Market Overview

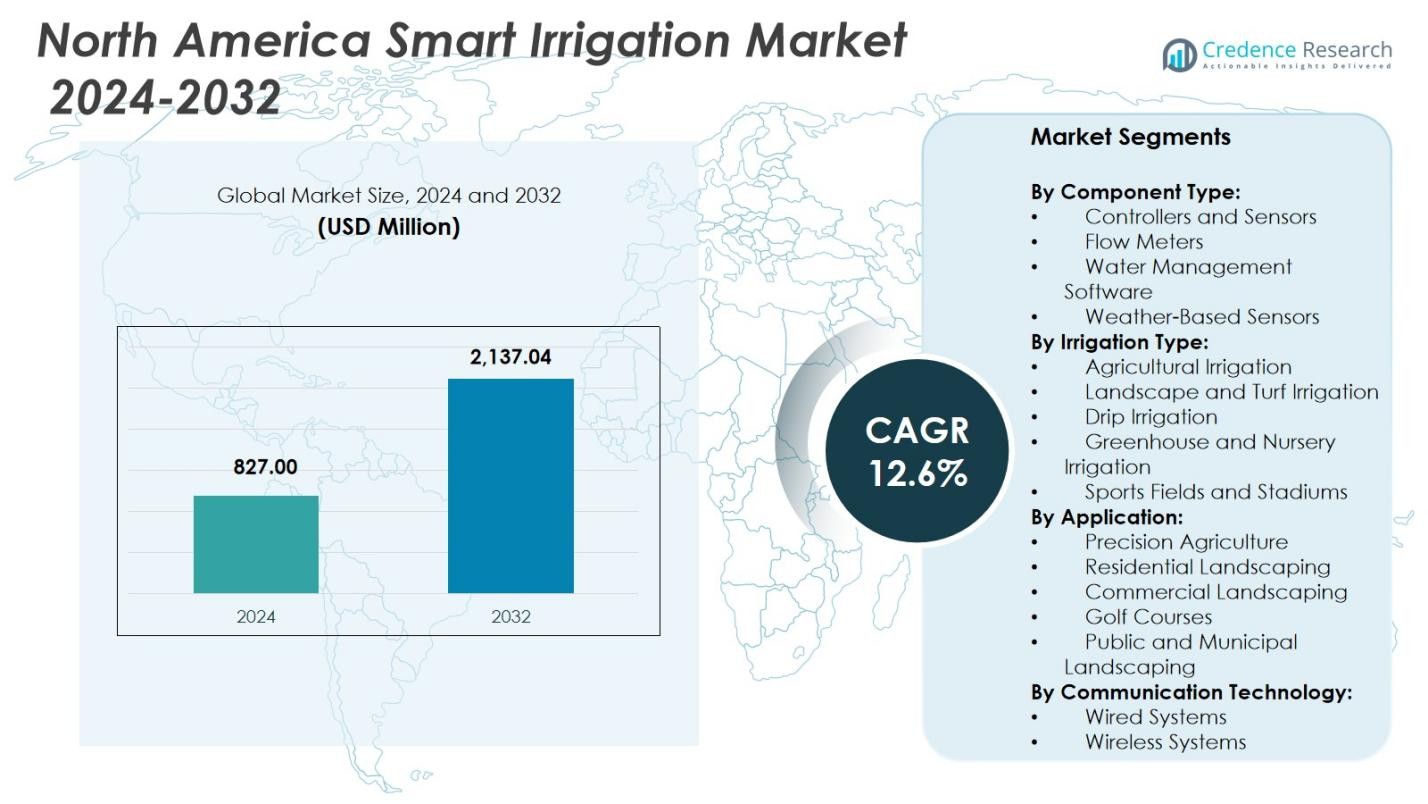

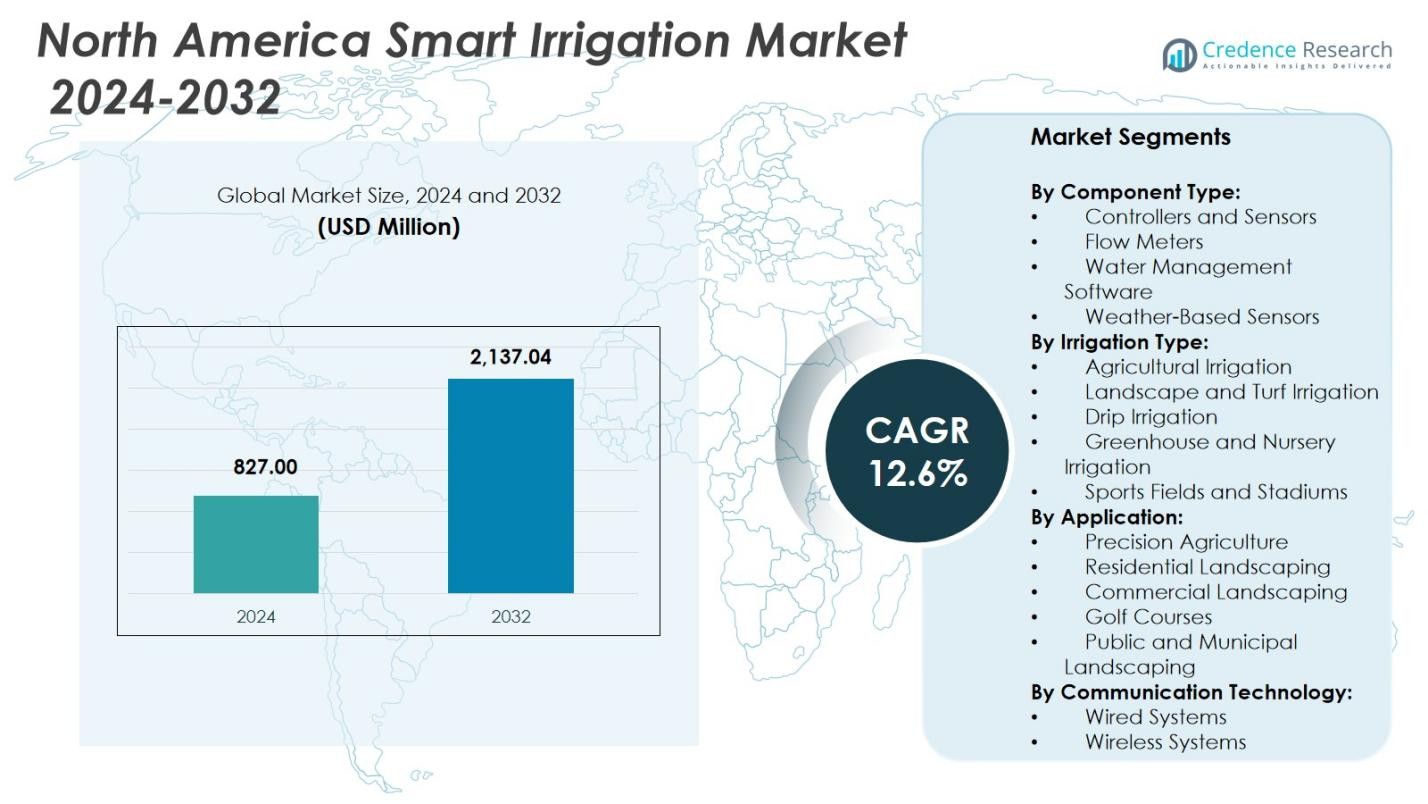

North America Smart Irrigation Market size was valued at USD 827.00 Million in 2024 and is anticipated to reach USD 2,137.04 Million by 2032, at a CAGR of 12.6% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| North America Smart Irrigation Market Size 2024 |

USD 827.00 Million |

| North America Smart Irrigation Market, CAGR |

12.6% |

| North America Smart Irrigation Market Size 2032 |

USD 2,137.04 Million |

North America Smart Irrigation Market features leading players such as Galcon, The Toro Company, Banyan Water, Inc., Rain Bird Corporation, NETAFIM, Weathermatic, Orbit Irrigation Products LLC, Rachio Inc., HUNTER INDUSTRIES, and HydroPoint, all driving innovation through advanced controllers, cloud-based platforms, and sensor-integrated irrigation systems. These companies focus on enhancing water efficiency, automation, and real-time monitoring across agriculture, residential landscapes, and commercial green spaces. The United States led the market with a 71.4% share in 2024, driven by strong adoption of precision agriculture technologies, drought-management initiatives, and expanding smart city landscaping programs, followed by Canada and Mexico with growing implementation across farms and urban landscapes.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- North America Smart Irrigation Market was valued at USD 827.00 Million in 2024 and is projected to grow at a CAGR of 12.6% through 2032.

- Strong market drivers include rising adoption of precision agriculture, expansion of automated irrigation controllers and sensors, and increasing municipal focus on water-conservation programs.

- Key market trends highlight rapid integration of IoT, AI-driven analytics, weather-based automation, and growing adoption of drip irrigation and soil-moisture monitoring technologies across farms and landscapes.

- Leading players such as Galcon, The Toro Company, Rain Bird Corporation, NETAFIM, and HydroPoint strengthen industry growth through product innovation, digital irrigation platforms, and strategic partnerships across agriculture and commercial landscaping.

- The United States dominated the market with a 4% share, supported by high deployment of smart controllers and precision agriculture tools, while Controllers and Sensors led segment performance with a 41.2% share, followed by Canada and Mexico showing rising adoption in greenhouse farming and urban green-space management.

Market Segmentation Analysis:

Market Segmentation Analysis:

By Component Type

Controllers and Sensors dominated the North America Smart Irrigation Market with a 41.2% share in 2024, driven by widespread adoption of automated scheduling, soil-moisture sensing, and real-time system adjustments across agriculture and landscaping. Their integration with weather-based inputs, IoT platforms, and wireless communication improves irrigation accuracy and reduces manual intervention, making them the preferred choice among farms, golf courses, and municipal landscapes. Water Management Software and Weather-Based Sensors are also growing steadily as data-driven irrigation gains traction, while Flow Meters support system-level efficiency monitoring and leak detection across high-use irrigation networks.

- For instance, Rain Bird’s ET Manager integrates weather data with sensor inputs to optimize irrigation timing, reducing water waste on golf courses.

By Irrigation Type

Agricultural Irrigation held the leading position with a 38.5% share in 2024, supported by the rapid shift toward precision water management across large farmlands in the U.S. and Canada. Farmers increasingly adopt sensor-driven and weather-responsive irrigation systems to reduce water wastage, improve crop yields, and address sustainability mandates. Landscape and Turf Irrigation continues expanding with strong adoption across urban green spaces, while Drip Irrigation and Greenhouse Irrigation gain momentum due to efficiency benefits. Sports Fields and Stadiums also demonstrate rising uptake for maintaining turf quality under fluctuating climatic conditions.

- For instance, CropX deploys AI-driven sensors that analyze soil moisture, weather forecasts, and crop cycles to automate irrigation scheduling.

By Application

Precision Agriculture emerged as the dominant application with a 36.7% share in 2024, driven by the growing need for real-time crop monitoring, optimized resource utilization, and automated irrigation control across high-value farming zones. Producers increasingly rely on IoT sensors, satellite imagery, soil-moisture probes, and weather analytics to execute targeted watering strategies that enhance productivity and reduce operational costs. Residential and Commercial Landscaping segments grow steadily due to water-conservation regulations, while Golf Courses and Public Landscaping increasingly adopt smart irrigation systems to maintain landscape quality under tightening municipal water-use policies.

Key Growth Drivers

Expansion of Precision Agriculture Practices

Precision agriculture significantly drives the North America Smart Irrigation Market as farmers increasingly adopt IoT-enabled sensors, weather-based controllers, and soil-moisture monitoring tools. These systems help optimize water usage, enhance crop yields, and lower operational costs across large agricultural zones. Government programs promoting water conservation further accelerate adoption, while advanced analytics support targeted irrigation decisions. The integration of automation and remote monitoring strengthens farm productivity, making precision irrigation an essential investment for modern agricultural operations.

- For instance, John Deere’s Field Connect utilizes soil moisture sensors to provide real-time irrigation data, helping farmers conserve water while increasing efficiency.

Urban Landscaping Modernization and Water Conservation Mandates

Urban regions across the U.S. and Canada are experiencing rising pressure to reduce water consumption in residential, municipal, and commercial landscapes. Smart irrigation systems support automated scheduling and real-time water adjustments, helping cities comply with conservation regulations. Adoption grows quickly across public parks, smart city projects, golf courses, and commercial complexes seeking sustainability certifications. The demand for efficient irrigation technologies intensifies due to rising water tariffs and expanding ESG-driven landscaping initiatives.

- For instance, Calsense smart irrigation systems deployed in U.S. cities for parks and public spaces optimize watering to cut water use while maintaining green areas efficiently. These systems integrate real-time data for precise control, supporting municipal sustainability goals in urban environments.

Technological Advancements in Connected Irrigation Systems

Rapid advancements in wireless communication, cloud platforms, AI-based prediction models, and mobile-enabled irrigation controls strongly support market growth. Integrated systems offer remote monitoring, leak detection, and predictive watering based on weather analytics, improving decision-making accuracy. Manufacturers increasingly embed machine learning features to anticipate plant needs and prevent over-irrigation. The shift toward fully connected ecosystems enhances system reliability, reduces water wastage, and strengthens adoption across agriculture and urban landscaping environments.

Key Trends & Opportunities

Growing Integration of IoT, AI, and Predictive Analytics

IoT devices, soil sensors, and AI-driven forecasting tools are becoming central to irrigation decision-making. Predictive analytics assists users in adjusting irrigation patterns based on real-time weather conditions, soil characteristics, and plant requirements. This trend creates strong opportunities for software-as-a-service irrigation platforms that provide remote control and automated scheduling. As climate variability increases, demand for intelligent, self-learning irrigation systems continues to expand across farms, golf courses, and municipal landscapes.

- For instance, AI models in Vassar Labs’ irrigation planning tools forecast water needs by analyzing weather forecasts and crop health data. The system proactively schedules irrigation to avoid over- or under-watering amid climatic variations.

Rising Adoption of Sustainable and Water-Efficient Irrigation Solutions

Sustainability goals across agriculture and landscaping are accelerating the shift toward efficient irrigation technologies. Water-efficient systems such as drip irrigation, weather-based controllers, and flow-monitoring devices are gaining momentum as organizations aim to reduce environmental impact. Federal and state incentives for water conservation create favorable market opportunities. Businesses and municipalities increasingly adopt smart irrigation to meet regulatory compliance, achieve green certifications, and optimize long-term irrigation costs through reduced water consumption.

- For instance, CropX employs soil sensors and data analytics for real-time irrigation optimization across various crops. This approach delivers over 40% water conservation while boosting yields by around 10%.

Key Challenges

High Initial Installation and Integration Costs

Despite strong benefits, the upfront cost of deploying smart irrigation systems remains a key barrier, particularly for small farms and residential users. Controllers, sensors, and cloud-based platforms require substantial investment, while integrating these systems with existing irrigation infrastructure adds technical complexity. Limited awareness of long-term cost savings further slows adoption. Budget constraints within municipal landscaping programs also hinder broader implementation, especially in regions with limited funding for infrastructure modernization.

Limited Connectivity and Technical Skill Gaps in Rural Areas

Many rural agricultural regions face connectivity issues that restrict the use of cloud-based and IoT-enabled irrigation tools. Weak cellular networks and limited broadband availability reduce the performance of real-time monitoring systems. Additionally, users often lack the technical expertise needed to operate advanced platforms, analyze sensor data, or troubleshoot system malfunctions. This skill gap increases dependence on service providers and slows widespread adoption in remote farming communities.

Regional Analysis

United States

The United States dominated the North America Smart Irrigation Market with a 71.4% share in 2024, driven by strong adoption across precision agriculture, commercial landscaping, golf courses, and municipal green spaces. The country benefits from advanced IoT infrastructure, supportive water-conservation regulations, and widespread use of automated controllers and soil-moisture sensors. States such as California, Texas, and Arizona lead deployment due to severe drought conditions and stringent water-use policies. Increasing integration of AI-enabled irrigation platforms and smart city landscaping programs continues to strengthen U.S. leadership, supported by significant investments from agriculture technology providers and urban sustainability initiatives.

Canada

Canada accounted for a 21.8% share in 2024, supported by rising adoption of smart irrigation systems across high-value agriculture, greenhouse production, and public landscaping. The country experiences growing demand for water-efficient solutions as climate variability intensifies, particularly in provinces like Alberta, Ontario, and British Columbia. Canadian farms increasingly adopt weather-based controllers, advanced drip irrigation, and sensor-driven monitoring to enhance crop resilience and optimize water usage. Government incentives promoting sustainable agriculture and municipal green-space management further stimulate market expansion. Continued integration of connected irrigation platforms and winter-resilient technologies strengthens Canada’s role in the regional market.

Mexico

Mexico held a 6.8% share in 2024, supported by expanding demand for modern irrigation solutions in agriculture-dominant regions facing chronic water scarcity. Adoption grows rapidly across fruit, vegetable, and export-oriented crop farms that rely on precise water management to maintain yield quality and reduce operational losses. Drip irrigation and sensor-enabled systems gain traction as growers prioritize efficiency under rising water-cost pressures. Government programs promoting irrigation modernization, particularly in arid northern states, support the shift toward smart irrigation. Increasing interest from commercial landscaping, hotels, and resorts further contributes to Mexico’s emerging presence in the regional market.

Market Segmentations:

By Component Type:

- Controllers and Sensors

- Flow Meters

- Water Management Software

- Weather-Based Sensors

By Irrigation Type:

- Agricultural Irrigation

- Landscape and Turf Irrigation

- Drip Irrigation

- Greenhouse and Nursery Irrigation

- Sports Fields and Stadiums

By Application:

- Precision Agriculture

- Residential Landscaping

- Commercial Landscaping

- Golf Courses

- Public and Municipal Landscaping

By Communication Technology:

- Wired Systems

- Wireless Systems

By Geography

- United States

- Canada

- Mexico

Competitive Landscape

Competitive landscape in the North America Smart Irrigation Market features key players such as Galcon, The Toro Company, Banyan Water, Inc., Rain Bird Corporation, NETAFIM, Weathermatic, Orbit Irrigation Products LLC, Rachio Inc., HUNTER INDUSTRIES, and HydroPoint. These companies actively expand their portfolios through advanced controllers, AI-enabled scheduling platforms, cloud-based water-management software, and sensor-integrated irrigation solutions designed for agricultural, residential, and commercial use. Vendors prioritize innovation in weather-based automation, flow monitoring, and predictive analytics to enhance water efficiency and system reliability. Strategic partnerships with municipalities, landscaping firms, and agritech integrators strengthen market penetration, while investments in mobile apps and connected IoT ecosystems improve user accessibility. Manufacturers also focus on regulatory compliance, sustainability-driven product design, and drought-resilient irrigation technologies to align with evolving water-use policies across the U.S., Canada, and Mexico. Overall, intensifying R&D initiatives and digital integration continue to shape a highly dynamic competitive environment.

Key Player Analysis

Recent Developments

- In October 2025 Rain Bird Corporation acquired Rachio, Inc., expanding its footprint in smart, sustainable irrigation solutions.

- In 2023, NETAFIM introduced a new line of smart drip irrigation systems equipped with IoT sensors and cloud-based analytics to support real-time soil-moisture monitoring and precision water management.

- In 2022 the company HydroPoint partnered with Aliaxis to offer integrated smart irrigation and leak/flow monitoring solutions for building irrigation and landscape water management.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Component Type, Irrigation Type, Application, Communication Technology and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Adoption of AI-enabled irrigation scheduling will increase as farms and landscapes prioritize data-driven water management.

- Integration of IoT sensors, cloud platforms, and mobile controls will expand across residential, commercial, and municipal applications.

- Water-scarcity challenges and stricter conservation regulations will accelerate demand for automated and efficient irrigation systems.

- Growth in precision agriculture will boost usage of soil-moisture sensors, weather-based controllers, and predictive analytics.

- Smart city development will create strong opportunities for connected irrigation networks in public parks and urban landscapes.

- The landscaping sector will adopt more advanced automation to reduce labor needs and enhance irrigation accuracy.

- Rising environmental sustainability requirements will support wider deployment of water-efficient irrigation technologies.

- Manufacturers will invest heavily in AI, ML, and remote-monitoring capabilities to improve system performance.

- Expansion of commercial green spaces, golf courses, and sports facilities will drive long-term adoption.

- Government incentives and supportive agricultural modernization programs will strengthen market penetration across the region.

Market Segmentation Analysis:

Market Segmentation Analysis: