Market Overview:

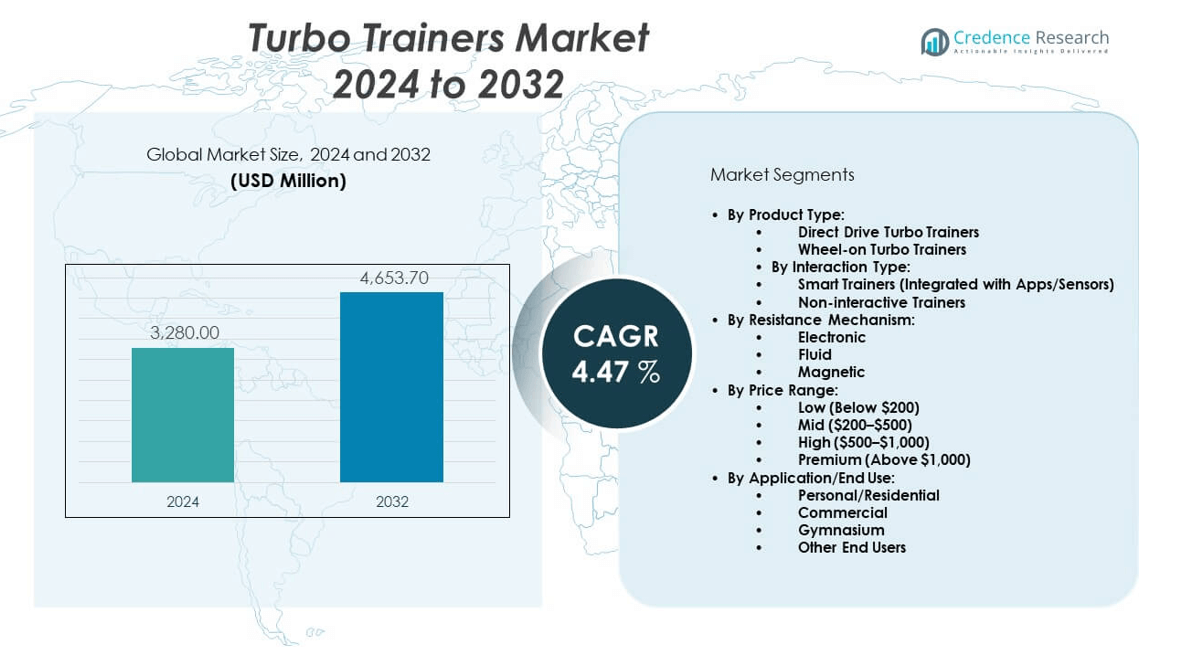

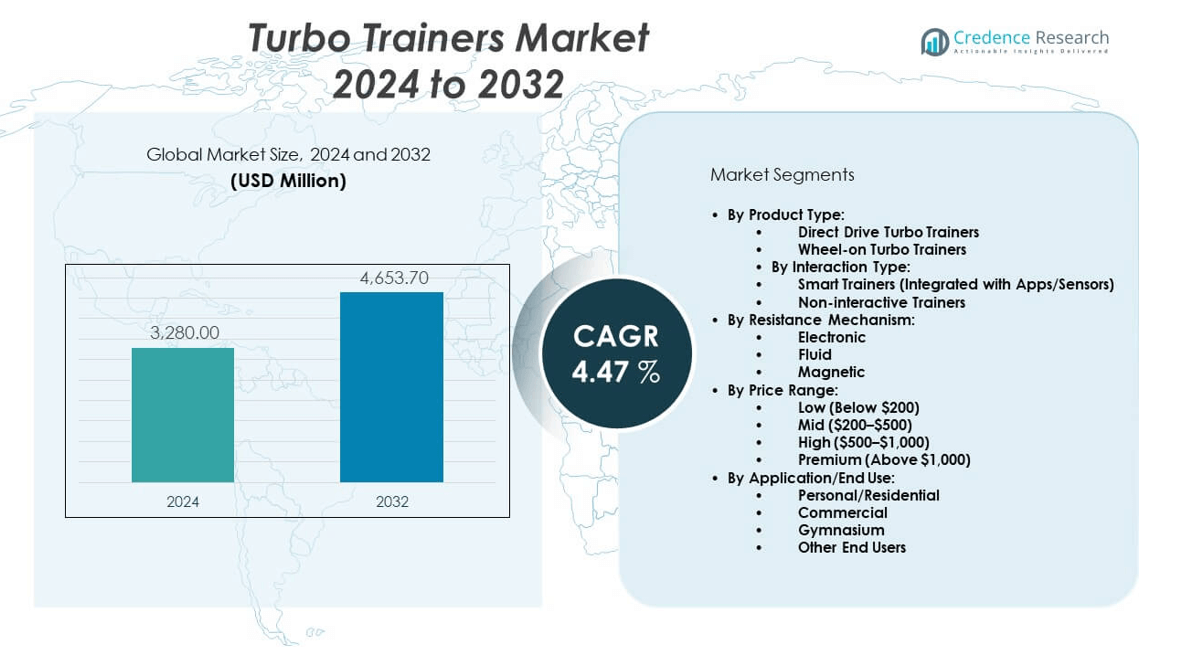

The Turbo trainers market is projected to grow from USD 3,280 million in 2024 to an estimated USD 4,653.7 million by 2032, with a compound annual growth rate (CAGR) of 4.47% from 2024 to 2032.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Turbo Trainers Market Size 2024 |

USD 3,280 million |

| Turbo Trainers Market, CAGR |

4.47% |

| Turbo Trainers Market Size 2032 |

USD 4,653.7 million |

The turbo trainers market is expanding due to rising fitness awareness and increasing demand for indoor cycling solutions that support consistent training regardless of weather conditions. Athletes and fitness enthusiasts favor smart turbo trainers for their connectivity with training apps, offering real-time feedback and performance analytics. Urbanization, busy lifestyles, and growing preference for home workouts have further accelerated product adoption. Manufacturers are innovating with noise reduction, power accuracy, and immersive simulation features, enhancing user experience and driving growth in both premium and mid-range segments.

North America dominates the turbo trainers market, led by strong consumer interest in home fitness equipment and high spending on smart health technologies. Europe holds a significant share due to cycling culture and government support for active lifestyles in countries like Germany and the Netherlands. Asia-Pacific is emerging as a high-growth region, driven by urban density, growing disposable income, and rapid adoption of app-based fitness. Latin America and the Middle East show growing potential due to evolving health trends.

Market Insights:

- The turbo trainers’ market was valued at USD 3,280 million in 2024 and is projected to reach USD 4,653.7 million by 2032, growing at a CAGR of 4.47% during the forecast period.

- Rising health consciousness and demand for weather-independent training solutions are key drivers supporting the expansion of smart and connected turbo trainers.

- High product costs, especially for premium smart trainers, and setup complexity for first-time users restrain broader adoption in emerging markets.

- North America leads the market with 34.5% share, driven by home fitness trends and high expenditure on smart wellness technology.

- Europe holds a 30.2% share, supported by a strong cycling culture and fitness-oriented infrastructure in countries like Germany and the Netherlands.

- Asia-Pacific captures 20.1% of the market, showing strong growth potential due to rising disposable income, fitness app adoption, and urban population density.

- Latin America and the Middle East & Africa together account for nearly 15.2%, with growing awareness and digital fitness integration driving gradual uptake.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers:

Rising Popularity of Indoor Cycling Amid Changing Fitness Preferences:

The turbo trainers market benefits from the shifting fitness landscape, where indoor cycling gains popularity among health-conscious consumers. Gym closures and social distancing norms during global health crises accelerated the adoption of home-based workout solutions. Cyclists now prioritize convenience, weather independence, and safety, all of which turbo trainers provide. The ability to train year-round, regardless of climate or location, drives recurring demand from both amateur and professional cyclists. Online fitness platforms and virtual riding apps like Zwift and TrainerRoad complement turbo trainer use, enhancing the overall indoor cycling experience. This integration reinforces user engagement and encourages long-term equipment investment. The market responds by offering compatible trainers with high-performance sensors and software integration. The turbo trainers market adapts quickly to evolving consumer behavior focused on personal fitness goals and technological convenience.

- For instance, Wahoo Fitness reported a 300% increase in registrations on its Wahoo SYSTM platform in 2020, reflecting the surge in home-based cycling training, while Garmin’s Tacx NEO 2T Smart became a popular choice among pro-cyclists for its near-silent operation (<59 dB) and year-round training capabilities.

Technological Advancements Improving Performance and Interactivity:

Continuous improvements in smart trainer technology drive strong interest in the turbo trainers market. Manufacturers incorporate real-time resistance adjustment, power accuracy calibration, and immersive feedback systems into their products. These innovations offer riders a realistic and personalized training environment that mirrors outdoor cycling conditions. Bluetooth and ANT+ connectivity allow seamless integration with popular fitness apps and wearable devices. Gamified cycling simulations and interactive group rides enhance training enjoyment and user retention. Professional athletes and serious amateurs demand precision and customizable features, spurring innovation in high-end models. Entry-level segments also benefit from trickle-down effects, with affordable options gaining smart features. The turbo trainers market expands its technological portfolio to meet user expectations for data-driven and engaging workouts.

- For instance, Elite’s Direto XR smart trainer delivers power measurement accuracy within ±1.5%, and offers up to 2,300 watts of resistance, while Saris’ H3 model operates at just 59 decibels at 20 mph, enabling riders to train with near-native outdoor feel and minimal noise disruption.

Expansion of the Home Fitness Equipment Market Supporting Growth:

The surge in home fitness equipment adoption strengthens the position of the turbo trainers market within the broader wellness ecosystem. Consumers increasingly invest in multi-functional, compact, and tech-enabled equipment for home gyms. Turbo trainers align with this demand by offering a space-efficient and low-maintenance solution that transforms standard bicycles into powerful training machines. The home-based fitness model appeals to users seeking time flexibility and personalized exercise routines. Brands leverage this trend by offering bundled packages that include software access, training plans, and customer support. Subscription-based services integrated with turbo trainers generate recurring revenue and reinforce brand loyalty. Global retailers and e-commerce platforms contribute to expanded product availability and user reach. The turbo trainers market leverages this environment to drive adoption across diverse demographic segments.

Growing Awareness of Athletic Training and Endurance Development:

Heightened interest in endurance sports and structured athletic training supports sustained growth in the turbo trainers market. Recreational riders, triathletes, and cyclists incorporate structured indoor training into their routines to improve stamina, performance, and race preparedness. Turbo trainers provide the consistency and control required for periodized training programs. Sports professionals and coaches promote their use for recovery, interval training, and power output optimization. Fitness influencers and community groups increase exposure by sharing turbo trainer routines and performance results. Product endorsements by elite athletes build trust and validate product capabilities. This influence drives adoption among aspiring athletes and fitness enthusiasts. The turbo trainers market capitalizes on this momentum by offering targeted features such as climb simulation, cadence tracking, and resistance levels matched to real-world terrains.

Market Trends:

Integration with Virtual Training Platforms and Competitive Ecosystems:

One of the most prominent trends in the turbo trainers market is the integration with digital platforms that offer structured training, virtual races, and online cycling communities. Platforms like Zwift, Rouvy, and Wahoo SYSTM create immersive digital environments that replicate competitive cycling events. These platforms turn solo workouts into social, interactive experiences that boost motivation and consistency. Riders benefit from personalized analytics, leaderboards, and adaptive training plans based on performance data. Brands actively partner with app developers to ensure seamless compatibility and real-time synchronization. The trend also drives demand for smart trainers equipped with automatic resistance adjustment and wireless data transmission. The turbo trainers market aligns itself with the gamification of fitness, transforming traditional training into a fully digital and competitive experience.

- For instance, Zwift reached over 4 million registered users by mid-2023 and regularly hosts online events with over 10,000 concurrent participants, leading Wahoo and Tacx to launch trainers with direct Bluetooth and ANT+ FE-C compatibility supporting real-time gradient simulations exceeding 20%.

Eco-Conscious Product Innovation Gaining Traction Among Manufacturers:

Sustainability influences product design and consumer choice in the turbo trainers market. Manufacturers explore recyclable materials, energy-efficient production processes, and durable build quality to reduce environmental impact. Eco-conscious consumers favor long-lasting equipment with minimal energy consumption and responsible packaging. Brands adopt modular designs that simplify repair, reduce waste, and extend product lifecycles. Marketing strategies emphasize sustainability credentials to attract environmentally aware buyers. This trend opens pathways for innovation in design and materials, such as aluminum frames, low-noise flywheels, and biodegradable components. The turbo trainers market strengthens its appeal to conscientious consumers by aligning product development with global sustainability goals and circular economy principles.

- For instance, Technogym reports that over 95% of the weight of each product is made from recyclable materials, with disassembly systems supporting efficient recovery of raw materials at the end of the product lifecycle. Select lines have over 60% recycled plastic content, reducing CO2 emissions by 50%.

Compact, Foldable, and Portable Trainers for Urban Living:

Urban consumers drive the demand for space-saving and portable turbo trainers that fit compact living environments. Foldable designs with integrated carry handles and quick-release mechanisms appeal to apartment dwellers and mobile users. Manufacturers focus on lightweight materials without compromising structural stability or performance. The growing remote workforce values versatile equipment that can be set up and stored easily. This trend encourages innovation in compact mechanical resistance systems and efficient footprint management. Brands position their products for flexible use, whether in small indoor spaces, garages, or temporary setups. The turbo trainers market evolves to accommodate urban lifestyles and shifting household fitness priorities.

Rise of Direct Drive and Wheel-Off Trainers in Premium Segment:

Direct drive turbo trainers dominate the high-end segment due to their precision, durability, and road-like feel. These trainers replace the rear wheel entirely and connect directly to the drivetrain, eliminating tire wear and noise. Enthusiasts and professionals value the consistent resistance, real-time feedback, and compatibility with wide gear ranges. Manufacturers expand product lines to include adjustable axle standards and multi-cassette options to support various bike types. The trend emphasizes long-term investment in performance-oriented trainers with high torque capacity and silent operation. The turbo trainers market responds by focusing R&D on wheel-off systems that offer superior user experience and mechanical accuracy, appealing to serious athletes and tech-savvy users.

Market Challenges Analysis:

High Cost and Limited Accessibility in Emerging Markets:

Price sensitivity remains a major obstacle for the turbo trainers market in developing regions. Premium models with smart features and direct drive mechanisms can cost several hundred dollars, making them less accessible to budget-conscious consumers. Economic disparity, lack of awareness, and lower indoor cycling culture hinder adoption across emerging economies. Distribution networks and service support are often limited outside metropolitan areas, creating barriers to market penetration. Import tariffs and taxes inflate final retail prices, reducing competitiveness against basic fitness alternatives. Consumers prioritize essential home appliances over discretionary purchases like advanced fitness equipment. Limited access to digital platforms and reliable internet connectivity also undermines the appeal of connected smart trainers. The turbo trainers market must overcome these constraints through price diversification, regional partnerships, and offline marketing strategies.

Technical Complexity and Setup Incompatibility Limiting User Adoption:

The setup process and compatibility issues present challenges for first-time users in the turbo trainers market. Wheel-off trainers often require knowledge of cassettes, thru-axles, and drivetrain alignment, which can overwhelm non-technical consumers. Lack of universal standards across bike types and frame sizes further complicates installation. Software integration with third-party apps may require firmware updates, app subscriptions, and device syncing, creating friction for casual users. Users who lack mechanical skills or guidance may abandon use altogether. Warranty concerns and lack of local technical support discourage high-value purchases. This complexity affects customer satisfaction and product return rates. The turbo trainers market needs to address these challenges through simplified onboarding, universal adapters, and improved customer education tools.

Market Opportunities:

Expansion Through E-commerce and Direct-to-Consumer Models:

The turbo trainers market can scale rapidly through digital commerce and brand-owned online stores. E-commerce platforms enable global product reach, eliminate intermediaries, and improve price competitiveness. Brands leverage these channels to offer exclusive bundles, subscription add-ons, and tailored promotions. Enhanced user analytics from direct sales support product customization and long-term engagement strategies.

Customization, Accessories, and Subscription Ecosystems:

Future growth in the turbo trainers market will emerge from value-added offerings such as training plans, personalized resistance settings, and compatible accessories like climbing simulators or riser blocks. Subscription models that include coaching, progress tracking, and community events increase recurring revenue and foster brand loyalty. The market can capitalize on cross-selling and bundled service strategies to boost profitability.

Market Segmentation Analysis:

By Product Type

The turbo trainers’ market is segmented into direct drive and wheel-on trainers. Direct drive turbo trainers lead in performance, offering higher accuracy, realistic road feel, and reduced noise. These are preferred by professionals and serious cyclists. Wheel-on trainers remain relevant due to lower cost and simpler setup, making them ideal for beginners and casual users. Both types serve distinct user bases and support varied training intensities.

- For instance, Tacx’s NEO 2T Smart direct-drive trainer features pedal stroke analysis and can simulate gradients up to 25%, while JetBlack Cycling’s VOLT direct drive model offers a claimed power accuracy of ±2.5% and is compatible with multiple cassette systems without adapters.

By Interaction Type

Smart trainers dominate the interaction segment, supported by compatibility with apps like Zwift, TrainerRoad, and Wahoo SYSTM. These units provide data tracking, dynamic resistance, and immersive ride experiences. Non-interactive trainers appeal to cost-sensitive users who prioritize basic indoor cycling functions without digital integration. This segment caters primarily to users with limited connectivity needs or traditional workout preferences.

- For instance, BKOOL’s Smart Pro 2 offers simulation of slopes up to 20% and supports BT/ANT+ connectivity for seamless app pairing, whereas Minoura’s M-agTire II remains a popular non-interactive model for its low-cost, magnetic resistance setup valued by entry-level users.

By Resistance Mechanism

Electronic resistance systems gain market share due to their precision and adaptive resistance features. Fluid resistance trainers remain popular for offering a quiet, progressive resistance curve, ideal for indoor use. Magnetic resistance trainers target budget-conscious users and offer fixed resistance levels suitable for steady-state workouts. Each mechanism addresses different training preferences and price points.

By Price Range

The mid ($200–$500) and high ($500–$1,000) price segments capture the majority of demand, balancing performance with affordability. Premium products above $1,000 cater to competitive cyclists seeking advanced simulation and durability. Low-cost models below $200 address entry-level use but have limited features.

By Application/End Use

Personal/residential use holds the largest market share, driven by growing interest in home fitness solutions. Commercial and gymnasium segments contribute stable demand for shared-use equipment with robust performance and longevity. Other end users include rehabilitation centers and institutional fitness setups.

Segmentation:

By Product Type:

- Direct Drive Turbo Trainers

- Wheel-on Turbo Trainers

By Interaction Type:

- Smart Trainers (Integrated with Apps/Sensors)

- Non-interactive Trainers

By Resistance Mechanism:

- Electronic

- Fluid

- Magnetic

By Price Range:

- Low (Below $200)

- Mid ($200–$500)

- High ($500–$1,000)

- Premium (Above $1,000)

By Application/End Use:

- Personal/Residential

- Commercial

- Gymnasium

- Other End Users

By Region:

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis:

North America

North America holds the largest share in the turbo trainers’ market, accounting for 34.5% of the global revenue. The region benefits from a strong culture of cycling, high disposable incomes, and widespread adoption of home fitness technologies. Consumers show high engagement with interactive training platforms, driving demand for smart and premium direct drive trainers. The United States leads regional growth with well-established brands and robust e-commerce penetration. Presence of fitness influencers and digital cycling communities supports product visibility. Canada follows with steady demand for indoor training equipment due to long winters and growing wellness awareness.

Europe

Europe captures 30.2% of the turbo trainers’ market, led by countries such as the UK, Germany, France, and the Netherlands. High cycling participation rates and government support for fitness initiatives drive sustained market interest. Brands like Tacx and Elite maintain strong local footholds, offering technologically advanced trainers suited to varying performance needs. Consumers in the region prioritize quality, connectivity, and environmental features in purchasing decisions. Growth in digital fitness subscriptions complements equipment sales. E-commerce platforms and specialty sports retailers play key roles in product accessibility across Western and Central Europe.

Asia Pacific and Other Regions

Asia Pacific accounts for 20.1% of the turbo trainers’ market, with China, Japan, Australia, and South Korea leading adoption. Rising urban fitness culture, smartphone penetration, and interest in connected health solutions fuel market expansion. Local and international brands compete through pricing and feature innovation. Latin America contributes 8.1%, driven by emerging fitness awareness and growing middle-class spending on home training tools. The Middle East & Africa holds a 7.1% share, where market growth remains limited due to infrastructure gaps and economic disparity. The turbo trainers market expands gradually across these regions as brands localize offerings and improve distribution networks.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- Garmin/Tacx

- Wahoo Fitness

- Elite

- Technogym

- JetBlack Cycling

- Saris

- Minoura

- Kurt Kinetic

- Peloton Interactive

- Wattbike Ltd.

Competitive Analysis:

The turbo trainers market features intense competition driven by innovation, brand reputation, and integration with smart training platforms. Key players like Garmin/Tacx, Wahoo Fitness, and Elite lead with advanced direct drive and smart trainer offerings. These companies prioritize precision, connectivity, and compatibility with third-party apps. Mid-tier brands such as JetBlack Cycling and Saris focus on cost-effective, feature-rich alternatives. Market leaders compete through software ecosystems, subscription services, and product durability. Differentiation often hinges on noise reduction, power accuracy, and app-based interactivity. New entrants face barriers due to brand loyalty and distribution dominance by incumbents. The turbo trainers market maintains a balance between premium and mid-range segments to address varied consumer needs.

Recent Developments:

- In July 2024, JetBlack Cyclingpartnered with Zwift to create bundled offerings, making JetBlack’s Volt smart trainers more accessible to users looking for a complete indoor cycling ecosystem.

- In 7 Dec 2023, Garmin/Tacx announced the launch of the Tacx NEO 3M, an advanced direct-drive smart trainer featuring enhanced realism and connectivity, aiming to strengthen its position among high-end indoor cycling enthusiasts.

Market Concentration & Characteristics:

The turbo trainers market shows moderate concentration, with a few global players accounting for a significant revenue share. It remains innovation-driven, with manufacturers competing on smart technology, build quality, and user experience. High brand loyalty, especially among performance cyclists, creates stability in premium segments. The market caters to both residential and commercial demand, with online distribution channels driving volume. It combines hardware precision with digital engagement, making product ecosystems a defining competitive feature.

Report Coverage:

The research report offers an in-depth analysis based on Product Type, Interaction Type, Resistance Mechanism, Price Range and Application/End Use. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Smart trainer integration with AR/VR platforms will redefine immersive indoor cycling.

- Demand for low-noise, high-accuracy trainers will drive direct drive product development.

- AI-based personalized training programs will gain traction across fitness levels.

- E-commerce platforms will remain dominant in sales channel expansion.

- Partnerships between hardware makers and app developers will strengthen product ecosystems.

- Emerging markets will show steady growth with price-sensitive models and regional distribution.

- Modular trainer designs will support customizability and component upgrades.

- Growth in indoor racing leagues and virtual events will boost product adoption.

- Sustainability in materials and packaging will influence purchase decisions.

- Subscription services bundled with hardware will create new recurring revenue models.