Market Overview:

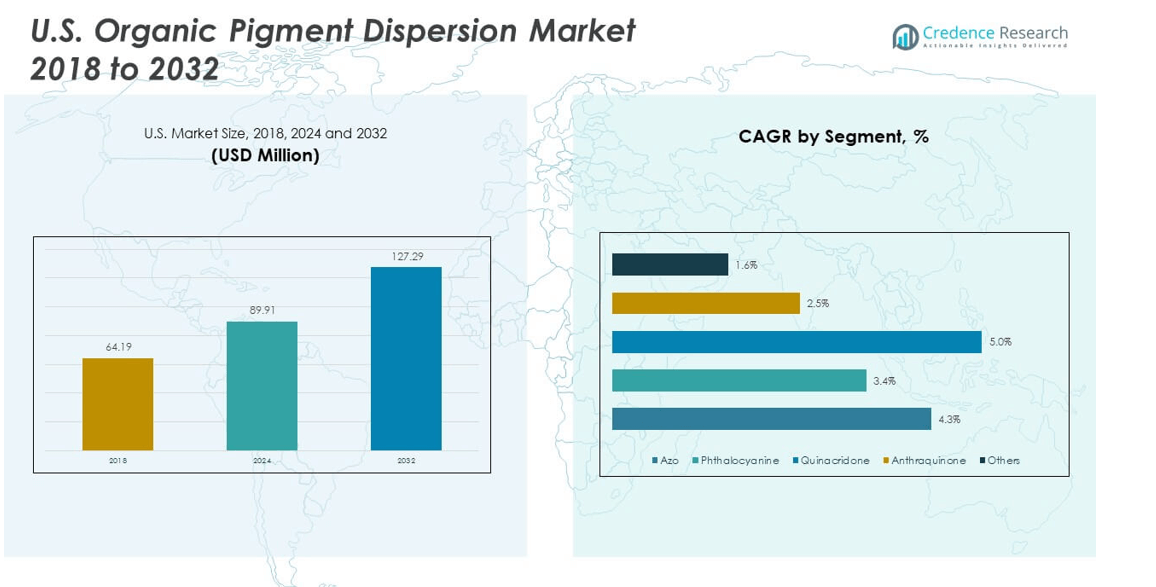

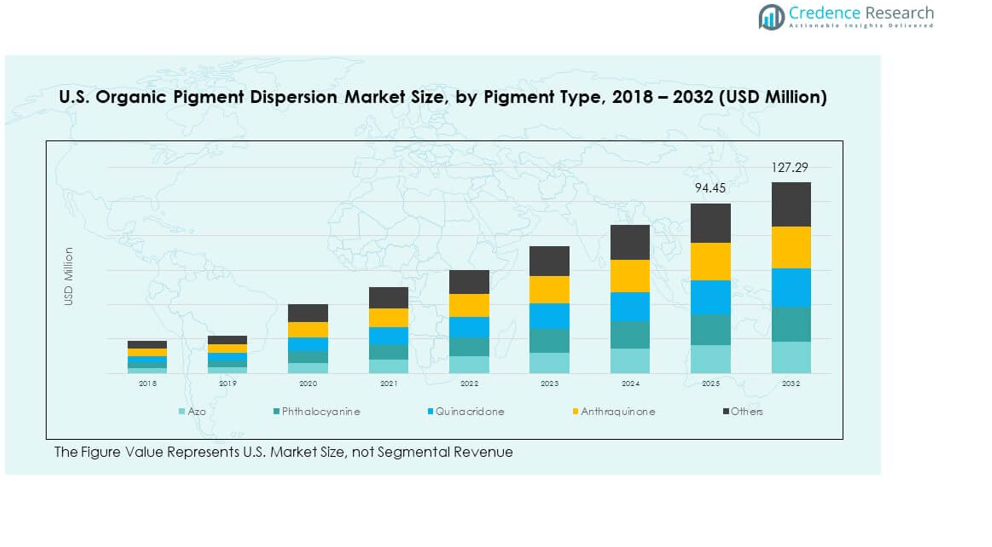

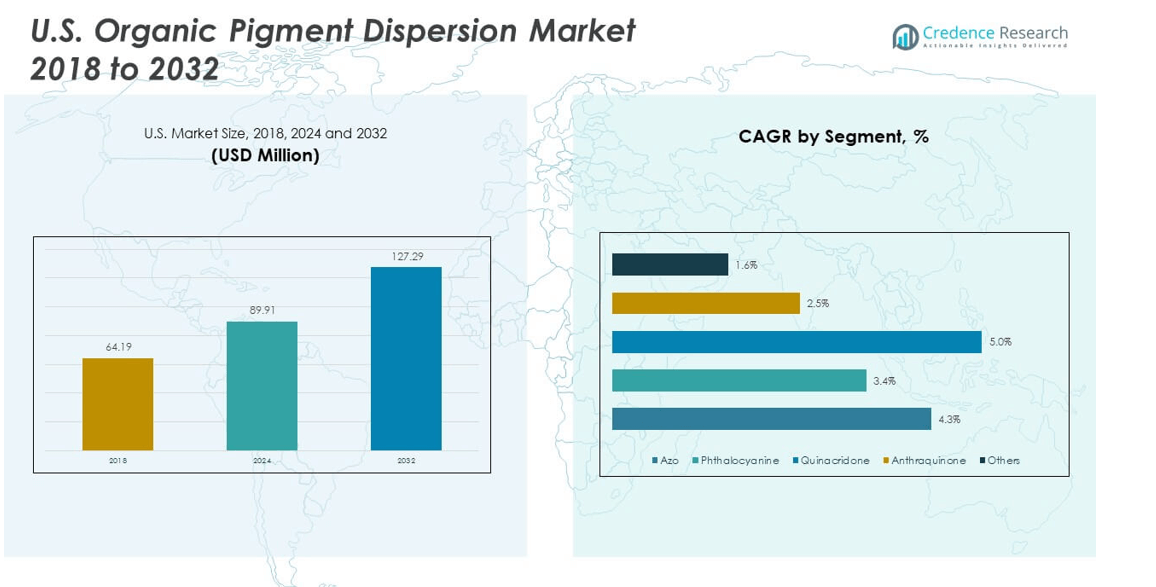

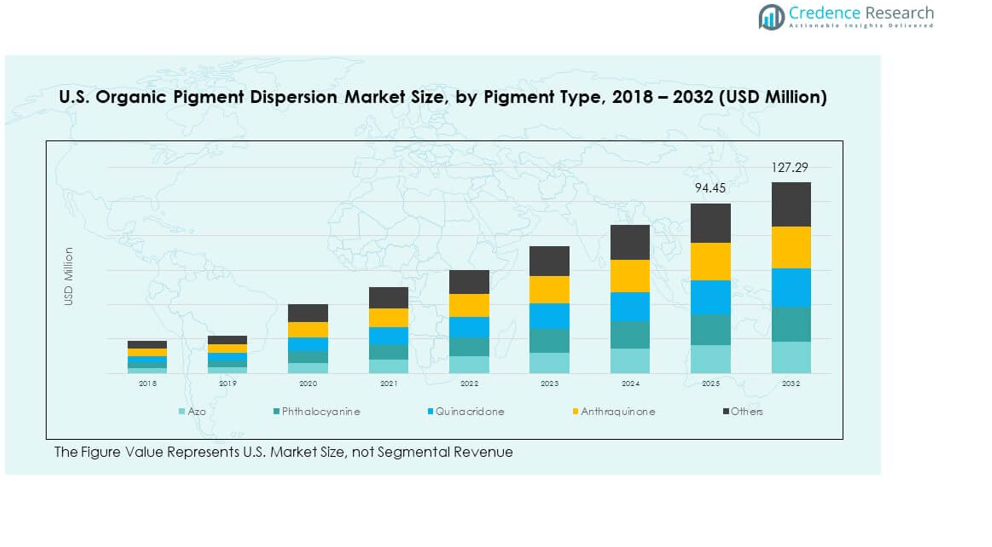

The U.S. Organic Pigment Dispersion Market size was valued at USD 64.19 million in 2018 to USD 89.91 million in 2024 and is anticipated to reach USD 127.29 million by 2032, at a CAGR of 4.36% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| U.S. Organic Pigment Dispersion Market Size 2024 |

USD 89.91 million |

| U.S. Organic Pigment Dispersion Market, CAGR |

4.36% |

| U.S. Organic Pigment Dispersion Market Size 2032 |

USD 127.29 million |

Market growth is driven by increasing demand from packaging, automotive, and textile sectors where organic dispersions provide vibrant colors, high stability, and safer alternatives to heavy-metal pigments. Strict environmental regulations encourage industries to transition toward sustainable coloring options. Companies benefit from consumer preference for eco-conscious materials, particularly in packaging and cosmetics. Expanding use of dispersions in paints and coatings further fuels growth, supported by their durability and weather resistance. Strong innovation in dispersion technology enhances efficiency, ensuring continued adoption across diverse industries.

Regionally, the U.S. market shows concentrated demand in industrialized areas where manufacturing and consumer goods production are prominent. The South and West lead adoption due to robust industrial growth, urbanization, and demand from construction and cosmetics. The Northeast holds steady due to its strong packaging and printing industries, while the Midwest benefits from automotive and polymer applications. Emerging demand stems from regions experiencing industrial expansion, coupled with rising consumer preference for sustainable products. This regional diversity strengthens the overall market trajectory.

Market Insights

- The U.S. Organic Pigment Dispersion Market was valued at USD 64.19 million in 2018, reached USD 89.91 million in 2024, and is projected to hit USD 127.29 million by 2032, growing at a CAGR of 4.36%.

- The South and West dominate with 40% share, supported by strong demand in construction, cosmetics, and industrial packaging.

- The Northeast holds 32% share, driven by packaging and printing industries, while the Midwest follows with 28% share from automotive and plastics demand.

- The fastest-growing subregion is the West, benefiting from urbanization, sustainability initiatives, and high consumer product adoption.

- Azo pigments lead with 35% share in pigment type, followed by Phthalocyanine at 28%, supported by their broad use across printing and coatings.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers

Rising Adoption of Eco-Friendly and Non-Toxic Coloring Agents

The U.S. Organic Pigment Dispersion Market is expanding as industries demand sustainable coloring agents that replace heavy metal-based pigments. Companies focus on non-toxic, biodegradable, and environmentally safe options to comply with strict U.S. environmental regulations. Increasing consumer awareness of sustainability encourages manufacturers to adapt greener formulations. The shift toward natural and eco-conscious products creates long-term opportunities in packaging, textiles, and coatings. Regulators enforce compliance across sectors, ensuring sustainable practices remain mandatory. The transition supports not only health safety but also brand reputation. Packaging companies particularly invest in eco-friendly pigments to meet customer preferences. This movement strengthens the market’s trajectory across major applications.

- For example, BASF’s Care Chemicals division, under its Care 360° program, provides Product Carbon Footprint transparency through a digital service platform. The program also applies a third-party-certified biomass balance approach that replaces fossil feedstocks with renewable raw materials while maintaining identical product performance.

Growing Demand from Packaging and Printing Industries

The packaging and printing industries remain key growth engines for the U.S. Organic Pigment Dispersion Market. The rise of e-commerce and consumer goods manufacturing increases the need for advanced packaging solutions. High-quality dispersions offer color vibrancy, stability, and durability across a wide range of substrates. Printing houses prefer organic dispersions for their compatibility with digital, flexographic, and gravure processes. Packaging companies value these pigments for enhancing visual appeal while maintaining compliance with food safety standards. Consumer preferences drive strong investments in premium and sustainable packaging formats. The demand accelerates further with growth in online retail and fast-moving consumer goods. It continues to reinforce the essential role of pigments in design and branding.

Expanding Use in Paints, Coatings, and Textiles

Paints, coatings, and textiles represent major demand verticals contributing to steady market growth. The U.S. construction and automotive sectors increasingly integrate organic dispersions in coatings for durability and aesthetics. Textile manufacturers adopt pigment dispersions to meet evolving fashion preferences with sustainable solutions. The U.S. Organic Pigment Dispersion Market gains traction as companies replace solvent-based colorants with safer alternatives. Industries seek pigments offering resistance to weathering, heat, and abrasion for improved product life. Demand also grows from architectural coatings driven by consumer housing renovation projects. In textiles, vibrant colors and eco-certified processes appeal strongly to both domestic and international buyers. These dynamics establish the dispersions as a core material in multiple industries.

Regulatory Push and Corporate Sustainability Goals

Governmental regulations and corporate commitments drive the adoption of eco-friendly pigments in the U.S. Companies align with policies restricting harmful chemicals and aim for greener supply chains. The Environmental Protection Agency sets stringent guidelines, pushing industries toward sustainable coloring solutions. Corporate sustainability targets require manufacturers to reduce carbon footprints and enhance recyclable product designs. These commitments lead to strong adoption of organic pigment dispersions across applications. The U.S. Organic Pigment Dispersion Market grows further as industries view compliance as an opportunity rather than a constraint. Large corporations implement sustainable procurement policies to influence their suppliers. This structured regulatory and corporate framework enhances growth momentum across the market landscape.

- For example, the U.S. FDA and EPA regulate pigment use in food packaging, placing strict limits on hazardous substances such as polynuclear aromatic hydrocarbons and benzopyrene. These regulatory standards push pigment manufacturers to focus on compliant organic dispersions for safe application in food-contact inks.

Market Trends

Integration of Smart and Functional Packaging Solutions

The U.S. Organic Pigment Dispersion Market experiences growth through innovations in smart and functional packaging. Companies incorporate pigments into intelligent packaging systems designed for traceability, freshness indicators, and consumer engagement. Smart packaging expands in food and beverages, pharmaceuticals, and premium consumer goods. Pigments improve design flexibility, enabling brands to stand out in competitive retail spaces. The integration of technology with organic dispersions highlights advanced product positioning. Consumer interest in visually enhanced, informative packaging drives further adoption. Brands leverage pigments not just for color but for functional differentiation. This trend aligns with the rising convergence of sustainability and digital consumer experiences.

- For example, BASF partnered with StePac in December 2022 to supply Ultramid® Ccycled®, a chemically recycled polyamide 6, for StePac’s Xgo® and Xtend® modified atmosphere packaging brands. These films help extend the shelf life of fresh produce by controlling humidity and atmosphere and now include recycled content to enhance sustainability while maintaining performance.

Technological Advancements in Dispersion Formulations

Technology improvements shape product performance by enhancing dispersibility, durability, and stability across applications. Research institutions and companies invest in advanced milling and processing techniques. The U.S. Organic Pigment Dispersion Market benefits as pigments achieve higher compatibility with modern inks and coatings. Improved formulations reduce waste and increase production efficiency. Industries demand pigments that resist fading, bleeding, and environmental degradation. Advanced surface treatments further enhance pigment performance in high-end applications. Manufacturers aim to deliver products that balance performance with sustainability. This trend demonstrates how technological upgrades continue to redefine pigment usability across demanding industries.

Customization and Personalization of Color Solutions

Consumer preferences for unique designs and customized products influence adoption trends. Companies respond by offering tailor-made pigment dispersions aligned with brand identity. The U.S. Organic Pigment Dispersion Market supports industries seeking distinct color profiles for packaging, textiles, and cosmetics. Customization strengthens brand loyalty and improves shelf visibility in competitive markets. The demand for specialty shades and unique textures fuels research into advanced dispersion systems. Industries pursue pigments that reflect both functionality and design creativity. Smaller players capitalize on niche markets with personalized pigment offerings. This trend positions dispersions as a versatile and brand-defining material.

- For example, Heubach expanded its Colanyl® 500 pigment preparation range in July 2022 with Colanyl Orange H5GD 500, delivering brilliant and stable orange shades for waterborne architectural and decorative coatings. The Colanyl 500 series is binder-free, APEO-free, low-VOC, offers a 24-month shelf life, and provides strong compatibility for in-plant and point-of-sale tinting, as confirmed in Heubach’s technical releases.

Digital Printing Growth and Its Impact on Pigments

Digital printing expansion drives the need for high-performance organic pigment dispersions. The sector demands pigments that ensure fast drying, vibrant colors, and precision printing. The U.S. Organic Pigment Dispersion Market strengthens as digital printing gains popularity in labels, packaging, and textiles. Small-batch and on-demand printing formats particularly rely on dispersions for consistent results. The technology reduces turnaround times and supports sustainability through low-waste printing. Pigments tailored for digital formats enhance the growth potential in this segment. Printing companies emphasize high compatibility with eco-friendly inks. This trend reinforces dispersions as a vital material in advanced digital printing ecosystems.

Market Challenges Analysis

High Production Costs and Raw Material Volatility

The U.S. Organic Pigment Dispersion Market faces challenges from rising production costs and fluctuating raw material supply. The cost of raw inputs, particularly petrochemical derivatives, affects the price stability of pigment dispersions. Smaller manufacturers struggle to compete due to limited resources and higher dependency on imports. Volatile raw material costs hinder long-term planning and affect margins across the value chain. Price-sensitive industries may shift toward alternative pigments when cost pressures intensify. It creates uncertainty in scaling production and maintaining consistent quality. Economic slowdowns and supply chain disruptions further aggravate this challenge. Manufacturers require strong sourcing strategies to mitigate volatility.

Competition from Alternatives and Performance Limitations

Competition from synthetic or inorganic pigments remains a key restraint for the U.S. Organic Pigment Dispersion Market. Inorganic pigments often deliver superior heat and light stability at lower cost. Industries with high-performance demands sometimes prefer alternatives, slowing adoption rates. The relative limitations of organic dispersions in extreme conditions affect their competitiveness. It requires consistent innovation to close the performance gap. Price competition adds another barrier, particularly in cost-sensitive end-user segments. Companies must balance performance improvements with affordability to remain competitive. These constraints present hurdles that challenge the overall pace of market expansion.

Market Opportunities

Expansion into High-Performance and Specialty Applications

The U.S. Organic Pigment Dispersion Market presents opportunities in high-performance coatings, automotive, and aerospace sectors. Demand grows for dispersions with enhanced resistance to weather, heat, and abrasion. Specialty applications in electronics and renewable energy create new avenues for pigment use. It strengthens the market by meeting advanced technical requirements across industries. Companies developing niche, high-value pigments gain a competitive edge. The opportunity also lies in providing pigments that align with global sustainability certifications. Market growth depends on innovation that meets both performance and compliance needs. This expansion positions dispersions as vital solutions for specialized industrial demands.

Growing Focus on Circular Economy and Recyclability

The shift toward circular economy principles opens significant opportunities for dispersions. Companies prioritize pigments that support recyclability of packaging and consumer goods. The U.S. Organic Pigment Dispersion Market benefits from this alignment with global recycling goals. Manufacturers that integrate eco-friendly dispersions into packaging gain strong brand advantage. Regulatory frameworks encourage recyclable and low-carbon materials in multiple industries. Consumer awareness accelerates the demand for sustainable pigment solutions. Companies that lead in developing recyclable pigment systems capture future market share. This opportunity aligns growth with broader sustainability and climate objectives across the U.S. market.

Market Segmentation Analysis

By pigment type, azo pigments represent a dominant segment due to their versatility, cost-effectiveness, and wide use in packaging and printing. Phthalocyanine pigments follow with strong demand from coatings and plastics for their stability and vibrant color strength. Quinacridone pigments gain traction in premium applications such as automotive coatings and high-end textiles. Anthraquinone pigments remain important for specialty uses requiring durability under extreme conditions. The U.S. Organic Pigment Dispersion Market also sees contributions from other pigments, serving niche needs in cosmetics and specialty polymers. It reflects a diverse pigment base aligned with application-specific performance.

- For example, Heubach’s Quinacridone Magenta PR 122 pigment grade is used in high-end coatings and digital inks, valued for its strong color retention and durability in demanding applications.

By application, printing inks hold the largest share, supported by extensive use across packaging, publishing, and commercial printing. Paints and coatings emerge as another key segment, driven by architectural, automotive, and industrial demand. Plastics and polymers adopt dispersions to achieve consistent color and compliance with environmental standards. Textiles incorporate pigments for sustainable fashion and durable finishes. Cosmetics show steady uptake with a focus on safe, non-toxic, and vibrant formulations. Other applications include niche uses across electronics and specialty goods. It demonstrates how broad adoption across industries continues to support market growth.

- For example, PPG supplies waterborne and powder coating solutions for architectural applications, offering zero- or low-VOC formulations that comply with strict environmental standards and support credits toward LEED-certified buildings.

Segmentation

By Pigment Type

- Azo

- Phthalocyanine

- Quinacridone

- Anthraquinone

- Others

By Application

- Printing Inks

- Paints & Coatings

- Plastics & Polymers

- Textiles

- Cosmetics

- Others

Regional Analysis

Northeast United States

The Northeast accounts for 32% share of the U.S. Organic Pigment Dispersion Market, driven by its established printing, packaging, and specialty chemicals industries. Strong demand emerges from states like New York, New Jersey, and Pennsylvania where packaging and textiles dominate consumption. Advanced R&D facilities and proximity to end-use industries strengthen the region’s growth. Companies in this area benefit from a skilled workforce and close connections to universities supporting innovation. Regulatory compliance remains strict, pushing businesses toward eco-friendly pigments. It reflects a steady balance of industrial use and sustainability initiatives.

Midwest United States

The Midwest holds 28% market share, supported by its strong industrial base and manufacturing clusters. States such as Illinois, Ohio, and Michigan contribute significantly with demand from automotive coatings, plastics, and construction applications. The U.S. Organic Pigment Dispersion Market gains traction here due to high-volume production facilities and a concentration of consumer goods manufacturing. Textiles and packaging industries rely on dispersions to maintain quality and compliance standards. The region shows consistent adoption of sustainable formulations, backed by corporate commitments. It remains a critical hub for bulk consumption and supply chain efficiency.

South and West United States

The South and West together account for 40% of market share, making them the leading subregions. California and Texas act as key growth engines, with industries like cosmetics, paints, and specialty packaging driving demand. The U.S. Organic Pigment Dispersion Market expands rapidly in these states due to urbanization, construction projects, and high consumer product demand. Cosmetic and personal care manufacturers adopt dispersions to enhance branding and regulatory alignment. The South shows rising adoption in industrial packaging, while the West emphasizes innovation in sustainable coatings. It secures a strong growth trajectory through broad end-user diversity and economic expansion.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- DCL Corporation

- Palmer Holland, Inc.

- Barentz

- First Source Worldwide, LLC

- Chromaflo: A Vibrantz Technologies

- Ravago Chemicals U.S.

- Neelikon Colors Global USA Inc.

- ColorChem International Corp.

- Plastiques St-Paul Inc.

- Liberty Specialty Chemicals

Competitive Analysis

The U.S. Organic Pigment Dispersion Market features a competitive landscape shaped by global and regional players. Leading companies such as DCL Corporation, Palmer Holland, and Chromaflo focus on broad product portfolios and innovation in eco-friendly pigment systems. It remains highly fragmented, with mid-sized firms like First Source Worldwide and Liberty Specialty Chemicals competing by offering niche and customized dispersions. Large distributors such as Barentz and Ravago Chemicals U.S. leverage strong supply chains and partnerships to strengthen market reach. Neelikon Colors Global and ColorChem International target specialty segments like cosmetics and textiles, aligning with consumer-driven demand. Plastiques St-Paul enhances its presence in polymers and industrial applications. Competitive differentiation centers on product performance, sustainability, and application-specific solutions. Companies emphasize R&D investment, regional expansions, and new product launches to maintain leadership in this evolving market.

Recent Developments

- In August 2025, DCL Corporation entered a new distribution partnership with Superior Materials Inc., effective August 1, expanding its reach in the U.S. organic pigment dispersion market. This collaboration is aimed at enhancing product availability and customer service across North America, reflecting DCL’s ongoing strategy to strengthen its distribution network for pigment dispersions in the U.S. coatings and plastics industries.

- In July 2025, Sun Chemical, a wholly owned subsidiary of DIC Corporation, launched a new effect pigment called Chione Electric Amber SB90D, expanding its Chione Electric product line with a shimmering amber hue. This pigment is designed for vegan beauty products in cosmetics, skin, and sun care, offering enhanced chroma, UV stability, and non-staining properties.

- In May 2023, Palmer Holland, Inc., a specialty chemical distributor headquartered in Cleveland, Ohio, restructured its executive team to strengthen its focus on people, growth, and customer service. New appointments included leadership roles in industrial specialties and consumer & life sciences segments to support market transformation and sustained growth

- In February 2023, The Heubach Group entered an exclusive distribution partnership with Lintech International LLC. The agreement brings Heubach’s full set of organic, inorganic, and anti-corrosive pigment dispersions to U.S. markets, supporting powerful outreach across coatings, plastics, and printing sectors.

Report Coverage

The research report offers an in-depth analysis based on Pigment Type and Application. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The U.S. Organic Pigment Dispersion Market will expand with steady demand across packaging and printing applications.

- Regulatory pressure will accelerate the shift from heavy-metal pigments to organic alternatives.

- Advancements in digital printing will strengthen adoption, particularly in labels and on-demand packaging.

- Sustainability goals will push companies to develop recyclable and eco-certified pigment dispersions.

- Growth in automotive and construction coatings will create new opportunities for durable pigment solutions.

- Customization trends in textiles and cosmetics will drive demand for unique, high-performance color dispersions.

- Investment in R&D will lead to advanced formulations with improved resistance and stability.

- Market players will focus on mergers and partnerships to expand distribution networks.

- Regional growth will be driven by strong industrial bases in the South and West.

- Rising consumer awareness of safe and sustainable products will ensure long-term market resilience.