Market Overview:

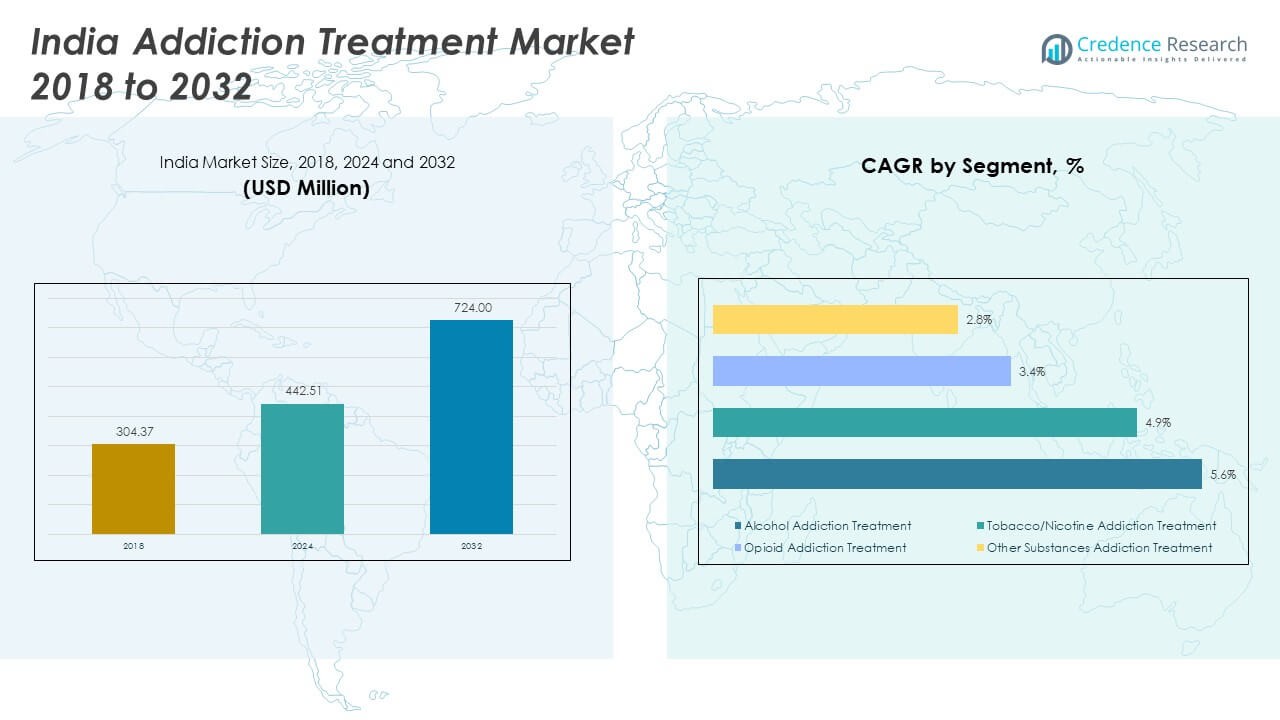

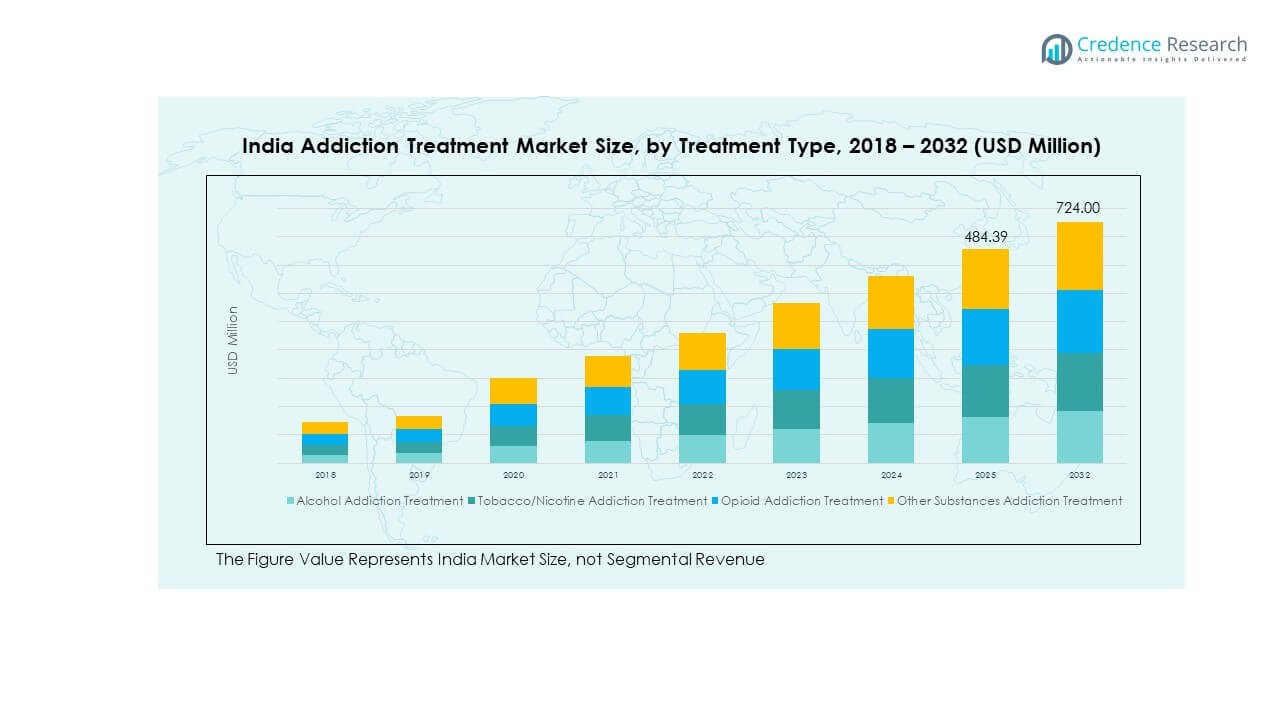

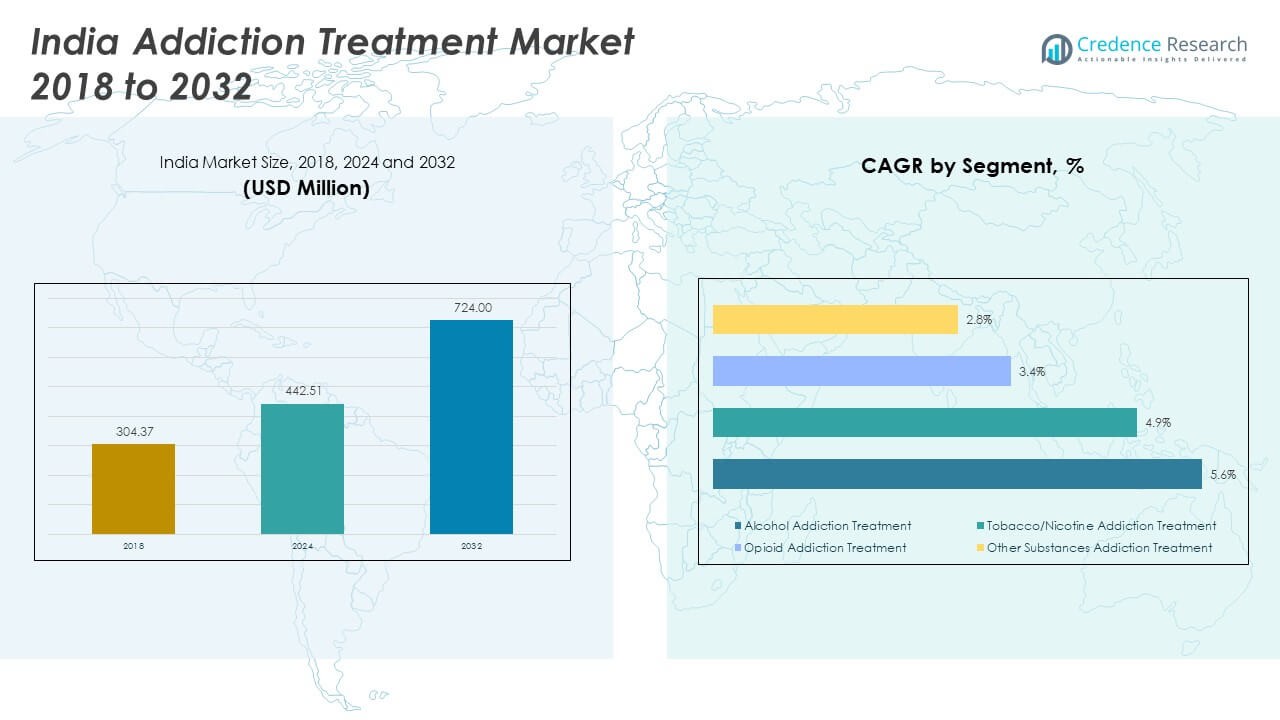

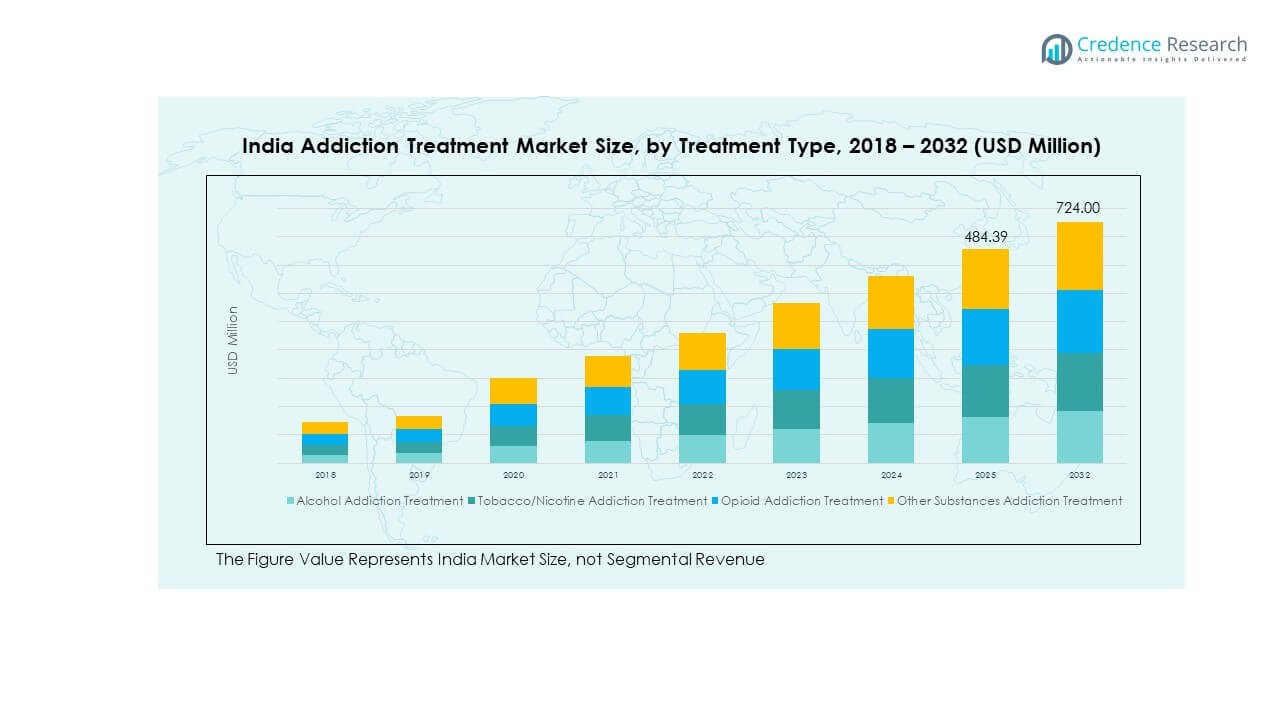

The India Addiction Treatment Market size was valued at USD 304.37 million in 2018 to USD 442.51 million in 2024 and is anticipated to reach USD 724.00 million by 2032, at a CAGR of 5.91% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| India Addiction Treatment Market Size 2024 |

USD 442.51 Million |

| India Addiction Treatment Market, CAGR |

5.91% |

| India Addiction Treatment Market Size 2032 |

USD 724.00 Million |

The market is driven by rising awareness of substance abuse, government-supported de-addiction programs, and the expansion of treatment centers across both public and private sectors. Growing demand for evidence-based therapies and increasing use of digital health platforms have strengthened patient access. It is further supported by pharmaceutical innovations that provide effective medication options for alcohol, opioid, and nicotine dependence. The market continues to grow as stigma reduces and acceptance of professional treatment improves across different demographics.

Regionally, North India leads due to its advanced healthcare infrastructure, concentration of specialized centers, and high awareness levels in urban areas. South India is emerging strongly, benefiting from established private hospitals and integration of digital therapy solutions. West India shows rising demand in metropolitan hubs, while East India, though slower in adoption, is gradually expanding access through government campaigns and telehealth services. It reflects a balanced regional landscape where metropolitan regions dominate, but emerging states present significant future opportunities.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The India Addiction Treatment Market was valued at USD 304.37 million in 2018, reached USD 442.51 million in 2024, and is projected to hit USD 724.00 million by 2032, growing at a CAGR of 5.91%.

- North India leads with a 36% share, driven by strong healthcare infrastructure and higher treatment awareness, while South India follows with 28% due to advanced private facilities and high literacy levels.

- West India holds 22% market share, supported by metro cities like Mumbai and Pune, while East India lags at 14% but is steadily improving through government-led campaigns.

- Alcohol addiction treatment dominates with 38% market share in 2024, reflecting rising demand for rehabilitation and awareness initiatives.

- Tobacco and nicotine addiction treatment accounts for 27% share, driven by anti-tobacco regulations, while opioid addiction treatment and other substances make up the remaining share.

Market Drivers

Rising Awareness Programs And Public Health Campaigns Expanding Treatment Demand

Government agencies and NGOs are leading awareness drives that highlight the harmful effects of addiction. Public health campaigns are improving knowledge about early intervention and recovery options. Awareness initiatives in schools, workplaces, and community centers are reducing stigma toward seeking help. The India Addiction Treatment Market benefits from better recognition of mental health as a priority. It gains momentum when awareness links addiction to wider social and economic costs. Television and digital platforms are reaching younger populations more effectively. This outreach supports consistent demand for treatment services. It also improves acceptance of professional rehabilitation programs across both urban and semi-urban populations.

- For example, in May 2025, under the Nasha Mukt Bharat Abhiyan, an anti-drug awareness campaign was held in Thonoknyu, Nagaland, with participation from government officials, community leaders, teachers, health workers, and students. The program focused on the theme “Empowered Youth, Addiction-Free Future.

Government Policy Support And Regulatory Push For Rehabilitation Infrastructure

Stronger policies are encouraging expansion of rehabilitation facilities across states. The central government is investing in de-addiction centers to expand service coverage. Regulations mandate integration of treatment within public healthcare systems. The India Addiction Treatment Market is reinforced by government incentives supporting counseling, therapy, and medication-assisted recovery. It benefits when policy frameworks emphasize affordability and accessibility. Regulatory backing ensures standardization of care quality across diverse centers. Subsidized programs target lower-income groups, ensuring broader participation. Such measures provide a solid foundation for long-term growth in addiction care.

- For example, in January 2025, the Maharashtra government announced plans to upgrade the Regional Mental Hospital (RMH) in Yerawada, Pune to NIMHANS standards. The initiative includes improving infrastructure, creating advanced treatment facilities, and establishing a postgraduate institute.

Advancement In Treatment Modalities And Use Of Evidence-Based Therapies

Healthcare providers are adopting advanced therapies that improve treatment outcomes. Evidence-based interventions like cognitive behavioral therapy and motivational enhancement therapy are now common. Integration of FDA-approved drugs such as buprenorphine strengthens the treatment system. The India Addiction Treatment Market incorporates modern methods that address both physical and psychological aspects. It gains traction when professionals combine traditional counseling with digital follow-up tools. Multidisciplinary approaches bring psychiatrists, psychologists, and social workers into the same care chain. Research-backed methods deliver stronger relapse prevention outcomes. This advancement drives higher trust among patients and families.

Growing Role Of Digital Health Platforms And Telemedicine Access

Digital health platforms are transforming how patients connect with counselors. Mobile apps enable monitoring and follow-up therapy in remote areas. Telemedicine services ensure rural patients access specialists without travel burdens. The India Addiction Treatment Market integrates technology to reduce treatment gaps. It grows when digital support improves patient engagement and compliance. Online consultations remove barriers related to stigma or privacy concerns. AI-based platforms track progress and adjust care plans. This digital shift makes addiction treatment more personalized and scalable across the country.

Market Trends

Integration Of Holistic And Wellness Approaches Into Treatment Programs

Treatment centers are incorporating yoga, meditation, and mindfulness into recovery programs. Holistic practices are strengthening patient resilience during withdrawal phases. Traditional Indian wellness methods are gaining credibility when combined with modern therapies. The India Addiction Treatment Market reflects this blending of ancient and modern systems. It demonstrates patient preference for natural, low-side-effect techniques. Wellness-based approaches improve emotional stability and lower relapse risks. Many rehabilitation facilities promote lifestyle management alongside therapy. This integration highlights a cultural shift toward balanced recovery pathways.

Rising Corporate Involvement In Workplace Addiction Prevention Programs

Companies are prioritizing employee mental health through structured addiction support systems. Workplace programs offer confidential counseling and screening sessions. Corporate social responsibility initiatives are extending into employee wellness packages. The India Addiction Treatment Market receives new momentum from this corporate backing. It benefits from higher awareness among working professionals. Employers invest in such programs to boost productivity and reduce absenteeism. Insurance-linked wellness benefits are broadening employee access to treatment. This trend shows how workplaces are becoming proactive contributors to addiction care.

- For instance, under the National Action Plan for Drug Demand Reduction (NAPDDR) 2024 guidelines, over 3.29 lakh (329,000) educational institutions including many corporate campuses formally participated in awareness and counseling programs, helping sensitize more than 10.73 crore (107.3 million) people about substance use prevention nationwide.

Expansion Of Private Sector Rehabilitation And Luxury Care Facilities

Private hospitals and investors are entering the rehabilitation space with premium offerings. Luxury centers provide personalized therapy in resort-like settings. High-income groups prefer such facilities for comfort and confidentiality. The India Addiction Treatment Market is witnessing demand for tailored treatment experiences. It grows as patients seek holistic therapies in upscale environments. Private investment drives innovation in service delivery models. These facilities often integrate international best practices. This expansion creates a dual market catering to both general and elite populations.

- For example, in March 2024, Sukoon Health inaugurated a state-of-the-art mental health hospital in Bengaluru, launched by Karnataka Health Minister Dinesh Gundu Rao. The facility offers both inpatient and outpatient psychiatric and de-addiction services.

Emergence Of Community-Based And Peer-Led Support Networks

Community-driven recovery groups are gaining wider recognition. Peer-led initiatives provide emotional support and practical guidance during treatment. Such networks often complement formal rehabilitation services. The India Addiction Treatment Market benefits from peer support that strengthens recovery journeys. It expands outreach into areas where formal infrastructure is limited. Group-based recovery models reduce feelings of isolation among patients. Families also gain confidence when support networks share success stories. This trend reflects a stronger grassroots foundation for long-term addiction management.

Market Challenges Analysis

Persistent Social Stigma And Low Awareness In Rural Regions

Stigma remains a strong barrier to treatment adoption, especially in rural and conservative communities. Many families hesitate to seek help due to fear of judgment. The India Addiction Treatment Market faces resistance when addiction is seen as a moral weakness. It struggles when patients hide their conditions to avoid discrimination. Awareness levels remain lower outside urban centers, limiting early intervention. Educational campaigns have not yet reached every demographic segment. Lack of awareness keeps demand below potential levels. This persistent stigma slows progress toward building inclusive treatment systems.

Infrastructure Gaps And Shortage Of Skilled Professionals In Rehabilitation Services

Rehabilitation infrastructure is uneven across different states, with capacity concentrated in large cities. Many centers face shortages of trained counselors and medical specialists. The India Addiction Treatment Market faces constraints when skilled staff are unavailable in smaller towns. It depends on a workforce capable of handling complex psychiatric cases. Limited government facilities struggle to manage growing demand. Private centers often remain unaffordable for low-income patients. Uneven distribution of resources creates treatment gaps across regions. These infrastructure and staffing challenges reduce accessibility and affect treatment quality.

Market Opportunities

Increasing Scope For Public-Private Partnerships And Capacity Expansion

Public-private partnerships are strengthening the treatment infrastructure with shared investments. Collaborations between hospitals, NGOs, and government agencies expand treatment coverage. The India Addiction Treatment Market gains from capacity growth in under-served regions. It improves when private expertise complements government funding. Larger networks improve access to rehabilitation in semi-urban belts. Technology transfer and training programs improve care standards. Such partnerships drive faster infrastructure development. They also create sustainable ecosystems for addiction recovery.

Rapid Expansion Of Digital Interventions And Affordable Treatment Models

Affordable mobile apps and online therapy platforms are widening treatment access. Digital solutions offer counseling at lower costs compared to physical centers. The India Addiction Treatment Market leverages this digital shift to scale outreach. It benefits when online therapy supports continuity of care. Low-cost models attract younger users and rural populations. Expansion of helpline services ensures quick access to support. Digital platforms build anonymity, reducing hesitation in seeking help. These interventions create strong growth opportunities for the industry.

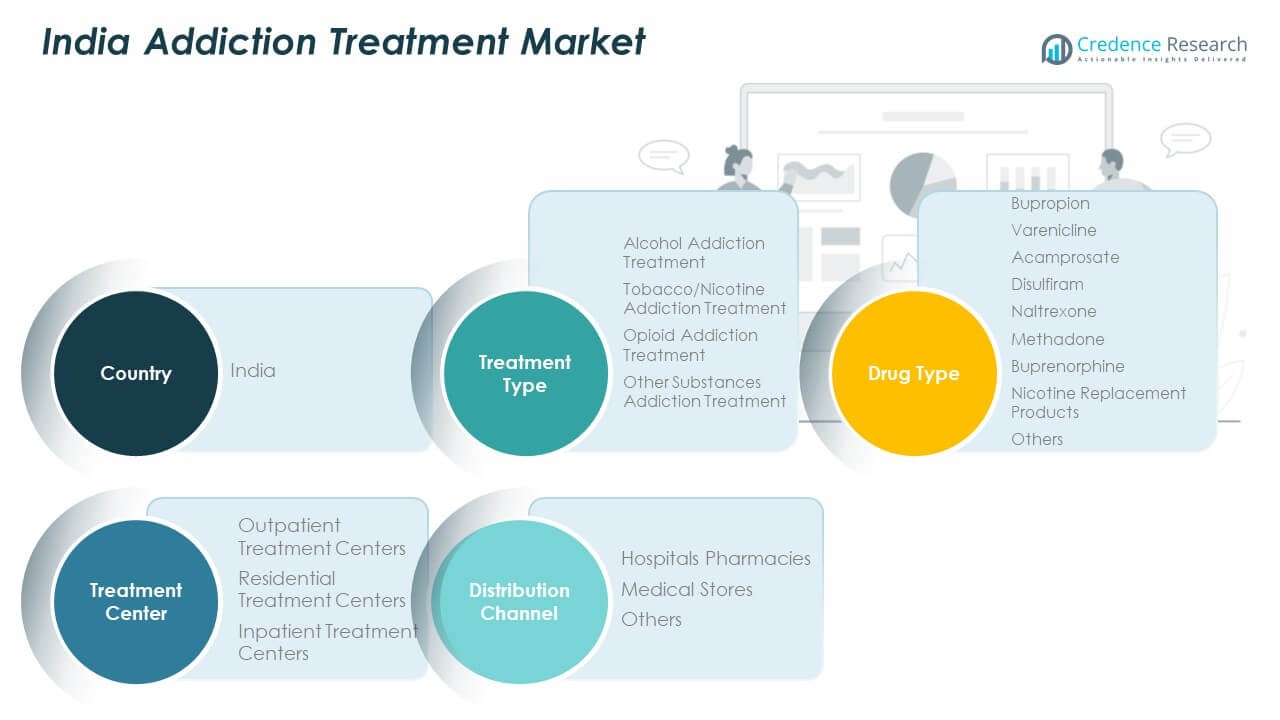

Market Segmentation Analysis

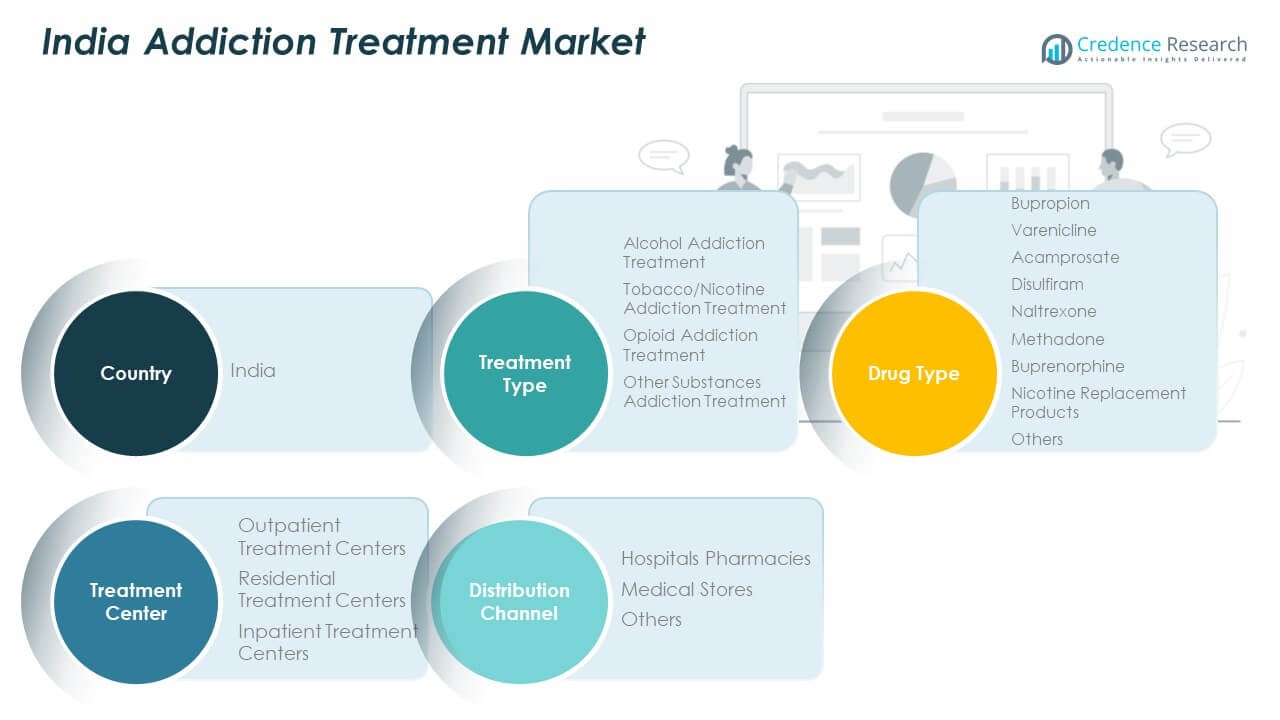

By treatment type, alcohol addiction treatment holds the largest share due to rising consumption patterns and higher awareness programs. Tobacco and nicotine addiction treatments also contribute significantly, supported by strict regulations on tobacco use. Opioid addiction treatments are expanding steadily, driven by the availability of substitute therapies, while treatments for other substances show gradual uptake in urban areas. The India Addiction Treatment Market benefits from this multi-segment coverage, ensuring demand across diverse patient groups.

- For instance, the Virtual Knowledge Network (VKN) and NIMHANS Digital Academy have trained over 10,000 healthcare professionals in addiction mental health and impacted more than 600,000 lives through capacity-building and remote care tools.

By drug type, buprenorphine and methadone dominate due to their effectiveness in managing withdrawal and relapse prevention. Naltrexone and acamprosate also show strong adoption, particularly in alcohol dependence cases. Bupropion and varenicline are widely used in tobacco cessation, supported by hospital initiatives and government campaigns. Nicotine replacement products remain accessible through pharmacies and retail outlets. It demonstrates a balanced structure where established therapies and newer drugs create sustainable growth opportunities.

By treatment center, outpatient facilities lead, supported by affordability and easier access for patients. Residential treatment centers attract individuals requiring longer recovery programs with continuous monitoring. Inpatient centers, though smaller in scale, remain critical for severe addiction cases requiring intensive care.

- For instance, the NIMHANS ECHO tele-mentoring platform enabled collaborative management of over 100 addiction cases, connecting community health providers with specialists through weekly remote sessions between January and July 2019.

By distribution channel, hospital pharmacies dominate, ensuring reliable access to prescription-based therapies. Medical stores provide over-the-counter solutions such as nicotine replacement products, while other channels, including online platforms, are gaining traction. It reflects the sector’s adaptability in expanding access across multiple distribution formats.

Segmentation

By Treatment Type

- Alcohol Addiction Treatment

- Tobacco/Nicotine Addiction Treatment

- Opioid Addiction Treatment

- Other Substances Addiction Treatment

By Drug Type

- Bupropion

- Varenicline

- Acamprosate

- Disulfiram

- Naltrexone

- Methadone

- Buprenorphine

- Nicotine Replacement Products

- Others

By Treatment Center

- Outpatient Treatment Centers

- Residential Treatment Centers

- Inpatient Treatment Centers

By Distribution Channel

- Hospital Pharmacies

- Medical Stores

- Others

Regional Analysis

North India

North India leads the India Addiction Treatment Market with a 36% share. Strong healthcare infrastructure in Delhi, Haryana, and Uttar Pradesh drives access to rehabilitation centers and specialized hospitals. High population density and urban stress factors increase demand for treatment services. It benefits from government-backed awareness campaigns and NGO participation. Advanced facilities in Delhi attract patients from surrounding states. The region shows strong acceptance of both medical and digital therapy models, making it the most developed segment of the market.

South India

South India holds a 28% share, supported by strong healthcare systems in Karnataka, Tamil Nadu, and Kerala. The presence of leading private hospitals and medical research institutions strengthens treatment availability. It benefits from high literacy levels that improve awareness of addiction care. Urban centers like Bengaluru and Chennai drive adoption of telemedicine and digital support tools. Traditional wellness methods, such as yoga and ayurvedic therapies, are often integrated with modern treatments. This region shows balanced growth due to both public and private participation.

West and East India

West India contributes 22% of the market, driven by economic hubs like Mumbai and Pune that offer specialized services and luxury rehabilitation facilities. It benefits from rising disposable income and higher awareness among professionals. East India holds a 14% share, with slower adoption due to weaker infrastructure in Bihar, Jharkhand, and Odisha. Government campaigns and telehealth programs are improving access in these areas. It shows gradual progress supported by outreach initiatives targeting rural populations. Together, West and East India highlight regional disparities but also reveal untapped opportunities for future expansion.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Teva Pharmaceutical Industries Ltd.

- Pfizer, Inc.

- Glenmark Pharmaceuticals

- GSK plc

- Johnson & Johnson Services, Inc.

- Novartis AG

- Reddy’s Laboratories Limited

Competitive Analysis

The India Addiction Treatment Market is highly competitive, with global and domestic players expanding their presence. Companies like Teva Pharmaceutical Industries, Pfizer, GSK, and Novartis dominate drug development with established addiction therapies. Dr. Reddy’s Laboratories, Glenmark, and other Indian firms strengthen the market with generic offerings and cost-effective drugs. It demonstrates a competitive balance between multinational corporations and local manufacturers. Players invest in expanding treatment portfolios, launching digital support tools, and entering new distribution networks. Strategic partnerships with hospitals and NGOs enhance reach across urban and rural regions. Market leaders also focus on clinical trials and evidence-based therapies to strengthen credibility and maintain long-term dominance.

Recent Developments

- In July 2025, Teva Pharmaceutical Industries reported a strategic boost with branded drug sales rising by 26% in the second quarter, supporting its ongoing efforts in the addiction therapy space, including treatments for alcohol use disorder and opioid dependence.

Report Coverage

The research report offers an in-depth analysis based on Treatment Type, Drug Type, Treatment Center and Distribution Channel. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Growing integration of digital health tools will expand accessibility across rural and semi-urban regions.

- Wider adoption of evidence-based therapies will improve recovery outcomes and treatment credibility.

- Expansion of public-private partnerships will accelerate infrastructure growth and increase service reach.

- Rising corporate wellness initiatives will create stronger demand from professional and working populations.

- Telemedicine and online counseling will reduce treatment gaps and enhance patient confidentiality.

- Development of luxury and specialized rehabilitation centers will target high-income patient segments.

- Government investment in de-addiction programs will strengthen nationwide awareness and affordability.

- Expansion of community-based and peer-led networks will build stronger support systems for recovery.

- Growing inclusion of holistic wellness practices will diversify treatment approaches across facilities.

- Stronger competition between global and domestic players will drive innovation and improve affordability.