Market Overview:

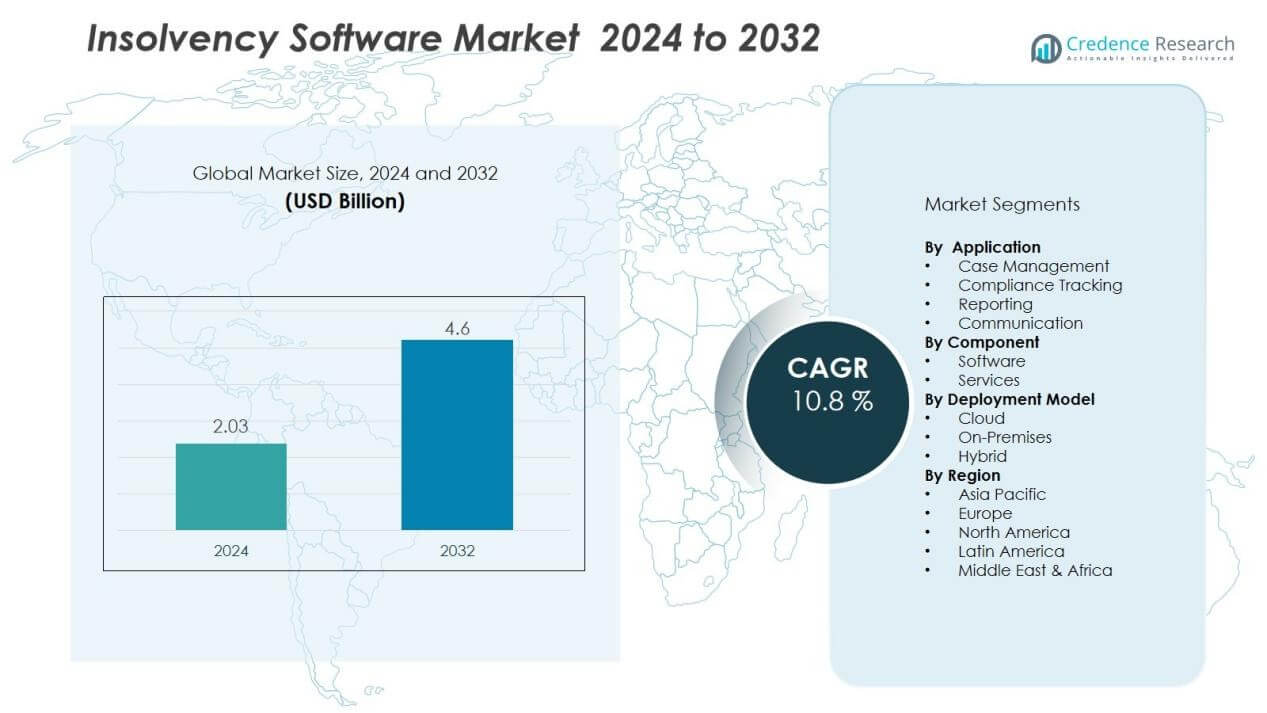

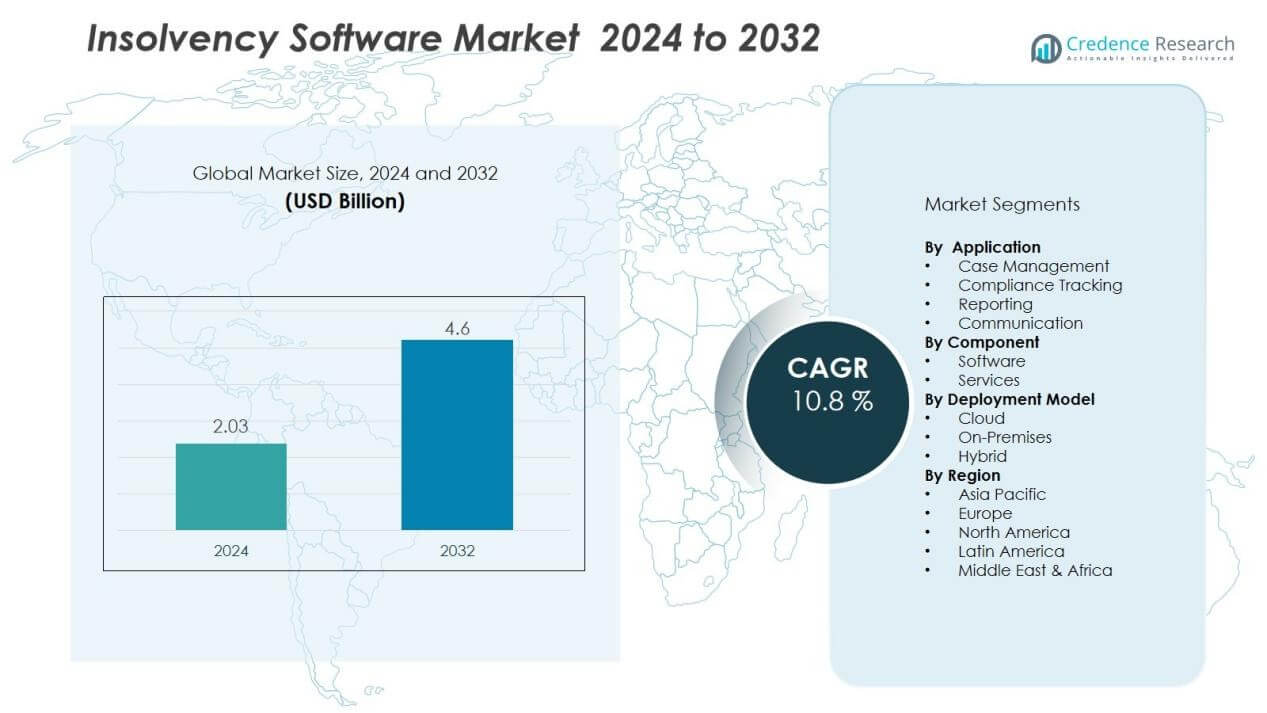

The insolvency software market size was valued at USD 2.03 billion in 2024 and is anticipated to reach USD 4.6 billion by 2032, at a CAGR of 10.8% during the forecast period (2024-2032).

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Insolvency Software Market Size 2024 |

USD 2.03 Billion |

| Insolvency Software Market, CAGR |

10.8% |

| Insolvency Software Market Size 2032 |

USD 4.6 Billion |

Key drivers include growing regulatory compliance needs, rising bankruptcy filings across industries, and demand for automation in insolvency proceedings. Cloud-based platforms and AI-enabled tools are enhancing case tracking, reporting, and creditor communication. The increasing pressure on businesses to manage financial restructuring quickly and cost-effectively further accelerates adoption. Vendors are also focusing on data security and integration with enterprise systems, which improves reliability and decision-making efficiency.

Regionally, North America holds the largest share due to early adoption of advanced financial technologies and strong regulatory frameworks. Europe follows with significant growth, supported by modernization of insolvency laws and digital initiatives. Asia-Pacific is projected to grow fastest, driven by increasing business insolvencies, expanding SME sector, and rising digitization of legal processes in China and India. Latin America and the Middle East & Africa are emerging markets, with adoption fueled by economic restructuring needs and modernization of financial governance.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- The insolvency software market was valued at USD 2.03 billion in 2024 and is expected to reach USD 4.6 billion by 2032, growing at a CAGR of 10.8%.

- Rising demand for streamlined case management is fueling adoption, with businesses and regulators seeking efficient tools for faster workflows, accurate reporting, and improved transparency.

- Regulatory compliance pressures are increasing adoption, as software solutions help meet strict filing deadlines, maintain accurate records, and reduce risks of penalties.

- Cloud-based and AI-enabled platforms are transforming the insolvency software market by supporting predictive analytics, fraud detection, and real-time collaboration.

- Economic instability and fluctuating markets are driving higher insolvency cases across SMEs and large enterprises, boosting demand for digital restructuring tools.

- Challenges such as varying regulations, integration with legacy systems, and data security concerns continue to restrict seamless adoption, particularly among SMEs.

- North America leads with 38% share in 2024, followed by Europe with 29%, while Asia-Pacific at 23% is projected to grow fastest due to rising insolvencies and rapid digital transformation.

Market Drivers:

Rising Demand for Streamlined Insolvency Case Management

The insolvency software market benefits from the growing need to simplify complex insolvency proceedings. Businesses, practitioners, and regulators seek digital platforms that enhance transparency and efficiency. It allows faster document management, automated workflows, and accurate reporting, reducing administrative burdens. This shift supports professionals in handling higher caseloads with precision.

- For instance, McCambridge Duffy Group implemented FileInvite’s document collection technology and achieved an 87.5% decrease in document collection time, with processes that previously took 40 days now completed in just 5 days

Increasing Focus on Regulatory Compliance and Governance

Regulatory frameworks around insolvency are becoming stricter across regions. The insolvency software market addresses this challenge by integrating compliance tools that align with evolving laws. It helps practitioners meet filing deadlines, maintain accurate records, and reduce risks of penalties. Compliance-driven adoption is creating strong momentum for specialized digital platforms.

- For instance, Epiq’s Bankruptcy Analytics platform integrates daily data from all 93 U.S. bankruptcy courts, enabling practitioners to automatically track and validate filings in real time.

Adoption of Cloud-Based and AI-Enabled Solutions

Cloud technology and artificial intelligence are reshaping insolvency practices. The insolvency software market is witnessing rising adoption of scalable cloud platforms that allow secure access and collaboration. It also leverages AI for predictive analytics, fraud detection, and automated decision support. These innovations improve accuracy and reduce operational costs for users.

Growing Insolvency Cases Across SMEs and Enterprises

Economic instability and market fluctuations have driven higher insolvency filings worldwide. The insolvency software market gains traction as organizations require tools to manage restructuring effectively. It supports small and medium enterprises in resolving financial distress with structured workflows. Rising insolvencies in large enterprises also expand demand for advanced, feature-rich platforms.

Market Trends:

Integration of Automation, Cloud, and Artificial Intelligence:

Automation, cloud platforms, and artificial intelligence are shaping the insolvency software market. It is driving adoption of tools that streamline document management, automate repetitive tasks, and improve reporting accuracy. Cloud-based solutions allow secure access, scalability, and real-time collaboration across multiple stakeholders. AI-driven features are enhancing fraud detection, predictive analytics, and workflow optimization, improving efficiency for practitioners and regulators. Vendors are also focusing on intuitive interfaces and integration with enterprise systems to ensure seamless operation. These technological advancements are reshaping insolvency management into a faster and more data-driven process.

- For instance, regulatory technology (RegTech) implementations, including those from firms like Deloitte, have enabled organizations to significantly reduce compliance costs compared to firms using manual processes. This is supported by market reports and industry analyses that consistently highlight RegTech’s potential for driving efficiency gains and cost savings

Rising Demand for Security, Collaboration, and Global Expansion:

Data security and compliance have become critical in the insolvency software market. It is leading vendors to embed advanced encryption, multi-factor authentication, and compliance-focused modules. Growing demand for collaboration between creditors, administrators, and legal bodies is fueling adoption of centralized platforms. The expansion of cross-border insolvencies is also creating demand for globally compatible solutions that adapt to diverse legal frameworks. Vendors are targeting emerging markets in Asia-Pacific, Latin America, and the Middle East with localized platforms and regulatory support. The combination of security, collaboration, and international applicability is defining the market’s growth trajectory.

- Fact Check This and Give me Final Verdict “For Instance, Relativity’s SaaS product, RelativityOne, serves more than 300,000 users in approximately 40 countries, including the U.S. Department of Justice and 198 of the Am Law 200.

Market Challenges Analysis:

Complex Regulatory Variations and Integration Barriers:

The insolvency software market faces challenges due to varying regulatory frameworks across regions. It must adapt constantly to evolving compliance requirements, which increases development complexity and costs for vendors. Integration with legacy enterprise systems and diverse legal databases often slows deployment. Many firms also face difficulties in ensuring interoperability between platforms used by regulators, creditors, and practitioners. These barriers limit seamless adoption, particularly in markets with fragmented regulations.

Data Security Concerns and Limited Awareness Among SMEs:

Data security remains a major concern in the insolvency software market. It involves handling sensitive financial records, making platforms vulnerable to cyber threats and breaches. Small and medium enterprises often lack awareness about the benefits of digital insolvency tools, delaying adoption. Limited budgets further restrict investment in advanced platforms among smaller firms. Vendors face the challenge of balancing affordability with robust security and advanced features. Addressing these concerns is essential to expand market reach across all enterprise sizes.

Market Opportunities:

Expansion of Cloud-Based and AI-Driven Platforms:

The insolvency software market offers strong opportunities through cloud-based and AI-enabled solutions. It enables real-time collaboration, predictive analytics, and automated workflows, making insolvency processes faster and more accurate. Cloud platforms also reduce infrastructure costs, which appeals to both large enterprises and SMEs. AI integration supports fraud detection and scenario planning, enhancing decision-making for practitioners and regulators. Growing demand for scalable and secure systems will push vendors to expand service portfolios. This shift is expected to drive long-term adoption across industries and regions.

Rising Adoption in Emerging Economies and SME Sector:

Emerging economies present significant growth opportunities for the insolvency software market. It is gaining traction as governments modernize insolvency frameworks and promote digital transformation. SMEs, which often face financial instability, are adopting cost-effective solutions to manage restructuring efficiently. Vendors can capture this segment by offering localized, affordable, and regulatory-compliant platforms. Cross-border insolvencies also open new markets, creating demand for globally adaptable solutions. Expanding into these regions and sectors provides a strong pathway for market growth.

Market Segmentation Analysis:

By Component:

The insolvency software market is segmented into software and services. Software holds the largest share due to strong adoption of automation, case management, and reporting tools. Services, including consulting, integration, and support, are expanding steadily as organizations require technical expertise. It helps businesses achieve compliance, optimize operations, and manage large insolvency caseloads effectively. Vendors are focusing on offering bundled solutions that combine software platforms with ongoing support.

- For Instances, Aryza Insolv’s case management platform has supported more than 20 years of insolvency workflow innovation, automating tasks and offering seamless banking integration for numerous professional restructuring firms globally as of 2024.

By Deployment Model:

Cloud deployment leads the insolvency software market due to its scalability, cost efficiency, and accessibility. It enables practitioners, regulators, and creditors to collaborate in real time, improving case outcomes. On-premises deployment continues to serve organizations with strict data privacy requirements. It is particularly relevant for large firms that manage sensitive financial records and require in-house control. Hybrid models are emerging to balance flexibility and security, offering tailored deployment options for enterprises.

- For instance, The Insolvency Service in the UK adopted a cloud platform based on Microsoft Dynamics 365, resulting in processing straightforward claims up to four times faster and handling 80,000 claims annually.

By Application:

The insolvency software market covers applications such as case management, compliance tracking, reporting, and communication. Case management dominates due to the rising complexity of insolvency proceedings and demand for streamlined workflows. Compliance tracking is gaining traction with stricter regulatory oversight worldwide. It also supports reporting and creditor communication to ensure transparency and trust. Growing demand across diverse applications highlights the software’s role in driving efficiency and accountability.

Segmentations:

By Component:

By Deployment Model:

By Application:

- Case Management

- Compliance Tracking

- Reporting

- Communication

By Region:

North America

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis:

North America:

North America holds the largest share of the insolvency software market with 38% in 2024. It benefits from advanced digital infrastructure, strict regulatory compliance standards, and early adoption of technology. The United States drives demand through frequent restructuring cases and high legal complexity. Canada follows with steady adoption supported by modernization of insolvency frameworks. It is also boosted by strong vendor presence and continuous innovation in cloud-based platforms. Growing focus on automation and predictive analytics further strengthens the region’s dominance.

Europe:

Europe accounts for 29% of the insolvency software market in 2024. The region benefits from modernization of insolvency laws, cross-border restructuring, and government-backed digital initiatives. The United Kingdom, Germany, and France lead adoption, supported by developed financial and legal systems. Smaller economies in Eastern Europe are catching up as digitization accelerates in insolvency management. It is also supported by increasing collaboration between regulators and practitioners on transparent processes. Strong demand for secure and compliant solutions continues to fuel steady growth across the region.

Asia-Pacific:

Asia-Pacific represents 23% of the insolvency software market in 2024. The region is projected to grow fastest due to rising insolvency cases among SMEs and large enterprises. China and India drive adoption with rapid digital transformation and evolving insolvency frameworks. Japan, South Korea, and Southeast Asia add momentum through strong investment in financial technologies. It benefits from government reforms promoting structured insolvency management. Growing cross-border trade and regional collaborations also increase demand for globally adaptable solutions. Expanding digitization makes Asia-Pacific a key growth engine for the coming years.

Key Player Analysis:

Competitive Analysis:

The insolvency software market is highly competitive, with global and regional players focusing on innovation, compliance, and integration. Key companies include Altisource, Caseware International Inc., Aryza Ltd., Cilo, Fastcase, Kroll, PracticePanther, Litera, Epiq Global, and Stretto. It is driven by continuous investment in cloud-based solutions, AI-enabled tools, and enhanced data security features. Vendors are differentiating their offerings by providing comprehensive case management, compliance tracking, and creditor communication tools. Strategic partnerships with legal firms and financial institutions are helping players expand reach and strengthen market presence. It also witnesses rising competition from niche providers that offer localized and cost-effective platforms, targeting SMEs and emerging economies. The competitive landscape is shaped by a balance between large multinational vendors delivering advanced, feature-rich platforms and smaller firms offering agile, customized solutions. This mix of global scale and regional specialization defines the growth trajectory of the market.

Recent Developments:

- In May 2025, Altisource effected a 1-for-8 reverse stock split to maintain compliance with Nasdaq requirements, consolidating its shares and impacting its shareholder structure.

- In January 2025, Caseware International Inc. completed the acquisition of LeaseJava, a SaaS company specializing in automated lease accounting, strengthening its audit and assurance portfolio.

- In September 2025, Aryza Ltd. announced the acquisition of Bravure, expanding its global reach in technology-enabled debt sale and recovery solutions, especially within Australia.

Report Coverage:

The research report offers an in-depth analysis based on Component, Deployment Model, Application and Region. It details leading Market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current Market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven Market expansion in recent years. The report also explores Market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on Market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the Market.

Future Outlook:

- The insolvency software market will experience rising demand for AI-enabled platforms that enhance predictive analytics and decision-making.

- Vendors will focus on developing secure cloud-based solutions that support real-time collaboration across stakeholders.

- Global expansion will accelerate as insolvency frameworks modernize in emerging economies and new regulatory standards evolve.

- Integration with enterprise systems such as ERP and financial management software will improve efficiency and adoption rates.

- The growing number of SME insolvencies will create demand for cost-effective and scalable platforms tailored to smaller firms.

- Cross-border insolvencies will increase the need for globally adaptable solutions that align with diverse legal frameworks.

- Vendors will strengthen cybersecurity features, including advanced encryption and compliance modules, to address data security risks.

- User-friendly platforms with intuitive interfaces will gain preference, reducing training needs for practitioners and regulators.

- Partnerships between software providers, legal firms, and government agencies will expand to enhance platform credibility.

- Sustainability and digital transformation initiatives will encourage adoption of paperless, automated insolvency management solutions worldwide.