Market Overview

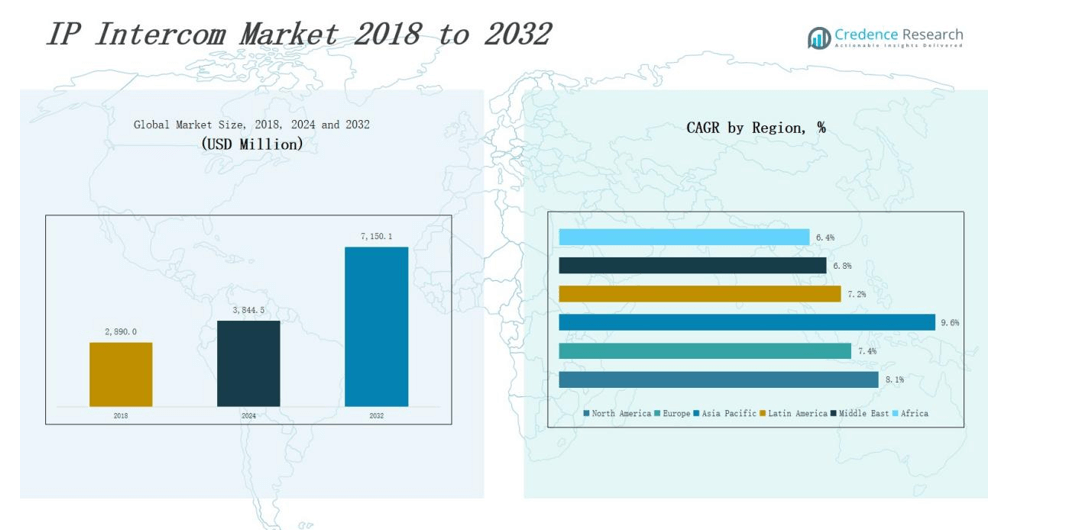

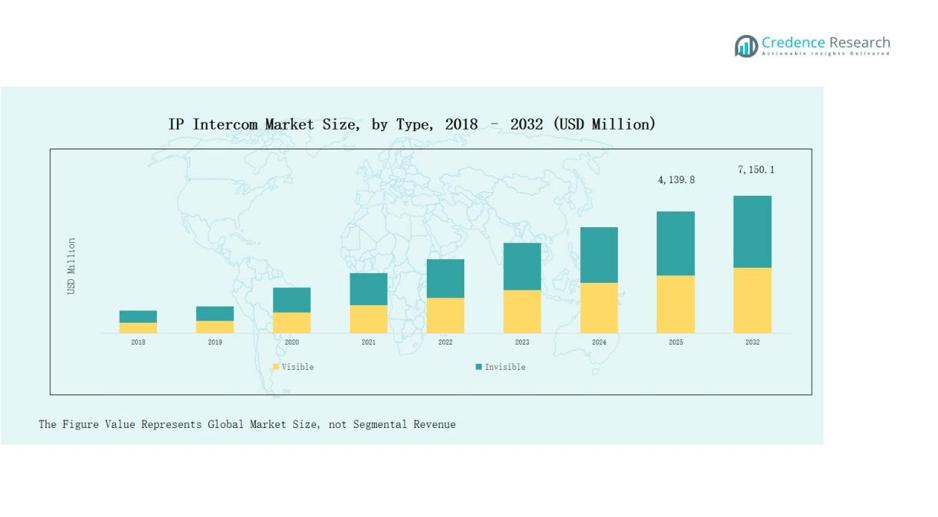

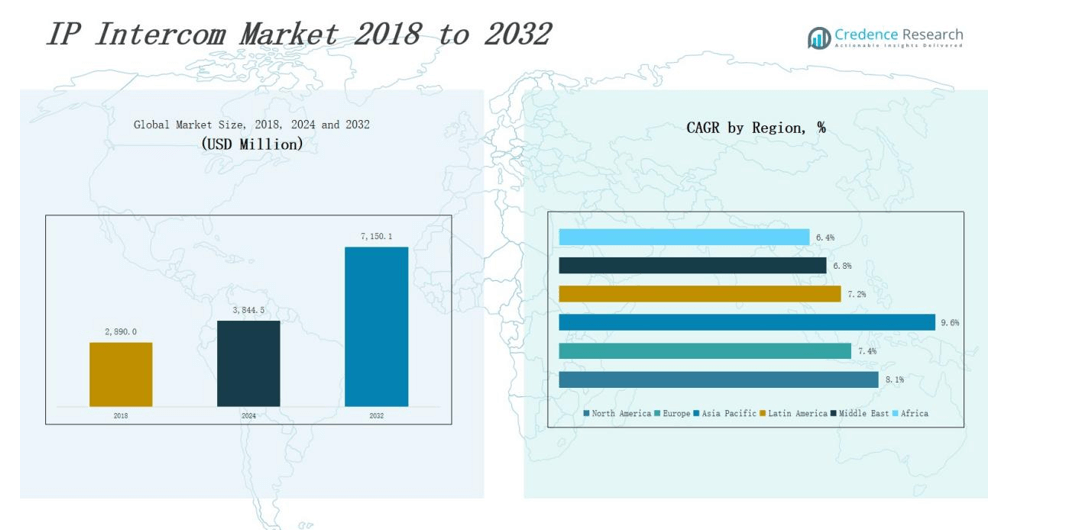

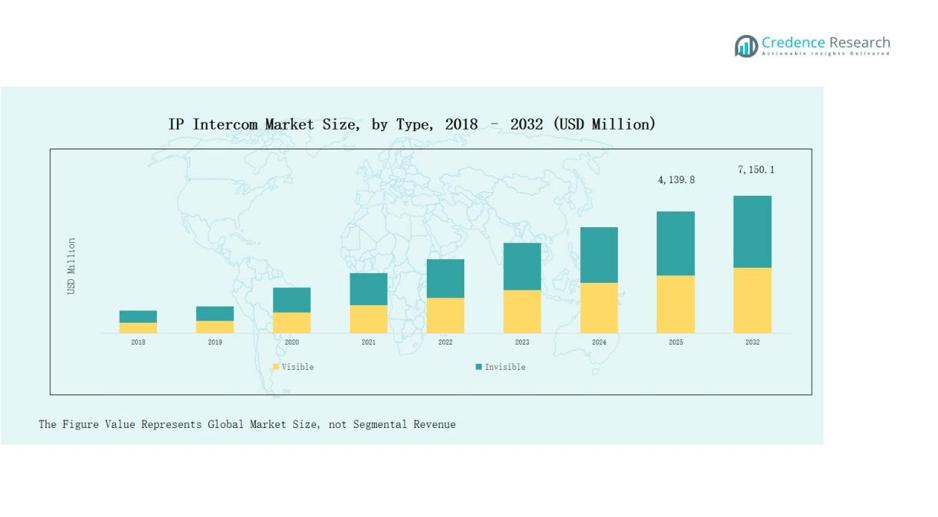

IP Intercom Market size was valued at USD 2,890.0 million in 2018 to USD 3,844.5 million in 2024 and is anticipated to reach USD 7,150.1 million by 2032, at a CAGR of 8.1% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| IP Intercom Market Size 2024 |

USD 3,844.5 million |

| IP Intercom Market, CAGR |

8.1% |

| IP Intercom Market Size 2032 |

USD 7,150.1 million |

The IP Intercom Market is defined by strong competition among leading global players such as Aiphone Corporation, 2N Telekomunikace, Comelit Group, Hikvision, Axis Communications, Legrand, Panasonic Corporation, Commend International, TOA Corporation, and Zenitel Group. These companies focus on product innovation, integration of IP-based technologies, and expanding partnerships across residential, commercial, and industrial sectors. North America holds the dominant share of the market with 38 percent, supported by advanced infrastructure, strong adoption of smart building technologies, and the presence of key manufacturers. The region’s emphasis on security solutions and networked communication systems continues to drive adoption, positioning it as the leading hub for IP intercom deployments worldwide.

Market Insights

- The IP Intercom Market grew from USD 2,890.0 million in 2018 to USD 3,844.5 million in 2024, and will reach USD 7,150.1 million by 2032.

- Visible intercoms lead with 63 percent share, driven by video verification demand in residential and commercial applications, while invisible systems hold 37 percent, favored in government and industrial sectors.

- By application, the commercial segment dominates with 38 percent share, followed by government at 22 percent, residential at 20 percent, industrial at 15 percent, and others at 5 percent.

- North America leads regionally with 34 percent share in 2024, followed by Europe at 25 percent, Asia Pacific at 23 percent, Latin America at 6 percent, Middle East at 5 percent, and Africa at 4 percent.

- Market growth is driven by urban security concerns, smart home integration, regulatory compliance, and expanding adoption across offices, institutions, housing, and smart city projects globally.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segment Insights

By type

By type, the visible IP intercom segment leads the market with a 63 percent share, driven by strong adoption in residential and commercial spaces where video verification is essential for safety. Integration with smart homes and rising demand for video-enabled access control further support growth. The invisible segment, holding 37 percent share, is expanding steadily in government and industrial facilities, where discreet communication and advanced security needs are critical. Its growth is fueled by robust audio quality, IP networking, and deployment in high-security environments.

- For instance, Aiphone’s IX Series IP video intercom is widely deployed in U.S. schools and hospitals for its video-based access verification.

By application

By application, the commercial sector dominates with 38 percent share, supported by adoption in offices, retail spaces, and business complexes requiring centralized communication. The government segment follows with 22 percent share, led by demand in defense, public buildings, and law enforcement facilities. Residential use accounts for 20 percent, fueled by smart home penetration and urban safety concerns, while the industrial segment holds 15 percent, supported by safety compliance in plants and utilities. The remaining 5 percent comes from other sectors such as education, healthcare, and hospitality, where operational efficiency and controlled access are key drivers.

- For instance, Honeywell deployed its Connected Plant solutions in refineries to facilitate real-time worker communication and monitoring, boosting safety compliance.

Market Overview

Rising Security Concerns in Urban Environments

Urbanization and rising crime rates are driving the demand for advanced IP intercom systems. These solutions provide video-enabled verification, remote access, and real-time monitoring, ensuring safer environments in residential and commercial spaces. Integration with surveillance and alarm systems further enhances overall security infrastructure, making IP intercoms a preferred choice. Growing adoption of gated communities, high-rise apartments, and smart office buildings continues to accelerate demand. This factor strongly positions security enhancement as one of the core growth drivers for the market.

- For example, Tata Eureka Park in Noida features smart gated security solutions enhancing resident safety through mobile-controlled gate access and emergency intercoms.

Smart Home and IoT Integration

The expansion of smart homes and IoT-based ecosystems is significantly boosting IP intercom adoption. Consumers prefer integrated communication systems that connect seamlessly with smartphones, smart locks, and home automation devices. These features provide convenience, real-time alerts, and improved control over access points. The growing penetration of Wi-Fi, 5G, and cloud-based platforms enhances system connectivity and functionality. As smart cities and connected infrastructure expand globally, the integration of IP intercoms with IoT devices emerges as a major driver for sustained market growth.

- For instance, ButterflyMX’s IoT intercom system enables residents to grant access remotely and features flawless audio and video communication through a mobile app, enhancing security and user convenience.

Commercial and Institutional Demand

Widespread adoption in offices, retail complexes, government institutions, and educational facilities is another strong growth driver. IP intercoms enable centralized communication, access control, and emergency response, meeting the rising need for operational safety. Large enterprises and government agencies are increasingly investing in secure communication systems to manage entry points and coordinate teams effectively. This trend is further supported by regulatory mandates emphasizing building security and compliance. Growing institutional focus on smart infrastructure is accelerating commercial and government adoption, contributing significantly to market revenue expansion.

Key Trends & Opportunities

Adoption of Video-Based and AI-Enabled Intercoms

The transition from audio-only intercoms to video-based systems represents a major trend. AI-enabled features, such as facial recognition and motion detection, are enhancing access control. These technologies improve user experience by providing real-time verification and automated threat alerts. Rising demand for touchless, intelligent systems post-pandemic has further fueled this adoption. Vendors are increasingly integrating cloud analytics and mobile apps, creating opportunities for recurring service revenues. This evolution positions video and AI-enabled IP intercoms as a transformative trend reshaping the market.

- For instance, Avigilon’s video intercoms combine HD live video calling with AI-powered call routing that uses voice recognition to identify visitors and direct calls appropriately, improving access control and user convenience

Growing Penetration in Emerging Markets

Rapid urbanization in Asia-Pacific, Latin America, and parts of Africa presents strong growth opportunities. Rising infrastructure investments in smart cities and residential developments are creating demand for IP-based security solutions. Affordable housing projects and government-backed safety initiatives support broader adoption of intercom systems. Additionally, increasing awareness about home automation and falling hardware costs make these solutions accessible to middle-income groups. Market players expanding into emerging economies with cost-effective and scalable systems stand to benefit from significant untapped potential in these regions.

- For instance, Binayak Group, an Indian real estate developer, rolled out a scalable IP intercom system across multiple residential towers to reduce cabling costs while enabling remote management.

Key Challenges

High Installation and Maintenance Costs

One of the key barriers to adoption is the high cost associated with IP intercom systems. Complex installations, cabling, and integration with existing infrastructure raise expenses, especially in large commercial or institutional settings. Maintenance and periodic upgrades further add to ownership costs. Small businesses and middle-income households often consider these systems less affordable compared to traditional intercoms. Unless vendors offer cost-effective, scalable solutions, pricing concerns are likely to hinder broader adoption, particularly in price-sensitive markets.

Cybersecurity and Data Privacy Risks

As IP intercoms rely on network connectivity, they face significant cybersecurity threats. Vulnerabilities in devices or applications can expose systems to unauthorized access and data breaches. Privacy concerns related to video recording and remote monitoring raise further challenges for adoption in residential and institutional settings. Growing regulatory scrutiny on data protection adds compliance burdens for vendors. Without robust encryption, secure protocols, and regular software updates, cybersecurity risks may reduce consumer trust, impacting large-scale deployment of IP-based systems.

Integration with Legacy Systems

Many existing buildings still rely on analog intercom systems, creating challenges for smooth IP system integration. Transitioning requires new cabling, compatible devices, and skilled technicians, which delays adoption. Limited interoperability between IP intercoms and older infrastructure also raises replacement costs. Commercial facilities and government institutions often face budget constraints, slowing system upgrades. Vendors must develop hybrid or retrofit solutions to address this gap. Without effective migration strategies, integration issues with legacy systems may restrict overall market expansion.

Regional Analysis

North America:

North America leads the IP intercom market with a 34 percent share in 2024, valued at USD 1,430.1 million. The region is projected to reach USD 2,655.7 million by 2032 at a CAGR of 8.1 percent. Growth is driven by high adoption of smart building solutions, strong security regulations, and the presence of leading technology providers. Demand across residential complexes, offices, and government institutions continues to expand. The U.S. dominates due to advanced infrastructure and rising smart home penetration, while Canada and Mexico contribute through investments in commercial and industrial security solutions.

Europe:

Europe holds a 25 percent share in the global IP intercom market, valued at USD 1,052.5 million in 2024. The market is projected to reach USD 1,857.3 million by 2032, growing at a 7.4 percent CAGR. Growth is supported by widespread adoption in commercial buildings, strict EU regulations on building safety, and increasing use in residential apartments. Germany, France, and the UK lead adoption, while Southern and Eastern Europe are witnessing rising demand in smart infrastructure. The region’s strong focus on sustainability and digital integration further boosts the adoption of advanced intercom solutions.

Asia Pacific:

Asia Pacific accounts for a 23 percent share of the IP intercom market in 2024, valued at USD 860.6 million. It is expected to grow to USD 1,783.5 million by 2032 at the fastest CAGR of 9.6 percent. Rising urbanization, rapid infrastructure development, and government-backed smart city projects fuel demand across China, Japan, India, and South Korea. Affordable housing growth and rising middle-class adoption of smart security solutions also support expansion. The region’s growing real estate sector, coupled with increasing adoption in schools, offices, and gated communities, positions Asia Pacific as the fastest-growing regional market.

Latin America:

Latin America holds a 6 percent market share, valued at USD 245.6 million in 2024 and projected to reach USD 424.6 million by 2032 at a CAGR of 7.2 percent. Brazil leads demand, driven by rising residential adoption in urban centers and growing need for secure communication in commercial facilities. Argentina and other regional economies are investing in smart infrastructure, boosting intercom deployment in public spaces and educational institutions. While economic volatility limits large-scale investments, the rising middle-class preference for enhanced residential security is a significant driver in the region.

Middle East:

The Middle East represents a 5 percent market share, valued at USD 140.3 million in 2024 and expected to reach USD 236.0 million by 2032 at a CAGR of 6.8 percent. The region benefits from expanding construction activities, particularly in GCC countries with large-scale commercial and residential projects. Growing demand for secure communication in luxury real estate, hospitality, and government facilities drives adoption. Saudi Arabia and the UAE lead adoption due to infrastructure modernization and smart city initiatives. Rising investments in advanced security systems across airports and public institutions further fuel market expansion.

Africa:

Africa contributes a 4 percent market share, valued at USD 115.4 million in 2024, projected to reach USD 193.1 million by 2032 at a CAGR of 6.4 percent. Growth is concentrated in South Africa, Egypt, and urban hubs across Nigeria and Kenya. Rising urbanization, infrastructure development, and increasing awareness of residential security drive demand. Although adoption remains limited due to budget constraints, affordable IP intercom solutions and government-led housing projects are creating new opportunities. The region’s gradual shift toward smart security in commercial and institutional buildings supports steady market expansion.

Market Segmentations:

By Type

By Application

- Commercial

- Government

- Industrial

- Residential

- Others

By Region

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the IP intercom market is characterized by the presence of global and regional players focusing on innovation, integration, and expansion strategies. Leading companies such as Axis Communications, Panasonic, Legrand, Hikvision, Commend International, Comelit Group, TOA Corporation, Fermax, 2N Telecommunications, and Barix dominate through diversified portfolios, covering both visible and invisible intercom systems across commercial, residential, and institutional applications. These players emphasize product differentiation by integrating AI, cloud platforms, and mobile connectivity to enhance user convenience and security performance. Strategic collaborations with smart building developers and security integrators further strengthen market reach, while acquisitions and geographic expansion allow companies to capture emerging growth in Asia-Pacific and Latin America. Price competitiveness, after-sales support, and compliance with cybersecurity standards also shape market rivalry. With rising demand for intelligent, video-enabled solutions, companies are increasingly investing in R&D and digital service ecosystems to sustain long-term growth and competitive positioning.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Players

- Axis Communications

- Barix

- TCS AG

- Legrand

- Panasonic

- Commend

- Comelit Group

- TOA Corporation

- Fermax

- Hangzhou Hikvision Digital Technology Co. Ltd.

- 2N Telecommunications Inc.

- Daccess Security Systems Pvt. Ltd.

- SPON Communications Co. Ltd.

- Digital Acoustics

Recent Developments

- l In July 2025, 2N launched the IP Force 2.0 vandal-resistant intercom at The Security Event in Birmingham, featuring WDR video, QR code access, and modular expansion via VBUS.

- In June 2025, Akuvox introduced the X937 AI Intercom Monitor and X910 Package Detection Door Phone, offering Android 14, LLM voice assistant, and advanced surveillance capabilities.

- In June 2025, Barix unveiled the Annuncicom AHE-YA404 analog-to-IP intercom solution at InfoComm 2025, enabling SIP connectivity and HDX audio for legacy systems.

- In August 2025, Pliant Technologies announced new CrewCom ecosystem enhancements, including the CXD-32CF I/O interface, six-bay charger, and in-ear universal headset for Dante/AES67 workflows.

Market Concentration & Characteristics

The IP Intercom Market demonstrates moderate concentration, with a mix of global leaders and regional players competing across diverse applications. It is defined by strong participation from established companies such as Axis Communications, Panasonic, Legrand, Hikvision, and Commend, which collectively account for a significant share of global revenues. The market shows characteristics of technology-driven competition, where innovation in video functionality, AI integration, mobile connectivity, and cloud-based platforms sets the pace of differentiation. It is marked by rising demand from commercial, residential, and government sectors, pushing vendors to balance performance, pricing, and scalability. Regional firms also compete by offering cost-effective and localized solutions, particularly in emerging economies. High customer expectations for security, reliability, and seamless integration with smart systems continue to shape the landscape. It remains moderately fragmented, yet competitive intensity is increasing as companies expand portfolios and target opportunities in fast-growing regions such as Asia-Pacific and Latin America.

Report Coverage

The research report offers an in-depth analysis based on Type, Application and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Video-enabled IP intercoms will experience rising demand across residential, commercial, and institutional buildings worldwide.

- Integration of AI features like facial recognition will enhance intercom functionality and strengthen access control solutions.

- Growing smart home adoption will accelerate demand for connected intercom systems offering advanced safety and convenience.

- Cloud-based platforms will enable seamless remote access, centralized monitoring, and scalable deployment across diverse applications.

- Strict global security regulations will drive organizations to adopt advanced, compliant IP intercom systems rapidly.

- Emerging markets will expand significantly due to rapid urbanization, infrastructure investments, and affordable security solutions availability.

- Hybrid intercom solutions will bridge compatibility gaps, easing transition from legacy analog systems to modern platforms.

- Partnerships with smart building developers will open new revenue streams for intercom vendors worldwide.

- Vendors will prioritize cybersecurity measures, ensuring reliable protection of communication networks and consumer privacy.

- Industry-specific customization in education, healthcare, and hospitality will broaden IP intercom adoption globally.