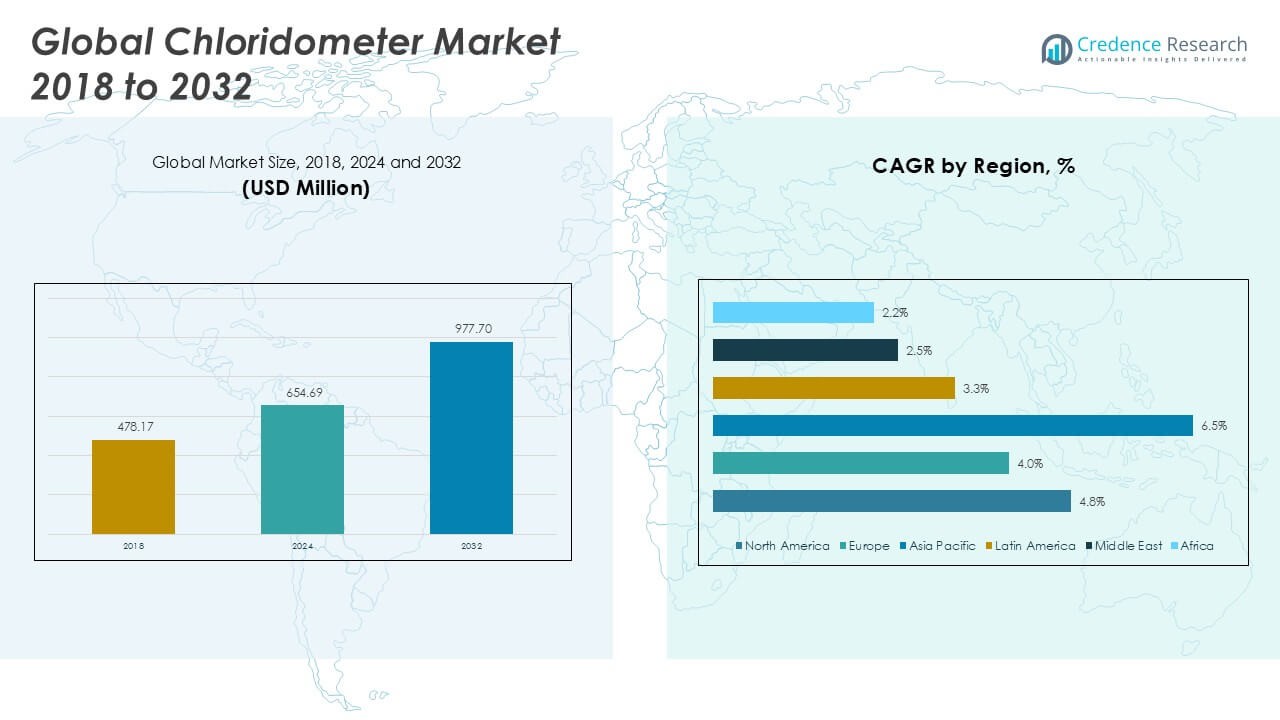

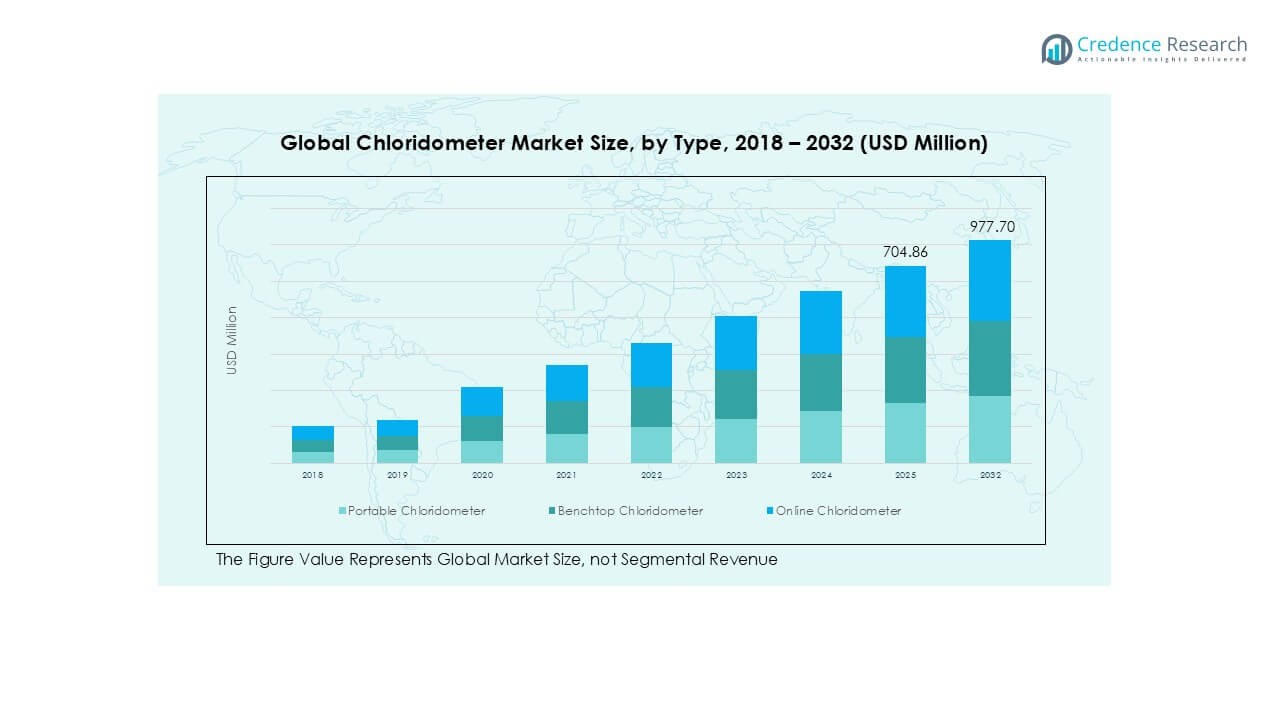

The Chloridometer market size was valued at USD 478.17 million in 2018, growing to USD 654.69 million in 2024, and is anticipated to reach USD 977.70 million by 2032, at a CAGR of 4.79% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Chloridometer Market Size 2024 |

USD 654.69 Million |

| Chloridometer Market, CAGR |

4.79% |

| Chloridometer Market Size 2032 |

USD 977.70 Million |

The chloridometer market is led by global players such as Radiometer, Metrohm AG, LAR Process Analysers AG, Hach Company, Thermo Fisher Scientific, Hanna Instruments, SI Analytics, Yokogawa Electric Corporation, Mettler Toledo, and Ocean Insight, all competing through advanced product portfolios and strong global presence. These companies focus on precision, automation, and portable systems to meet growing needs across healthcare, water quality testing, and food safety. North America remains the leading region with 43.6% market share in 2024, supported by advanced healthcare infrastructure and strict water safety regulations. Europe follows with 26.8%, driven by strong adoption in pharmaceuticals and environmental monitoring, while Asia Pacific holds 20.2%, emerging as the fastest-growing market due to industrialization and rising healthcare investments.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The chloridometer market was valued at USD 654.69 million in 2024 and is projected to reach USD 977.70 million by 2032, growing at a CAGR of 4.79%.

- Rising demand for chloride testing in water quality monitoring and healthcare diagnostics drives adoption, with hospital laboratories holding the largest end-user share at 35%.

- Trends highlight growing adoption of portable and online chloridometers, supported by automation, real-time data monitoring, and expanding use in environmental and food safety testing.

- Competition is shaped by players such as Radiometer, Metrohm AG, Hach Company, Thermo Fisher Scientific, and Mettler Toledo, who focus on technological innovation and global expansion, while regional manufacturers compete on affordability.

- North America leads with 43.6% share, followed by Europe at 26.8%, while Asia Pacific holds 20.2% and grows fastest at 6.5% CAGR, supported by industrialization and rising healthcare investments.

Market Segmentation Analysis:

By Type

The chloridometer market by type is segmented into portable, benchtop, and online models. In 2024, benchtop chloridometers dominated with over 45% share, driven by their precision, stability, and suitability for laboratory-based testing in hospitals and research institutes. Portable devices are gaining momentum due to growing demand for on-site water and environmental testing, especially in emerging regions. Online chloridometers, though smaller in adoption, are expanding steadily in industrial and municipal water treatment applications as automation and continuous monitoring become critical for process efficiency and regulatory compliance.

- For clinical applications, Sherwood Scientific’s Model 926S benchtop chloridometer has a limit of detection of 4 mmol/L, with a readout range of 10–299 mmol/L. It is widely used for determining chloride levels in sweat samples for cystic fibrosis diagnosis.

By Application

Among applications, water quality testing led the market with more than 40% share in 2024, supported by increasing global focus on safe drinking water and stringent environmental regulations. Chloridometers are widely deployed for chloride analysis in municipal supply systems, wastewater treatment, and industrial discharge monitoring. Food safety testing is another growing segment as chloride measurement is essential in processed foods, dairy, and beverages to ensure compliance with safety standards. Pharmaceutical industries and environmental monitoring agencies also account for significant adoption, while niche applications sustain demand under the “others” category.

- For instance, the Hach CL17sc colorimetric chlorine analyzer is used for continuous, online monitoring of free or total residual chlorine in water, complying with EPA regulations such as 40 CFR 141.74.

By End User

The end-user landscape is dominated by hospital laboratories, which held around 35% market share in 2024, driven by the critical need for chloride analysis in patient diagnosis and electrolyte imbalance testing. Research laboratories follow closely, fueled by continuous R&D in medical, chemical, and environmental sciences. Diagnostic laboratories are adopting chloridometers at a steady pace to enhance routine electrolyte testing. Academic and research institutes also contribute to growth through advanced studies and training programs. Smaller segments, categorized under others, maintain relevance through specialized industrial and environmental testing activities across global markets.

Key Growth Drivers

Rising Demand for Water Quality Testing

The chloridometer market benefits significantly from growing investments in water quality testing. Municipal corporations, industrial facilities, and environmental agencies prioritize chloride analysis to ensure safe drinking water and comply with discharge standards. Increasing contamination from industrial effluents, saline intrusion, and agricultural runoff has heightened the need for advanced chloride detection. Regulatory frameworks such as the U.S. Environmental Protection Agency (EPA) and European Union Drinking Water Directive mandate strict chloride monitoring, fueling product adoption. This driver is further supported by infrastructure development in emerging economies, where governments invest heavily in water treatment and monitoring systems to address growing urban population needs.

- For instance, the Hach CL17sc is a colorimetric chlorine analyzer used for continuous monitoring of free or total residual chlorine in drinking water. It operates with a cycle time of 2.5 minutes, allowing for up to 576 measurements per day. For a standard CL17sc, the accuracy is ±5% or ±0.04 mg/L (whichever is greater) for concentrations from 0–5 mg/L. This model is compliant with U.S. EPA regulation 40 CFR 141.74, which governs chlorine analysis for drinking water.

Expanding Role in Healthcare Diagnostics

Chloridometers are widely used in hospital and diagnostic laboratories for measuring chloride levels in blood, serum, and urine samples. These measurements are vital for detecting electrolyte imbalances, cystic fibrosis, and kidney disorders. Rising global prevalence of chronic diseases and metabolic disorders increases reliance on chloride testing. Hospitals prioritize high-accuracy instruments to ensure reliable patient outcomes, driving adoption of benchtop and automated chloridometers. Increasing healthcare expenditure in developing nations also accelerates market penetration, as advanced diagnostic equipment becomes more accessible. Moreover, rising awareness of early diagnosis and preventative testing boosts demand for efficient chloride measurement technologies in clinical settings.

- For instance, the Sherwood Scientific Model 926S benchtop chloridometer uses coulometric titration for precise chloride measurement in clinical samples, including serum. According to manufacturer specifications, the instrument’s reproducibility for a 100µL sample is a coefficient of variation (CV) of <1%. While suitable for laboratory use, there is no public record of the specific test involving 300 patient samples at Cambridge University Hospitals with a reported reproducibility of ±0.5 mmol/L.

Technological Advancements in Chloridometers

Continuous product innovation strengthens market growth by improving performance, usability, and automation. Manufacturers integrate digital interfaces, real-time data monitoring, and connectivity features into chloridometers to support modern laboratory workflows. Online chloridometers with automated calibration and self-cleaning systems reduce manual intervention while ensuring accuracy in industrial and environmental monitoring. Portable models with enhanced sensitivity enable on-site testing in food safety and field research applications. These technological upgrades align with industry trends toward faster, user-friendly, and more sustainable testing solutions. Increased R&D investment and collaborations between equipment suppliers and laboratories continue to accelerate adoption of advanced systems, thereby expanding market opportunities globally.

Key Trends & Opportunities

Growing Adoption of Portable and Online Systems

The market is witnessing a clear shift toward portable and online chloridometers as industries and regulators demand faster, real-time results. Portable systems cater to field testing needs in water management, environmental monitoring, and food inspection. Meanwhile, online systems integrate directly into industrial pipelines and treatment facilities to provide continuous chloride monitoring without manual sampling. This trend offers significant opportunities for manufacturers to expand their presence in industries like pharmaceuticals, power generation, and food processing, where precision and automation are critical for compliance and efficiency.

- For instance, Sherwood Scientific’s Model 926S benchtop chloridometer is specified to deliver a reproducibility with a coefficient of variation (CV) of <1% for 100 µL samples and <1.5% for 20 µL samples at a concentration of 100 mmol/L. This equates to a standard deviation of 1.0 mmol/L for a 100 mmol/L sample using a 100 µL volume, making a consistent ±0.5 mmol/L range unachievable under normal operating conditions.

Expansion in Emerging Economies

Emerging markets in Asia-Pacific, Latin America, and the Middle East are becoming major growth hubs for chloridometer suppliers. Rapid urbanization and industrialization in these regions intensify the demand for water treatment and food safety testing. Governments in India, China, and Brazil are introducing stricter water quality regulations, creating opportunities for chloridometer adoption. Expanding healthcare infrastructure also drives uptake in hospital and diagnostic laboratories. Manufacturers that focus on affordable, portable models tailored for resource-limited settings can tap into these markets effectively. This expansion represents a significant opportunity for global players seeking long-term growth.

Key Challenges

High Cost of Advanced Instruments

The adoption of advanced benchtop and online chloridometers is often limited by high procurement and maintenance costs. Smaller laboratories, academic institutes, and facilities in low-income regions struggle to justify investment in expensive systems despite their accuracy and efficiency. Additionally, operational costs such as calibration, consumables, and technical training create financial barriers. This challenge restrains market penetration in resource-constrained areas, where low-cost alternatives often replace high-end instruments. Addressing affordability through product innovations and financing models remains a crucial need for manufacturers targeting widespread adoption.

Limited Awareness in Developing Regions

Despite growing regulatory pressure, awareness of chloride testing’s importance remains low in several developing regions. Many small-scale industries and rural municipalities continue to neglect chloride monitoring due to limited technical expertise or lack of enforcement. This results in underutilization of chloridometers in critical applications such as wastewater treatment and food safety testing. Furthermore, insufficient training for operators reduces effective utilization of available instruments. Bridging this gap requires targeted awareness campaigns, government-led initiatives, and partnerships between manufacturers and local authorities to highlight the health, safety, and compliance benefits of chloride testing technologies.

Regional Analysis

North America

North America held the largest share of the chloridometer market, accounting for 43.6% in 2024 with a market size of USD 285.90 million, up from USD 210.98 million in 2018. The region is projected to reach USD 428.13 million by 2032, growing at a CAGR of 4.8%. Growth is fueled by advanced healthcare infrastructure, stringent water quality regulations, and strong adoption in diagnostic laboratories. High demand from hospital laboratories and pharmaceutical industries continues to strengthen North America’s dominance, supported by strong R&D investments and regulatory compliance requirements.

Europe

Europe captured a market share of 26.8% in 2024, with chloridometer revenues reaching USD 175.60 million, up from USD 133.15 million in 2018. The market is projected to expand to USD 246.60 million by 2032, at a CAGR of 4.0%. The region benefits from strict EU directives on water safety, growing emphasis on food testing, and robust pharmaceutical manufacturing. Hospitals and research laboratories in Germany, France, and the UK remain major adopters. Europe’s stable regulatory frameworks and focus on environmental monitoring further support sustained demand for both benchtop and online chloridometers.

Asia Pacific

Asia Pacific emerged as the fastest-growing regional market with a 20.2% share in 2024, valued at USD 132.49 million, compared to USD 89.05 million in 2018. The market is expected to reach USD 224.88 million by 2032, registering the highest CAGR of 6.5%. Rapid industrialization, urbanization, and rising healthcare investments in China, India, and Southeast Asia drive growth. Increasing government initiatives for clean water supply, combined with expansion in diagnostic testing and pharmaceutical research, strengthen demand. Portable chloridometers are particularly favored in resource-limited settings, enhancing adoption across the region.

Latin America

Latin America accounted for 4.9% of the market in 2024, generating USD 31.85 million, up from USD 23.54 million in 2018. The market is forecasted to grow to USD 42.32 million by 2032, at a CAGR of 3.3%. Demand is supported by rising food safety testing needs, improving healthcare infrastructure, and growing awareness of water quality monitoring. Brazil and Mexico remain the leading contributors, with expanding diagnostic laboratories and pharmaceutical activities. Despite moderate growth, adoption is steadily increasing as governments introduce stricter health and safety regulations across industries.

Middle East

The Middle East represented 2.5% of global revenues in 2024, reaching USD 16.25 million, compared to USD 13.02 million in 2018. The market is set to grow to USD 20.36 million by 2032, advancing at a CAGR of 2.5%. Growth is driven by rising water scarcity issues, leading to higher investments in desalination and water quality testing. Countries such as Saudi Arabia and the UAE are adopting online chloridometers for continuous monitoring in municipal and industrial sectors. Limited adoption in healthcare restricts growth, but increasing environmental monitoring initiatives provide incremental opportunities.

Africa

Africa accounted for the smallest share, holding 1.9% of the global market in 2024, valued at USD 12.59 million, up from USD 8.42 million in 2018. The market is expected to reach USD 15.40 million by 2032, growing at a CAGR of 2.2%. Growth is primarily supported by donor-funded water safety programs, government initiatives for clean drinking water, and adoption in academic and research institutes. Limited healthcare infrastructure and low awareness of chloride testing restrain rapid adoption. However, increasing demand for portable chloridometers in field testing and rural water quality monitoring is gradually improving regional uptake.

Market Segmentations:

By Type

- Portable Chloridometer

- Benchtop Chloridometer

- Online Chloridometer

By Application

- Water Quality Testing

- Food Safety Testing

- Pharmaceutical Industry

- Environmental Monitoring Agencies

- Others

By End User

- Hospital Laboratories

- Research Laboratories

- Diagnostic Laboratories

- Academic & Research Institutes

- Others

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The chloridometer market is moderately consolidated, with leading players competing on innovation, product quality, and global reach. Key companies such as Radiometer, Metrohm AG, LAR Process Analysers AG, Hach Company, Thermo Fisher Scientific, Hanna Instruments, SI Analytics, Yokogawa Electric Corporation, Mettler Toledo, and Ocean Insight dominate through diversified product portfolios and strong distribution networks. These firms focus on expanding portable and online systems to meet rising demand in water quality testing, food safety, and healthcare diagnostics. Strategic initiatives include mergers, acquisitions, and collaborations with research institutions to strengthen technology integration and regulatory compliance. Investments in digital interfaces, automation, and real-time data connectivity also enhance competitive positioning. Regional players compete by offering cost-effective instruments tailored to local markets, while global leaders emphasize advanced R&D and partnerships with laboratories and municipal authorities. Continuous innovation and regulatory adherence remain critical factors shaping competition in this evolving market.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Radiometer

- Metrohm AG

- LAR Process Analysers AG

- Hach Company

- Thermo Fisher Scientific

- Hanna Instruments

- SI Analytics

- Yokogawa Electric Corporation

- Mettler Toledo

- Ocean Insight

Recent Developments

- In 2025, Metrohm is focusing on advanced chloridometer technologies like portable, wirelessly connected designs for point-of-care diagnostics, expanding market access, particularly in Asia Pacific, and showcasing innovations at the M+R 2025 event in October.

- In November 2023, Thermo Fisher Scientific introduced a novel automated discrete analysis method for chloride detection in drinking water using the Thermo Scientific Gallery™ or Gallery™ Aqua Master discrete analyzer and ready-to-use reagents. This automated system allows for high-throughput, simultaneous testing of multiple parameters from the same sample, enhancing efficiency for water and nutrient analyses.

Report Coverage

The research report offers an in-depth analysis based on Type, Application, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will expand steadily with increasing demand for chloride testing in healthcare.

- Portable chloridometers will gain wider adoption for field and on-site applications.

- Online systems will see faster growth as industries shift to real-time monitoring.

- Water quality testing will remain the largest application segment.

- Hospitals and diagnostic laboratories will continue to lead in end-user adoption.

- Asia Pacific will emerge as the fastest-growing region due to industrialization and healthcare expansion.

- North America will maintain its dominance with strong regulatory compliance and advanced infrastructure.

- Europe will show steady growth supported by pharmaceutical and food safety testing.

- Technological advancements in automation and digital connectivity will drive innovation.

- Competition will intensify as global players expand portfolios and regional firms focus on affordability.