| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Wide Area RFID Systems Market Size 2024 |

USD 3,162.4 million |

| Wide Area RFID Systems Market, CAGR |

7.63% |

| Wide Area RFID Systems Market Size 2032 |

USD 5,684.4 million |

Market Overview:

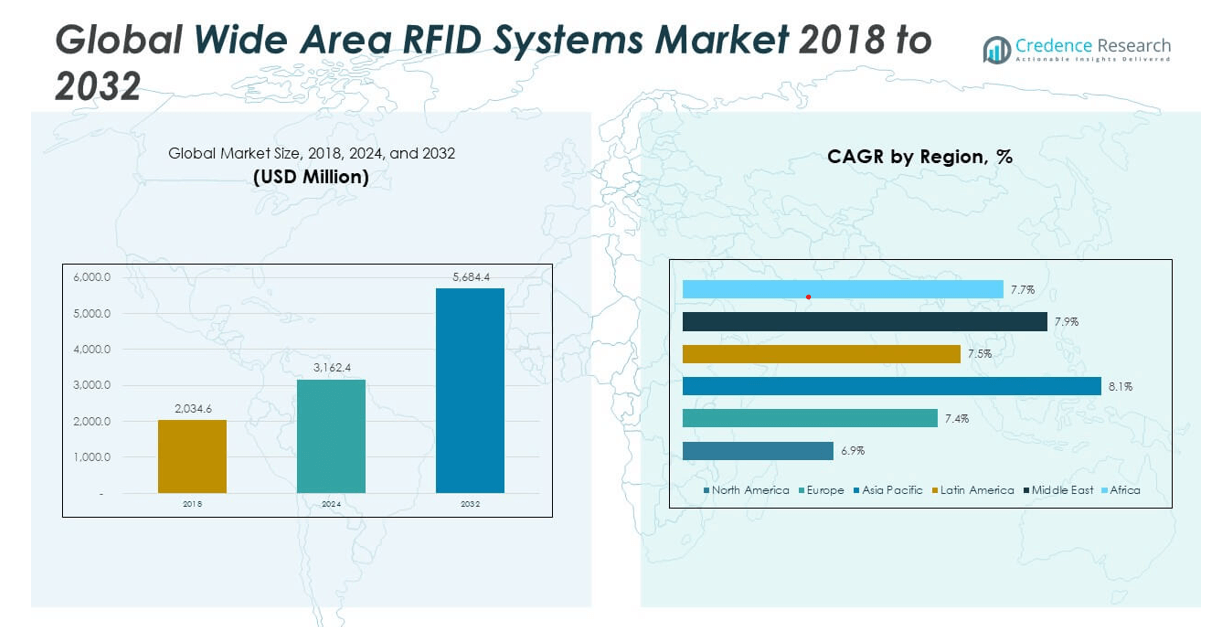

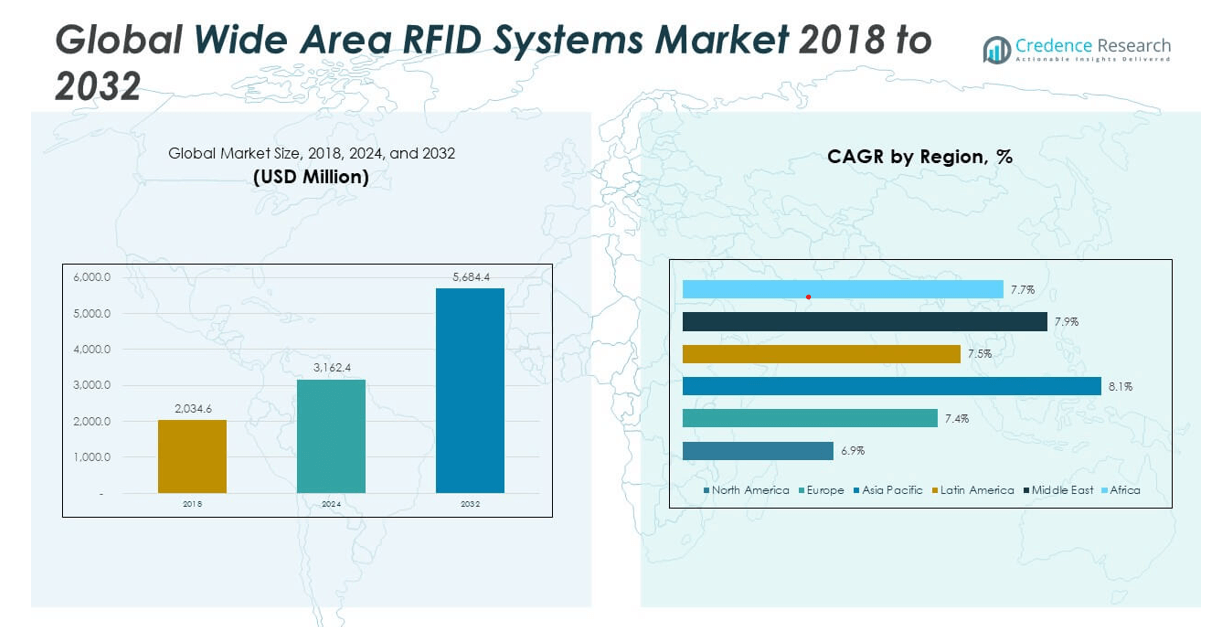

The Wide Area RFID Systems Market size was valued at USD 2,034.6 million in 2018 to USD 3,162.4 million in 2024 and is anticipated to reach USD 5,684.4 million by 2032, at a CAGR of 7.63% during the forecast period.

The market is primarily driven by the growing need for automated, real-time asset tracking over wide geographical areas. Companies are increasingly adopting RFID technologies to streamline supply chains, monitor inventories, and reduce operational inefficiencies. The expansion of smart infrastructure and Industry 4.0 initiatives is accelerating the deployment of wide area RFID systems, as enterprises seek to digitally transform their asset management capabilities. Technological advancements such as the development of long-range passive tags, ultra-high frequency (UHF) solutions, and enhanced reader antennas are significantly improving read range, tag accuracy, and data transfer speed. These innovations, combined with declining hardware costs and improved energy efficiency, are making RFID solutions more accessible to medium and large enterprises alike. Furthermore, the convergence of RFID with Internet of Things (IoT) platforms, artificial intelligence, and cloud-based analytics is enabling predictive maintenance, advanced inventory forecasting, and improved supply chain transparency.

Regionally, the North American market holds the largest share due to the early adoption of RFID technologies, well-established industrial infrastructure, and the presence of leading market players such as Impinj, Mojix, and Guard RFID Solutions. The U.S. dominates the regional landscape with extensive deployments across logistics hubs, hospitals, retail chains, and military installations. Europe follows closely, benefiting from stringent regulatory frameworks and high levels of automation across manufacturing and transportation sectors. Countries like Germany, the UK, and France are spearheading adoption, particularly in supply chain and pharmaceutical tracking applications. The Asia-Pacific region, however, is emerging as the fastest-growing market, driven by rapid industrialization, booming e-commerce sectors, and smart city initiatives in countries such as China, India, South Korea, and Japan. The expansion of logistics networks and growing investments in digital infrastructure are further supporting RFID penetration across the region. Meanwhile, Latin America and the Middle East & Africa are gradually gaining traction, with demand rising in sectors like oil & gas, mining, and public asset monitoring.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- The Wide Area RFID Systems Market was valued at USD 3,162.4 million in 2024 and is projected to reach USD 5,684.4 million by 2032, growing at a CAGR of 7.63%.

- Increasing demand for real-time asset tracking across logistics hubs, warehouses, and manufacturing plants is a key driver for widespread adoption.

- Technological advancements, including UHF tags, long-range passive RFID, and enhanced antennas, are improving system efficiency and lowering infrastructure costs.

- Enterprises are integrating RFID with IoT, AI, and cloud platforms to support predictive maintenance, automate inventory, and optimize supply chain operations.

- Growing regulatory compliance requirements in pharmaceuticals, food, and aerospace sectors are pushing demand for traceable, tamper-proof tracking systems.

- High initial setup costs and infrastructure complexity continue to limit adoption among small and medium enterprises, despite long-term ROI benefits.

- North America leads the market due to early technology adoption and industrial maturity, while Asia-Pacific emerges as the fastest-growing region, driven by smart city initiatives and expanding logistics infrastructure.

Market Drivers:

Rising Demand for Real-Time Asset Tracking and Inventory Management in Large-Scale Operations

The Wide Area RFID Systems Market is gaining traction due to the growing requirement for real-time tracking of assets and inventory across extended areas such as warehouses, distribution centers, and industrial facilities. Traditional barcode systems fall short in such settings due to limited range and manual intervention. RFID solutions offer automated, wide-coverage identification with high accuracy, enabling companies to improve inventory visibility and reduce shrinkage. Businesses in logistics, manufacturing, and retail sectors are adopting wide-area systems to improve supply chain transparency and responsiveness. This capability supports better decision-making, improves resource allocation, and lowers operational costs. The market continues to expand as organizations seek technologies that support end-to-end asset tracking without line-of-sight restrictions.

Advancements in RFID Technology Enabling Long-Range, Low-Power, and Cost-Effective Solutions

Technological innovations are pushing the capabilities of wide area RFID systems, making them more accessible and reliable. Developments in passive ultra-high frequency (UHF) tags and low-power long-range readers have enhanced the performance of RFID networks in large-scale deployments. These innovations have enabled data capture over hundreds of meters, significantly reducing infrastructure needs. The integration of RFID with edge computing, cloud platforms, and AI-driven analytics is making it easier to process and interpret massive datasets in real time. Tag manufacturing costs have also declined, encouraging wider use in high-volume applications. The Wide Area RFID Systems Market benefits from these advancements by offering enterprises flexible, scalable, and intelligent solutions that adapt to complex operational environments.

- For example, Impinj’s R700 reader, launched in 2023, supports up to 1,100 tag reads per second at ranges exceeding 20 meters using passive UHF tags, while maintaining power consumption below 15W per reader.

Digital Transformation and Integration with IoT Platforms to Improve Operational Efficiency

The acceleration of digital transformation across industries is a major driver for the adoption of wide area RFID systems. Companies are increasingly integrating RFID with IoT platforms to create intelligent ecosystems that monitor, analyze, and manage physical assets remotely. This combination enables predictive maintenance, automated alerts, and real-time decision-making. In sectors such as transportation, energy, and healthcare, these capabilities help reduce downtime, extend equipment life, and enhance safety protocols. It supports the shift from reactive to proactive operations, which is critical in high-value and high-risk environments. The Wide Area RFID Systems Market benefits from this transformation by offering infrastructure that supports seamless connectivity and data flow across digital and physical assets.

Growing Compliance Requirements and Security Concerns Driving Need for Traceability Solutions

Enterprises are facing increased pressure to comply with regulatory standards related to asset traceability, product authentication, and security. Industries such as pharmaceuticals, food and beverage, aerospace, and defense are subject to strict guidelines that mandate accurate, tamper-proof tracking systems. RFID offers the ability to log asset location, condition, and movement history with minimal human intervention. It helps companies detect anomalies, prevent theft, and verify compliance throughout the supply chain. The Wide Area RFID Systems Market addresses these needs by offering robust tracking infrastructure capable of covering large areas and integrating with audit systems. Demand for such traceability solutions is likely to grow with tightening regulations and rising accountability expectations.

- For instance, Inditex (Zara) implemented RFID-based traceability across more than 2,000 retail stores, using item-level tags and handheld readers to achieve nearly 100% inventory accuracy and a 15% reduction in out-of-stock incidents, directly supporting regulatory compliance for product traceability.

Market Trends:

Growing Adoption of Hybrid RFID Architectures Combining Active and Passive Tag Technologies

The Wide Area RFID Systems Market is witnessing a shift toward hybrid deployments that incorporate both active and passive tags within a single infrastructure. Organizations are leveraging the long-range capabilities of active tags for high-value or mobile assets, while using passive tags for high-volume, low-cost inventory items. This hybrid approach offers a balance of cost efficiency and performance, particularly in environments that require multi-tiered asset visibility. It allows businesses to optimize tracking systems according to asset criticality and movement frequency. Hybrid architectures reduce system redundancy and simplify network management. The trend is reshaping deployment strategies and enabling more tailored solutions across various industries.

- For example, EM Microelectronic has developed a comprehensive suite of hybrid tags and readers that seamlessly integrate both active and passive RFID technologies within a single infrastructure.

Integration of RFID with Blockchain for Enhanced Data Security and Supply Chain Transparency

Companies are increasingly exploring the combination of RFID and blockchain to strengthen data integrity and traceability across supply chains. Blockchain provides a decentralized ledger that securely records every transaction and asset movement captured by RFID systems. This integration helps prevent data tampering, supports regulatory compliance, and builds trust among stakeholders. It is particularly gaining traction in industries such as pharmaceuticals, luxury goods, and food processing, where counterfeit risks and safety standards are high. The Wide Area RFID Systems Market is benefiting from this convergence, as end-users seek more secure, auditable systems. The trend signals a growing demand for transparent, tamper-resistant solutions that go beyond standard RFID deployments.

Use of Drone-Mounted RFID Readers for Remote and Inaccessible Asset Monitoring

A rising trend in the Wide Area RFID Systems Market is the use of drones equipped with RFID readers to scan tags in remote, hazardous, or hard-to-reach areas. This approach enhances operational efficiency by eliminating the need for manual inspection in large-scale or elevated environments, such as warehouses, mining sites, and wind farms. It allows real-time, autonomous data collection over vast areas without human intervention. Drone-based systems reduce safety risks and improve coverage, especially for outdoor and mobile asset tracking. The adoption of this technology is transforming how companies approach large-area scanning and surveillance. It reflects the market’s shift toward automation and aerial intelligence in industrial operations.

- For instance, in a recent pilot program, drones equipped with RFID readers autonomously navigated warehouse aisles and scanned up to 1,000 items per second, achieving 99.9% inventory accuracy and processing over 80 million RFID reads across 1.25 million items in just three months.

Expansion of RFID-Enabled Smart Shelving and Infrastructure in Retail and Healthcare

Retailers and healthcare providers are implementing smart shelving systems embedded with wide area RFID technology to streamline stock management and service delivery. These shelves automatically detect the presence, quantity, and movement of tagged items, enabling accurate inventory control without manual checks. In retail, this supports just-in-time replenishment, theft prevention, and better customer service. In healthcare, it improves the management of medical supplies, pharmaceuticals, and patient tracking. The Wide Area RFID Systems Market is expanding with these applications, where infrastructure plays an active role in operational intelligence. This trend illustrates the growing demand for environment-embedded RFID systems that automate routine workflows.

Market Challenges Analysis:

High Initial Investment and Infrastructure Complexity Limiting Adoption Among Small Enterprises

The Wide Area RFID Systems Market faces challenges related to the high capital expenditure required for deployment, especially in large-scale or multi-site operations. Setting up long-range RFID systems demands investment in advanced readers, antennas, network infrastructure, and integration with enterprise resource planning (ERP) or IoT platforms. Small and medium-sized enterprises often struggle to justify these costs, particularly when the return on investment is not immediate. The complexity of installation, calibration, and maintenance further deters businesses with limited technical resources. It must also address concerns about system scalability and compatibility with legacy infrastructure, which can increase integration timelines and costs. The financial and technical barriers continue to slow adoption in cost-sensitive segments.

Signal Interference, Data Overload, and Environmental Limitations Affecting System Accuracy

Environmental factors and signal interference pose persistent technical challenges to wide area RFID deployment. Materials such as metal and liquids can disrupt radio wave transmission, leading to missed reads or inaccurate data collection. In crowded environments with numerous tags and readers, signal collision and data overload can reduce system efficiency. It must manage high volumes of real-time data without compromising accuracy or latency, especially in mission-critical applications. Performance issues can undermine user confidence and delay enterprise-wide rollouts. The Wide Area RFID Systems Market must overcome these limitations by advancing signal optimization techniques and improving tag-reader protocols to ensure consistent performance in diverse operating conditions.

Market Opportunities:

Expansion in Emerging Economies and Underserved Industrial Sectors Offering Untapped Potential

The Wide Area RFID Systems Market holds significant growth opportunities in emerging economies where industrial digitization is accelerating. Countries across Asia-Pacific, Latin America, and Africa are investing in infrastructure, logistics, and manufacturing modernization. These regions present untapped demand for scalable asset tracking and supply chain visibility solutions. Industries such as agriculture, construction, and mining remain largely underpenetrated by RFID technology. It can expand its footprint by offering tailored, cost-effective solutions suited to these sectors. Localized deployments and public-private partnerships can further drive adoption in these high-growth regions.

Rising Demand for Smart City and Public Infrastructure Integration Creating New Avenues

Smart city initiatives worldwide are incorporating RFID for intelligent transportation, waste management, and public asset monitoring. Urban planners and municipalities are leveraging long-range RFID systems for vehicle identification, tolling, and fleet tracking. The Wide Area RFID Systems Market can benefit from this trend by aligning its solutions with urban digital infrastructure. It can also support government-driven programs that emphasize transparency, efficiency, and automation in public services. This creates new use cases beyond traditional enterprise environments and opens opportunities in civic administration and public safety applications.

Market Segmentation Analysis:

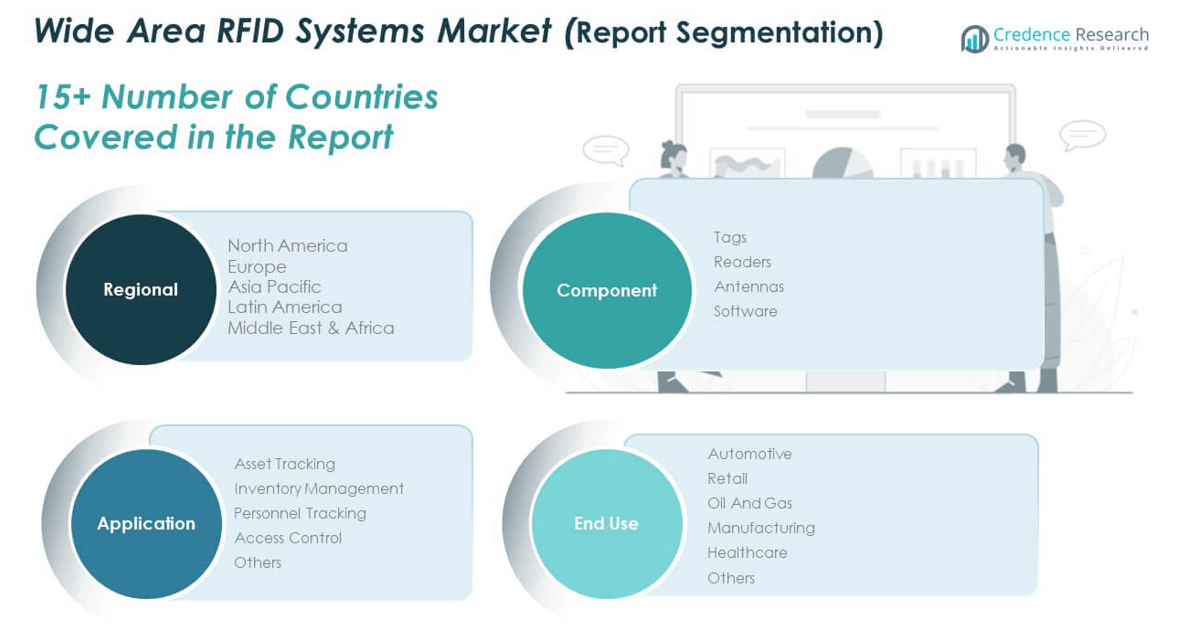

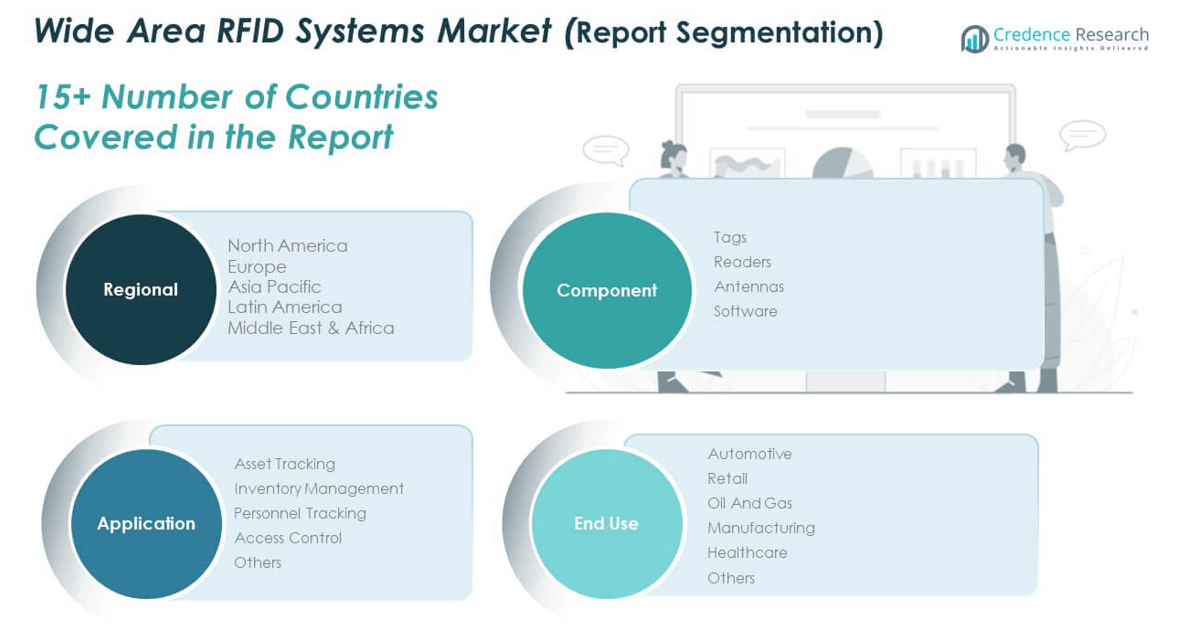

The Wide Area RFID Systems Market is segmented by component, application, and end use, each contributing distinct value to overall growth.

By component, tags hold the largest share due to their widespread deployment in logistics and manufacturing. Readers and antennas follow, driven by technological improvements in long-range communication and signal clarity. Software is gaining momentum with increasing demand for real-time data analytics, system integration, and cloud-based asset tracking platforms.

- For instance, BMW’s Regensburg plant integrated RFID tags on vehicle bodies and components, supporting automated assembly line routing and error-proofing. This deployment covers over 300,000 vehicles annually and has reduced production errors by 8% since implementation.

By application, asset tracking dominates the market, supported by strong adoption across supply chain and logistics operations. Inventory management also contributes significantly, with retailers and manufacturers prioritizing stock accuracy and loss prevention. Personnel tracking and access control segments are expanding within healthcare, oil and gas, and industrial facilities, where operational safety is critical.

- For example, Shell’s Gulf of Mexico oil and gas facilities use RFID-enabled badges for personnel tracking, ensuring compliance with safety protocols and enabling rapid evacuation during emergencies.

By end use, manufacturing leads demand due to automation initiatives and large-scale inventory control. The retail and automotive sectors follow closely, while oil and gas and healthcare are adopting wide-area RFID systems to improve safety, compliance, and equipment visibility. The market supports varied needs across industries, reinforcing its versatility and long-term relevance.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Segmentation:

By Component:

- Tags

- Readers

- Antennas

- Software

By Application:

- Asset Tracking

- Inventory Management

- Personnel Tracking

- Access Control

- Others

By End Use:

- Automotive

- Retail

- Oil and Gas

- Manufacturing

- Healthcare

- Others

By Region:

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis:

The North America Wide Area RFID Systems Market size was valued at USD 379.87 million in 2018 to USD 567.78 million in 2024 and is anticipated to reach USD 966.36 million by 2032, at a CAGR of 6.9% during the forecast period. North America holds a market share of 17.9% in the global Wide Area RFID Systems Market, driven by high levels of automation and early adoption of advanced asset tracking technologies. The United States leads regional growth, supported by strong infrastructure across logistics, retail, and defense sectors. It benefits from significant investments in real-time visibility solutions and the presence of key market players such as Impinj and Mojix. Healthcare and transportation are also contributing to adoption due to regulatory compliance needs and high-value asset tracking. Government support for digital transformation and supply chain transparency strengthens regional deployment. The market continues to evolve with the integration of RFID into enterprise-wide IoT platforms.

The Europe Wide Area RFID Systems Market size was valued at USD 490.75 million in 2018 to USD 752.19 million in 2024 and is anticipated to reach USD 1,326.75 million by 2032, at a CAGR of 7.4% during the forecast period. Europe accounts for a 23.8% share of the global Wide Area RFID Systems Market, led by widespread implementation in manufacturing, transportation, and retail sectors. Countries such as Germany, the United Kingdom, and France are at the forefront due to strong regulatory frameworks and investments in supply chain automation. The region prioritizes traceability and sustainability, which supports the adoption of RFID across food, pharma, and automotive industries. It sees rising integration of RFID with blockchain and cloud platforms for enhanced traceability. Demand for warehouse automation and contactless inventory tracking continues to rise. The market remains competitive and innovation-driven, supported by public and private sector collaboration.

The Asia Pacific Wide Area RFID Systems Market size was valued at USD 694.01 million in 2018 to USD 1,110.40 million in 2024 and is anticipated to reach USD 2,071.98 million by 2032, at a CAGR of 8.1% during the forecast period. Asia Pacific holds the largest regional share of 35.2% in the global Wide Area RFID Systems Market, fueled by rapid industrialization, expanding logistics networks, and e-commerce growth. China, India, Japan, and South Korea are key contributors due to strong manufacturing bases and government initiatives for digital infrastructure. Demand for smart warehousing, public transportation monitoring, and healthcare automation is accelerating adoption. The market benefits from a strong local ecosystem of hardware manufacturers and systems integrators. RFID integration with 5G and IoT platforms is enhancing application versatility. It shows the fastest growth rate, reflecting the region’s appetite for scalable and cost-efficient tracking solutions.

The Latin America Wide Area RFID Systems Market size was valued at USD 213.84 million in 2018 to USD 329.65 million in 2024 and is anticipated to reach USD 586.07 million by 2032, at a CAGR of 7.5% during the forecast period. Latin America contributes 10.3% to the global Wide Area RFID Systems Market, supported by growing adoption in retail, agriculture, and logistics. Brazil and Mexico lead regional development due to increased investment in supply chain modernization. Companies are adopting RFID for real-time asset tracking, inventory management, and theft prevention. Infrastructure constraints and high upfront costs remain challenges, but local deployments continue to expand. Public sector interest in RFID for urban management and public safety is growing. The market is gradually evolving with targeted adoption in high-value industries.

The Middle East Wide Area RFID Systems Market size was valued at USD 167.25 million in 2018 to USD 263.74 million in 2024 and is anticipated to reach USD 483.18 million by 2032, at a CAGR of 7.9% during the forecast period. The Middle East holds a 8.5% share in the global Wide Area RFID Systems Market, led by developments in the UAE and Saudi Arabia. The market is growing steadily due to increasing adoption in oil and gas, logistics, and healthcare sectors. RFID is being deployed in airport baggage tracking, port operations, and asset monitoring for critical infrastructure. Governments are investing in digital transformation and smart city initiatives, which support the use of wide-area tracking solutions. It faces barriers related to system complexity and integration, but enterprise interest is growing. The region shows strong demand for rugged and scalable RFID applications.

The Africa Wide Area RFID Systems Market size was valued at USD 88.91 million in 2018 to USD 138.60 million in 2024 and is anticipated to reach USD 250.12 million by 2032, at a CAGR of 7.7% during the forecast period. Africa holds a 4.4% market share in the global Wide Area RFID Systems Market, with slow but steady growth driven by urban development and industrial projects. South Africa leads adoption, particularly in logistics, healthcare, and retail environments. RFID is gaining attention in public transportation and agriculture, where asset visibility remains limited. Budget constraints, technical skill gaps, and infrastructure barriers slow broader deployment. International vendors and partnerships are expanding access to affordable solutions. The market shows potential with increased support for automation in key economic sectors.

Key Player Analysis:

- Alien Technology

- Avery Dennison Corporation

- Checkpoint Systems, Inc.

- GAO RFID Inc.

- Honeywell International Inc.

- Impinj, Inc.

- Nedap N.V.

- NXP Semiconductors N.V.

- Omni-ID, Ltd.

- RF Code, Inc.

- SATO Holdings Corporation

- Siemens AG

- Other Key Players

Competitive Analysis:

The Wide Area RFID Systems Market features a competitive landscape shaped by innovation, strategic partnerships, and regional expansion. Key players such as Impinj, Mojix, GAO RFID, Zebra Technologies, and Guard RFID Solutions lead with differentiated portfolios and strong R&D capabilities. These companies focus on extending read range, enhancing data accuracy, and integrating with IoT and cloud-based platforms. New entrants and niche players target specific verticals with cost-effective or application-specific solutions. It remains dynamic as firms compete on product performance, scalability, and interoperability with enterprise systems. Mergers, acquisitions, and collaborations are common strategies to strengthen geographic presence and accelerate technology adoption. The market rewards agility and technical expertise, favoring vendors that can deliver end-to-end solutions tailored to complex industrial environments.

Recent Developments:

- In June 2025, Bold Reuse, in partnership with Avery Dennison, launched a smart RFID pilot at Portland venues on June 23, 2025. The pilot focuses on reusable packaging and aims to improve tracking and sustainability efforts through RFID adoption.

- In May 2025, Powercast introduced a wirelessly powered, battery-free RAIN RFID sensor condition monitoring system tailored for data center environments. It received the RFID Journal LIVE! 2025 Best New Product Award on May 8, 2025, for its innovative ability to power itself via RF signals and deliver maintenance-free environmental monitoring in server racks.

Market Concentration & Characteristics:

The Wide Area RFID Systems Market demonstrates moderate market concentration, with a mix of established global players and emerging regional firms. It is characterized by continuous innovation, high customization, and demand for interoperability with enterprise and IoT ecosystems. Vendors compete by offering scalable solutions with extended range, low latency, and robust data analytics capabilities. The market favors companies that provide full-stack offerings, from hardware to software integration. Demand spans across diverse sectors, including logistics, healthcare, manufacturing, and public infrastructure, each requiring tailored applications. It evolves rapidly due to advancements in RFID protocols, power efficiency, and integration with cloud and AI platforms. The competitive environment encourages strategic alliances and technology-driven differentiation.

Report Coverage:

The research report offers an in-depth analysis based on component, application, and end use. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Increasing adoption of RFID in logistics and warehouse automation will boost market demand globally.

- Integration with IoT and AI platforms will enhance data analytics and asset intelligence.

- Expansion in emerging economies will create new growth opportunities for vendors.

- Demand for long-range, energy-efficient RFID tags will drive product innovation.

- Smart city projects will accelerate deployment in transportation and public infrastructure.

- Healthcare sector will adopt RFID for patient tracking and inventory management.

- Retailers will implement wide area RFID for real-time inventory visibility and theft reduction.

- Strategic partnerships between RFID providers and cloud service firms will shape future solutions.

- Regulatory mandates around traceability and data transparency will support long-term adoption.

- Drone and robotic integration will open new use cases in remote and industrial environments.