Market Overview

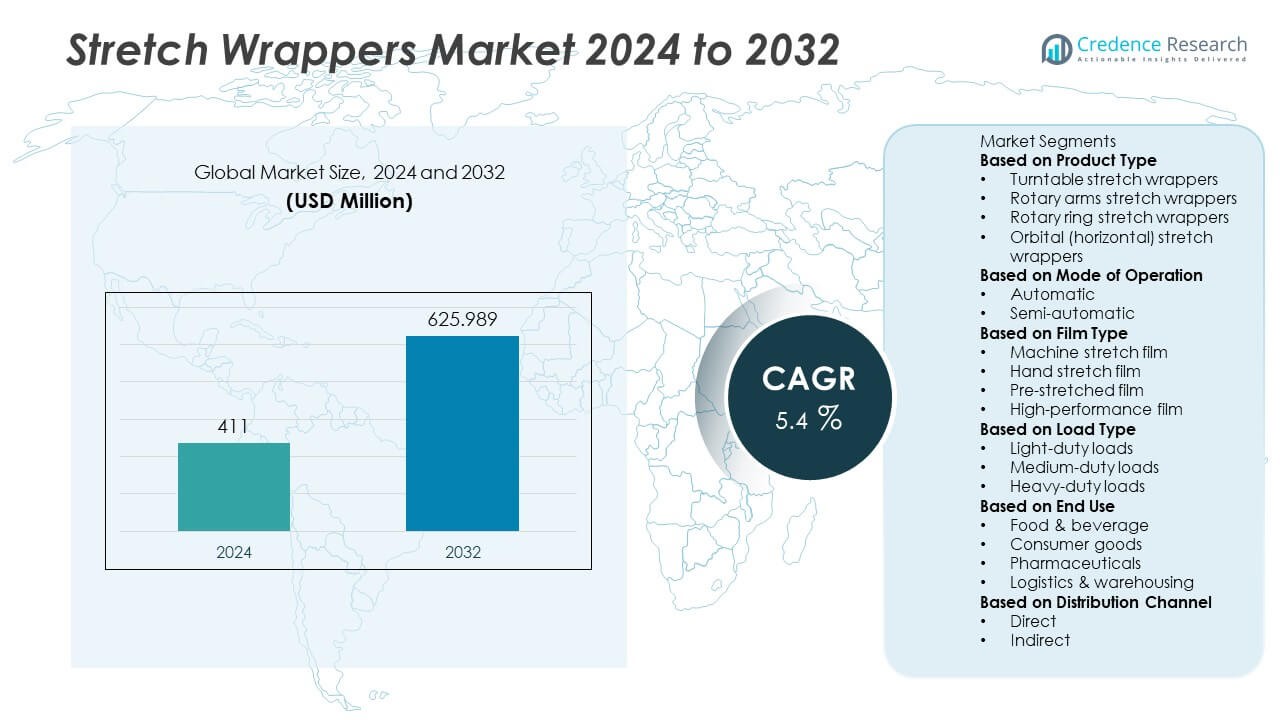

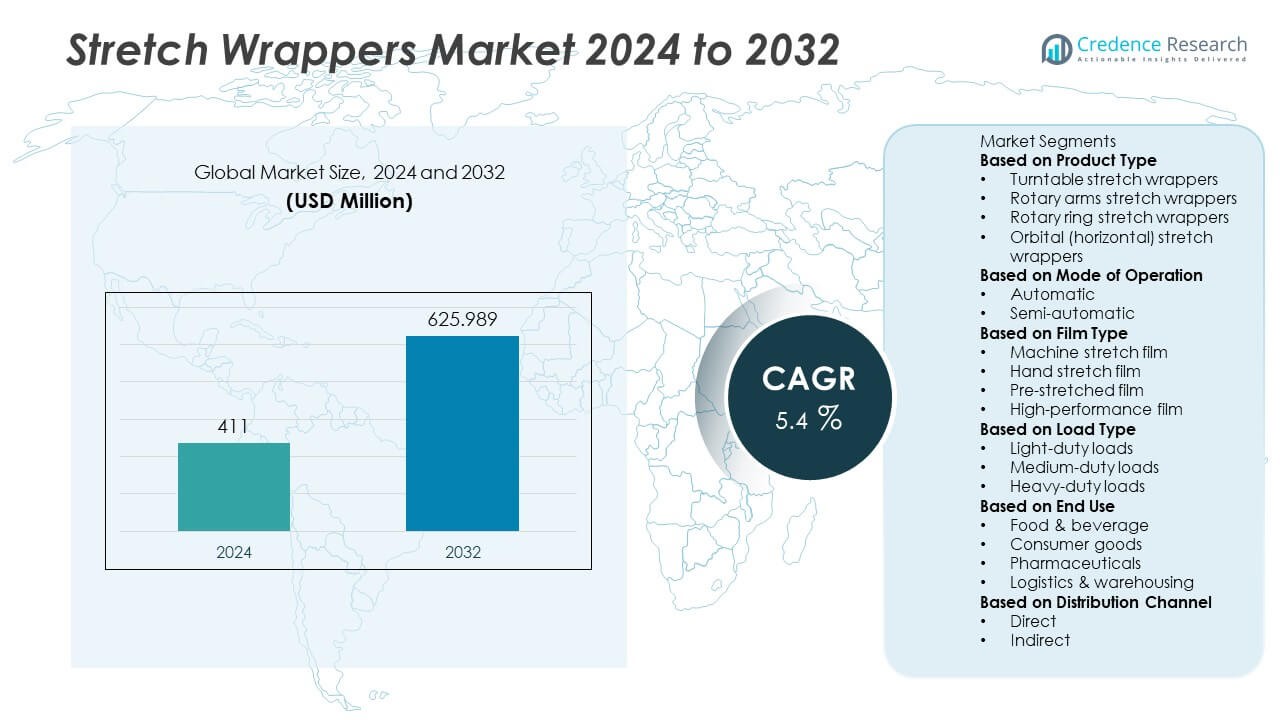

The global Stretch Wrappers Market was valued at USD 411 million in 2024 and is projected to reach approximately USD 625.989 million by 2032, expanding at a compound annual growth rate (CAGR) of 5.4% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2024 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Stretch Wrappers Market Size 2024 |

USD 411 Million |

| Stretch Wrappers Market, CAGR |

5.4% |

| Stretch Wrappers Market Size 2032 |

USD 625.989 Million |

The Stretch Wrappers Market is driven by rising demand for efficient packaging solutions in logistics, food, and manufacturing sectors. Companies seek automation to improve load stability, reduce product damage, and lower labor costs. Growing e-commerce activity has increased the need for secure pallet packaging during transit. The market trends highlight a shift toward eco-friendly films and energy-efficient machines. Integration of IoT and smart sensors into stretch wrappers supports better operational control and predictive maintenance.

The Stretch Wrappers Market shows strong activity across key regions such as North America, Europe, Asia Pacific, and Latin America. North America remains a prominent market due to its advanced logistics infrastructure and high automation adoption across industries. Europe emphasizes sustainable packaging solutions and regulatory compliance, which drives demand for energy-efficient and recyclable stretch wrapping systems. Asia Pacific is witnessing rapid growth, particularly in China and India, where expanding manufacturing and e-commerce sectors fuel the need for robust packaging systems. Latin America and the Middle East are gradually adopting automated wrapping technologies to improve packaging efficiency.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Stretch Wrappers Market was valued at USD 411 million in 2024 and is expected to reach USD 625.989 million by 2032, growing at a CAGR of 5.4% during the forecast period.

- Strong demand for automated packaging solutions across logistics, food, and beverage industries is a key driver boosting equipment adoption and operational efficiency.

- Sustainability trends are reshaping product development, with manufacturers investing in machines that reduce film waste, support recyclable materials, and enhance energy efficiency.

- The market features moderate competition with companies such as Lantech, Phoenix Wrappers, and Fromm Packaging Systems focusing on innovation, durability, and customization to meet industry-specific needs.

- High initial investment cost and maintenance complexities act as key restraints, especially for small and medium-sized enterprises with limited budgets.

- North America leads the market in technology integration and automation, while Asia Pacific shows rapid growth due to manufacturing expansion and rising e-commerce activities.

- European regions focus on eco-compliance and energy-efficient operations, while Latin America and the Middle East gradually adopt semi-automatic systems to modernize their packaging infrastructure.

Market Drivers

Rising Demand for Automation Across End-Use Industries Enhances Market Penetration

The Stretch Wrappers Market benefits from increasing automation in logistics, food and beverage, pharmaceuticals, and manufacturing. Companies aim to improve packaging speed, consistency, and safety through automated stretch wrapping systems. These machines reduce manual labor requirements and enhance load stability during storage and transportation. The push for operational efficiency and reduced downtime drives demand for semi-automatic and fully automatic machines. E-commerce growth has also contributed to higher throughput requirements in distribution centers, prompting investments in advanced stretch wrapping solutions. The Stretch Wrappers Market reflects this demand shift through higher adoption across both large-scale production lines and mid-sized operations.

- For instance, Lantech reported in its 2023 product release that its fully automatic Q-3000 stretch wrapper achieves up to 150 loads per hour, reducing manual labor by 70% while maintaining consistent film tension for load stability. These machines reduce manual labor requirements and enhance load stability during storage and transportation.

Focus on Load Stability and Product Safety in Transit Promotes Equipment Use

Companies prioritize load containment and damage prevention during shipping, prompting widespread deployment of stretch wrappers. The Stretch Wrappers Market responds to this need by offering machines capable of consistent film application, ensuring secure pallet loads. Industries such as chemicals, electronics, and consumer goods require strict packaging standards to avoid loss or liability during transport. Stretch wrappers help maintain load integrity and minimize movement, reducing product waste and return costs. Innovations in film tension control and pre-stretch capabilities also support greater efficiency in film usage. It enables firms to meet safety regulations while optimizing material consumption.

- For instance, Orion Packaging Systems integrated InstaThread technology into its Sentry LP machine, enabling a 260% film pre-stretch ratio, which helped BASF reduce annual stretch film usage by 18,200 kg in its chemical logistics division in Germany.

Sustainability Goals and Film Optimization Drive Equipment Advancements

Sustainability objectives lead businesses to optimize film consumption and reduce plastic waste, influencing purchase decisions in the Stretch Wrappers Market. Equipment manufacturers are developing machines with advanced film carriage systems that enable precise film usage and reduced environmental impact. Load-specific wrapping programs also allow customization that avoids excess material use. By minimizing over-wrapping, companies lower operational costs and improve eco-performance metrics. The market supports this transition with innovations that balance performance and material efficiency. It aligns with broader corporate sustainability commitments across global supply chains.

Rising Labor Costs and Shortage of Skilled Operators Encourage Machine Adoption

High labor costs and workforce shortages in packaging facilities create favorable conditions for automated stretch wrapper adoption. The Stretch Wrappers Market reflects this shift through increased demand for plug-and-play systems that require minimal training. User-friendly interfaces, programmable logic controllers, and remote diagnostics further reduce dependency on skilled technicians. These capabilities lower the total cost of ownership while improving productivity. Businesses are seeking reliable automation to mitigate labor risks and maintain consistent packaging output. It supports long-term operational stability and reduces process variability.

Market Trends

Integration of Smart Technologies Enhances Machine Efficiency and Monitoring

The Stretch Wrappers Market is witnessing growing integration of smart technologies such as IoT-enabled sensors, machine learning algorithms, and real-time monitoring tools. These features allow businesses to track performance metrics, reduce downtime, and conduct predictive maintenance. Operators can access machine data remotely, helping streamline workflows and make informed decisions. It improves equipment uptime while reducing unexpected maintenance costs. Demand for smart stretch wrappers is rising in sectors that prioritize operational intelligence and data-driven packaging processes. This trend supports long-term digital transformation strategies within manufacturing and logistics facilities.

- For instance, Atlanta Stretch’s SYNTHESI with Arm model features an 11″ touch-screen panel and programmable logic controller (PLC) allowing storage of up to 99 wrap programs for versatile load handling, aiding businesses facing frequent product changes on the line.

Customization and Modularity Gain Importance for End-User Flexibility

End users increasingly require packaging systems that offer adaptability across diverse product lines and pallet sizes. The Stretch Wrappers Market addresses this trend by offering modular designs and customizable configurations. Machines with adjustable wrapping parameters and scalable components provide flexibility for manufacturers with varied load types. It enables smooth transitions between product runs without extensive reconfiguration. Industries with seasonal demand shifts or mixed-product pallets benefit from this design approach. Customization allows businesses to improve efficiency while avoiding excess equipment investment.

- For instance, Phoenix Wrappers introduced its PLP-2150 with a modular turntable design and 10 pre-programmable wrap profiles, which allowed PepsiCo India to switch between 7 different bottle configurations per shift without stopping the line, reducing line changeover time to under 6 minutes.

Sustainable Film Use and Material Optimization Shape Purchase Decisions

Demand for eco-conscious packaging practices influences technology choices in the Stretch Wrappers Market. Companies are adopting machines that optimize film use through pre-stretch capabilities and precision control features. This reduces plastic consumption while maintaining load integrity and compliance. It helps firms align with internal sustainability goals and emerging regulatory expectations. Businesses are evaluating wrappers based on film efficiency, recyclability support, and material compatibility. Sustainable packaging practices now form a key factor in procurement and operational strategy.

Compact and Space-Saving Equipment Designs Gain Popularity in Urban Facilities

The rise of micro-fulfillment centers and urban warehousing drives interest in compact stretch wrapping machines. The Stretch Wrappers Market is seeing a shift toward smaller footprint equipment that fits within tight production or packaging zones. Space-efficient designs allow for smooth integration without major facility upgrades. It supports agile operations in locations with limited square footage. Businesses operating in high-rent or metropolitan areas are prioritizing machines that combine performance with layout flexibility. This trend aligns with the evolving structure of distribution and manufacturing networks.

Market Challenges Analysis

High Initial Investment and Maintenance Complexity Limit Adoption in Small Enterprises

The Stretch Wrappers Market faces a notable challenge in the form of high capital expenditure required for advanced machinery. Small and medium-sized enterprises often struggle to justify the cost of automated systems, particularly when packaging needs fluctuate. It requires a significant upfront investment in both equipment and skilled labor for operation and upkeep. Maintenance tasks involve technical knowledge and scheduled servicing to avoid mechanical failures, which adds operational costs. Many businesses hesitate to adopt fully automated wrappers due to uncertainty around long-term return on investment. This financial barrier restricts market penetration in developing regions and cost-sensitive industries.

Inconsistency in Film Quality and Load Compatibility Affects Performance Standards

Stretch wrapping performance depends heavily on the quality of film and load stability, and inconsistency in these areas hampers effectiveness. The Stretch Wrappers Market experiences operational setbacks when low-grade or incompatible films lead to tears, over-stretching, or load failure. It results in increased waste, safety concerns, and product damage during transportation. Manufacturers must fine-tune machine settings for varying pallet configurations and film properties, which adds complexity to usage. Lack of standardization in film specifications across suppliers further complicates operations. These issues reduce efficiency and hinder the reliability of automated systems in dynamic packaging environments.

Market Opportunities

Growing Demand for Automation in Logistics and Warehousing Supports Equipment Integration

The Stretch Wrappers Market holds strong potential in industries modernizing their logistics and warehousing operations. Manufacturers and distributors increasingly invest in automated packaging solutions to reduce manual labor and improve throughput. It aligns with broader trends in smart factories and Industry 4.0 adoption. Integration of stretch wrappers with conveyor systems and warehouse management software enhances overall operational efficiency. Faster wrapping cycles, reduced film waste, and minimal human intervention appeal to high-volume environments. Companies that prioritize automation to meet tight delivery schedules and labor cost management present new demand avenues.

Rising Focus on Sustainable Packaging Drives Need for Film Optimization Technology

Sustainability targets across industries create new growth prospects for film-efficient wrapping technologies. The Stretch Wrappers Market can leverage this shift by promoting equipment that uses minimal film while maintaining load security. It encourages manufacturers to adopt film pre-stretch capabilities and load stabilization features that reduce material usage. Demand is growing for machines compatible with recyclable and biodegradable films. Regulatory pressure and corporate ESG commitments further push businesses toward sustainable packaging practices. These trends open up opportunities for innovation in eco-efficient wrapping solutions and aftermarket services focused on sustainable upgrades.

Market Segmentation Analysis:

By Product Type:

The Stretch Wrappers Market segments product types into turntable, rotary arm, ring, and robotic stretch wrappers. Turntable models dominate the segment due to their compact design and cost-effectiveness, making them suitable for small to medium-scale operations. Rotary arm and ring stretch wrappers serve high-speed production lines where stability and continuous operation are critical. Robotic stretch wrappers offer flexibility for wrapping irregular loads and support decentralized packaging. It supports logistics operations requiring mobility and variable load handling. Manufacturers prefer robotic units in facilities with limited floor space and varied packaging needs.

- For instance, Robopac’s Robot S7 robotic stretch wrapper features a 300% pre-stretch film carriage and can wrap up to 250 loads per charge, improving material efficiency in variable-load facilities. Manufacturers prefer robotic units in facilities with limited floor space and varied packaging needs.

By Mode of Operation:

The Stretch Wrappers Market categorizes operation modes into automatic, semi-automatic, and manual systems. Automatic systems lead the segment due to their higher efficiency and compatibility with large-scale industrial packaging environments. It supports high throughput, consistent load wrapping, and integration with end-of-line automation. Semi-automatic machines serve mid-tier users balancing cost with moderate automation needs. Manual stretch wrappers remain relevant in small businesses and low-volume applications due to their affordability and ease of use. The demand for automated systems grows in sectors prioritizing labor reduction and packaging consistency.

- For instance, Orion’s automatic stretch top loaders process between 30 to 120 loads per hour, depending on the model and integration level, delivering wrap automation with load height sensing and film tail sealing both fully automated.

By Film Type:

The Stretch Wrappers Market segments film usage into pre-stretched film and standard stretch film. Pre-stretched films gain preference due to reduced film consumption, lighter rolls, and easier handling. It helps minimize film breakage while maintaining load integrity. Standard stretch films maintain application in operations requiring high elasticity and varied load profiles. Compatibility with eco-friendly and recyclable films influences machine selection across industries. Companies focus on film performance and sustainability to align with cost-control strategies and environmental standards. This shift encourages innovation in film tension control and material adaptability.

Segments:

Based on Product Type

- Turntable stretch wrappers

- Rotary arms stretch wrappers

- Rotary ring stretch wrappers

- Orbital (horizontal) stretch wrappers

Based on Mode of Operation

Based on Film Type

- Machine stretch film

- Hand stretch film

- Pre-stretched film

- High-performance film

Based on Load Type

- Light-duty loads

- Medium-duty loads

- Heavy-duty loads

Based on End Use

- Food & beverage

- Consumer goods

- Pharmaceuticals

- Logistics & warehousing

Based on Distribution Channel

Based on the Geography:

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis

North America

North America commands approximately 35% of the global Stretch Wrappers Market. Strong demand stems from established logistics, warehousing, and manufacturing sectors. The United States and Canada drive adoption through automation investments, particularly in e‑commerce fulfillment. High labor costs and regulatory expectations prompt demand for energy-efficient film use and advanced stretch wrapping equipment. It thrives on supply chains prioritizing operational reliability and speed. Machine suppliers respond with IoT-enabled solutions, predictive maintenance tools, and comprehensive aftermarket services suited to North American needs.

Asia Pacific

Asia Pacific accounts for close to 30% of the global market. Rapid industrialization, expanding manufacturing bases, and booming e‑commerce—especially in China and India—fuel automation in packaging. The region demands efficient and cost-effective stretch wrapping systems for high-volume operations. It pushes for eco-friendly innovations, with many operators seeking solutions compatible with recyclable and biodegradable films.

Europe

Europe occupies around 20% of the market. Stringent environmental regulations and circular economy goals drive preference for low-waste, energy-saving stretch wrappers. Countries like Germany, France, Italy, and the UK lead adoption of advanced, modular systems optimized for recycled films and sustainable operation. It supports production lines in automotive, pharmaceuticals, and retail sectors that demand precision and regulatory compliance.

Latin America

Latin America holds approximately 8% of the market. Growth centers on Brazil and Argentina, where food processing and chemical industries increasingly adopt automated wrapping to boost packaging efficiency. It benefits from machinery that balances performance with affordability. Demand continues to grow as local manufacturers modernize and align with export standards.

Middle East & Africa

The Middle East & Africa region contributes about 7% of the global. Leading markets like Saudi Arabia, South Africa, and the UAE invest in stretch wrappers to support growing industrial and pharmaceutical packaging needs. It sees rising interest in rotary arm systems and smart machinery capable of handling complex load types. Infrastructure development and regulatory shifts encourage further adoption of efficient packaging technologies

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Competitive Analysis

The Stretch Wrappers Market features a competitive landscape shaped by innovation, product customization, and service reliability. Leading players such as Lantech, Phoenix Wrappers, Fromm Packaging Systems, Arpac, Orion Packaging Systems, Premier Tech, Atlanta Stretch, Nitech IPM, Paxiom Group, and Berran Industrial consistently focus on expanding their portfolios to meet evolving packaging demands. These companies invest in automation technologies, offering advanced control systems, improved film tensioning mechanisms, and reduced cycle times to enhance throughput. Lantech remains a pioneer in semi-automatic and automatic stretch wrappers, prioritizing durability and operator safety. Phoenix Wrappers emphasizes machine versatility and support services to retain its strong client base. Fromm Packaging Systems and Arpac develop robust solutions for high-volume applications, targeting industries such as food and beverage, pharmaceuticals, and logistics. Companies like Orion and Atlanta Stretch focus on modular designs that integrate easily into existing production lines.

Recent Developments

- In January 2025, FROMM Packaging, in collaboration with Duplomatic MS Mechatronics, launched an all-electric strapping machine designed for lumber packs. This innovation aims to enhance performance and efficiency while promoting sustainability through reduced energy consumption and maintenance, and eliminating hydraulic fluids.

- In September 2024, Premier Tech launched the TOMA™ line, its first cobot-based packaging automation system. This system combines collaborative robotics with Premier Tech’s MOVN™ software for a user-friendly, “do-it-yourself” automation experience.

- In June 2024, Phoenix Wrappers, now part of the Pacteon Group, continues to focus on developing innovative, rugged, and reliable semi-automatic and automatic stretch wrap machines.

Market Concentration & Characteristics

The Stretch Wrappers Market exhibits a moderately concentrated structure, with a mix of global manufacturers and regional suppliers shaping its competitive dynamics. It features a blend of established companies offering comprehensive packaging solutions and niche players catering to specific industry needs. The market favors players that deliver durable, customizable, and automated machinery suited to high-speed operations across logistics, food and beverage, and pharmaceuticals. It emphasizes machine adaptability, low maintenance, and energy efficiency, which encourages continuous innovation. Vendors focus on developing cost-effective systems that reduce film waste and enhance load stability. The market displays characteristics of stable demand, driven by consistent packaging needs and a shift toward automation in end-use sectors. It also supports long product lifecycles, with after-sales service and technical support playing a crucial role in vendor selection. Strong customer relationships, machine performance, and integration with digital control systems define competitive strength in the Stretch Wrappers Market.

Report Coverage

The research report offers an in-depth analysis based on Product Type, Mode of Operation, Film Type, Load Type, End Use, Distribution Channel and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for automation in packaging processes will continue to boost the adoption of stretch wrappers across industries.

- Manufacturers will invest in energy-efficient and low-maintenance machines to meet sustainability goals.

- The market will see rising demand for semi-automatic models in small and mid-sized enterprises seeking cost-effective solutions.

- Integration of IoT and smart controls will enhance operational efficiency and reduce human error.

- Growth in e-commerce and third-party logistics will drive the need for high-speed stretch wrapping systems.

- Manufacturers will focus on modular and customizable machines to suit diverse application requirements.

- Demand for high-performance film compatibility will influence product development strategies.

- Emerging economies will provide expansion opportunities due to increasing industrial activity and packaging needs.

- Players will strengthen service offerings such as remote diagnostics, predictive maintenance, and training.

- The market will witness stronger regulatory influence pushing for eco-friendly materials and efficient energy usage