Market Overview

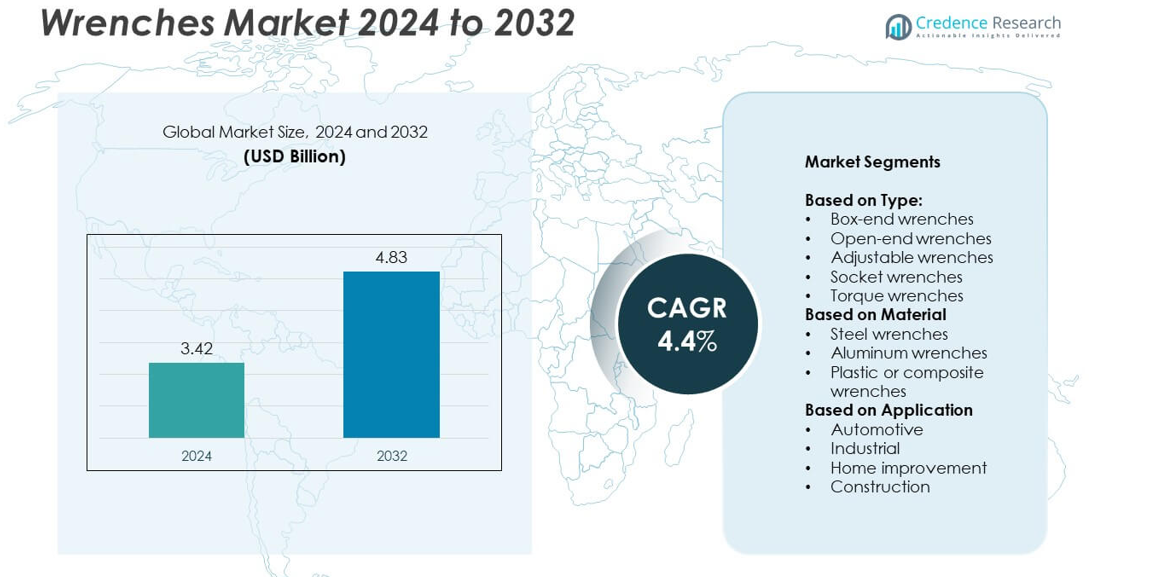

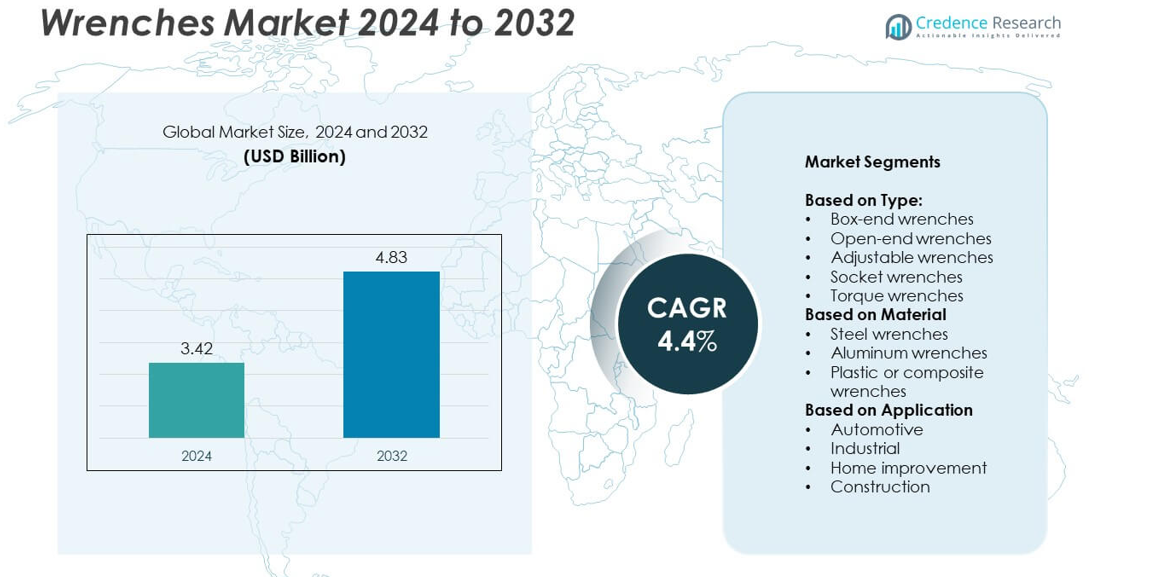

Wrenches market size was valued at USD 3.42 Billion in 2024 and is anticipated to reach USD 4.83 Billion by 2032, at a CAGR of 4.4% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Wrenches Market Size 2024 |

USD 3.42 Billion |

| Wrenches Market , CAGR |

4.4% |

| Wrenches Market Size 2032 |

USD 4.83 Billion b |

The wrenches market is led by major players including Proto, Klein, Snap-on, Bahco, Atlas, Channellock, Hazet, Apex Tool Group, Stanley Black & Decker, GearWrench, Bosch, Facom, Knipex, Matco, Beta, Mac, and Irwin. These companies focus on developing ergonomic, durable, and precision-engineered tools to meet the needs of automotive, industrial, and construction users. Product portfolios increasingly include digital torque and smart wrenches to serve high-accuracy applications. Asia-Pacific dominated the market in 2024 with over 35% share, supported by rapid industrialization, strong automotive production, and growing construction projects, making it the fastest-growing regional market.

Market Insights

- The wrenches market was valued at USD 3.42 Billion in 2024 and is projected to reach USD 4.83 Billion by 2032, growing at a CAGR of 4.4% between 2025 and 2032.

- Rising automotive production, infrastructure development, and industrial maintenance activities are major drivers boosting demand for socket and torque wrenches.

- Key trends include the adoption of smart torque wrenches with digital readouts, ergonomic designs, and the rise of e-commerce channels enabling global accessibility.

- The market is competitive with global and regional players focusing on product innovation, sustainability, and strategic distribution partnerships to strengthen their presence.

- Asia-Pacific led with over 35% share in 2024, followed by North America at 32% and Europe at 27%, while socket wrenches dominated with more than 35% share across all product types.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Type

Socket wrenches held the largest share of over 35% in 2024, driven by their versatility and efficiency in tightening and loosening fasteners in confined spaces. Their compatibility with ratchets and power tools supports faster operations, which appeals to both industrial and automotive users. Growing adoption in assembly lines and vehicle maintenance workshops is boosting demand. Adjustable wrenches are also gaining traction due to their multi-size adaptability, reducing the need for multiple tools. Rising DIY activities and increased professional tool usage further support growth across the box-end and open-end wrench segments.

- For instance, Renoir helped a global oil & gas company increase technician wrench-time by 82 % after implementing better tool logistics and planning.

By Material

Steel wrenches dominated the market with nearly 60% share in 2024, owing to their high strength, durability, and resistance to wear. These characteristics make them preferred in heavy-duty industrial and automotive applications where high torque is required. Advancements in chrome-vanadium alloy production and ergonomic handle designs further drive steel wrench adoption. Aluminum wrenches are experiencing growing demand for lightweight applications, particularly in aerospace and electrical work. Plastic or composite wrenches remain niche but are favored where non-sparking or corrosion-resistant properties are critical, such as in chemical plants and sensitive electronic assembly environments.

- For instance, RAD Torque Systems introduced the B-RAD X 3000 battery-powered torque wrench in January 2025, targeting heavy torque applications in oil & gas.

By Application

The automotive segment led the market with a share exceeding 40% in 2024, driven by vehicle production growth and rising maintenance demand. OEM assembly operations, repair shops, and aftermarket services continue to invest in precision wrenches, especially torque and socket types, to ensure accuracy and compliance with safety standards. Industrial applications follow closely, supported by expanding manufacturing activities and infrastructure development. Home improvement projects are boosting sales through retail channels, while construction applications benefit from rising global construction spending and demand for heavy-duty tools suited for on-site assembly and structural installation tasks.

Market Overview

Rising Demand from Automotive and Industrial Sectors

The automotive sector is the key growth driver, generating the highest demand for socket and torque wrenches. Expanding vehicle production, strict maintenance standards, and growth in aftermarket services fuel adoption worldwide. Industrial sectors such as manufacturing and heavy equipment also rely on wrenches for assembly, repair, and maintenance tasks. Increasing automation and infrastructure investment in Asia-Pacific create steady demand. These factors collectively strengthen market growth and encourage manufacturers to expand production capacity and diversify product portfolios to serve multiple industrial applications.

- For instance, TORQUE-TECH’s Aluminum Mini Cycling Torque Wrench uses 6061 aluminum alloy, has a 72-tooth ratchet head, and guarantees torque accuracy within ±4 % under DIN ISO 6789 standard.

Shift Toward Ergonomic and Durable Designs

The demand for ergonomic, lightweight, and high-strength wrenches is rising among professionals. Advanced materials such as chrome-vanadium alloys and anti-slip handle designs improve safety and user comfort, reducing fatigue during extended use. Precision torque output is increasingly required to meet quality control standards in automotive and aerospace applications. Regulatory emphasis on workplace safety further drives adoption of improved tools. Manufacturers are innovating with enhanced coatings and designs, boosting product replacement cycles and supporting premium wrench segment growth across global industrial and commercial markets.

- For instance, Allwrencher manufactures a line of multi-size hand tools, including the patented Smart Wrench, which is an open-end ratcheting wrench featuring 6 sizes in a single tool. This design consolidates multiple wrench sizes into a more compact form factor, reducing the overall number of tools needed. The company also offers other multi-size tools, such as an adjustable socket that accommodates up to 20 sizes.

Growing DIY and Home Improvement Activities

DIY culture is becoming a strong driver, increasing sales of adjustable and socket wrenches for home projects. Online retail channels and hardware stores offer affordable professional-grade tools, making them accessible to homeowners and hobbyists. Growing interest in furniture assembly, bicycle repair, and home renovation contributes to higher consumption. Promotional campaigns and bundled tool sets encourage purchase of multi-functional kits. This trend is particularly strong in developed regions, where rising disposable incomes and lifestyle changes drive consumers to invest in quality tools for regular maintenance tasks.

Key Trends & Opportunities

Adoption of Smart and Digital Torque Wrenches

One of the key trends is the shift toward smart torque wrenches with digital displays and Bluetooth connectivity. These tools deliver precise torque readings and enable data logging for quality assurance. Industries like automotive, aerospace, and energy increasingly demand traceability and error-proofing in assembly processes. Manufacturers see this as an opportunity to target premium segments and differentiate through innovation. Integration with IoT systems creates additional value, as connected tools support predictive maintenance and process optimization, further driving market adoption of advanced wrench technologies.

- For instance, Atlas Copco offers smartHEADs for its STRwrench product family, allowing for digital tightening with traceability in manufacturing lines. The available smartHEADs for the STRwrench enable a torque capacity range from a minimum of 1.5 Nm on the lower end to a maximum of 1000 Nm on the higher end, with specific heads available for capacities such as 15 Nm, 600 Nm, and 1000 Nm.

Expansion of E-Commerce Distribution Channels

The rise of e-commerce creates a major opportunity for market growth by improving accessibility. Online platforms enable manufacturers to offer wider product ranges, competitive pricing, and quick delivery to both professionals and DIY users. Direct-to-consumer models help brands collect customer insights and launch targeted promotions. Smaller manufacturers benefit by reaching global buyers without heavy investment in retail networks. This trend also supports growth in bundled tool kits and subscription models, increasing recurring sales and strengthening customer engagement across multiple end-use applications.

- For instance, Bosch Rexroth launched the OPEX digital torque wrench with range from 3 to 800 Nm; it transmits both torque and angle measurements directly to a user’s IT system without extra control.

Key Challenges

Fluctuating Raw Material Prices

Volatility in steel and alloy prices remains a major challenge, directly impacting production costs and profit margins. Manufacturers face difficulty maintaining stable pricing, especially in competitive markets with thin margins. Supply chain disruptions and shortages of specialty materials can delay production schedules and create inventory issues. Companies are working on securing long-term supplier contracts, using recycled materials, and optimizing procurement strategies to minimize the impact. However, sudden spikes in raw material costs continue to pressure manufacturers and hinder profitability across the global market.

Intense Market Competition and Price Pressure

he wrenches market is highly fragmented, with numerous global and regional players offering similar products. This creates significant price pressure, leading to aggressive competition and reduced margins. Low-cost imports from Asia further challenge established brands, forcing them to balance quality with affordability. To stay competitive, companies invest in differentiation strategies such as patented product designs, brand marketing, and after-sales support. However, sustaining innovation while maintaining cost competitiveness remains a constant struggle, particularly for mid-sized manufacturers targeting both industrial and consumer markets.

Regional Analysis

North America

North America accounted for around 32% of the wrenches market share in 2024, driven by strong demand from the automotive, construction, and home improvement sectors. The U.S. leads the region due to high vehicle production and a mature aftermarket industry requiring socket and torque wrenches. Rising DIY culture and growing e-commerce sales channels further support market expansion. Manufacturers are focusing on premium, ergonomic tool designs and smart torque solutions to meet professional user needs. Infrastructure upgrades and housing renovation projects continue to fuel demand, making North America a significant growth contributor during the forecast period.

Europe

Europe held nearly 27% of the market share in 2024, supported by robust manufacturing activities and a well-established automotive sector. Germany, France, and the U.K. lead the region, with strong adoption of precision torque wrenches in automotive assembly lines and aerospace industries. Sustainability initiatives encourage the use of durable and recyclable materials, boosting demand for high-quality steel wrenches. Growth in DIY activities across Western Europe also contributes to higher sales through retail and online platforms. Regional manufacturers emphasize compliance with strict safety standards, ensuring consistent product demand across industrial, construction, and maintenance applications.

Asia-Pacific

Asia-Pacific dominated the global wrenches market with over 35% share in 2024, making it the fastest-growing region. Expanding automotive production hubs in China, India, and Japan drive strong consumption of socket and torque wrenches. Rapid infrastructure development and growth in small-scale manufacturing increase demand from construction and industrial applications. Rising disposable incomes and urbanization boost sales of DIY and home improvement tools. Local manufacturers offer competitively priced products, while global brands expand their presence through partnerships and e-commerce platforms. Government initiatives supporting manufacturing expansion further accelerate market growth across the region during the forecast period.

Latin America

Latin America captured about 4% of the global wrenches market share in 2024, with Brazil and Mexico being the leading contributors. Growth is supported by expanding automotive assembly plants, construction activities, and small-scale industrial projects. Demand for cost-effective wrenches remains high, favoring adjustable and basic tool types. Increasing penetration of e-commerce platforms and hardware retail chains is improving product accessibility. Despite economic fluctuations, the region offers growth opportunities as infrastructure projects gain momentum. International manufacturers are targeting this region with affordable yet durable wrench solutions to meet the needs of professional and home users.

Middle East & Africa

The Middle East & Africa region accounted for around 2% of the wrenches market share in 2024, showing gradual but steady growth. Rising construction projects, especially in the Gulf Cooperation Council countries, drive demand for heavy-duty wrenches in infrastructure and oil & gas sectors. South Africa contributes to market growth through mining and industrial activities requiring maintenance tools. Limited local manufacturing creates opportunities for global players to expand through distribution partnerships. Increased availability of international brands through online and offline channels supports wider adoption across professional workshops and home improvement enthusiasts.

Market Segmentations:

By Type:

- Box-end wrenches

- Open-end wrenches

- Adjustable wrenches

- Socket wrenches

- Torque wrenches

By Material

- Steel wrenches

- Aluminum wrenches

- Plastic or composite wrenches

By Application

- Automotive

- Industrial

- Home improvement

- Construction

By Geography:

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The wrenches market is led by key players such as Proto, Klein, Snap-on, Bahco, Atlas, Channellock, Hazet, Apex Tool Group, Stanley Black & Decker, GearWrench, Bosch, Facom, Knipex, Matco, Beta, Mac, and Irwin. The market is highly competitive with companies focusing on innovation, product diversification, and advanced manufacturing techniques to meet evolving user needs. Leading brands invest in ergonomic designs, durable materials, and precision torque solutions to enhance user efficiency and safety. Expansion through e-commerce channels, strategic partnerships, and global distribution networks strengthens their market presence. Manufacturers are also emphasizing sustainability by using recyclable materials and energy-efficient production methods. Pricing strategies remain crucial, with companies balancing affordability and premium product offerings to cater to both professional and DIY customers. Continuous investment in digital torque tools and smart solutions positions manufacturers to capture emerging opportunities in automotive, industrial, and construction applications during the forecast period.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Proto

- Klein

- Snap-on

- Bahco

- Atlas

- Channellock

- Hazet

- Apex Tool Group

- Stanley Black & Decker

- GearWrench

- Bosch

- Facom

- Knipex

- Matco

- Beta

- Mac

- Irwin

Recent Developments

- In 2025, Bosch introduced a new range of hand tools, including more durable socket ratchet sets.

- In 2024, Atlas Copco (via its Chicago Pneumatic brand) launched the CP8609 series of eBlueTork battery-operated torque wrenches.

- In 2022, Matco Tools partnered with Milwaukee Tool on its cordless product line. These types of alliances often lead to future product developments that include cordless wrench models.

Report Coverage

The research report offers an in-depth analysis based on Type, Material, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The wrenches market will grow steadily, supported by rising automotive production and maintenance activities.

- Demand for ergonomic and lightweight wrenches will increase to improve user comfort and efficiency.

- Digital torque and smart wrenches will gain traction in automotive and aerospace assembly lines.

- E-commerce will continue to drive global sales, making tools accessible to DIY and professional users.

- Manufacturers will focus on sustainable materials and energy-efficient production methods to meet regulations.

- Emerging economies in Asia-Pacific will remain the fastest-growing markets due to infrastructure development.

- Product innovation will focus on multi-functional and precision tools to reduce tool replacement cycles.

- Collaborations and distribution partnerships will expand market reach across underpenetrated regions.

- Intense competition will drive price optimization and differentiation strategies among leading brands.

- Growing DIY culture and home renovation projects will sustain demand in consumer markets worldwide.