Market Overview:

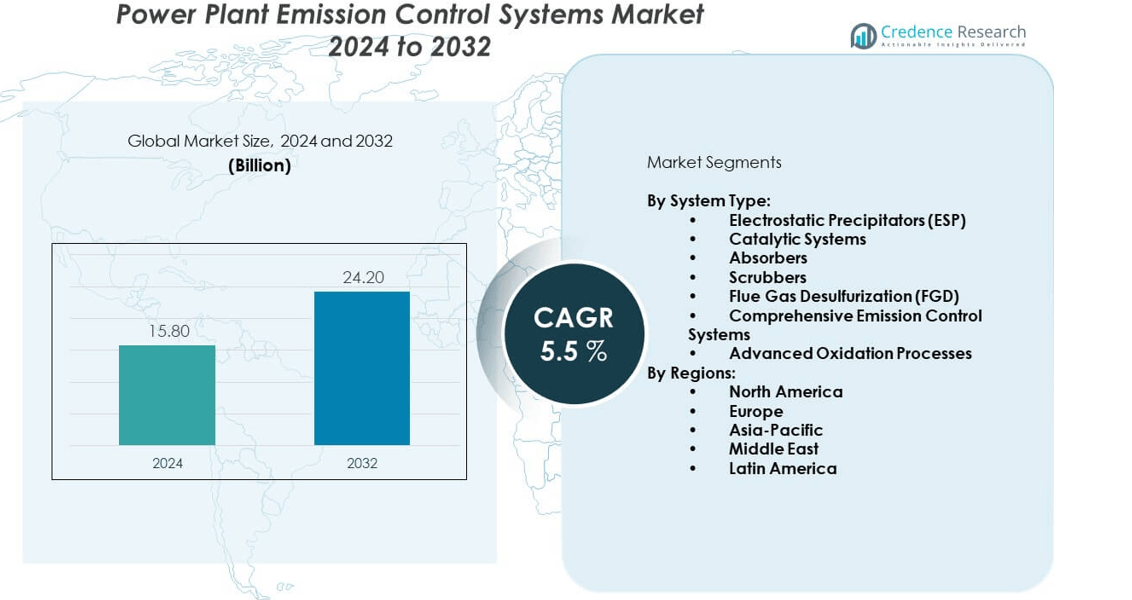

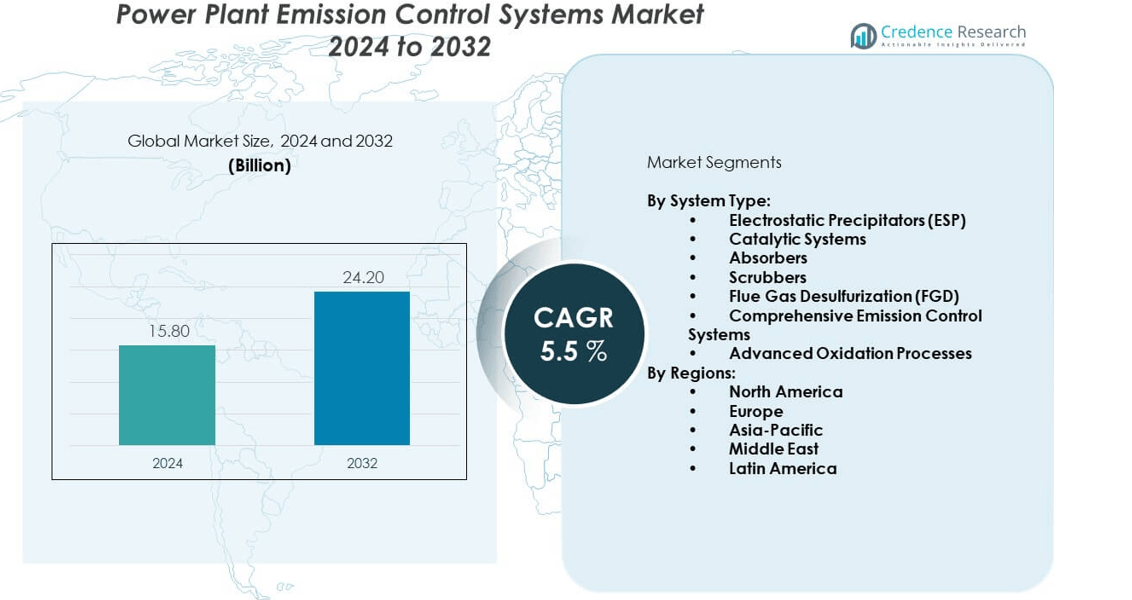

The Power plant emission control systems market is projected to grow from USD 15.8 billion in 2024 to USD 24.2 billion by 2032, registering a CAGR of 5.5% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Power Plant Emission Control Systems Market Size 2024 |

USD 15.8 billion |

| Power Plant Emission Control Systems Market, CAGR |

5.5% |

| Power Plant Emission Control Systems Market Size 2032 |

USD 24.2 billion |

Growing regulatory pressure drives this market as governments impose strict emission norms to curb air pollution. Power plants adopt advanced systems such as flue gas desulfurization, selective catalytic reduction, and electrostatic precipitators to meet standards. Increasing public awareness of health hazards linked to emissions, along with the transition toward sustainable energy practices, fuels demand. Continuous innovation in control technologies enhances efficiency and cost-effectiveness, pushing utilities and independent producers to modernize facilities and maintain environmental accountability.

North America and Europe lead the power plant emission control systems market due to mature regulatory frameworks and high investments in cleaner technologies. Asia-Pacific is emerging rapidly, with China and India pushing adoption to manage rising coal-based power generation and urban pollution challenges. Latin America and the Middle East are also gaining traction, supported by industrial expansion and policy shifts toward emission reduction. Regional growth reflects a mix of regulatory enforcement, economic capacity, and energy demand trends across global power sectors.

Market Insights:

- The power plant emission control systems market is projected to grow from USD 15.8 billion in 2024 to USD 24.2 billion by 2032, at a CAGR of 5.5%.

- Strict environmental regulations on SOx, NOx, and particulate matter emissions are driving widespread adoption of advanced systems.

- Rising public awareness about health impacts of air pollution is pushing governments and utilities toward clean energy compliance.

- High capital and operational costs remain key restraints, limiting adoption in smaller utilities and developing economies.

- Aging infrastructure in emerging markets slows modernization, as operators prioritize energy availability over emission reduction.

- North America and Europe lead due to strict laws and advanced technologies, while Asia-Pacific shows the fastest growth with China and India focusing on pollution control.

- Middle East and Latin America are gradually expanding adoption, supported by natural gas expansion and industrialization trends.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers

Growing Stringency of Global Environmental Regulations Driving Adoption of Advanced Emission Control Systems:

Governments worldwide are enforcing tighter rules on carbon dioxide, sulfur oxides, and nitrogen oxides emissions from coal and gas-fired plants. These regulations are creating strong demand for advanced control systems. The power plant emission control systems market benefits as plants upgrade operations to avoid penalties and ensure compliance. It supports a global shift toward cleaner power generation. Utilities are investing heavily in technologies like flue gas desulfurization and selective catalytic reduction. These systems reduce harmful pollutants and extend plant viability. The adoption trend is expanding rapidly in developed economies with strict legal frameworks. Emerging nations are also adopting such policies to improve air quality.

- For instance, Babcock & Wilcox’s BrightLoop™ hydrogen production technology has demonstrated nearly 100% coal conversion with high purity hydrogen and carbon dioxide streams, supporting carbon capture and low-carbon energy production, helping plants meet strict emissions targets effectively.

Rising Public Awareness of Health Impacts from Industrial Emissions Encouraging Technology Deployment:

Public concern about air pollution and its link to respiratory and cardiovascular diseases is rising globally. Governments respond with stricter public health mandates, creating pressure on power producers. The power plant emission control systems market is directly impacted as companies adopt efficient filtering and scrubbing solutions. Public awareness campaigns further highlight the urgency of clean energy solutions. It reinforces government programs promoting emissions reduction technology adoption. Utilities face growing public scrutiny over emissions data, driving faster compliance. This encourages firms to replace outdated systems with modern, efficient solutions. The rising health burden associated with air pollution makes this driver even stronger.

- For instance, ABB’s integration of AI and digital sensor technologies in emission monitoring has enabled utilities to reduce operational downtime by optimizing maintenance, thus ensuring continuous compliance with health-driven emissions standards.

Rising Global Power Demand and Continued Dependence on Thermal Power Plants Supporting Technology Growth:

Global electricity demand continues to increase, with coal and gas still playing a major role in supply. This dependence sustains the demand for reliable emission control systems. The power plant emission control systems market grows as operators modernize plants for efficiency and compliance. It helps utilities balance energy production with environmental obligations. High electricity needs in developing economies reinforce the relevance of coal and gas power. Operators invest in advanced filtration and monitoring technologies to maintain competitiveness. Strong industrialization and urbanization trends strengthen this demand further. Emission control systems become a necessity for sustainable power generation.

Technological Advancements Enhancing Efficiency and Cost-Effectiveness of Emission Control Systems:

Innovation in emission control solutions has led to systems that reduce pollutants more efficiently. Breakthroughs in electrostatic precipitators, catalytic filters, and carbon capture drive adoption. The power plant emission control systems market benefits as solutions become more affordable and scalable. It ensures broader acceptance across developed and developing regions. R&D efforts improve cost efficiency, encouraging operators to upgrade older units. Integration of IoT-enabled monitoring enhances operational visibility and real-time compliance. These innovations ensure plants remain competitive under tightening environmental rules. Continuous upgrades in technology strengthen the long-term growth of the market.

Market Trends:

Increasing Integration of Digital Monitoring and Smart Technologies in Emission Control Systems:

Power producers are investing in smart sensors and AI-driven platforms for monitoring emissions. Digitalization improves predictive maintenance and enhances regulatory reporting accuracy. The power plant emission control systems market experiences growth from this trend as utilities adopt intelligent platforms. It enables better transparency in compliance with environmental standards. AI-based tools allow early detection of system inefficiencies. Real-time monitoring also reduces operational downtime and optimizes maintenance schedules. Utilities recognize the value of integrating emission data with broader energy management platforms. Digitalization creates an important shift toward smarter compliance management.

- For instance, Honeywell’s deployment of its JetWave™ X high-speed satellite communication system enhances real-time data transmission for critical infrastructure, enabling improved monitoring and control of emission parameters on airborne and ground platforms.

Expanding Role of Renewable Energy Integration Influencing Hybrid Power Plant Emission Strategies:

The global shift toward renewables reduces overall emissions but sustains hybrid generation models. Traditional plants are paired with solar or wind power for efficiency. The power plant emission control systems market adapts to these models by deploying flexible solutions. It ensures compliance even in plants with mixed fuel use. Hybrid models create unique challenges in emission patterns requiring adaptive controls. Utilities adopt modular systems to handle variable loads. This trend reflects broader sustainability goals while maintaining energy security. It also highlights the ongoing relevance of control systems even during energy transitions.

- For instance, Infosys aims to implement digital platforms that help manage hybrid energy systems’ emissions, ensuring compliance and optimal operation amidst fuel variability.

Growing Adoption of Carbon Capture and Storage (CCS) as a Long-Term Sustainability Strategy:

Many countries invest in carbon capture and storage to meet decarbonization targets. CCS technologies reduce greenhouse gas emissions and extend the viability of thermal plants. The power plant emission control systems market benefits by integrating CCS into broader emission solutions. It creates long-term opportunities for companies developing capture-ready plants. Governments and private players are expanding CCS pilot projects. Deployment of large-scale carbon capture facilities strengthens the role of emission technologies. Public and private investments reinforce CCS as a major emission reduction pathway. This trend highlights the integration of emission control with climate goals.

Rising Focus on Regional Energy Transition Policies Creating Diverse Growth Patterns Globally:

Regional differences in policies are shaping the market in distinct ways. Developed nations enforce stricter norms and promote cleaner technology adoption. The power plant emission control systems market sees strong uptake in these regions. It faces growing demand in Asia-Pacific where coal still dominates power generation. Middle Eastern countries invest in natural gas plants with advanced emission technologies. Latin America follows a moderate adoption path due to slower industrial growth. Regional strategies define the type and scale of emission control technologies adopted. These diverse patterns reflect different energy transition stages globally.

Market Challenges Analysis:

High Capital Costs and Operational Complexity Creating Barriers for Adoption Among Smaller Operators:

Installing advanced emission control systems requires significant upfront investment. Smaller utilities often lack resources to adopt high-cost technologies quickly. The power plant emission control systems market faces hurdles where financial support is limited. It impacts adoption rates in developing economies where budget constraints remain. Operational complexity further increases maintenance costs. Utilities need specialized staff to manage sophisticated systems. This raises the total cost of ownership and limits faster deployment. Financial and technical constraints continue to slow widespread adoption.

Dependence on Aging Infrastructure and Slow Transition in Developing Economies Hindering Market Growth:

Many regions still rely on outdated plants with limited ability to integrate modern systems. The power plant emission control systems market struggles with slow upgrades in such areas. It reflects the broader challenge of balancing power demand with environmental sustainability. Governments in developing economies prioritize energy availability over emission goals. This often delays major investments in control systems. Aging infrastructure raises risks of non-compliance but replacement is costly. Political and economic factors also affect investment decisions. These challenges create uneven growth patterns globally.

Market Opportunities:

Rising Global Investments in Clean Energy Infrastructure Opening New Growth Avenues for Emission Technologies:

Governments and private players are allocating funds to cleaner power generation projects. This creates opportunities for emission control technologies to expand adoption. The power plant emission control systems market gains relevance as plants integrate hybrid systems. It supports transition strategies while keeping emissions in check. Operators are incentivized to adopt systems that align with long-term environmental goals. Growing project pipelines in Asia-Pacific and North America provide strong demand. It allows system providers to expand their global footprint.

Emergence of Advanced Modular and Retrofitting Solutions Creating Scalable Market Potential:

New modular systems offer flexible deployment options for diverse plant sizes. Retrofitting old plants with efficient systems is becoming more cost-effective. The power plant emission control systems market benefits by catering to operators extending plant lifespans. It allows compliance without building entirely new facilities. Companies offering modular retrofitting solutions are gaining significant contracts. This expands opportunities across developed and emerging economies. Flexibility and scalability make retrofitting a strong market growth driver.

Market Segmentation Analysis:

Electrostatic Precipitators (ESP)

Electrostatic precipitators remain one of the most established solutions in the power plant emission control systems market. They are widely adopted for their ability to capture fine particulate matter effectively. ESPs are especially important in coal-fired plants where dust and ash volumes are high. Their reliability and relatively low maintenance needs make them a long-term choice. It continues to be used across both developed and emerging economies. The technology supports compliance with air quality standards. Utilities invest in ESP upgrades to meet stricter regulations. This segment holds steady demand as particulate removal remains a priority.

- For instance, S.A. Hamon provides upgraded ESP systems capable of treating flue gas streams from plants burning over 2 million tons of coal annually, improving particulate collection efficiency to meet tightened emission norms.

Catalytic Systems (Including Selective Catalytic Reduction – SCR)

Catalytic systems are critical for controlling nitrogen oxide emissions. Selective catalytic reduction (SCR) dominates this segment with proven efficiency levels. The power plant emission control systems market benefits from strong adoption in Europe and North America. These regions enforce strict air quality norms for NOx reduction. It provides utilities with effective compliance solutions while supporting environmental commitments. SCR systems are also being deployed in Asia-Pacific as urban air quality concerns rise. Their integration in large-scale plants makes them a preferred option. Strong regulatory pressure ensures this segment’s continued growth globally.

- For instance, FLSmidth Cement has supplied SCR solutions that achieved NOx emission reductions of up to 90% at coal-fired power plants in Europe, meeting stringent EU air quality directives.

Absorbers and Scrubbers

Absorbers and scrubbers play a versatile role in reducing a wide range of pollutants. They are widely applied in coal and natural gas power stations. Their ability to capture acidic gases makes them valuable for diverse plant setups. The power plant emission control systems market relies on these systems to manage multiple emission categories. It reflects their adaptability in both industrial and utility-scale operations. Scrubbers are strongly deployed in North America and Asia-Pacific. Their use ensures compliance with particulate and gas emission regulations. Continuous demand for flexible systems supports the relevance of this segment.

Flue Gas Desulfurization (FGD)

Flue gas desulfurization technologies are dominant in reducing sulfur dioxide emissions. This segment is vital in coal-based power generation markets. The power plant emission control systems market records strong FGD adoption in Asia-Pacific and Europe. These regions prioritize sulfur emission control due to coal dependence and strict standards. It enables compliance while allowing plants to continue operations sustainably. FGD solutions are also being modernized with improved efficiency. Utilities deploy both wet and dry FGD systems based on local conditions. This segment will remain essential as SOx reduction stays central to policy frameworks.

Comprehensive Emission Control Systems

Comprehensive systems integrate multiple technologies to manage different pollutants. They are suited for large-scale utilities facing diverse compliance requirements. The power plant emission control systems market recognizes this segment as a reliable compliance option. It helps operators achieve efficiency while reducing investment in separate systems. These solutions are widely adopted in Europe and North America. It reflects the demand for holistic emission control strategies. Comprehensive systems are increasingly being developed with digital monitoring features. Their scalability ensures future relevance across global markets.

Advanced Oxidation Processes

Advanced oxidation processes represent an emerging technology within the market. They are designed to target trace pollutants and stricter carbon reduction goals. The power plant emission control systems market sees early adoption in North America and Europe. These regions are driving innovation in next-generation emission technologies. It reflects a transition toward advanced solutions beyond conventional systems. Adoption is expected to expand as regulatory frameworks evolve further. Advanced oxidation processes are still limited but hold strong potential. Their role highlights the industry’s focus on sustainable, future-ready technologies.

Segmentation:

By System Type:

- Electrostatic Precipitators (ESP)

- Catalytic Systems (including Selective Catalytic Reduction – SCR)

- Absorbers

- Scrubbers

- Flue Gas Desulfurization (FGD)

- Comprehensive Emission Control Systems

- Advanced Oxidation Processes

By Regions:

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis:

North America and Europe

North America holds around 28% share of the power plant emission control systems market. Strong regulatory frameworks such as the Clean Air Act in the United States drive consistent demand. Utilities invest heavily in selective catalytic reduction (SCR) and flue gas desulfurization (FGD) to comply with strict emission norms. Europe contributes nearly 25% share, supported by EU directives focused on lowering SOx, NOx, and particulate emissions. The market benefits from early adoption of digital monitoring systems and advanced oxidation technologies. It demonstrates maturity in compliance practices and continuous investment in upgrades. Both regions remain innovation hubs for emission control solutions.

Asia-Pacific

Asia-Pacific leads the power plant emission control systems market with nearly 35% share. Rapid industrialization and reliance on coal-based power generation make emission control technologies critical. China represents the largest market with extensive deployment of FGD and electrostatic precipitators. India is also expanding investments to address urban pollution and meet international commitments. It shows strong potential for catalytic systems as nitrogen oxide regulations become tighter. Growing electricity demand across Southeast Asia strengthens opportunities for integrated systems. The region reflects the fastest growth due to rising capacity expansions and environmental mandates.

Middle East, Latin America, and Africa

The Middle East, Latin America, and Africa collectively account for about 12% share of the market. The Middle East focuses on natural gas-fired plants, driving adoption of scrubbers and catalytic systems. Latin America shows moderate growth with increasing investments in clean power technologies. It reflects gradual adoption of emission control systems in Brazil and Mexico. Africa remains in an early stage, but rising industrial activity creates opportunities for ESP and absorber technologies. The power plant emission control systems market in these regions grows with government-backed energy projects. It highlights the importance of infrastructure investment and policy development in shaping adoption.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- Babcock & Wilcox Enterprises, Inc.

- DÜRR Group

- FLSmidth Cement A/S

- General Electric (GE)

- Mitsubishi Heavy Industries, Ltd.

- A. Hamon

- ABB (Switzerland)

- Honeywell (US)

- Siemens (Germany)

- Emerson Electric

- Rockwell Automation

- Schneider Electric

- Yokogawa Electric

- Thermax Limited

- Air Clear LLC

- BASF SE

Competitive Analysis:

The power plant emission control systems market is highly competitive, with established global engineering firms and automation leaders driving growth. Companies such as Babcock & Wilcox, Mitsubishi Heavy Industries, and GE dominate large-scale projects, while ABB, Siemens, and Honeywell strengthen the market with automation and monitoring integration. BASF, Thermax, and Air Clear provide specialized chemical and process solutions, adding diversity to offerings. It demonstrates intense competition focused on innovation, cost efficiency, and compliance-ready systems. Strategic partnerships, R&D investments, and regional expansions shape the evolving competitive dynamics of the industry.

Recent Developments:

- In June 2025, Babcock & Wilcox Enterprises, Inc. announced it agreed to sell its Diamond Power International business to Austria-based ANDRITZ for $177 million. This strategic move will allow Babcock & Wilcox to focus on expanding its core business and deploy its BrightLoop™ hydrogen production technology supporting low-cost hydrogen and steam generation with CO2 capture. Additionally, in May 2025, Babcock & Wilcox revealed plans to use proceeds from asset sales for deploying BrightLoop™ technology, including a project in Massillon, Ohio.

- In June 2025, the Dürr Group agreed to sell its air and noise filtration technology business to Stellex Capital Management, a New York-based private equity firm. The division, known for exhaust air purification and sound insulation systems, will operate independently within Stellex’s portfolio after the acquisition, expected to close in Q4 2025.

- FLSmidth Cement announced the signing of an agreement in June 2025 to divest its cement business to Pacific Avenue Capital Partners, a global private equity firm. This divestment aligns with FLSmidth’s strategy to concentrate exclusively on mining technology and services, with the acquisition expected to close in the second half of 2025.

- In April 2025, Mitsubishi Heavy Industries (MHI) expanded its collaboration with Infosys by acquiring a 2% stake in the Infosys-led joint venture HIPUS in Japan. This initiative aims to accelerate business process transformation leveraging digital procurement platforms with closure expected by Q1 fiscal 2026.

Report Coverage:

The research report offers an in-depth analysis based on system type and regional segmentation. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Rising adoption of carbon capture technologies will strengthen long-term demand.

- Hybrid renewable and thermal power plants will increase integration of emission control systems.

- Digital monitoring and AI-enabled platforms will drive operational efficiency.

- Stricter global environmental regulations will sustain compliance-driven investments.

- Modular and retrofitting solutions will expand adoption across aging plants.

- Public-private partnerships will accelerate project pipelines in emerging markets.

- Advanced oxidation processes will gain traction as next-generation solutions.

- Regional policy differences will shape technology preferences and adoption speed.

- Continuous R&D investments will lower system costs and improve efficiency.

- Global energy transition goals will ensure the market’s strategic importance.