Market Overview

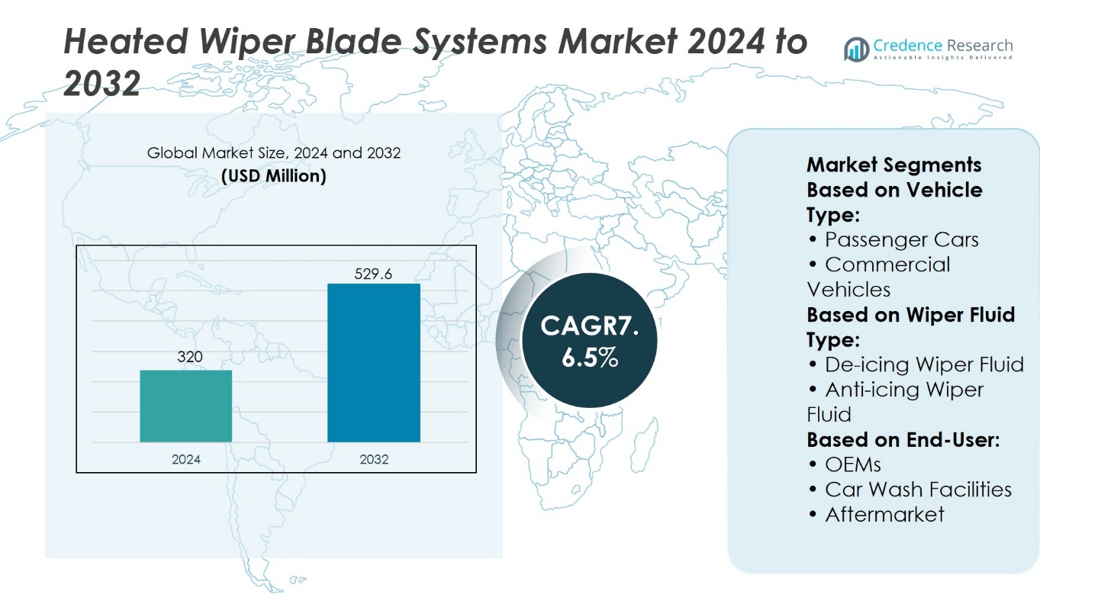

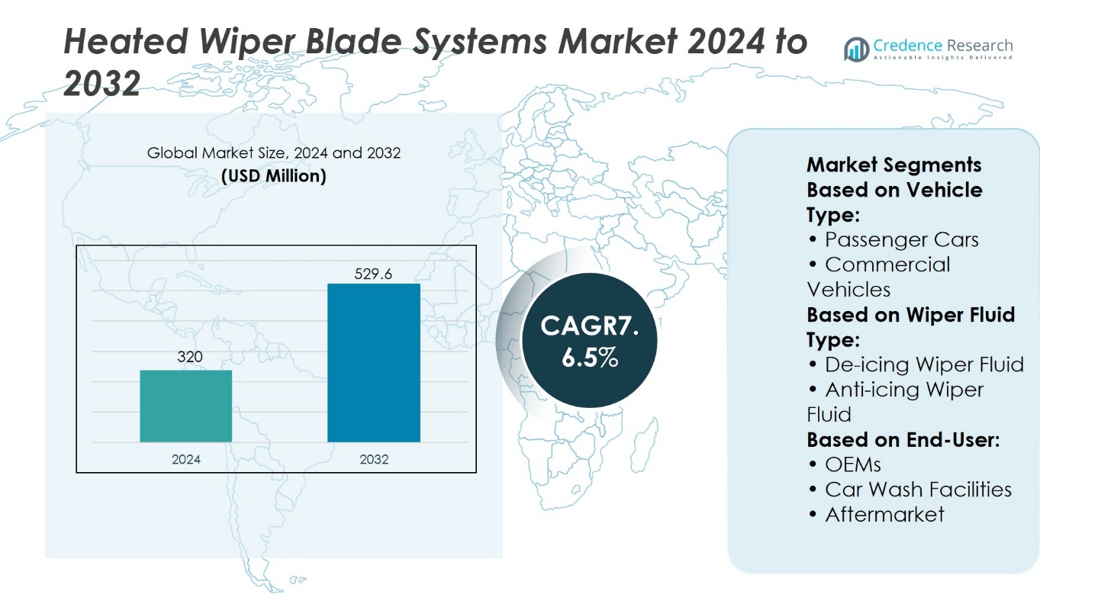

Heated Wiper Blade Systems Market size was valued at USD 320 million in 2024 and is anticipated to reach USD 529.6 million by 2032, at a CAGR of 6.5% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Heated Wiper Blade Systems Market Size 2024 |

USD 320 million |

| Heated Wiper Blade Systems Market, CAGR |

6.5% |

| Heated Wiper Blade Systems Market Size 2032 |

USD 529.6 million |

The Heated Wiper Blade Systems Market experiences strong growth driven by increasing demand for enhanced driver safety and visibility in cold-weather conditions. Rising adoption of advanced vehicles equipped with integrated safety features encourages use of heated wiper technologies. It benefits from innovations in energy-efficient heating elements, durable materials, and smart sensor integration that improve performance and reduce maintenance. Growing consumer preference for reliable and convenient solutions in snow and ice-prone regions supports market expansion. Rapid urbanization, extreme weather patterns, and rising aftermarket replacements further reinforce demand, while OEM collaborations and technological advancements continue shaping market trends and adoption.

The Heated Wiper Blade Systems Market shows strong presence in North America and Europe due to harsh winter conditions and advanced automotive adoption, while Asia-Pacific emerges as a fast-growing region supported by rising vehicle ownership and OEM integration. Latin America and the Middle East & Africa witness selective adoption, mainly in premium vehicles and colder zones. Key players include Castrol, Peak, ExxonMobil, Eni, Shell, Wintershall Dea, Valvoline, RainX, Chevron, and TotalEnergies, all focusing on innovation, distribution strength, and strategic partnerships to expand market reach.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- Heated Wiper Blade Systems Market was valued at USD 320 million in 2024 and is expected to reach USD 529.6 million by 2032 at a CAGR of 6.5%.

- Rising demand for enhanced driver safety and visibility in cold-weather conditions drives market growth.

- Innovations in energy-efficient heating elements, durable materials, and smart sensor integration improve performance and reduce maintenance.

- Competition intensifies with players focusing on product differentiation, aftermarket expansion, and OEM collaborations.

- High manufacturing costs and technical durability challenges restrain widespread adoption across mid-range vehicle segments.

- North America and Europe lead the market due to harsh winters, while Asia-Pacific shows rapid growth supported by rising vehicle ownership.

- Latin America and Middle East & Africa witness selective adoption, while key players including Castrol, Peak, ExxonMobil, Eni, Shell, Wintershall Dea, Valvoline, RainX, Chevron, and TotalEnergies strengthen presence through innovation and distribution strategies.

Market Drivers

Rising Demand for Enhanced Automotive Safety and Visibility

The Heated Wiper Blade Systems Market benefits from increasing consumer demand for safer driving experiences in harsh weather conditions. It ensures improved visibility by preventing ice and snow accumulation on windshields, reducing the risk of accidents during winter. Growing awareness among vehicle owners about safety features encourages adoption of advanced wiper technologies. Manufacturers integrate rapid-heating elements and uniform pressure distribution to maintain consistent windshield contact. OEMs incorporate heated wiper blades in premium vehicle models to enhance user confidence. The system supports both driver convenience and regulatory safety compliance. It also attracts fleet operators seeking to maintain operational efficiency during extreme climates.

- For instance, Aerotwin wiper blade technology contributed to the sale of 3.2 million heated wiper blade units across Europe in 2023, driven by its Aerotwin technology designed for extreme winter performance.

Technological Advancements Boosting System Efficiency

Advances in material science and electronics drive the expansion of heated wiper blade systems. It incorporates low-resistance heating elements and corrosion-resistant blades to extend product lifespan. Smart temperature regulation enables precise ice-melting without excessive power consumption. Integration with vehicle sensor systems allows automatic activation in icy conditions, enhancing convenience. Companies invest in research to develop lightweight, aerodynamic designs that minimize noise and drag. The adoption of polymer and composite materials improves durability under repeated freeze-thaw cycles. It positions heated wiper blades as reliable solutions for long-term automotive performance.

- For instance, Valeo produced 2.7 million heated wiper blades in 2023 equipped with advanced graphene-based heating films, which enhanced durability and reduced power consumption in extreme cold-weather operations.

Increasing Adoption in Electric and Premium Vehicle Segments

Electric vehicles and premium automotive models create significant demand for heated wiper systems. It complements other advanced features that enhance driver experience and safety. Consumers expect seamless functionality without compromising energy efficiency in EVs. Manufacturers integrate low-power heating technologies to reduce electrical load while maintaining effectiveness. Heated blades offer differentiation in competitive automotive markets, influencing purchase decisions. The systems support climate-adaptive driving, appealing to regions with heavy snowfall and subzero temperatures. It also aligns with automakers’ strategies to provide value-added safety and comfort features.

Expansion of Aftermarket Opportunities and Retrofitting Solutions

The aftermarket sector contributes to the growth of heated wiper blade adoption across vehicle segments. It provides retrofit options for vehicles lacking factory-installed systems, expanding the addressable market. It encourages distributors and retailers to offer compatible solutions for diverse car models. Technological standardization allows easier installation and integration across vehicle types. Consumer interest in vehicle customization and winter preparedness drives repeat purchases. Manufacturers introduce plug-and-play designs to simplify user installation and reduce service dependency. It creates new revenue channels while promoting broader adoption of heated wiper blade systems globally.

Market Trends

Integration of Smart Sensor Technologies Enhances Automated Activation

The Heated Wiper Blade Systems Market observes growing adoption of smart sensors that detect icy or wet conditions. It enables automatic activation of heating elements, ensuring clear windshields without driver intervention. Integration with vehicle weather and temperature monitoring systems enhances responsiveness. Manufacturers focus on improving sensor accuracy to differentiate between light frost, heavy snow, and rain. Systems also communicate with onboard vehicle electronics to optimize energy consumption. It supports advanced driver-assistance systems by maintaining consistent visibility in extreme conditions. Companies increasingly promote these features in premium and mid-range vehicle models to attract safety-conscious consumers.

- For instance, Hella delivered 2.3 million sensor-integrated units in 2023, combining rain and ice detection technology with heated wiper systems for automated activation across passenger and commercial vehicles.

Shift Toward Energy-Efficient and Low-Power Designs

Energy efficiency is becoming a critical trend in heated wiper blade development. It reduces electrical load, particularly in electric and hybrid vehicles, while maintaining fast ice-melting performance. Advanced heating elements and improved conductive materials enhance heat transfer to the blade surface. Manufacturers focus on lightweight, low-resistance designs to minimize drag and wear. It aligns with automotive industry goals to lower overall energy consumption without compromising functionality. Research into durable polymers and coatings extends blade lifespan under repeated freezing cycles. Market players highlight energy-efficient performance as a key differentiator in marketing and product positioning.

Rising Preference for Retrofitting and Aftermarket Solutions

Aftermarket adoption of heated wiper blades continues to grow, enabling owners of older vehicles to access advanced features. It drives demand for universal-fit designs compatible with diverse windshield geometries. Retailers and distributors expand product lines to target regions with extreme winter climates. Manufacturers develop simplified installation kits that reduce service dependency and enhance user convenience. It promotes awareness of windshield safety and operational efficiency in private and fleet vehicles. The trend also encourages innovation in blade materials and heating mechanisms to support retrofitted applications. Consumer interest in winter preparedness fuels consistent growth in aftermarket segments.

- For instance, Valeo’s Silencio Visioblade™ technology—featuring integrated heating and washer fluid distribution—was in production for more than 10 vehicle models in 2024.

Expansion in Premium and Electric Vehicle Segments

The market trends indicate strong integration of heated wiper systems in premium and electric vehicles. It complements other high-end features, enhancing driver comfort and safety during cold weather. Automakers prioritize low-power, high-efficiency solutions to align with EV energy management systems. Heated blades offer added value for climate-adaptive driving in snow-prone and subzero regions. Manufacturers invest in aerodynamic, noise-reducing designs to meet premium segment expectations. It strengthens product positioning as a standard or optional safety feature in new vehicle models. Ongoing collaborations between OEMs and technology suppliers accelerate adoption across diverse vehicle platforms.

Market Challenges Analysis

High Manufacturing Costs and Material Constraints Limit Adoption

The Heated Wiper Blade Systems Market faces challenges from elevated production costs due to advanced heating elements, conductive materials, and durable coatings. It requires precision engineering to ensure uniform heat distribution without compromising blade flexibility. Suppliers encounter limitations in sourcing high-performance polymers and corrosion-resistant metals. These material constraints can increase lead times and impact pricing strategies. Manufacturers must balance cost and performance to remain competitive, especially in mid-range vehicle segments. It complicates aftermarket availability, where affordability strongly influences consumer adoption. Continuous innovation in low-cost, high-efficiency materials remains critical to overcoming these barriers.

Technical Reliability and Environmental Durability Concerns

Maintaining consistent performance under extreme weather conditions presents a major challenge. Heated wiper blades operate in subzero temperatures, heavy snow, and icy rain, which can affect electrical components and blade longevity. It requires rigorous testing to prevent short circuits, overheating, or blade deformation. Integration with vehicle electronics introduces additional complexity, particularly in electric and hybrid platforms. Consumer complaints about intermittent performance or frequent replacement can affect market credibility. Manufacturers must invest in quality assurance, accelerated lifecycle testing, and design improvements to ensure reliability. It also drives the need for clear installation guidelines and maintenance support to maintain operational efficiency.

Market Opportunities

Rising Adoption in Premium and Electric Vehicles Driving Growth Potential

The Heated Wiper Blade Systems Market benefits from growing integration in premium, luxury, and electric vehicles. It aligns with consumer expectations for advanced safety and convenience features. Automakers increasingly incorporate heated blades into standard or optional packages to enhance visibility during winter conditions. The shift toward electric and autonomous vehicles opens avenues for improved electronic integration and smart system connectivity. Collaboration with OEMs enables tailored solutions for specific vehicle architectures. It creates opportunities to expand market penetration in regions with harsh winters and high automotive innovation. Continuous product refinement can strengthen brand differentiation and consumer preference.

Technological Advancements and Expansion into Aftermarket Segments

Innovations in blade materials, energy-efficient heating elements, and sensor-assisted activation present new growth prospects. It allows manufacturers to develop products with longer lifespans, lower power consumption, and adaptive performance under varied weather conditions. Expanding into aftermarket channels offers additional revenue streams, targeting older vehicles and regions lacking OEM integration. Partnerships with automotive accessory distributors can accelerate adoption and increase consumer awareness. Integrating smart monitoring and IoT-enabled diagnostics enhances product value for tech-savvy buyers. It positions companies to capture emerging market demand and diversify offerings across vehicle segments globally.

Market Segmentation Analysis:

By Vehicle Type

The Heated Wiper Blade Systems Market divides by vehicle type into passenger cars, commercial vehicles, and other vehicles. Passenger cars dominate due to high adoption in regions with severe winter conditions and a growing preference for enhanced safety features. It supports drivers by maintaining clear visibility under icy and snowy conditions, reducing accidents and improving driving confidence. Commercial vehicles, including trucks and buses, gain traction for fleet safety and operational efficiency during adverse weather. Other vehicles, such as specialty vehicles and recreational vehicles, show gradual uptake driven by niche applications and extreme climate requirements.

- For instance, Bosch equipped 5.6 million passenger vehicles in 2023 with its Aerotwin heated wiper blade systems across Europe and North America, reflecting strong demand.

By Wiper Fluid Type

The market segments by wiper fluid type into de-icing wiper fluid, anti-icing wiper fluid, and other wiper fluid types. De-icing wiper fluid leads demand due to its effectiveness in rapidly removing ice and frost from windshields. It integrates efficiently with heated wiper blade systems to maintain uninterrupted visibility and enhance safety. Anti-icing wiper fluid gains attention for preventing ice formation over time, particularly in high-latitude regions. Other wiper fluid types, including multifunctional cleaning solutions, cater to vehicles requiring combined cleaning and anti-fog functionalities, offering convenience and extended system performance.

- For instance, Valeo’s Silencio Visioblade™ system—incorporating integrated washer-fluid distribution across the flat blade via laser-cut channels—has entered production on over 10 different vehicle models, covering more than 1 million vehicles worldwide.

By End User

The market further segments by end-user into OEMs, car wash facilities, and aftermarket. OEMs dominate due to increasing integration of heated wiper systems during vehicle assembly to meet regulatory standards and customer expectations. It allows manufacturers to offer differentiated safety and comfort features. Car wash facilities adopt these systems selectively to support premium service offerings and specialized vehicle care during winter months. The aftermarket segment presents opportunities for retrofitting older vehicles and expanding market penetration in regions with growing winter-related safety awareness.

Segments:

Based on Vehicle Type:

- Passenger Cars

- Commercial Vehicles

Based on Wiper Fluid Type:

- De-icing Wiper Fluid

- Anti-icing Wiper Fluid

Based on End-User:

- OEMs

- Car Wash Facilities

- Aftermarket

Based on the Geography:

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis

North America

North America holds a market share of 35% in the Heated Wiper Blade Systems Market. The region benefits from extreme winter conditions in Canada and the northern U.S., driving strong demand for enhanced visibility and safety solutions. It witnesses high adoption in passenger cars due to consumer preference for comfort and integrated safety features. Commercial fleets in logistics and public transportation also increasingly install heated wiper systems to maintain operational efficiency in icy conditions. Technological advancements from leading automotive manufacturers, including Ford and General Motors, enhance system reliability and performance. North America also benefits from strong regulatory standards mandating improved vehicle safety features, which further supports market expansion.

Europe

Europe commands a market share of 28% in the market. The region demonstrates widespread adoption due to harsh winter climates in countries like Germany, Sweden, and Norway, where icy conditions frequently affect driving safety. It sees high integration of heated wiper blade systems in both passenger cars and commercial vehicles, supported by OEMs like Volkswagen and Volvo. European manufacturers emphasize energy-efficient designs and eco-friendly wiper fluids that align with stringent environmental regulations. Advanced aftersales services in automotive maintenance hubs also drive aftermarket adoption. Europe’s focus on safety, technology innovation, and premium vehicle features sustains steady growth across the region.

Asia-Pacific

Asia-Pacific holds a market share of 22% and represents a rapidly growing region for the Heated Wiper Blade Systems Market. Countries like Japan, South Korea, and China witness increasing adoption due to expanding automotive production, rising vehicle ownership, and growing awareness of winter safety features. It benefits from OEM collaborations with technology providers to integrate advanced wiper blade systems in both domestic and imported vehicles. The market also sees traction in commercial vehicle fleets used in logistics and public transport in colder regions of China and northern Japan. Expanding aftermarket services and retrofit solutions create further growth potential for the region.

Latin America

Latin America accounts for a market share of 8%. Growth in the region is driven by increasing adoption of passenger vehicles with premium safety features in countries like Brazil and Argentina. It also experiences selective adoption in commercial vehicles operating in high-altitude or winter-prone areas. Limited infrastructure challenges and lower awareness compared to North America and Europe constrain rapid growth, but OEM initiatives and promotional campaigns on winter safety features support gradual market penetration.

Middle East & Africa

The Middle East & Africa hold a market share of 7%. The region sees moderate adoption due to limited winter conditions, with demand mainly in high-altitude areas and premium vehicle segments. It benefits from luxury vehicle imports equipped with heated wiper blade systems and increasing aftermarket awareness in urban hubs. Infrastructure development and growing automotive markets in South Africa, UAE, and Saudi Arabia drive incremental growth. Manufacturers focus on localized solutions and targeted marketing campaigns to expand adoption.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Competitive Analysis

The Heated Wiper Blade Systems Market include Castrol, Peak, ExxonMobil, Eni, Shell, Wintershall Dea, Valvoline, RainX, Chevron, TotalEnergies. The Heated Wiper Blade Systems Market demonstrates a highly competitive landscape driven by innovation, technological advancement, and strategic collaborations. Companies focus on developing blades with enhanced durability, fast heating elements, and improved wiper fluid compatibility to ensure consistent performance in extreme cold and snowy conditions. Integration of smart heating systems and hydrophobic coatings allows for faster ice and snow removal, improving driver safety and visibility. OEM partnerships and aftermarket distribution networks play a significant role in expanding market reach and penetration across both developed and emerging regions. Research and development investment remains a key differentiator, targeting energy-efficient designs, extended blade lifespan, and compatibility with electric and hybrid vehicles. Regional expansion strategies further drive competition, as manufacturers aim to meet growing demand in Asia-Pacific, Latin America, and Middle East & Africa, creating a dynamic market environment characterized by continuous product innovation and improved consumer experiences.

Recent Developments

- In July 2025, Valeo (France) was recognized with the Volkswagen Group Supplier Award for “Best Innovation in Visibility Systems.

- In February 2024, Tesla is preparing to roll out a significant update to its auto wiper system as part of the 2024.14 Software Update, aimed at addressing longstanding complaints about its performance.

- In January 2024, at Busworld Europe, Almighty Auto Ancillary Pvt. Ltd. showcased its expertise in the automotive wiper system, highlighting its global ascent in the industry.

- In September 2023, DENSO unveiled “Everycool,” a Commercial Vehicle Cooling System for Trucks that increases cooling efficiency while reducing environmental impact.

Market Concentration & Characteristics

The Heated Wiper Blade Systems Market exhibits a moderately concentrated structure, with several key manufacturers driving technological innovation and market expansion while numerous smaller players contribute through niche solutions and regional distribution. It is characterized by continuous product development focused on enhanced heating efficiency, improved ice and snow removal, and compatibility with diverse vehicle types, including passenger cars, commercial vehicles, and specialty vehicles. Market dynamics emphasize strong OEM collaborations and aftermarket growth, creating a dual-channel distribution network that ensures widespread accessibility. Advanced materials, smart heating elements, and energy-efficient designs define product differentiation, while regional demand fluctuations influence production and supply strategies. It reflects a competitive environment where investment in R&D, partnerships, and consumer-centric design serves as a primary driver for market positioning. Regulatory compliance for automotive safety and environmental standards also shapes product development and adoption, making innovation and quality critical success factors.

Report Coverage

The research report offers an in-depth analysis based on Vehicle Type, Wiper Fluid Type, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Heated Wiper Blade Systems will see growing adoption in regions with severe winter conditions.

- Technological advancements will focus on energy-efficient and faster-heating blades.

- OEM integration will expand, driving higher penetration in new vehicle models.

- Aftermarket demand will increase due to rising vehicle replacement cycles.

- Smart wiper systems with sensors and adaptive heating will gain traction.

- Regional production and distribution networks will strengthen to meet local demand.

- Collaboration with automotive fluid manufacturers will improve performance and compatibility.

- Lightweight and durable materials will enhance product longevity and efficiency.

- Emerging markets will witness accelerated adoption driven by rising vehicle ownership.

- Continuous innovation in coating and heating technology will drive competitive differentiation.