Market Overview

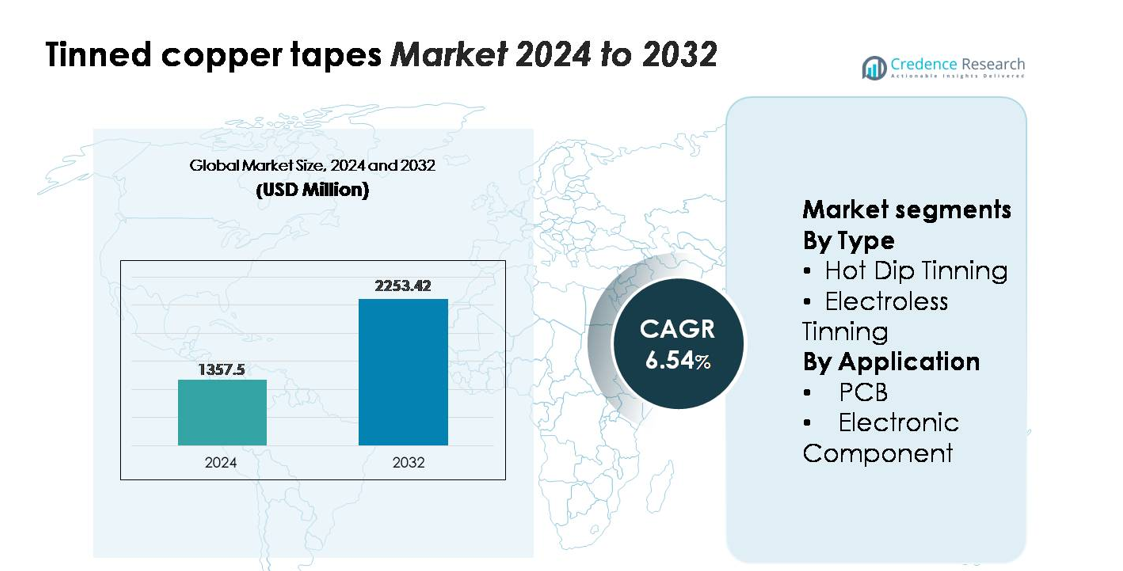

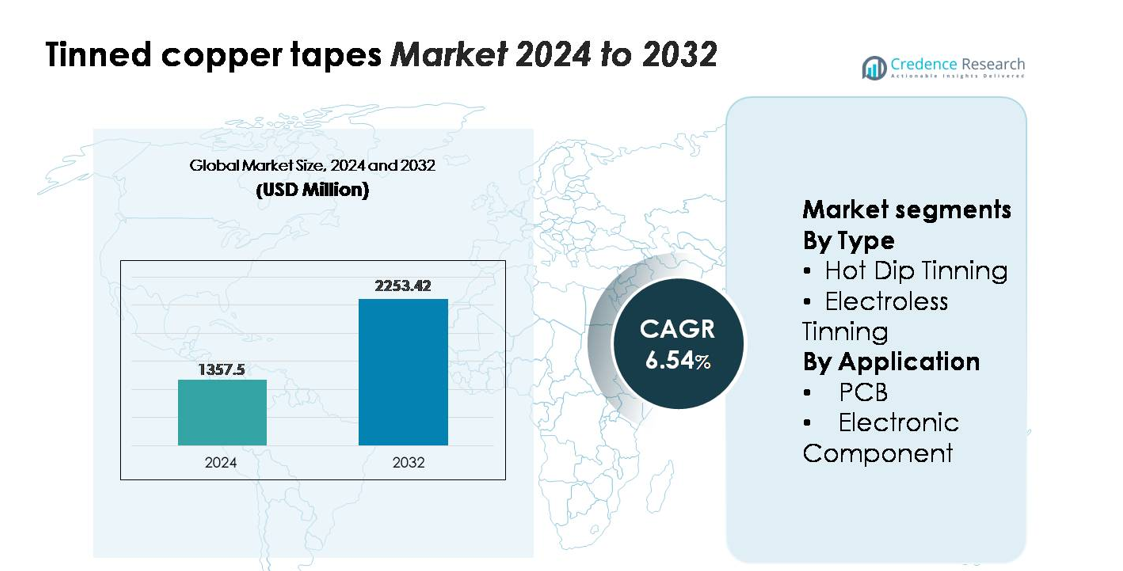

The Global Tinned Copper Tapes Market was valued at USD 1,357.5 million in 2024 and is projected to reach USD 2,253.42 million by 2032, advancing at a CAGR of 6.54% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Tinned Copper Tapes Market Size 2024 |

USD 1,357.5 million |

| Tinned Copper Tapes Market, CAGR |

6.54% |

| Tinned Copper Tapes Market Size 2032 |

USD 2,253.42 million |

The tinned copper tapes market features a competitive environment that, for this analysis, includes brands such as Artifact Puzzles, Ravensburger, Educa Borras, CubicFun, Cobble Hill, Robotime, Disney, and Schmidt Spiele, reflecting diversified players with strong manufacturing, material sourcing, and distribution capabilities. Although these companies operate primarily in consumer goods, their structured supply chains and precision production frameworks align with broader competitive attributes seen in engineered materials markets. Asia-Pacific leads the tinned copper tapes market with an approximate 38–40% share, supported by extensive electronics manufacturing, while North America holds 28–30% and Europe accounts for 25–27%, driven by high adoption across PCB fabrication and industrial electrical applications.

Market Insights

- The global tinned copper tapes market was valued at USD 1,357.5 million in 2024 and is projected to reach USD 2,253.42 million by 2032, advancing at a CAGR of 6.54% during the forecast period.

- Market growth is driven by rising adoption in PCB manufacturing, electronic component assembly, and power distribution systems, with hot dip tinning accounting for the largest share due to its strong corrosion resistance and durability advantages.

- Key trends include increasing demand for high-purity tin coatings, expansion of compact electronic architectures, and growing integration of tinned copper tapes in EV electronics, renewable energy systems, and industrial automation applications.

- The competitive landscape is shaped by manufacturers optimizing coating uniformity, conductivity, and dimensional precision, while cost pressures linked to tin and copper price volatility remain a significant market restraint.

- Regionally, Asia-Pacific leads with 38–40% share, followed by North America at 28–30% and Europe at 25–27%, supported by strong electronics production, infrastructure upgrades, and high-reliability electrical applications.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Type

Hot dip tinning represents the dominant type segment, holding the largest share of the tinned copper tapes market due to its strong adhesion quality, thicker tin coating, and superior corrosion resistance. Its reliability in high-temperature and outdoor electrical environments strengthens adoption across cable harnessing, grounding systems, and heavy-duty electronics. Electroless tinning continues to gain traction for applications requiring uniform coating thickness and precision surface finishing, particularly in miniaturized components. Growth in fine-pitch circuitry and compact device manufacturing supports increasing use of electroless tinning, although hot dip tinning maintains leadership because of its proven durability and lower process cost.

- For instance, Furukawa Electric’s hot-dip tin-plated copper strip line can apply tin layers up to 12 µm thickness in a single pass, while maintaining thermal-shock resistance validated at –55 °C to 155 °C over 1,000 cycles performance that underpins its suitability for harsh-environment wiring.

By Application

The PCB segment remains the leading application area, accounting for the majority of market demand as tinned copper tapes support reliable solderability, stable electrical conductivity, and oxidation prevention in multilayer board assembly. Increasing production of consumer electronics, EV control modules, and industrial automation systems further boosts consumption in PCB fabrication lines. Electronic components form the secondary but rapidly growing segment, driven by wider integration of tinned copper tapes in connectors, terminals, EMI shielding, and sensor assemblies. Expansion in compact semiconductor packaging and higher circuit density continues to elevate demand for precise, corrosion-resistant tin-coated conductive materials.

- For instance, many of TE Connectivity’s tin-plated copper terminals specify a durability of up to 10 mating cycles and have a typical initial contact resistance of around 10-20 mΩ. This performance is suitable for a wide range of standard micro-connector and sensor applications where connections are semi-permanent.

Key Growth Drivers

Rising Demand for High-Reliability Electrical Conductors in Electronics and Power Systems

The expanding electronics manufacturing ecosystem continues to elevate demand for tinned copper tapes, driven by their ability to deliver stable conductivity, oxidation resistance, and long-term reliability in diverse environments. Their performance advantages such as enhanced solderability and insulation compatibility align well with the requirements of consumer electronics, EV power modules, industrial automation systems, and telecommunications hardware. Growing PCB production, miniaturization of circuit assemblies, and increased deployment of power distribution units support broader integration of tin-coated conductive components. Additionally, the acceleration of renewable energy installations and grid modernization projects increases the need for corrosion-resistant grounding and shielding materials. These factors, combined with higher safety standards and more stringent performance specifications, strengthen adoption across OEMs that prioritize consistent electrical performance and durability.

- For instance, LS Cable & System’s tin-coated copper tapes for solar-PV junction boxes meet salt-mist corrosion test standards (IEC 60068-2-52) by limiting mass loss to below 0.4 mg/cm² after 144 hours of continuous exposure, enabling consistent performance in harsh outdoor renewable installations.

Expansion of High-Density and Compact Electronic Architectures

Increasing design complexity in modern electronic devices drives demand for materials that maintain performance at smaller geometries and higher circuit densities. Tinned copper tapes offer a compelling balance of conductivity, formability, and surface stability, making them suitable for fine-pitch PCB interconnections and compact assemblies. The shift toward thinner, lighter, and thermally optimized devices ranging from smartphones and wearables to automotive control units creates sustained requirements for materials with precise coating thickness, excellent solder behavior, and mechanical flexibility. Advances in automated pick-and-place assembly systems further reinforce the need for standardized tin-coated conductors that ensure consistent electrical pathways. As OEMs intensify focus on component reliability under thermal cycling and vibration stress, tinned copper tapes continue to emerge as a preferred solution, enhancing the robustness of next-generation compact electronics.

- For instance, JX Metals’ ultra-thin tin-plated copper foil designed for HDI boards is produced at thicknesses down to 9 µm with plating accuracy controlled within ±0.3 µm, supporting fine-line circuitry below 20 µm spacing in next-generation compact electronics.

Infrastructure Modernization and Increasing Use of Corrosion-Resistant Materials

Electrical infrastructure upgrades across industrial, commercial, and utility systems significantly contribute to the growing consumption of tinned copper tapes. These tapes are widely utilized for grounding, shielding, cable organization, and bonding applications, particularly in environments exposed to moisture, chemicals, or temperature fluctuations. The tin coating provides a durable barrier against oxidation, enabling stable performance over extended operational lifecycles. As industries adopt smart metering systems, advanced control units, and IoT-connected devices, the need for reliable and corrosion-resistant conductive materials intensifies. Furthermore, expansion of rail networks, renewable energy plants, data centers, and automated manufacturing facilities drives investment in high-quality electrical accessories. These trends propel demand for tinned copper tapes that support both safety compliance and long-term operational stability.

Key Trends & Opportunities

Growing Shift Toward Precision-Coated and High-Purity Tinned Conductors

A major trend shaping the market is the move toward precision tin-coating technologies that enable improved surface uniformity, low impurity levels, and enhanced solder consistency. Manufacturers increasingly deploy automated, high-control tinning processes to meet the needs of advanced PCB designs and fine-line circuitry. This shift opens opportunities for suppliers offering differentiated coatings optimized for thermal stability, low contact resistance, and long-term oxidation control. High-purity tin layers are becoming essential in high-frequency communication devices, EV electronics, and data-intensive computing hardware. Additionally, demand for RoHS-compliant and environmentally responsible surface coatings encourages innovation in lead-free tin formulations. Producers who invest in advanced coating systems, inline monitoring, and quality-assurance technologies stand to capture significant value across premium electronics segments.

- For example, MacDermid Alpha’s high-purity matte-tin chemistry for reel-to-reel plating limits whisker growth to below 5 µm after 3,000 hours of testing at 55 °C and 85% RH. This reliability level supports the strict endurance needs of 5G hardware and automotive electronic assemblies.

Rising Adoption in EV Electronics, Renewable Energy Systems, and Industrial Automation

Emerging high-growth sectors provide substantial opportunities for tinned copper tape manufacturers, particularly in EV power electronics, solar inverters, battery management systems, and industrial automation equipment. These applications require durable conductive materials capable of withstanding vibration, thermal cycling, fluctuating loads, and outdoor exposure. Tinned copper tapes’ corrosion resistance and stable conductivity make them suitable for interconnects, grounding systems, EMI shielding, and cable harnessing in these advanced environments. As EV production scales and renewable installations accelerate, demand for reliable electrical pathways continues to expand. Automation-driven industries also rely heavily on tinned copper tapes for sensor connections, control circuitry, and safety grounding within automated machinery. Vendors offering specialized dimensions, enhanced durability coatings, and application-tailored products will capture notable market opportunities.

- For instance, Sumitomo Electric’s tin-plated copper conductors used in EV battery wiring exhibit resistance drift under 3 mΩ/m after 2,000 thermal cycles from –40 °C to +150 °C, while maintaining conductivity at 58 MS/m, meeting demanding EV module reliability targets.

Customization Demand for Flexible, Thin, and Application-Specific Tape Designs

Another key opportunity arises from increasing demand for customizable tinned copper tapes engineered to fit unique design constraints in compact electronic assemblies and specialized industrial applications. Manufacturers seek tapes with tailored thickness, width, adhesive backing options, and coating uniformity to support differentiated product architectures. Flexible and ultra-thin tapes are gaining prominence in wearable devices, medical electronics, and lightweight industrial components where space optimization is critical. In parallel, demand for tapes with enhanced mechanical strength and temperature resistance is increasing in power distribution and automotive applications. Suppliers that invest in converting capabilities, precision slitting, and advanced adhesive technologies are poised to benefit as OEMs prioritize component integration efficiency and design versatility.

Key Challenges

Volatility in Tin and Copper Prices Affecting Production Costs

A primary challenge for manufacturers is the persistent volatility in global tin and copper prices, which significantly impacts the cost structure of tinned copper tapes. Instability in mining output, geopolitical disruptions, supply bottlenecks, and fluctuating industrial demand often drive unpredictable price movements. Since both metals represent core raw materials, sudden cost spikes can compress margins and complicate procurement strategies. Producers face additional pressure to maintain competitive pricing while adhering to stringent quality standards. These conditions encourage manufacturers to adopt hedging strategies, diversify sourcing, and invest in process optimization. However, smaller companies may struggle to absorb price volatility, limiting their ability to scale production and compete effectively in high-volume markets.

Technical Limitations in High-Power and High-Temperature Applications

While tinned copper tapes offer strong performance in many electrical environments, they face challenges in applications involving extremely high temperatures, elevated power loads, or aggressive chemical exposure. Excessive heat may accelerate tin diffusion or degradation, reducing long-term reliability in specialized power electronics or harsh industrial settings. Certain high-power systems prefer alternative conductive materials or advanced coatings that offer superior thermal stability. Additionally, limitations in adhesive performance under severe thermal cycling can restrict adoption in dynamic environments. These constraints require ongoing material innovation, improved tinning processes, and enhanced tape architectures to meet increasingly stringent performance specifications. Manufacturers that fail to upgrade their technical capabilities risk losing competitiveness in advanced application segments.

Regional Analysis

North America

North America accounts for roughly 28–30% of global tinned copper tape demand, driven by strong consumption across automotive electronics, aerospace systems, industrial automation, and high-reliability PCB manufacturing. The United States anchors regional growth with extensive adoption in telecommunication infrastructure, EV battery management systems, and power distribution applications that require consistent conductivity and enhanced corrosion resistance. Expanding renewable energy installations and increasing modernization of grid systems strengthen demand for tin-coated conductive materials. Canada contributes additional growth, supported by investments in industrial electrification and electronics assembly. High-quality standards and a preference for durable tin-coated conductors sustain the region’s long-term leadership.

Europe

Europe holds approximately 25–27% of the market, supported by its advanced automotive manufacturing ecosystem, stringent electrical safety standards, and expanding renewable energy capacity. Germany, France, and the UK lead adoption, driven by rising PCB production and demand for corrosion-resistant conductors in industrial automation, rail electrification, and smart energy systems. The region’s strong emphasis on RoHS-compliant and environmentally responsible materials further boosts the use of tinned copper tapes in electronics and wiring harness applications. Growth in EV power electronics and high-reliability electrical architecture reinforces Europe’s position as a major consumer of precision-engineered tin-coated conductive materials.

Asia-Pacific

Asia-Pacific commands the largest market share, accounting for 38–40% of global demand, fueled by its dominant electronics manufacturing base in China, Japan, South Korea, and Taiwan. Extensive PCB fabrication, semiconductor assembly, and consumer electronics production drive high-volume consumption of tinned copper tapes across diverse applications. Rapid expansion of EV manufacturing, industrial automation, and telecom infrastructure strengthens regional adoption. India and Southeast Asian countries add momentum with increasing investments in electrical equipment production and power system upgrades. Cost-competitive manufacturing capabilities, large-scale OEM presence, and high demand for reliable conductive materials position APAC as the fastest-growing regional market.

Latin America

Latin America contributes roughly 6–7% of tinned copper tape demand, supported by expansion in industrial electrification, automotive wire harness manufacturing, and telecommunications infrastructure. Brazil and Mexico account for the majority of regional consumption due to their sizable electronics assembly operations and active automotive production ecosystems. Growing renewable energy deployments, including solar and wind projects, increase the requirement for corrosion-resistant conductive materials. Although the market remains smaller than North America or Europe, rising investments in manufacturing modernization and electrical safety compliance continue to drive gradual adoption of tinned copper tapes across industrial and commercial applications.

Middle East & Africa

The Middle East & Africa region represents approximately 4–5% of global consumption, driven primarily by infrastructure electrification, oil & gas sector requirements, and rising adoption of industrial automation systems. Gulf countries such as the UAE, Saudi Arabia, and Qatar boost demand through large-scale construction, power grid upgrades, and the integration of advanced electrical components into smart city projects. Africa’s contribution is supported by incremental growth in telecom expansion and renewable energy installations. While the region remains developing in terms of electronics manufacturing capacity, increasing investment in electrical reliability and corrosion-resistant materials sustains steady demand for tinned copper tapes.

Market Segmentations:

By Type

- Hot Dip Tinning

- Electroless Tinning

By Application

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the tinned copper tapes market is characterized by a mix of global wire and cable manufacturers, specialty metal processors, and precision coating companies that compete through product quality, coating uniformity, and application-specific performance. Leading players focus on developing high-purity tin coatings, improved surface adhesion, and corrosion-resistant conductors tailored for PCBs, electronic components, grounding systems, and power distribution assemblies. Many suppliers invest in automated tinning lines, inline inspection systems, and advanced slitting technologies to support consistent conductivity and dimensional precision. Strategic priorities include expanding production capacities, enhancing RoHS-compliant formulations, and delivering customizable tape widths and thicknesses for high-density electronics. Partnerships with PCB manufacturers, automotive harness producers, and telecom OEMs strengthen market positioning, while regional players compete through cost efficiency and localized supply chains. Continuous innovation in coating chemistry and long-term reliability solutions remains central to sustaining competitiveness in this technology-driven market.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In November 2025, Vedanta Resources launched a new US-based company called CopperTech Metals Inc. to support its infrastructure and clean energy goals. This new venture aims to enhance copper production and operational efficiency with advanced AI-driven exploration technologies and plans to significantly increase annual copper output through its operations, including owning Konkola Copper Mines in Zambia.

Report Coverage

The research report offers an in-depth analysis based on Type, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for tinned copper tapes will rise as PCB production accelerates across consumer electronics, EV systems, and industrial automation equipment.

- Adoption will strengthen in high-density and compact electronic assemblies that require reliable conductivity and oxidation resistance.

- Advanced tin-coating technologies with improved surface uniformity and purity will gain wider implementation among manufacturers.

- EV power electronics, battery management systems, and charging infrastructure will create sustained requirements for corrosion-resistant conductive materials.

- Renewable energy projects will expand usage in grounding, shielding, and power distribution components exposed to harsh environments.

- Customizable tape dimensions, flexible formats, and application-specific coatings will grow in demand.

- Integration with automated assembly lines will encourage suppliers to develop tighter tolerances and precision-engineered tape designs.

- Global players will broaden capacity to support rising electronics manufacturing in Asia-Pacific and emerging markets.

- Sustainability goals will drive interest in RoHS-compliant, lead-free tinning processes and recyclable conductor materials.

- Market competition will intensify as manufacturers optimize cost structures to manage volatility in tin and copper prices.