| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

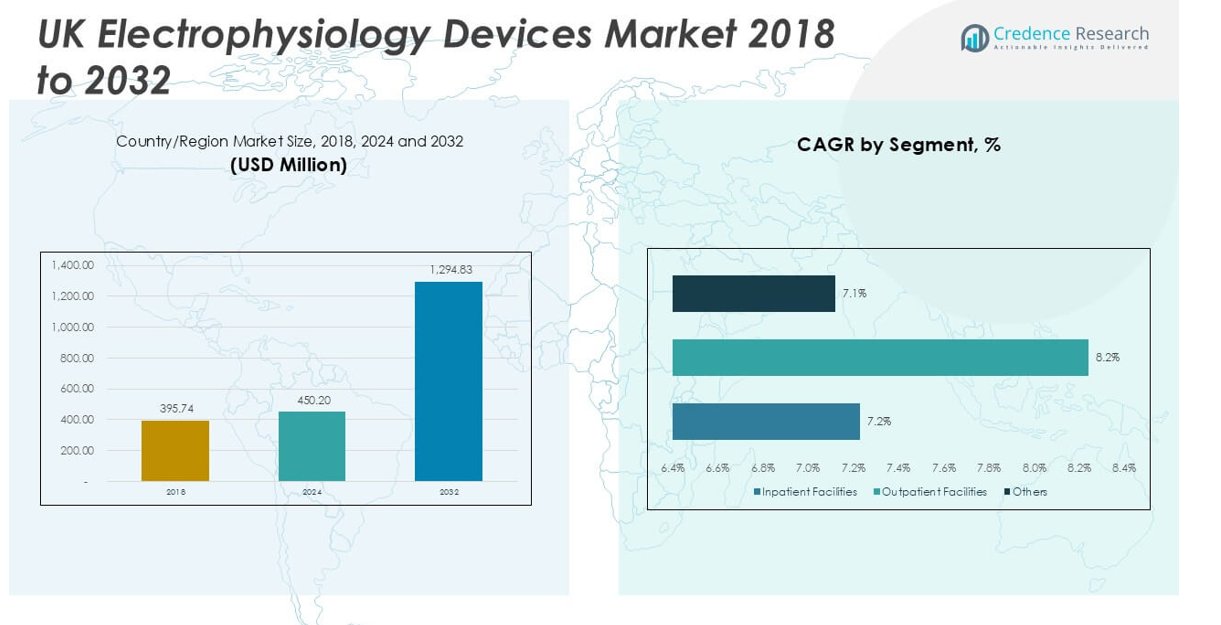

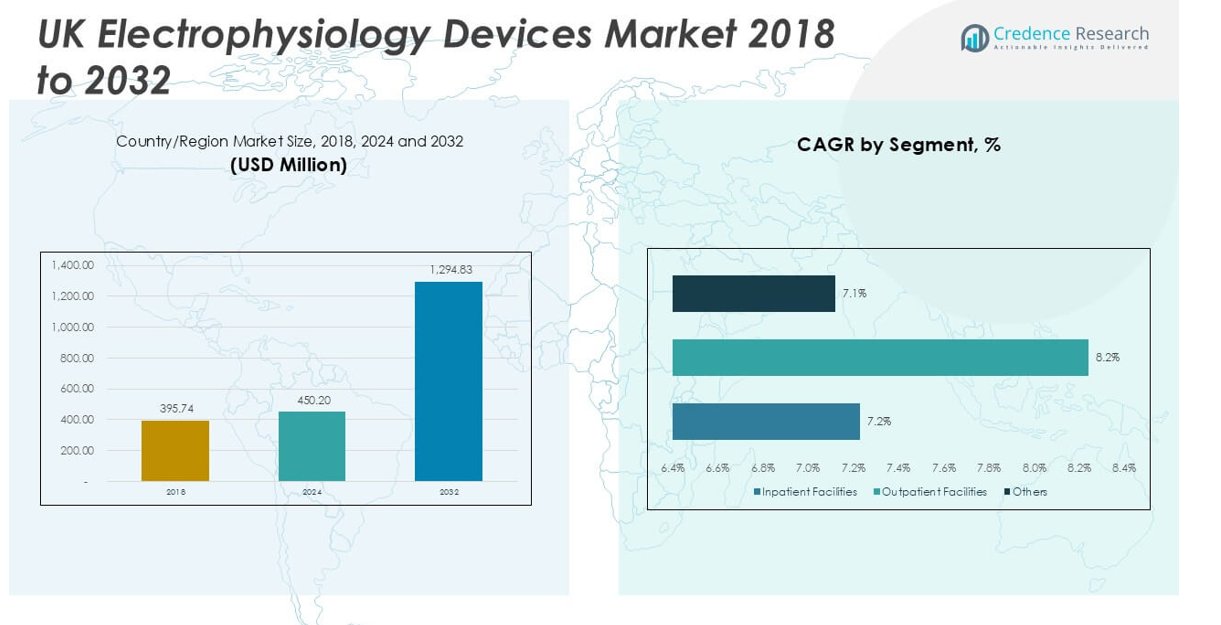

| UK Electrophysiology Devices Market Size 2024 |

USD 450.20 million |

| UK Electrophysiology Devices Market, CAGR |

14.95% |

| UK Electrophysiology Devices Market Size 2032 |

USD 1,294.83 million |

Market Overview

UK Electrophysiology Devices Market size was valued at USD 395.74 million in 2023 to USD 450.20 million in 2024 and is anticipated to reach USD 1,294.83 million by 2032, at a CAGR of 14.12% during the forecast period.

Key drivers propelling the UK Electrophysiology Devices Market include a rising incidence of cardiac arrhythmias, growing adoption of minimally invasive procedures, and increasing investments in healthcare infrastructure. Enhanced awareness of the benefits of early diagnosis and treatment, coupled with advancements in mapping and ablation technologies, continues to accelerate market demand. The expanding geriatric population and the prevalence of lifestyle-related risk factors further contribute to the need for effective electrophysiological interventions. Trends in the market highlight a shift toward integration of digital and remote monitoring solutions, as well as the development of novel catheters and 3D mapping systems that improve procedural efficiency and patient outcomes. Strategic collaborations among healthcare providers, device manufacturers, and research institutions also foster innovation and accelerate clinical adoption. Collectively, these factors position the UK Electrophysiology Devices Market for sustained growth and technological advancement through the forecast period.

The geographical analysis of the UK Electrophysiology Devices Market reveals that major urban centers such as London, Manchester, and Birmingham serve as primary hubs for advanced cardiac care, supported by strong healthcare infrastructure and access to leading research institutions. Scotland is also making notable progress by expanding specialized cardiac services and investing in telemedicine initiatives to improve access across rural and remote areas. This regional distribution ensures widespread adoption of electrophysiology technologies throughout the country. Key players driving innovation and competition in the UK Electrophysiology Devices Market include Boston Scientific Corp., Medtronic, and Abbott, each recognized for their comprehensive product portfolios, ongoing research and development, and collaboration with clinical centers. Biosense Webster also maintains a strong presence, contributing to the development and deployment of advanced mapping and ablation systems that elevate the standard of care in electrophysiology across the UK.

Market Insights

- The UK Electrophysiology Devices Market was valued at USD 450.20 million in 2024 and is projected to reach USD 1,294.83 million by 2032, registering a CAGR of 14.12%.

- Growing prevalence of cardiac arrhythmias and increasing demand for minimally invasive procedures are key drivers fueling market expansion.

- Digital health integration and remote monitoring adoption represent major trends, enabling early arrhythmia detection and improving patient management across the UK.

- Boston Scientific Corp., Medtronic, Abbott, and Biosense Webster are leading companies shaping innovation and competition with advanced product portfolios and research collaborations.

- Regulatory complexities and reimbursement challenges present notable restraints, delaying device approvals and complicating widespread adoption for healthcare providers.

- London, Manchester, Birmingham, and Scotland act as critical regional hubs, each supporting robust healthcare infrastructure, research, and accessibility to electrophysiology procedures.

- Ongoing investments in healthcare modernization and telemedicine, combined with collaborative research initiatives, position the UK Electrophysiology Devices Market for continued technological progress and broader patient reach.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers

Growing Prevalence of Cardiac Arrhythmias and Aging Population Drive Demand

The UK Electrophysiology Devices Market benefits significantly from a rising prevalence of cardiac arrhythmias, especially among the elderly. The incidence of conditions such as atrial fibrillation and other rhythm disorders has increased in recent years, putting pressure on healthcare systems to provide advanced diagnostic and therapeutic solutions. An aging population with a higher susceptibility to cardiovascular disease continues to influence demand. This demographic trend heightens the necessity for effective electrophysiology procedures that can deliver accurate diagnosis and successful intervention. Hospitals and clinics across the UK are witnessing a steady rise in referrals for electrophysiological assessment and treatment. The market capitalizes on this growing patient base by offering increasingly sophisticated devices tailored to these needs.

- For instance, atrial fibrillation affects approximately 1.5 million people in the UK, with projections indicating a continued rise due to aging demographics.

Advancements in Mapping and Ablation Technologies Improve Patient Outcomes

Technological innovation remains a central driver for the UK Electrophysiology Devices Market. Developments in high-definition mapping and precision ablation tools have transformed the management of complex arrhythmias. These advancements enable clinicians to achieve more precise targeting of abnormal cardiac tissue, resulting in improved procedural safety and effectiveness. Hospitals invest in state-of-the-art equipment that supports better visualization and navigation within the heart, reducing procedure times and complications. Device manufacturers focus on launching products that combine accuracy with user-friendly interfaces for electrophysiologists. This ongoing evolution in device technology consistently raises the standard of care available to patients.

- For instance, UK hospitals are increasingly adopting robotic-assisted electrophysiology procedures to enhance precision and reduce complications.

Healthcare Infrastructure Investment and Strategic Collaborations Foster Growth

Investment in healthcare infrastructure plays a pivotal role in supporting the UK Electrophysiology Devices Market. The expansion and modernization of cardiac centers, coupled with increased government and private sector funding, creates new opportunities for device adoption. Strategic partnerships between hospitals, research institutions, and medical device companies accelerate the introduction of innovative products. These collaborations facilitate clinical trials and training programs that boost awareness and competence among healthcare professionals. The market leverages these investments to expand its footprint across both NHS and private healthcare networks. Sustained infrastructure development ensures accessibility and efficiency in electrophysiology services.

Rising Patient Awareness and Demand for Minimally Invasive Procedures Stimulate Market Expansion

Awareness campaigns and education initiatives drive greater patient understanding of electrophysiological disorders and available treatment options. Many individuals now seek early diagnosis and intervention, recognizing the benefits of minimally invasive procedures over traditional surgery. This shift in patient preference propels hospitals to adopt the latest electrophysiology devices, which offer shorter recovery times and fewer complications. The UK Electrophysiology Devices Market responds by promoting advanced solutions that align with patient needs and clinical guidelines. Increased public knowledge and expectations for high-quality care continue to fuel market growth. It remains responsive to evolving patient and clinician demands for innovation and improved outcomes.

Market Trends

Integration of Digital Health and Remote Monitoring Solutions

A major trend in the UK Electrophysiology Devices Market is the integration of digital health technologies and remote monitoring systems into standard clinical practice. Hospitals and healthcare providers increasingly deploy wearable devices and advanced telemetry platforms to track cardiac rhythm disorders outside traditional settings. These technologies enable continuous monitoring, early detection of arrhythmias, and prompt clinical intervention. Patients benefit from greater convenience, while clinicians access valuable real-time data that enhances decision-making. It reflects a broader shift toward patient-centric care and digital transformation within the UK healthcare landscape. Adoption of telemedicine and remote consultation further supports this movement.

- For instance, the NHS has implemented remote monitoring programs to track cardiac rhythm disorders and improve early intervention.

Development of Advanced 3D Mapping and Navigation Technologies

The market sees significant progress in the development of sophisticated 3D mapping and navigation systems. These advancements empower electrophysiologists to create highly accurate models of cardiac anatomy and electrical activity, streamlining the diagnosis and treatment of complex arrhythmias. Leading hospitals invest in equipment that delivers detailed visualization, reducing procedure times and improving safety. The UK Electrophysiology Devices Market features robust collaboration between device manufacturers and clinical centers to refine these systems. It drives competition and fosters rapid adoption of next-generation solutions. The trend toward precision and efficiency defines ongoing innovation within the market.

- For instance, advanced 3D mapping systems generate precise, real-time maps of the heart’s electrical activity, improving catheter placement accuracy during ablation treatments.

Focus on Minimally Invasive Ablation Procedures

Minimally invasive ablation procedures represent a growing focus within the UK Electrophysiology Devices Market. Clinicians and patients increasingly prefer catheter-based interventions that reduce recovery times, lower complication risks, and minimize hospital stays. This trend is driven by continuous improvements in ablation catheter design and energy delivery technologies. Hospitals prioritize investments in these devices to meet patient expectations for less invasive, highly effective treatment options. It underscores the demand for procedures that offer both safety and optimal outcomes. Minimally invasive solutions maintain strong momentum across both public and private healthcare sectors.

Emphasis on Personalized Medicine and Data-Driven Care

The market demonstrates an increasing emphasis on personalized medicine and data-driven care models. Electrophysiologists leverage advanced analytics, artificial intelligence, and patient-specific data to tailor treatment strategies for arrhythmia management. Device manufacturers introduce platforms that support individualized care pathways and seamless integration with electronic health records. The UK Electrophysiology Devices Market adapts rapidly to these innovations, reinforcing a commitment to improved patient outcomes. It highlights the importance of combining technology with clinical expertise to deliver targeted, effective therapies. Ongoing research and adoption of data-centric approaches continue to shape future market direction.

Market Challenges Analysis

Regulatory Complexities and Reimbursement Constraints Limit Market Growth

The UK Electrophysiology Devices Market faces significant challenges due to evolving regulatory requirements and complex approval pathways. Stringent standards set by regulatory authorities demand extensive clinical evidence, leading to prolonged approval timelines for new devices. These hurdles create uncertainty for manufacturers seeking to launch innovative solutions. Reimbursement frameworks also present obstacles, with many advanced electrophysiology procedures receiving limited or delayed coverage by public and private insurers. Hospitals often struggle to absorb the costs of high-end devices without clear reimbursement guidance. It must navigate this environment carefully to achieve broad clinical adoption and commercial success.

- For instance, stringent approval processes for medical devices in the UK require extensive clinical evidence, leading to prolonged market entry timelines.

Skilled Workforce Shortages and High Equipment Costs Restrain Adoption

A shortage of trained electrophysiologists and specialized support staff affects the market’s ability to keep pace with rising demand. The intensive training required for proficiency in advanced procedures limits the pool of qualified professionals in the UK. This challenge is compounded by high acquisition and maintenance costs for state-of-the-art electrophysiology equipment, which can strain hospital budgets, especially in smaller or rural facilities. The UK Electrophysiology Devices Market responds by advocating for expanded training programs and flexible financing models, yet workforce and cost issues persist. It continues to seek solutions that promote broader access and address persistent operational barriers.

Market Opportunities

Expansion of Digital Health and Telemedicine Unlocks New Growth Potential

The rapid adoption of digital health solutions and telemedicine presents significant opportunities for the UK Electrophysiology Devices Market. Hospitals and clinics embrace remote patient monitoring, wearable devices, and virtual care platforms to extend access to cardiac care across diverse regions. These innovations facilitate early detection of arrhythmias and continuous management for patients outside traditional clinical settings. Integration of digital health tools into existing workflows streamlines data collection and supports more personalized treatment strategies. It leverages these advancements to enhance patient engagement and improve clinical outcomes. Continued investment in telemedicine infrastructure is expected to drive sustained market expansion.

Rising Collaborations and Research Initiatives Accelerate Innovation

Collaborations between device manufacturers, research institutions, and healthcare providers create a fertile environment for innovation in the UK Electrophysiology Devices Market. Joint research projects and clinical trials accelerate the development and validation of next-generation devices tailored to local healthcare needs. These partnerships also facilitate knowledge sharing and advanced training for clinicians. The market benefits from an influx of novel products and techniques designed to improve procedural efficiency and patient safety. It stands well-positioned to capitalize on opportunities created by ongoing research and collaborative efforts. Such activities foster a culture of continuous improvement and leadership in electrophysiology care.

Market Segmentation Analysis:

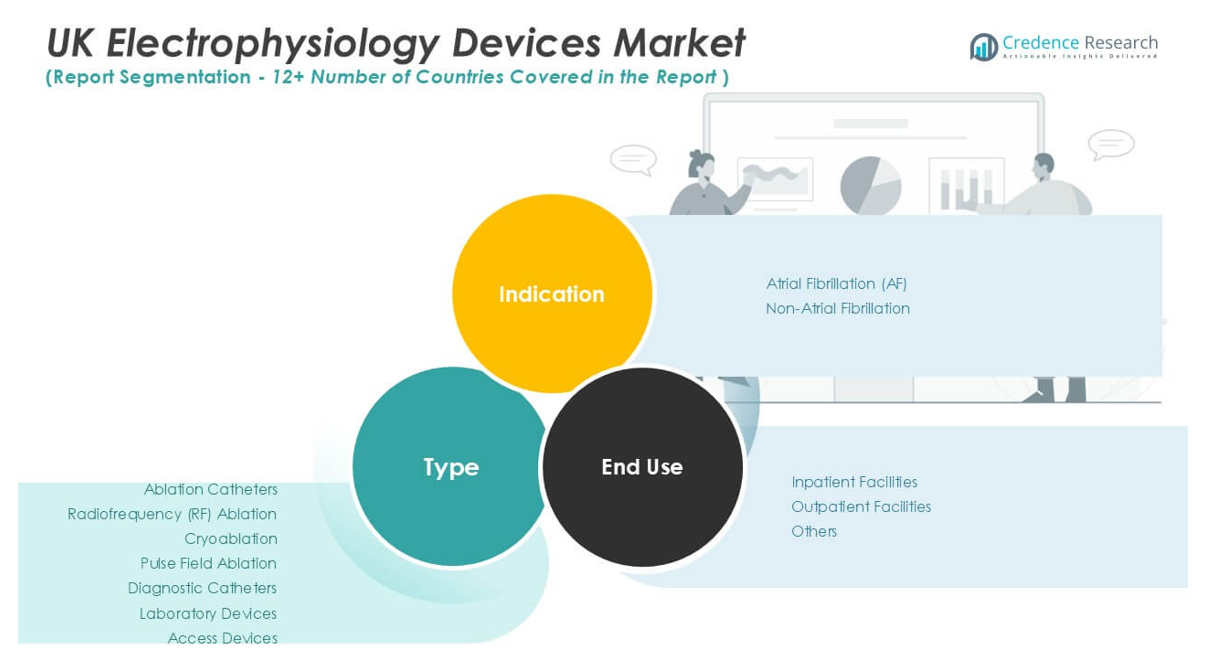

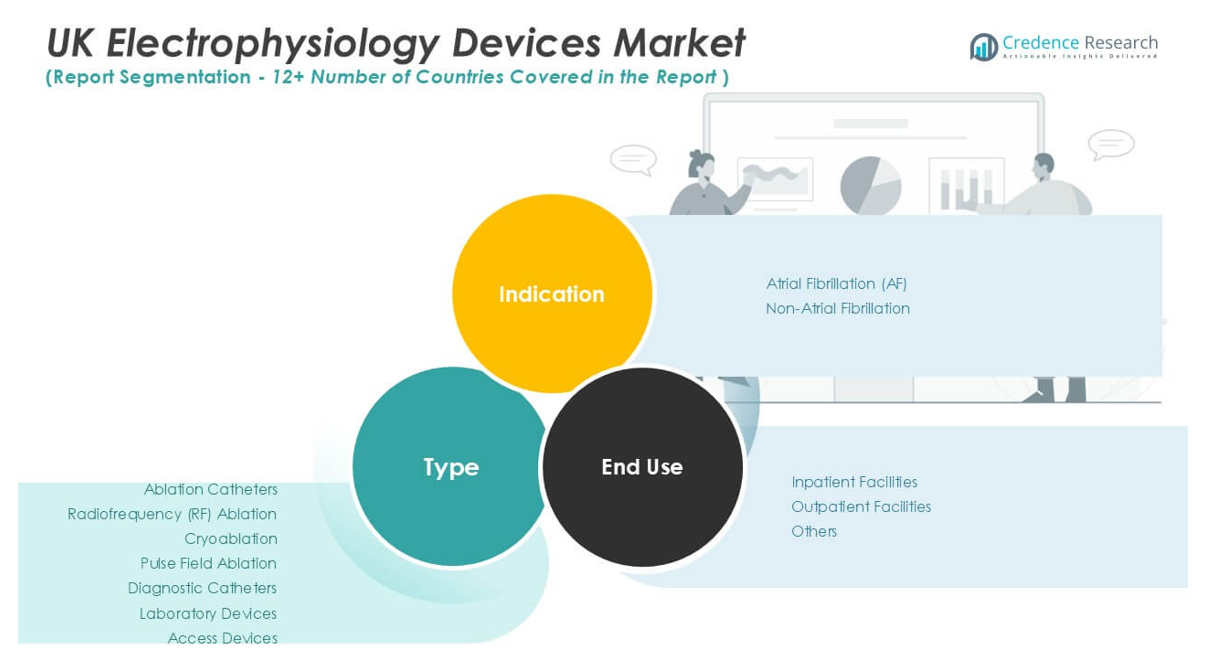

By Type:

The UK Electrophysiology Devices Market demonstrates a diverse landscape across product type, clinical indication, and end-use setting. Among device types, ablation catheters hold a dominant share, driven by rising demand for minimally invasive arrhythmia treatment. Within this segment, radiofrequency (RF) ablation catheters lead due to well-established clinical efficacy and widespread adoption for a broad range of cardiac rhythm disorders. Cryoablation catheters are gaining traction, supported by positive outcomes in atrial fibrillation ablation and a favorable safety profile. Pulse field ablation, an emerging technology, shows promise in providing targeted ablation with minimal collateral damage, attracting interest from leading cardiac centers. Diagnostic catheters contribute significantly by enabling detailed cardiac mapping and assessment, which are critical to successful intervention. Laboratory devices, including mapping systems and electrophysiology recording equipment, support procedural precision and workflow efficiency. Access devices, such as sheaths and introducers, round out the market by facilitating safe and effective vascular entry for complex procedures.

By Indication:

Atrial fibrillation (AF) accounts for the largest proportion of procedures, reflecting the high prevalence of this condition in the UK population and the strong evidence base supporting ablation therapy. The non-atrial fibrillation segment, which includes supraventricular tachycardia and ventricular arrhythmias, also sees steady growth, driven by improvements in diagnostic accuracy and expanded treatment options. Hospitals and clinicians increasingly utilize advanced electrophysiology devices to manage these diverse arrhythmias, underscoring the market’s versatility.

By End-Use:

The market further segments by end-use, with inpatient facilities such as hospitals and specialist cardiac centers representing the primary site for complex electrophysiology procedures. These settings invest heavily in advanced equipment and skilled personnel to deliver comprehensive arrhythmia care. Outpatient facilities are gaining momentum, supported by advancements in device miniaturization and streamlined protocols that enable safe, efficient same-day interventions. The “Others” category, including ambulatory centers and research institutions, expands market reach by facilitating clinical trials and early-stage adoption of innovative devices. The UK Electrophysiology Devices Market leverages this diverse segmentation to meet evolving clinical needs and deliver high-quality care across multiple healthcare environments.

Segments:

Based on Type:

- Ablation Catheters

- Radiofrequency (RF) Ablation

- Cryoablation

- Pulse Field Ablation

- Diagnostic Catheters

- Laboratory Devices

- Access Devices

Based on Indication:

- Atrial Fibrillation (AF)

- Non-Atrial Fibrillation

Based on End-Use:

- Inpatient Facilities

- Outpatient Facilities

- Others

Based on the Geography:

- London

- Manchester

- Birmingham

- Scotland

Regional Analysis

London

London commands the largest share of the UK Electrophysiology Devices Market, accounting for approximately 35% of the national revenue. This dominance stems from its concentration of premier cardiac centers, including institutions like St. Bartholomew’s Hospital and the Royal Brompton & Harefield NHS Foundation Trust. The city’s robust healthcare infrastructure, coupled with a high prevalence of cardiac arrhythmias, drives substantial demand for electrophysiology procedures. Moreover, London’s status as a hub for medical research and innovation attracts significant investments in advanced electrophysiology technologies. The presence of leading medical device companies and a skilled workforce further bolster its market position. London’s commitment to integrating cutting-edge technologies ensures its continued leadership in the electrophysiology devices sector.

Manchester

Manchester holds a significant position in the UK Electrophysiology Devices Market, contributing around 20% to the national revenue. The city’s emphasis on expanding its healthcare services, particularly in cardiology, has led to increased adoption of electrophysiology devices. Institutions like Manchester Royal Infirmary play a pivotal role in providing specialized cardiac care. Manchester’s strategic investments in healthcare infrastructure and research initiatives have attracted collaborations with medical device manufacturers, fostering innovation and accessibility. The city’s focus on training and retaining skilled healthcare professionals ensures the effective implementation of advanced electrophysiology procedures. Manchester’s proactive approach positions it as a growing hub in the electrophysiology devices market.

Birmingham

Birmingham contributes approximately 15% to the UK’s electrophysiology devices market revenue. The city’s strategic investments in healthcare infrastructure, including the development of specialized cardiac units, have enhanced its capabilities in electrophysiology. Hospitals like Queen Elizabeth Hospital Birmingham have been instrumental in adopting advanced electrophysiology technologies. Birmingham’s focus on research and development, supported by collaborations with academic institutions, has led to innovations in device usage and procedural techniques. The city’s initiatives to improve patient outcomes and streamline healthcare delivery have increased the adoption of electrophysiology devices. Birmingham’s commitment to healthcare excellence continues to strengthen its market presence.

Scotland

Scotland accounts for about 10% of the UK Electrophysiology Devices Market revenue. The country’s efforts to expand access to specialized cardiac care have led to the establishment of electrophysiology services in key hospitals, such as the Golden Jubilee National Hospital in Glasgow. Scotland’s investment in telemedicine and remote monitoring technologies has improved patient management, particularly in rural areas. Collaborations between healthcare providers and research institutions have facilitated the adoption of innovative electrophysiology devices. Scotland’s focus on training programs ensures a skilled workforce capable of delivering advanced cardiac care. These initiatives contribute to the steady growth of the electrophysiology devices market in the region.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Boston Scientific Corp.

- Medtronic

- Abbott

- Biosense Webster

- General Electric Company

- Siemens Healthcare AG

- MicroPort Scientific Corporation

Competitive Analysis

The UK Electrophysiology Devices Market is characterized by intense competition among leading players, including Boston Scientific Corp., Medtronic, Abbott, and Biosense Webster. These companies command strong market positions through comprehensive product portfolios that span advanced ablation catheters, diagnostic devices, and cutting-edge mapping systems. Each player invests significantly in research and development to introduce innovative technologies tailored to evolving clinical demands, such as improved 3D mapping, precision ablation, and digital integration for remote monitoring. Their robust distribution networks and established relationships with UK hospitals and cardiac centers ensure broad market penetration and service reliability. Competitive strategies include frequent product launches, targeted training programs, and active participation in collaborative clinical research to validate the safety and efficacy of innovative devices. The landscape is further influenced by mergers, acquisitions, and strategic partnerships, which help companies expand their capabilities and reach new segments within the market. This dynamic environment drives continuous improvement and elevates standards of care across the UK electrophysiology sector.

Recent Developments

- In August 2023, Biosense Webster received approval for various atrial fibrillation ablation products that can be utilized in a workflow without fluoroscopy during catheter ablation procedures.

- In August 2023, Boston Scientific Corporation (US) launched the POLARx cryoablation system. This system is used to treat patients with paroxysmal atrial fibrillation.

- In May 2023 Abbott Laboratories launched the Tactiflex ablation catheter which is sensor-enabled and it is used to treat the most common abnormal heart rhythm.

Market Concentration & Characteristics

The UK Electrophysiology Devices Market demonstrates a moderate to high level of market concentration, with a few established players supplying a significant share of advanced devices to leading cardiac centers and hospitals. It features a technologically driven environment, where continuous innovation in ablation, mapping, and digital monitoring shapes product differentiation and clinical adoption. The market prioritizes high-quality standards, robust clinical evidence, and strong partnerships with healthcare institutions, creating barriers for new entrants. Product portfolios typically cover a full spectrum of electrophysiology needs, from diagnostic catheters to sophisticated laboratory equipment. It values ongoing training and support for clinicians, reflecting a commitment to procedural safety and patient outcomes. The competitive landscape benefits from strategic collaborations, clinical research, and investment in digital health, further strengthening the market’s technological edge and responsiveness to evolving clinical requirements.

Report Coverage

The research report offers an in-depth analysis based on Type, Indication, End-Use and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The UK electrophysiology devices market is expected to witness steady growth due to the rising prevalence of cardiac arrhythmias.

- Increasing awareness about early diagnosis and treatment of heart rhythm disorders will likely boost market demand.

- Technological advancements in 3D mapping systems and ablation catheters are anticipated to drive product innovation.

- The growing adoption of minimally invasive procedures is expected to support market expansion.

- A strong focus on improving healthcare infrastructure will enhance access to advanced electrophysiology treatments.

- The aging population in the UK is projected to increase the incidence of heart-related conditions, supporting market growth.

- Collaborative efforts between hospitals and medical device companies are likely to accelerate the adoption of novel devices.

- Rising investments in research and development will continue to introduce high-precision and efficient electrophysiology tools.

- Favorable reimbursement policies may encourage both patients and providers to opt for advanced electrophysiological procedures.

- Strategic partnerships and acquisitions among key players are expected to strengthen market presence and expand product portfolios.