Market Overview

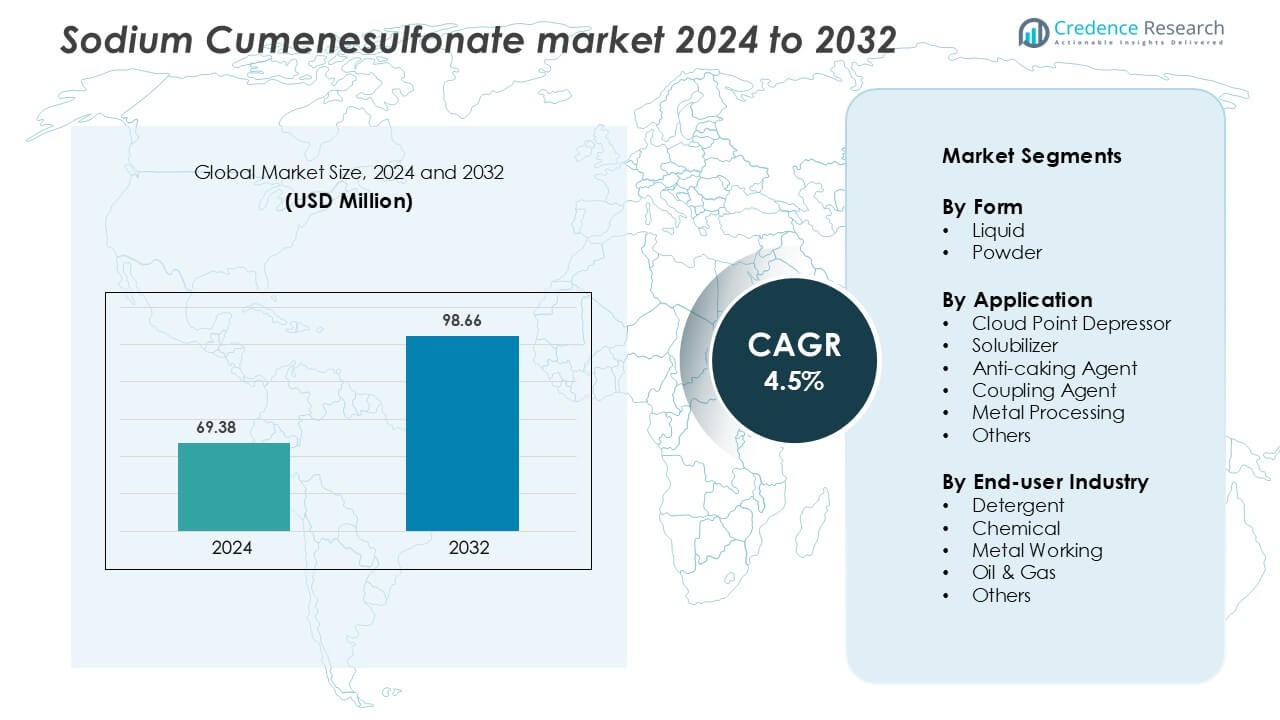

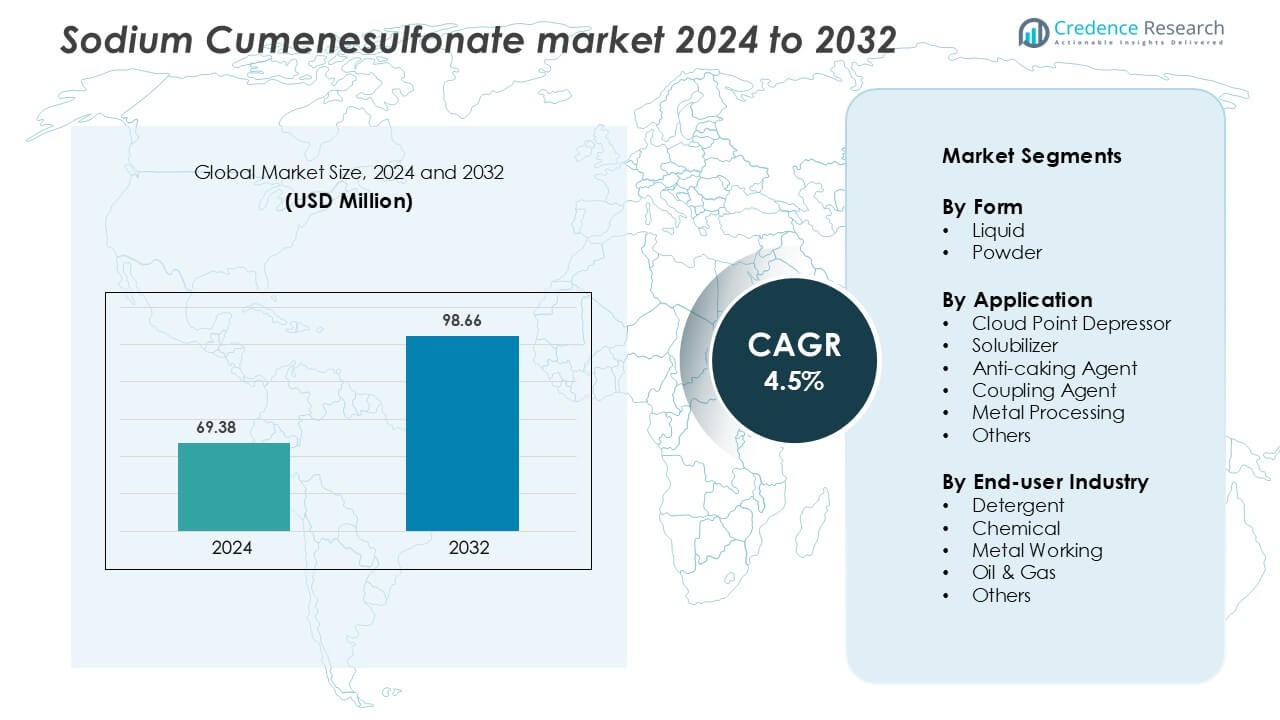

Sodium Cumenesulfonate Market was valued at USD 69.38 million in 2024 and is anticipated to reach USD 98.66 million by 2032, growing at a CAGR of 4.5 % during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Sodium Cumenesulfonate Market Size 2024 |

USD 69.38 Million |

| Sodium Cumenesulfonate Market, CAGR |

4.5% |

| Sodium Cumenesulfonate Market Size 2032 |

USD 98.66 Million |

Leading companies in the Sodium Cumenesulfonate Market include BASF SE, Solvay S.A., Evonik Industries AG, Croda International Plc, Arkema Group, Kao Corporation, Huntsman Corporation, LG Chem Ltd., Ashland Global Holdings Inc., and Nouryon. These players focus on product innovation, advanced chemical processing, and sustainable formulation technologies to enhance solubility and performance in detergents, industrial cleaners, and oilfield applications. Strategic collaborations and capacity expansions help them strengthen their global footprint. Asia-Pacific leads the Sodium Cumenesulfonate Market with a 38% market share, driven by large-scale detergent production, expanding industrial applications, and strong demand from emerging economies like China and India.

Market Insights

- The Sodium Cumenesulfonate Market was valued at USD 69.38 million in 2024 and is projected to expand at a CAGR of 4.5% through 2032.

- Growing demand for concentrated and eco-friendly cleaning formulations drives market growth, supported by its use as a solubilizer and hydrotrope in detergents and industrial products.

- A key trend includes the adoption of sodium cumenesulfonate in high-performance and biodegradable formulations, aligning with global sustainability goals.

- The market remains moderately competitive, with major players such as Solvay S.A., BASF SE, Evonik Industries AG, and Croda International Plc focusing on product innovation and regional expansion.

- Asia-Pacific leads with a 38% share, followed by North America with 27%, while the liquid form segment holds 64% of total market share due to its ease of blending and superior solubility across detergent, chemical, and metalworking industries.

Market Segmentation Analysis:

By Form

The liquid form dominates the Sodium Cumenesulfonate Market with a market share of 64%. Its high solubility and ease of blending make it the preferred choice across detergents, cleaners, and personal care products. The liquid form enhances formulation stability, allowing better dispersion of surfactants and additives. Its compatibility with aqueous systems drives demand in household and industrial cleaning solutions. Continuous adoption by detergent manufacturers for efficient processing and cost-effectiveness further supports its leadership in this segment.

- For instance, BASF SE produces various chemical ingredients, including sodium cumenesulfonate, which is a highly soluble hydrotrope commonly used in concentrated detergent formulations and industrial cleaning systems.

By Application

Among applications, the solubilizer segment leads with a market share of 42%. Sodium cumenesulfonate acts as an effective hydrotrope, improving the solubility of surfactants and organic compounds in complex formulations. This role is vital in liquid detergents, shampoos, and agrochemical solutions. Rising demand for clear, stable, and high-performance formulations in consumer and industrial products drives growth. Manufacturers favor solubilizers to enhance product consistency, transparency, and performance in both cleaning and personal care applications.

- For instance, Syensqo (previously part of Solvay S.A.) produces the Rhodacal® range of anionic surfactants, which are widely used as emulsifiers, stabilizers, and hydrotropes in applications such as paints, coatings, detergents, and personal care products.

By End-user Industry

The detergent industry holds the largest market share of 47% in the Sodium Cumenesulfonate Market. Its wide use as a hydrotrope enhances surfactant efficiency and prevents phase separation in concentrated cleaning agents. Increasing consumption of liquid and low-foam detergents globally boosts product utilization. Growth in the home and industrial cleaning sectors further strengthens this dominance. The shift toward environmentally compliant, biodegradable cleaning products also contributes to the strong market presence of sodium cumenesulfonate in the detergent industry.

Key Growth Drivers

Expanding Detergent and Cleaning Product Demand

Rising consumption of household and industrial cleaning agents serves as a major growth driver for the Sodium Cumenesulfonate Market. The compound acts as an efficient hydrotrope that improves solubility and stability in concentrated formulations, helping manufacturers reduce surfactant levels without compromising cleaning performance. Increased urbanization and hygiene awareness are fueling detergent use in residential and institutional settings. Moreover, the shift toward biodegradable and low-VOC cleaning solutions enhances product adoption as sodium cumenesulfonate supports eco-friendly formulations. Strong demand from Asia-Pacific markets, particularly China and India, underpins this growth trend.

- For instance, BASF product documentation specifies that the viscosity of diluted Texapon N70 solutions (typically 5-28% active substance) is primarily adjusted using sodium chloride (common salt) or alkanolamides.

Rising Utilization in Industrial Formulations

The growing use of sodium cumenesulfonate in metalworking, oil & gas, and chemical processing applications drives market expansion. Its ability to act as a coupling agent and solubilizer improves formulation performance under high temperature and pressure conditions. In metal processing, it enhances wetting and cleaning efficiency, extending equipment life and reducing downtime. The chemical industry benefits from its compatibility with various solvents, supporting complex formulations. With industrial modernization and process optimization gaining pace globally, sodium cumenesulfonate continues to gain traction as a cost-effective and versatile additive.

- For instance, Sodium cumenesulfonate (SCS) is widely used in the chemical industry as a hydrotrope to improve the solubility and stability of surfactant-heavy formulations, and the Lutensit® series are indeed surfactants and emulsifiers used in industrial and household cleaning agents.

Increasing Preference for Eco-Friendly Additives

The global push toward sustainable manufacturing is boosting demand for environmentally safe and non-toxic additives like sodium cumenesulfonate. Its low volatile organic compound (VOC) content and biodegradability make it suitable for green cleaning products and industrial formulations. Regulatory support for reducing hazardous chemicals in detergents and personal care products further strengthens its market position. Manufacturers are also focusing on cleaner production methods to comply with sustainability goals, thereby expanding the compound’s use across multiple industries. This eco-friendly advantage significantly supports long-term market growth.

Key Trend and Opportunity

Integration into High-Performance Formulations

A key trend shaping the Sodium Cumenesulfonate Market is its integration into high-performance and multifunctional formulations. Manufacturers are using it in combination with advanced surfactants to enhance cleaning, dispersing, and emulsifying properties. The demand for transparent, stable, and concentrated liquid products has accelerated its use in both industrial and consumer segments. Product innovation, particularly in specialty detergents and industrial cleaners, drives adoption. The compound’s compatibility with biodegradable and plant-based surfactants also aligns with the shift toward sustainable formulation development.

- For instance, GlucoPure Sense has a high Renewable Carbon Index RCI of over 96 and is described as readily biodegradable suitable for common European Ecolabels.

Growing Opportunities in Emerging Economies

Expanding manufacturing and consumer markets in emerging economies offer new growth opportunities for sodium cumenesulfonate suppliers. Rapid industrialization in countries such as India, Brazil, and Indonesia is driving demand for cost-effective and high-performing additives. Increasing local production of detergents, metal cleaners, and chemical intermediates further boosts regional consumption. Strategic investments by global players to establish regional manufacturing units also strengthen supply chains and reduce logistics costs. This localized growth is expected to contribute significantly to overall market expansion.

- For instance, Galaxy Surfactants has a manufacturing facility at Plot No. 892, Jhagadia Notified GIDC Industrial Estate, in Bharuch, Gujarat, India. The company is a key manufacturer of performance surfactants and specialty care products used in home and personal care applications.

Key Challenge

Price Fluctuations in Raw Materials

Volatility in the prices of raw materials, particularly cumene and sulfur-based intermediates, poses a significant challenge for sodium cumenesulfonate manufacturers. Price instability affects production costs and profit margins, leading to supply chain uncertainties. Dependence on petrochemical feedstocks exposes producers to fluctuations in global crude oil prices. To address this, companies are exploring backward integration and long-term supply agreements. However, cost control remains a key concern, especially for small and mid-sized manufacturers operating in competitive markets.

Regulatory and Environmental Compliance Pressure

Stringent environmental regulations related to chemical manufacturing and waste management create challenges for market participants. Compliance with evolving standards on emissions, effluents, and chemical safety increases operational costs. Manufacturers face the added burden of obtaining environmental certifications and maintaining sustainable production practices. Regional disparities in regulatory frameworks further complicate market operations. Despite these challenges, the emphasis on cleaner chemistry and adherence to eco-label standards is encouraging companies to invest in advanced, compliant manufacturing technologies.

Regional Analysis

North America

North America holds a 27% share of the Sodium Cumenesulfonate Market, driven by strong demand from the detergent, oil & gas, and metalworking industries. The U.S. leads the region with advanced production technologies and established cleaning product manufacturers. Growing preference for eco-friendly and high-performance hydrotropes supports steady market expansion. The presence of major chemical producers and increasing industrial cleaning applications strengthen regional consumption. Additionally, regulatory focus on sustainable chemical use continues to encourage sodium cumenesulfonate adoption in industrial and consumer formulations across the United States and Canada.

Europe

Europe accounts for 24% of the global Sodium Cumenesulfonate Market, supported by stringent environmental regulations and growing use in biodegradable cleaning products. Countries such as Germany, France, and the U.K. lead due to their mature chemical industries and sustainability-driven innovations. The compound’s compatibility with green surfactants aligns with EU directives promoting low-VOC and eco-labeled detergents. Demand in metal processing and industrial cleaning sectors remains robust. Increasing investment in chemical process optimization and energy-efficient production also contributes to maintaining Europe’s strong market position.

Asia-Pacific

Asia-Pacific dominates the Sodium Cumenesulfonate Market with a 38% share, supported by rapid industrialization and expanding detergent manufacturing capacity. China and India are the key contributors, with large-scale domestic production and rising consumption of cleaning and chemical products. Growing urban populations and rising hygiene awareness further fuel demand in household cleaning and personal care segments. The region benefits from cost-effective raw materials and favorable trade policies, encouraging international investments. Expanding applications in oil & gas and metalworking industries also strengthen Asia-Pacific’s leadership in global sodium cumenesulfonate consumption.

Latin America

Latin America captures an 8% market share, primarily led by Brazil and Mexico. Rising demand for cleaning and industrial maintenance products fuels market growth. The adoption of sodium cumenesulfonate in detergents and chemical formulations is increasing, driven by urbanization and improved consumer awareness. Local manufacturers are expanding production capacities to meet regional demand efficiently. Although regulatory frameworks remain less stringent compared to developed regions, the gradual shift toward environmentally friendly chemicals supports long-term market potential. Steady growth in oil refining and metal processing industries further contributes to regional expansion.

Middle East & Africa

The Middle East & Africa region holds a 3% share of the Sodium Cumenesulfonate Market, driven by industrial growth and oilfield chemical applications. The compound’s role as a solubilizer and coupling agent supports its use in oil & gas processing and metal cleaning. Growing investments in industrial infrastructure, especially in the Gulf countries, create steady demand. South Africa contributes to regional consumption through the detergent and industrial cleaning sectors. Despite a smaller market base, the gradual adoption of sustainable formulations indicates promising growth prospects for sodium cumenesulfonate suppliers.

Market Segmentations:

By Form

By Application

- Cloud Point Depressor

- Solubilizer

- Anti-caking Agent

- Coupling Agent

- Metal Processing

- Others

By End-user Industry

- Detergent

- Chemical

- Metal Working

- Oil & Gas

- Others

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The Sodium Cumenesulfonate Market features a competitive landscape characterized by a mix of global chemical giants and regional manufacturers focusing on formulation innovation and sustainability. Leading players such as Solvay S.A., BASF SE, Huntsman Corporation, and Evonik Industries AG emphasize product purity, high solubility, and process efficiency to cater to detergent, oil & gas, and industrial cleaning applications. Companies like LG Chem Ltd. and Kao Corporation invest in eco-friendly production and low-VOC surfactant systems to align with environmental regulations. Strategic partnerships, backward integration, and capacity expansions are common among key players to strengthen supply security and cost competitiveness. Emerging players also focus on customized hydrotrope solutions and regional distribution networks to meet diverse industrial needs, intensifying market rivalry and technological advancement across the global landscape.

Key Player Analysis

- Solvay S.A. (Belgium)

- Huntsman Corporation (USA)

- LG Chem Ltd. (South Korea)

- Croda International Plc (UK)

- BASF SE (Germany)

- Arkema Group (France)

- Kao Corporation (Japan)

- Evonik Industries AG (Germany)

- Ashland Global Holdings Inc. (USA)

- Nouryon (Netherlands)

Recent Developments

- In April 2023, Solvay announced that it has launched a new line of sodium cumenesulfonate products that are designed for use in the food and beverage industry.

- In March 2023, Evonik Industries announced that it has developed a new, more sustainable process for the production of sodium cumenesulfonate.

- In February 2023, Stepan Company announced that it has signed a new contract to supply sodium cumenesulfonate to a major personal care manufacturer.

Report Coverage

The research report offers an in-depth analysis based on Form, Application, End-user Industry and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for sodium cumenesulfonate will grow steadily with the expansion of detergent and cleaning product industries.

- Manufacturers will invest in sustainable production technologies to reduce emissions and enhance process efficiency.

- The compound will gain wider adoption in industrial applications such as oilfield chemicals and metal processing.

- Asia-Pacific will continue to dominate due to growing industrialization and large-scale detergent manufacturing.

- Companies will focus on eco-friendly formulations to comply with tightening environmental regulations.

- Technological advancements in hydrotrope chemistry will improve product performance and formulation stability.

- Strategic collaborations between global and regional producers will strengthen supply chain resilience.

- Rising consumer preference for biodegradable cleaning products will boost market penetration.

- Expanding end-user industries, including personal care and chemical processing, will create new opportunities.

- Continuous R&D efforts will drive innovation in multifunctional and high-efficiency sodium cumenesulfonate formulations.