Market Overview

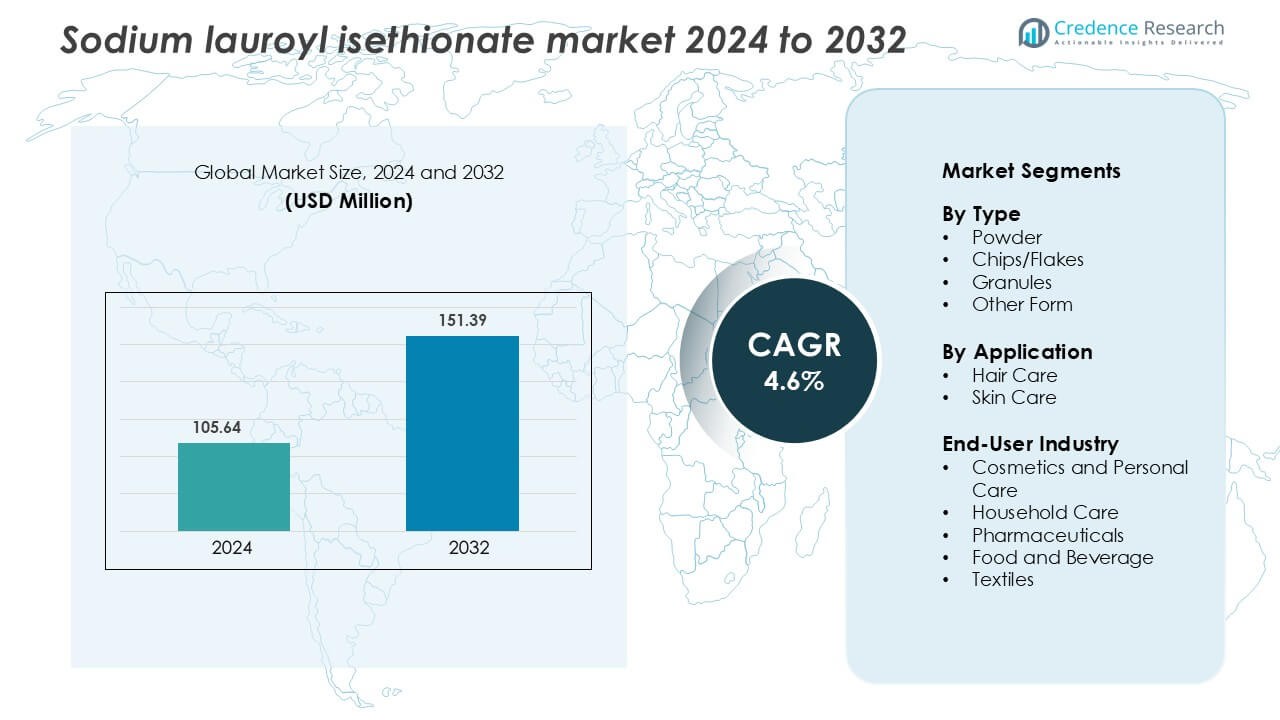

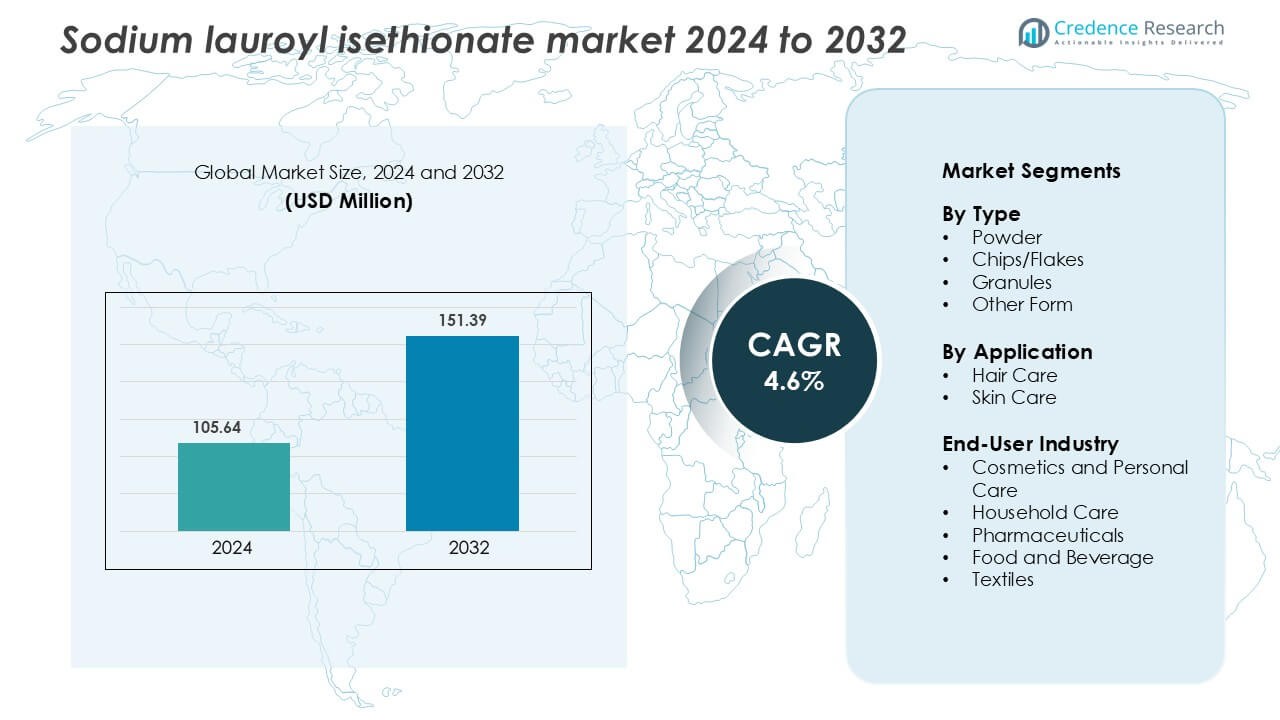

Sodium Lauroyl Isethionate Market was valued at USD 105.64 million in 2024 and is anticipated to reach USD 151.39 million by 2032, growing at a CAGR of 4.6% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Sodium Lauroyl Isethionate Market Size 2024 |

USD 105.64 Million |

| Sodium Lauroyl Isethionate Market, CAGR |

4.6% |

| Sodium Lauroyl Isethionate Market Size 2032 |

USD 151.39 Million |

Key players shaping the Sodium Lauroyl Isethionate market include BASF SE, Galaxy Surfactants, Innospec Performance Chemicals, JEEN International Corporation, Parchem Fine & Specialty Chemicals, KIYU New Material, McKinely Resources, Henan Surface Chemical Industry, Taiwan NJC Corporation, and Jilin Aegis Chemical. These companies focus on producing high-purity, biodegradable surfactants for premium personal and household care formulations. They invest in advanced processing technologies and sustainable sourcing to strengthen their competitive edge. North America leads the global market with a 34% share in 2024, driven by strong demand for sulfate-free products, well-established beauty brands, and regulatory emphasis on eco-friendly ingredients.

Market Insights

- The global Sodium Lauroyl Isethionate market was valued at USD 105.64 million in 2024 and is projected to grow at a CAGR of 4.6 % from 2025 to 2032. North America led with a 34% share, while powder form held 46% among product types.

- Rising consumer demand for mild, sulfate-free, and biodegradable surfactants is a major driver, especially in skincare and haircare formulations.

- The market trend favors solid cleansing bars, waterless beauty products, and sustainable ingredient sourcing, with key players investing in eco-friendly technologies.

- Competition remains moderate, with major companies such as BASF SE, Galaxy Surfactants, and Innospec Performance Chemicals focusing on innovation, product quality, and regional expansion.

- Raw material price volatility and formulation challenges slightly restrain growth, but Asia-Pacific’s rising middle-class population and expanding beauty sector continue to present strong opportunities for market expansion.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Type

Powder form dominates the Sodium Lauroyl Isethionate market, accounting for 46% of the total share in 2024. Its superior solubility, easy handling, and compatibility with multiple surfactant systems make it the preferred choice for formulating shampoos, facial cleansers, and syndet bars. The powder form’s cost-effectiveness and efficient foaming properties further enhance its demand across both mass and premium personal care segments. Meanwhile, chips/flakes and granules serve niche formulations requiring specific concentration levels and product textures, primarily in customized cosmetic and household formulations.

- For instance, Galaxy Surfactants’ “Galaxy Syndet Additive” includes approximately 40.0% active SLI in a solid format designed for easy incorporation.

By Application

The hair care segment leads the market with a 41% share, driven by the rising demand for sulfate-free shampoos and conditioners. Sodium Lauroyl Isethionate’s mild cleansing action and ability to produce rich, creamy foam make it ideal for sensitive scalp products. Skin care follows closely, supported by its growing use in facial cleansers, body washes, and moisturizing bars. Expanding consumer awareness of pH-balanced and eco-friendly ingredients fuels adoption across premium personal care lines globally.

- For instance, Innospec Performance Chemicals reports that its “Iselux® LQ-CLR-SB” grade contains 32% active content in a clear liquid form designed for transparent sulfate-free shampoo systems.

By End-User Industry

Cosmetics and personal care remain the dominant end-user segment, holding a 52% market share in 2024. The shift toward mild, biodegradable surfactants in premium beauty and grooming products continues to drive growth. Major manufacturers incorporate Sodium Lauroyl Isethionate in facial bars, shampoos, and body cleansers to meet consumer demand for gentle yet effective cleansing agents. Household care and pharmaceuticals are emerging sectors, while food and textile applications remain limited to specialized formulations requiring mild surfactant properties.

Key Growth Drivers

Rising Demand for Mild and Sulfate-Free Surfactants

The growing consumer preference for gentle cleansing formulations is a major driver for the Sodium Lauroyl Isethionate (SLI) market. With increased awareness about skin sensitivity and scalp irritation linked to harsh sulfates, cosmetic and personal care brands are shifting toward sulfate-free alternatives. SLI’s mildness, excellent foaming properties, and biodegradability make it a preferred surfactant in shampoos, face washes, and body cleansers. The ingredient’s compatibility with other amphoteric and anionic surfactants allows manufacturers to create high-performance yet skin-friendly formulations. This trend is particularly strong across North America and Europe, where clean-label and dermatologically tested products dominate consumer demand.

- For instance, Innospec Performance Chemicals’s Iselux® Ultra Mild blend delivers a naturally-derived content of 81% and supports formulation pH range of 5.5–8.5, facilitating gentle cleansing systems.

Expanding Application in Premium Personal Care Products

The rising adoption of premium and natural beauty products is fueling SLI’s market expansion. The compound is increasingly used in luxury skincare and haircare lines due to its creamy foam texture and moisturizing benefits. Major cosmetic companies are formulating syndet bars and facial cleansers with SLI to provide a smooth sensory experience and maintain pH balance. Additionally, the growing influence of e-commerce and social media marketing is pushing premium product sales in emerging economies. Manufacturers benefit from the rising disposable income and willingness of consumers to pay for high-quality, skin-safe ingredients. This shift supports steady demand across personal and professional grooming segments.

- For instance, Innospec Performance Chemicals’s Iselux® SLI flakes deliver about 80% active content and support a broad pH range of 4.8–8.5, enabling high-performance syndet bars and facial cleansers.

Growing Awareness of Biodegradable and Sustainable Ingredients

Environmental sustainability is a key factor driving the use of Sodium Lauroyl Isethionate in personal and household care products. Consumers and manufacturers are increasingly seeking biodegradable, non-toxic ingredients to meet global sustainability standards. SLI’s renewable raw material base, typically derived from coconut or palm kernel oil, aligns with eco-friendly formulations. Regulatory support for reducing synthetic chemical usage in detergents and cosmetics further accelerates adoption. Companies are investing in greener production technologies and certifications to enhance brand reputation and appeal to environmentally conscious consumers. This sustainability-driven preference is expected to sustain long-term market growth across regions.

Key Trend & Opportunity

Growth of Solid and Waterless Beauty Products

The increasing popularity of solid and waterless formulations presents new opportunities for SLI manufacturers. The compound’s solid-state compatibility and mild cleansing nature make it ideal for shampoo bars, facial cleansing bars, and solid body washes. These products reduce water usage and plastic packaging, supporting eco-conscious lifestyles and sustainable supply chains. Major brands are introducing compact, travel-friendly products that integrate SLI for convenience and reduced carbon footprint. This trend aligns with the broader shift toward minimalism and zero-waste beauty, particularly in Europe and Asia-Pacific, driving innovation in solid personal care categories.

- For instance, Galaxy Surfactants developed a sustainable shampoo bar format using SLI-based technology with a processing melt point of 75 °C and moisture content below 3.0%, enabling stable formats free of added liquid surfactants.

Expansion in Emerging Economies

Rapid urbanization, rising disposable income, and increasing personal grooming awareness in emerging economies create strong growth opportunities. Countries in Asia-Pacific, Latin America, and the Middle East are witnessing expanding beauty and hygiene product consumption. Local manufacturers are incorporating SLI into affordable sulfate-free formulations to target the growing middle-class population. Additionally, multinational brands are establishing regional production units to lower logistics costs and meet rising regional demand. This expansion provides lucrative prospects for suppliers and distributors of high-quality SLI-based surfactants.

- For instance, SLI Chemicals GmbH supplies mild surfactants and has developed a distribution partnership for zinc-oxide based UV filters with Uviva Technologies GmbH covering Germany, Austria and Switzerland.

Key Challenge

Fluctuating Raw Material Prices

The volatility in prices of key raw materials, such as coconut and palm kernel oil, poses a major challenge for SLI producers. These oils are influenced by climatic changes, trade restrictions, and sustainability certifications, leading to cost instability. Since SLI production relies heavily on these natural feedstocks, any disruption directly impacts pricing and profit margins. Manufacturers are exploring diversified sourcing strategies and synthetic substitutes to mitigate cost fluctuations. However, maintaining consistent product quality and meeting green certification requirements remains a balancing challenge for producers and formulators.

Limited Solubility and Processing Complexity

Sodium Lauroyl Isethionate presents formulation challenges due to its limited solubility and sensitivity to temperature and pH. Its use requires specific processing conditions, making it difficult for small and medium-sized manufacturers to integrate efficiently into existing production lines. These technical constraints can limit scalability, especially in liquid formulations. Producers must invest in specialized equipment or blends to ensure stable performance and texture. Continuous R&D efforts are directed at improving its compatibility and ease of formulation, but widespread adoption is still hindered by higher production complexity compared to conventional surfactants.

Regional Analysis

North America

North America leads the Sodium Lauroyl Isethionate market with a 34% share in 2024. The dominance is driven by the strong presence of established personal care brands and high consumer demand for sulfate-free formulations. The U.S. accounts for most regional revenue, supported by premium product launches and growing awareness of clean-label beauty ingredients. The region also benefits from advanced production capabilities, sustainable sourcing practices, and R&D investments in biodegradable surfactants. Regulatory support promoting eco-friendly and non-toxic chemicals continues to strengthen market growth across household and personal care applications.

Europe

Europe holds a 27% share of the global Sodium Lauroyl Isethionate market, driven by strict environmental regulations and consumer preference for sustainable products. Countries such as Germany, France, and the U.K. are leading adopters of mild surfactants in skincare and haircare formulations. Major cosmetic producers are focusing on green chemistry innovations and ingredient transparency to align with EU sustainability directives. Demand for solid cleansing bars and sulfate-free body washes continues to rise. The region’s mature beauty industry and ongoing emphasis on eco-certifications enhance its long-term market stability.

Asia-Pacific

Asia-Pacific captures 29% of the global market and is the fastest-growing region. Rapid urbanization, rising disposable income, and increased spending on personal grooming drive demand in China, Japan, South Korea, and India. Expanding e-commerce and social media influence further boost awareness of sulfate-free and natural beauty products. Regional manufacturers are scaling production of Sodium Lauroyl Isethionate to cater to both mass-market and premium brands. The availability of raw materials, such as coconut and palm oil, strengthens regional competitiveness and supports long-term supply chain stability.

Latin America

Latin America accounts for 6% of the market share, led by Brazil and Mexico. The region’s growth is fueled by the expanding cosmetics sector and adoption of international beauty trends. Rising consumer awareness of skin-friendly formulations and the shift toward sulfate-free shampoos contribute to steady demand. Local brands increasingly incorporate Sodium Lauroyl Isethionate into affordable personal care ranges to meet diverse consumer needs. Economic recovery and improved distribution networks also help strengthen product accessibility in emerging urban markets across the region.

Middle East & Africa

The Middle East and Africa region holds a 4% share of the global Sodium Lauroyl Isethionate market. Growth is supported by increasing hygiene awareness, urbanization, and the rising influence of global beauty brands. Gulf Cooperation Council (GCC) countries, in particular, are witnessing higher adoption of premium personal care products featuring mild surfactants. The expanding retail sector and rising disposable income levels enhance product penetration. However, limited local manufacturing capabilities and dependency on imports may slightly restrain faster market expansion across the region.

Market Segmentations:

By Type

- Powder

- Chips/Flakes

- Granules

- Other Form

By Application

By End-User Industry

- Cosmetics and Personal Care

- Household Care

- Pharmaceuticals

- Food and Beverage

- Textiles

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The Sodium Lauroyl Isethionate market features a moderately consolidated competitive landscape, with key players focusing on product innovation, quality enhancement, and sustainable production. Leading companies such as BASF SE, Galaxy Surfactants, Innospec Performance Chemicals, and JEEN International Corporation emphasize developing biodegradable, high-purity formulations to meet rising demand for mild and sulfate-free surfactants. Regional manufacturers like KIYU New Material, Henan Surface Chemical Industry, and Jilin Aegis Chemical are expanding capacity to serve the growing Asian personal care sector. Meanwhile, Parchem Fine & Specialty Chemicals and McKinely Resources strengthen global supply networks through strategic partnerships and efficient distribution systems. Taiwan NJC Corporation continues to enhance product performance through advanced processing technology. Competitive strategies center on regulatory compliance, environmental certifications, and cost optimization to capture emerging market opportunities in skincare, haircare, and household applications, positioning these companies to maintain steady growth amid evolving consumer preferences.

Key Player Analysis

- BASF SE

- Galaxy Surfactants

- JEEN International Corporation

- Parchem Fine & Specialty Chemicals

- KIYU New Material

- Taiwan NJC Corporation

- McKinely Resources

- Henan Surface Chemical Industry

- Innospec Performance Chemicals

- Jilin Aegis Chemical

Recent Developments

- In Oct 2025, BASF showcased new personal care formulations at in‑cosmetics Asia featuring mild cleansers built on its bio‑based surfactant portfolio (e.g., Emulgade Verde 10 LA, Plantapon Amino SLG‑P) aligned with sulfate‑free, sensitive‑skin trends that commonly utilize isethionate systems in syndet cleansers.

- In Mar 2022, BASF launched Plantapon Soy, a bio‑based anionic surfactant for clean‑beauty cleansing systems, reinforcing its push into mild, sulfate‑free frameworks often paired with SLI in rinse‑off formats.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Report Coverage

The research report offers an in-depth analysis based on Type, Application, End-User Industry and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The demand for sulfate-free and mild surfactants will continue to rise globally.

- Manufacturers will focus on expanding sustainable and biodegradable product portfolios.

- Asia-Pacific will emerge as the fastest-growing regional market due to rising beauty awareness.

- Premium skincare and haircare applications will drive consistent product innovation.

- The popularity of solid and waterless beauty products will boost SLI adoption.

- Companies will invest in green chemistry and low-impact production technologies.

- Strategic collaborations will strengthen supply chain efficiency and regional presence.

- Ongoing R&D will improve formulation stability and performance consistency.

- Growing e-commerce platforms will enhance accessibility for personal care brands.

- Regulatory emphasis on eco-friendly ingredients will favor long-term market expansion.