Market Overview:

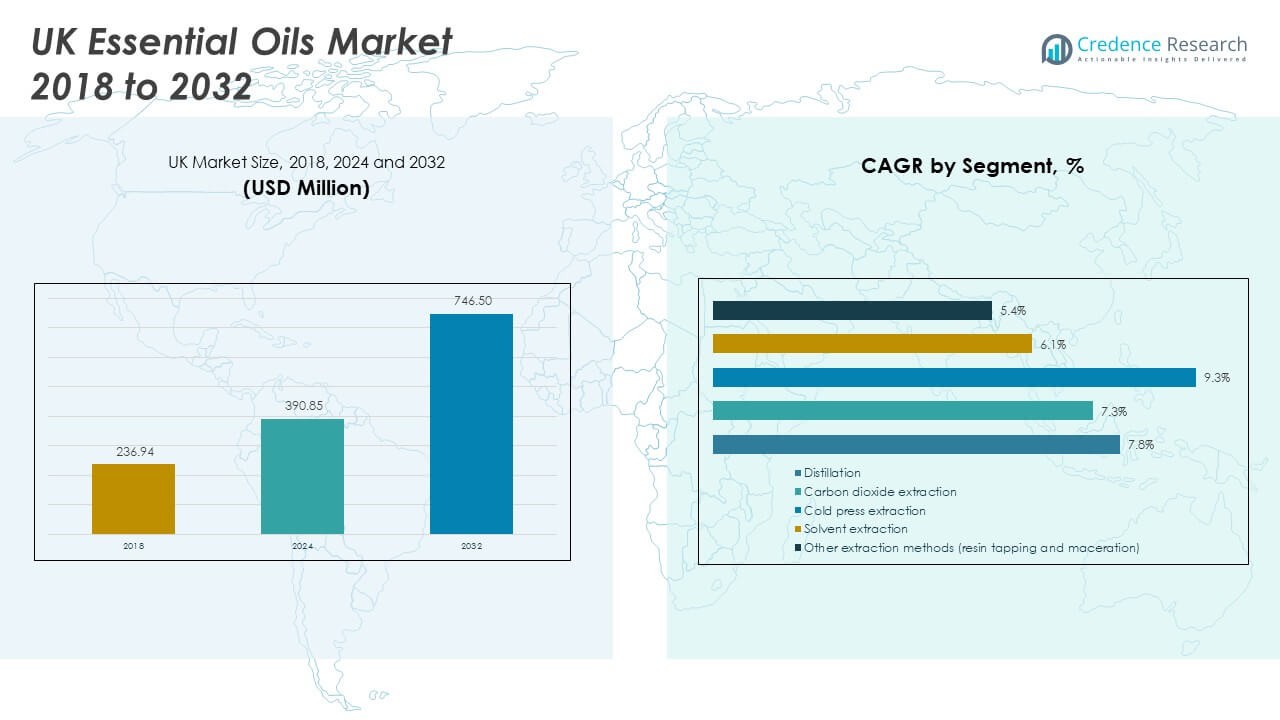

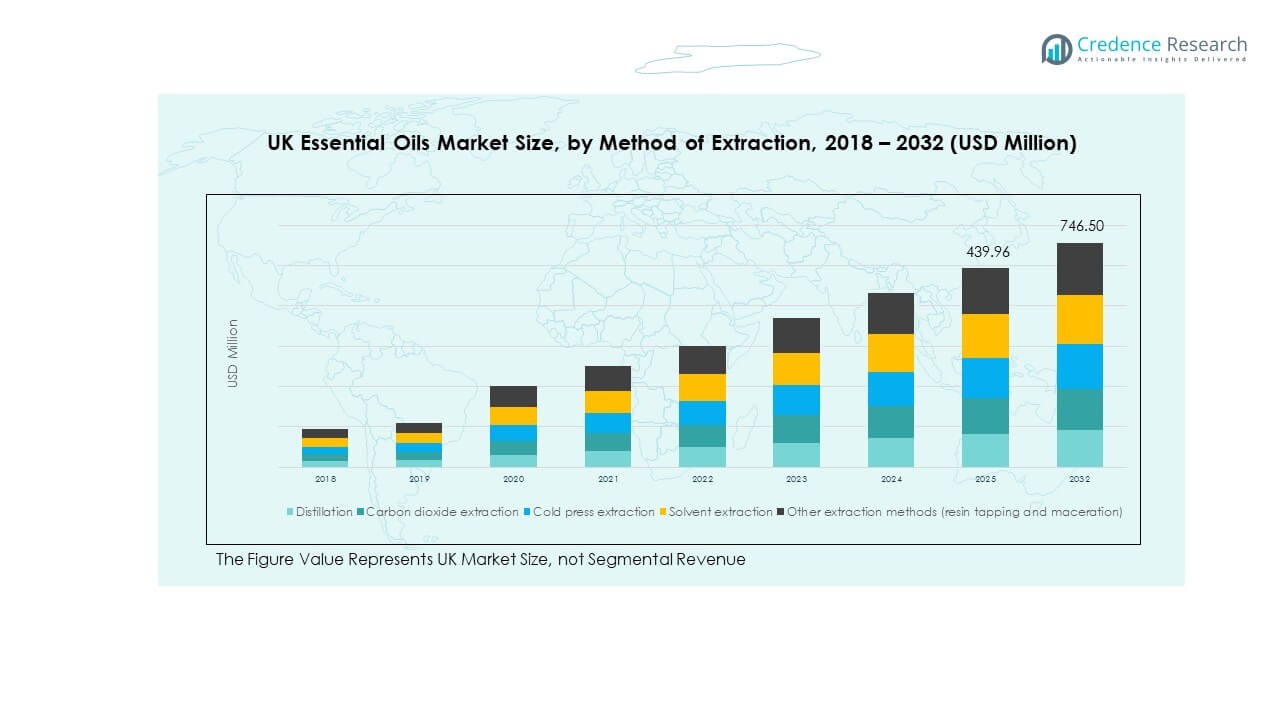

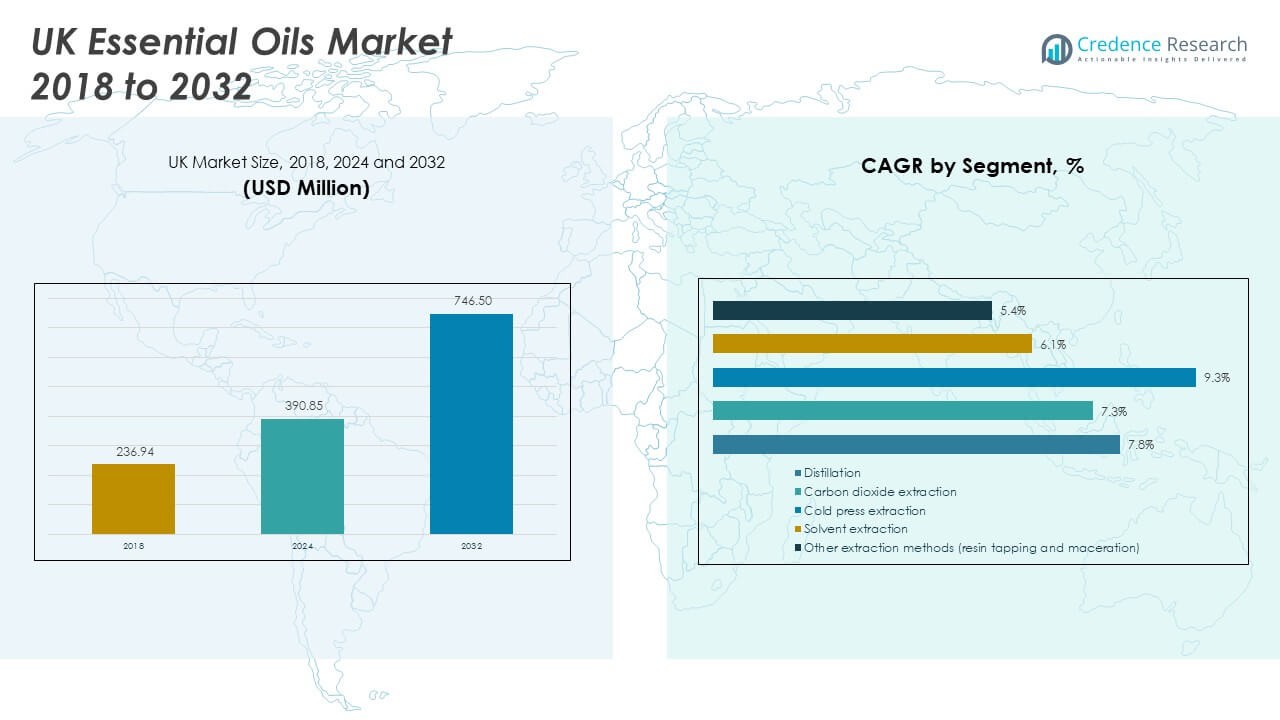

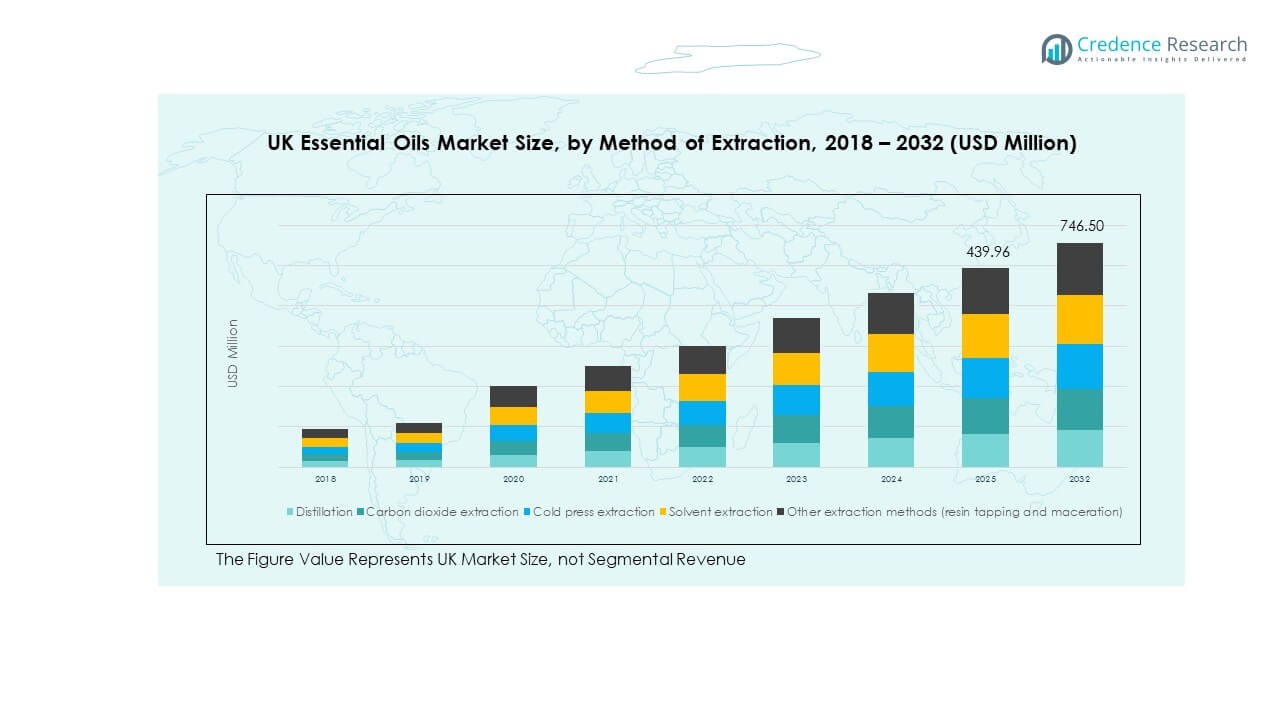

The UK Wood Essential Oils Market size was valued at USD 236.94 million in 2018 to USD 390.85 million in 2024 and is anticipated to reach USD 746.50 million by 2032, at a CAGR of 7.85% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| UK Wood Essential Oils Market Size 2024 |

USD 390.85 Million |

| UK Wood Essential Oils Market, CAGR |

7.85% |

| UK Wood Essential Oils Market Size 2032 |

USD 746.50 Million |

Growing consumer demand for natural and sustainable products drives this market. Rising awareness of wellness benefits associated with essential oils encourages adoption in aromatherapy, cosmetics, and personal care. The market benefits from expanding applications in pharmaceuticals and homecare, supported by a shift toward eco-friendly ingredients. Strong investments in product innovation and organic-certified formulations enhance consumer confidence. Regulatory frameworks promoting safer alternatives to synthetic chemicals also support wider adoption. Increasing online distribution further boosts accessibility, driving consistent sales momentum.

The UK Wood Essential Oils Market is primarily concentrated in Western Europe, where demand for aromatherapy and natural personal care is strongest. The United Kingdom leads adoption due to high consumer awareness and established retail channels. France and Germany also show strong growth, supported by large cosmetics industries and wellness-focused lifestyles. Emerging opportunities are visible in Eastern Europe, where rising incomes and interest in natural products are opening new markets. This geographic spread highlights the importance of both mature and developing regions in sustaining long-term growth.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- The UK Wood Essential Oils Market size was valued at USD 236.94 million in 2018, reaching USD 390.85 million in 2024, and is projected to hit USD 746.50 million by 2032, growing at a CAGR of 7.85%.

- North America (38%), Europe (32%), and Asia Pacific (22%) hold the top shares, driven by advanced healthcare infrastructure, strong cosmetic industries, and rising wellness adoption.

- Asia Pacific is the fastest-growing region with 22% share, fueled by expanding healthcare access, growing disposable incomes, and surging demand for natural personal care products.

- Distillation accounts for 37% of the UK market in 2024, maintaining dominance due to efficiency, tradition, and wide applicability across product lines.

- Solvent extraction holds 25% share, supported by its cost-effectiveness and strong adoption in large-scale industrial and cosmetic applications.

Market Drivers:

Rising Consumer Preference for Natural and Plant-Based Wellness Solutions:

The UK Wood Essential Oils Market is growing with consumers favoring natural and plant-based solutions over synthetic products. Demand for aromatherapy and holistic healing creates strong adoption in households and wellness centers. Personal care brands are formulating with wood oils to address rising interest in eco-friendly cosmetics. Pharmaceutical companies also invest in plant-derived alternatives to meet safety standards. E-commerce platforms are expanding accessibility, encouraging frequent purchases across urban and rural areas. Educational campaigns highlight the therapeutic benefits of oils, building trust among consumers. Sustainability-focused lifestyles drive consistent product integration into daily routines.

- For instance, Symrise AG’s Cosmetic Ingredients division expanded its portfolio in 2024 with bio-based innovations, emphasizing sustainable sourcing and eco-friendly product innovation. Symrise also continued its focus on creating value with a circular economy, such as by using by-products from vegetable production to create new fragrance notes using patented technology.

Expanding Applications Across Healthcare, Cosmetics, and Household Products:

Healthcare providers increasingly promote wood essential oils for their anti-inflammatory and antimicrobial benefits. The cosmetics industry adopts these oils in skincare and haircare formulations, strengthening market integration. Household cleaning products now include wood oil components for natural fragrance and germ-fighting properties. Aromatherapy practices continue to rise in popularity, supported by clinical evidence of stress-relieving properties. Retail channels leverage demand by offering premium organic-certified variants. The UK Wood Essential Oils Market benefits from consumer trust in products that enhance health while maintaining safety standards. It demonstrates resilience with rising multipurpose use across several sectors.

- For instance, in March 2025, BASF’s Isobionics brand launched two new natural flavor ingredients produced via fermentation: Isobionics® Natural beta-Sinensal 20, a citrus flavor, and Isobionics® Natural alpha-Humulene 90, a woody flavor. The latter has a high purity and is primarily for beverage applications.

Strong Support from Regulatory Frameworks and Sustainability Standards:

Government policies encourage the adoption of eco-friendly raw materials and natural ingredients. Regulatory agencies enforce strict quality and safety standards, building confidence in essential oil products. Organic certification and labelling regulations provide transparency to consumers seeking verified natural products. Manufacturers align with sustainability frameworks to expand export opportunities. Industry players also focus on reducing environmental footprints across sourcing and packaging. The UK Wood Essential Oils Market gains momentum from alignment with the European Green Deal and sustainable business models. It benefits from long-term consumer loyalty and positive brand positioning in the market.

Growth of Online Retail and Expanding Distribution Channels:

E-commerce has transformed accessibility of wood essential oils, making them available beyond specialty stores. Online platforms offer broad product choices and educational resources that inform buyers. Subscription models and bundled wellness kits increase consumer retention. Retailers also integrate digital marketing campaigns that highlight product benefits with high engagement. Direct-to-consumer models expand profit margins for emerging players. Physical retail, including pharmacies and wellness shops, maintains consistent demand with trust-based sales. The UK Wood Essential Oils Market leverages omni-channel strategies to reach diverse audiences effectively. It strengthens market competitiveness by ensuring consistent supply and awareness.

Market Trends:

Integration of Essential Oils into Premium Skincare and Beauty Products:

Luxury skincare brands are increasingly formulating with wood essential oils for natural and effective benefits. Consumers demand transparency in ingredient sourcing, creating momentum for clean beauty products. Anti-aging and skin-repairing formulations attract strong demand in urban demographics. Brands market oils as multipurpose solutions, suitable for both skincare and aromatherapy. Celebrity endorsements and influencer campaigns drive visibility across social media platforms. The UK Wood Essential Oils Market adapts to these shifts by offering premium-grade oils with verified quality. It enhances value perception among consumers who prioritize natural beauty solutions.

- For instance, Givaudan SA publicly committed to developing innovative and sustainable fragrance ingredients within its 2025 strategy, emphasizing green chemistry and traceable supply chains.

Increasing Role of Essential Oils in Workplace and Lifestyle Wellness:

Workplace wellness programs promote aromatherapy and essential oils for stress relief and productivity. Companies provide employees with essential oil kits as part of corporate wellness strategies. Lifestyle trends emphasize mindfulness, meditation, and natural stress-reducing practices. Essential oils are incorporated into candles, diffusers, and sprays for professional and home use. Young professionals increasingly adopt these products to balance busy routines. The UK Wood Essential Oils Market benefits from growing cultural acceptance of alternative wellness practices. It secures growth through lifestyle alignment and consistent consumer adoption in modern urban households.

- For instance, in 2024, Kerry Group plc strategically evolved its taste and nutrition portfolio by divesting its dairy business and acquiring a lactase enzymes business to focus on sustainable nutrition and plant-based solutions, and it continued to expand its offerings of botanical extracts and textured plant proteins for food and beverage applications.

Advancements in Extraction Technology and Product Innovation:

Manufacturers invest in advanced extraction technologies to ensure purity and high yield from raw wood materials. Cold-press and steam-distillation improvements reduce environmental impact and enhance oil quality. Companies launch innovative blends tailored for specific therapeutic uses. Research partnerships enable continuous innovation and expand medical applications of essential oils. Packaging innovations, such as eco-friendly materials, align with sustainability expectations. The UK Wood Essential Oils Market adapts through new product development to remain competitive. It reflects industry resilience with consistent technological upgrades across the value chain.

Expanding Popularity of DIY and Home-Based Applications:

Consumers are increasingly creating DIY beauty, wellness, and cleaning products using wood essential oils. Online tutorials and digital communities spread knowledge about safe and effective uses. Essential oils are now considered staples in home wellness kits. Demand for multipurpose natural oils supports bulk and retail sales. Educational platforms guide safe use, reducing risks and building trust among new users. The UK Wood Essential Oils Market grows steadily as households integrate oils into daily practices. It strengthens adoption by positioning essential oils as affordable and versatile lifestyle products.

Market Challenges Analysis:

Rising Competition and Price Pressures from Global Players:

The UK Wood Essential Oils Market faces rising competition from international brands offering lower-cost alternatives. Imported products often challenge domestic producers with aggressive pricing strategies. Smaller local companies struggle to maintain market share against large-scale global manufacturers. High operational costs for quality control and certification further strain local businesses. Price-sensitive consumers may shift toward cheaper options, slowing premium segment growth. The competitive intensity forces innovation but reduces profitability in the short term. It highlights the challenge of balancing affordability with quality assurance across diverse segments.

Supply Chain Volatility and Regulatory Complexities:

Sourcing sustainable raw wood materials is a challenge due to deforestation concerns and supply chain volatility. Seasonal variations in availability create fluctuations in production and pricing. Strict regulatory frameworks require ongoing compliance, which raises operational costs. Import-export restrictions complicate trade with non-EU partners. Manufacturers also face delays in approvals for new formulations, slowing product launches. The UK Wood Essential Oils Market remains vulnerable to geopolitical factors affecting trade flows. It must navigate complex supply and regulation dynamics to ensure consistent market stability.

Market Opportunities:

Rising Demand for Sustainable and Organic-Certified Product Lines:

Sustainability-focused consumers create strong opportunities for certified organic and ethically sourced oils. Retailers highlight eco-friendly credentials as key differentiators in competitive markets. Brands that align with carbon reduction goals attract loyalty from environmentally conscious buyers. The UK Wood Essential Oils Market benefits from premium pricing opportunities for sustainable offerings. It strengthens position in both domestic and export markets through verified certifications. Consumer trust in transparent labelling further drives long-term demand for eco-friendly oils.

Expansion into Emerging Aromatherapy and Wellness Tourism Segments:

Aromatherapy centers, spas, and wellness retreats increasingly use wood essential oils to enhance services. Tourism-driven wellness experiences in the UK and Europe expand usage across international visitors. Hotels and resorts introduce essential oil therapies as part of luxury services. This trend creates strong cross-sector demand beyond traditional consumer sales. The UK Wood Essential Oils Market secures growth by leveraging its role in wellness tourism. It captures opportunities through partnerships with hospitality and healthcare-focused businesses seeking differentiation.

Market Segmentation Analysis:

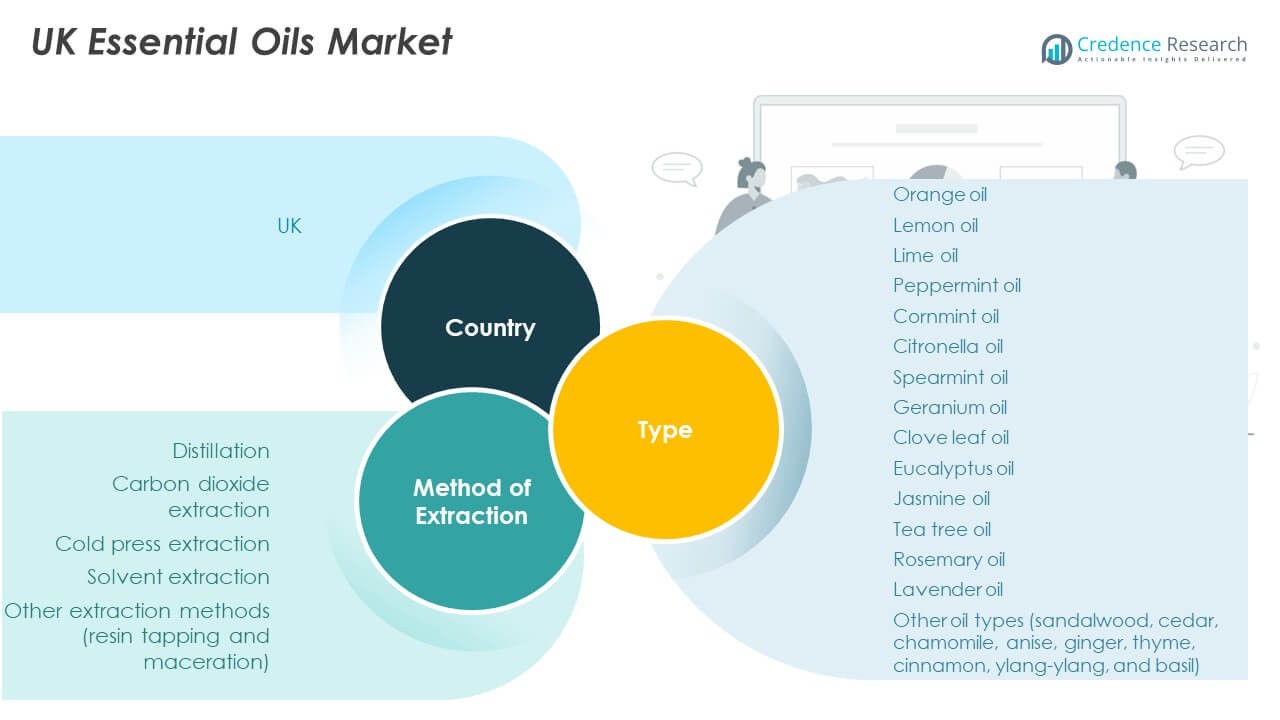

By Type

The UK Wood Essential Oils Market shows strong product diversity. Orange oil, lemon oil, and peppermint oil lead due to their wide use in food, beverages, and aromatherapy. Tea tree oil, eucalyptus oil, and lavender oil hold vital roles in pharmaceuticals and personal care, supported by therapeutic and antimicrobial benefits. Specialty oils such as sandalwood, cedar, chamomile, and ginger serve niche segments, especially in luxury cosmetics and wellness. This wide portfolio ensures stable demand across consumer and industrial applications.

- For instance, Robertet Group reported a 10.1% increase in revenue for the first half of 2024, driven by a recovery in the Raw Materials division and strong performance in luxury fine fragrances. The growth was also partially influenced by customers rebuilding inventories. While the Raw Materials division saw an upturn in organic products, strong market engagement in luxury fragrance sales was also a key driver, alongside other factors.

By Method of Extraction

Distillation dominates the market, offering efficiency and scalability across most oil types. Carbon dioxide extraction is gaining importance for producing premium-grade, high-purity oils used in cosmetics and pharmaceuticals. Cold press extraction remains crucial for citrus-based oils, ensuring freshness and natural quality. Solvent extraction supports large-scale industrial applications, particularly in fragrances and cosmetics. Other methods, including resin tapping and maceration, sustain specialized categories, enriching the technological mix of the sector.

- For instance, Flavex Naturextrakte GmbH continues to invest in optimizing its production capabilities, including its supercritical CO2 extraction technology, and supplies high-quality extracts to the cosmetic, food, and fragrance industries globally.

By Application

Food and beverages represent a consistent demand driver, where natural flavoring agents enhance formulations. Cosmetics and personal care act as a key growth engine, supported by increasing consumer preference for natural skincare and haircare. Aromatherapy demonstrates rapid growth, driven by wellness-focused lifestyles and stress relief solutions. Pharmaceuticals utilize essential oils for therapeutic functions, while household products integrate them as natural cleaning and fragrance alternatives. The UK Wood Essential Oils Market secures its momentum through broad adoption across both consumer and industrial applications.

Segmentation:

By Type

- Orange oil

- Lemon oil

- Lime oil

- Peppermint oil

- Cornmint oil

- Citronella oil

- Spearmint oil

- Geranium oil

- Clove leaf oil

- Eucalyptus oil

- Jasmine oil

- Tea tree oil

- Rosemary oil

- Lavender oil

- Other oil types (sandalwood, cedar, chamomile, anise, ginger, thyme, cinnamon, ylang-ylang, basil)

By Method of Extraction

- Distillation

- Carbon dioxide extraction

- Cold press extraction

- Solvent extraction

- Other extraction methods (resin tapping and maceration)

By Application

- Food & Beverages

- Cosmetics & Personal Care

- Aromatherapy

- Pharmaceuticals

- Household Products

- Others

By Country (within UK scope)

- England

- Scotland

- Wales

- Northern Ireland

Regional Analysis:

England

England dominates the UK Wood Essential Oils Market with the largest share, driven by strong demand from cosmetics, pharmaceuticals, and food industries. London and other major cities foster premium consumption of aromatherapy, luxury skincare, and natural wellness products. Established retail chains and wide distribution networks support product accessibility across urban and suburban markets. England also plays a central role in imports and exports, reinforcing its leadership within the UK. Research and development centers enhance innovation in formulations and sustainable production. It secures further momentum from regulatory backing for organic and eco-certified essential oils.

Scotland

Scotland contributes a moderate share, underpinned by its heritage in herbal remedies and natural wellness practices. Local producers emphasize sustainable sourcing and organic farming, which align with consumer demand for eco-friendly solutions. The tourism sector, particularly spas and wellness retreats, boosts the use of essential oils. Pharmaceuticals and food sectors also integrate wood oils, strengthening local adoption. Scotland enhances its position by promoting eco-conscious agriculture and niche product development. It secures growth potential through a balance of domestic demand and export opportunities.

Wales

Wales holds a smaller yet consistent share, with demand rising in cosmetics, household care, and aromatherapy applications. Local cooperatives and small producers focus on authenticity and quality, appealing to premium buyers. Government initiatives supporting rural businesses and farming contribute to market resilience. Urban households increasingly adopt natural oils for personal and wellness use. Retail expansion strengthens consumer access, broadening reach across local markets. Wales benefits from positioning itself as a source of premium, locally produced essential oils.

Northern Ireland

Northern Ireland accounts for the smallest share but demonstrates steady growth within the UK market. Demand for aromatherapy and natural personal care is expanding across urban and semi-urban centers. Small-scale producers support supply by emphasizing quality and community-driven production. Cross-border trade with Ireland enhances regional opportunities and market access. Food and beverage applications also integrate essential oils, adding to demand diversity. Northern Ireland secures long-term potential by strengthening retail channels and adopting sustainable business practices.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- Symrise AG

- Givaudan SA

- Firmenich International SA

- Robertet Group

- Mane SA

- BASF SE

- Kerry Group plc

- Biolandes SAS

- Flavex Naturextrakte GmbH

- Ungerer Limited

- Other regional and domestic players

Competitive Analysis:

The UK Wood Essential Oils Market is highly competitive, with multinational corporations and regional producers competing for market share. Leading companies such as Symrise AG, Givaudan SA, Firmenich, Robertet, and BASF dominate through strong distribution networks and diversified product portfolios. Local players focus on niche oils and organic-certified offerings, appealing to premium buyers. Competition is shaped by innovation in extraction technologies and sustainability practices, which strengthen consumer trust. The market demonstrates significant differentiation through branding, quality certifications, and vertical integration strategies. It also benefits from collaborations between producers and end-use industries to drive specialized applications. The UK Wood Essential Oils Market shows resilience by balancing global dominance with domestic niche strengths.

Recent Developments:

- In August 2025, Givaudan SA announced its 2030 strategy focusing on sustainable growth by leveraging strengths in fragrances and flavors and expanding into high-value adjacent areas. The strategy includes pursuing acquisitions aligned with their focus areas, aiming to drive innovation and profitability over the next five years.

- In the UK Wood Essential Oils Market, Symrise AG reported its first half 2025 results on July 29, 2025, showing organic sales growth of 3.1% mainly driven by its Scent & Care segment which achieved 2.9% organic growth. The company focused on high-margin products and improved profitability with an EBITDA margin increase to 21.7%.

- BASF SE introduced two new biotech flavor ingredients, Isobionics Natural beta-Sinensal 20 and Isobionics Natural alpha-Humulene 90, in April 2025. These fermentation-produced woody flavor ingredients are suitable for beverages and essential oil applications, highlighting BASF’s innovation in aroma ingredients.

- Kerry Group plc, active in plant-based preservatives and ingredients used in the food and beverage sector, was mentioned in the context of the UK market in March 2025. Kerry, along with Givaudan and others, focuses on sustainability and regional manufacturing hubs in the UK.

Report Coverage:

The research report offers an in-depth analysis based on type, method of extraction, and application. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Rising consumer demand for natural wellness products will expand essential oil applications.

- Strong regulatory backing for organic-certified products will encourage premium market positioning.

- Advanced extraction technologies will improve product quality and sustainability practices.

- Growth in aromatherapy adoption will strengthen sales across wellness and spa industries.

- Cosmetic and personal care integration will remain a core revenue driver.

- Food and beverage formulations will increasingly utilize essential oils for natural flavors.

- Online distribution growth will expand consumer reach across the UK.

- Strategic mergers and partnerships will enhance global and domestic competitiveness.

- Rising consumer awareness of eco-friendly products will shape brand loyalty.

- Continued research in therapeutic uses will open new opportunities in pharmaceuticals.