Market Overview

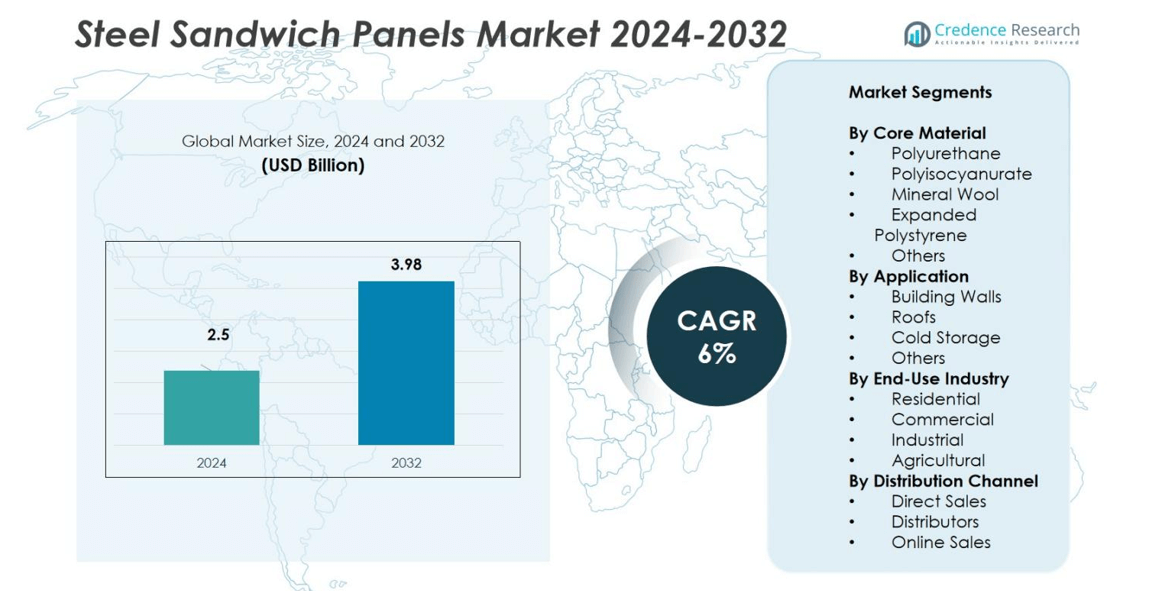

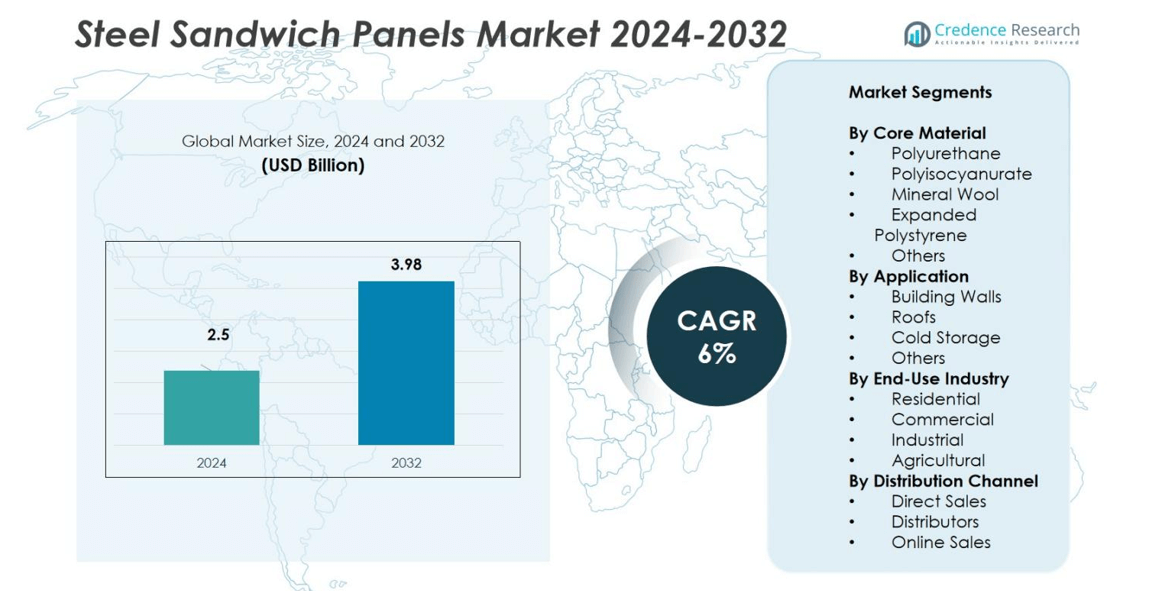

Steel Sandwich Panels Market size was valued at USD 2.5 billion in 2024 and is anticipated to reach USD 3.98 billion by 2032, growing at a CAGR of 6% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Steel Sandwich Panels Market Size 2024 |

USD 2.5 billion |

| Steel Sandwich Panels Market, CAGR |

6% |

| Steel Sandwich Panels Market Size 2032 |

USD 3.98 billion |

The Steel Sandwich Panels Market is highly competitive, featuring prominent players such as Tata Steel Limited, ArcelorMittal, Kingspan Group, Nucor Corporation, Mitsubishi Chemical Corporation, Ruukki Construction, Metecno Group, Assan Panel, Isopan S.p.A., and Paroc Group. These companies focus on product innovation, energy-efficient insulation technologies, and sustainable material development to strengthen their market presence. Strategic expansions, mergers, and technological advancements in fire-resistant and eco-friendly panels drive their competitiveness. Europe leads the global market with a 32% share in 2024, supported by strict energy efficiency regulations, modernization of infrastructure, and strong demand for green building materials across industrial and commercial construction projects.

Market Insights

- The Steel Sandwich Panels Market was valued at USD 2.5 billion in 2024 and is projected to reach USD 3.98 billion by 2032, growing at a CAGR of 6%.

- Rising construction of industrial, commercial, and cold storage facilities is driving market demand for durable and energy-efficient panel solutions.

- Increasing adoption of recyclable and fire-resistant materials reflects a trend toward sustainability and compliance with global green building standards.

- The competitive landscape features major players such as Tata Steel, Kingspan Group, ArcelorMittal, and Nucor, focusing on innovation and regional expansion.

- Europe leads with a 32% share due to strict insulation regulations, followed by North America at 28% and Asia Pacific at 27%, supported by rapid industrialization and infrastructure growth.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis

By Core Material

Polyurethane (PU) dominates the steel sandwich panels market with a 38% share in 2024, driven by its superior thermal insulation, lightweight properties, and moisture resistance. The material’s low thermal conductivity enhances building energy efficiency, making it the preferred choice for modern construction projects. Polyisocyanurate follows closely due to its improved fire resistance and structural integrity. Rising demand for energy-efficient and eco-friendly building materials further supports PU’s dominance, especially in industrial and commercial cold storage facilities where insulation performance is critical.

- For instance, Covestro’s PU foam is widely used in refrigerated trucks and cold storage facilities, providing excellent energy conservation and maintaining food freshness by effectively blocking ambient temperatures.

By Application

Building walls represent the dominant application segment, accounting for 42% of the market share in 2024, supported by rapid urbanization and increasing demand for modular construction. Steel sandwich panels are widely adopted for external and internal walls in industrial and commercial buildings due to their strength, insulation, and quick installation. Roof applications also hold significant potential, driven by their ability to enhance energy efficiency. Government incentives for green construction and retrofitting projects continue to reinforce the use of panels in wall systems.

- For instance, ArcelorMittal’s Promisol® sandwich panels with polyisocyanurate (PIR) core are used in the external walls of large industrial facilities, delivering high thermal insulation and fire resistance, which are critical for energy-efficient and safe building envelopes.

By End-Use Industry

The industrial sector leads the steel sandwich panels market with a 40% share in 2024, driven by growing investments in manufacturing and logistics infrastructure. Industries prefer these panels for warehouses, cleanrooms, and processing units due to their fire resistance, load-bearing capacity, and low maintenance. The commercial sector follows, fueled by expansion in retail and office construction. Increasing adoption of prefabricated structures and sustainable materials strengthens demand from industrial users seeking cost-effective and thermally efficient building solutions.

Key Growth Drivers

Rising Demand for Energy-Efficient Building Materials

The growing focus on energy-efficient infrastructure significantly drives the steel sandwich panels market. These panels offer excellent thermal insulation, reducing heating and cooling costs by up to 30%. Government policies promoting green building standards accelerate their adoption across residential and commercial sectors. Industries favor them for sustainability and reduced carbon emissions. Increasing construction activities in urban areas, coupled with stricter energy codes, further strengthen market expansion for steel sandwich panels as an eco-friendly and cost-efficient solution.

- For instance, Viraat Industries’ PUF Sandwich Panels are documented to reduce HVAC energy usage by up to 40%, supporting builders in meeting green certifications like LEED.

Expansion of Industrial and Commercial Infrastructure

Rapid industrialization and commercial development globally are fueling market growth. Manufacturers and logistics companies increasingly prefer steel sandwich panels for warehouses, factories, and distribution centers due to their durability, fire resistance, and quick installation. The commercial sector also benefits from modern aesthetics and insulation properties suited for malls and offices. The rise of prefabricated construction methods further supports this growth, as panels enable faster completion times and reduced labor costs while maintaining high structural performance.

Increasing Cold Storage and Refrigeration Facilities

The expansion of the cold chain sector contributes significantly to steel sandwich panel demand. These panels maintain consistent internal temperatures and minimize energy losses in refrigeration units and storage facilities. Growth in food processing, pharmaceuticals, and e-commerce logistics sectors is accelerating installations of temperature-controlled buildings. The panels’ moisture resistance and hygiene-friendly surfaces make them ideal for cold storage construction, supporting the preservation of perishable goods. Global demand for efficient cold chain solutions reinforces their market share in industrial applications.

- For instance, Rauta Group’s frameless sandwich panel technology enables rapid construction of refrigerator warehouses with high energy efficiency, allowing cold storage chambers to be built without separate framing and assembled within days.

Key Trends & Opportunities

Adoption of Sustainable and Recyclable Materials

Sustainability trends strongly influence market innovation, with manufacturers investing in recyclable and low-emission materials. The use of eco-friendly core materials, such as mineral wool and bio-based foams, reduces environmental impact. Companies also enhance recyclability through modular design, allowing easier dismantling and reuse. Rising environmental awareness among builders and developers creates opportunities for steel sandwich panels in green-certified projects. This trend aligns with global initiatives promoting circular construction practices and energy-efficient materials in infrastructure development.

- For instance, ROCKWOOL Core Solutions, a brand within the independent ROCKWOOL Group, supplies the Spanrock® mineral wool core, which has achieved the Cradle to Cradle (C2C) Material Health Certificate at the Bronze level.

Integration of Smart Manufacturing Technologies

Automation and digital manufacturing are transforming steel sandwich panel production. Advanced robotics and precision cutting technologies improve consistency, reduce waste, and enhance panel performance. Integration of IoT systems in production lines allows real-time quality monitoring, ensuring optimal insulation and fire-resistance properties. Manufacturers adopting Industry 4.0 practices gain efficiency and flexibility to meet customized project demands. These innovations not only lower production costs but also position manufacturers to meet growing global demand with faster delivery times.

- For instance, Jinggong has developed continuous sandwich panel machine lines that utilize smart monitoring to track production metrics in real time, ensuring consistent product quality with minimized material waste.

Key Challenges

Fluctuating Raw Material Prices

Volatility in steel and insulation material prices presents a major challenge for manufacturers. Steel, a primary component, is sensitive to global supply chain disruptions, energy costs, and geopolitical tensions. Frequent price shifts impact production costs and profit margins. Companies struggle to maintain competitive pricing while ensuring product quality. This instability may also slow down project timelines as contractors hesitate to commit to bulk purchases. Managing procurement strategies and adopting long-term supplier partnerships are key to mitigating this challenge.

High Initial Investment and Installation Costs

Despite long-term energy savings, the high initial installation cost of steel sandwich panels restricts adoption among small contractors and residential developers. Advanced materials like polyurethane and mineral wool add to expenses. Transportation and handling costs further increase due to the panels’ size and weight. Limited awareness in emerging markets about lifecycle benefits also slows adoption. To overcome this, manufacturers focus on modular and lightweight innovations that reduce cost barriers and make panels more accessible across all construction segments.

Regional Analysis

North America

North America held a 28% share in 2024, driven by strong demand from industrial, commercial, and cold storage construction. The U.S. leads the region, supported by increasing adoption of energy-efficient materials and stringent building insulation standards. Growing investment in logistics and food storage infrastructure further boosts panel installations. Manufacturers focus on fire-resistant and sustainable solutions to meet regulatory and environmental requirements. Ongoing warehouse expansion and renovation projects across Canada and Mexico also contribute to regional growth, supported by rising interest in modular and prefabricated construction systems.

Europe

Europe accounted for a 32% market share in 2024, making it the leading region due to advanced construction practices and strict energy efficiency regulations. Countries such as Germany, France, and the U.K. drive demand through sustainable building initiatives and retrofitting projects. The growing preference for recyclable materials, including mineral wool-based panels, supports regional sustainability goals. Increasing demand from industrial and agricultural sectors further strengthens the market outlook. Government subsidies for green buildings and modernization of public infrastructure continue to enhance the adoption of steel sandwich panels across European countries.

Asia Pacific

Asia Pacific captured a 27% share in 2024, propelled by rapid urbanization and industrial expansion in China, India, and Southeast Asia. Rising investments in manufacturing, logistics, and commercial real estate increase panel usage across new infrastructure projects. The growing emphasis on affordable housing and energy-efficient buildings supports long-term growth. Local manufacturers are expanding production capacity to meet demand for thermally insulated and cost-effective solutions. Governments promoting sustainable urban construction and industrial modernization projects further enhance regional demand for steel sandwich panels across diverse end-use industries.

Latin America

Latin America represented a 7% share in 2024, supported by increasing investments in industrial and commercial facilities. Brazil and Mexico lead regional adoption, driven by infrastructure modernization and warehouse development. Growing construction in retail and hospitality sectors also contributes to market expansion. Rising awareness of energy-efficient building materials promotes the use of insulated panels for temperature regulation and durability. However, economic volatility and fluctuating raw material prices restrain faster growth. Manufacturers are focusing on local partnerships and low-cost production to strengthen their regional presence.

Middle East & Africa

The Middle East & Africa held a 6% market share in 2024, with steady growth supported by infrastructure and commercial construction projects. Gulf countries, including the UAE and Saudi Arabia, drive demand through large-scale developments and cold storage facilities for food distribution. Rising temperatures in the region increase the need for thermal insulation in industrial and residential buildings. In Africa, expanding industrial parks and logistics hubs boost demand for durable construction materials. Increasing investments in renewable energy and sustainable construction are expected to enhance future market potential.

Market Segmentations:

By Core Material

- Polyurethane

- Polyisocyanurate

- Mineral Wool

- Expanded Polystyrene

- Others

By Application

- Building Walls

- Roofs

- Cold Storage

- Others

By End-Use Industry

- Residential

- Commercial

- Industrial

- Agricultural

By Distribution Channel

- Direct Sales

- Distributors

- Online Sales

By Region

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the Steel Sandwich Panels Market includes major players such as Tata Steel Limited, ArcelorMittal, Kingspan Group, Nucor Corporation, Mitsubishi Chemical Corporation, Ruukki Construction, Metecno Group, Assan Panel, Isopan S.p.A., and Paroc Group. These companies compete on product innovation, thermal efficiency, and sustainable material development. Leading players focus on expanding production capacity, introducing fire-resistant and eco-friendly panels, and strengthening regional distribution networks. Kingspan and Tata Steel emphasize advanced insulation technologies and modular construction systems to meet global green building standards. ArcelorMittal and Nucor invest heavily in R&D to enhance structural performance and corrosion resistance. Meanwhile, local manufacturers such as Metecno and Assan Panel focus on cost-effective solutions and rapid delivery. Strategic mergers, partnerships, and new plant establishments remain common, enabling companies to expand their geographic reach and improve product portfolios to serve growing construction, industrial, and cold storage applications worldwide.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Tata Steel Limited

- ArcelorMittal

- Metecno Group

- Isopan S.p.A.

- Paroc Group

- Assan Panel

- Kingspan Group

- Mitsubishi Chemical Corporation

- Nucor Corporation

- Ruukki Construction

Recent Developments

- In October 2024, Invespanel introduced a new series of sandwich panels made with ArcelorMittal’s XCarb® recycled and renewably produced steel, enhancing sustainability in construction.

- In June 2025, Rinac India Limited announced a strategic partnership with Epta to bolster India’s sandwich panels market.

- In June 2025, EPACK Prefab Technologies Limited inaugurated a modern sandwich panel manufacturing facility in Mambattu, Andhra Pradesh, aimed at increasing production capacity and strengthening its presence in India’s growing prefab construction sector.

Report Coverage

The research report offers an in-depth analysis based on Core Material, Application, End Use Industry, Distribution Channel and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will witness steady growth driven by demand for energy-efficient construction materials.

- Adoption of eco-friendly and recyclable core materials will rise in green building projects.

- Technological advancements in automated panel manufacturing will improve quality and reduce costs.

- Industrial infrastructure expansion will continue to fuel demand for durable insulated panels.

- Cold storage and logistics facilities will remain a major application area due to temperature control needs.

- Prefabricated and modular construction methods will accelerate panel usage in commercial projects.

- Fire-resistant and sound-insulated panels will gain traction in urban construction.

- Asia Pacific will emerge as the fastest-growing regional market with strong industrial investments.

- Strategic collaborations and acquisitions among key manufacturers will enhance market competitiveness.

- Digitalization and smart factory integration will drive operational efficiency in panel production.