Market Overview:

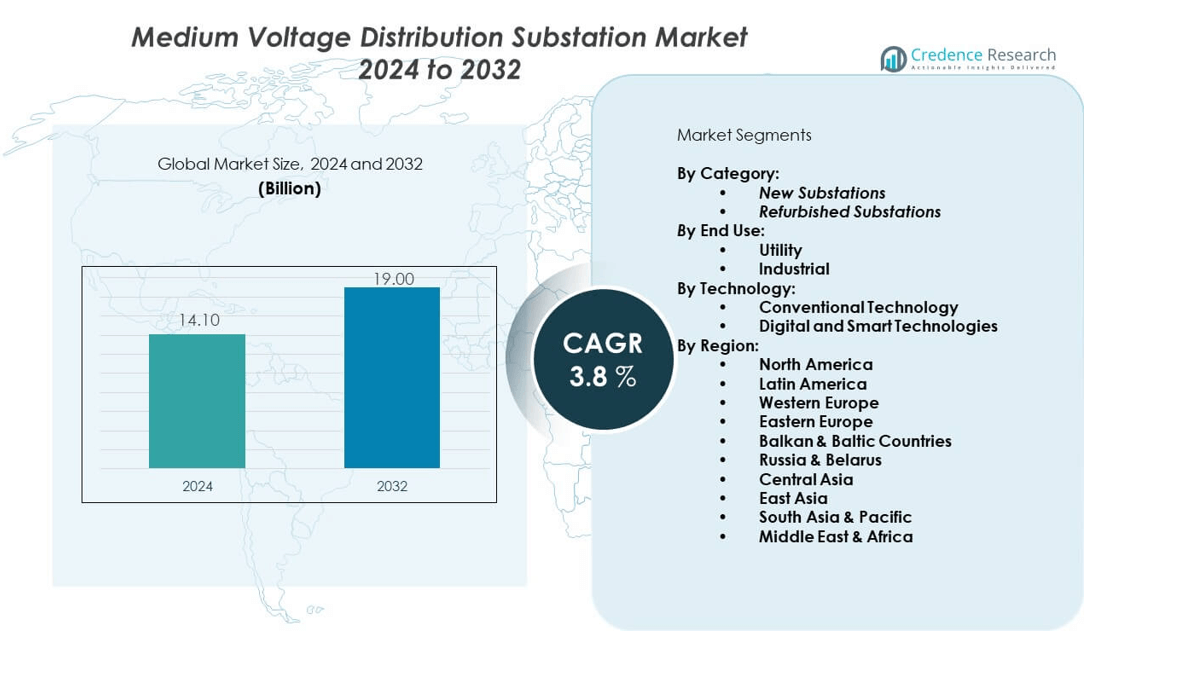

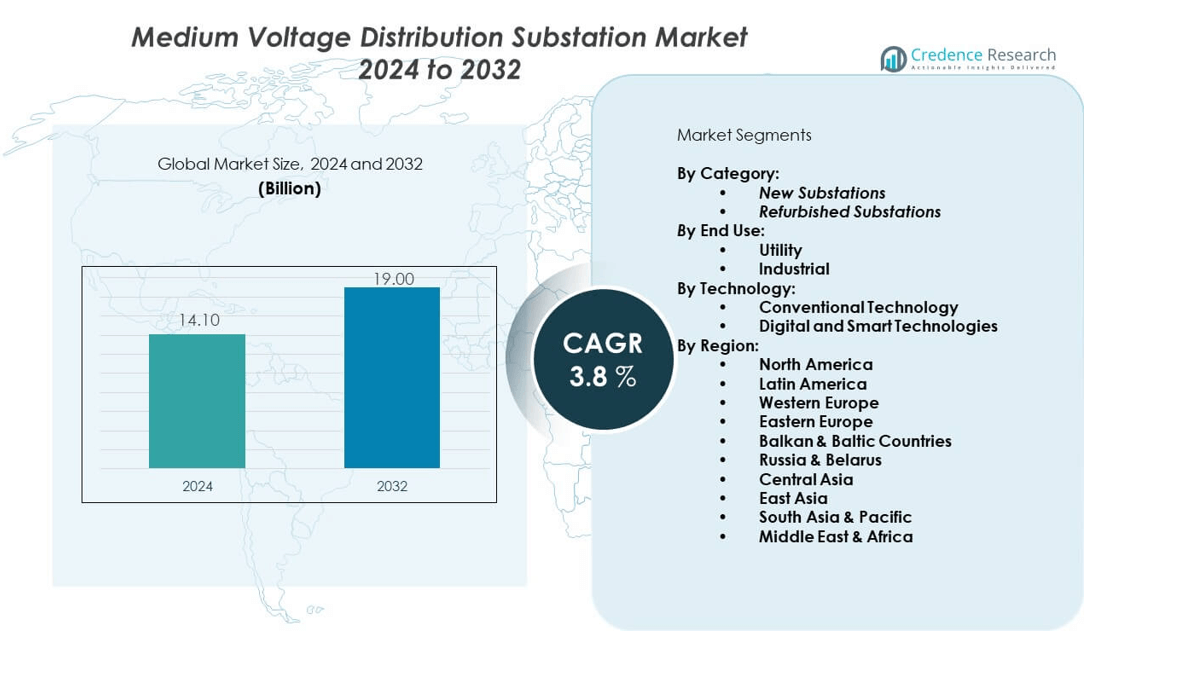

The medium voltage distribution substation market is projected to grow from USD 14.1 billion in 2024 to an estimated USD 19 billion by 2032, at a CAGR of 3.8% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Medium Voltage Distribution Substation Market Size 2024 |

USD 14.1 billion |

| Medium Voltage Distribution Substation Market, CAGR |

3.8% |

| Medium Voltage Distribution Substation Market Size 2032 |

USD 19 billion |

Growth in this market is driven by rapid urbanization, rising industrialization, and increasing electricity consumption across residential and commercial sectors. Governments are investing in grid modernization and renewable energy integration, creating a strong need for medium voltage substations. The shift toward smart grids and digital monitoring solutions further boosts adoption, while ongoing upgrades in aging infrastructure across developed economies ensure steady demand. Emerging economies are expanding their transmission and distribution networks, reinforcing the market’s growth momentum.

Asia Pacific leads the medium voltage distribution substation market due to large-scale urban development, rising electricity demand, and major infrastructure investments in countries such as China and India. North America and Europe follow, supported by strong initiatives in grid modernization, renewable energy integration, and replacement of old substations. Latin America and the Middle East & Africa represent emerging markets, where growing urbanization, industrial expansion, and government focus on electrification projects are creating new opportunities for substation deployment and capacity enhancement.

Market Insights:

- The medium voltage distribution substation market was valued at USD 14.1 billion in 2024 and is projected to reach USD 19 billion by 2032, registering a CAGR of 3.8% during the forecast period.

- Demand is fueled by urbanization, industrial growth, and rising electricity consumption across residential, commercial, and manufacturing sectors.

- Integration of renewable energy sources such as solar and wind into local grids strengthens the need for modern substations.

- High capital investment requirements and complex regulatory approvals remain key restraints for market expansion.

- Modernization of aging grid infrastructure and adoption of smart, automated substations create significant growth opportunities.

- Asia Pacific leads the market with strong investments in power infrastructure, industrial zones, and urban electrification projects.

- North America and Europe show steady growth from modernization and renewable integration, while Latin America and Middle East & Africa emerge as promising markets through expanding electrification and industrial activity.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers:

Growing Urbanization and Expanding Power Demand Across Multiple End-User Sectors:

The medium voltage distribution substation market is strongly driven by rising urbanization and rapid growth in electricity consumption. Expanding cities require stable and uninterrupted power distribution to support residential, commercial, and industrial facilities. It ensures efficient transfer of electricity from high-voltage transmission lines to local distribution networks. Governments and private operators are making heavy investments in transmission and distribution infrastructure to reduce outages. Growing consumer demand for reliable electricity access supports adoption of new substations. Aging distribution systems in developed regions also need replacement to meet current load requirements. Emerging nations are developing large housing projects, industrial clusters, and IT hubs. Substations remain critical in addressing this rising demand with improved grid reliability.

- For instance, ABB supplied 220 kV medium-voltage substations in India, enhancing grid reliability for Delhi Metro and enabling continuous power supply to more than 2.7 million daily passengers.

Rising Integration of Renewable Energy Sources Into Existing Grid Infrastructure:

The global shift toward clean energy is a powerful driver of the medium voltage distribution substation market. Renewable power generation through solar and wind requires advanced substations for smooth integration into local grids. It balances variable power flows while preventing instability in supply lines. Utility providers are expanding grid connections to rural and semi-urban areas, where renewable projects are growing rapidly. Medium voltage substations improve the efficiency of renewable energy utilization by stabilizing supply fluctuations. Governments are enforcing regulations that push for renewable integration with smart distribution infrastructure. Renewable expansion is also driving investments in digital substations with real-time monitoring systems. This transition ensures reliable power delivery from green sources to end-users.

- For instance, Siemens Energy delivered a digital substation solution for the Amrumbank West offshore wind farm in Germany, supporting integration of 302 MW wind power into the grid.

Growing Industrialization and Electrification Across Manufacturing and Heavy-Duty Applications:

Industrial expansion contributes significantly to the growth of the medium voltage distribution substation market. Rising demand from sectors such as steel, cement, chemicals, and automotive requires stable and scalable distribution networks. It ensures consistent energy supply for high-capacity machinery and manufacturing operations. Expanding industrial zones in emerging economies need reliable power infrastructure to maintain competitiveness. Government policies encouraging industrial growth create further demand for substations. Electrification of heavy-duty applications in mining, oil and gas, and construction also supports growth. Power reliability enhances operational efficiency and prevents costly downtime in large-scale production units. Substations play a central role in strengthening industrial supply chains with stable power.

Modernization of Existing Grids and Introduction of Digital Distribution Technologies:

The modernization of power grids is another key factor advancing the medium voltage distribution substation market. Developed economies are focusing on replacing outdated infrastructure with advanced substations. It enables utilities to incorporate automation, digital monitoring, and smart control systems. Modern substations reduce transmission losses and optimize power allocation across networks. Governments in Europe and North America are investing in digital grids to meet efficiency goals. Developing regions are also starting modernization projects to align with future energy demands. Smart substations enable predictive maintenance, which lowers operational costs and improves asset lifespan. This push toward modernized infrastructure strengthens adoption rates worldwide.

Market Trends:

Rising Adoption of Smart and Automated Substation Technologies:

Smart technology adoption is emerging as a major trend in the medium voltage distribution substation market. Utilities and governments are implementing automated systems to monitor, control, and analyze energy flows. It reduces downtime and enhances grid stability with predictive maintenance features. Substations are increasingly equipped with advanced sensors and IoT-enabled devices for real-time monitoring. Data-driven insights allow faster decision-making during grid fluctuations. Automation also helps improve safety by reducing reliance on manual interventions. Growing focus on digital transformation in power utilities is strengthening this trend. These innovations mark a shift toward fully intelligent substations.

- For instance, General Electric’s (GE) Grid Solutions deployed an automated digital substation platform in France capable of processing 15,000 data points per second for predictive fault detection.

Expanding Use of Gas-Insulated Substations for Compact and Urban Installations:

Gas-insulated substations are gaining popularity in the medium voltage distribution substation market due to space constraints in urban areas. Utilities prefer compact designs that reduce land use without compromising performance. It offers high reliability, low maintenance, and enhanced safety features. Rising demand for energy in megacities is fueling adoption of these advanced solutions. Governments are encouraging the use of space-efficient designs in crowded metropolitan areas. Gas-insulated substations also support renewable integration with minimal footprint. Cost efficiency over long-term operation further makes them attractive. Their deployment is set to increase steadily across both developed and developing economies.

- For instance, Hitachi Energy delivered a 132 kV gas-insulated substation in Dubai within a 40% smaller footprint compared to conventional systems, enabling efficient power delivery in congested urban space.

Rising Adoption of Hybrid Substations for Flexible and Scalable Grid Applications:

Hybrid substations, combining air-insulated and gas-insulated systems, represent a growing trend in the medium voltage distribution substation market. This approach delivers both space efficiency and cost optimization benefits. It addresses the needs of utilities operating across diverse terrains and environments. Hybrid designs provide flexible solutions for expanding distribution networks in semi-urban and rural regions. Utilities can scale up infrastructure without complete redesigns, enhancing adaptability. Growing industrial projects in developing regions support wider adoption of hybrid systems. It helps balance investment costs while ensuring long-term efficiency. Hybrid substations are steadily shaping the future of distribution infrastructure.

Growing Emphasis on Cybersecurity and Digital Protection in Substation Operations:

The increasing digitalization of power networks has raised cybersecurity as a vital trend in the medium voltage distribution substation market. Substations equipped with advanced monitoring systems face risks of cyberattacks. It has prompted utilities to invest heavily in secure communication protocols and advanced firewalls. Governments are enforcing regulations on cybersecurity compliance for critical energy infrastructure. Vendors are offering integrated solutions that combine power management with threat detection systems. Cyber resilience is now a priority in digital substation projects across the globe. Growing interconnection of grids increases the urgency for security upgrades. The market is witnessing rising demand for solutions that ensure digital safety and operational reliability.

Market Challenges Analysis:

High Capital Costs and Complex Deployment Requirements for Substation Projects:

The medium voltage distribution substation market faces challenges from high capital requirements and complex installation needs. Substation projects demand large upfront investments that can delay implementation, especially in developing regions. It requires advanced equipment, skilled labor, and regulatory approvals, which often extend timelines. Urban land scarcity further complicates deployment in crowded cities. Utilities in emerging economies struggle with financing constraints that slow down grid expansion. Integration of new substations into existing power networks also involves technical hurdles. Vendors face pressure to balance cost efficiency with performance. These barriers limit the pace of large-scale adoption in several regions.

Regulatory Compliance and Environmental Impact Concerns in Distribution Infrastructure Expansion:

Regulatory frameworks create significant challenges in the medium voltage distribution substation market. Stringent approval processes extend project timelines and increase costs for utilities. It requires compliance with environmental, safety, and grid efficiency standards. Governments demand strict adherence to emission and noise regulations in urban deployments. Rising awareness of ecological impacts adds more scrutiny to infrastructure projects. Environmental activists often resist large substation developments near residential zones. Utility operators face added costs for adopting eco-friendly materials and processes. Meeting these diverse requirements without slowing down grid expansion is a key challenge. Vendors must align innovations with evolving regulatory landscapes.

Market Opportunities:

Expanding Demand in Emerging Economies and Rural Electrification Projects:

The medium voltage distribution substation market is witnessing strong opportunities in emerging economies. Rapid industrial growth and rural electrification initiatives are driving large investments in new substations. It provides reliable electricity to underserved populations and strengthens local development. Expanding infrastructure projects in Asia, Africa, and Latin America enhance market scope. Governments are partnering with private firms to accelerate deployment timelines. Substations supporting renewable projects in rural regions create further prospects. Rising disposable income and industrial activity ensure long-term demand. Vendors focusing on emerging markets stand to gain significant revenue.

Integration With Advanced Energy Storage and Smart Grid Solutions:

Integration with energy storage and smart grid technologies creates promising opportunities for the medium voltage distribution substation market. It enables better balancing of renewable power fluctuations and peak demand cycles. Utilities are investing in storage-backed substations to improve grid flexibility. Smart grids integrated with digital substations enhance efficiency and monitoring capabilities. Demand for electric vehicles and charging stations further supports deployment of advanced substations. Governments are funding smart infrastructure upgrades to meet climate goals. Vendors offering combined solutions of substations and storage gain a competitive edge. This opportunity will drive innovation and partnerships across the sector.

Market Segmentation Analysis:

By Category

The medium voltage distribution substation market is divided into new substations and refurbished substations. New substations dominate due to rapid urbanization, industrial expansion, and grid development projects in emerging economies. Governments prioritize new installations to expand electrification and meet rising demand. Refurbished substations hold steady demand in developed regions, where modernization of aging grids is cost-effective and aligned with sustainability goals. It enables utilities to extend asset life while integrating modern features.

- For example, in 2024 Schneider Electric accelerated deployment of its EcoStruxure™ Grid Automation platform for new substations, enabling the integration of AI-powered diagnostics and supporting over 15,000 real-time monitoring points per substation, as cited in its Universal Registration Document.

By End Use

Utilities represent the largest segment, driven by national electrification initiatives, renewable integration, and the need for grid reliability. Industrial adoption is rising with increased electricity demand from sectors such as manufacturing, mining, and oil and gas. Industries prefer advanced substations to ensure uninterrupted operations and reduce downtime. Both segments continue to expand with growing emphasis on reliable and efficient power supply.

- For example, Schneider Electric’s recent projects with utility partners added 127 million tonnes of CO₂ savings for customers in 2024 alone and expanded access to green electricity to over 23.6 million people since 2020, directly from the company’s sustainability report.

By Technology

Conventional technology holds the majority share, accounting for 61% of market revenue in 2025. Utilities continue to rely on conventional systems for stable performance and cost advantages in large-scale operations. Digital and smart technologies are gaining momentum with the adoption of IoT, automation, and predictive maintenance. It strengthens operational efficiency, reduces energy losses, and supports integration of distributed energy resources. The transition toward digital substations highlights the market’s movement to smarter and more resilient infrastructure.

Segmentation:

By Category:

- New Substations

- Refurbished Substations

By End Use:

By Technology:

- Conventional Technology (holding 61% market revenue share in 2025)

- Digital and Smart Technologies

By Region:

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis:

North America and Europe

North America holds around 24% of the medium voltage distribution substation market, supported by strong grid modernization programs and renewable energy integration. The United States leads with extensive investments in smart grid technology and upgrades of aging infrastructure. Canada follows with rising demand for substations in renewable projects and rural electrification. Europe accounts for nearly 21% of the market, driven by strict regulatory frameworks and commitments to sustainability. Countries such as Germany, France, and the UK prioritize digital substations to align with clean energy targets. It continues to strengthen through investment in compact and gas-insulated designs that suit urban environments. Both regions maintain steady growth through modernization and green energy policies.

Asia Pacific

Asia Pacific dominates with nearly 38% share of the medium voltage distribution substation market. China leads with rapid urbanization, industrial expansion, and ambitious renewable energy projects. India follows with strong government-backed electrification initiatives and rural development programs. Japan and South Korea contribute through advanced digital substation deployments integrated with automation technologies. Southeast Asia is witnessing rising demand as industrial hubs expand and urban populations grow. It remains the fastest-growing regional market due to large infrastructure investments and ongoing economic development. The region is expected to maintain leadership with continuous growth in utility and industrial applications.

Latin America, Middle East & Africa, and Central & Eastern Regions

Latin America contributes around 7% of the medium voltage distribution substation market, supported by energy projects in Brazil, Mexico, and Argentina. Middle East & Africa hold close to 10%, with demand fueled by electrification programs, industrialization, and renewable energy expansion in GCC countries and South Africa. Central and Eastern Europe, including Russia, Belarus, Balkan, and Baltic countries, account for about 8% of the market. These regions are investing in both refurbishment and new installations to stabilize power supply. Central Asia is also emerging as an attractive market with rising industrial demand and government focus on infrastructure development. It continues to create opportunities through combined modernization and electrification strategies.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- Siemens

- Schneider Electric

- ABB

- Eaton

- General Electric

Competitive Analysis:

The medium voltage distribution substation market is highly competitive, with global players such as Siemens, ABB, Schneider Electric, Eaton, and General Electric dominating market share. It is defined by strong technological innovation and continuous investment in smart and digital substations. Companies focus on expanding portfolios with gas-insulated and hybrid solutions to meet urban space constraints and renewable integration. Regional players compete by offering cost-effective refurbishment services and localized solutions. Strategic alliances, partnerships, and acquisitions strengthen the global presence of established firms. The market reflects a balance between established multinationals leveraging advanced technologies and emerging players offering flexible, low-cost deployments.

Recent Developments:

- In April 2025, Schneider Electric partnered with EAM Netz in Germany to implement SF₆-free medium voltage switchgear technology called GM AirSeT. This new equipment uses pure air for insulation and vacuum interruption, replacing environmentally harmful SF₆ gas, and supports advanced digital monitoring for real-time health insights, facilitating the energy transition and local sustainability goals.

- In February 2025, Eaton introduced its Xiria NGX, a compact medium voltage switchgear platform combining up to 24 kV, 1250 A, and 25 kA ratings with natural air insulation technology. This modular system targets high-end secondary switchgear applications in distribution substations, commercial, and industrial sectors, focusing on safety, reliability, and environmental sustainability.

- In June 2025, GE Vernova formed a new partnership with MIT to advance energy innovation research. The collaboration aims to accelerate development in grid technologies supporting modern medium voltage systems. This partnership reflects GE’s commitment to driving digital and sustainable advancements in power distribution.

Report Coverage:

The research report offers an in-depth analysis based on category, end use, and technology. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Rising demand for reliable power supply will drive new substation installations.

- Refurbishment projects in developed economies will expand due to aging infrastructure.

- Utilities will accelerate adoption of smart and digital substations.

- Hybrid substations will gain prominence for balancing cost and flexibility.

- Renewable energy integration will remain a key growth driver.

- Asia Pacific will continue to dominate market growth.

- Urbanization and industrialization in emerging regions will fuel demand.

- Compact gas-insulated substations will see wider deployment in megacities.

- Cybersecurity and digital resilience will become critical investment areas.

- Partnerships and acquisitions will strengthen competitive positions of global players.