Market Overview:

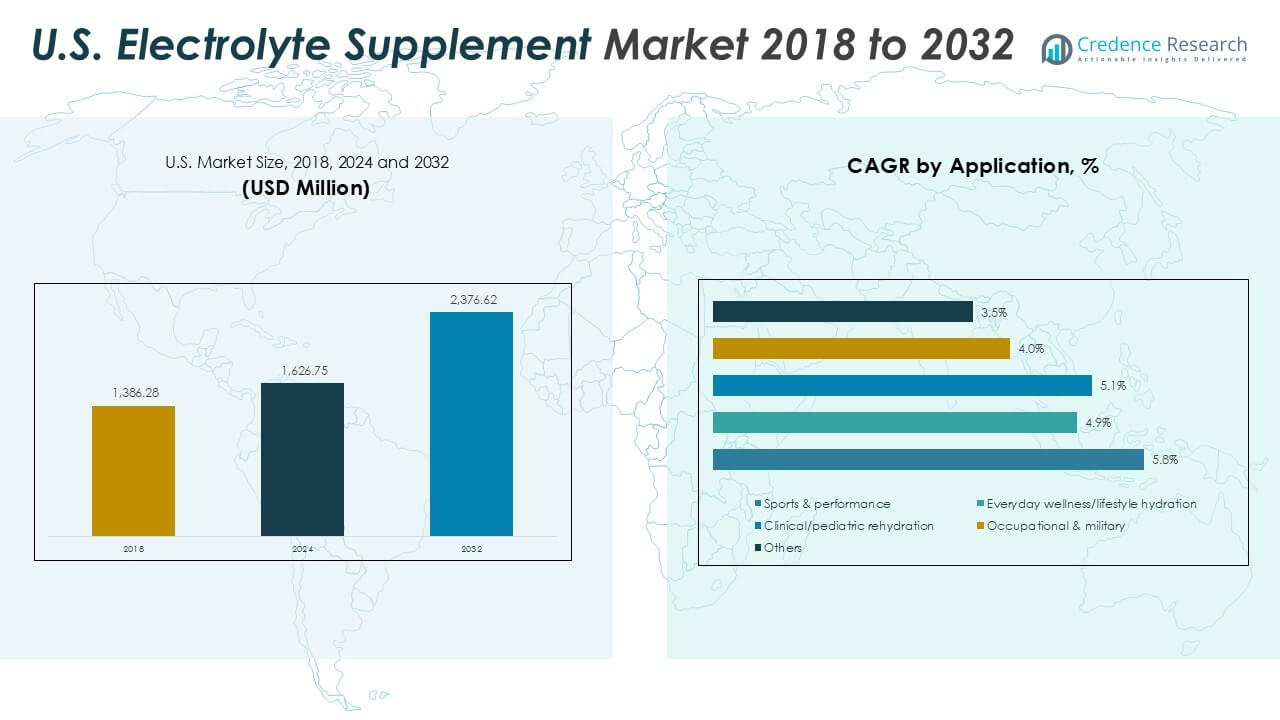

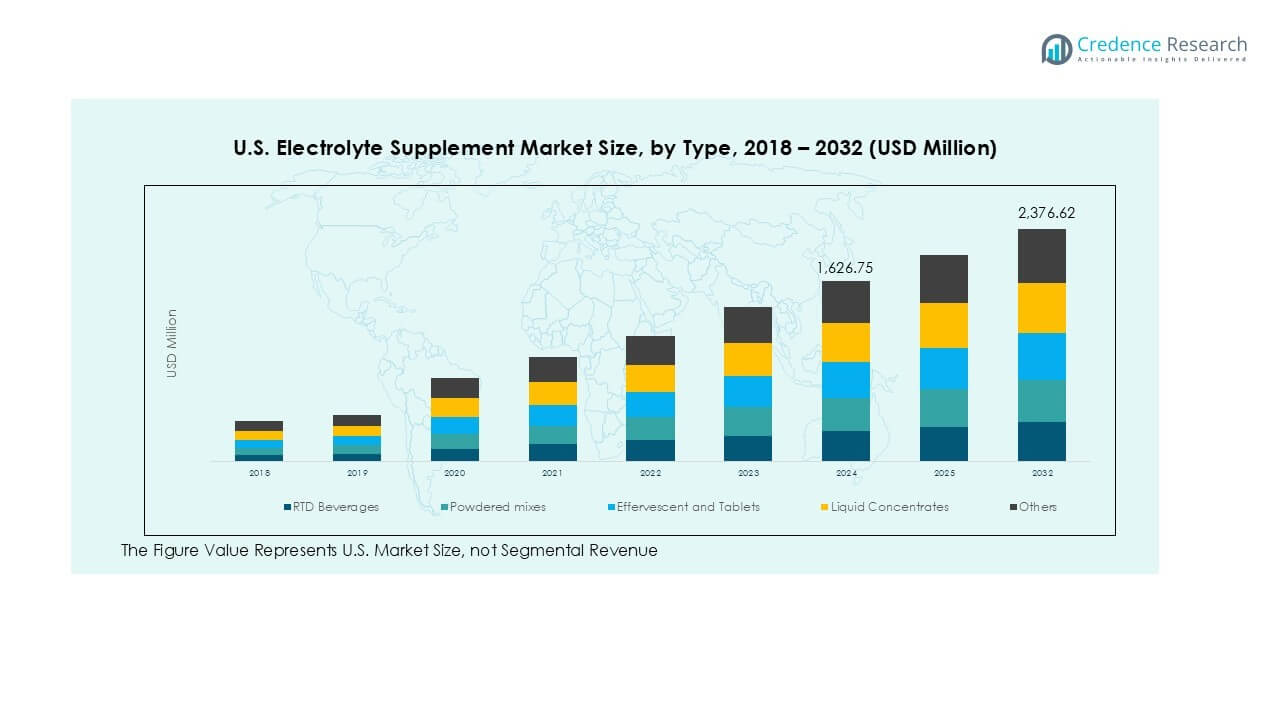

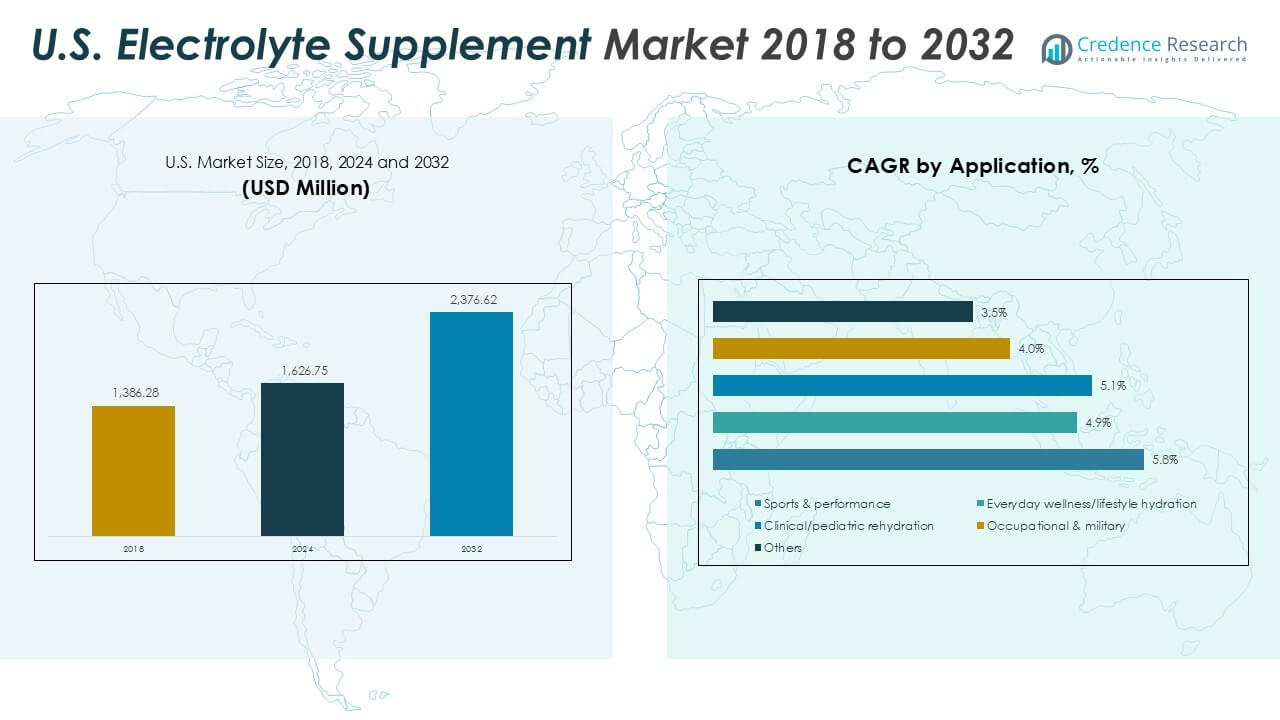

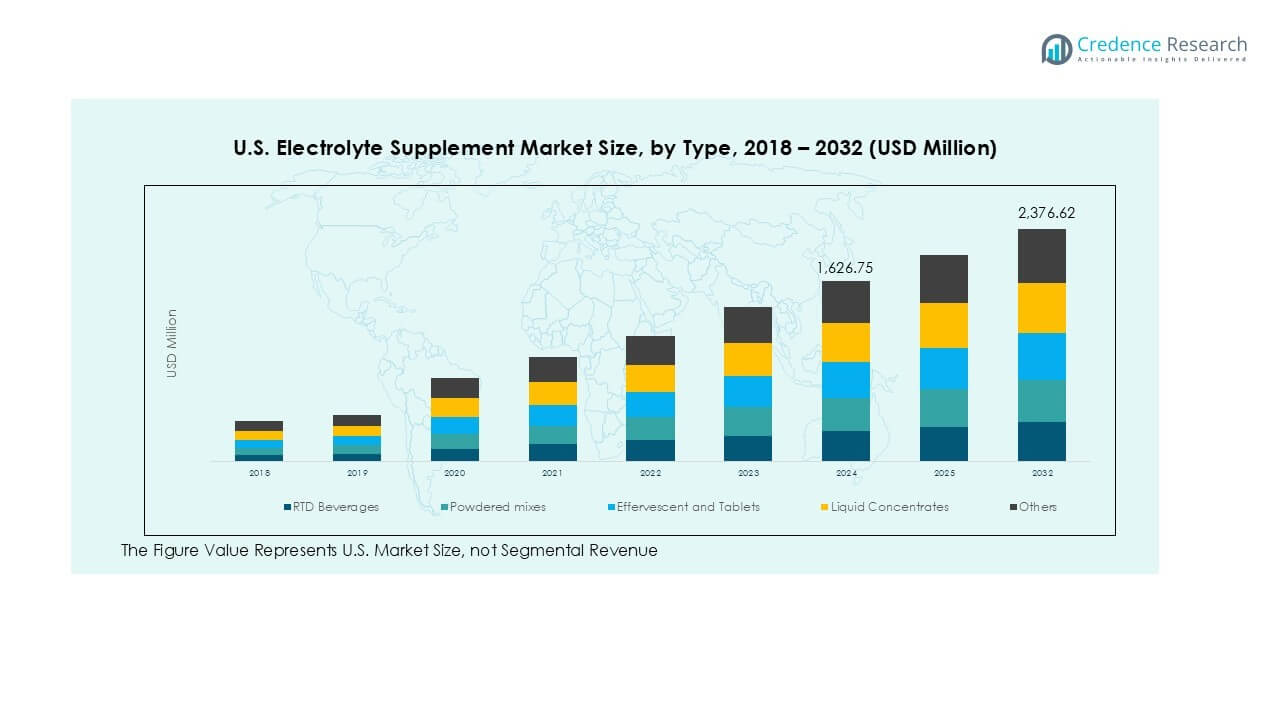

The U.S. Electrolyte Supplement Market size was valued at USD 1,386.28 million in 2018 to USD 1,626.75 million in 2024 and is anticipated to reach USD 2,376.62 million by 2032, at a CAGR of 4.85% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| U.S. Electrolyte Supplement Market Size 2024 |

USD 1,626.75 Million |

| U.S. Electrolyte Supplement Market, CAGR |

4.85% |

| U.S. Electrolyte Supplement Market Size 2032 |

USD 2,376.62 Million |

The market is driven by increasing consumer awareness of the importance of hydration, particularly among athletes, fitness enthusiasts, and health-conscious individuals. As dehydration awareness rises, so does the demand for electrolyte supplements. Sports nutrition, rising health concerns related to dehydration, and the growing popularity of performance-enhancing products are key factors boosting market growth.

In the U.S., the market is primarily driven by a large, health-conscious population, with high demand from both the athletic community and general consumers. The growing popularity of fitness activities, including sports and wellness trends, fuels demand for electrolyte supplements. Additionally, regions with higher concentrations of sports enthusiasts, such as California and Texas, show strong growth potential due to the focus on hydration and performance in these areas.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- The U.S. Electrolyte Supplement Market was valued at USD 1,386.28 million in 2018 and is projected to reach USD 2,376.62 million by 2032, growing at a CAGR of 4.85%.

- Increasing consumer awareness about the importance of hydration is driving demand for electrolyte supplements, particularly among athletes and fitness enthusiasts.

- Rising participation in fitness and endurance sports is boosting demand for electrolyte supplements to support optimal hydration and performance.

- Growing concerns over dehydration-related health issues, like heat stroke and muscle cramps, are further fueling the market’s expansion.

- Product innovations, such as sugar-free, plant-based, and low-calorie electrolyte supplements, are attracting a broader range of consumers.

- Competition from alternative hydration options, including plain water and fruit-infused drinks, challenges electrolyte supplements to highlight their unique benefits.

- Regional trends show that the Northeast leads with urban health consciousness, while the West Coast focuses on innovation and premium products, supporting diverse market growth.

Market Drivers:

Growing Consumer Awareness of Hydration Needs

The increasing awareness of the importance of hydration is a key driver for the U.S. Electrolyte Supplement Market. Consumers are becoming more educated about the health risks associated with dehydration, particularly for athletes, fitness enthusiasts, and people living in hot climates. This has led to a significant rise in demand for electrolyte supplements, which help maintain fluid balance and replenish essential minerals lost during physical activities. The U.S. Electrolyte Supplement Market benefits from this growing focus on wellness and hydration as more consumers incorporate supplements into their daily routines.

- For instance, Nuun Hydration developed its wellness-focused tablets to contain just 1 gram of sugar, which aids in electrolyte absorption for daily hydration needs.

Rising Popularity of Sports and Performance Nutrition

Sports nutrition plays a critical role in driving demand for electrolyte supplements in the U.S. The increasing participation in fitness activities, including endurance sports, has prompted athletes and fitness enthusiasts to prioritize optimal hydration for peak performance. Electrolyte supplements are often seen as essential for preventing dehydration and improving stamina during intense physical activities. The market sees a continuous growth trend as more individuals seek out these supplements to enhance athletic performance and overall wellness.

Health Concerns Related to Dehydration

The rising concerns about dehydration-related health issues, such as heat stroke, fatigue, and muscle cramps, further contribute to the growth of the U.S. Electrolyte Supplement Market. Dehydration can negatively impact physical performance and overall well-being, especially in active individuals. As the U.S. population becomes more health-conscious, individuals are increasingly turning to electrolyte supplements to help maintain proper hydration and support their daily activities, further boosting market demand.

- For instance, to address health concerns linked to fluid loss, Skratch Labs’ Unsweetened hydration mix delivers 400mg of sodium to help maintain the body’s fluid balance and support normal muscle function.

Expansion of Product Offerings and Innovation

Product innovation within the electrolyte supplement space has also played a significant role in the market’s growth. Brands are expanding their offerings to cater to various consumer needs, such as sugar-free, plant-based, and low-calorie options. These innovations meet the diverse preferences of consumers, encouraging broader adoption of electrolyte supplements. The U.S. Electrolyte Supplement Market is benefiting from the increased availability of personalized products that cater to specific dietary needs and lifestyle choices.

Market Trends:

Increasing Demand for Convenient and On-the-Go Solutions

A prominent trend in the U.S. Electrolyte Supplement Market is the growing demand for convenient, on-the-go products. Busy lifestyles and the rising preference for portable solutions have led to an increase in single-serve packets, ready-to-drink (RTD) beverages, and electrolyte-infused snacks. Consumers are looking for easy ways to hydrate and replenish electrolytes without interrupting their daily routines. This trend is particularly strong among athletes and fitness enthusiasts who need quick and effective hydration solutions during workouts or while traveling. The U.S. Electrolyte Supplement Market is witnessing the development of more consumer-friendly formats, making it easier for individuals to integrate electrolyte supplementation into their everyday lives.

- For instance, Liquid I.V. offers its Hydration Multiplier in single-serving stick packs that deliver enhanced hydration using a specific ratio of ingredients. One stick contains 3x the electrolytes of the leading sports drink.

Shift Towards Natural and Clean Label Products

Another significant trend in the U.S. Electrolyte Supplement Market is the increasing preference for natural, clean-label products. Consumers are becoming more conscious of the ingredients in the supplements they consume, seeking products free from artificial additives, sweeteners, and preservatives. This shift is driving the demand for electrolyte supplements made with natural ingredients such as coconut water, sea salt, and fruit extracts. Brands that offer transparent ingredient sourcing and sustainability practices are gaining traction in the market. The growing interest in clean-label, plant-based, and organic products reflects a broader trend in the health and wellness industry, with consumers prioritizing products that align with their clean-living values.

- For instance, NativePath redesigned its Hydrate formula to align with clean-label demands by using non-synthetic ingredients and removing artificial flavors, the updated product now includes a combination of 11 additional micronutrients to support overall mineral balance.

Market Challenges Analysis:

Competition from Alternative Hydration Solutions

The U.S. Electrolyte Supplement Market faces significant competition from alternative hydration solutions, such as plain water, sports drinks, and homemade beverages like fruit-infused water. Consumers often view these alternatives as more accessible or cost-effective compared to electrolyte supplements. The market struggles to differentiate itself, particularly when consumers may not always recognize the specific benefits of electrolyte supplementation over regular hydration methods. Overcoming this challenge requires continuous education on the importance of maintaining electrolyte balance, especially during physical activity or hot weather.

Regulatory and Compliance Issues

The U.S. Electrolyte Supplement Market also faces challenges related to regulatory and compliance issues. The lack of clear, consistent standards for the labeling and marketing of electrolyte supplements can lead to confusion among consumers. Regulatory bodies such as the FDA impose guidelines on supplement ingredients, which can vary between products. These inconsistencies can create difficulties for manufacturers in ensuring product compliance and maintaining consumer trust. Stringent regulatory requirements may also limit the speed at which new products or innovations can be introduced to the market, hindering growth potential.

Market Opportunities:

Growth in the Sports and Fitness Sector

The U.S. Electrolyte Supplement Market has significant growth opportunities within the expanding sports and fitness sector. As more individuals adopt active lifestyles and engage in fitness activities, the demand for products that support hydration and performance continues to rise. Athletes, fitness enthusiasts, and even casual exercisers are increasingly turning to electrolyte supplements for optimal hydration. This growing market segment presents an opportunity for brands to innovate and develop specialized products tailored to various types of physical activity, from endurance sports to strength training. Catering to this consumer base can drive demand for both general and performance-specific electrolyte products.

Increasing Focus on Personalized Health Solutions

Another opportunity in the U.S. Electrolyte Supplement Market lies in the rising consumer interest in personalized health and wellness solutions. Consumers are increasingly seeking products that cater to their specific health needs, such as those with dietary restrictions, lifestyle choices, or fitness goals. This trend allows companies to offer electrolyte supplements that are customized, such as plant-based, low-sugar, or keto-friendly options. The market can capitalize on this demand by creating more targeted products, fostering customer loyalty, and establishing strong brand differentiation.

Market Segmentation Analysis:

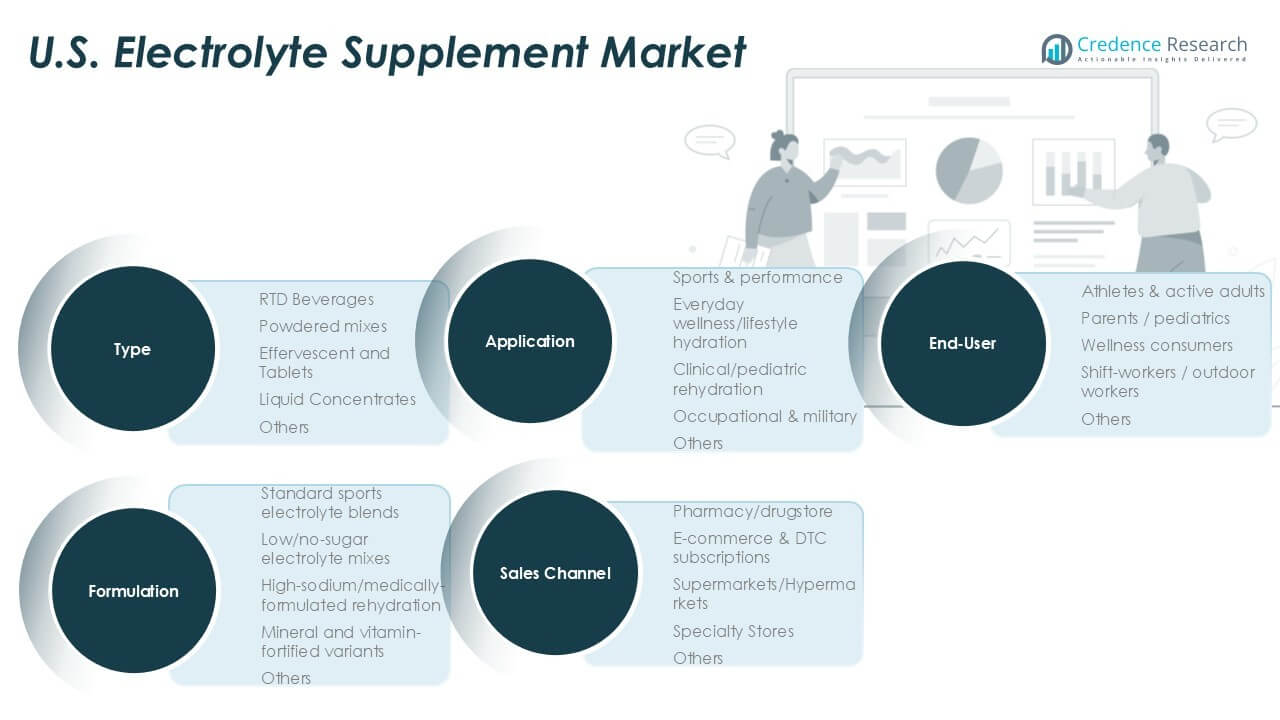

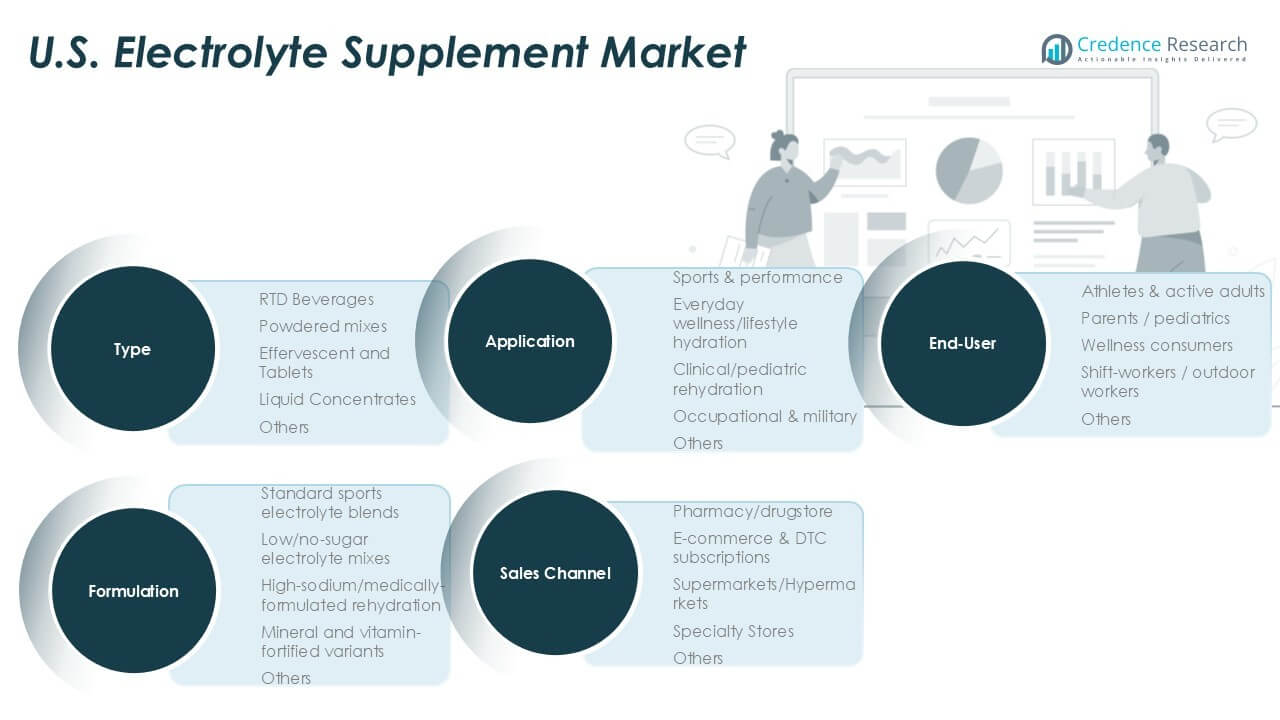

By Type

The U.S. Electrolyte Supplement Market is driven by various types of products, with RTD beverages leading the market due to their convenience for on-the-go hydration. Powdered mixes and effervescent tablets also see strong demand, offering cost-effective and customizable hydration solutions. Liquid concentrates and other niche formats contribute to the market, but they hold a smaller share compared to the more mainstream options.

- For instance, Skratch Labs developed its Hydration Sport Drink Mix to provide rapid absorption by creating a formula with low osmolality. Each serving is designed to replace electrolytes lost in sweat, delivering a precise profile of 400mg of sodium and 100mg of potassium.

By Application

In the U.S. Electrolyte Supplement Market, the sports and performance segment leads the way. Athletes and fitness enthusiasts rely on electrolyte supplements to maintain hydration and boost performance during intense activities. The everyday wellness and lifestyle hydration segment is also growing as more consumers incorporate electrolyte supplements into their daily routines. Clinical and pediatric rehydration applications, while important, represent a smaller share, primarily driven by medical and healthcare needs. The occupational and military segment adds value by catering to workers in physically demanding environments.

- For instance, Gatorade developed its Gatorlyte ready-to-drink beverage for rapid rehydration, featuring a specialized blend of five electrolytes that includes 490mg of sodium per 20 oz bottle.

By End-User

The largest consumer group in the U.S. Electrolyte Supplement Market consists of athletes and active adults, who prioritize hydration for exercise and recovery. Wellness consumers represent another significant group, using supplements for overall health and hydration. Parents of young children and shift workers/outdoor workers also contribute to the market, each with specific hydration needs. This broad range of end-users supports consistent growth and demand in the electrolyte supplement market.

Segmentations:

By Type:

- Ready-to-Drink (RTD) Beverages

- Powdered Mixes

- Effervescent Tablets

- Liquid Concentrates

- Others

By Application:

- Sports & Performance

- Everyday Wellness/Lifestyle Hydration

- Clinical/Pediatric Rehydration

- Occupational & Military

- Others

By End-User:

- Athletes & Active Adults

- Parents/Pediatrics

- Wellness Consumers

- Shift Workers/Outdoor Workers

- Others

By Formulation:

- Standard Sports Electrolyte Blends

- Low/No-Sugar Electrolyte Mixes

- High-Sodium/Medically-Formulated Rehydration

- Mineral and Vitamin-Fortified Variants

- Others

By Sales Channel:

- Pharmacy/Drugstore

- E-commerce & Direct-to-Consumer (DTC) Subscriptions

- Supermarkets/Hypermarkets

- Specialty Stores

- Others

Regional Analysis:

Northeast U.S. Market Dynamics: Urban Health Consciousness and Fitness Integration

The Northeast holds 25% of the U.S. Electrolyte Supplement Market, driven by urban health trends. Cities like New York and Boston exhibit strong demand for electrolyte powders and drinks, spurred by fitness culture and wellness awareness. Retailers report a steady rise in sales, especially in urban areas where consumers seek convenient hydration solutions. The region’s market growth is further fueled by a preference for clean-label products and multifunctional hydration options.

Midwest Region: Sports Enthusiasm and Supplement Adoption

The Midwest accounts for 20% of the U.S. Electrolyte Supplement Market, supported by strong sports participation and outdoor activities. States such as Michigan and Ohio show significant sales growth, with athletes and fitness enthusiasts adopting electrolyte powders and drinks for recovery. Retail data indicates a consistent rise in demand across the region, emphasizing health-conscious behaviors. This trend reflects the broader regional focus on fitness and wellness.

West Coast: Innovation and Premium Product Preferences

The West Coast commands 40% of the U.S. Electrolyte Supplement Market, known for its innovation and premium product preferences. California leads in the adoption of advanced hydration solutions, including electrolyte gummies and vitamin-infused waters. Consumers in this region prioritize natural ingredients and sustainability, significantly influencing product offerings. The market benefits from a strong e-commerce presence and influencer-driven marketing strategies that drive consumer engagement.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- Abbott Laboratories

- Nestlé S.A.

- Unilever PLC

- GlaxoSmithKline plc

- Otsuka Pharmaceutical Co., Ltd.

- GU Energy Labs

- Skratch Labs

- Ultima Health Products, Inc.

- Hammer Nutrition

- LyteLine LLC

- Hydralyte LLC

- Denver Bodega LLC

- Liquid I.V.

- Pedialyte (by Abbott Laboratories)

- ZICO Rising

- Adapted Nutrition

- Tailwind Nutrition

- SaltStick

- SOS Hydration

- Nuun Hydration

- Vital Proteins

- DripDrop

- Key Nutrients

- BodyHealth

- Elemental Labs

- UCAN

- Pure Encapsulations

- Orgain

- Swolverine

- Kaged

- Onnit

- Transparent Labs

Competitive Analysis:

The U.S. Electrolyte Supplement Market is highly competitive, with major players like Gatorade (PepsiCo), Bodyarmor (Coca-Cola), and Liquid I.V. (Unilever) leading through strong brand recognition and extensive distribution networks. These companies benefit from partnerships with retailers and sports organizations to enhance visibility. Emerging brands such as Nuun, Skratch Labs, and GU Energy Labs target niche segments with specialized products, including low-sugar and plant-based options, catering to health-conscious consumers and athletes. The competition is intensified by regional preferences, with North America holding the largest market share. Companies increasingly focus on e-commerce platforms and direct-to-consumer subscriptions to meet the demand for convenience and personalized hydration solutions. Innovation in product offerings and marketing strategies is key for maintaining a competitive edge in this rapidly evolving market.

Recent Developments:

- In August 2025, Abbott Laboratories’ Navitor™ Transcatheter Aortic Valve Implantation (TAVI) system received a CE Mark for an expanded indication, allowing it to treat a wider range of individuals with aortic stenosis.

- In May 2025, Nestlé launched a new line of wood-fired style crust pizzas under its DiGiorno brand brand.

Report Coverage:

The research report offers an in-depth analysis based on Type, Application, End-User, Formulation, Sales Channel. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- The U.S. Electrolyte Supplement Market will continue to grow as consumers prioritize hydration and wellness.

- Demand for specialized products, such as low-sugar, plant-based, and performance-focused supplements, will increase.

- Innovation in product formulations, such as electrolyte-infused gummies and vitamin-enhanced beverages, will drive market expansion.

- E-commerce and direct-to-consumer subscriptions will play a significant role in shaping purchasing trends and convenience.

- Sports and fitness enthusiasts will remain key drivers of growth, with electrolyte supplements becoming integral to athletic performance and recovery.

- Increased awareness of dehydration risks will encourage broader adoption across various consumer segments, including outdoor workers and shift workers.

- The rise in health-conscious consumers will support demand for clean-label, natural, and sustainable products.

- Regional growth will be influenced by localized consumer needs, with states like California and Texas seeing higher consumption due to sports culture.

- Companies will invest in research and development to offer personalized hydration solutions tailored to specific health needs.

- As market competition intensifies, companies will focus on effective marketing strategies, influencer partnerships, and collaborations to capture new customer segments.