Market Overview:

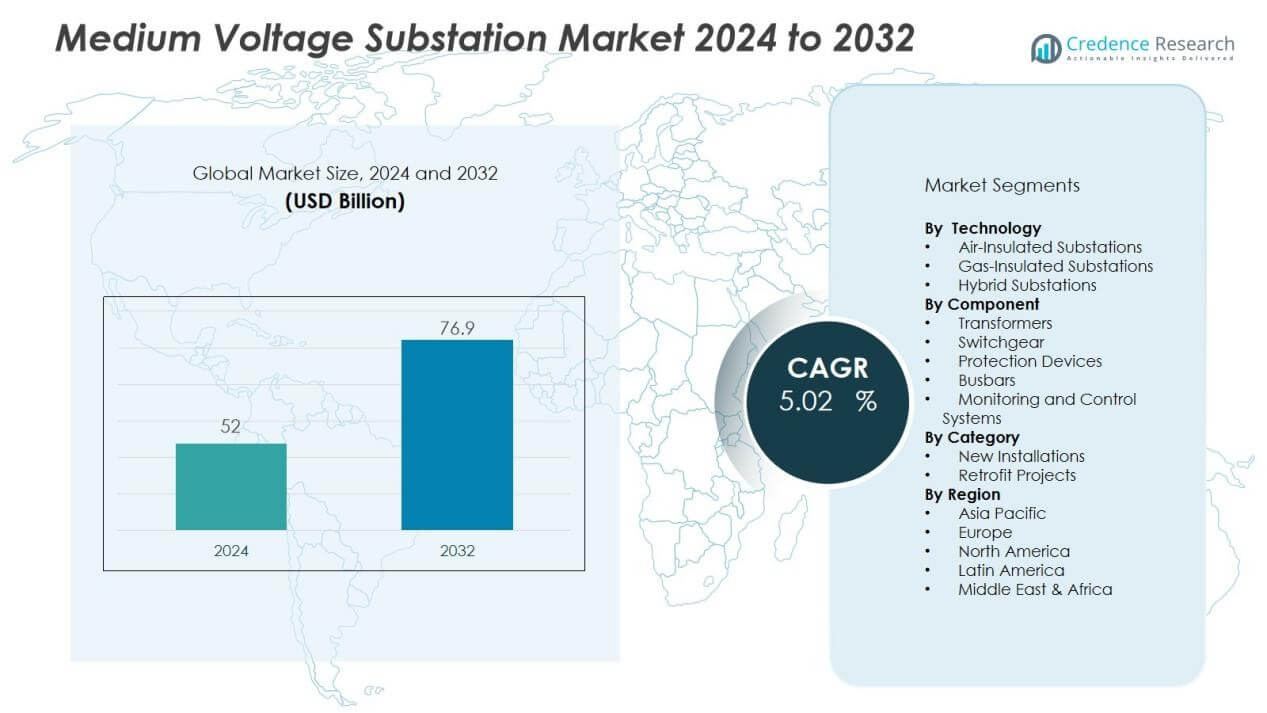

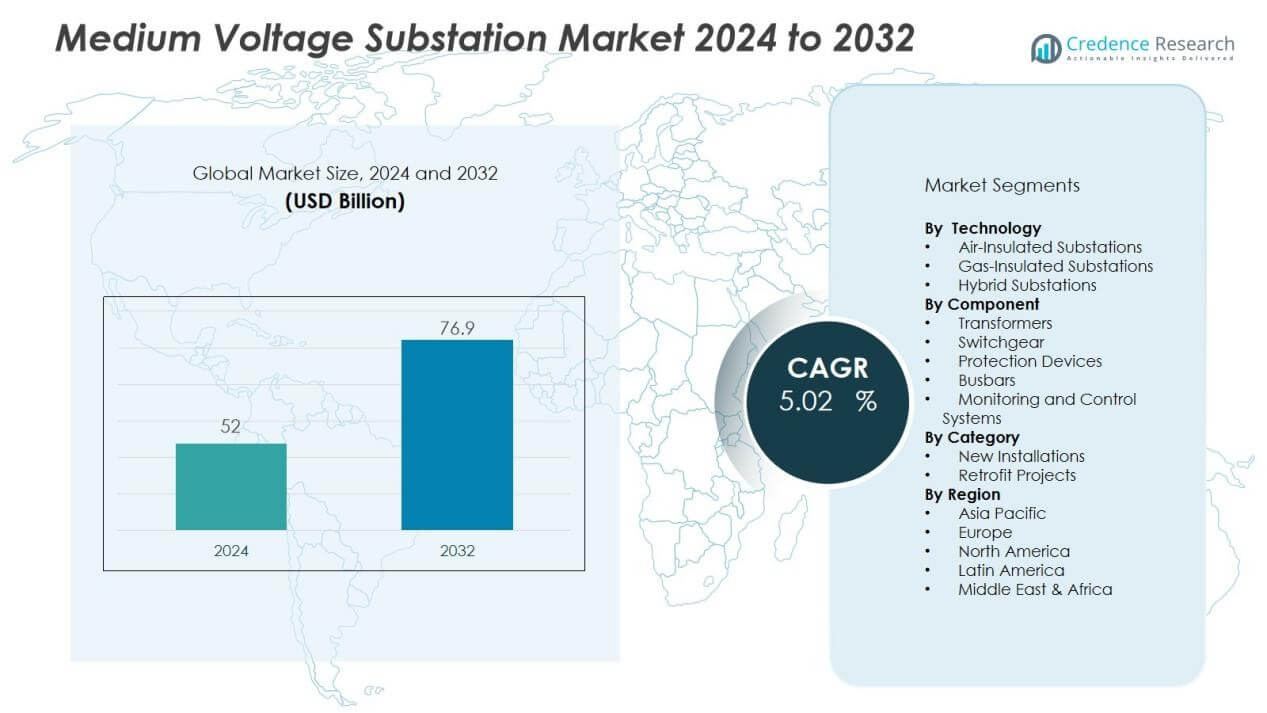

The medium voltage substation market size was valued at USD 52 billion in 2024 and is anticipated to reach USD 76.9 billion by 2032, at a CAGR of 5.02 % during the forecast period (2024-2032).

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Medium Voltage Substation Market Size 2024 |

USD 52 Billion |

| Medium Voltage Substation Market, CAGR |

5.02% |

| Medium Voltage Substation Market Size 2032 |

USD 76.9 Billion |

Key drivers of the market include growing adoption of renewable energy, rising demand for grid reliability, and upgrades to aging infrastructure. Governments and utilities are investing in smart substations to support digital monitoring, remote control, and predictive maintenance. The integration of automation, IoT, and advanced protection systems enhances operational safety and reduces downtime, making medium voltage substations a central component of smart grid development.

Regionally, North America leads the market due to strong investments in grid modernization and renewable integration. Europe follows with robust government policies supporting energy transition and cross-border electricity networks. Asia-Pacific is expected to witness the fastest growth, driven by rapid industrialization, expanding urban infrastructure, and large-scale renewable projects in countries such as China and India. Latin America and the Middle East & Africa also present emerging opportunities through infrastructure expansion and rural electrification programs.

Market Insights:

- The medium voltage substation market was valued at USD 52 billion in 2024 and is projected to reach USD 76.9 billion by 2032, growing at a CAGR of 5.02%.

- Rising demand for reliable power distribution drives adoption as utilities aim to reduce outages and enhance efficiency.

- Growing integration of renewable energy sources such as wind and solar strengthens demand for advanced substations.

- Modernization of aging grid infrastructure creates significant opportunities for smart and automated substation systems.

- High installation costs and shortage of skilled professionals remain key challenges limiting faster adoption.

- North America leads with 34% market share, while Europe follows with 29% supported by energy transition policies.

- Asia-Pacific holds 26% market share and is the fastest-growing region, driven by rapid industrialization and large-scale renewable projects.

Market Drivers:

Rising Demand for Reliable Power Distribution:

The medium voltage substation market benefits from the growing need for reliable electricity supply. Expanding residential, commercial, and industrial sectors place continuous pressure on distribution networks. Substations in the medium voltage range bridge the gap between transmission and end-user delivery, ensuring stable voltage levels. It plays a vital role in reducing outages, improving efficiency, and supporting uninterrupted power to consumers.

- For instance, ABB implemented a digital medium voltage substation using Relion 615 series protection relays in an East China data center, achieving 80% faster commissioning” is accurate and correctly reflects a specific ABB case study.

Integration of Renewable Energy Sources:

The global shift toward renewable energy fuels investments in medium voltage substations. Wind and solar farms require substations to connect variable generation to the grid. The medium voltage substation market supports grid stability by handling fluctuations in renewable output. It strengthens energy security by enabling distributed generation and smoother integration of cleaner energy into national grids.

- In May 2019, Siemens Gamesa Renewable Energy opened the 130 MW Badgingarra Wind Farm in Western Australia, which included a new substation to connect the facility to the grid

Grid Modernization and Infrastructure Upgrades:

Aging electrical infrastructure worldwide is driving substantial upgrades to substation systems. Many existing substations require modernization to handle higher loads and advanced technologies. The medium voltage substation market benefits from projects aimed at replacing outdated equipment with smart and automated systems. It helps utilities improve monitoring, efficiency, and resilience against power disruptions.

Adoption of Digital and Smart Technologies:

The use of digital solutions such as IoT, SCADA, and advanced protection relays is transforming substations. Smart substations provide real-time monitoring, predictive maintenance, and enhanced operational control. The medium voltage substation market gains momentum from these innovations, which reduce downtime and lower maintenance costs. It positions substations as critical enablers of the smart grid vision worldwide.

Market Trends:

Shift Toward Smart and Automated Substations:

The medium voltage substation market is witnessing a strong shift toward automation and digital control. Utilities are deploying intelligent electronic devices, smart sensors, and SCADA systems to improve operational visibility. It allows operators to monitor grid performance in real time and predict faults before failures occur. The trend reduces downtime, improves efficiency, and enhances grid resilience against growing power demand. Cybersecurity measures are also gaining importance as digital adoption increases. Integration of automation helps utilities optimize resource allocation while ensuring safer and faster restoration during outages.

- For instance, ABB installed Relion 615 series protection relays in an advanced data center in East China, achieving an 80% faster commissioning time

Growing Role of Renewable Integration and Modular Solutions:

The medium voltage substation market is evolving with the rapid adoption of renewable energy and decentralized generation. Substations are being adapted to manage variable renewable output while maintaining grid stability. It supports large-scale wind and solar projects that require flexible and reliable connections. Modular and prefabricated substations are becoming popular for faster deployment and reduced construction costs. These solutions allow utilities to expand capacity in urban and remote regions with minimal disruption. Growing emphasis on sustainability and carbon reduction further strengthens the demand for renewable-ready substations worldwide.

- For instance, Hitachi Energy won a contract to supply two HVDC Light® converter systems to transmit 2.85 GW of renewable power from the Hornsea Three offshore wind farm to the UK grid.

Market Challenges Analysis:

High Installation Costs and Capital Constraints:

The medium voltage substation market faces challenges due to the high capital required for installation and upgrades. Utilities and industrial operators often delay projects because of budget limitations and lengthy approval cycles. It becomes difficult for smaller utilities to invest in modern substations with advanced automation features. Rising costs of raw materials and specialized equipment further increase the financial burden. Complex construction and integration with existing grid infrastructure add to project timelines. These factors restrict widespread adoption in developing economies where funding is limited.

Technical Complexity and Skilled Workforce Shortage:

The medium voltage substation market also struggles with technical complexity and the lack of skilled professionals. Installation and maintenance of smart substations demand expertise in automation, cybersecurity, and grid management. It creates a shortage of qualified personnel capable of handling advanced systems. Frequent upgrades to meet regulatory and operational standards increase the training needs for utilities. Integration of renewable energy sources adds more complexity to system design and operation. Limited workforce availability can delay projects and reduce the efficiency of substation operations worldwide.

Market Opportunities:

Expansion of Renewable Energy and Electrification Projects:

The medium voltage substation market presents strong opportunities through the global push for renewable energy. Governments and utilities are investing in solar, wind, and hybrid projects that depend on substations for stable grid integration. It enables efficient transmission of variable power sources to meet growing demand. Electrification of transport and industrial sectors also increases the need for reliable medium voltage substations. Large infrastructure projects in developing regions provide further scope for deployment. Rising focus on sustainability ensures long-term investments in renewable-ready and energy-efficient substations.

Adoption of Smart Grid and Digital Solutions:

The medium voltage substation market benefits from increasing adoption of digital and automated technologies. Smart substations equipped with IoT sensors, SCADA systems, and predictive analytics create new growth prospects. It allows utilities to optimize asset performance, reduce maintenance costs, and improve reliability. Growing urbanization and industrialization drive the demand for compact and modular substations that can be quickly deployed. Strong emphasis on resilient grids against climate events also enhances adoption of advanced systems. These trends create significant opportunities for technology providers and equipment manufacturers worldwide.

Market Segmentation Analysis:

By Technology:

The medium voltage substation market is segmented by technology into air-insulated and gas-insulated substations. Air-insulated substations remain widely adopted due to lower installation costs and simpler maintenance. Gas-insulated substations are gaining traction for compact design, higher efficiency, and suitability in urban and space-constrained environments. It supports utilities in achieving better reliability, reduced losses, and enhanced safety standards. Demand for hybrid solutions is also emerging to balance performance and cost efficiency.

- For instance, Siemens’ air-insulated switchgear (AIS) technology is designed for fast installation with pre-assembled units, reducing on-site time significantly while also ensuring a lifespan of 30-40 years with minimal maintenance requirements.

By Component:

Key components include transformers, switchgear, protection devices, busbars, and monitoring systems. Transformers hold a significant share as they are central to voltage regulation and efficient power flow. Switchgear and protection devices ensure safe and controlled distribution of electricity. The medium voltage substation market also benefits from growing demand for digital monitoring systems that support predictive maintenance. It allows utilities to reduce downtime and improve asset performance. Integration of advanced relays and sensors further strengthens operational reliability.

- For instance, G&W Electric’s Viper-ST model recloser offers up to a 16kA symmetrical interrupting rating at 27kV, and features integral current and up to six internal voltage sensing capabilities that enable advanced automation and significantly improve network reliability.

By Category:

The market is categorized into new installations and retrofit projects. New installations dominate in emerging economies driven by infrastructure expansion and electrification initiatives. Retrofit projects are prominent in developed regions where aging substations require modernization. It drives investments in automation, IoT-enabled solutions, and modular substations. Both categories are essential in meeting the global push for grid efficiency, reliability, and renewable integration. This balanced demand ensures steady growth across diverse applications.

Segmentations:

By Technology:

- Air-Insulated Substations

- Gas-Insulated Substations

- Hybrid Substations

By Component:

- Transformers

- Switchgear

- Protection Devices

- Busbars

- Monitoring and Control Systems

By Category:

- New Installations

- Retrofit Projects

By Region:

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis:

North America and Europe:

North America holds 34% market share in the medium voltage substation market, driven by modernization programs and renewable integration. Europe follows with 29% market share supported by energy transition policies and cross-border grid expansion. Utilities in these regions prioritize grid reliability and invest heavily in automation, IoT, and smart monitoring systems. It supports the replacement of aging infrastructure while enabling better integration of wind and solar projects. Governments provide funding and regulatory support for sustainable electricity networks. Both regions also emphasize cybersecurity measures for protecting digital substations.

Asia-Pacific:

Asia-Pacific accounts for 26% market share in the medium voltage substation market, led by rapid urbanization and industrialization. China and India drive demand through large-scale renewable projects and infrastructure expansion. It supports significant investments in modular and digital substations to meet rising energy needs. Japan, South Korea, and Southeast Asia also contribute with growing adoption of smart grid technologies. Government-backed initiatives for electrification and decarbonization strengthen the region’s growth prospects. The scale of renewable energy deployment positions Asia-Pacific as the fastest-growing regional market.

Latin America and Middle East & Africa:

Latin America holds 6% market share in the medium voltage substation market, supported by renewable adoption and grid expansion. The Middle East & Africa account for 5% market share driven by urban growth and electrification projects. It creates opportunities through rural grid connections, oil and gas investments, and infrastructure modernization. Brazil, Mexico, and South Africa remain central to growth with ongoing utility reforms and energy diversification. Gulf countries are investing in renewable-ready substations to reduce reliance on fossil fuels. Both regions are expected to record steady growth with international funding and technology partnerships.

Key Player Analysis:

- ABB

- Belden

- Alstom

- Cisco Systems

- Efacec

- Eaton

- General Electric

- Hitachi Energy

- Grid to Great

- L&T Electrical and Automation

- Netcontrol Group

- Mitsubishi Electric

Competitive Analysis:

The medium voltage substation market features a competitive landscape shaped by global technology providers and regional players. Key companies include ABB, Belden, Alstom, Cisco Systems, Efacec, and Eaton, each leveraging expertise in power systems and digital solutions. These firms focus on delivering reliable substations that meet growing demand for grid stability and efficiency. It emphasizes advanced automation, compact designs, and integration with renewable energy sources to strengthen market presence. Strategic investments in smart grid technology, modular substations, and cybersecurity solutions are central to their competitive edge. Partnerships with utilities and governments further enhance adoption in both developed and emerging markets. Continuous innovation, product diversification, and service expansion define the strategies of leading players to address global infrastructure challenges.

Recent Developments:

- In July 2025, Alstom received the Red Dot Award 2025 for the design of the Avelia Stream Nordic X80 high-speed train. Alstom secured a €2 billion railcar contract from the New York Metropolitan Transportation Authority for M-9A railcars, with deliveries planned to start in 2029.

- In October 2023, Belden introduced a new Partner Alliance Ecosystem Program to enhance collaboration with global technology partners.

Report Coverage:

The research report offers an in-depth analysis based on Technology, Component, Category and Region. It details leading Market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current Market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven Market expansion in recent years. The report also explores Market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on Market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the Market.

Future Outlook:

- The medium voltage substation market will advance with continuous investment in smart grid infrastructure.

- Utilities will adopt digital monitoring and predictive maintenance solutions to improve operational reliability.

- Renewable energy integration will remain a key driver, creating demand for flexible substation designs.

- Modular and prefabricated substations will gain wider adoption for faster deployment and reduced costs.

- Governments will increase funding for infrastructure upgrades to replace aging electrical systems.

- Automation and IoT-enabled devices will strengthen efficiency, safety, and fault detection in substations.

- Cybersecurity solutions will become a standard requirement for digital substation operations worldwide.

- Emerging economies will expand deployment to support electrification and rural grid connectivity.

- Strategic partnerships among technology providers, utilities, and governments will shape future development.

- The market will witness sustained demand across residential, commercial, and industrial applications, reinforcing its central role in energy distribution.