Market Overview

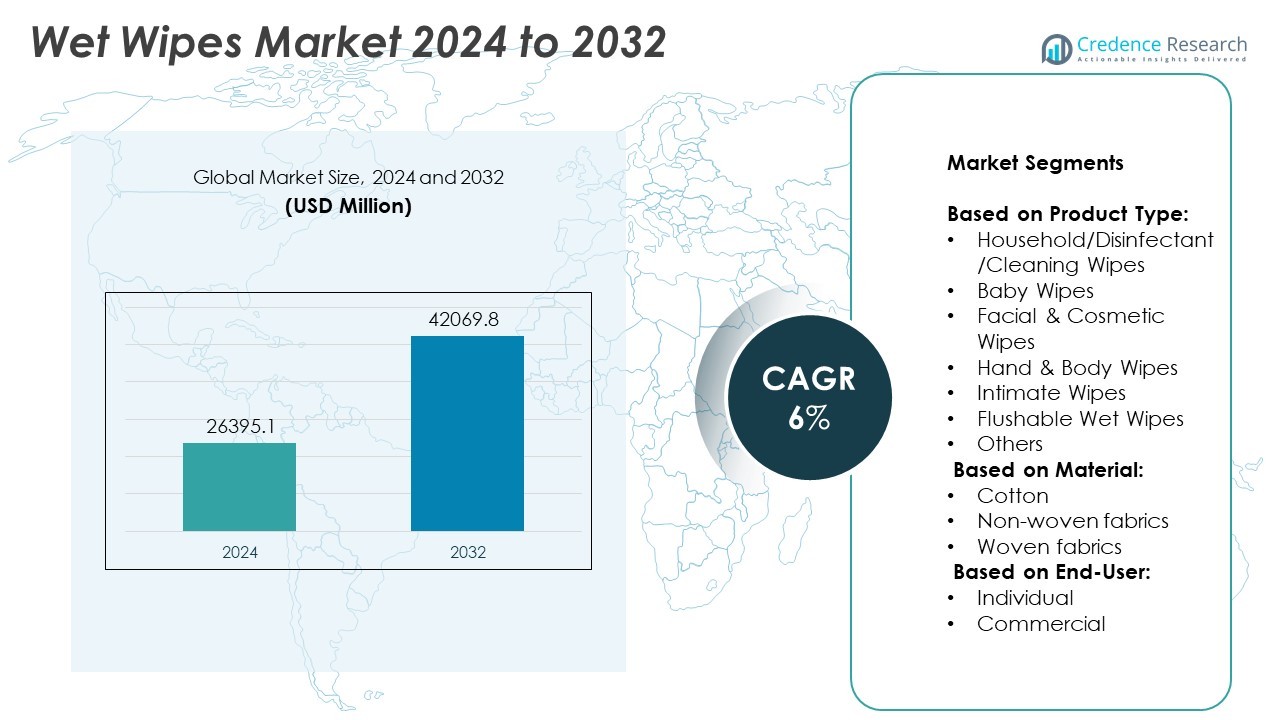

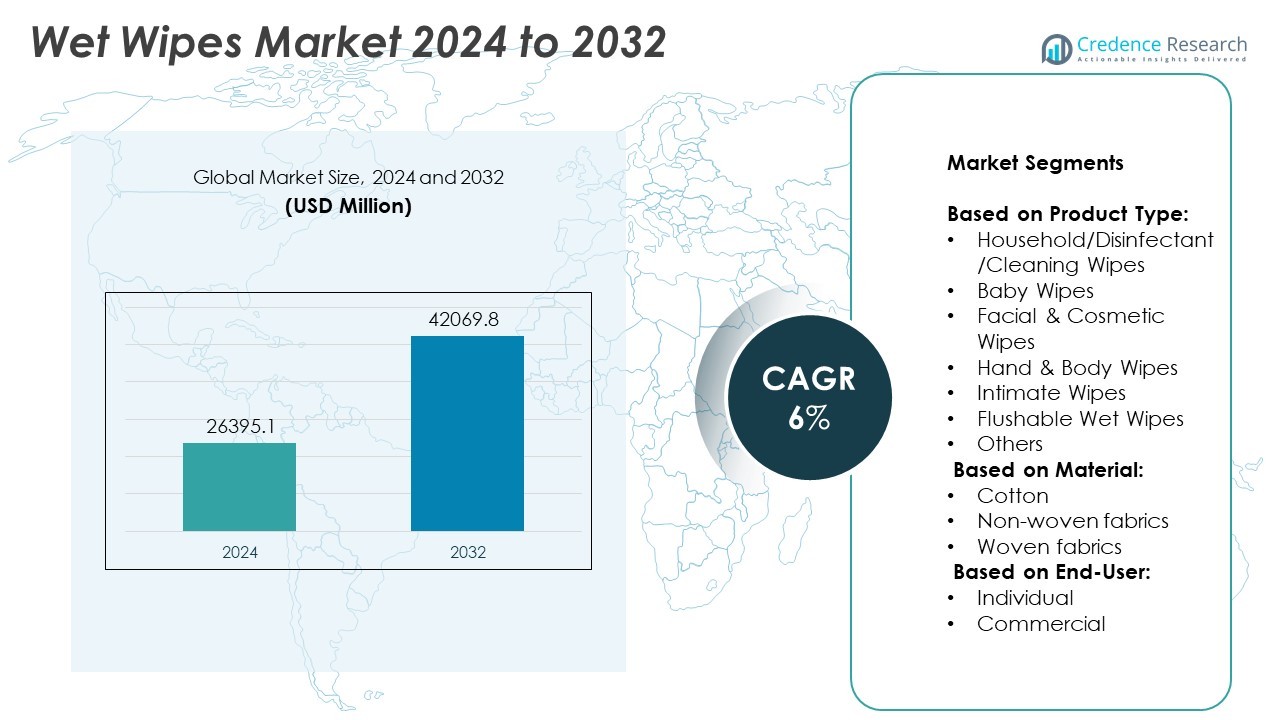

Wet Wipes Market size was valued at USD 26395.1 million in 2024 and is anticipated to reach USD 42069.8 million by 2032, at a CAGR of 6% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2024 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Wet Wipes Market Size 2024 |

USD 26395.1 Million |

| Wet Wipes Market, CAGR |

6% |

| Wet Wipes Market Size 2032 |

USD 42069.8 Million |

The Wet Wipes market advances through rising demand for convenient hygiene solutions, driven by urban lifestyles, health awareness, and expanding baby care needs. Consumers seek portable, skin-safe, and biodegradable products, pushing manufacturers to innovate in formulation and packaging. Growing adoption of disinfectant wipes in households and healthcare supports volume growth, while premium cosmetic and intimate wipes gain traction in developed markets. Trends favor natural ingredients, eco-friendly materials, and functional variants tailored for travel, sports, or beauty routines.

The Wet Wipes market shows strong presence in North America and Europe due to advanced hygiene standards, established retail infrastructure, and consumer preference for premium personal care products. Asia-Pacific emerges as a fast-growing region supported by urbanization and rising disposable incomes. Latin America and the Middle East & Africa offer gradual expansion opportunities through increased healthcare and household applications. Key players influencing global competition include Procter & Gamble, Kimberly-Clark, Unilever, and Johnson & Johnson, each leveraging strong brand portfolios and wide distribution networks.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Wet Wipes market was valued at USD 26,395.1 million in 2024 and is projected to reach USD 42,069.8 million by 2032, growing at a CAGR of 6% during the forecast period.

- Rising consumer focus on personal hygiene, convenient cleaning solutions, and baby care needs continues to drive product demand across multiple segments.

- Biodegradable wipes, natural ingredient formulations, and sustainable packaging dominate recent trends, with growing demand from eco-conscious consumers.

- Leading companies such as Procter & Gamble, Kimberly-Clark, and Unilever maintain competitive strength through product innovation and global distribution networks.

- Environmental regulations, concerns over sewer system clogging, and raw material price volatility act as key restraints in production and market expansion.

- North America leads the market due to high hygiene awareness and advanced retail infrastructure, while Asia-Pacific shows rapid growth through rising urbanization and income levels.

- Manufacturers continue to invest in e-commerce channels, subscription models, and region-specific product formats to reach diverse consumer bases efficiently.

Market Drivers

Rising Demand for Convenient Personal Hygiene Products Among Urban Consumers

The Wet Wipes market benefits from increased consumer preference for portable, disposable hygiene solutions. Urbanization and busy lifestyles push individuals to seek quick and effective alternatives to traditional cleaning methods. Wet wipes offer an on-the-go solution for facial cleansing, hand sanitization, and intimate care, meeting rising hygiene standards. Demand rises across age groups, particularly among working professionals and travelers. The market aligns with consumer habits that favor time-saving personal care formats. It responds to hygiene-conscious behavior influenced by pandemic-era health practices.

- For instance, Johnson & Johnson introduced its Cottontouch Baby Wipes made with 100% cotton and clinically proven to maintain skin pH, with over 12 million units sold globally in the first six months.

Expanding Infant and Baby Care Sector Driving Product Adoption

The Wet Wipes market experiences sustained growth through the baby care segment, where hygiene and skin safety remain primary concerns. Parents increasingly opt for dermatologically tested, fragrance-free wipes that protect sensitive skin. Major brands launch products with plant-based ingredients to meet natural care preferences. Baby wipes see consistent demand in hospitals, households, and daycare centers. It supports the market’s expansion through high-volume, frequent-use consumer behavior. Growth in birth rates across emerging economies further strengthens product penetration.

- For instance, PDI Healthcare’s Super Sani-Cloth® Germicidal Disposable Wipe achieves broad-spectrum efficacy, verified to inactivate 34 different microorganisms—including SARS-CoV-2 and Candida auris—within a 2-minute contact time on hard, nonporous surfaces, according to its official product claims.

Healthcare and Medical Applications Enhancing Institutional Consumption

The Wet Wipes market gains traction in healthcare settings, where disinfectant and medical wipes play a vital role in infection control. Hospitals and clinics require sterile solutions for cleaning equipment, patient skin, and surfaces. It addresses the growing need for cross-contamination prevention and compliance with hygiene standards. Medical wipes infused with alcohol or chlorhexidine attract institutional buyers seeking effective antiseptic alternatives. The demand also extends to elderly care facilities, where adult incontinence wipes support both hygiene and dignity. This segment contributes significantly to bulk procurement and repeat usage.

Shift Toward Biodegradable and Sustainable Wipe Materials

The Wet Wipes market responds to environmental concerns by embracing biodegradable, plastic-free materials. Consumers show strong interest in flushable, compostable wipes that reduce landfill impact. Regulatory frameworks in Europe and North America promote the use of eco-labeled products. It encourages manufacturers to innovate with cellulose-based fibers and water-based formulations. Sustainability becomes a differentiating factor in brand positioning and retail shelf placement. Retailers and e-commerce platforms feature green-labeled wipes more prominently to align with consumer values.

Market Trends

Surge in Demand for Natural and Organic Ingredients in Wipe Formulations

The Wet Wipes market shows a strong shift toward plant-based and chemical-free ingredients to meet clean label demands. Consumers increasingly avoid wipes containing alcohol, parabens, and artificial fragrances due to skin sensitivity and long-term health concerns. Brands reformulate products with aloe vera, chamomile, coconut oil, and bamboo extracts to ensure gentler application. It reflects growing awareness of dermatological safety and environmental sustainability. Organic certification and dermatologist-tested labels play a larger role in influencing buyer choices. Product differentiation relies heavily on natural origin claims across retail and e-commerce platforms.

- For instance, Nivea launched its Biodegradable Cleansing Wipes made from 100% plant fibers and plastic-free materials, reaching over 2,500 retail locations across Europe, as stated in its official sustainability disclosures.

Growing Popularity of Functional Wipes with Specialized Applications

The Wet Wipes market trends toward multifunctional variants designed for specific needs such as makeup removal, surface disinfection, and fitness use. Brands launch niche formats like menthol-infused sports wipes or antibacterial wipes for public transportation hygiene. It addresses changing consumer routines that prioritize targeted utility in compact formats. Product innovation supports expansion into travel kits, gym bags, and school packs. Functional segmentation allows manufacturers to capture value across non-traditional personal care spaces. The market witnesses higher margins in premium, purpose-driven wipe categories.

- For instance, Clorox released its Scentiva Disinfecting Wipes infused with Tuscan Lavender & Jasmine, tested to kill 99.9% of bacteria and viruses, and distributed the product across more than 4,500 retail outlets across the U.S.

Rise of Sustainable Packaging and Plastic-Free Product Formats

The Wet Wipes market adapts to environmental mandates by embracing recyclable, refillable, and compostable packaging formats. Traditional plastic tubs and pouches are replaced with paper-based wrappers and biodegradable dispensers. It aligns with government regulations and retailer pressure to reduce single-use plastic waste. Consumer preference for eco-conscious brands supports investment in low-impact material technologies. Product labeling now emphasizes sustainability credentials, including FSC certification and water-based printing. Packaging innovations influence both brand perception and shelf appeal.

Expansion of Direct-to-Consumer and E-commerce Sales Channels

The Wet Wipes market embraces digital-first strategies to capitalize on growing online demand. Direct-to-consumer brands offer subscription-based delivery of personal and baby wipes to build customer retention. It benefits from detailed product filtering, reviews, and personalized hygiene bundles. E-commerce platforms enable rapid entry of emerging brands targeting niche preferences. Online promotions, influencer endorsements, and social media marketing amplify product visibility. The shift supports rapid innovation cycles and lower distribution costs compared to traditional retail channels.

Market Challenges Analysis

Environmental Concerns and Regulatory Pressure on Disposal Practices

The Wet Wipes market faces scrutiny due to its environmental impact, particularly concerning plastic content and non-biodegradable waste. Many conventional wipes contain synthetic fibers that contribute to sewer blockages and marine pollution. Governments and environmental groups intensify campaigns to ban or restrict non-flushable wipes. It must comply with evolving legislation in Europe and North America, which mandates clearer labeling and material disclosures. Brands incur higher production costs when shifting to biodegradable materials or gaining eco-certifications. These challenges affect pricing strategies and long-term supply chain planning.

Rising Raw Material Costs and Disruptions in Global Supply Chains

The Wet Wipes market encounters pressure from volatile raw material prices, particularly for nonwoven fabrics, resins, and packaging substrates. Increased demand for hygiene products during global health events amplifies pressure on manufacturing capacity. It struggles to balance cost-efficiency with consistent product quality across regional markets. Delays in logistics and sourcing, especially from Asia-Pacific suppliers, disrupt inventory planning and affect delivery timelines. Smaller players face higher risks of supply gaps due to limited procurement flexibility. These cost-related constraints reduce competitiveness and challenge sustained profitability.

Market Opportunities

Product Innovation in Biodegradable and Skin-Sensitive Wipe Solutions

The Wet Wipes market holds strong potential in developing biodegradable and dermatologically safe products that align with environmental and health-conscious preferences. Consumer interest in flushable, compostable, and plastic-free wipes opens opportunities for new material technologies. Brands can invest in cellulose-based fibers and plant-derived formulations to replace synthetic blends. It benefits from demand in baby care, feminine hygiene, and sensitive skin segments where safety and sustainability drive loyalty. Companies that secure eco-certifications and dermatological validations gain a competitive edge in regulated and premium markets. Product differentiation through skin-specific formulations and green packaging enhances shelf visibility and consumer trust.

Rising Penetration in Emerging Economies with Expanding Middle Class

The Wet Wipes market can expand rapidly in regions such as Southeast Asia, Latin America, and Africa, where hygiene awareness and disposable income continue to rise. Urbanization and lifestyle changes in these economies drive demand for affordable, accessible personal care products. It can tap into new retail partnerships, localized branding, and region-specific formats to reach underserved populations. Growth in modern retail infrastructure and mobile commerce supports brand outreach across rural and semi-urban areas. Manufacturers that adapt to price sensitivity and local preferences secure long-term volume gains. These markets offer strong growth potential across baby care, medical, and household cleaning segments.

Market Segmentation Analysis:

By Product Type:

Baby wipes account for a significant share due to consistent demand from households, maternity clinics, and childcare facilities. Parents prioritize safety, softness, and skin-friendliness, encouraging manufacturers to develop fragrance-free and hypoallergenic variants. Household/disinfectant/cleaning wipes gain traction in both residential and institutional cleaning routines where quick sanitation is required. Facial and cosmetic wipes expand through beauty retail channels, targeting makeup removal, skin hydration, and on-the-go freshness. The Wet Wipes market also sees growing demand for hand & body wipes, particularly in travel, fitness, and outdoor segments. Intimate wipes cater to niche health and hygiene needs, while flushable wet wipes offer convenience but face regulatory scrutiny in urban wastewater systems. Other variants include specialty wipes for pets, footwear, and automotive cleaning.

- For instance, PDI Healthcare Super Sani-Cloth wipes, a widely used disinfectant in hospitals, are supplied in high volume (over 500 million annually) and are known for their rapid efficacy against a broad range of pathogens. Specifically, they achieve a 2-minute kill time against over 30 pathogens, a claim validated through clinical lab testing. This rapid action is crucial for maintaining hygiene in fast-paced healthcare environments.

By Material:

Non-woven fabrics dominate due to their cost efficiency, absorbency, and adaptability across personal care and cleaning applications. It allows customization in terms of texture, strength, and softness, meeting diverse product performance needs. Cotton-based wipes appeal to environmentally conscious users who prefer biodegradable and skin-safe materials, particularly in premium baby and facial care lines. Woven fabrics offer higher strength and durability, making them suitable for heavy-duty cleaning and reusable wipe formats. Manufacturers focus on combining material sustainability with functional integrity to meet rising consumer expectations.

- For instance, Albaad Cotton-Like Eco Wipes are produced with certified 100% cotton fiber, achieving a breakdown time of under 60 days in industrial compostability trials and distributed across more than 20 European markets.

By End-User:

Individual consumers drive most of the Wet Wipes market volume, especially in personal hygiene and household maintenance. It aligns with lifestyle habits, self-care routines, and daily cleaning needs. Commercial usage expands steadily across healthcare, hospitality, foodservice, and transportation sectors. These environments require reliable, high-volume disinfecting and cleaning solutions that comply with hygiene regulations. Commercial segments present strong opportunities for recurring bulk orders and long-term supplier contracts.

Segments:

Based on Product Type:

- Household/Disinfectant/Cleaning Wipes

- Baby Wipes

- Facial & Cosmetic Wipes

- Hand & Body Wipes

- Intimate Wipes

- Flushable Wet Wipes

- Others

Based on Material:

- Cotton

- Non-woven fabrics

- Woven fabrics

Based on End-User:

Based on the Geography:

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis

North America

North America holds the largest share of the Wet Wipes market, accounting for 31.6% of global revenue in 2024. The region’s leadership is driven by high consumer awareness, advanced retail infrastructure, and demand for hygiene-focused personal care products. Baby wipes and disinfectant household wipes dominate usage due to established parenting practices, hospital protocols, and household cleaning standards. Consumers in the United States and Canada prioritize dermatologically tested, eco-labeled products, pushing manufacturers to innovate in sustainable packaging and biodegradable materials. It also benefits from strong online retail penetration, where brands offer subscription-based delivery and tailored product bundles. Institutional buyers, including healthcare and hospitality sectors, contribute to recurring demand across commercial end-user segments.

Europe

Europe represents the second-largest Wet Wipes market, contributing 28.4% of the global share. The region enforces strict environmental and product safety regulations that shape both product development and labeling. Demand for biodegradable, plastic-free, and flushable wipes continues to grow, driven by consumer preference and policy mandates under the EU Single-Use Plastics Directive. Countries such as Germany, France, and the UK lead in adopting natural fiber wipes, especially in baby care, intimate hygiene, and household cleaning categories. It also sees increasing demand for facial and cosmetic wipes from the region’s well-established skincare and beauty industries. Retailers across Europe focus on clean label transparency, prompting product reformulation and innovation in raw material sourcing.

Asia-Pacific

Asia-Pacific holds a significant growth position, currently representing 21.9% of the global Wet Wipes market. Rapid urbanization, population growth, and rising middle-class incomes in China, India, Indonesia, and Southeast Asia drive volume sales across both baby wipes and general-purpose hygiene wipes. It experiences strong uptake of household cleaning wipes and hand & body wipes due to lifestyle modernization and higher hygiene awareness, especially post-pandemic. E-commerce and organized retail sectors play a key role in expanding product access and awareness. Local and international manufacturers invest in affordable, multi-pack options tailored to regional preferences and price sensitivity. Governments promote public health campaigns, further supporting demand in institutional and healthcare settings.

Latin America

Latin America contributes 9.2% to the global Wet Wipes market, with Brazil and Mexico as the largest consumers. Regional demand centers around baby wipes, facial wipes, and general-purpose household variants, particularly in urban zones. It gains support from modern trade formats, including supermarkets and pharmacy chains, which offer private-label and economy-priced products. Manufacturers focus on improving distribution networks and adapting packaging sizes to suit varying income levels. Environmental awareness is rising, although sustainable wipe adoption remains limited to premium segments. Commercial applications in hospitality and public healthcare present steady opportunities for mid-sized suppliers.

Middle East & Africa

The Middle East & Africa region holds 8.9% of the Wet Wipes market, supported by growing hygiene awareness and urban expansion in Gulf Cooperation Council (GCC) countries and parts of North Africa. Baby wipes dominate consumption, particularly among high-income households, while facial and hand wipes gain momentum in retail and personal care channels. It shows potential in sectors such as hospitality, transportation, and healthcare where hygiene standards evolve. Religious tourism in countries like Saudi Arabia further increases short-term demand for portable hygiene products. Domestic manufacturing remains limited, prompting high reliance on imports across key product categories. Retailers promote smaller packaging formats for cost accessibility in lower-income areas.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Nice-Pak Products

- Kimberly-Clark

- Estee Lauder

- Beiersdorf

- Reckitt Benckiser

- Sani Professional

- Unilever

- Cascades

- PDI

- Johnson & Johnson

- Seventh Generation

- Clorox

- Procter & Gamble

- Kirkland Signature

- Essity

Competitive Analysis

The Wet Wipes market features strong competition among leading players including Nice-Pak Products, Kimberly-Clark, Estee Lauder, Beiersdorf, Reckitt Benckiser, Sani Professional, Unilever, Cascades, PDI, Johnson & Johnson, Seventh Generation, Clorox, Procter & Gamble, Kirkland Signature, and Essity.These companies compete on innovation, sustainability, pricing strategies, and product range diversification. Leading brands invest in biodegradable materials, skin-safe formulations, and recyclable packaging to address growing environmental concerns and regulatory demands. They maintain strong distribution networks across supermarkets, pharmacies, and e-commerce platforms, ensuring high product availability and visibility. Several players focus on specialized segments such as baby care, cosmetic wipes, and disinfectant formats to secure consumer loyalty. R&D investment enables continuous development of dermatologically tested and multi-functional products, appealing to both individual and institutional buyers. Manufacturers adopt regional branding strategies and promotional campaigns to align with cultural preferences and regulatory standards. Competitive advantage also stems from private-label partnerships and healthcare sector contracts, especially in North America and Europe. Market leaders leverage digital marketing and subscription models to build direct-to-consumer engagement, expanding recurring revenue streams.

Recent Developments

- In April 2025, Essity reported a 0.4% increase in net sales compared to a year earlier, amounting to SEK 34,976 million in the first quarter. Organic sales grew by 2.1%, with strong gains in Health & Medical and Consumer Goods segments.

- In February 2023, The Honest Company, Inc. released its Clean Conscious Wipes. This mild cleaner makes these compostable wipes safe for sensitive skin. They are also made plastic-free, quaternary-free, perfume-free, chlorine-free processing, and parabens-free

- In June 2023 US-based plastic packaging products manufacturer Berry Global Inc launched its new wipes materials for hard-surface disinfecting, sustainable range.

Market Concentration & Characteristics

The Wet Wipes market shows moderate concentration, with a mix of multinational corporations and specialized regional players shaping competitive dynamics. Leading companies such as Procter & Gamble, Kimberly-Clark, and Unilever hold strong brand equity, advanced distribution networks, and consistent R&D capabilities. It features product diversity across personal care, household cleaning, healthcare, and cosmetic segments, supported by continuous innovation in formulation and packaging. Market characteristics include high volume turnover, price sensitivity in emerging regions, and premiumization trends in developed economies. Sustainability expectations influence product development, with biodegradable materials and recyclable packaging becoming standard in new launches. Consumer demand fluctuates by application, with baby wipes maintaining consistent use, while disinfectant and facial wipes respond to seasonal and health-driven demand. Manufacturers prioritize dermatological safety, environmental compliance, and convenience features such as resealable packs and multi-use formats. The market supports private label expansion, particularly through supermarkets and e-commerce platforms targeting budget-conscious consumers.

Report Coverage

The research report offers an in-depth analysis based on Product Type, Material, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for biodegradable and plastic-free wet wipes will continue to rise due to stricter environmental regulations and consumer awareness.

- Baby wipes will remain a stable revenue segment driven by consistent global birth rates and hygiene priorities.

- Growth in disinfectant and antibacterial wipes will sustain due to ongoing focus on public health and sanitation standards.

- Manufacturers will expand product portfolios with skin-sensitive, pH-balanced, and dermatologically tested formulations.

- E-commerce and direct-to-consumer sales will grow rapidly, supported by subscription models and digital marketing.

- Emerging markets will offer high growth potential with increasing urbanization, disposable income, and hygiene education.

- Premiumization will drive demand for specialty wipes, including organic, cosmetic, and fitness-focused variants.

- Innovation in packaging will focus on resealable, recyclable, and travel-friendly formats to enhance usability and reduce waste.

- Institutional demand from healthcare, hospitality, and transportation sectors will support commercial product lines.

- Private label brands will gain traction by offering competitive pricing and customized regional assortments.