Market Overview:

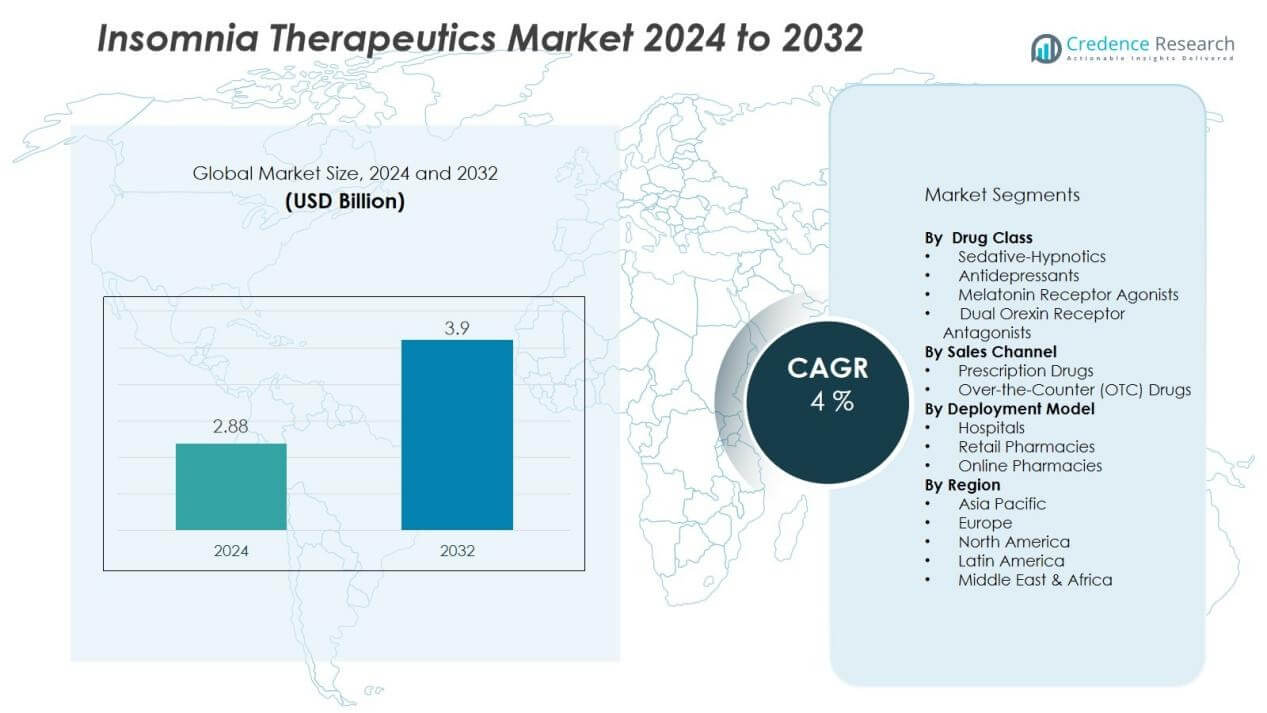

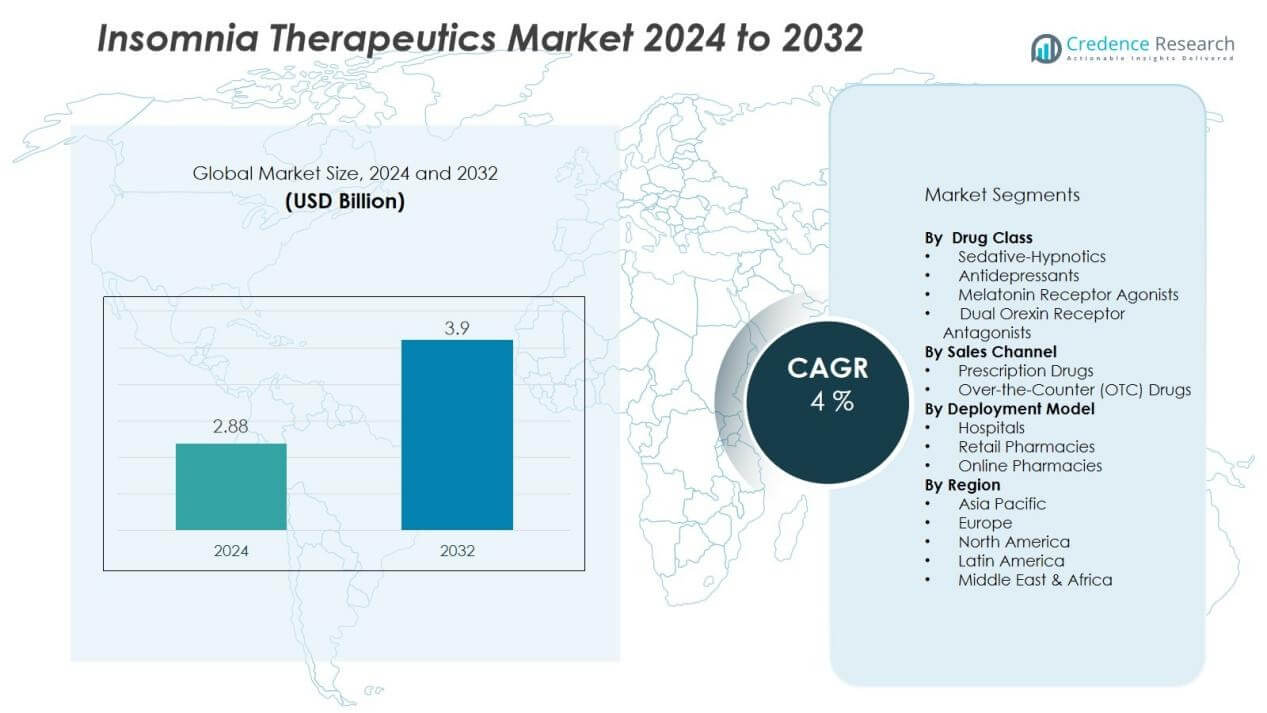

The insomnia therapeutics market size was valued at USD 2.88 billion in 2024 and is anticipated to reach USD 3.9 billion by 2032, at a CAGR of 4% during the forecast period (2024-2032).

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Insomnia Therapeutics Market Size 2024 |

USD 2.88 Billion |

| Insomnia Therapeutics Market, CAGR |

4% |

| Insomnia Therapeutics Market Size 2032 |

USD 3.9 Billion |

Market drivers include rising incidence of chronic diseases, mental health disorders, and lifestyle-related stress, all of which contribute to poor sleep health. Growing adoption of cognitive behavioral therapy for insomnia (CBT-I), along with the availability of prescription drugs and over-the-counter treatments, fuels demand. Pharmaceutical innovations, including dual orexin receptor antagonists (DORAs), are further enhancing therapeutic options, driving patient adoption and physician prescribing rates.

Regionally, North America holds the largest share due to advanced healthcare infrastructure, early adoption of novel therapies, and higher awareness levels. Europe follows, supported by strong research activity and favorable reimbursement policies. Asia-Pacific is expected to witness the fastest growth, driven by expanding healthcare systems, rising urban stress, and growing sleep disorder prevalence. Emerging markets in Latin America and the Middle East & Africa show potential as awareness and healthcare investment increase.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- The insomnia therapeutics market size was USD 2.88 billion in 2024 and will reach USD 3.9 billion by 2032, growing at 4% CAGR.

- Rising prevalence of sleep disorders, depression, and lifestyle-induced stress continues to drive therapeutic demand globally.

- Dual orexin receptor antagonists (DORAs) are reshaping treatment by offering safer alternatives to traditional hypnotics.

- Cognitive Behavioral Therapy for Insomnia (CBT-I) adoption is expanding through digital health and telehealth platforms.

- Safety concerns, side effects, and underdiagnosis remain key challenges limiting therapy adoption in several regions.

- North America led with 41% share in 2024, followed by Europe at 30% and Asia-Pacific at 20%.

- Asia-Pacific is the fastest-growing region, supported by rising healthcare investment, awareness, and digital therapy adoption.

Market Drivers:

Rising Prevalence of Sleep Disorders and Stress-Related Conditions:

The insomnia therapeutics market is driven by the growing incidence of sleep disorders linked to modern lifestyles. Rising stress levels, long working hours, and irregular sleep patterns contribute to demand for effective treatments. Increasing prevalence of psychiatric conditions such as depression and anxiety further escalates sleep-related issues. It creates consistent demand for both pharmacological and non-pharmacological therapies.

- For instance, Idorsia’s QUVIVIQ™ (daridorexant) was approved by the US FDA for adult insomnia after successful phase 3 trials involving 1,854 participants across 18 countries, where significant improvement in sleep onset and maintenance was objectively measured compared to placebo.

Advancements in Drug Development and Treatment Options:

Pharmaceutical innovation is expanding the range of therapies available for insomnia management. The introduction of dual orexin receptor antagonists (DORAs) provides safer alternatives to traditional hypnotics. It enhances patient compliance by reducing risks of dependency and cognitive impairment. Growing clinical trials and regulatory approvals continue to strengthen therapeutic portfolios.

- In the SUNRISE-1 Phase III trial, Eisai’s lemborexant significantly improved sleep onset compared to placebo. At the end of one month, the time to persistent sleep was reduced to 25.8 minutes with the 5 mg dose and 22.8 minutes with the 10 mg dose, compared to 36 minutes with placebo.

Growing Adoption of Cognitive Behavioral Therapy for Insomnia (CBT-I):

Healthcare providers are increasingly adopting CBT-I as a first-line treatment for insomnia. Its proven long-term benefits and lower risk of side effects support greater acceptance. It is now widely integrated into digital platforms, making therapy more accessible to patients globally. The combination of CBT-I with pharmacological options offers a holistic approach to insomnia management.

Rising Healthcare Awareness and Access Across Emerging Regions:

Awareness of sleep health is expanding across developing markets, supported by rising healthcare investment. Patients are increasingly seeking medical attention for chronic sleep issues rather than relying on self-care. It encourages pharmaceutical companies and digital health providers to expand services in these regions. Growing government initiatives for mental health support further boost therapeutic adoption.

Market Trends:

Integration of Digital Therapeutics and Telehealth Solutions:

The insomnia therapeutics market is witnessing rapid integration of digital health tools to enhance accessibility. Mobile applications and online platforms deliver cognitive behavioral therapy for insomnia (CBT-I), providing cost-effective and scalable solutions. It expands reach to patients in remote areas and reduces dependency on in-person consultations. Telehealth platforms also enable real-time monitoring of patient progress and adherence. Pharmaceutical companies are collaborating with digital health startups to combine medication with behavioral therapy. This trend reflects a shift toward holistic, patient-centered treatment models that blend technology with traditional care pathways.

- For instance, in an evaluation of the SHUTi (Sleep Healthy Using the Internet) digital therapeutic used by over 7,200 adults, 61% of users achieved meaningful clinical improvement, defined as a reduction of more than 7 points on the ISI, and 40% achieved remission (ISI <8) at the program’s end.

Focus on Next-Generation Therapies and Personalized Medicine:

Pharmaceutical innovation is shaping the future of insomnia management with safer and more targeted therapies. Development of dual orexin receptor antagonists (DORAs) highlights the market’s move beyond conventional hypnotics. It reduces side effects such as dependency and residual drowsiness, improving long-term adherence. Research is increasingly exploring personalized approaches based on genetic profiles and patient-specific factors. Growing emphasis on combination therapies, integrating behavioral interventions with pharmacological solutions, strengthens patient outcomes. The market trend aligns with broader healthcare priorities toward precision medicine and evidence-based treatment adoption.

- For Instance, Idorsia’s daridorexant (Quviviq) received FDA approval in January 2022 for treating adults with insomnia. In a Phase 3 clinical trial, the highest approved dose of 50 mg significantly improved sleep onset latency by an average of 11.7 minutes compared to placebo at three months.

Market Challenges Analysis:

Concerns Over Side Effects and Dependency Risks:

The insomnia therapeutics market faces challenges from concerns related to drug safety and dependency. Long-term use of sedative-hypnotics often leads to issues such as tolerance, withdrawal symptoms, and cognitive impairment. It limits patient adherence and influences physician prescribing behavior. Growing awareness of these risks has shifted demand toward safer alternatives, yet many patients remain reliant on conventional therapies. Regulatory authorities are tightening approval standards, which slows the introduction of new drugs. These concerns create hurdles for companies aiming to expand product adoption.

Limited Access and Underdiagnosis of Sleep Disorders:

Underdiagnosis of insomnia remains a barrier to market growth across both developed and developing regions. Many individuals avoid seeking medical help, viewing poor sleep as a lifestyle issue rather than a disorder. It reduces demand for professional treatment and delays timely intervention. In emerging markets, limited access to advanced healthcare services and digital therapies further restricts adoption. High treatment costs and inadequate insurance coverage also discourage patients from pursuing long-term solutions. These factors collectively hinder the full potential of therapeutic expansion.

Market Opportunities:

Expansion of Digital and Non-Pharmacological Therapies:

The insomnia therapeutics market presents strong opportunities in digital and behavioral solutions. Growing acceptance of cognitive behavioral therapy for insomnia (CBT-I) through mobile apps and telehealth platforms is creating new growth channels. It enables wider accessibility, especially in regions with limited specialist availability. Digital therapeutics also attract healthcare providers seeking safer alternatives to drug-based treatments. Partnerships between pharmaceutical firms and technology companies can accelerate integrated care models. Rising patient awareness of non-pharmacological therapies further strengthens the adoption potential of digital solutions.

Innovation in Next-Generation Drug Development:

Pharmaceutical advancements are opening pathways for next-generation insomnia treatments with improved safety profiles. Dual orexin receptor antagonists (DORAs) and other novel drug classes address concerns of dependency and side effects linked to traditional therapies. It supports higher physician confidence and long-term patient adherence. Personalized medicine based on genetic insights offers another area for expansion. Growing demand in emerging markets encourages global companies to launch affordable and localized versions of advanced drugs. These opportunities position innovative solutions as a key driver of sustained market growth.

Market Segmentation Analysis:

By Drug Class:

Sedative-hypnotics, antidepressants, melatonin receptor agonists, and dual orexin receptor antagonists (DORAs) form the major categories. It is witnessing rising demand for DORAs due to their favorable safety profile and reduced dependency risks. Antidepressants remain widely prescribed for patients with comorbid conditions, while melatonin receptor agonists attract attention for long-term therapy. Sedative-hypnotics continue to dominate in short-term treatment scenarios despite safety concerns.

- For instance, Acacia Pharma’s BYFAVO™ (remimazolam) was approved by the US FDA in July 2020 for procedural sedation, supporting approximately 40 million annual medical procedures in the US that require sedation.

By Sales Channel:

Sales are classified into prescription and over-the-counter (OTC) drugs. It is dominated by prescription drugs given the clinical need for physician-directed therapy. OTC drugs show steady growth driven by consumer preference for self-care solutions. Increasing digital health integration is also creating opportunities for online prescription fulfillment.

- For instance, CVS Health dispensed 445.9 million prescriptions in the fourth quarter of 2024, contributing to 1.7155 billion total prescriptions filled for the full year

By Distribution Channel:

Hospitals, retail pharmacies, and online pharmacies are the key channels. It is dominated by retail pharmacies due to their strong accessibility and widespread presence. Hospitals play a critical role in prescribing advanced therapies for complex cases. Online pharmacies are rapidly expanding due to convenience, rising e-commerce penetration, and growing demand for discreet purchases.

Segmentations:

By Drug Class:

- Sedative-Hypnotics

- Antidepressants

- Melatonin Receptor Agonists

- Dual Orexin Receptor Antagonists (DORAs)

By Sales Channel:

- Prescription Drugs

- Over-the-Counter (OTC) Drugs

By Distribution Channel:

- Hospitals

- Retail Pharmacies

- Online Pharmacies

By Region:

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis:

North America :

North America accounted for 41% market share in 2024, supported by advanced healthcare infrastructure and early adoption of novel therapies. The insomnia therapeutics market in this region benefits from high awareness levels and significant R&D investments. It is strengthened by a strong presence of pharmaceutical companies driving innovation in dual orexin receptor antagonists and digital health solutions. The rising prevalence of stress-related disorders and lifestyle-induced insomnia continues to fuel demand. Favorable reimbursement policies and widespread telehealth adoption further accelerate access to therapies. North America remains the leading region for both drug-based and behavioral insomnia treatments.

Europe:

Europe held 30% market share in 2024, driven by strong regulatory frameworks and established healthcare systems. The insomnia therapeutics market in this region is supported by growing use of eco-friendly digital therapies and government-backed mental health programs. It is enhanced by a large population base facing sleep disorders due to aging demographics and workplace stress. Pharmaceutical companies benefit from favorable clinical trial environments across key countries such as Germany, France, and the UK. Rising awareness campaigns and expanding behavioral therapy programs encourage early diagnosis. Europe continues to emphasize evidence-based care and integrated treatment pathways.

Asia-Pacific:

Asia-Pacific captured 20% market share in 2024, marking it as the fastest-growing regional market. The insomnia therapeutics market in this region is supported by increasing healthcare investment and growing awareness of sleep health. It is further driven by urbanization, higher stress levels, and expanding middle-class populations. Pharmaceutical companies are targeting this region with affordable versions of novel therapies to meet rising demand. Digital health adoption through mobile-based CBT-I programs is gaining traction across countries such as China, India, and Japan. Asia-Pacific is expected to see strong expansion as healthcare infrastructure improves and patient awareness strengthens.

Key Player Analysis:

- Eisai

- Meiji Seika Pharma

- Eli Lilly and Company

- Merck & Co.

- Pfizer

- Sanofi

- Neurocrine Biosciences

- Takeda Pharmaceutical Company Limited

- Vanda Pharmaceuticals

- Teva Pharmaceutical Industries

Competitive Analysis:

The insomnia therapeutics market is highly competitive, driven by innovation and expanding treatment portfolios. Key players include Eisai, Meiji Seika Pharma, Eli Lilly and Company, Merck & Co., Pfizer, Sanofi, and Neurocrine Biosciences. It is shaped by the introduction of novel therapies such as dual orexin receptor antagonists, which are gaining preference over traditional hypnotics. Companies invest heavily in research and development to address safety concerns and improve long-term patient outcomes. Strategic collaborations with digital health providers are strengthening integrated treatment offerings that combine pharmacological and behavioral solutions. Firms are also focusing on regional expansion to capture growth in emerging markets with rising healthcare access. The competitive landscape reflects continuous efforts to differentiate through innovation, clinical efficacy, and global reach.

Recent Developments:

- In August 2025, Eisai launched LEQEMBI (lecanemab) in Austria on August 25, 2025 and confirmed launch in Germany on September 1, 2025, making these the first European markets for LEQEMBI following European Commission approval in April 2025 for treatment of early Alzheimer’s disease.

- In January 2025, Meiji Seika Pharma announced a strategic investment of USD 20 million into MPM BioImpact, a Boston-based biotech investment firm, to further innovation in virology and next-generation therapies.

- In May 2025, Eli Lilly and Company disclosed an expansion of its collaboration with Purdue University, committing up to $250 million over 8 years to accelerate pharmaceutical innovation.

Report Coverage:

The research report offers an in-depth analysis based on Drug Class, Sales Channel, Distribution Channel and Region. It details leading Market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current Market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven Market expansion in recent years. The report also explores Market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on Market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the Market.

Future Outlook:

- Rising diagnosis of sleep disorders will increase demand for advanced therapeutic solutions.

- Dual orexin receptor antagonists are expected to replace traditional hypnotics in prescribing patterns.

- Digital therapeutics, including CBT-I apps, will expand accessibility across developed and emerging regions.

- Pharmaceutical companies will focus on safer drug profiles to address dependency and side effect concerns.

- Telehealth platforms will integrate behavioral therapies with medication for comprehensive patient care.

- Personalized medicine approaches will gain traction through genetic profiling and targeted treatment strategies.

- Awareness campaigns will encourage early treatment adoption, especially in underdiagnosed populations.

- Emerging markets will create opportunities for affordable and localized versions of advanced therapies.

- Collaborations between technology firms and pharmaceutical companies will drive innovation in hybrid treatment models.

- The market will continue shifting toward holistic and long-term management of insomnia.