Market Overview

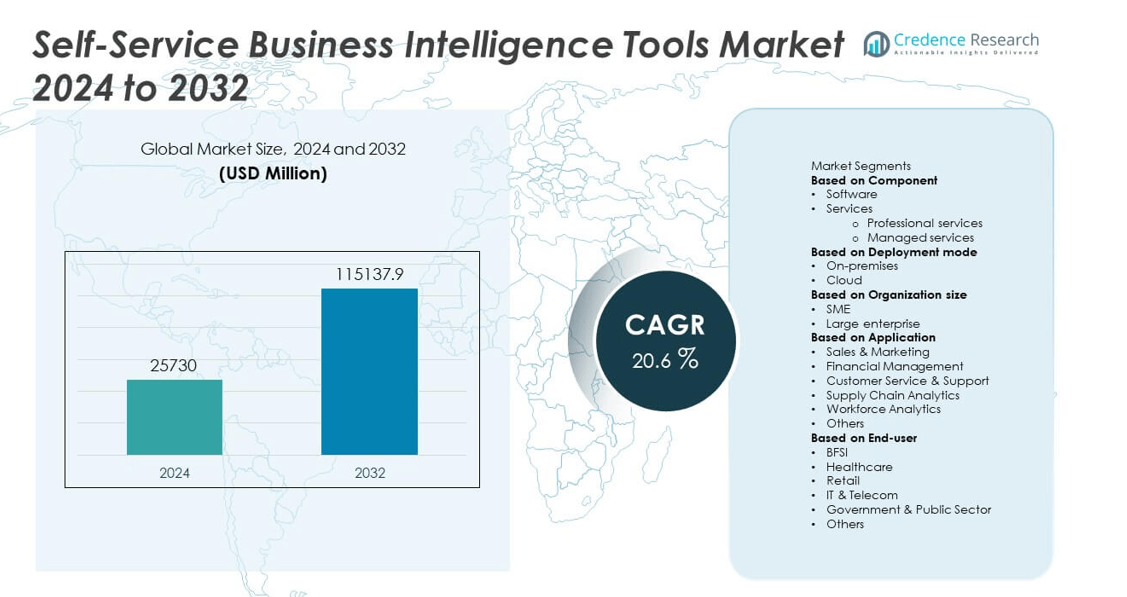

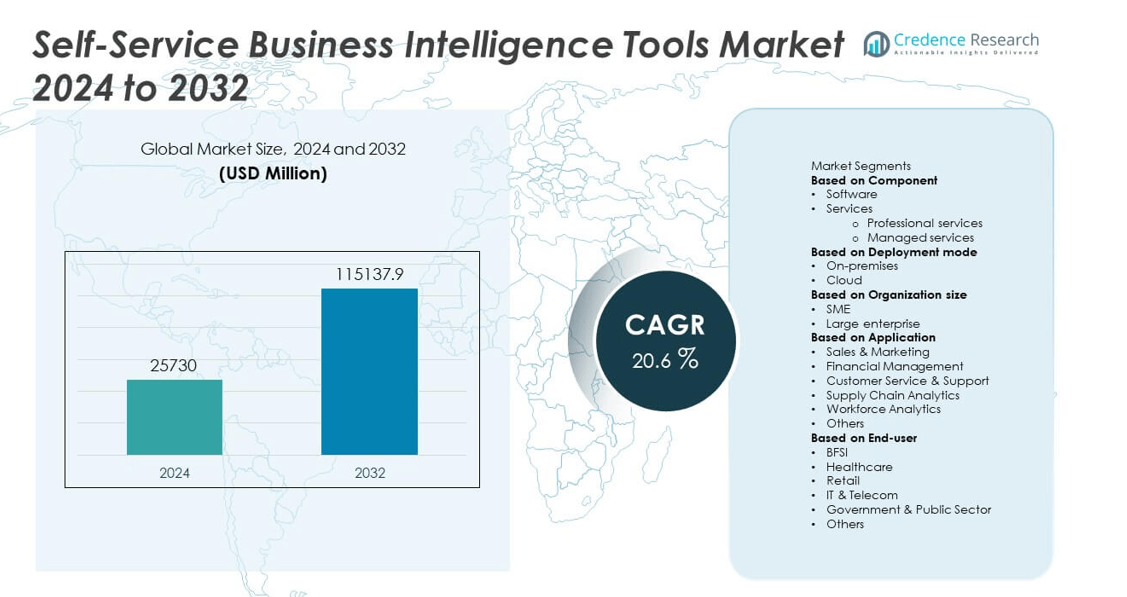

The Self-Service Business Intelligence Tools Market was valued at USD 25,730 million in 2024 and is anticipated to reach USD 115,137.9 million by 2032, growing at a CAGR of 20.6% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2019-2022 |

| Base Year |

2023 |

| Forecast Period |

2024-2032 |

| Self-Service Business Intelligence Tools Market Size 2024 |

USD 25,730 million |

| Self-Service Business Intelligence Tools Market, CAGR |

20.6% |

| Self-Service Business Intelligence Tools Market Size 2032 |

USD 115,137.9 million |

The Self-Service Business Intelligence Tools Market grows through rising demand for data-driven decision-making, rapid adoption of cloud-based deployments, and integration with enterprise applications. Organizations use these tools to reduce reliance on IT teams and improve operational agility.

The Self-Service Business Intelligence Tools Market shows strong geographical presence across North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa. North America leads with advanced adoption in finance, healthcare, and retail industries, supported by mature digital infrastructure. Europe emphasizes compliance-driven analytics and sustainability-focused reporting, while Asia-Pacific experiences rapid growth fueled by digital transformation in banking, telecom, and e-commerce. Latin America and the Middle East & Africa expand steadily with growing investments in digital business models. Key players driving innovation include Microsoft Corporation, known for its Power BI platform; SAP, with its integrated analytics suite; Salesforce, leveraging CRM-driven insights; and Qlik, delivering strong data visualization and associative analytics. Other significant contributors such as IBM and Oracle enhance competitiveness with AI-driven and cloud-based capabilities, reinforcing the market’s dynamic growth across industries and regions.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Self-Service Business Intelligence Tools Market was valued at USD 25,730 million in 2024 and is projected to reach USD 115,137.9 million by 2032, growing at a CAGR of 20.6% during the forecast period.

- The market grows due to rising demand for data-driven decision-making and increased adoption across industries such as healthcare, finance, retail, and manufacturing.

- Cloud-based deployment strengthens adoption by offering scalability, reduced costs, and remote accessibility, while AI and natural language processing make platforms easier for non-technical users.

- Competitive dynamics are shaped by leading players including Microsoft Corporation, SAP, Salesforce, Oracle, and Qlik, who focus on AI integration, advanced analytics, and strong visualization features to expand market presence.

- The market faces challenges from data quality issues, integration complexities, and skill gaps among employees, which limit the effectiveness of advanced self-service BI solutions.

- Regional growth is diverse, with North America leading adoption, Europe emphasizing compliance and sustainability reporting, Asia-Pacific showing rapid expansion through digital transformation, and Latin America and the Middle East & Africa displaying steady progress supported by rising investments.

- Overall, the market reflects a shift toward democratized analytics, predictive insights, and customized dashboards that empower employees at all organizational levels, driving greater agility and cost efficiency in business operations.

Market Drivers

Rising Demand for Data-Driven Decision-Making Across Enterprises

Organizations increasingly rely on data to improve business operations and competitive positioning. The Self-Service Business Intelligence Tools Market benefits from enterprises that want to reduce dependence on IT departments. It provides managers and employees with faster access to reports and dashboards. Decision-makers use these tools to identify patterns and trends that improve outcomes. The ability to make timely decisions drives efficiency and profitability. Enterprises across industries adopt self-service BI to enhance productivity and customer satisfaction.

- For instance, Microsoft reported that over 95% of Fortune 500 companies were using Power BI, a figure cited as early as 2020 and mentioned in a Microsoft blog post from 2021. This figure was reiterated in June 2025.

Expansion of Cloud-Based Solutions and Integration Capabilities

Cloud deployment models strengthen adoption by lowering upfront investment and improving scalability. The Self-Service Business Intelligence Tools Market gains traction as companies integrate solutions with enterprise systems. It allows seamless access to data across platforms, improving workflow efficiency. Cloud-based BI reduces maintenance costs and supports remote teams with reliable access. Businesses leverage integration with CRM, ERP, and HR systems to achieve broader insight. Flexible deployment options encourage both large enterprises and SMEs to expand usage.

- For instance, In December 2022, Salesforce announced its Data Cloud (then called Genie) was processing over 100 billion customer records daily across the entire Customer 360 ecosystem. This figure represents the total average processing volume of the platform, not a single customer’s data. The announcement highlighted the system’s scale and real-time analytics capabilities across its vast user base.

Increasing Adoption of Artificial Intelligence and Advanced Analytics

Artificial intelligence and machine learning enhance BI platforms with predictive and prescriptive insights. The Self-Service Business Intelligence Tools Market evolves with embedded AI that simplifies complex analysis. It empowers non-technical users to interpret advanced models without specialist support. Natural language processing and automated queries reduce learning curves for employees. Companies deploy AI-driven dashboards that forecast trends and assess performance gaps. These advanced capabilities raise the value of BI investments across organizations.

Growing Focus on Cost Efficiency and Operational Agility

Companies seek tools that improve efficiency while reducing operating expenses. The Self-Service Business Intelligence Tools Market addresses this demand with automated reporting and real-time analytics. It helps reduce manual data processing and repetitive IT tasks. Organizations improve agility by empowering employees to explore data independently. The approach shortens response times to market changes and customer needs. Cost savings combined with agility position self-service BI as a core strategic investment.

Market Trends

Wider Adoption of Data Democratization Across Organizations

Enterprises seek to make data accessible to employees at every level. The Self-Service Business Intelligence Tools Market aligns with this trend by offering intuitive platforms. It helps reduce reliance on IT specialists and improves transparency across business units. Employees in marketing, sales, finance, and operations use BI dashboards to guide actions. Broader access to insights fosters accountability and informed decision-making. This democratization of data is becoming a standard practice in modern enterprises.

- For instance, In its 2024 Global Impact Report, Qlik states it serves over 40,000 customers worldwide. The company’s press releases from 2024 and 2025 also refer to more than 40,000 active customers.

Shift Toward Mobile and Remote Accessibility of BI Platforms

Remote work models have increased demand for mobile-friendly analytics. The Self-Service Business Intelligence Tools Market adapts by supporting access through smartphones and tablets. It ensures employees can review dashboards and reports outside traditional office settings. Mobile BI improves agility for decision-makers who need instant updates. Organizations gain stronger control of real-time metrics, even with distributed teams. Enhanced remote access strengthens user engagement and tool adoption rates.

- For instance, SAP Analytics Cloud supports remote employees in over 180 countries with mobile access to real-time dashboards. While the platform is used extensively on mobile devices.

Growing Integration with Advanced Collaboration Tools and Workflows

Business teams now require BI platforms that align with existing collaboration systems. The Self-Service Business Intelligence Tools Market responds with integration into Microsoft Teams, Slack, and project management software. It enables faster sharing of dashboards within daily workflows. Seamless integration supports quick discussions based on real-time data. Companies benefit from reduced delays in team-based decision-making. Collaborative BI transforms analytics into a shared function across departments.

Rising Importance of Predictive and Prescriptive Capabilities

Organizations are moving beyond descriptive analytics to advanced forecasting models. The Self-Service Business Intelligence Tools Market reflects this trend through embedded predictive features. It equips users to identify potential risks and growth opportunities with greater accuracy. Predictive models enable more confident planning and resource allocation. Prescriptive analytics adds value by recommending actions to optimize outcomes. These capabilities expand the role of BI platforms from insight providers to strategic advisors.

Market Challenges Analysis

Data Quality Issues and Integration Complexity Across Enterprises

Organizations face challenges in ensuring consistent and accurate data. The Self-Service Business Intelligence Tools Market often struggles when users access fragmented or incomplete information. It creates risks of misleading insights and flawed decision-making. Integration with legacy systems and multiple data sources further complicates adoption. Companies must invest in governance frameworks to maintain reliability. Without strong data management practices, the benefits of self-service BI remain limited.

Skill Gaps and Resistance to Cultural Change in Businesses

User adoption depends on both training and willingness to embrace new tools. The Self-Service Business Intelligence Tools Market encounters resistance from employees unfamiliar with analytics platforms. It highlights the need for structured training programs and ongoing support. Skill gaps in interpreting data reduce the value of advanced dashboards. Some organizations also face cultural barriers where IT departments hesitate to lose control of analytics. Overcoming these obstacles is essential for long-term success and wider implementation.

Market Opportunities

Expansion Potential in Emerging Economies and SME Adoption

Rapid digital transformation in emerging markets creates significant opportunities for vendors. The Self-Service Business Intelligence Tools Market benefits as small and medium enterprises seek affordable, scalable solutions. It supports faster adoption where businesses lack advanced IT infrastructure. SMEs value the ability to generate insights without relying on specialized staff. Expanding into Asia-Pacific, Latin America, and Africa offers strong growth potential. Vendors that tailor cost-effective models for these markets gain competitive advantage.

Opportunities in Advanced Analytics and Industry-Specific Customization

Demand for predictive modeling and industry-focused applications drives innovation in BI platforms. The Self-Service Business Intelligence Tools Market gains opportunities from tailored solutions for healthcare, finance, retail, and manufacturing. It allows organizations to address sector-specific compliance, reporting, and performance needs. Custom dashboards designed for unique use cases improve adoption and satisfaction. Growth also lies in expanding AI-driven and natural language query features. Vendors offering specialized solutions stand to secure long-term partnerships.

Market Segmentation Analysis:

By Component

The Self-Service Business Intelligence Tools Market is segmented into software and services. Software remains the dominant segment due to growing demand for user-friendly platforms that enable data visualization and reporting. It allows employees to build dashboards, create custom reports, and interpret business data independently. Vendors focus on adding advanced analytics, AI features, and natural language query options to strengthen adoption. Services also gain importance, as organizations require consulting, integration, and training to maximize software potential. It helps ensure smooth deployment and long-term success for enterprises adopting self-service BI.

- For instance, In 2024, MicroStrategy concentrated on its Bitcoin strategy, using capital raises to acquire more of the cryptocurrency. The company also released new AI features for its business intelligence platform, MicroStrategy ONE, such as “Auto SQL” and “Auto Dashboard”.

By Deployment Mode

Deployment modes include on-premises and cloud-based solutions. Cloud-based deployment continues to gain significant traction, offering scalability, lower upfront costs, and remote accessibility. The Self-Service Business Intelligence Tools Market benefits from enterprises shifting toward cloud to support flexible work environments. It provides seamless integration with enterprise applications and ensures real-time access to data across locations. On-premises deployment still appeals to organizations with strict data security and compliance requirements. Vendors develop hybrid models that combine flexibility with control, addressing diverse enterprise needs.

- For instance, Oracle Analytics Cloud can be configured to track a maximum of 100,000 usage entries. For many deployments, tracking over 10,000 entries is both technically possible and a standard operating metric.

By Organization Size

The market caters to both large enterprises and small and medium-sized enterprises (SMEs). Large organizations lead adoption, driven by complex data requirements and a need for advanced analytics. The Self-Service Business Intelligence Tools Market gains momentum among SMEs, which value affordability and ease of use. It supports smaller firms in reducing reliance on IT staff and accelerating decision-making. SMEs benefit from cloud-based offerings that require limited infrastructure investment. Growing participation from SMEs expands the overall user base and increases competitive intensity across industries.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Segments:

Based on Component

- Professional services

- Managed services

Based on Deployment mode

Based on Organization size

Based on Application

- Sales & Marketing

- Financial Management

- Customer Service & Support

- Supply Chain Analytics

- Workforce Analytics

Based on End-user

- BFSI

- Healthcare

- Retail

- IT & Telecom

- Government & Public Sector

- Others

Based on the Geography:

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis

North America

North America holds the largest share of the Self-Service Business Intelligence Tools Market, accounting for around 38% in 2024. The region leads due to early adoption of advanced analytics and a mature technology ecosystem. Organizations across sectors such as finance, healthcare, retail, and manufacturing use BI platforms to drive digital transformation strategies. It benefits from the presence of leading vendors, strong investment in AI-powered analytics, and widespread use of cloud infrastructure. Enterprises adopt these tools to empower non-technical staff and support real-time decision-making, enhancing operational efficiency. The region’s emphasis on data-driven strategies, combined with regulatory compliance needs, ensures sustained demand and continued innovation.

Europe

Europe represents approximately 27% of the Self-Service Business Intelligence Tools Market in 2024, making it the second-largest region. Strong regulatory frameworks such as GDPR increase demand for tools that offer secure data access and transparent reporting. It gains traction in industries such as automotive, energy, retail, and healthcare where compliance and efficiency are critical. European enterprises increasingly integrate BI solutions into sustainability initiatives, tracking metrics like energy consumption and emissions. The presence of global and regional vendors, along with government support for digital adoption, reinforces market growth. A shift toward cloud-based deployments and AI-driven insights enhances competitiveness across enterprises.

Asia-Pacific

Asia-Pacific accounts for about 22% of the Self-Service Business Intelligence Tools Market in 2024 and demonstrates the fastest growth potential. Rapid digitalization, expanding internet connectivity, and rising enterprise investments drive adoption across the region. It benefits from large-scale adoption in sectors such as banking, telecom, e-commerce, and manufacturing. Countries like China, India, and Japan lead demand, with enterprises focusing on real-time analytics to strengthen business agility. SMEs in this region embrace cloud-based BI tools due to their cost efficiency and scalability. Increasing awareness of data-driven decision-making and government-led digital initiatives further enhance adoption across diverse industries.

Latin America

Latin America holds a smaller but growing share, contributing around 7% to the Self-Service Business Intelligence Tools Market in 2024. Enterprises across retail, financial services, and logistics adopt self-service BI to optimize operations and reduce costs. It is driven by the need for organizations to compete in increasingly digital economies. Cloud-based platforms see stronger adoption due to lower infrastructure requirements and easier scalability. Brazil and Mexico lead adoption, with growing activity in Colombia, Chile, and Argentina. Market penetration increases steadily as vendors expand their presence and provide tailored solutions for regional businesses.

Middle East & Africa

The Middle East & Africa account for about 6% of the Self-Service Business Intelligence Tools Market in 2024. Enterprises adopt these tools to improve efficiency in industries such as oil and gas, banking, and telecommunications. It supports organizations in responding to evolving customer expectations and modernizing traditional business models. The market is growing in Gulf Cooperation Council (GCC) countries where governments drive digital transformation programs. South Africa also emerges as a strong adopter, with enterprises using BI to enhance competitiveness. Although the market share remains smaller compared to other regions, investments in infrastructure and technology promise steady growth over the forecast period.

Key Player Analysis

Competitive Analysis

The competitive landscape of the Self-Service Business Intelligence Tools Market is shaped by leading players such as Microsoft Corporation, SAP, Salesforce, Oracle, Qlik, IBM, SAS, MicroStrategy, Sisense Ltd., and TIBCO Software Inc. These companies focus on continuous innovation to strengthen their product portfolios and expand global reach. They integrate artificial intelligence, natural language processing, and predictive analytics into platforms to enhance usability for non-technical users. Cloud-based deployment models and mobile accessibility are central to their strategies, supporting enterprises with scalability and remote operations. Strategic acquisitions, partnerships, and investments in industry-specific solutions allow these players to cater to diverse sectors such as finance, healthcare, retail, and manufacturing. Strong emphasis on visualization capabilities, real-time dashboards, and integration with enterprise applications further increases competitiveness. With rising demand for data democratization, these companies prioritize user-centric designs and advanced automation to maintain leadership and address evolving customer needs worldwide.

Recent Developments

- In April 2025, Sisense launched a self‑service managed cloud with multi‑tenant support and introduced consumption‑based pricing.

- In March 2025, SAP released BusinessObjects BI 2025 with enhancements for usability and efficiency.

- In March 2025, Oracle rolled out an Oracle Analytics Cloud update improving AI assistant availability and integration.

- In February 2025, SAP announced its new Business Data Cloud (BDC) SaaS offering, incorporating Databricks, Datasphere, Analytics Cloud.

Report Coverage

The research report offers an in-depth analysis based on Component, Deployment mode, Organization size, Application, End-user and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- AI-driven interfaces with natural language and conversational agents will become standard in BI platforms.

- Augmented analytics will automate insight generation through machine learning and advanced algorithms.

- Embedded analytics will expand, integrating dashboards directly into everyday business applications.

- Real-time BI will deliver faster insights to support immediate operational and strategic actions.

- Stronger data governance frameworks will ensure secure and responsible use of BI tools.

- Mobile BI adoption will rise as organizations demand anytime, anywhere access to interactive dashboards.

- Collaborative BI solutions will grow, enabling teams to share insights and drive collective decisions.

- AutoML features will simplify advanced analytics, making them accessible to non-technical users.

- Demand for BI-as-a-Service will increase, offering scalable and cost-efficient analytics delivery.

- BI tools will evolve into strategic partners, guiding executive decision-making with predictive intelligence.