Market Overview

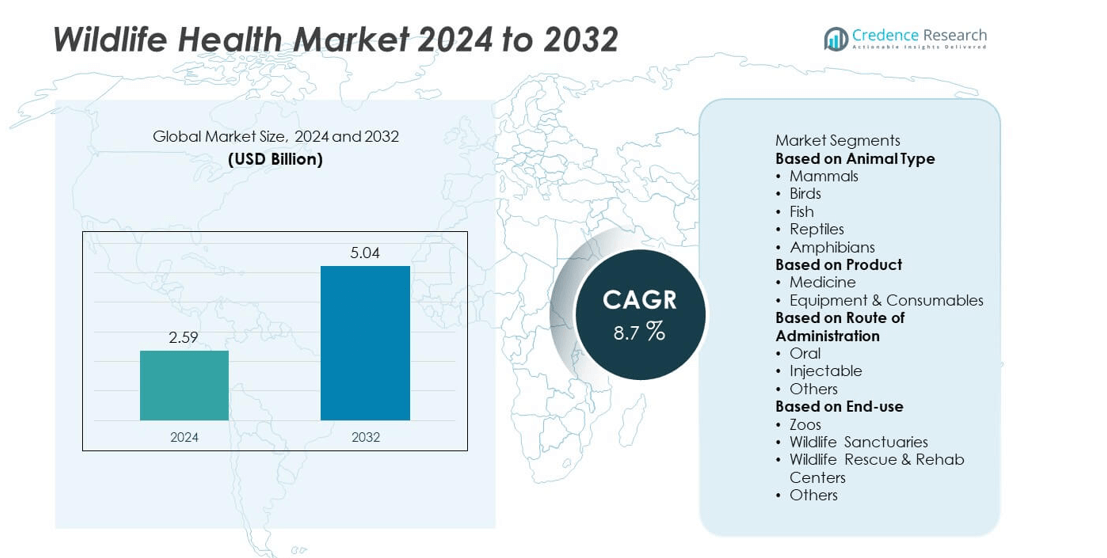

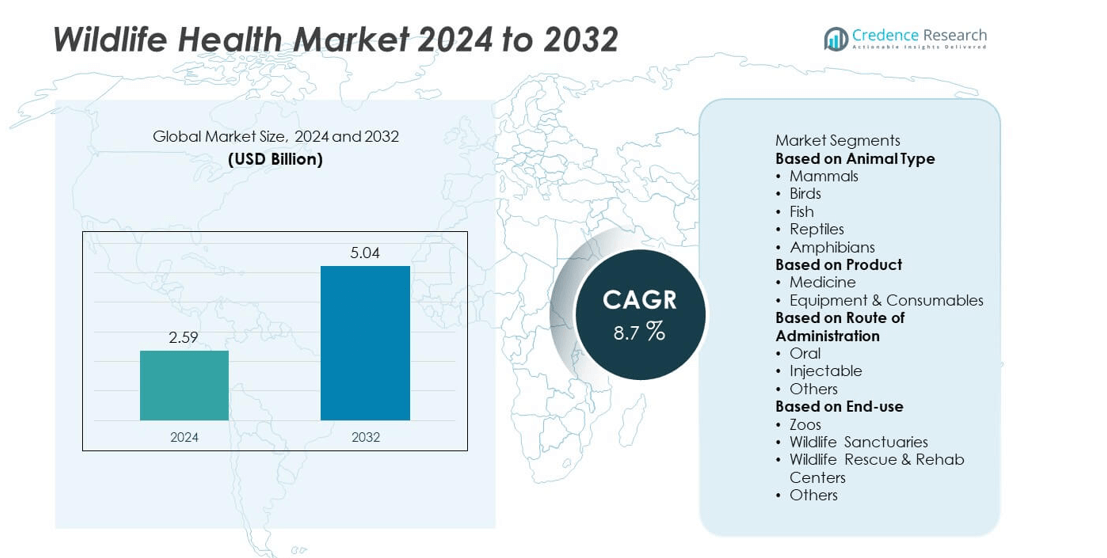

Wildlife Health market size was valued at USD 2.59 billion in 2024 and is projected to reach USD 5.04 billion by 2032, registering a CAGR of 8.7% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Wildlife Health Market Size 2024 |

USD 2.59 billion |

| Wildlife Health Market, CAGR |

8.7% |

| Wildlife Health Market Size 2032 |

USD 5.04 billion |

The wildlife health market features prominent players such as Boehringer Ingelheim International GmbH, NexGen Pharmaceuticals, Virbac, Dong Bang Co., Ltd., Pneu-Dart Inc., DANiNJECT, Genia, Wedgewood Pharmacy, The Pet Apothecary, and Taylors Pharmacy. These companies drive innovation through development of advanced medicines, diagnostic tools, and darting systems to support disease control and wildlife conservation efforts. North America leads the market with 35% share, supported by robust infrastructure, funding, and strong disease surveillance programs. Europe follows with 28% share, driven by strict biodiversity regulations and research initiatives. Asia Pacific, holding 22%, is rapidly expanding due to government-backed conservation projects and growing awareness of zoonotic disease management.

Market Insights

- The wildlife health market was valued at USD 2.59 billion in 2024 and is projected to reach USD 5.04 billion by 2032, growing at a CAGR of 8.7%.

- Rising zoonotic disease outbreaks and global conservation initiatives are driving demand for vaccines, diagnostics, and treatment solutions for wild mammals, birds, and aquatic species.

- Key trends include adoption of One Health programs, portable diagnostics, and digital monitoring tools such as GPS collars and biosensors to track animal health in remote habitats.

- The market is competitive with major players like Boehringer Ingelheim International GmbH, NexGen Pharmaceuticals, Virbac, Pneu-Dart Inc., and DANiNJECT focusing on R&D, partnerships, and geographic expansion.

- North America leads with 35% share, followed by Europe at 28% and Asia Pacific at 22%, while mammals remain the dominant segment with over 40% share supported by strong investments in disease prevention programs and rehabilitation projects.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Animal Type

Mammals dominated the wildlife health market in 2024, accounting for over 40% share. Rising prevalence of zoonotic diseases such as rabies and tuberculosis in wild mammals drives significant demand for monitoring and treatment solutions. Conservation programs for endangered species, including tigers, elephants, and primates, further support investment in diagnostics and preventive care. Birds followed closely, supported by surveillance of avian influenza outbreaks and rehabilitation programs for migratory species. Fish and reptiles collectively hold a growing share, driven by aquaculture health management and exotic species care, while amphibians represent a niche segment focusing on fungal infection control.

- For instance, oral bait immunization programs in Europe, which involve various vaccines and have been co-funded by the EU and individual nations, have led to the near elimination of fox-mediated rabies. While companies like Boehringer Ingelheim provide vaccines, the broader elimination effort was achieved through the collaborative distribution of hundreds of millions of baits by government-run programs and is not solely attributable to one company.

By Product

Medicines led the market with over 55% share in 2024, reflecting growing adoption of vaccines, antiparasitics, and antibiotics for disease prevention and control in wildlife populations. Rising awareness about wildlife disease impact on human health and ecosystems is encouraging large-scale vaccination campaigns. Equipment and consumables, holding the remaining share, are gaining traction due to the need for portable diagnostic devices, capture tools, and field testing kits. Increased funding from conservation agencies and NGOs for advanced treatment infrastructure is driving steady growth in this segment across wildlife sanctuaries and research facilities worldwide.

- For instance, Boehringer Ingelheim, a significant manufacturer of oral rabies vaccines, participates in wildlife rabies control programs in North America and Europe, which have contributed to drastic reductions in rabies transmission among fox and raccoon populations.

By Route of Administration

Oral route accounted for nearly 50% share of the wildlife health market in 2024, supported by ease of mass administration through baits, feed, or water sources. This method is preferred for vaccinating wild carnivores and herbivores with minimal human intervention. Injectable administration held around 35% share, remaining crucial for targeted treatments during rescue operations and rehabilitation of injured animals. Other routes, including topical and intranasal applications, represent a smaller but growing segment, driven by innovations in slow-release formulations and minimally invasive drug delivery methods for sensitive species and remote ecosystems.

Market Overview

Rising Zoonotic Disease Incidences

Increasing outbreaks of zoonotic diseases such as rabies, avian influenza, and leptospirosis are boosting demand for wildlife health solutions. Governments and NGOs are investing heavily in vaccination and surveillance programs to curb disease transmission between wildlife and humans. This focus supports market expansion by encouraging adoption of diagnostics, preventive medicine, and monitoring equipment. Rising public health concerns and the “One Health” initiative further integrate wildlife health into global disease prevention strategies, driving continuous growth across multiple animal populations and conservation efforts worldwide.

- For instance, Oregon State University collaborated with the U.S. Department of Agriculture (USDA) to test approximately 1,600 wild mammal samples for SARS-CoV-2. The testing was funded by a cooperative agreement with the USDA’s Animal and Plant Health Inspection Service (APHIS), with the goal of understanding which species can harbor and transmit the virus.

Growing Conservation and Rehabilitation Programs

Wildlife protection initiatives are expanding worldwide, supported by government funding and international organizations. Sanctuaries, national parks, and research facilities are increasingly investing in health management programs for endangered species. Rehabilitation centers rely on diagnostics, medicines, and equipment to rescue and treat injured or diseased animals. Public-private partnerships are helping to establish advanced veterinary infrastructure in biodiversity-rich regions. Rising awareness campaigns and ecotourism projects are encouraging better health monitoring, contributing to consistent demand for products and services in the wildlife health market.

- For instance, Pneu-Dart Inc. is a leading manufacturer of remote drug delivery systems used by wildlife management professionals, ranchers, and veterinarians for safe and humane animal handling. The company has been in operation for over 50 years and produces various darts and projectors for immobilizing, medicating, and treating animals.

Advancements in Veterinary Diagnostics and Treatment

Rapid innovation in point-of-care diagnostics, molecular testing, and remote monitoring is enhancing wildlife disease detection. Portable equipment allows field veterinarians to test samples in remote areas, reducing treatment delays. Development of species-specific vaccines, long-acting antiparasitics, and controlled-release drug formulations is improving outcomes. Digital tools such as GIS-based disease mapping are also gaining traction, helping authorities predict and prevent outbreaks. These technological advancements are increasing adoption of modern health solutions, propelling overall market growth and expanding opportunities for veterinary equipment manufacturers and pharmaceutical companies.

Key Trends & Opportunities

Integration of One Health Approach

The One Health framework is emerging as a major opportunity, promoting collaboration between human, animal, and environmental health sectors. Wildlife health programs are now aligned with public health policies to prevent cross-species disease transmission. This integration is driving funding for research, biosurveillance, and capacity building. It also opens opportunities for pharmaceutical companies to launch tailored solutions for wildlife, while governments strengthen regulatory support for vaccination campaigns and habitat health monitoring.

- For instance, India’s National One Health Mission was approved in July 2022, and its implementation began in 2024, institutionalizing a cross-sectoral approach to disease surveillance. The mission established integrated disease surveillance systems with a national network of labs, including high-risk pathogen labs (BSL-3/4) and Infectious Disease Research and Diagnostic Laboratories (IRDLs), and sentinel sites to detect and report numerous endemic and emerging zoonotic diseases across all states and union territories.

Rising Use of Digital Monitoring Solutions

Digital tools such as GPS collars, drones, and biosensors are revolutionizing wildlife health tracking. These technologies allow real-time monitoring of animal movements, disease symptoms, and habitat conditions. Data analytics platforms help predict outbreaks and optimize intervention strategies. Growing adoption of AI-enabled diagnostics and cloud-based data sharing creates opportunities for tech companies to collaborate with wildlife health agencies. This trend improves efficiency, reduces manual effort, and enhances overall wildlife conservation efforts globally.

- For instance, in recent large-scale wildlife monitoring initiatives across various reserves, GPS-enabled tracking collars from reputable manufacturers like Vectronic Aerospace are used to provide location and, in some cases, physiological data. These collars can have battery lives exceeding 24 months, particularly when optimized for less frequent data transmissions. The collected data is then integrated into cloud-based platforms and analyzed using AI.

Key Challenges

Limited Funding in Low-Income Regions

Wildlife health initiatives often face budget constraints in developing countries, limiting access to advanced diagnostics and treatment solutions. Conservation programs rely on government or donor funding, which can fluctuate with economic conditions. This financial gap hinders large-scale vaccination drives and disease surveillance, allowing preventable outbreaks to persist. Lack of trained veterinarians in rural areas further exacerbates the issue, restricting timely interventions and leading to higher wildlife mortality rates in key biodiversity zones.

Logistical and Operational Constraints

Reaching remote habitats and administering care to free-ranging animals pose significant operational challenges. Capturing or tracking wildlife for treatment requires specialized equipment, skilled personnel, and careful planning to avoid stress or injury. Harsh environmental conditions and limited infrastructure delay response times, reducing treatment effectiveness. The need for cold-chain storage of vaccines and drugs further complicates field operations. These logistical difficulties increase overall costs and limit the scalability of wildlife health programs across vast and inaccessible regions.

Regional Analysis

North America

North America held over 35% share of the wildlife health market in 2024, driven by advanced veterinary infrastructure, strong government funding, and active wildlife conservation programs. The U.S. leads with extensive zoonotic disease surveillance initiatives and large-scale vaccination projects for rabies and chronic wasting disease. Canada contributes significantly through national parks and wildlife rehabilitation programs supported by federal funding. High adoption of portable diagnostic tools and telemedicine solutions enhances early detection and treatment. Growing public awareness and collaboration between federal agencies and NGOs continue to strengthen market growth across both preventive and curative health segments.

Europe

Europe accounted for around 28% of the market share in 2024, supported by strict biodiversity protection policies and EU funding for habitat and species conservation. Countries like Germany, France, and the UK invest heavily in wildlife disease monitoring programs, including surveillance for avian influenza and African swine fever. Widespread implementation of the One Health approach drives integrated initiatives between veterinary and public health authorities. Expanding research projects, coupled with strong presence of pharmaceutical companies developing species-specific medicines, are boosting market growth. The region benefits from robust collaborations between academic institutions, NGOs, and government agencies to protect endangered species.

Asia Pacific

Asia Pacific captured nearly 22% share of the wildlife health market in 2024, fueled by rising government efforts to address zoonotic outbreaks and protect endangered species such as tigers and elephants. China and India are leading with investments in national parks, wildlife sanctuaries, and vaccination programs. The growing aquaculture industry in Southeast Asia is also driving demand for fish health management products. Increased funding for veterinary research and rapid adoption of mobile diagnostic kits are improving disease surveillance. Rising ecotourism activities and public awareness campaigns are further supporting regional growth, especially in biodiversity-rich nations.

Latin America

Latin America represented about 9% of the wildlife health market share in 2024, with Brazil, Mexico, and Argentina leading conservation and rehabilitation efforts. Growing initiatives to protect Amazon rainforest species and marine life in coastal areas are driving adoption of veterinary solutions. Partnerships between international NGOs and local governments are helping improve disease monitoring and rescue operations. Expansion of research centers and training programs for wildlife veterinarians supports better treatment outcomes. Rising concerns about zoonotic spillover risks from forest encroachment and deforestation are creating opportunities for vaccination and surveillance programs across protected reserves and buffer zones.

Middle East & Africa

Middle East & Africa held nearly 6% market share in 2024, with growth supported by wildlife conservation projects in South Africa, Kenya, and the UAE. The region is focusing on anti-poaching measures and disease control in iconic species such as rhinos, lions, and camels. Increasing investment in wildlife tourism and national park infrastructure is boosting demand for veterinary medicines and diagnostic kits. Collaborative programs with global conservation agencies are improving vaccination coverage for rabies and foot-and-mouth disease. Limited infrastructure and funding remain challenges, but rising government involvement and donor support are expected to drive gradual market expansion.

Market Segmentations:

By Animal Type

- Mammals

- Birds

- Fish

- Reptiles

- Amphibians

By Product

- Medicine

- Equipment & Consumables

By Route of Administration

By End-use

- Zoos

- Wildlife Sanctuaries

- Wildlife Rescue & Rehab Centers

- Others

By Geography

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Competitive Landscape

The competitive landscape of the wildlife health market is shaped by key players such as Boehringer Ingelheim International GmbH, NexGen Pharmaceuticals, Virbac, Dong Bang Co., Ltd., Pneu-Dart Inc., DANiNJECT, Genia, Wedgewood Pharmacy, The Pet Apothecary, and Taylors Pharmacy. These companies focus on developing advanced veterinary medicines, precision darting equipment, and portable diagnostic tools to support wildlife conservation and disease management. Strategic collaborations with NGOs, governments, and research institutions enable expansion of vaccination and surveillance programs globally. Players are investing in R&D for species-specific vaccines and long-acting drug formulations to improve treatment outcomes. Many are also adopting digital health technologies and point-of-care solutions for remote disease monitoring. Expanding product portfolios, geographical presence, and partnerships with conservation projects are key strategies to strengthen market share and meet rising demand for preventive and therapeutic wildlife health solutions.

Key Player Analysis

- NexGen Pharmceuticals

- Wedgewood Pharmacy

- aceuticals

- Wedgewood Pharmacy

- Boehringer Ingelheim International GmbH

- Taylors Pharmacy

- Genia

- Pneu-Dart Inc.

- Virbac

- DANiNJECT

- The Pet Apothecary

- Dong Bang Co., Ltd.

Recent Developments

- In May 2025, Virbac Revamped its Veterinary HPM® physiological food range. The changed line is being rolled out progressively ten years after its original launch.

- In 2025, Virbac Released its half-year financial report. The company recorded €738.3 million revenue, up from €702.9 million in H1 2024. The adjusted recurring operating income ratio was 18.3%.

- In September 2024, Boehringer Ingelheim Acquired Saiba Animal Health to strengthen its R&D pipeline in the pet therapeutics category, especially for chronic diseases in companion animals.

Report Coverage

The research report offers an in-depth analysis based on Animal Type, Product, Route of Administration, End-use and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will expand steadily, supported by increasing government and NGO funding for wildlife conservation.

- Rising awareness of zoonotic diseases will drive higher demand for vaccination and surveillance programs.

- Adoption of portable diagnostic tools and digital monitoring technologies will improve field disease detection.

- Pharmaceutical companies will invest in species-specific vaccines and long-acting drug formulations.

- Public-private partnerships will strengthen veterinary infrastructure in biodiversity-rich regions.

- Growing ecotourism and conservation tourism will create opportunities for wildlife health investments.

- Integration of One Health initiatives will link wildlife health with human and environmental safety.

- Aquaculture growth will boost demand for fish health management products and biosecurity measures.

- Emerging markets in Asia Pacific and Latin America will experience rapid growth due to policy support.

- Technological advances like GIS mapping and AI-driven analytics will improve outbreak prediction and response efficiency.