Market Overview:

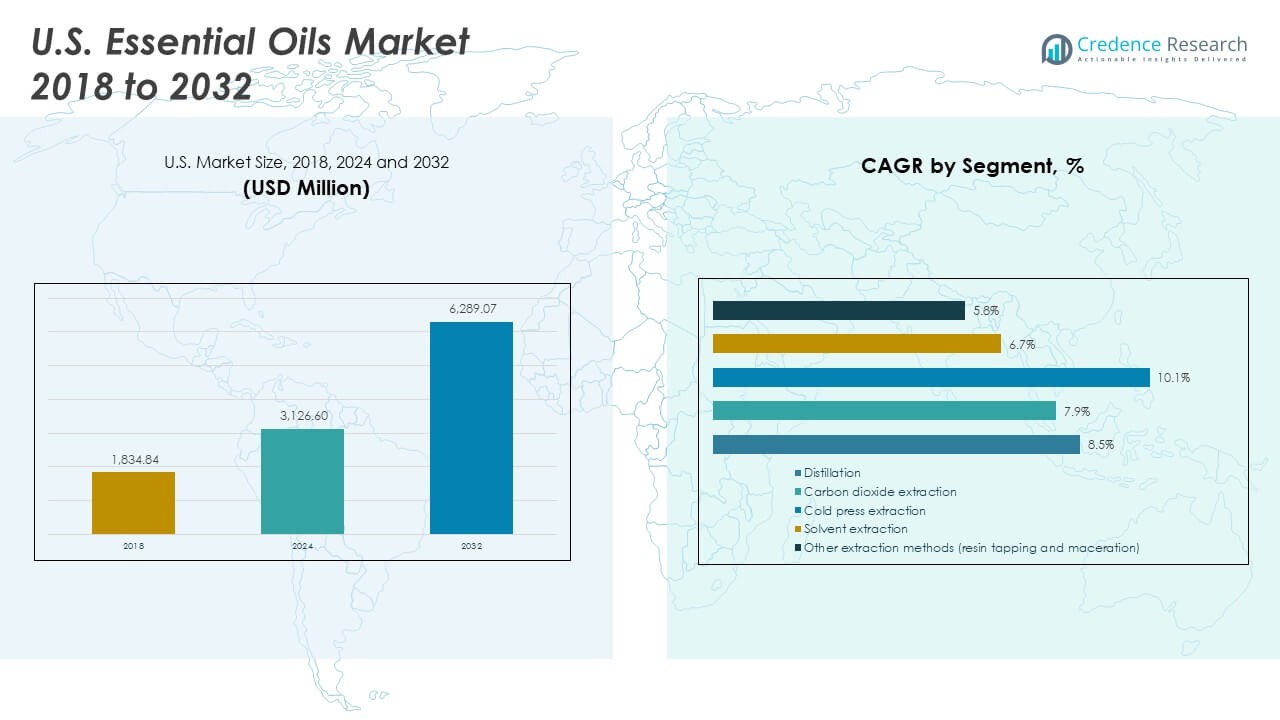

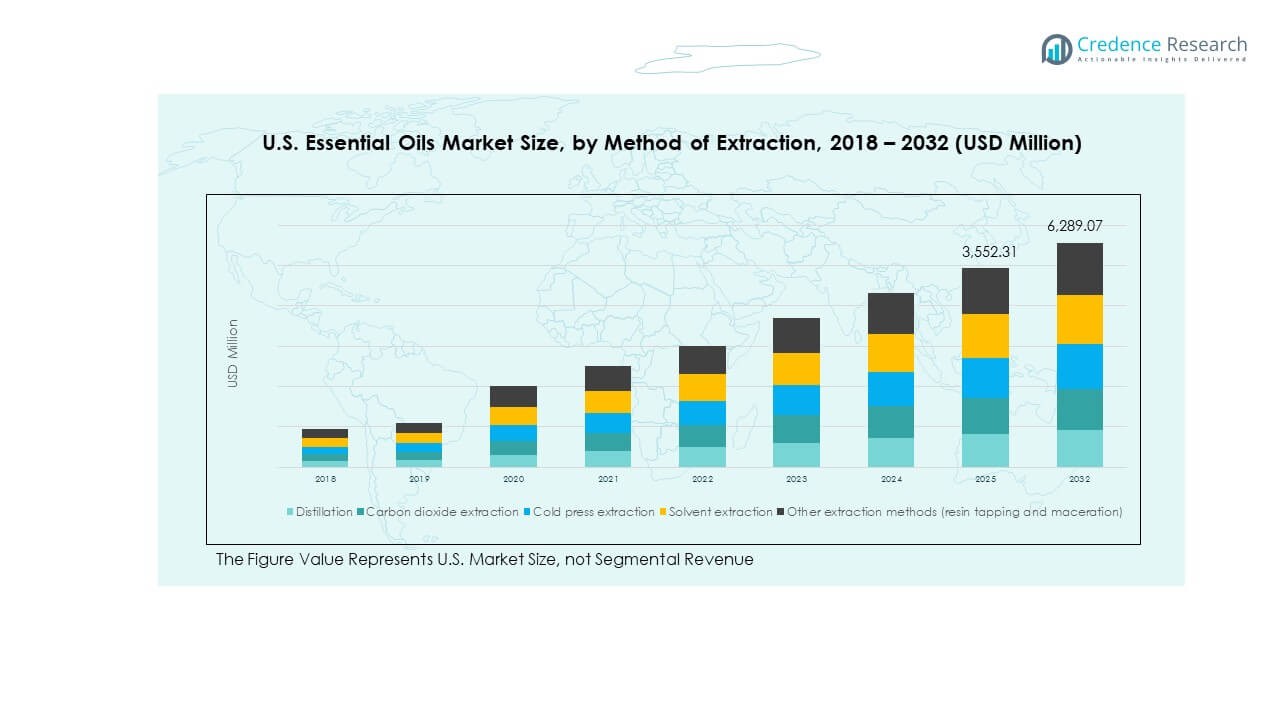

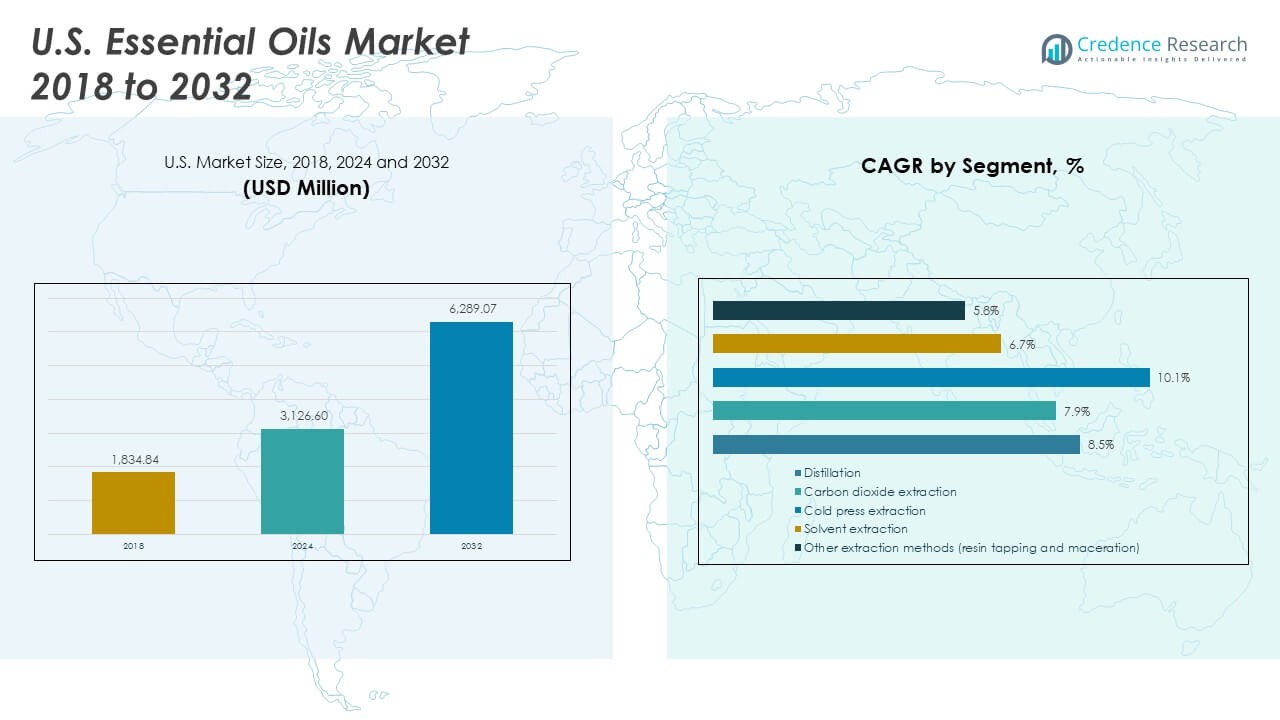

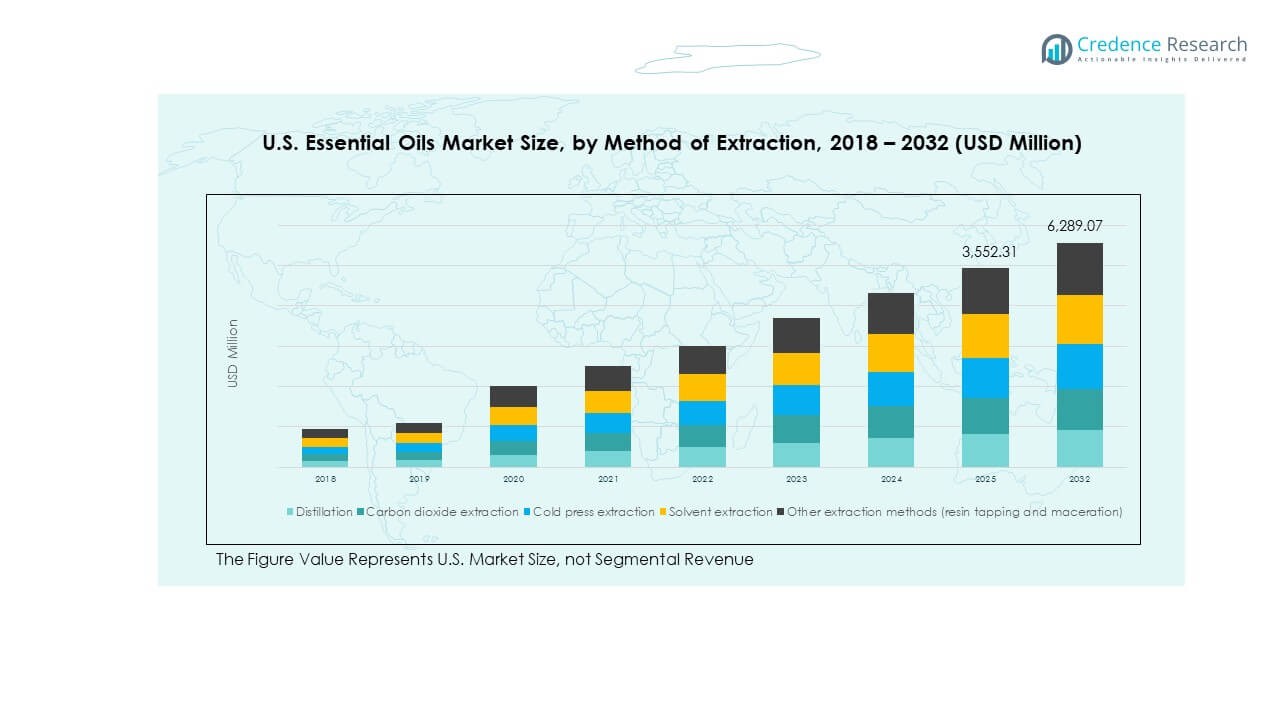

The U.S. Wood Essential Oils Market size was valued at USD 1,834.84 million in 2018 to USD 3,126.60 million in 2024 and is anticipated to reach USD 6,289.07 million by 2032, at a CAGR of 8.50% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| U.S. Wood Essential Oils Market Size 2024 |

USD 3,126.60 Million |

| U.S. Wood Essential Oils Market, CAGR |

8.50% |

| U.S. Wood Essential Oils Market Size 2032 |

USD 6,289.07 Million |

The market is driven by increasing consumer preference for natural and sustainable products in personal care, aromatherapy, and household applications. Rising awareness of the therapeutic benefits of wood essential oils, such as stress relief, improved sleep quality, and enhanced mental wellness, supports growth. Expanding use in cosmetics, fragrances, and cleaning solutions also contributes to higher adoption. Furthermore, manufacturers are focusing on sustainable sourcing practices and innovative blends to meet evolving consumer expectations, further boosting demand across the country.

Geographically, the U.S. Wood Essential Oils Market shows strong traction across developed regions with well-established wellness, cosmetics, and personal care industries. States with higher consumer spending on natural and organic products, such as California and New York, lead adoption. Emerging demand in regions focusing on alternative medicine and eco-conscious lifestyles also strengthens growth. Expansion of distribution through e-commerce platforms and specialty stores ensures wider accessibility, reinforcing the market’s overall presence across the U.S.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- The U.S. Wood Essential Oils Market was valued at USD 1,834.84 million in 2018, reached USD 3,126.60 million in 2024, and is projected to reach USD 6,289.07 million by 2032, growing at a CAGR of 8.50%.

- California holds 28%, New York 22%, and Texas 18% of the market, driven by high consumer spending, strong cosmetic and fragrance industries, and advanced retail networks.

- The Midwest, with 12% share, is the fastest-growing region, supported by rising demand for eco-friendly products and adoption of aromatherapy in wellness practices.

- Distillation accounts for 46% of the market, making it the dominant extraction method due to efficiency and widespread industrial application.

- Carbon dioxide extraction captures 25%, driven by demand for high-purity oils in premium personal care and therapeutic products.

Market Drivers:

Rising Demand for Natural Wellness Products:

The U.S. Wood Essential Oils Market benefits from growing consumer preference for natural and plant-based wellness solutions. People are increasingly replacing synthetic fragrances and therapeutic products with essential oils due to safety and sustainability. Aromatherapy applications continue to gain momentum as consumers prioritize stress relief, relaxation, and emotional well-being. The growing focus on holistic health drives greater adoption of oils derived from sandalwood, cedarwood, and rosewood. Companies emphasize clean labeling and transparency, which resonates strongly with health-conscious buyers. It also expands acceptance among younger demographics looking for eco-friendly choices. The strong alignment between wellness trends and essential oils boosts long-term growth in the market.

- For instance, Firmenich has developed Dreamwood™, a sandalwood-derived ingredient sourced from 100% renewable carbon, showcasing innovation in sustainable ingredient creation and CO2 emission reductions by 44.9% compared to its 2015 baseline.

Expansion Across Personal Care and Cosmetic Industries:

The demand for wood essential oils has strengthened in personal care and cosmetic formulations, ranging from skincare to luxury fragrances. Growing consumer interest in products with therapeutic and aromatic properties drives wider usage. Leading brands integrate natural oils to enhance sensory appeal and align with sustainable beauty goals. This trend is supported by rising disposable income and willingness to invest in premium personal care products. Manufacturers position wood oils as high-value ingredients with multiple benefits, including antimicrobial and soothing effects. The U.S. Wood Essential Oils Market thrives on this expansion, as companies highlight innovation in blends and applications. It supports long-term product diversification and broadens revenue potential.

- For instance, Givaudan participates in a vetiver cultivation program using unused arid lands in India to grow sustainable vetiver with distinct olfactory properties, combining ethical sourcing and innovation to preserve natural resources while enhancing fragrance quality.

Rising Penetration in Household and Cleaning Products:

The shift toward eco-friendly household solutions has created a solid market for wood essential oils. Consumers demand natural disinfectants and cleaning products that avoid harsh chemicals. Oils such as cedarwood and pine are used for antibacterial and aromatic properties, meeting both functional and lifestyle needs. It enhances indoor environments by offering natural fragrance combined with cleaning efficiency. Companies invest in product innovation to strengthen their presence in sustainable homecare solutions. Market adoption increases through distribution in both online and offline channels, giving consumers broader access. The preference for safe, natural household alternatives ensures steady demand for wood oils in this sector.

Strong Role of E-Commerce and Retail Expansion:

Digital platforms have played a crucial role in expanding consumer access to essential oils. Online marketplaces showcase diverse brands, packaging options, and pricing models, which encourage trial and repeat purchases. The U.S. Wood Essential Oils Market benefits from social media influence, where wellness-focused content drives awareness and adoption. Retail expansion through specialty stores and wellness outlets further reinforces accessibility. Companies leverage targeted marketing campaigns to highlight authenticity and therapeutic value. The combination of digital and offline strategies ensures greater consumer engagement and retention. It creates a competitive landscape where brand differentiation plays a key role in growth.

Market Trends:

Innovation in Blending and Product Customization:

A strong trend shaping the U.S. Wood Essential Oils Market is the focus on innovative blending and product customization. Brands experiment with unique combinations of wood oils and other botanicals to create premium offerings. Customized essential oil blends appeal to consumers seeking personalized wellness solutions. Companies develop signature scents for luxury fragrances and therapeutic products, targeting niche segments. It drives higher value perception and brand loyalty in an increasingly competitive market. Digital platforms also allow consumers to access personalized recommendations based on lifestyle needs. This trend reflects an industry shift toward personalization as a key differentiator.

Growth of Premium and Luxury Positioning:

Premiumization has become a defining trend as consumers associate wood essential oils with sophistication and exclusivity. Sandalwood and rosewood oils, in particular, hold prestige value in fragrances and skincare. The U.S. Wood Essential Oils Market capitalizes on this perception by aligning with luxury product lines. High-income consumers demand rare and sustainably sourced oils, pushing brands to highlight sourcing integrity. It supports partnerships with high-end cosmetic and fragrance companies, further elevating market value. Companies invest in elegant packaging and storytelling to emphasize exclusivity. This trend not only increases margins but also strengthens long-term brand equity.

- For instance, Estée Lauder introduced its Wood Mystique fragrance, incorporating ultra-rich cedarwood extracted by supercritical fluid extraction (SFE), known for enhancing aroma longevity and rare ingredient purity, thus reinforcing luxury positioning.

Emphasis on Sustainable and Ethical Sourcing:

Sustainability plays an increasingly critical role in shaping consumer expectations. Companies emphasize traceable supply chains, responsible forestry practices, and certifications to establish trust. The U.S. Wood Essential Oils Market integrates sustainability into its growth strategy to align with eco-conscious buyers. Brands focus on community-based sourcing programs that ensure fair trade and long-term availability of raw materials. It also mitigates risks of resource depletion and strengthens global competitiveness. Marketing messages centered on ethical sourcing resonate with millennial and Gen Z consumers. The trend highlights the growing intersection between consumer values and corporate responsibility in this sector.

Rising Integration into Alternative Therapies:

Alternative medicine and complementary therapies continue to expand across the U.S., strengthening the role of wood essential oils. Oils such as cedarwood and sandalwood are increasingly integrated into therapies targeting stress, anxiety, and respiratory wellness. It expands applications beyond cosmetics and household uses into holistic healthcare practices. Practitioners recommend oils as supportive treatments alongside conventional medicine, broadening adoption. The U.S. Wood Essential Oils Market benefits from consumer trust in alternative solutions. Growing institutional acceptance of aromatherapy in wellness centers and clinics accelerates this trend. It underlines the widening scope of essential oils as both preventive and therapeutic tools.

Market Challenges Analysis:

Supply Chain Volatility and Resource Scarcity:

The U.S. Wood Essential Oils Market faces significant challenges due to volatility in raw material supply. Essential oils such as sandalwood and rosewood depend on long growth cycles and limited geographic sources. Overharvesting and deforestation concerns restrict supply, creating higher costs for manufacturers. It increases dependency on imports and exposes the market to geopolitical and environmental risks. Small producers struggle to maintain consistent quality due to limited infrastructure. Certification and compliance requirements add further complexities to the sourcing process. These constraints challenge scalability and threaten the long-term stability of supply chains.

Intense Competition and Consumer Education Gaps:

The market also confronts strong competition from synthetic substitutes and alternative natural oils. Price sensitivity among certain consumer groups limits the adoption of premium wood oils. It creates pressure on companies to differentiate through branding and authenticity. Consumer education gaps about benefits and applications of wood oils also hinder growth. Mislabeling and adulteration of products weaken trust and reduce demand in some categories. Regulatory scrutiny adds compliance burdens for both domestic and international players. The U.S. Wood Essential Oils Market must overcome these challenges through clear communication, innovation, and stricter quality controls.

Market Opportunities:

Expanding Role in Functional Wellness Products:

The U.S. Wood Essential Oils Market holds strong potential through integration into functional wellness categories. Rising interest in mental health, sleep improvement, and stress management supports new product development. It enables brands to position wood oils as solutions for both physical and emotional wellness. Companies can expand into dietary supplements, diffusers, and spa products with targeted formulations. Growing demand in institutional wellness programs also presents new avenues. Strategic partnerships with healthcare providers and fitness centers enhance visibility. The diversification into broader wellness applications creates a solid foundation for sustainable growth.

Emerging Opportunities in Sustainable Luxury and Exports:

The emphasis on sustainability and luxury positioning opens opportunities for U.S. producers to capture premium niches. Brands highlighting ethical sourcing and exclusive blends can appeal to global luxury markets. The U.S. Wood Essential Oils Market benefits from increasing exports to regions valuing natural and eco-friendly products. It also creates scope for collaboration with international fragrance and cosmetic houses. Companies can leverage certifications to strengthen credibility in both domestic and global markets. Consumer willingness to invest in sustainable luxury creates a profitable pathway. It allows producers to balance ethical practices with higher-value returns, ensuring long-term competitiveness.

Market Segmentation Analysis:

By Type

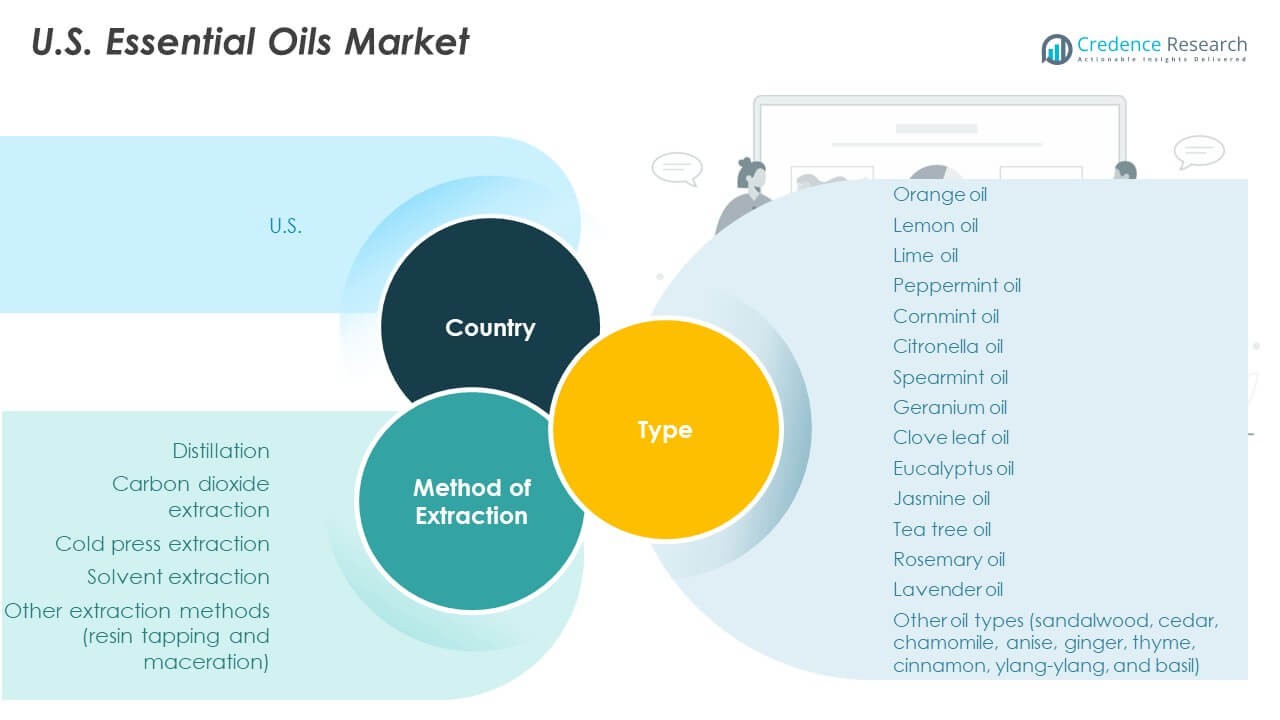

The U.S. Wood Essential Oils Market is segmented into a wide range of oils serving personal care, aromatherapy, household, and therapeutic uses. Orange oil, lemon oil, and lime oil register high demand in fragrances, cleaning products, and wellness solutions. Peppermint, cornmint, and spearmint oils hold strong traction in oral care, pharmaceuticals, and skincare due to their cooling and soothing properties. Citronella and eucalyptus oils find applications in insect repellents and respiratory aids, while clove leaf and geranium oils capture interest in cosmetics and niche therapeutic products. Jasmine, tea tree, rosemary, and lavender oils remain preferred choices for premium skincare and aromatherapy. Other oils, including sandalwood, cedar, chamomile, ginger, thyme, cinnamon, ylang-ylang, and basil, support luxury, holistic wellness, and alternative medicine segments.

- For instance, East Indian Sandalwood oil typically yields around 3% to 6% oil through steam distillation, with its characteristic aroma and therapeutic properties largely attributed to its high content of \(\alpha \)-santalol, which usually exceeds 40%.

By Method of Extraction

By extraction method, distillation dominates the U.S. Wood Essential Oils Market for its scalability, efficiency, and ability to preserve purity. Carbon dioxide extraction is expanding due to growing demand for high-purity oils in premium cosmetics and therapeutic applications. Cold press extraction plays a vital role in citrus oils, maintaining aroma and bioactive components. Solvent extraction remains important for delicate floral oils such as jasmine, where preserving fragrance is essential. Other extraction methods, including resin tapping and maceration, hold a smaller share but are indispensable for specialty oils like sandalwood and cedar. These varied methods ensure adaptability to different consumer preferences and industrial applications, strengthening the market’s overall resilience.

- For instance, traditional steam distillation of Santalum spicatum heartwood achieves a 1.15% yield of sandalwood oil with significant sesquiterpene content after a 16.5-hour batch process, highlighting extraction efficiency.

Segmentation:

By Type

- Orange oil

- Lemon oil

- Lime oil

- Peppermint oil

- Cornmint oil

- Citronella oil

- Spearmint oil

- Geranium oil

- Clove leaf oil

- Eucalyptus oil

- Jasmine oil

- Tea tree oil

- Rosemary oil

- Lavender oil

- Other oil types (sandalwood, cedar, chamomile, anise, ginger, thyme, cinnamon, ylang-ylang, basil)

By Method of Extraction

- Distillation

- Carbon dioxide extraction

- Cold press extraction

- Solvent extraction

- Other extraction methods (resin tapping and maceration)

Regional Analysis:

Dominant Regions: California, New York, and Texas

The U.S. Wood Essential Oils Market demonstrates strong regional variations driven by consumer demand, industrial base, and wellness adoption patterns. California leads with 28% share, supported by high consumer spending on natural wellness, strong penetration of premium cosmetics, and advanced retail networks. New York follows with 22% share, benefiting from a robust luxury fragrance and skincare industry, alongside a growing preference for organic products. Texas holds 18% share, driven by large-scale distribution, expanding wellness outlets, and increasing consumer focus on aromatherapy and household applications. Together, these three regions form the core revenue contributors, reflecting both purchasing power and industry integration.

Emerging Growth in the Midwest

The Midwest accounts for 12% share, emerging as the fastest-growing region due to rising awareness of sustainable wellness and increasing access to essential oil products through digital platforms. It benefits from a growing consumer shift toward eco-friendly household cleaning and healthcare solutions. Strong adoption across mid-sized cities highlights the region’s evolving preference for natural alternatives over synthetic counterparts. Companies expand distribution in this region by leveraging e-commerce and retail channels, enhancing visibility and accessibility. It positions the Midwest as a future growth hub for the market, attracting both local and international suppliers.

Contribution of Other Regions

The remaining 20% share is distributed across the Southeast, Northwest, and Mountain states. These areas exhibit steady demand, driven by growing interest in natural therapies, niche applications in spas, and expanding holistic wellness practices. It also reflects rising penetration of wood essential oils in aromatherapy and personal care products across suburban and rural communities. Growth in these regions is supported by the presence of specialty stores and rising popularity of online wellness platforms. Together, they add resilience and diversity to the U.S. Wood Essential Oils Market by expanding consumer adoption beyond traditional strongholds.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

Competitive Analysis:

The U.S. Wood Essential Oils Market is characterized by strong competition among global and regional players focusing on product innovation, sustainable sourcing, and brand positioning. Leading companies, including doTERRA, Young Living Essential Oils, and Plant Therapy, dominate through extensive product portfolios and wide distribution networks. Smaller firms strengthen their presence by offering niche blends and cost-effective products, targeting wellness, personal care, and household applications. It remains dynamic, with players investing in certifications, partnerships, and e-commerce expansion to differentiate their offerings. Competitive intensity is reinforced by rising consumer awareness and demand for authentic, traceable products, compelling companies to innovate continuously.

Recent Developments:

- Eden’s Garden hosted its annual team-building event in July 2025, focused on strengthening teamwork and promoting workplace values across its global branches. This initiative reflects the company’s commitment to fostering a positive organizational culture and long-term corporate growth, emphasizing team collaboration and employee engagement through fun, interactive activities.

- In January 2025, Young Living Essential Oils, LC introduced Wyld Notes, a sister company designed to complement its network marketing model. Wyld Notes launched a collection of five 100% natural fine fragrances alongside a unique affiliate program that allows Young Living Brand Partners to earn commissions across both platforms. This initiative reflects Young Living’s strategy to blend direct selling with digital affiliate marketing to engage younger and diverse audiences, officially launched in February 2025.

- Mountain Rose Herbs held the Virtual Free Herbalism Project in February 2025, an interactive community event featuring expert herbalists. This free online project aims to deepen botanical expertise and community connection, supporting wellness education and advancing the public knowledge of botanical remedies and essential oils.

Report Coverage: Type and Method of Extraction.

The research report offers an in-depth analysis based on type and method of extraction. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Rising consumer preference for natural and sustainable wellness products will expand adoption.

- Innovation in blending and personalized formulations will strengthen product differentiation.

- Growth in e-commerce and digital marketing will broaden distribution reach.

- Increased focus on sustainable sourcing will define competitive positioning.

- Expanding applications in personal care and luxury fragrances will boost demand.

- Integration into alternative therapies will diversify end-user adoption.

- Investments in premium packaging and branding will elevate market value.

- Regional expansion into emerging states will unlock new revenue opportunities.

- Advances in extraction technologies will enhance oil purity and efficiency.

- Stronger regulatory frameworks will reinforce consumer trust and market transparency.