Market Overview:

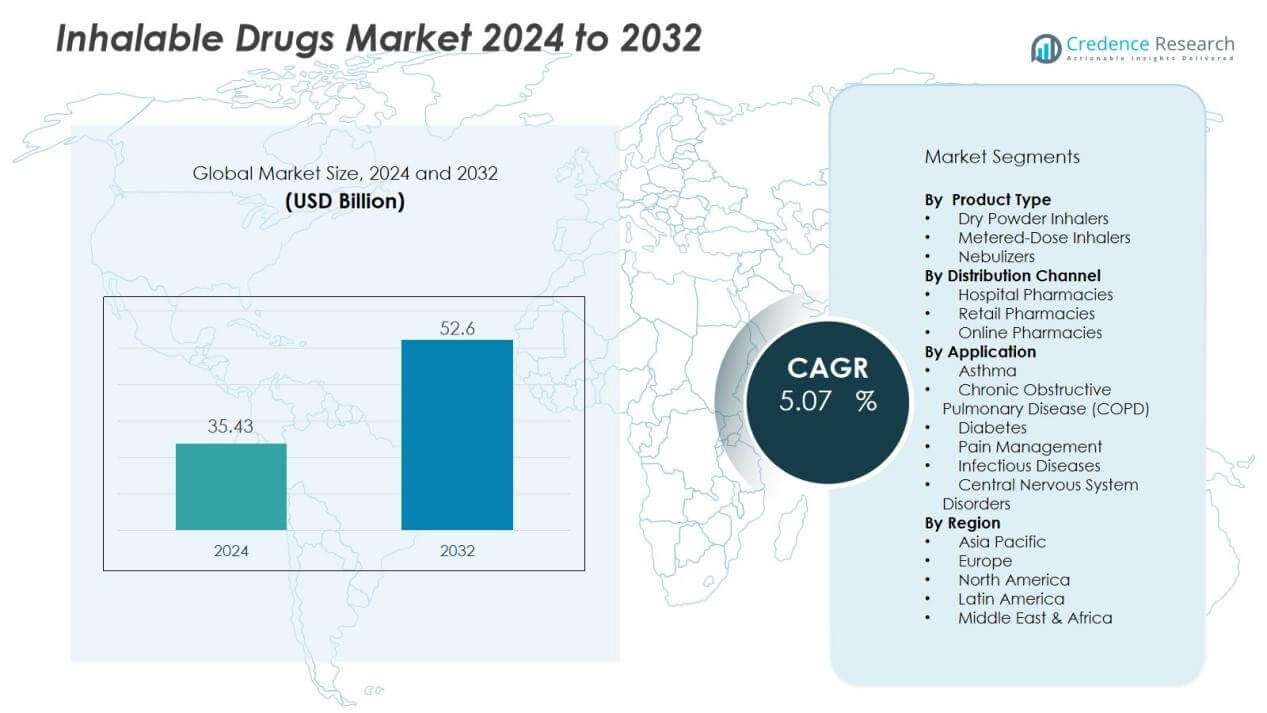

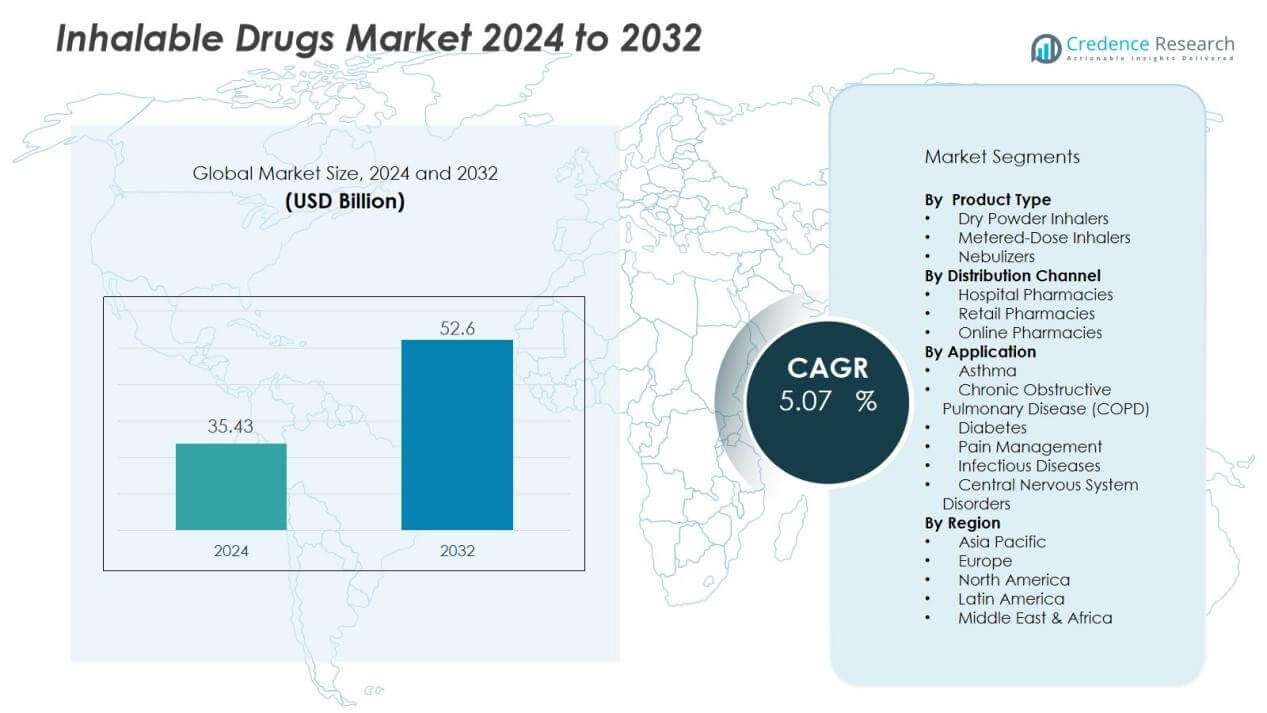

The inhalable drugs market size was valued at USD 35.43 billion in 2024 and is anticipated to reach USD 52.6 billion by 2032, at a CAGR of 5.07 % during the forecast period (2024-2032).

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Inhalable Drugs Market Size 2024 |

USD 35.43 Billion |

| Inhalable Drugs Market, CAGR |

5.07% |

| Inhalable Drugs Market Size 2032 |

USD 52.6 Million |

Key drivers of the inhalable drugs market include the increasing prevalence of asthma, COPD, and other respiratory conditions worldwide. Rising investments in advanced inhalation technologies, such as dry powder inhalers and metered-dose inhalers, are enhancing treatment outcomes. Pharmaceutical companies are also prioritizing non-invasive drug delivery methods due to patient preference and improved bioavailability. Growing research into inhalable vaccines and biologics further expands the scope of this market.

Regionally, North America dominates the inhalable drugs market, supported by advanced healthcare infrastructure, high disease prevalence, and significant R&D spending. Europe follows closely, driven by strong regulatory frameworks and widespread adoption of innovative inhalation therapies. Asia-Pacific is expected to record the fastest growth, fueled by rising healthcare expenditure, expanding patient populations, and increasing pharmaceutical manufacturing capacity. Latin America and the Middle East & Africa present emerging opportunities through expanding healthcare access and government-led initiatives.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- The inhalable drugs market was valued at USD 35.43 billion in 2024 and is set to reach USD 52.6 billion by 2032 at a CAGR of 5.07%.

- Rising prevalence of asthma, COPD, and other respiratory diseases drives demand for effective inhalation therapies.

- Technological advances in dry powder inhalers, metered-dose inhalers, and smart inhalers improve compliance and treatment outcomes.

- Expanding research into inhalable biologics and vaccines creates new opportunities beyond traditional respiratory treatments.

- Regulatory complexities and high development costs pose significant challenges, particularly for small and mid-sized firms.

- North America led with 42% share in 2024, supported by advanced healthcare systems and strong R&D activity.

- Asia-Pacific recorded 21% share in 2024 and is expected to grow fastest, driven by large patient bases and rising healthcare investment.

Market Drivers:

Rising Prevalence of Respiratory Diseases Driving Adoption:

The inhalable drugs market is propelled by the growing incidence of asthma, COPD, and other respiratory disorders. Millions of patients require fast and effective treatments that improve quality of life. Inhalation therapies provide direct drug delivery to the lungs, ensuring rapid onset of action. It continues to attract patients and healthcare providers due to improved efficacy and reduced systemic side effects.

- For instance, Boehringer Ingelheim’s Spiriva Respimat inhaler delivers a 2.5 µg tiotropium dose per puff with 60 actuations available in each cartridge²

Advancements in Inhalation Technology Enhancing Treatment Outcomes:

Technological progress in dry powder inhalers, metered-dose inhalers, and nebulizers supports market expansion. Companies invest in user-friendly devices that ensure accurate dosing and higher patient compliance. Innovations in smart inhalers with digital monitoring features are strengthening clinical management. It ensures better adherence and improved outcomes in both chronic and acute cases.

- For instance, Chiesi Farmaceutici’s NEXThaler® is a breath-actuated dry powder inhaler that guarantees dose release only when the inspiratory flow rate exceeds 35 L/min, ensuring consistent dosing and reducing errors in patients with variable inhalation strengths.

Expanding Role of Inhalable Biologics and Vaccines:

The development of inhalable biologics and vaccines broadens the scope of this market. Non-invasive delivery methods are gaining acceptance for both preventive and therapeutic applications. Research efforts focus on enhancing drug stability and lung deposition efficiency. It is creating opportunities for new drug classes beyond traditional respiratory medicines.

Patient Preference for Non-Invasive Drug Delivery:

Patients increasingly prefer non-invasive routes that minimize discomfort and improve convenience. Inhalable formulations deliver drugs without the pain or complexity of injections. This preference supports long-term adherence in chronic therapies. It strengthens the position of the inhalable drugs market within modern healthcare delivery systems.

Market Trends:

Integration of Digital Health Solutions with Inhalation Devices :

The inhalable drugs market is witnessing a strong shift toward digital-enabled therapies. Smart inhalers with built-in sensors and connectivity features allow patients and clinicians to track usage and adherence in real time. These devices generate valuable data that improve disease management and support personalized treatment strategies. Pharmaceutical companies collaborate with technology firms to integrate mobile applications and cloud-based platforms. It enables remote monitoring, reduces hospital visits, and enhances patient engagement. The adoption of such solutions is growing across developed regions and gradually expanding into emerging markets.

- For Instance, Adherium’s Hailie® sensor technology has been shown to increase adherence to preventative medication by 59% in adults and 180% in children. This technology has also been referenced in over 100 publications involving more than 13,000 patients.

Expansion of Inhalable Therapies Beyond Respiratory Diseases :

The scope of inhalable treatments is no longer confined to traditional respiratory conditions. Research pipelines are exploring inhalable formulations for vaccines, insulin, pain management, and central nervous system disorders. It reflects the rising interest in delivering systemic therapies through the pulmonary route due to its fast absorption and high bioavailability. The trend highlights growing opportunities for drug makers to diversify portfolios and reach wider patient groups. Regulatory agencies are also providing guidance to accelerate the development of novel inhaled products. This expansion is shaping the future of the inhalable drugs market with new therapeutic categories and broader clinical applications.

- For Instance, MannKind Corporation’s Afrezza showed positive 30-week phase 4 clinical results with patients achieving target A1c levels effectively after switching from injections or pumps.

Market Challenges Analysis:

Regulatory Complexities and Stringent Approval Pathways:

The inhalable drugs market faces challenges from strict regulatory frameworks that demand extensive safety and efficacy data. Developing inhalable formulations requires specialized trials to evaluate lung deposition, long-term safety, and device compatibility. Regulatory agencies impose detailed guidelines that extend approval timelines and increase costs for manufacturers. It raises barriers for small and mid-sized companies that lack resources for compliance. Variations in approval standards across regions further complicate global product launches. These factors slow the pace of innovation and restrict faster patient access to advanced therapies.

High Development Costs and Technical Barriers in Formulation:

Formulating inhalable drugs presents technical difficulties that drive up production costs. Achieving consistent particle size, drug stability, and efficient lung delivery requires advanced manufacturing processes. Device-drug integration adds complexity and limits scalability for many companies. It restricts the ability of firms to deliver cost-effective products in competitive markets. High R&D investment with uncertain returns often discourages entry into this space. These challenges collectively hinder wider adoption, despite the clinical benefits inhalable drugs can offer.

Market Opportunities:

Rising Demand for Novel Therapeutic Applications:

The inhalable drugs market offers opportunities through expansion beyond traditional respiratory treatments. Researchers are developing inhalable formulations for diabetes, oncology, and pain management, leveraging rapid absorption and high bioavailability. Growing focus on inhalable vaccines presents a strong pipeline of preventive solutions for infectious diseases. It enables drug makers to diversify portfolios and address unmet clinical needs. Pharmaceutical companies that invest in multi-therapy inhalation platforms gain a competitive advantage. This expansion strengthens the role of inhalable drugs as a versatile and patient-friendly drug delivery option.

Growth Potential in Emerging Healthcare Markets:

Emerging regions provide attractive prospects due to rising healthcare expenditure and expanding patient populations. Governments in Asia-Pacific, Latin America, and the Middle East are supporting access to advanced therapies through policy reforms and infrastructure development. Increasing awareness of chronic respiratory diseases fuels demand for cost-effective inhalation treatments. It creates long-term opportunities for both multinational firms and regional players. Strategic partnerships with local distributors and healthcare providers enhance market penetration. These dynamics position emerging markets as critical growth engines for the inhalable drugs market.

Market Segmentation Analysis:

By Product Type:

The inhalable drugs market is segmented into dry powder inhalers, metered-dose inhalers, and nebulizers. Dry powder inhalers dominate due to ease of use and accurate dosing. Metered-dose inhalers remain widely adopted in chronic disease management. Nebulizers are essential in hospital and emergency care settings, offering rapid relief for severe conditions. It reflects strong demand for diverse devices tailored to different patient needs and clinical environments.

- For instance, GSK’s ELLIPTA DPI delivers over 85.9% of its nominal blister content across inspiratory flow rates from 30 to 90 L/min, ensuring consistent dose delivery for patients with varying inhalation capacities.

By Application:

Applications span respiratory diseases, systemic disorders, and preventive care. Respiratory conditions such as asthma and COPD account for the largest share, supported by growing global prevalence. Systemic therapies, including inhalable insulin and pain relief drugs, are gaining importance in clinical use. Preventive care through inhalable vaccines is strengthening pipelines for infectious disease management. It expands the relevance of inhalable therapies across multiple therapeutic domains.

- For instance, MannKind Corporation’s Afrezza®, an FDA-approved ultra-rapid-acting inhaled insulin, showed peak insulin levels within 12 to 15 minutes after administration in clinical trials involving over 3,000 diabetic patients, highlighting its speed and efficacy in glycemic control management.

By Distribution Channel:

Distribution channels include hospital pharmacies, retail pharmacies, and online platforms. Hospital pharmacies dominate due to immediate availability in critical care. Retail pharmacies provide broad accessibility to chronic patients requiring regular medication. Online platforms are expanding with the rise of e-health and digital prescription services. It enhances convenience for patients while supporting wider market penetration of inhalable therapies.

Segmentations:

By Product Type:

- Dry Powder Inhalers

- Metered-Dose Inhalers

- Nebulizers

By Application:

- Asthma

- Chronic Obstructive Pulmonary Disease (COPD)

- Diabetes

- Pain Management

- Infectious Diseases

- Central Nervous System Disorders

By Distribution Channel:

- Hospital Pharmacies

- Retail Pharmacies

- Online Pharmacies

By Region:

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis:

North America:

North America held 42% market share in 2024, supported by advanced healthcare infrastructure and strong R&D activity. The United States dominates the region with high prevalence of asthma and COPD, driving demand for innovative inhalable therapies. Favorable reimbursement frameworks and early adoption of digital inhalers strengthen regional growth. It benefits from strategic partnerships between pharmaceutical firms and technology companies. Canada contributes through rising investments in respiratory care and growing awareness of patient-friendly drug delivery systems. The region continues to lead in clinical trials, product launches, and regulatory support for novel inhalation therapies.

Europe:

Europe accounted for 29% market share in 2024, driven by widespread adoption of innovative inhalation devices and strong regulatory frameworks. Countries such as Germany, the United Kingdom, and France lead through advanced healthcare systems and large patient populations. The European Medicines Agency provides structured guidance that accelerates approvals of inhalable therapies. It supports expansion into broader therapeutic areas, including inhalable biologics and vaccines. Collaborative initiatives between academia and industry boost research output and strengthen competitiveness. The region emphasizes sustainable manufacturing practices, enhancing the value of European-based pharmaceutical production.

Asia-Pacific:

Asia-Pacific captured 21% market share in 2024, fueled by expanding patient populations and rising healthcare expenditure. China and India are central to this growth with high respiratory disease burdens and large pharmaceutical manufacturing capacity. Governments invest heavily in healthcare infrastructure and policy reforms to improve drug accessibility. It benefits from partnerships between global drug makers and regional distributors. Japan, South Korea, and Australia also contribute through advanced R&D ecosystems and early technology adoption. The region is expected to record the fastest growth, positioning Asia-Pacific as a critical hub in the inhalable drugs market.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- AbbVie

- Boehringer Ingelheim

- AstraZeneca

- Chiesi Pharmaceuticals

- CanSino Biologics

- F-Hoffman Roche

- Mannkind

- Kamada Pharmaceuticals

- Merxin

- United Therapeutics

- Teva Pharmaceutical

Competitive Analysis:

The inhalable drugs market is shaped by strong competition among leading pharmaceutical companies focusing on innovation and patient-centric solutions. Key players include AbbVie, Boehringer Ingelheim, AstraZeneca, Chiesi Pharmaceuticals, CanSino Biologics, F. Hoffmann-La Roche, MannKind, and Kamada Pharmaceutical. These companies invest heavily in R&D to expand portfolios across respiratory diseases, vaccines, and systemic therapies. Strategic collaborations with technology firms support advancements in smart inhalers and digital monitoring platforms. It strengthens market positioning by combining therapeutic expertise with connected health solutions. Regional players also contribute through cost-effective manufacturing and distribution networks. Continuous product launches, clinical trials, and regulatory approvals highlight the competitive intensity. The landscape favors firms that integrate innovation, affordability, and sustainability into their strategies while addressing growing global healthcare needs.

Recent Developments:

- In March 2025, AstraZeneca announced its acquisition of EsoBiotec to boost its cell therapy portfolio in March 2025. Boehringer Ingelheim partnered with Veeva Systems to launch the One Medicine Platform on March 11, 2025.

- In July 2024, Boehringer Ingelheim acquired Nerio Therapeutics for $1.3 billion in July 2024 to bolster its immuno-oncology pipeline.

- In August 2025, AbbVie completed its acquisition of Capstan Therapeutics on August 19, 2025. AstraZeneca launched FluMist, an at-home flu vaccine nasal spray, on August 15, 2025.

Report Coverage:

The research report offers an in-depth analysis based on Product Type, Application, Distribution Channel and Region. It details leading Market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current Market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven Market expansion in recent years. The report also explores Market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on Market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the Market.

Future Outlook:

- The inhalable drugs market will expand into therapeutic areas beyond respiratory diseases, including oncology and diabetes.

- Pharmaceutical companies will prioritize patient-friendly, non-invasive delivery methods to improve adherence.

- Smart inhalers with digital monitoring features will become standard in chronic disease management.

- It will experience stronger collaboration between pharmaceutical manufacturers and digital health technology firms.

- Inhalable biologics and vaccines will emerge as key focus areas for innovation and product pipelines.

- Regulatory agencies will streamline approval processes to support rapid adoption of advanced inhalable therapies.

- Emerging regions such as Asia-Pacific and Latin America will play a larger role in global demand.

- Partnerships with regional distributors and healthcare providers will enhance access to innovative inhalation products.

- Investments in sustainable manufacturing practices will improve environmental impact and strengthen brand positioning.

- Continuous clinical research will expand evidence supporting inhalable therapies, ensuring broader integration into mainstream healthcare.