Market Overview:

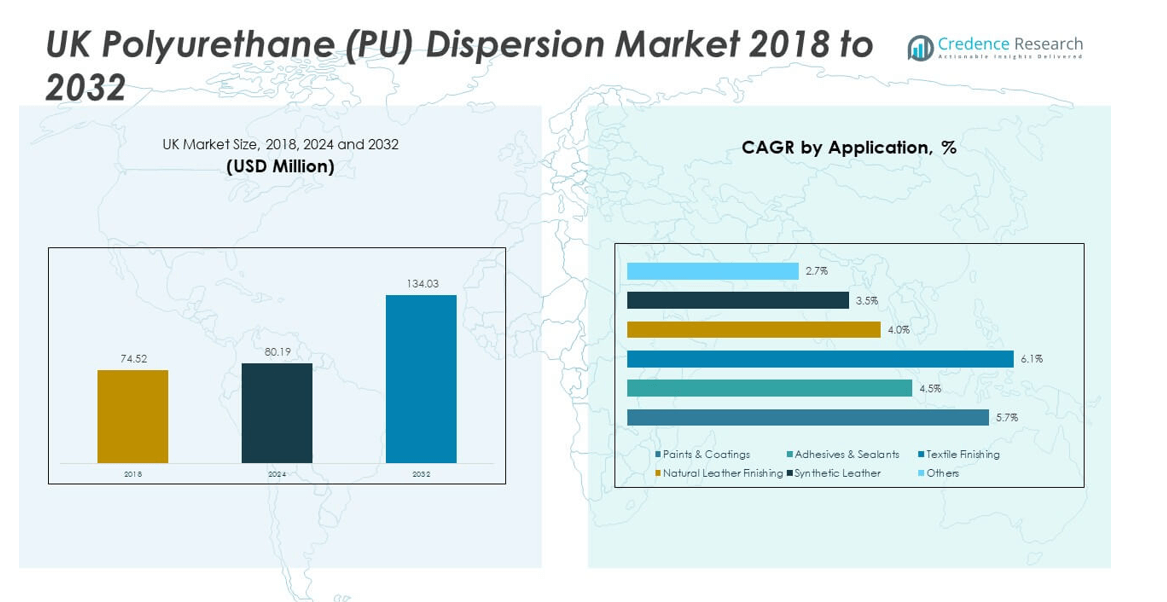

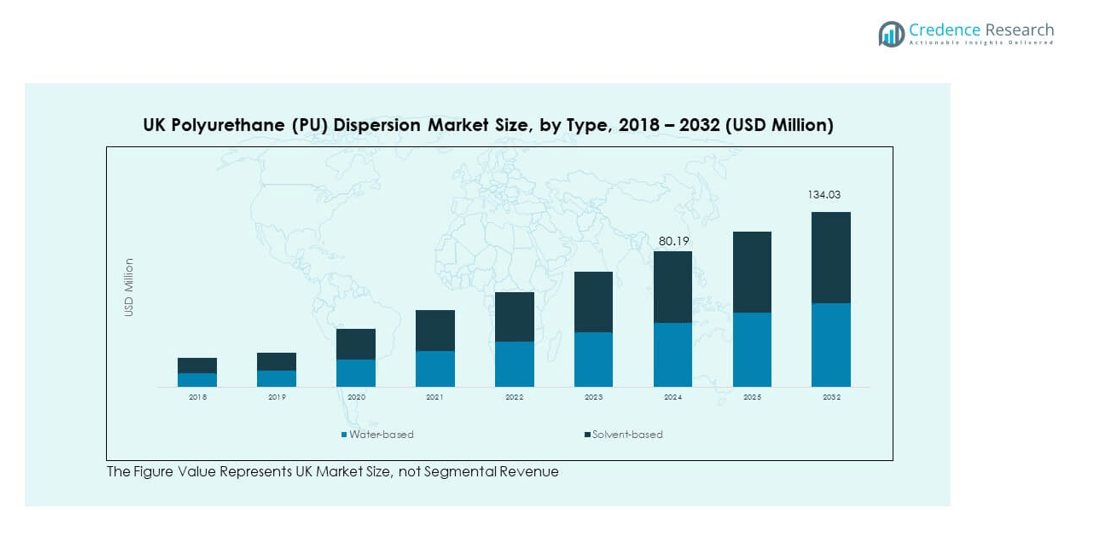

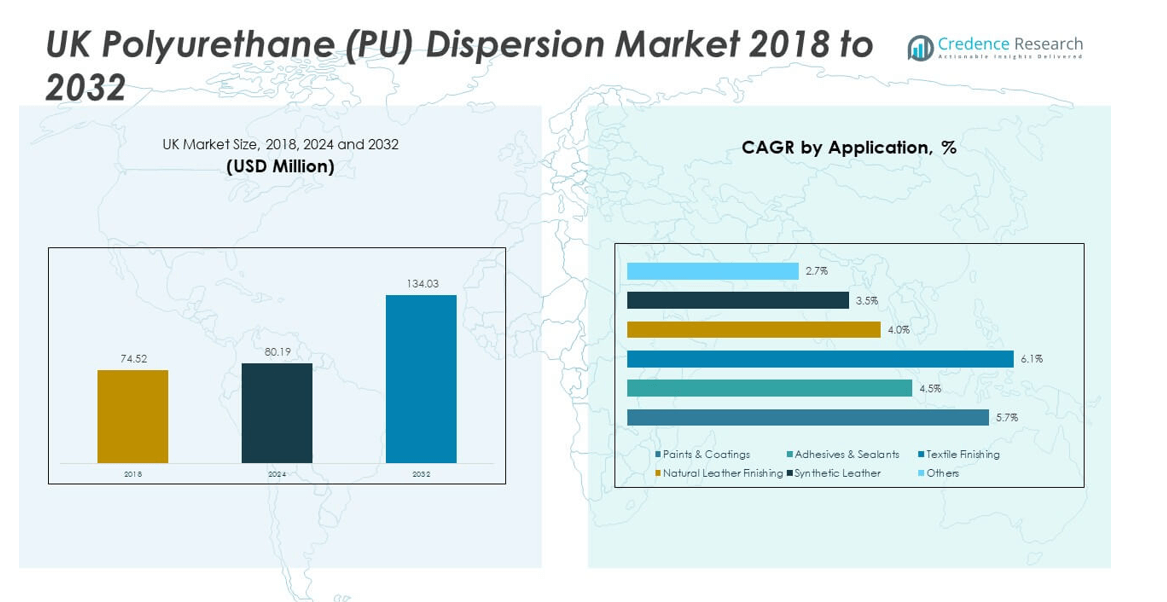

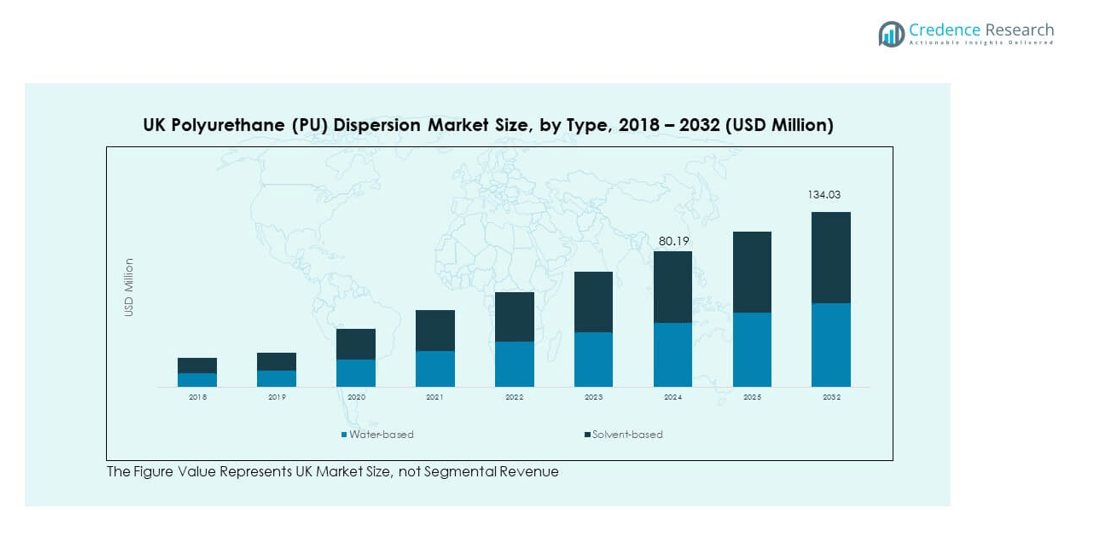

The UK Polyurethane Dispersion Market size was valued at USD 74.52 million in 2018 to USD 80.19 million in 2024 and is anticipated to reach USD 134.03 million by 2032, at a CAGR of 6.63% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| UK Polyurethane Dispersion Market Size 2024 |

USD 80.19 million |

| UK Polyurethane Dispersion Market, CAGR |

6.63% |

| UK Polyurethane Dispersion Market Size 2032 |

USD 134.03 million |

Market growth is driven by rising demand for eco-friendly and water-based coatings across industries. Manufacturers adopt polyurethane dispersions to meet strict environmental regulations and reduce volatile organic compound emissions. Applications in automotive, construction, and textiles support consistent demand. Consumer preference for sustainable materials strengthens market adoption in packaging and furniture. Investments in R&D enhance product performance, ensuring dispersions meet evolving industrial requirements. It benefits from strong innovation pipelines, creating long-term opportunities for manufacturers.

Regionally, England leads the UK Polyurethane Dispersion Market due to its established manufacturing base and advanced industrial infrastructure. Scotland demonstrates strong potential with rising adoption across construction, coatings, and textiles. Wales and Northern Ireland are emerging hubs, supported by growing infrastructure projects and increasing demand for sustainable materials. The market benefits from supportive regulatory policies that encourage water-based solutions. It shows balanced growth across regions, with each contributing to diversification. Nationwide adoption reflects both strong industry compliance and consumer-driven sustainability trends.

Market Insights:

- The UK Polyurethane Dispersion Market size was USD 74.52 million in 2018, reached USD 80.19 million in 2024, and is expected to attain USD 134.03 million by 2032, registering a CAGR of 6.63%.

- England held the largest share at 59% in 2024, supported by advanced infrastructure and strong industrial adoption across construction, automotive, and textiles.

- Scotland accounted for 22% of the market in 2024, driven by construction expansion, coatings adoption, and government support for sustainable materials.

- Wales and Northern Ireland collectively captured 19% share, with Wales emerging as the fastest-growing region due to infrastructure development and rising demand for water-based dispersions.

- Water-based dispersions represented 62% of the market in 2024, while solvent-based dispersions accounted for 38%, reflecting a clear shift toward eco-friendly solutions.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers:

Rising Demand for Eco-Friendly Water-Based Coatings:

The UK Polyurethane Dispersion Market is expanding due to the strong shift toward sustainable solutions. Water-based dispersions reduce volatile organic compound emissions and meet strict regulatory standards. Industries across automotive, furniture, and construction adopt these eco-friendly coatings to align with environmental goals. Growing awareness among consumers about sustainable products further accelerates adoption. Companies invest in greener technologies to maintain competitiveness. The regulatory framework ensures continuous demand for low-toxicity materials. This regulatory support strengthens market growth and drives innovation in formulation and performance.

- For instance, Lanxess expanded its portfolio significantly through acquiring Emerald Kalama Chemical in 2021, adding specialty chemicals including non-phthalate plasticizers that optimize production and improve film formation in water-based coatings, highlighting strategic moves to address sustainability and eco-friendly demands.

Expanding Applications Across Diverse Industrial Sectors:

Polyurethane dispersions are used in adhesives, textiles, leather, and packaging applications. Their versatility makes them a preferred material across multiple industries. Automotive companies use them for coatings and finishes that ensure durability and aesthetics. Furniture manufacturers adopt them for performance and environmental compliance. Textile producers rely on dispersions for advanced finishes and water resistance. Packaging firms explore them for lightweight and sustainable solutions. The UK Polyurethane Dispersion Market benefits from this cross-industry adoption. This growing application base secures long-term demand stability.

- For instance, Lanxess’ acquisition brought specialized plasticizers and coalescents which improve adhesives, coatings, and sealants relevant across automotive, packaging, and textile segments, supporting industrial-scale manufacturing processes globally, including UK sites.

Regulatory Push for Green Materials and Compliance:

Government policies in the UK support the adoption of low-emission and eco-friendly materials. Polyurethane dispersions provide safer alternatives to solvent-based solutions. Manufacturers align with these regulatory standards to ensure market acceptance. Continuous compliance drives investments in sustainable formulations and eco-certifications. Industry players face pressure to innovate without compromising performance. This compliance-driven demand strengthens reliance on polyurethane dispersions. The UK Polyurethane Dispersion Market continues to grow as industries adapt to strict sustainability standards. Regulatory enforcement ensures that adoption will remain consistent over time.

Technological Advancements in Polyurethane Dispersion Formulations:

Ongoing research delivers enhanced properties for dispersions including better adhesion, flexibility, and chemical resistance. Companies invest in innovation to meet evolving industrial requirements. Developments in nanotechnology improve performance in coatings and adhesives. Manufacturers enhance durability and efficiency through advanced dispersion technologies. This drives adoption in high-value industries such as automotive and electronics. Enhanced properties strengthen product competitiveness in international markets. The UK Polyurethane Dispersion Market leverages these advancements to secure long-term growth. Innovation ensures dispersions remain preferred solutions across demanding applications.

Market Trends:

Increased Use of Bio-Based Polyurethane Dispersions:

The market is seeing rapid interest in bio-based dispersions sourced from renewable feedstocks. This trend aligns with consumer preference for natural and sustainable materials. Companies focus on reducing reliance on petroleum-based inputs. Bio-based formulations appeal to environmentally conscious industries such as packaging and textiles. Producers highlight these innovations to strengthen their sustainability credentials. The UK Polyurethane Dispersion Market benefits from this movement toward circular economy practices. Growing investments in renewable raw material supply chains sustain the momentum. This bio-based transition reshapes product development and long-term industry strategies.

- For instance, BASF launched products under its biomass balance approach, integrating biobased raw materials in dispersions, significantly lowering carbon footprint in industrial coatings production.

Growing Adoption of Polyurethane Dispersions in Textile and Footwear:

The textile and footwear industries increasingly integrate polyurethane dispersions into products. They offer water resistance, flexibility, and durability that meet consumer expectations. Footwear makers use them for coatings that enhance comfort and strength. Textile companies apply dispersions for weather-resistant and fashionable finishes. This trend aligns with the UK’s strong apparel and footwear sector. The UK Polyurethane Dispersion Market grows steadily due to such demand shifts. Manufacturers innovate to provide lightweight and flexible solutions. The increasing use in apparel applications ensures a reliable demand base.

Digitalization and Smart Manufacturing Practices in Coatings Industry:

The coatings sector integrates automation and digital technologies to improve efficiency. Companies adopt advanced processes to enhance production accuracy. Predictive maintenance tools and smart monitoring improve consistency and reduce costs. This digital shift supports better quality control in dispersion applications. Manufacturers enhance customization and rapid product adaptation. The UK Polyurethane Dispersion Market adapts well to these digitalization trends. This transition improves scalability and reduces production waste. Industry-wide digital strategies ensure competitive growth opportunities across value chains.

Collaboration and Strategic Partnerships Among Industry Players:

Key producers and suppliers form alliances to enhance innovation and market reach. Joint ventures help expand product portfolios and access new end-user industries. Partnerships strengthen supply chain resilience in the face of global disruptions. Collaborations with research institutions speed up development of advanced dispersions. Companies share expertise to meet regulatory and sustainability standards. The UK Polyurethane Dispersion Market benefits from this ecosystem of cooperation. Strategic relationships strengthen innovation pipelines and international competitiveness. Collaborative approaches redefine the long-term landscape of the market.

Market Challenges Analysis:

High Production Costs and Raw Material Price Volatility:

Polyurethane dispersions often involve higher production costs compared to conventional coatings. Manufacturers face challenges in balancing quality with cost efficiency. Volatile prices of petrochemical-based raw materials add uncertainty. Smaller companies struggle to maintain margins in this competitive environment. Consumers may shift to cheaper alternatives in cost-sensitive applications. Rising operational expenses further strain profitability in the sector. The UK Polyurethane Dispersion Market needs consistent innovation to offset these limitations. Managing costs while ensuring performance remains a significant challenge for producers.

Intense Competition and Limited Awareness Among End-Users:

Market growth is restricted by the strong presence of substitutes and competing technologies. Industries sometimes opt for traditional coatings due to lower costs or familiarity. Lack of awareness about the long-term benefits of dispersions hampers adoption. Smaller businesses hesitate to switch because of initial investment barriers. Competition among established players limits profit margins and pricing flexibility. Local producers face difficulty in differentiating products from international brands. The UK Polyurethane Dispersion Market requires active promotion to highlight benefits. Educating end-users and expanding outreach is essential for overcoming these challenges.

Market Opportunities:

Rising Adoption in Construction and Infrastructure Applications:

The growing construction sector in the UK presents strong opportunities for dispersions. Companies use them in coatings, sealants, and adhesives for long-term durability. Increasing demand for sustainable construction materials drives adoption further. Dispersions meet both performance and environmental compliance requirements. This alignment creates significant openings for producers. The UK Polyurethane Dispersion Market leverages this trend effectively. Continuous urban development ensures steady demand across applications. Expansion in infrastructure fuels opportunities for long-term revenue growth.

Expansion Potential in Niche High-Value Applications:

Specialized industries such as electronics, medical devices, and advanced textiles offer new demand bases. Dispersions provide high-performance features suitable for sensitive and innovative uses. Manufacturers explore tailored formulations to meet sector-specific requirements. This creates pathways for product diversification and premium offerings. Export opportunities in high-value segments also strengthen revenue potential. The UK Polyurethane Dispersion Market secures an edge through such targeted innovation. Entry into niche domains expands market reach. These specialized opportunities shape future growth trajectories for producers.

Market Segmentation Analysis:

By Product Segment

The UK Polyurethane Dispersion Market is segmented into water-based and solvent-based dispersions. Water-based dispersions dominate due to their eco-friendly profile and compliance with stringent environmental standards. These products reduce volatile organic compound emissions and find extensive usage across industries prioritizing sustainability. Solvent-based dispersions hold a smaller share but continue to serve niche applications requiring high durability and chemical resistance. While regulatory pressures limit their growth, demand remains steady in specialized end-use cases where performance attributes outweigh environmental constraints.

- For instance, BASF launched Efka® PX 4360 in May 2024, a next-generation solvent-based dispersing agent developed with controlled free radical polymerization technology, offering superior performance and stability in industrial coatings.

By Application Segment

Paints and coatings form the largest application segment, driven by widespread adoption in construction, automotive, and furniture industries. Adhesives and sealants represent another critical segment, benefiting from their versatility in packaging, flooring, and assembly processes. Textile finishing demonstrates strong demand as dispersions deliver flexibility, water resistance, and durability to fabrics. Natural leather finishing maintains a consistent share, supported by premium product demand in footwear and upholstery. Synthetic leather applications show rapid expansion, driven by cost efficiency, durability, and preference for cruelty-free alternatives. The “others” category covers diverse uses across electronics, medical devices, and specialty industrial applications, reflecting the adaptability of polyurethane dispersions. This broad application base ensures that the UK Polyurethane Dispersion Market maintains a balanced and resilient growth trajectory across multiple sectors.

- For instance, Lanxess’ extended plasticizer and additives portfolio from its 2021 acquisition supports multiple segments including paints, adhesives, and coatings with high compatibility and improved product properties.

Segmentation:

By Product Segment

- Water-based Dispersion

- Solvent-based Dispersion

By Application Segment

- Paints & Coatings

- Adhesives & Sealants

- Textile Finishing

- Natural Leather Finishing

- Synthetic Leather

- Others

Regional Analysis:

England – Core Market Leader

England holds the largest share of the UK Polyurethane Dispersion Market, accounting for nearly 59% of total revenue in 2024. Strong industrial bases in automotive, construction, and textiles drive significant adoption of polyurethane dispersions. Manufacturers in England benefit from advanced R&D infrastructure and a well-developed supply chain that supports innovation and scalability. Demand for water-based dispersions is particularly high due to strict environmental regulations and consumer preference for sustainable solutions. The market thrives on continuous investments in green technologies and expanding end-use applications. England’s leadership position is reinforced by its role as the hub for multinational corporations and regional producers. This dominance positions the region as the anchor for future growth and innovation.

Scotland – Growing Adoption Across Industrial Segments

Scotland contributes around 22% to the UK Polyurethane Dispersion Market, supported by steady expansion in construction and infrastructure projects. Adoption is rising in coatings and adhesives due to increasing demand for durable, eco-friendly materials. Textile finishing and leather applications also gain traction, driven by Scotland’s established apparel and upholstery industries. The market benefits from government initiatives promoting sustainable practices and low-emission materials. It continues to attract investments from international players targeting regional demand for specialized solutions. Scotland demonstrates strong growth potential by aligning industrial activity with environmental compliance. The region plays a critical role in diversifying market opportunities beyond England’s core dominance.

Wales and Northern Ireland – Emerging Demand Hubs

Wales and Northern Ireland together account for nearly 19% of the UK Polyurethane Dispersion Market. Both regions are witnessing gradual adoption of dispersions, particularly in paints, coatings, and adhesives for housing and infrastructure development. Rising interest in synthetic leather and textile finishing applications reflects evolving consumer preferences in these areas. Local industries increasingly seek water-based solutions to align with regulatory frameworks and sustainable practices. While these markets are smaller in size, they provide attractive opportunities for niche applications and specialized product lines. It continues to show steady growth by leveraging supportive policies and regional industrial expansion. Collectively, Wales and Northern Ireland strengthen the overall resilience of the UK market by contributing to balanced nationwide adoption.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- BASF SE

- Covestro AG

- The Dow Chemical Company

- Huntsman Corporation

- Lanxess AG

- Alberdingk Boley GmbH

- Lubrizol Corporation

- Wanhua Chemical Group Co., Ltd.

- DSM Coating Resins (DSM)

- Chase Corporation

- Hauthaway Corporation

- Michelman, Inc.

- Stahl Holdings B.V.

Competitive Analysis:

The UK Polyurethane Dispersion Market is characterized by intense competition among global chemical giants and specialized regional players. Leading companies such as BASF SE, Covestro AG, Huntsman Corporation, and Dow Chemical Company focus on sustainable innovation and regulatory compliance to strengthen their positions. Domestic players and niche manufacturers contribute by catering to specific applications in textiles, leather, and coatings. It is highly competitive, with differentiation achieved through eco-friendly solutions, product performance, and customer service. Strategic partnerships, acquisitions, and product innovation continue to shape the market landscape.

Recent Developments:

- In August 2025, Lanxess acted to counter a weak market environment by divesting its Urethane Systems business to Japan’s UBE Corporation, signaling a strategic shift away from this polymer segment.

- In May 2024, BASF SE launched Efka® PX 4360, a next-generation dispersing agent specifically developed for solvent-based industrial coatings. This product was introduced at the 2024 American Coatings Show and is formulated using BASF’s Controlled Free Radical Polymerization (CFRP) technology. Efka PX 4360 provides superior performance, durability, and storage stability. It offers excellent compatibility across a wide range of solvent-based resin systems and enables the formulation of tin- and aromatic-free solutions.

- In January 2024, BASF SE introduced Basonol® AC 2120 W, a binder dispersion that combines the benefits of primary and secondary dispersions. This product delivers high gloss, low haze, faster drying, and longer pot life. It is designed for use in high-gloss 2K PU clear and pigmented topcoats, primers and topcoats, and direct-to-metal applications. Basonol AC 2120 W offers excellent adhesion, high chemical and scratch resistance, and flexibility. Additionally, it is water-based, APEO-free, and requires around 15-20% less isocyanate than conventional products, making it more cost-efficient and sustainable. It is available in a CO2-reduced product version using BASF’s biomass balance approach, helping customers improve their sustainability profile.

Report Coverage:

The research report offers an in-depth analysis based on product type and application. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Rising demand for eco-friendly water-based dispersions will drive product adoption across industries.

- Regulatory policies will continue to enforce stricter compliance, supporting sustainable formulations.

- Expansion in construction and infrastructure applications will create new opportunities for dispersions.

- Growth in synthetic leather applications will strengthen adoption in footwear and upholstery markets.

- Advanced R&D will deliver high-performance dispersions with improved flexibility and chemical resistance.

- Bio-based raw materials will gain traction, reducing dependence on petroleum-derived inputs.

- Digital manufacturing practices will optimize production efficiency and quality consistency.

- Strategic partnerships will enhance innovation pipelines and expand product reach.

- Regional diversification within the UK will balance market growth across all segments.

- Export opportunities in high-value niche industries will expand revenue potential for UK producers.