Market Overview

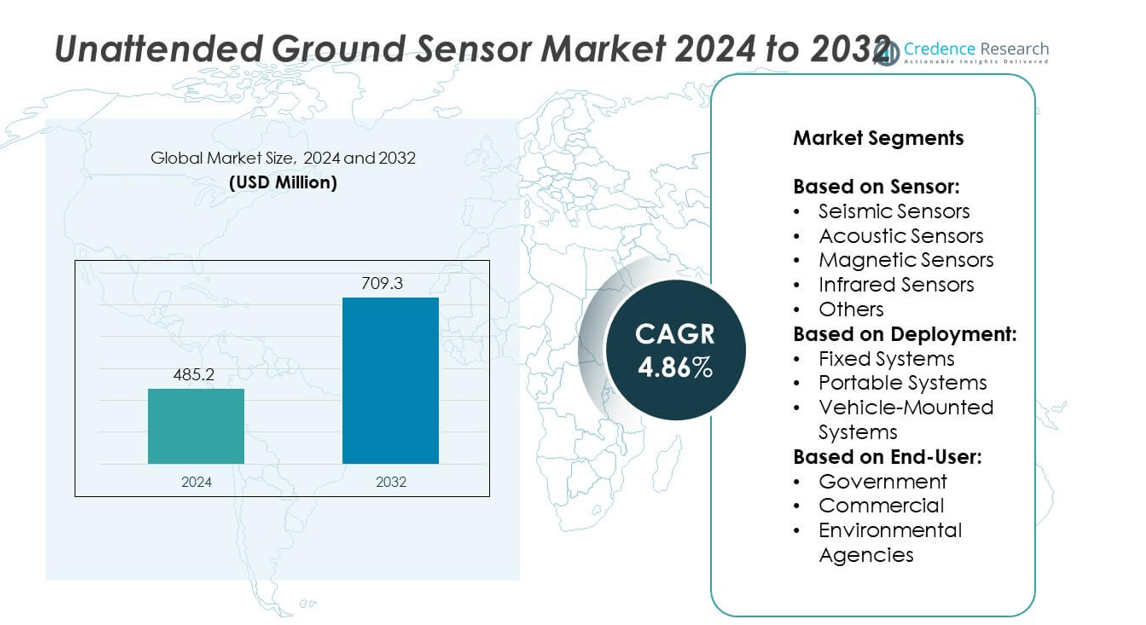

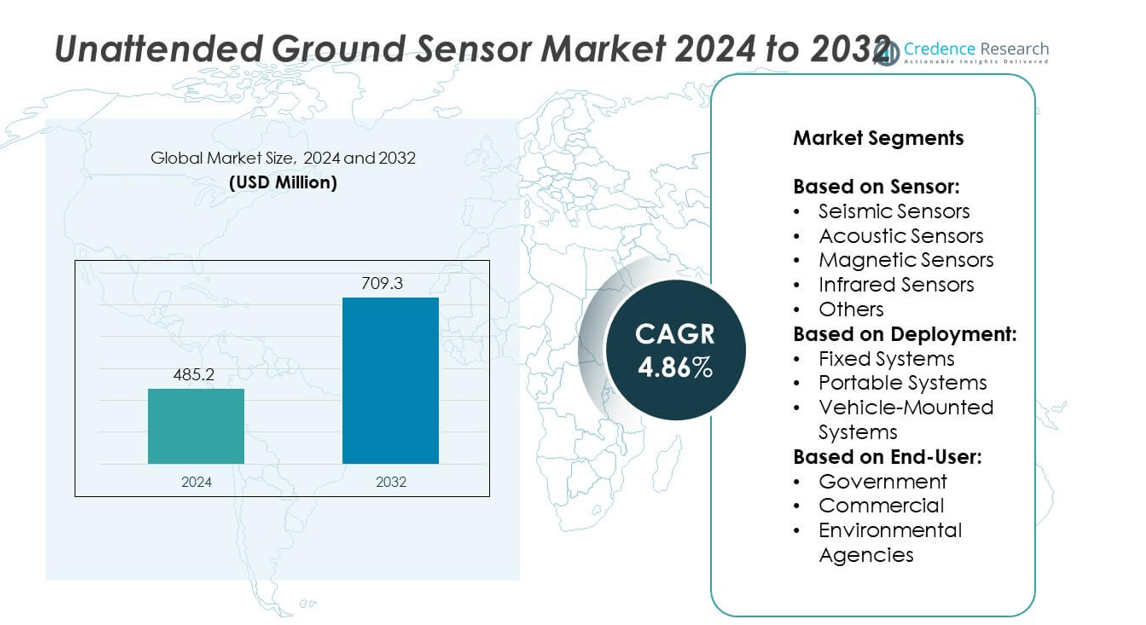

The Unattended Ground Sensor Market size was valued at USD 485.2 million in 2024 and is anticipated to reach USD 709.3 million by 2032, registering a CAGR of 4.86% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Unattended Ground Sensor Market Size 2024 |

USD 485.2 million |

| Unattended Ground Sensor Market, CAGR |

4.86% |

| Unattended Ground Sensor Market Size 2032 |

USD 709.3 million |

The Unattended Ground Sensor market grows through strong drivers such as rising border security demands, defense modernization programs, and the need for real-time surveillance in high-risk areas. It benefits from increasing investments in automated monitoring solutions that reduce reliance on manpower while enhancing situational awareness. Key trends include the integration of artificial intelligence, IoT, and wireless communication to improve detection accuracy and connectivity. Miniaturization and low-power designs extend operational life.

The Unattended Ground Sensor market shows strong geographical presence across North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa, with each region driving adoption through defense, infrastructure, and environmental applications. North America leads with advanced defense programs and high investment in surveillance technologies, while Europe emphasizes homeland security and infrastructure protection. Asia-Pacific emerges as a rapidly growing region due to rising border security needs and expanding urban infrastructure. Key players shaping the market include Northrop Grumman Corporation, Thales Group, L3Harris Technologies, and BAE Systems, who invest in advanced sensor technologies and integrated surveillance solutions.

Market Insights

- The Unattended Ground Sensor market was valued at USD 485.2 million in 2024 and is projected to reach USD 709.3 million by 2032, registering a CAGR of 4.86% during the forecast period.

- Growing demand for border surveillance, defense modernization, and real-time monitoring in high-risk areas drives market adoption, supported by government investments in advanced detection systems.

- Integration of artificial intelligence, IoT, and wireless communication technologies enhances detection accuracy, improves connectivity, and reduces false alarms, while miniaturization and low-power designs extend operational efficiency.

- Leading companies such as Northrop Grumman Corporation, Thales Group, Lockheed Martin, and BAE Systems focus on developing advanced, networked sensor solutions and expanding partnerships to strengthen global presence.

- High costs of deployment, limited defense budgets in developing regions, and technical challenges such as vulnerability to environmental factors and cybersecurity risks act as restraints on widespread adoption.

- North America leads with large-scale defense investments, Europe emphasizes homeland security and infrastructure protection, Asia-Pacific shows fastest growth with rising geopolitical tensions, while Latin America and the Middle East & Africa display steady uptake in border and environmental applications.

- Expanding applications beyond defense, including infrastructure safety, disaster management, and environmental monitoring, create new growth opportunities for sensor manufacturers and highlight the versatility of unattended ground sensor technologies

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers

Rising Security Concerns and Border Surveillance Needs

The Unattended Ground Sensor market gains momentum from growing security threats and the need for continuous border monitoring. Governments deploy these sensors to track unauthorized movements and safeguard national boundaries. It enhances perimeter surveillance by detecting vibrations, acoustic signals, and thermal activities in real time. Rising geopolitical tensions create a stronger demand for automated detection systems with minimal human intervention. It reduces reliance on large manpower while maintaining high efficiency in remote and high-risk zones. This driver positions the technology as a critical tool for defense and homeland security agencies.

- For instance, Lockheed Martin Corporation delivered over 800 advanced unattended ground sensor units to strengthen U.S. border surveillance capabilities.

Expansion of Defense Modernization Programs

Defense modernization programs across leading nations propel the adoption of unattended ground sensors. Armed forces integrate these devices into advanced situational awareness systems to improve operational intelligence. It supports automated monitoring of sensitive areas without exposing soldiers to direct threats. Investments in tactical surveillance infrastructure highlight the importance of low-power, long-duration sensor operations. Governments channel defense budgets toward developing resilient ground-based sensor networks. This commitment creates consistent opportunities for sensor manufacturers and technology providers.

- For instance, BAE Systems supplied more than 600 next-generation unattended ground sensors to European defense forces under modernization programs.

Growing Role of Smart Technologies and IoT Integration

Integration of smart technologies drives significant improvements in unattended ground sensors. IoT-enabled devices allow real-time data transfer to command centers, improving responsiveness. It supports layered defense strategies by linking sensors with drones, radars, and satellite systems. Advanced analytics and AI algorithms refine detection accuracy and reduce false alarms. Military and commercial sectors benefit from compact, low-maintenance systems with remote accessibility. These advancements strengthen the long-term adoption of sensor-based security solutions across multiple industries.

Rising Applications Beyond Defense and Security

Expanding applications in disaster management and infrastructure protection strengthen demand for unattended ground sensors. It assists emergency teams in detecting movements during rescue operations and monitoring hazardous areas. Critical facilities such as pipelines, power grids, and airports rely on sensors to identify potential intrusions. The growing role of environmental monitoring also enhances its scope, with sensors deployed in wildlife protection and seismic detection. Increasing interest from both government and private stakeholders supports technology diffusion. This wider adoption ensures steady market growth across both defense and civilian domains.

Market Trends

Integration of AI and Advanced Analytics for Enhanced Detection

The Unattended Ground Sensor market reflects a growing trend of incorporating artificial intelligence and advanced analytics to improve accuracy. AI-powered systems reduce false alarms by distinguishing between human, animal, and environmental activities. It enhances decision-making through predictive insights and real-time situational awareness. Defense and security agencies increasingly deploy sensors with built-in analytics to shorten response times. The adoption of machine learning enables adaptive performance under varying conditions. This trend elevates the role of unattended ground sensors in high-risk and complex operational environments.

- For instance, Saab AB integrated AI-enabled algorithms into its ground sensor systems, achieving a 35% improvement in detection accuracy during field operations.

Miniaturization and Low-Power Sensor Development

Manufacturers focus on miniaturization and the creation of low-power sensors to increase operational flexibility. The trend emphasizes compact designs that support easy deployment in challenging terrains. It extends operational life by reducing the need for frequent maintenance or battery replacement. Lightweight designs also make sensors more adaptable to mobile defense units and emergency teams. Growing demand for portability supports innovations in sensor architecture and material selection. This approach aligns with modern battlefield and civilian applications that require cost-effective yet resilient systems.

- For instance, Elbit Systems Ltd. deployed more than 1,200 unattended ground sensors across Middle Eastern energy infrastructures, enhancing monitoring and reducing intrusion incidents.

Increased Adoption of Wireless and Networked Systems

Wireless communication and networked sensor systems define another key trend in the unattended ground sensor market. These systems enable seamless integration with command centers and defense networks. It strengthens surveillance capabilities by connecting multiple sensors into cohesive monitoring grids. Enhanced data transmission improves coordination between ground units and aerial or satellite assets. Military operations value the reduced installation complexity and higher mobility of wireless solutions. This trend accelerates the shift toward interconnected and scalable surveillance infrastructures.

Diversification of Applications in Civilian and Commercial Domains

The use of unattended ground sensors extends beyond defense into civilian and commercial sectors. Infrastructure operators deploy sensors to safeguard pipelines, energy grids, and transportation hubs. It supports disaster management by monitoring landslides, earthquakes, and hazardous zones. Environmental agencies rely on sensors for wildlife tracking and habitat protection. Rising investment from private organizations highlights the versatility of the technology. This broadening application base creates long-term growth opportunities for manufacturers and solution providers.

Market Challenges Analysis

High Costs and Complex Deployment Requirements

The Unattended Ground Sensor market faces significant challenges due to high costs and deployment complexities. Advanced sensor systems require substantial investment in hardware, software, and integration with defense networks. It often demands specialized installation and maintenance teams, raising operational expenses for governments and private operators. Rugged terrain and remote border areas further complicate deployment, limiting accessibility and scalability. Limited budgets in developing nations restrict adoption despite the pressing need for security. These financial and logistical constraints hinder the pace of widespread sensor network expansion.

Technical Limitations and Vulnerability to Environmental Factors

Unattended ground sensors encounter operational challenges from environmental conditions and technical shortcomings. Harsh climates, soil composition, and extreme weather reduce sensor accuracy and reliability. It remains vulnerable to false alarms caused by wildlife, ground vibrations, or shifting natural elements. Limited battery life and power dependency further impact long-term performance in isolated regions. Cybersecurity risks also emerge as interconnected sensors become part of larger defense networks. These technical and environmental limitations continue to affect trust in sensor efficiency and adoption across large-scale projects.

Market Opportunities

Expansion into Civilian Infrastructure and Environmental Monitoring

The Unattended Ground Sensor market presents strong opportunities through adoption in civilian infrastructure and environmental projects. Critical facilities such as oil pipelines, rail networks, and energy grids rely on advanced sensors for intrusion detection and operational safety. It also supports disaster management by monitoring seismic activity, floods, and landslides in vulnerable zones. Environmental agencies deploy sensors to track wildlife movement and protect endangered habitats. Growing interest from commercial operators increases the scope beyond traditional defense use. This broader adoption pathway creates new revenue streams for manufacturers and technology developers.

Advancement in Wireless Connectivity and Autonomous Operations

Ongoing innovation in wireless communication and autonomous operations expands the opportunity for next-generation ground sensors. Networked systems allow integration with drones, satellites, and command platforms, offering real-time intelligence sharing. It improves mobility and reduces the need for manual supervision, making deployment easier in remote locations. Enhanced battery technologies and energy-harvesting methods extend sensor life cycles, improving cost-efficiency for long-term projects. Governments and private enterprises benefit from scalable solutions tailored for border control, infrastructure security, and smart city initiatives. These advancements strengthen the position of unattended ground sensors in future surveillance ecosystems.

Market Segmentation Analysis:

By Sensor:

The Unattended Ground Sensor market demonstrates strong diversification across sensor types, each serving specific detection requirements. Seismic sensors remain widely adopted for detecting ground vibrations caused by vehicles or human movement, making them essential for border security and military applications. Acoustic sensors provide critical support by identifying sound signatures and enhancing situational awareness in complex terrains. Magnetic sensors detect metallic objects and vehicle movements, playing a vital role in infrastructure and convoy protection. Infrared sensors offer high efficiency in low-visibility conditions, supporting night surveillance and thermal monitoring. It also includes other specialized sensors designed for niche applications, strengthening adaptability across varied operational needs.

- For instance, Textron Systems has been providing innovative solutions to the defense, homeland security and aerospace communities for more than 50 years.

By Deployment:

Deployment models show significant variation with fixed, portable, and vehicle-mounted systems shaping operational use. Fixed systems dominate in border control and facility protection, where continuous monitoring remains essential. Portable systems offer flexibility for defense units and emergency response teams operating in unpredictable environments. It provides rapid deployment with minimal infrastructure, making them valuable for short-term missions. Vehicle-mounted systems enhance mobility and allow integration with armored fleets, improving coverage in dynamic defense operations. Each deployment method aligns with specific tactical or civilian requirements, reinforcing the versatility of unattended ground sensors.

- For instance, Leonardo S.p.A. supplied more than 500 unattended ground sensors to environmental agencies across Italy for seismic monitoring and wildlife conservation programs.

By End-User:

End-user segmentation highlights the broadening scope of adoption across government, commercial, and environmental sectors. Governments remain the largest end-user, driven by defense modernization programs and national security imperatives. Commercial adoption grows with rising investments in infrastructure protection, energy facilities, and transportation networks. It supports critical asset safety through cost-effective surveillance systems. Environmental agencies increasingly rely on unattended ground sensors for monitoring wildlife, seismic activity, and natural disasters. This wide adoption base ensures continued expansion across multiple industries, strengthening the long-term position of the Unattended Ground Sensor market.

Segments:

Based on Sensor:

- Seismic Sensors

- Acoustic Sensors

- Magnetic Sensors

- Infrared Sensors

- Others

Based on Deployment:

- Fixed Systems

- Portable Systems

- Vehicle-Mounted Systems

Based on End-User:

- Government

- Commercial

- Environmental Agencies

Based on the Geography:

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis

North America

North America holds the largest share of the Unattended Ground Sensor market, accounting for 38% of global revenue in 2024. The region’s dominance stems from strong government spending on defense modernization and border security initiatives. The United States plays a central role, with the Department of Defense and the Department of Homeland Security deploying extensive unattended ground sensor networks along critical borders and military installations. It benefits from significant investments in research and development by leading defense contractors, who integrate advanced technologies such as AI and wireless communication into sensor platforms. Canada also contributes through investments in border monitoring and environmental applications, focusing on safeguarding pipelines and remote infrastructures. The region’s advanced infrastructure and strong industrial base ensure continued leadership throughout the forecast period.

Europe

Europe represents approximately 27% of the Unattended Ground Sensor market in 2024, supported by rising security concerns and defense upgrades across multiple countries. Nations such as the United Kingdom, France, and Germany prioritize surveillance technologies to protect critical infrastructure and counter cross-border threats. It reflects growing investment in NATO-driven projects that emphasize interoperability and networked defense systems. The European Union’s focus on strengthening homeland security and infrastructure resilience further boosts adoption. Beyond defense, European agencies deploy unattended ground sensors for environmental monitoring, including seismic activity and wildlife tracking in conservation areas. A combination of regulatory support, technological partnerships, and demand from both military and civilian sectors reinforces the region’s solid position in the market.

Asia-Pacific

Asia-Pacific accounts for around 22% of the global market share in 2024 and emerges as the fastest-growing regional market. Rising geopolitical tensions and border disputes across countries such as China, India, and South Korea drive investments in advanced surveillance systems. Governments in the region prioritize large-scale deployment of unattended ground sensors for perimeter defense, coastal security, and strategic asset monitoring. It benefits from the presence of domestic manufacturers who offer cost-effective solutions tailored to regional requirements. Expanding urbanization and infrastructure projects also fuel adoption, particularly in critical areas such as transportation hubs and energy facilities. Growing collaboration between governments and private enterprises positions Asia-Pacific as a key growth engine for the global market.

Latin America

Latin America captures about 7% of the Unattended Ground Sensor market share in 2024, with gradual adoption driven by infrastructure protection and homeland security initiatives. Countries like Brazil and Mexico invest in sensor networks to monitor borders and secure energy pipelines from potential threats. It also supports environmental and disaster management programs, with agencies deploying sensors to monitor landslides, deforestation, and seismic activity. Limited defense budgets restrict large-scale deployment, but partnerships with international technology providers help bridge capability gaps. Increasing security challenges linked to organized crime and illegal trafficking highlight the growing importance of unattended ground sensors in the region. The steady adoption across both government and environmental agencies strengthens long-term market potential.

Middle East & Africa

The Middle East & Africa region holds nearly 6% of the market share in 2024, driven primarily by defense investments and infrastructure security. Gulf countries allocate substantial budgets to surveillance technologies to safeguard critical oil and gas infrastructure. It also finds application in border monitoring, where nations with high-security risks rely on unattended ground sensors to detect unauthorized movements. African nations adopt the technology at a slower pace, focusing on environmental monitoring and protection of wildlife reserves. Regional instability and budget constraints hinder widespread deployment, though demand continues to rise in countries experiencing infrastructure expansion. The growing focus on smart city initiatives in parts of the Middle East also creates new opportunities for integrating unattended ground sensors into broader security ecosystems.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Saab AB

- Raytheon Technologies Corporation

- Rheinmetall AG

- Honeywell International Inc.

- Rafael Advanced Defense Systems Ltd.

- Textron Systems

- L3Harris Technologies, Inc.

- Northrop Grumman Corporation

- Leonardo S.p.A.

- Elbit Systems Ltd.

- BAE Systems

- Harris Corporation

- FLIR Systems, Inc.

- Lockheed Martin Corporation

- Thales Group

Competitive Analysis

The leading players in the Unattended Ground Sensor market include Northrop Grumman Corporation, Thales Group, Lockheed Martin Corporation, L3Harris Technologies, BAE Systems, Raytheon Technologies Corporation, Saab AB, Elbit Systems Ltd., Rafael Advanced Defense Systems Ltd., Leonardo S.p.A., Rheinmetall AG, FLIR Systems Inc., Textron Systems, Harris Corporation, and Honeywell International Inc. These companies focus on delivering advanced sensor solutions tailored for defense, homeland security, and infrastructure protection. They invest heavily in research and development to integrate artificial intelligence, IoT, and advanced analytics, which enhance detection accuracy and reduce operational risks. Product innovation centers on miniaturization, low-power systems, and wireless connectivity to meet evolving defense requirements and civilian applications. Strategic partnerships with governments and international defense agencies strengthen their global reach and support long-term contracts. Continuous technological upgrades, including sensor fusion and networked surveillance systems, reinforce their competitive advantage. Strong presence across multiple regions enables these players to capture both mature and emerging markets, while diversification into environmental and commercial applications expands their opportunities.

Recent Developments

- In May 2025, The Thales Pathmaster solution is the world’s first sea-proven system and is currently already in service with the British Royal Navy.

- In October 2024, Rheinmetall and DOK-ING, a Croatian manufacturer of unmanned ground systems (UGS), entered into a Memorandum of Understanding (MoU) to establish a joint venture. The collaboration is focused on developing and marketing advanced unmanned combat and support vehicles, initially concentrating on systems for mine scattering and counter-mobility operations. This European partnership combines the strengths of both companies in unmanned systems technology and industrial capabilities, aiming to position them as leaders in the UGS market. A system demonstrator is expected to be unveiled in 2025.

- In May 2023, Elbit Systems Ltd. successfully delivered its Unattended Ground Sensor (UGS) system to a client in the Middle East.

Market Concentration & Characteristics

The Unattended Ground Sensor market demonstrates a moderately concentrated structure, with a few global defense contractors and technology leaders dominating overall revenue share. It reflects strong entry barriers due to high capital requirements, advanced research needs, and strict defense procurement standards. Competition emphasizes innovation in AI integration, wireless communication, and low-power sensor technologies to enhance detection accuracy and operational efficiency. Companies strengthen their positions through long-term government contracts, strategic alliances, and continuous upgrades in surveillance capabilities. It also shows characteristics of dual-use adoption, serving both defense and civilian applications such as infrastructure safety, disaster management, and environmental monitoring. Demand patterns remain influenced by geopolitical conditions, defense modernization programs, and rising investments in homeland security. It benefits from a mix of established multinational corporations and regional players who cater to localized needs with cost-effective and adaptable solutions. The market continues to evolve toward networked and scalable systems that align with both military requirements and broader security demands.

Report Coverage

The research report offers an in-depth analysis based on Sensor, Deployment, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The Unattended Ground Sensor market will expand steadily with rising demand for border and perimeter security.

- Defense modernization programs will continue to drive large-scale deployment across advanced economies.

- Integration of artificial intelligence will enhance detection accuracy and minimize false alarms.

- Wireless and IoT-enabled systems will strengthen connectivity and real-time monitoring capabilities.

- Miniaturized and low-power sensors will gain adoption due to improved portability and longer operational life.

- Civilian applications in infrastructure safety and environmental monitoring will broaden the market scope.

- Strategic partnerships between governments and technology providers will secure long-term contracts.

- Cybersecurity measures will become critical as sensors integrate into larger defense networks.

- Emerging regions will increase adoption with growing investments in security and smart infrastructure.

- Continuous product innovation and sensor fusion technologies will define the competitive landscape.