| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Soil Stabilization Market Size 2023 |

USD 28815 million |

| Soil Stabilization Market, CAGR |

5.1% |

| Soil Stabilization Market Size 2032 |

42898.32 million |

Market Overview:

The Soil Stabilization Market is projected to grow from USD 28815 million in 2024 to an estimated USD 42898.32 million by 2032, with a compound annual growth rate (CAGR) of 5.1% from 2024 to 2032.

Several factors are propelling the growth of the soil stabilization market. Foremost among them is the surge in infrastructure development projects, including roads, railways, airports, and residential constructions, particularly in emerging economies. The increasing demand for sustainable agricultural practices and effective soil erosion control measures also contributes significantly to market expansion. Advancements in soil stabilization technologies, such as the development of eco-friendly additives and innovative polymers, enhance operational efficiency and environmental sustainability, further driving market growth. Additionally, growing awareness of the environmental impact of traditional construction methods has led to a shift towards greener solutions that improve soil strength while reducing ecological footprints.

The soil stabilization market exhibits a diverse geographical landscape, with North America and Asia-Pacific leading in terms of market share and growth potential. North America, accounting for approximately 30% of the global market, benefits from robust investments in infrastructure development, particularly in the United States, where there is a high demand for soil stabilization in transportation networks and urban expansion projects. The region’s stringent environmental regulations also encourage the adoption of sustainable construction practices. Asia-Pacific is experiencing rapid growth, fueled by urbanization, agricultural development, and significant infrastructure projects in countries like China and India. The region’s focus on sustainable land management practices and the increasing need for improved soil properties in construction are driving the demand for effective stabilization solutions. Europe also presents substantial opportunities, with countries like Germany and the UK investing in green technologies and infrastructure, aligning with the European Union’s objectives for climate neutrality and sustainable development

Market Insights:

- The Soil Stabilization Market is projected to grow from USD 28,815 million in 2024 to USD 42,898.32 million by 2032, registering a CAGR of 5.1%.

- Accelerated infrastructure development in roads, railways, and airports—especially across emerging markets—is a primary growth driver.

- Rising adoption of eco-friendly additives and polymers is reshaping the industry, aligning with global sustainability and ESG goals.

- Technological advances, including GPS-guided equipment and nano-modified stabilizers, are improving efficiency and project outcomes.

- Agricultural demand is increasing as farmers adopt soil stabilization to prevent erosion and improve land productivity in arid regions.

- High material costs and limited access to advanced technologies remain barriers, especially for small-scale and rural projects.

- North America holds a 30% market share, while Asia-Pacific shows the fastest growth, driven by urbanization and infrastructure funding.

Report scope

This report segments the Soil Stabilization Market as follow

Market Drivers:

Increasing Global Infrastructure Development Spurs Material Demand

The Soil Stabilization Market is witnessing strong growth due to a global surge in infrastructure projects, particularly in developing economies. Governments are investing heavily in transportation networks, residential zones, and industrial corridors to support urbanization. These large-scale projects require stable and durable soil foundations, driving demand for stabilization materials and techniques. Roads, highways, bridges, and airport runways are key areas where soil stabilization enhances safety, reduces maintenance costs, and improves load-bearing capacity. Rapid population growth and migration to urban centers intensify the need for structured land use and soil reinforcement solutions. The market benefits from public-private partnerships focused on infrastructure resilience and long-term performance.

Growing Environmental Awareness Promotes Sustainable Building Solutions

The push for sustainable construction practices is another critical driver of the Soil Stabilization Market. Regulatory bodies and industry stakeholders are emphasizing eco-friendly construction materials that reduce environmental harm and carbon emissions. Traditional soil treatment methods often involve high energy consumption and emissions, prompting a shift toward bio-based polymers, recycled binders, and mechanical stabilization methods. This transition supports green certification requirements and aligns with corporate ESG goals. It also helps improve soil quality while preserving natural ecosystems, making stabilized soil suitable for construction without harming surrounding environments. Public infrastructure agencies now consider environmental compatibility as a key evaluation factor in project planning.

- For example, Global Road Technology (GRT) has reported that its polymer-based soil stabilization products, such as GRT9000, have helped construction clients reduce water usage by up to 60% and cut dust emissions by more than 90% on infrastructure sites in Australia and Southeast Asia.

Technological Advancements Enhance Efficiency and Customization

Innovations in soil stabilization technologies have significantly improved material performance and field application. The development of advanced chemical additives, such as nano-modified binders and synthetic polymers, allows for enhanced bonding, water resistance, and load capacity. It has enabled customized stabilization solutions for different soil types and environmental conditions. Modern mixing equipment, GPS-controlled application systems, and automated testing tools improve construction precision and efficiency. These innovations lower labor costs, minimize downtime, and ensure compliance with evolving engineering standards. The Soil Stabilization Market benefits from increased research investments by manufacturers aiming to deliver more effective and faster-curing materials.

- For instance, Tensar’s TriAx® geogrids have been shown to increase pavement life by up to 50% and reduce aggregate thickness requirements by 30%, according to field trials in the United States and the UK.

Expansion of Agriculture and Land Reclamation Drives Application Growth

Beyond construction, soil stabilization is increasingly applied in agriculture and land rehabilitation projects. Farmers use stabilization methods to improve soil structure, manage erosion, and enhance irrigation efficiency, especially in arid and semi-arid regions. Land reclamation for new developments or restoration of degraded zones also drives demand for stabilization techniques that restore soil strength and fertility. Governments support such initiatives to optimize land use and reduce desertification risks. The Soil Stabilization Market gains from this cross-sectoral relevance, as stabilized soils become essential in both infrastructure and ecological resilience strategies. It is becoming a key tool for climate adaptation and sustainable land management policies.

Market Trends:

Adoption of Eco-Friendly Binders and Sustainable Stabilization Methods

The Soil Stabilization Market is embracing environmentally sustainable solutions as demand grows for green construction practices. Bio-based binders, recycled materials, and low-carbon additives are replacing traditional cement and lime options. These materials reduce greenhouse gas emissions and minimize environmental degradation during application. Governments and regulatory bodies are setting stricter emission and sustainability targets, prompting wider use of eco-friendly stabilizers in infrastructure and land development projects. Construction firms adopt these solutions to align with green certification requirements and improve their environmental profiles. It encourages innovation in product formulations tailored to meet both performance and sustainability criteria.

- For instance, AggreBind’s patented copolymer binders are non-toxic, non-polluting, and do not release harmful chemicals or heavy metals into the environment.

Rising Use of Advanced Equipment and Automation in Soil Treatment

The integration of advanced machinery and automated systems is transforming field operations in the Soil Stabilization Market. Modern stabilizers are applied using GPS-enabled equipment that ensures uniform distribution and precision. Contractors deploy automated mixers, compactors, and real-time monitoring tools to reduce human error and improve quality control. This shift improves project efficiency, lowers operational costs, and enhances worker safety. It supports large-scale infrastructure projects that require consistent and high-performance ground conditions. Demand continues to grow for equipment that simplifies soil assessment, blending, and application in diverse environments.

- For instance, companies like AMIX Systems provide high-shear colloidal mixers and modular grout plants, which deliver superior particle dispersion and consistent mix quality for ground improvement projects.

Growing Popularity of Polymer-Based and Nano-Modified Stabilization Solutions

Polymers and nano-materials are gaining momentum in the Soil Stabilization Market due to their superior performance and adaptability. These materials provide enhanced bonding, increased load-bearing strength, and better water resistance across a range of soil types. Polymer-based stabilizers work effectively in regions with extreme weather or high moisture content, expanding their utility in diverse geographies. Nano-technology introduces finer particles that improve soil interaction and reduce curing time. It opens new opportunities for stabilizing marginal or problematic soils without requiring extensive excavation or replacement. These trends support rapid construction timelines and long-term durability of built infrastructure.

Expansion of Soil Stabilization in Non-Traditional Sectors

The Soil Stabilization Market is expanding beyond construction into sectors such as mining, waste management, and disaster response. Stabilization techniques are being used to secure slopes, manage tailing dams, and reduce erosion in mining operations. In disaster-prone areas, stabilized soil helps create resilient infrastructure that withstands landslides and floods. It also plays a role in managing landfills and contaminated sites by encapsulating waste and preventing leachate migration. Government initiatives focused on climate adaptation and environmental restoration are driving multi-sector adoption. This diversification strengthens the market’s long-term outlook and fosters new application innovations.

Market Challenges Analysis:

High Material Costs and Limited Access to Advanced Technologies

The Soil Stabilization Market faces challenges due to the high cost of advanced stabilizing agents and specialized equipment. Small contractors and rural infrastructure developers often struggle to afford polymer-based or nano-enhanced solutions. Access to cutting-edge machinery remains limited in low-income regions, where manual or outdated methods still dominate. This cost disparity creates an uneven adoption rate across global markets, hindering the scalability of efficient stabilization practices. Training requirements for operating new technologies also raise implementation costs, particularly in developing countries. It limits the pace at which innovation reaches underserved construction zones and agricultural lands.

Variability in Soil Conditions and Regulatory Inconsistencies

The Soil Stabilization Market must navigate the complexity of varied soil types, each requiring tailored treatment approaches. Unpredictable moisture content, organic matter levels, and regional geological factors can affect stabilizer performance. Companies must invest in thorough site investigations and laboratory testing to ensure compatibility, increasing time and project costs. Regulatory inconsistencies across regions add another layer of complexity. Some countries lack clear standards or guidelines for material usage and testing protocols, delaying approvals and implementation. It creates uncertainty for suppliers and contractors, especially when operating across borders or under public procurement frameworks.

- For example, a 2024 technical bulletin from the U.S. Federal Highway Administration highlighted that stabilizer performance can vary by over 30% depending on soil organic content and moisture variability, necessitating extensive site-specific laboratory testing.

Market Opportunities:

The Soil Stabilization Market holds strong growth potential in emerging economies where governments are prioritizing road, rail, and housing developments. Rapid urbanization and industrial expansion in countries like India, Brazil, and Indonesia create continuous demand for soil enhancement solutions. These regions face challenges related to weak subgrade conditions, which stabilization techniques can address efficiently. Public infrastructure funding and international development programs support the adoption of modern soil treatment technologies. The need for cost-effective and durable construction methods positions soil stabilization as a preferred solution. It provides long-term value by extending the lifespan of infrastructure in challenging terrains.

The Soil Stabilization Market is well positioned to support global climate resilience goals through sustainable construction and ecological restoration. Stabilized soils offer improved resistance to erosion, flooding, and land degradation, making them valuable in areas affected by extreme weather. Governments and NGOs are investing in land rehabilitation and disaster recovery projects, where soil stability is critical. It contributes to reforestation efforts, slope protection, and reclaimed land development. Market players have opportunities to expand service offerings by aligning products with climate adaptation funding and sustainability targets. These initiatives open new application segments beyond traditional construction.

Market Segmentation Analysis:

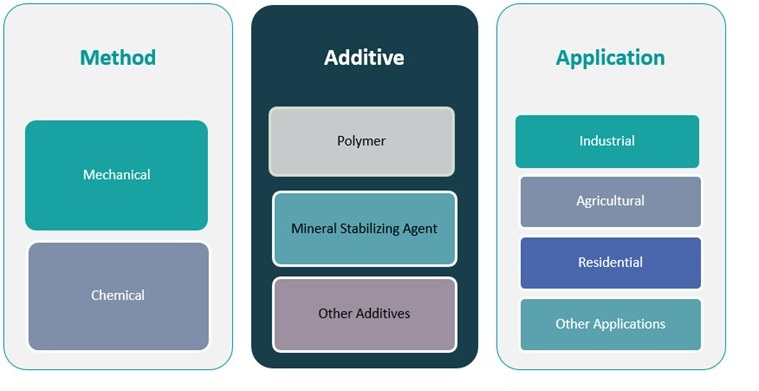

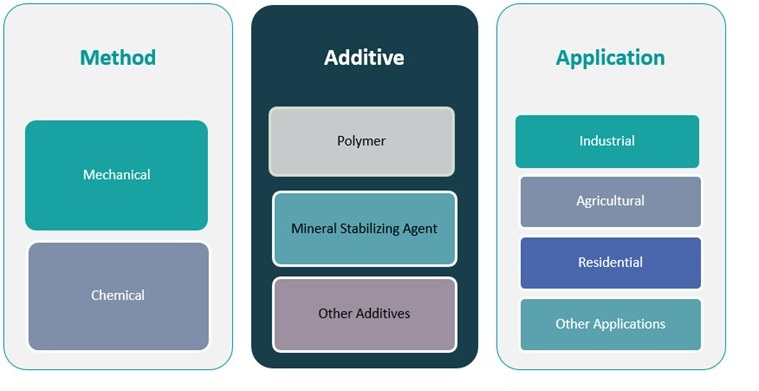

The Soil Stabilization Market is segmented

By method into mechanical and chemical stabilization. Mechanical stabilization dominates in large-scale infrastructure projects due to its cost-efficiency and immediate performance in enhancing soil strength. Chemical stabilization, using binders like lime and cement, is widely applied where long-term durability and moisture control are critical, particularly in roads and foundation work.

By application, the market is classified into industrial, agricultural, residential, and other applications. Industrial projects lead the segment due to extensive land modification needs in mining, energy, and logistics sectors. Agricultural applications are growing steadily, driven by the need for erosion control and soil productivity improvements. Residential demand is rising in urban areas, where soil quality must support housing developments. Other applications include land reclamation and disaster mitigation, reflecting the market’s expanding utility.

By additive type into polymer, mineral stabilizing agent, and other additives. Polymer-based additives are gaining traction for their versatility and high binding efficiency across various soil types. Mineral stabilizing agents, including lime and fly ash, remain the most used due to cost-effectiveness and widespread availability. Other additives address niche requirements, such as environmental compliance and localized soil conditions. It reflects the increasing demand for tailored, high-performance stabilization solutions across sectors.

Segmentation:

By Method Segment:

By Application Segment:

- Industrial

- Agricultural

- Residential

- Other Applications

By Additive Segment:

- Polymer

- Mineral Stabilizing Agent

- Other Additives

Regional Analysis:

North America Leads with Strong Infrastructure and Regulatory Backing

North America holds the largest share of the Soil Stabilization Market, accounting for 30% of global revenue. The United States drives most of this demand through ongoing highway modernization projects, smart city initiatives, and agricultural land optimization. Strict environmental regulations support the use of sustainable and low-emission soil stabilization methods across public works. Federal and state-level funding accelerates adoption of innovative materials, including polymer and bio-based stabilizers. Contractors benefit from advanced machinery and skilled labor, which enhance efficiency and compliance. It continues to lead in technological integration and public-private partnerships for large-scale infrastructure upgrades.

Asia-Pacific Emerges as the Fastest-Growing Regional Market

Asia-Pacific commands 28% of the Soil Stabilization Market and is expected to witness the highest growth rate over the forecast period. Massive investments in transportation, housing, and industrial corridors across China, India, and Southeast Asia create a consistent need for soil enhancement solutions. Governments in the region focus on durable, cost-effective construction techniques to support expanding urban populations. Local soil variability and weather extremes prompt the use of region-specific stabilization methods, including lime treatment and mechanical techniques. Construction firms adopt innovative solutions to meet rising environmental and performance standards. It benefits from a growing base of domestic manufacturers and regional suppliers.

Europe Focuses on Sustainable Solutions and Green Infrastructure

Europe contributes 22% to the global Soil Stabilization Market, with strong emphasis on sustainability and climate-resilient infrastructure. Countries like Germany, France, and the UK implement eco-friendly building codes that encourage the use of recycled binders and low-carbon additives. The European Union’s Green Deal initiatives provide funding and policy support for soil rehabilitation and erosion control across rural and urban areas. Infrastructure modernization programs focus on railway expansion, renewable energy projects, and flood-resistant structures. It benefits from mature technology adoption and a skilled workforce that supports high-performance implementation. The region continues to set benchmarks for environmental compliance in soil stabilization practices.

Key Player Analysis:

- AltaCrete

- AggreBind Inc.

- Soilworks LLC

- Wirtgen Group

- FAYAT SAS

Competitive Analysis:

The Soil Stabilization Market features a moderately consolidated competitive landscape with both multinational corporations and regional players. Leading companies such as AB Volvo, Caterpillar Inc., Wirtgen Group, and SNF Holding Company maintain strong positions through diverse product portfolios and robust global distribution networks. These firms invest in research and development to introduce advanced stabilizers, sustainable binders, and equipment-integrated solutions. Smaller players focus on niche applications, such as rural infrastructure or eco-friendly additives, to differentiate their offerings. Strategic collaborations with governments and infrastructure developers help market leaders secure large-scale contracts. The Soil Stabilization Market demands continuous innovation and adherence to evolving environmental standards, pushing companies to align with sustainable construction goals. It rewards firms that offer flexible solutions, technical expertise, and local adaptability in both product performance and service delivery. Competitive intensity remains steady, driven by infrastructure spending, regulatory shifts, and the rising need for long-lasting ground reinforcement methods.

Recent Developments:

- In January 2022, Bomag, a leading German manufacturer of construction equipment, introduced two new tractor-towed soil stabilizers, the RS250 and RS300, specifically designed for soil stabilization in road and path construction. The RS250 offers a milling depth of up to 40 cm, while the RS300 reaches 50 cm, both featuring a 2.5-meter working width and advanced cutting technology. These new models are engineered for high performance, efficient power transfer, and ease of maintenance, making them suitable for both large and smaller, more maneuverable construction sites.

Market Concentration & Characteristics:

The Soil Stabilization Market shows moderate concentration, with key players holding sizable shares due to strong brand presence, proprietary technologies, and broad geographic reach. It features a mix of global corporations and specialized regional firms that cater to diverse application needs. High entry barriers exist due to capital requirements, technical expertise, and regulatory compliance demands. The market favors companies that offer integrated solutions combining stabilizers, equipment, and field support. Price sensitivity varies across segments, with government-funded projects prioritizing cost efficiency and private developments focusing on performance and sustainability. It relies heavily on infrastructure cycles, regional soil conditions, and environmental regulations that shape material selection and technology adoption.

Report Coverage:

The research report offers an in-depth analysis based on Method, Application and Additive. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- The market will expand steadily due to increasing infrastructure investments across Asia-Pacific, Africa, and Latin America.

- Adoption of eco-friendly stabilizers will rise in response to global sustainability and carbon reduction targets.

- Demand for polymer-based and nano-modified solutions will grow in projects requiring high-performance soil reinforcement.

- Government incentives and public infrastructure funding will boost market penetration in emerging economies.

- Technological advancements in mixing equipment and GPS-enabled application tools will improve operational efficiency.

- Urbanization and smart city initiatives will drive the need for durable, low-maintenance soil stabilization methods.

- Climate change adaptation will create new opportunities in flood-prone and erosion-sensitive regions.

- Land reclamation and rehabilitation projects will expand the application of stabilization techniques beyond construction.

- Regulatory shifts will favor companies that align with green building certifications and environmental standards.

- Strategic collaborations between material suppliers and construction firms will shape future market competitiveness.