Market Overview:

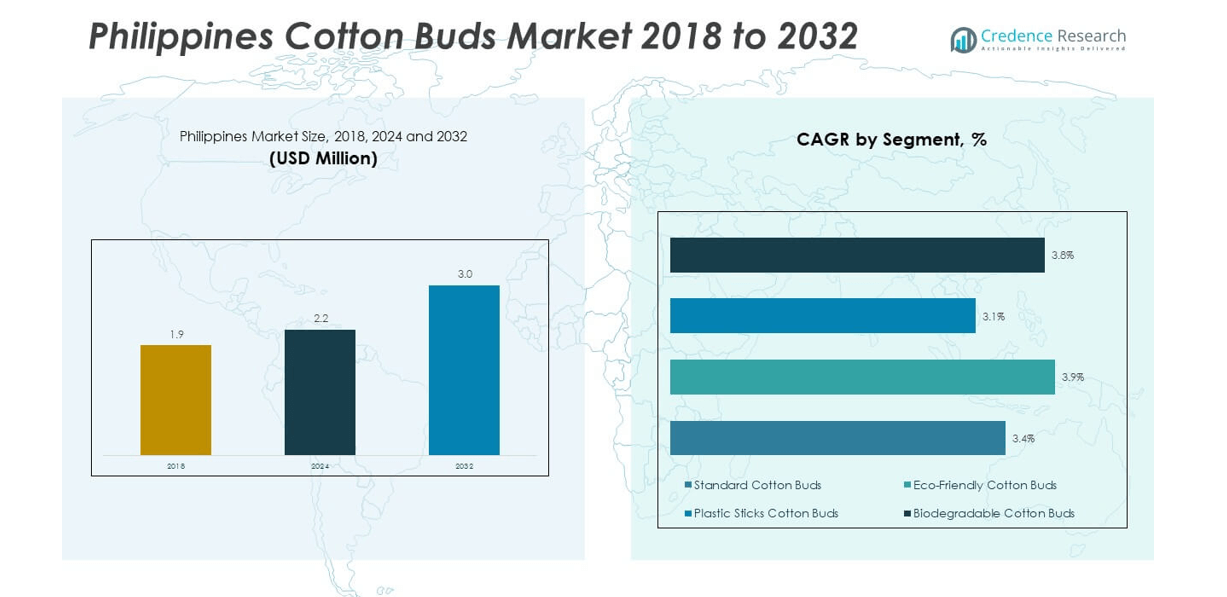

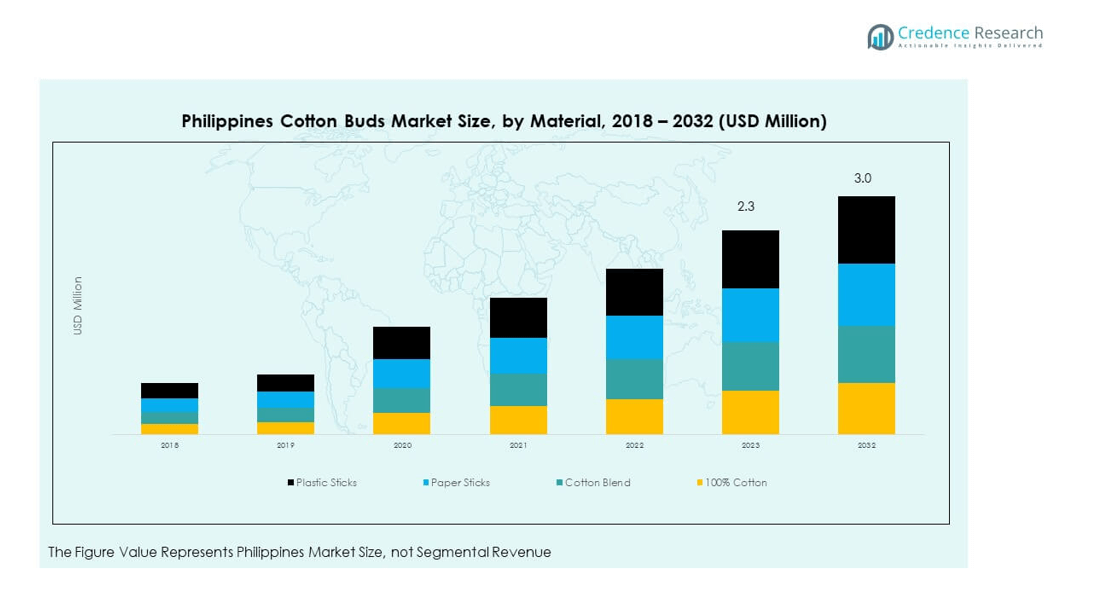

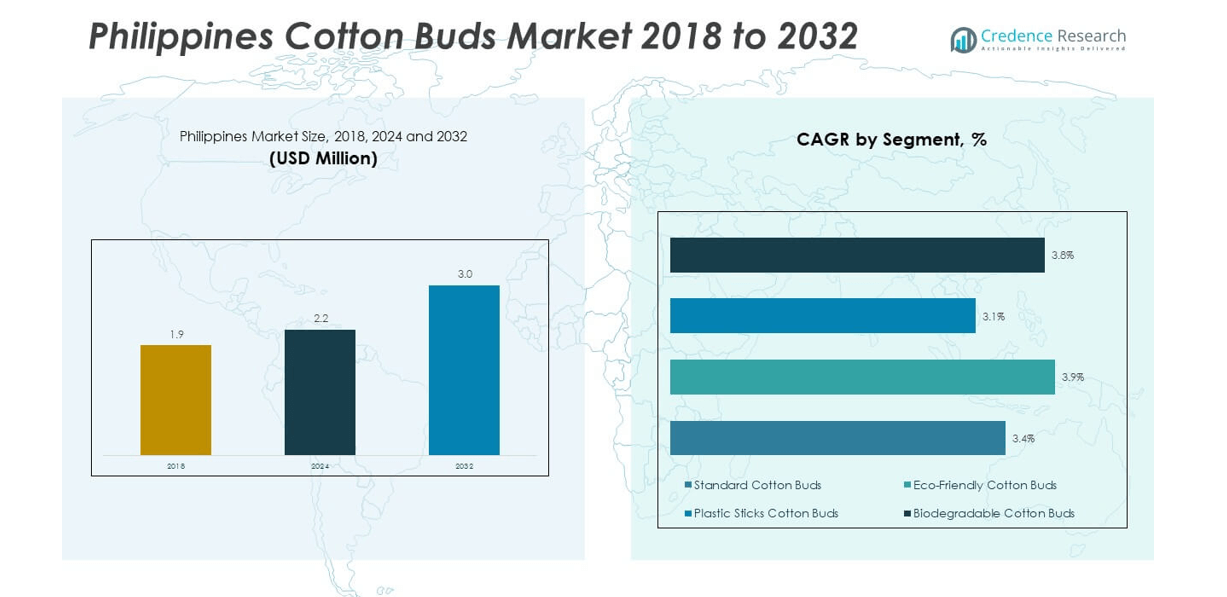

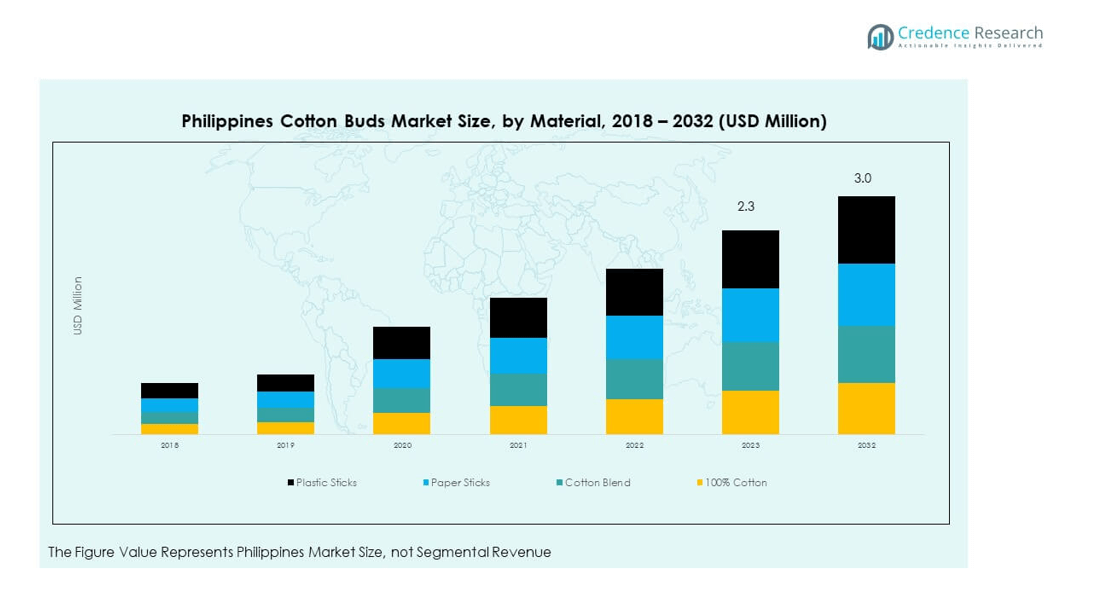

The Philippines Cotton Buds Market size was valued at USD 1.9 million in 2018 to USD 2.2 million in 2024 and is anticipated to reach USD 3.0 million by 2032, at a CAGR of 3.90% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Philippines Cotton Buds Market Size 2024 |

USD 2.2 million |

| Philippines Cotton Buds Market, CAGR |

3.90% |

| Philippines Cotton Buds Market Size 2032 |

USD 3.0 million |

The market is expanding due to rising consumer awareness regarding personal hygiene, increasing demand for eco-friendly alternatives, and the availability of affordable products across various retail channels. Consumers are shifting toward biodegradable and paper-stick variants in response to environmental concerns, prompting manufacturers to innovate sustainable product lines. The growing influence of modern retail formats and e-commerce platforms has made cotton buds more accessible, boosting sales in both urban and rural areas. Rising disposable incomes and the adoption of premium personal care products also support market growth, while health and beauty industries increasingly use cotton buds for cosmetic and medical applications.

Regionally, Metro Manila dominates the Philippines Cotton Buds Market due to its high population density, urban lifestyle, and concentration of retail outlets. The Visayas and Mindanao regions are emerging growth areas, driven by expanding retail networks, improving household incomes, and greater awareness of hygiene products. The spread of modern trade channels, such as supermarkets and convenience stores, is enhancing product penetration in semi-urban and rural markets. Increased government and NGO-led hygiene campaigns are also contributing to demand in less developed areas. The shift toward sustainable and biodegradable materials is expected to further strengthen the market across all regions, particularly in areas with rising environmental consciousness.

Market Insights:

- The Philippines Cotton Buds Market was USD 1.9M (2018), reached USD 2.2M (2024), and is projected at USD 3.0M (2032), CAGR 3.90%.

- Hygiene routines, cosmetic precision, and infant care anchor repeat purchases in urban and suburban households.

- Input cost swings and counterfeit risks constrain pricing power and require stronger QA controls.

- Paper and biodegradable sticks gain share as retailers tighten sustainability criteria.

- E-commerce and subscriptions lift replenishment frequency and basket size.

- Institutional demand from clinics, salons, and pharmacies stabilizes base volume.

- Portfolio focus on hero SKUs and value-plus eco tiers improves availability and margins.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers:

Elevated Hygiene Consciousness and Everyday Multipurpose Use:

The Philippines Cotton Buds Market benefits from entrenched daily hygiene rituals spanning ear care, cosmetic touch-ups, and minor wound cleaning. Public-health messaging and consumer education normalize frequent replacement and safe use, supporting steady offtake. Cross-utility in beauty, baby care, and micro-cleaning raises household stock levels and multi-room storage. Urban lifestyles increase on-the-go kits, while work-from-home routines sustain personal-care moments throughout the day. Hospitals and clinics use cotton buds for swabbing and topical application, anchoring institutional demand. Convenience stores and pharmacies maintain impulse purchases alongside essentials. Low unit prices keep the category accessible, with premium lines adding margin without alienating value seekers. It sustains relevance across income tiers and distribution formats.

- For instance, Convenience retailers such as 7-Eleven Philippines place single-use and travel packs of cotton buds near checkout for impulse buying, as seen in in-store stock photos and press releases.

Retail Modernization, E-Commerce Scale, and Private-Label Expansion:

Modern trade growth provides shelf discipline, brand blocking, and visibility for eco lines. E-commerce marketplaces enable bulk-pack promotions, subscription replenishment, and targeted ads that lift repeat rates. Fulfillment improvements expand delivery to secondary and tertiary cities, broadening the buyer base. Private labels leverage retailer data to tune pack counts and price ladders, squeezing inefficient SKUs. National brands respond with dermatologically tested claims, softer cotton, and precision-wound tips to defend share. Shopper marketing pushes value bundles with wipes and pads, raising basket size. Review ecosystems reward consistent quality, pushing laggards to improve. It creates a healthier, data-driven competitive environment.

Sustainability Shift Paper and Biodegradable Sticks Becoming the Norm:

Plastic-stick fatigue is steering buyers toward paper and biodegradable alternatives with clear on-pack eco cues. Retailers increasingly favor compliant products, nudging assortments toward greener options. Local converters invest in paper-stick lines and FSC-aligned sourcing to secure long-term listings. Brands use recyclable films, compact boxes, and reduced-ink designs to strengthen sustainability credentials. Clear labeling on safe disposal and responsible use builds trust and loyalty. Eco-led innovation encourages premium pricing headroom without sacrificing velocity. Institutional buyers adopt sustainable SKUs to meet corporate ESG targets. It positions the category for durable growth with lower reputational risk.

Product Quality Upgrades and Pack Architecture Optimization:

Improved tip winding, lint-control, and shaft rigidity reduce breakage and improve user experience. Dual-ended shapes, pointed tips, and sterile variants address precise cosmetic and medical tasks. Pack formats are tuned for sari-sari stores, pharmacies, supermarkets, and online shoppers, balancing price points and daily use. Tamper-evident, resealable, and travel-friendly packs cut wastage and lift portability. Co-branding with baby-care and beauty ranges drives trial via curated kits. Local manufacturing shortens lead times, supports custom runs, and stabilizes availability. Promotional cadence aligns with pay cycles and festival periods to maximize throughput. It refines margin structure while sustaining volume.

Market Trends:

Premiumization Through Dermatological Claims and Precision Formats:

Shoppers favor cues like “100% pure cotton,” “hypoallergenic,” and “dermatologist tested” to minimize irritation risk. Precision tips for eyeliner corrections and nail art broaden cosmetic relevance. Sterile or medical-grade variants attract clinics and discerning home users. Brands highlight fiber uniformity, tip symmetry, and dust-free packing to signal quality. QR codes for batch verification and usage tips enhance transparency. Limited-edition bundles with cosmetic accessories create seasonal buzz. Influencer how-tos normalize advanced use cases. The Philippines Cotton Buds Market uses these signals to separate value and premium tiers.

Eco-Design, Minimalist Packaging, and Material Transparency:

Paper sticks, biodegradable shafts, and recyclable boxes are moving from niche to mainstream. Minimalist pack art, reduced plastics, and compostability claims resonate with eco-conscious households. Material disclosures on cotton origin and stick composition aid trust and retail acceptance. Compact packaging lowers logistics cost per unit and improves shelf density. Brands test refill concepts and dispenser packs to cut waste. Retailers add eco tags on shelves and filters online, simplifying discovery. Certifications and third-party audits strengthen credibility. It builds a defensible moat around sustainable SKUs.

- For instance, Paper sticks, biodegradable shafts, and recyclable boxes are moving from niche to mainstream. Minimalist pack art, reduced plastics, and compostability claims resonate with eco-conscious households. Material disclosures on cotton origin and stick composition aid trust and retail acceptance. Compact packaging lowers logistics cost per unit and improves shelf density.

Channel Blending: Omnichannel Journeys and Auto-Replenishment:

Consumers browse reviews online, purchase in-store, and reorder via marketplaces when promotions peak. Subscriptions reduce stock-outs for households with babies or high cosmetic use. Pharmacies push health-led messaging, while supermarkets win on price packs; convenience wins emergencies. Live-commerce demos showcase tip precision and fiber integrity. Data-driven promotions align to regional paydays and local events. Click-and-collect helps urban buyers manage time. Marketplace ratings serve as quality arbiters, accelerating share shifts. It makes distribution strategy a competitive differentiator.

Portfolio Simplification and SKU Rationalization for Efficiency:

Brands prune slow movers and focus on hero SKUs to improve availability and working capital turns. Pack sizes ladder cleanly from travel to family formats, easing shopper decisions. Standardized components reduce changeovers and stabilize quality. Clear tiering—value, core, eco, premium—supports planograms and ad spend allocation. Private labels mirror winning specs quickly, keeping pressure on incumbents. Co-packing partnerships absorb seasonal spikes without overinvesting in capacity. Supply planning models include weather and festival effects to predict runs. It sharpens execution and protects margins.

Market Challenges Analysis:

Price Sensitivity, Input Volatility, and Counterfeit Risk:

Low involvement and high substitutability make shoppers price sensitive, compressing margins during promotions. Cotton price swings and currency movements affect converter costs, straining stable pricing. Smaller players struggle to absorb logistics and packaging inflation without sacrificing quality. Counterfeit or sub-standard products can erode trust, especially online. Inconsistent winding or weak shafts trigger negative reviews that spread quickly. Retailer chargebacks for quality misses add financial stress. Visibility across fragmented wholesale channels remains limited, complicating recalls. The Philippines Cotton Buds Market must enforce QA rigor and brand protection to sustain loyalty.

Compliance Upgrades, Plastic Transition, and Education Gaps:

Shifting from plastic to paper or biodegradable sticks requires capex, supplier vetting, and process changes. Packaging compliance on claims, safety icons, and disposal instructions needs diligence. Consumer misuse risks (ear canal insertion) demand clearer guidance and pictograms. Institutional buyers request documentation on sterility, fiber origin, and audits, raising admin load. Smaller firms may lag on certifications, risking delistings. Recycling infrastructure gaps can blunt eco claims if not communicated well. Category education must balance safety, efficacy, and sustainability without complicating the message. It requires coordinated action across brands, retailers, and regulators.

Market Opportunities:

Eco-Led Differentiation and Institutional Partnerships:

Eco SKUs with verified paper or biodegradable sticks can capture premium share and retailer advocacy. Hospitals, clinics, and beauty chains seek consistent quality, traceability, and compliant packs. Tender participation and white-label programs open stable volume lanes. Education campaigns on safe, sustainable use build brand equity. Co-developed dispenser packs fit salons and clinics. Local sourcing stories resonate with consumers. It positions leaders for durable growth.

Digital Acceleration, Bundles, and Export Niches:

Subscriptions and marketplace bundles with wipes and pads raise lifetime value. Micro-influencer content drives precise beauty use-cases and conversion. Export into nearby ASEAN markets can leverage Philippine manufacturing agility. Refill concepts and compact dispensers reduce waste and shipping cost. Data-led promo calendars maximize ROI. QA storytelling via QR codes reassures buyers. It expands reach while protecting margins.

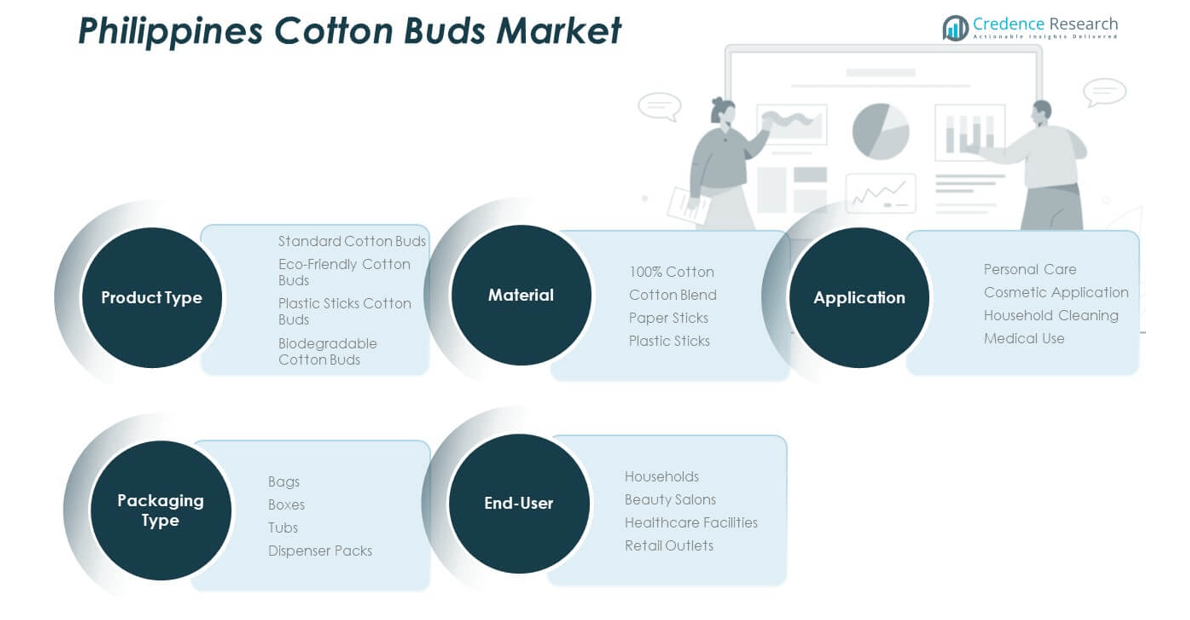

Market Segmentation Analysis:

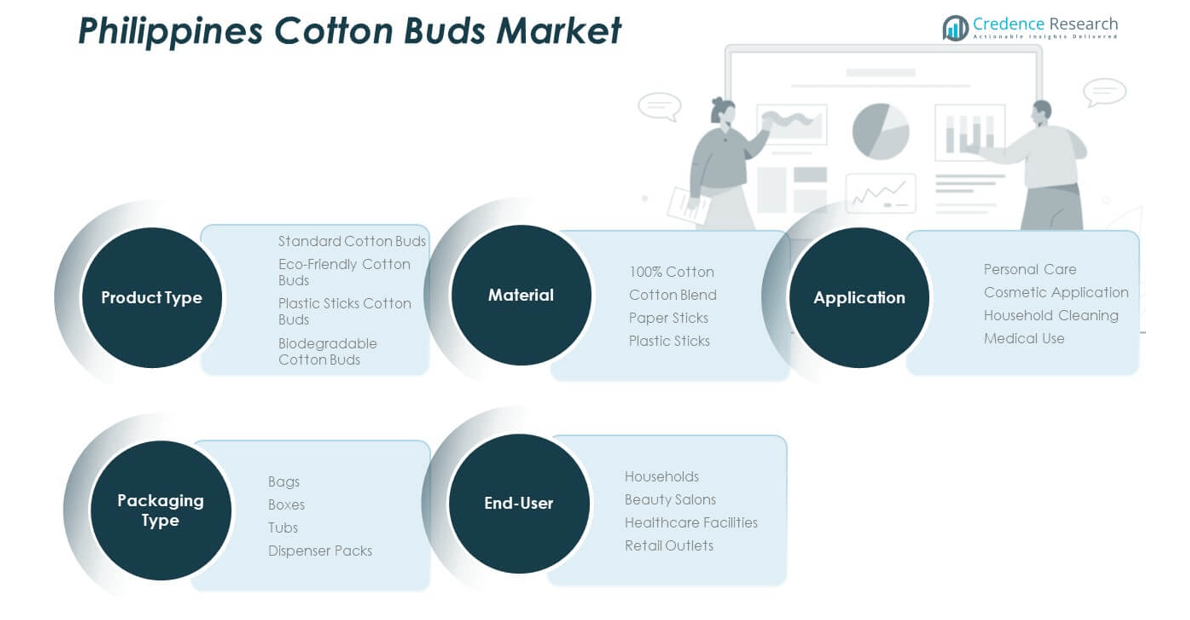

By Product Type

Standard and eco-friendly variants lead volume, with standard lines winning in sari-sari and value channels and eco lines scaling in modern trade. Biodegradable sticks and paper shafts secure premium shelf space and retailer endorsements. Plastic-stick SKUs persist in value niches but face tighter space allocation. Portfolio balance ensures price-tier coverage while meeting sustainability expectations.

- For instance, Biodegradable sticks and paper shafts secure premium shelf space and retailer endorsements. Plastic-stick SKUs persist in value niches but face tighter space allocation. Portfolio balance ensures price-tier coverage while meeting sustainability expectations.reduced plastics, and compostability claims resonate with eco-conscious households. Material disclosures on cotton origin and stick composition aid trust and retail acceptance. Compact packaging lowers logistics cost per unit and improves shelf density.

By Material

100% cotton signals purity and softness, driving premium appeal in baby and cosmetic use. Cotton blends offer cost efficiency for mass formats. Paper sticks gain momentum as compliant, sturdy alternatives; plastic sticks are rationalized. Material transparency on packs supports trust and repeat.

By Application

Personal care dominates, spanning ear-adjacent hygiene, make-up fixes, and nail detailing. Cosmetic application grows via influencer content and beauty-retail tie-ins. Household cleaning adds steady incidental usage; medical use anchors institutional orders. Clear usage icons improve adoption.

By Packaging Type

Bags and boxes cover core retail; tubs and dispenser packs serve high-frequency and institutional settings. Resealability and travel sizes reduce waste and aid portability. Compact designs improve shelf density and shipping efficiency. Pack cues emphasize eco credentials and safety.

By End-User

Households carry the base, salons drive premium precision tips, and healthcare facilities demand sterile, documented SKUs. Retail outlets act as both sales points and private-label incubators. It benefits from diversified channels that stabilize throughput across seasons.

Segmentation:

By Product Type:

- Standard Cotton Buds

- Eco-Friendly Cotton Buds

- Plastic Sticks Cotton Buds

- Biodegradable Cotton Buds

By Material:

- 100% Cotton

- Cotton Blend

- Paper Sticks

- Plastic Sticks

By Application:

- Personal Care

- Cosmetic Application

- Household Cleaning

- Medical Use

By Packaging Type:

- Bags

- Boxes

- Tubs

- Dispenser Packs

By End-User:

- Households

- Beauty Salons

- Healthcare Facilities

- Retail Outlets

By Region:

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis:

Luzon (incl. NCR)

Luzon, anchored by the National Capital Region, commands the largest share due to population density, higher incomes, and the concentration of modern retail. Supermarkets, pharmacies, and beauty specialty chains provide broad aisle space for both value and eco SKUs. E-commerce penetration is deepest in NCR, supporting subscriptions and bulk multipacks. Salons and clinics cluster in urban hubs, lifting precision and sterile variants. Marketing activations and sampling programs are more frequent, accelerating premium mix. Logistics networks enable rapid replenishment and tighter promotion cycles. Private labels scale faster here through data-driven planograms. Estimated share leadership is sustained by retail maturity and institutional demand depth.

Visayas

Visayas contributes a meaningful mid-teens share supported by regional cities with growing modern trade footprints. Pharmacy chains and supermarkets in Cebu and Iloilo improve assortment breadth, while sari-sari stores maintain base velocity on core packs. Online marketplaces extend reach to secondary towns with acceptable delivery times. Tourism and hospitality hubs stimulate demand for travel sizes and convenience packs. Beauty services growth boosts precision tips and salon-oriented dispenser packs. Education around eco sticks is gaining traction, helped by retailer shelf tags. Distribution requires adaptive routing across islands, favoring partners with multi-hub networks. Share growth is underpinned by urbanization and channel mix upgrades.

Mindanao

Mindanao’s share is expanding from a lower base as retail infrastructure improves in Davao, Cagayan de Oro, and General Santos. Pharmacies and minimarts increase category visibility, while e-commerce shortens access gaps for specialty SKUs. Institutional demand rises with clinic expansion and government health initiatives. Value packs dominate early, with eco transitions following retailer guidelines. Security of supply and consistent QA build trust in newer outlets. Brand activations focus on safety guidance and appropriate use, curbing misuse concerns. Logistics resilience and local warehousing reduce stock-outs during weather disruptions. The region’s trajectory remains positive with rising incomes and improving distribution.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

Competitive Analysis:

The Philippines Cotton Buds Market features a blend of multinational brands, strong local players, and expanding private labels competing on safety, softness, stick integrity, and sustainability. PHILUSA Corporation leverages local manufacturing agility and wide retail relationships across modern and traditional trade. Multinationals such as Johnson & Johnson, Unilever, and Kimberly-Clark Philippines Inc. defend share with trust cues, dermatological testing, and baby-care adjacencies. Retail-led brands from Watsons and MR.DIY sharpen price ladders and bundle strategies, accelerating value penetration. Muji positions minimalist, quality-led packs that resonate with urban eco shoppers. Winning playbooks emphasize eco paper sticks, lint control, precise tip shaping, and resealable packaging. Digital engagement, reviews, and marketplace subscriptions strengthen retention, while institutional channels reward documented QA and reliable lead times.

Recent Developments:

- In July 2025, PHILUSA Corporation launched the “Katuwang ng Tahanang Pilipino” campaign, underscoring its commitment to delivering accessible and high-quality consumer products, including personal care essentials such as cotton buds, to Filipino households. The initiative aligns with PHILUSA’s sustainability efforts and ongoing strategic partnerships, notably its recent collaboration with Bayer Philippines to improve access to affordable generic medicines, further cementing the company’s role as a trusted local personal care provider.

- In April 2025, Muji Europe Holdings Ltd. completed the sale of its European business and assets following an administration process. While this restructuring ensures Muji’s continued retail operations in the region, it does not indicate new product launches in the Philippine market specifically for cotton buds or personal care during this period.

- Kimberly-Clark Philippines Inc. reported robust second-quarter 2025 growth, driven by innovation-led volume gains and the launch of pioneering personal care products. Although specific new launches in cotton buds weren’t detailed, the company’s active presence at WOFEX Manila 2025 and strong brand innovation suggest continued leadership and renewal across its hygiene and personal care portfolio for the Filipino consumer.

- Watsons Philippines revealed substantial expansion plans in November 2024, announcing the opening of up to 90 additional stores in 2025. This growth underlines Watsons’ commitment to increasing accessibility to health and beauty products—including house-brand and multinational cotton buds—across both major cities and provincial areas in the country.

Market Concentration & Characteristics:

Market concentration is moderate, with national brands and retailer private labels holding most shelf space and local converters supplying a diversified base. Entry barriers include consistent cotton sourcing, winding precision, stick rigidity standards, and packaging compliance. The category carries low absolute prices yet relies on high unit velocity; margin management hinges on pack architecture and sourcing efficiency. Sustainability shifts are re-ordering assortments toward paper and biodegradable sticks. QA credibility is central, supported by batch coding, audits, and clear use-and-safety labeling. E-commerce and pharmacy channels shape discovery and education, while sari-sari stores sustain everyday throughput.

Report Coverage:

The research report offers an in-depth analysis based on product type, material, application, packaging type, and end-user, linking segment roles to price tiers and channel dynamics. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Eco paper and biodegradable sticks to reach mainstream planograms across modern trade.

- Portfolio focus on hero SKUs, refill formats, and dispenser packs for clinics and salons.

- Stronger QA signals via batch QR codes and visible dermatological testing claims.

- E-commerce subscriptions and value multipacks to lift repeat rates and AOV.

- Institutional tenders and private-label collaborations to stabilize base volume.

- Pack right-sizing and minimalist materials to reduce waste and logistics cost.

- Deeper penetration in Visayas and Mindanao through localized supply hubs.

- Influencer education to promote safe, precise cosmetic use-cases.

- Co-bundling with pads and wipes to grow basket size in pharmacies and online.

- Export pilots into nearby ASEAN niches leveraging agile Philippine converters.