Market Overview:

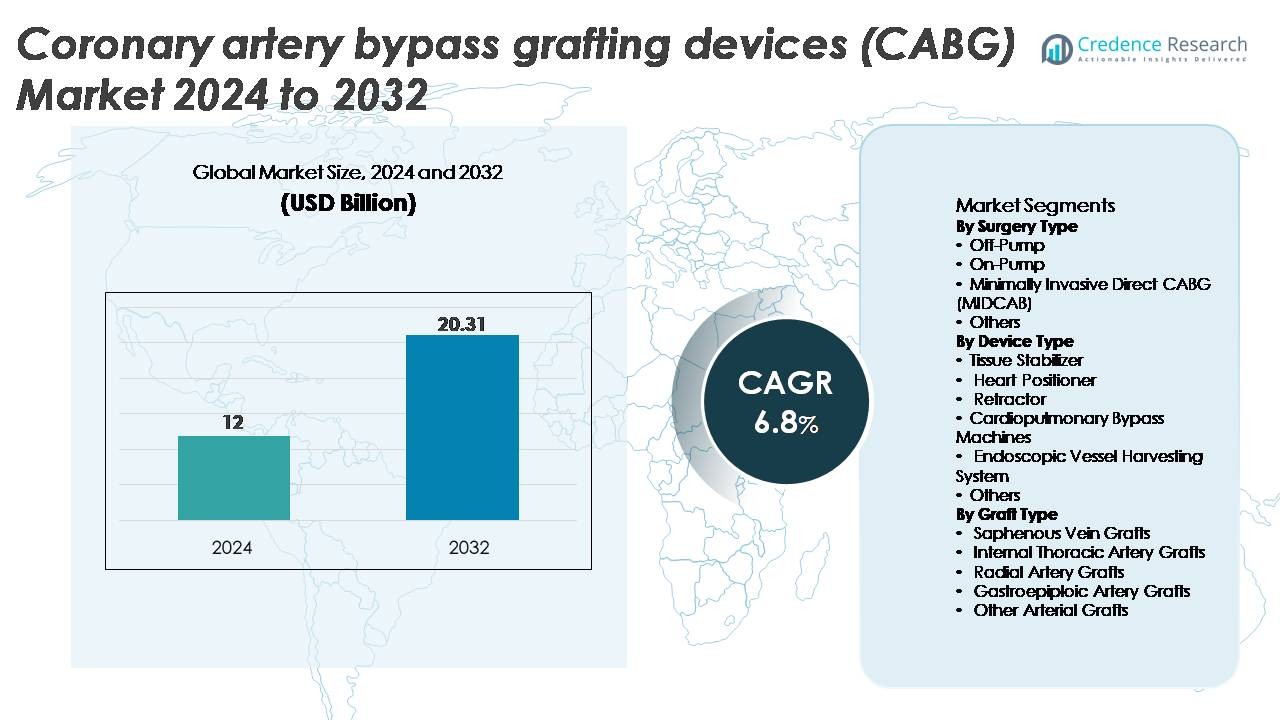

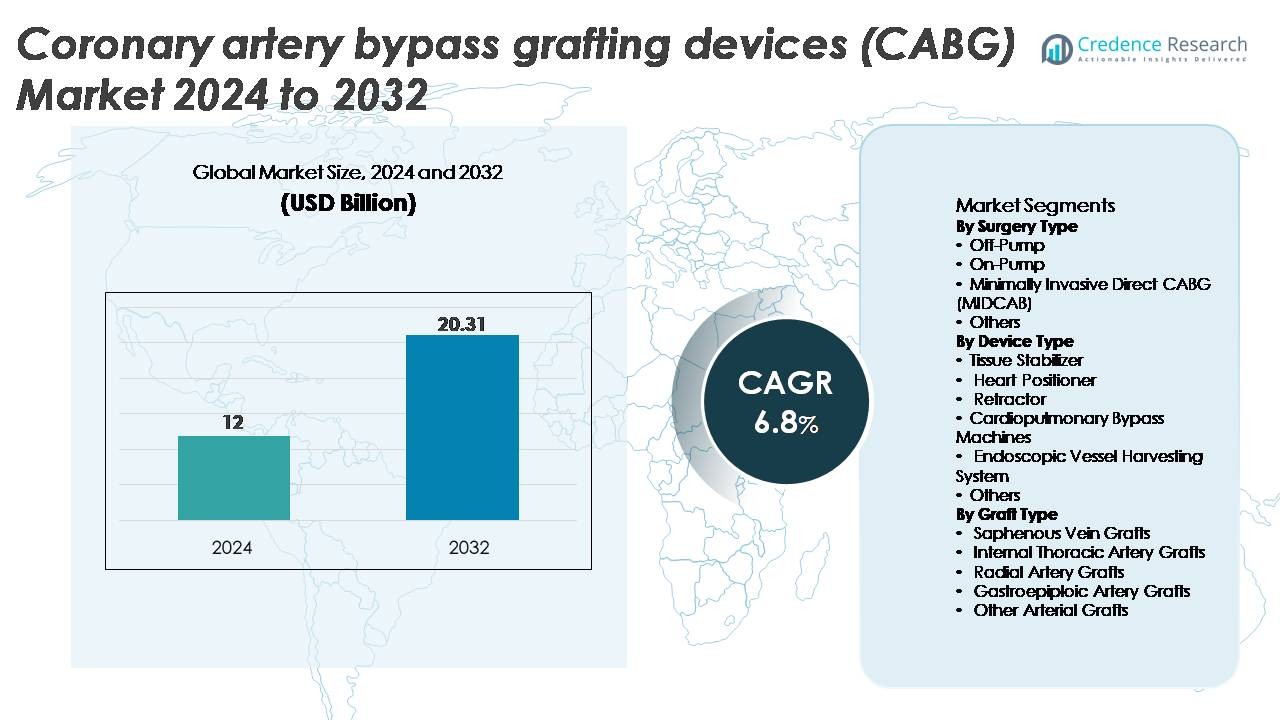

The coronary artery bypass grafting (CABG) devices market was valued at USD 12 billion in 2024 and is projected to reach USD 20.31 billion by 2032, exhibiting a CAGR of 6.8% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Coronary Artery Bypass Grafting Devices (CABG) Market Size 2024 |

USD 12 Billion |

| Coronary Artery Bypass Grafting Devices (CABG) Market, CAGR |

6.8% |

| Coronary Artery Bypass Grafting Devices (CABG) Market Size 2032 |

USD 20.31 Billion |

The CABG devices market is shaped by a strong group of leading players, including Genesee BioMedical, KARL STORZ, Transonic, AtriCure, Terumo Cardiovascular Systems, Teleflex, Medtronic, Boston Scientific, Cigna, and Edwards Lifesciences. These companies compete through advancements in cardiopulmonary bypass machines, tissue stabilizers, heart positioners, and endoscopic vessel-harvesting systems. North America remains the dominant regional market, holding 38% of global share, supported by high procedural volumes, advanced cardiac surgery infrastructure, and rapid adoption of minimally invasive and robotic-assisted techniques. Europe follows with 27%, benefiting from established cardiac centers and strong clinical adherence to multi-arterial grafting practices.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- The CABG devices market reached USD 12 billion in 2024 and is projected to hit USD 20.31 billion by 2032, registering a 6.8% CAGR during the forecast period.

- Market growth is driven by rising coronary artery disease prevalence, increasing off-pump and minimally invasive CABG adoption, and advancements in stabilizers, positioners, bypass systems, and endoscopic harvesting technologies.

- Key trends include expanding hybrid revascularization, greater use of arterial grafts, and integration of digital monitoring and robotics into surgical workflows.

- Competitive activity intensifies as major players enhance perfusion safety, launch minimally invasive toolkits, and expand training partnerships, while high procedure costs and preference for PCI in select cases restrain adoption.

- Regionally, North America leads with 38%, followed by Europe at 27% and Asia-Pacific at 24%, while segment-wise, off-pump surgery holds the largest share among surgery types and saphenous vein grafts remain the dominant graft category.

Market Segmentation Analysis:

By Surgery Type

Off-pump CABG holds the largest share of the surgery-type segment, driven by its reduced complication rates, avoidance of cardiopulmonary bypass, and faster postoperative recovery. Surgeons increasingly prefer off-pump techniques for high-risk patients due to lower neurological and inflammatory risks. On-pump CABG remains widely used for multi-vessel disease and complex grafting, sustaining stable demand. Minimally Invasive Direct CABG (MIDCAB) continues to expand as hybrid revascularization and small-incision approaches gain acceptance. The “Others” category includes robotic-assisted CABG, which is gradually growing as robotic platforms evolve and clinical proficiency improves.

- For instance, Medtronic’s Octopus® NUVO Tissue Stabilizer uses up to –400 mm Hg of suction to effectively immobilize targeted coronary segments during off-pump grafting.

By Device Type

Cardiopulmonary bypass machines account for the dominant share within device types, supported by their essential role in on-pump CABG procedures and continuous advancements in perfusion safety, flow regulation, and integrated monitoring. Tissue stabilizers and heart positioners show strong adoption in off-pump surgeries, enabling precise immobilization and reducing intraoperative movement. Retractors remain widely used across all surgical approaches. Endoscopic vessel harvesting (EVH) systems exhibit growing demand as they reduce incision size, postoperative pain, and wound complications. The “Others” segment includes ancillary surgical tools that support procedure efficiency and vessel preparation.

- For instance, Terumo’s Capiox® FX25 Oxygenator integrates a 2.5 m² microporous hollow-fiber membrane, enabling highly efficient gas exchange during cardiac bypass.

By Graft Type

Saphenous vein grafts maintain the largest share in graft type usage due to their accessibility, ease of harvesting, and suitability for multi-vessel bypass. Internal thoracic artery grafts continue to gain prominence as they demonstrate superior long-term patency, particularly for left anterior descending (LAD) artery revascularization. Radial artery grafts are increasingly used as secondary conduits for younger patients, supported by improved harvesting techniques. Gastroepiploic artery grafts show limited but specialized use in select anatomical situations. Other arterial grafts contribute marginally, generally applied when primary conduits are unsuitable or insufficient.

Key Growth Drivers:

Rising Prevalence of Coronary Artery Disease and Expanding Surgical Volumes

The global increase in coronary artery disease cases continues to drive the demand for CABG devices, supported by aging populations, sedentary lifestyles, and rising metabolic disorders that elevate cardiovascular risks. As more patients present with multi-vessel or complex coronary blockages, CABG remains the preferred treatment, particularly when long-term outcomes outweigh those of percutaneous interventions. High surgical success rates and proven durability of grafts reinforce clinician preference for CABG in high-risk cohorts. Hospitals are expanding cardiovascular surgery capacities, and emerging markets are witnessing improved reimbursement structures, enabling wider access to bypass surgeries. Collectively, these factors strengthen long-term procedural demand, ensuring sustained adoption of core CABG devices such as tissue stabilizers, heart positioners, bypass machines, and harvesting systems.

- For instance, Transonic’s TTFM systems such as the AureFlo® console provide flow measurement accuracy within ±10% and evaluate graft patency in real time using probes ranging from 1.5 mm to 6 mm, supporting intraoperative quality assurance during bypass procedures.

Advancements in Surgical Technologies and Grafting Materials

Technological innovation across surgical platforms, grafting devices, and perfusion systems serves as a major growth catalyst for the CABG devices market. Modern cardiopulmonary bypass units now offer superior hemodynamic control, compact designs, and integrated sensors that enhance perfusion accuracy. Endoscopic vessel harvesting (EVH) systems continue to evolve with smaller incisions, improved visualization, and automated blade mechanisms that reduce trauma and wound complications. Enhanced tissue stabilizers and heart positioners enable precision during off-pump procedures, supporting faster surgical adoption. Simultaneously, arterial graft innovations especially improved handling of radial and thoracic artery conduits boost long-term graft patency. As hospitals upgrade equipment to meet safety and efficiency standards, device manufacturers gain opportunities to introduce next-generation, digitally enhanced CABG tools.

- For instance, Surgeons often use a Harmonic Scalpel(an ultrasonic instrument) or electrocautery during endoscopic harvesting of the radial or internal mammary artery to minimize thermal injury, control bleeding, and enable the use of a ‘no-touch’ technique for atraumatic handling of the conduit.

Growing Preference for Minimally Invasive and Off-Pump Procedures

The shift toward low-trauma cardiac surgeries significantly strengthens demand for advanced CABG devices optimized for minimally invasive and off-pump techniques. Off-pump CABG eliminates reliance on cardiopulmonary bypass, reducing risks of neurological complications, inflammatory responses, and extended hospital stays. Surgeons increasingly adopt stabilizers, positioners, and EVH systems that support smaller incisions and precise graft deployment. Minimally Invasive Direct CABG (MIDCAB) and hybrid revascularization approaches further accelerate growth as patients and providers prioritize faster recovery and reduced postoperative morbidity. Hospitals adopting robotic-assisted and thoracoscopic platforms also stimulate investment in compatible instrumentation. As evidence supporting comparable or superior outcomes of off-pump procedures expands, demand for technologically enhanced devices in this segment continues to rise.

Key Trends and Opportunities:

Expansion of Hybrid Revascularization and Robot-Assisted CABG

Hybrid revascularization, which combines minimally invasive CABG for critical lesions with PCI for remaining arteries, is emerging as a powerful trend in cardiac care. This approach reduces surgical trauma, shortens recovery time, and leverages the strengths of both modalities. Increasing adoption of robotic-assisted CABG systems also reshapes surgical workflows, enabling precision grafting through small incisions with enhanced visualization and ergonomic control. Robotics-ready stabilizers, positioners, and micro-instrumentation create new device opportunities, especially in high-volume cardiac centers. As hybrid cardiac suites become standard in tertiary hospitals, the market experiences rising demand for compatible bypass machines, EVH systems, and specialized retractors that support advanced surgical configurations.

- For instance, the Senhance® Surgical System developed by Asensus Surgical and recently acquired by KARL STORZ supports ultra-fine 3 mm robotic instruments and provides haptic feedback (tactile sensing) to the surgeon, enabling highly controlled manipulation during a range of general, gynecological, urological, and specific thoracic procedures.

Growing Emphasis on Arterial Grafting for Long-Term Outcomes

A strong clinical shift toward arterial grafting presents significant opportunities for manufacturers of internal thoracic, radial, and other arterial graft devices. Superior long-term patency of arterial conduits compared to saphenous vein grafts is increasingly recognized, prompting surgeons to expand multi-arterial grafting strategies. This trend favors innovations that simplify arterial harvesting, improve vessel integrity, and reduce spasm risk during preparation. Adoption of atraumatic EVH instruments and enhanced imaging modalities creates a favorable environment for growth. As clinical trials continue to validate survival benefits associated with arterial grafts, demand for specialized graft devices and harvesting technologies is expected to grow steadily.

- For instance, Terumo’s Radial Artery Cannulation Kit (such as the Glidesheath or Prelude lines) incorporates ultra-thin wall needles, typically 21-gauge (G) or 20G, designed to facilitate sheath placement using a compatible 018″ (0.46 mm) or 0.025″ (0.64 mm) guidewire, enabling precise vessel access and minimizing trauma during radial conduit preparation.

Integration of Digital Monitoring and AI in Perfusion Management

The integration of digital technologies into cardiopulmonary bypass and intraoperative monitoring systems represents an emerging opportunity. AI-enabled perfusion platforms can optimize flow parameters, track patient-specific hemodynamic responses, and automatically adjust oxygenation and temperature controls. Advanced sensors and connectivity allow real-time data sharing with surgical teams and hospital information systems, improving procedural safety and postoperative outcomes. This trend aligns with broader hospital digitization strategies and opens avenues for manufacturers to differentiate their devices with smart capabilities. As cardiac centers prioritize precision, automation, and data transparency, digitally enhanced CABG devices gain traction rapidly.

Key Challenges:

High Procedure Costs and Limited Access in Low-Resource Settings

The substantial cost of CABG surgeries including devices, operating room resources, and postoperative care remains a major barrier in many regions. Advanced stabilizers, perfusion systems, and EVH devices significantly increase procedural expenses, limiting their use in low-income and underfunded healthcare settings. Reimbursement disparities further widen the accessibility gap, particularly in markets where cardiovascular coverage is limited or fragmented. Smaller cardiac centers struggle to justify capital investments in next-generation systems, slowing adoption. These financial barriers restrict market penetration, especially in emerging economies where the burden of coronary disease is rising but infrastructure and funding lag behind clinical needs.

Competition from Minimally Invasive PCI and Evolving Treatment Guidelines

Rapid advancements in percutaneous coronary interventions (PCI), including drug-eluting stents and intravascular imaging technologies, pose a competitive challenge to CABG procedures. PCI is widely preferred for lower-risk or single-vessel disease, reducing the surgical candidate pool. As clinical guidelines evolve and interventional cardiology expands its capabilities, CABG must demonstrate superior long-term benefits to sustain its position in multi-vessel and complex cases. Patient preference for less invasive procedures further shifts demand toward PCI. This competitive landscape requires continuous technological innovation in CABG devices to maintain clinical relevance and ensure that surgical outcomes remain favorable against evolving non-surgical alternatives.

Regional Analysis:

North America

North America holds the largest share of the CABG devices market, accounting for around 38%, driven by high procedure volumes, advanced cardiac surgery infrastructure, and strong adoption of minimally invasive and off-pump techniques. The U.S. leads the region due to widespread availability of hybrid ORs, extensive use of cardiopulmonary bypass systems, and rapid integration of endoscopic vessel-harvesting technologies. Favorable reimbursement policies, strong presence of leading device manufacturers, and well-established cardiovascular programs further reinforce regional dominance. Ongoing investments in robotic-assisted CABG and evidence-backed arterial grafting practices continue to strengthen market expansion across premier cardiac centers.

Europe

Europe captures approximately 27% of the CABG devices market, supported by a mature cardiovascular care ecosystem and strong clinical preference for multi-arterial grafting across Germany, the U.K., France, and Italy. High adoption of minimally invasive CABG techniques and structured clinical guidelines promote stable device demand. Regional emphasis on long-term graft patency encourages the use of internal thoracic and radial artery grafts, driving procurement of advanced stabilizers and EVH systems. Increasing investments in cardiac research, aging populations with complex coronary disease, and expansion of tertiary cardiac centers sustain the region’s solid procedure volume and device utilization rates.

Asia-Pacific

Asia-Pacific accounts for around 24% of the global CABG devices market and represents the fastest-growing regional segment. Rising incidence of coronary artery disease across China, India, and Southeast Asia accelerates surgical demand, supported by expanding cardiac specialty hospitals and improvements in cardiovascular diagnostics. Increasing adoption of off-pump CABG in India and Japan drives procurement of stabilizers and heart positioners. Growing medical tourism, favorable device manufacturing economics, and government-led investments in cardiac surgery capacity strengthen regional growth. As healthcare access improves and arterial grafting gains acceptance, Asia-Pacific is poised to capture a greater share of global device consumption.

Latin America

Latin America captures about 6% of the CABG devices market, supported by gradually expanding cardiac surgery capabilities in Brazil, Mexico, Argentina, and Chile. Growth is driven by rising cardiovascular disease prevalence, improved access to tertiary cardiac centers, and slow but steady adoption of minimally invasive techniques. Public healthcare modernization and private-sector expansion support increased use of cardiopulmonary bypass machines and graft-harvesting devices. However, constrained budgets and unequal healthcare access limit large-scale technological upgrades. As governments prioritize cardiovascular outcomes and local training programs strengthen, the region shows improving uptake of advanced CABG device systems.

Middle East & Africa

The Middle East & Africa region holds approximately 5% of the CABG devices market, driven primarily by the Middle East’s rapidly developing cardiac care infrastructure. Countries such as Saudi Arabia, the UAE, and Qatar invest heavily in advanced surgical technologies, including hybrid ORs and robotic-assisted CABG systems. Africa’s adoption remains slower due to limited specialized cardiac centers and affordability constraints. Nonetheless, rising urbanization, expanding private hospitals, and medical tourism hubs in the Gulf region support growing demand for stabilizers, bypass machines, and arterial grafting tools. Training initiatives and international clinical collaborations further strengthen regional market penetration.

Market Segmentations:

By Surgery Type

- Off-Pump

- On-Pump

- Minimally Invasive Direct CABG (MIDCAB)

- Others

By Device Type

- Tissue Stabilizer

- Heart Positioner

- Retractor

- Cardiopulmonary Bypass Machines

- Endoscopic Vessel Harvesting System

- Others

By Graft Type

- Saphenous Vein Grafts

- Internal Thoracic Artery Grafts

- Radial Artery Grafts

- Gastroepiploic Artery Grafts

- Other Arterial Grafts

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape:

The competitive landscape of the CABG devices market is characterized by the presence of established global cardiovascular device manufacturers that compete through technological innovation, product portfolio depth, and strong clinical partnerships. Leading companies focus on advancing tissue stabilizers, heart positioners, cardiopulmonary bypass systems, and endoscopic vessel harvesting technologies to support both on-pump and off-pump procedures. Strategic priorities include improving device ergonomics, enhancing perfusion safety, and integrating digital monitoring capabilities into bypass equipment. Market players increasingly invest in minimally invasive and robotic-assisted CABG product lines to align with shifting surgical preferences. Collaborations with hospitals, surgeon training programs, and clinical trial support remain crucial for maintaining competitive differentiation. Additionally, geographic expansion into high-growth markets in Asia-Pacific and the Middle East strengthens market positioning, while product upgrades, regulatory approvals, and portfolio diversification continue to shape competition among major CABG device manufacturers.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

Recent Developments:

- In 22 August 2024, KARL STORZ the company completed acquisition of Asensus Surgical, signaling strategic expansion into advanced minimally invasive/robotic-assisted surgical and visualization technologies that may support CABG-related procedures.

- In August 2024, Transonic announced that ADInstruments became its exclusive global distributor (outside Japan & Korea) for their transit-time flow measurement (TTFM) research consoles, underscoring ongoing support for flow measurement solutions applicable to coronary bypass grafts.

- In 23 July 2024, AtriCure, Inc. the company received regulatory approval to sell its AtriClip® devices in China, expanding its access to international cardiac-surgery markets.

Report Coverage:

The research report offers an in-depth analysis based on Surgery type, Device type, Graft type and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Demand for CABG devices will rise as multi-vessel and complex coronary disease cases continue increasing globally.

- Off-pump and minimally invasive CABG will gain further adoption, driving demand for advanced stabilizers and positioners.

- Hybrid revascularization strategies will expand, supporting greater integration of CABG tools with catheter-based technologies.

- Arterial grafting will see wider use, boosting the need for refined arterial harvesting and preparation systems.

- Robotic-assisted CABG will accelerate, stimulating investment in compatible surgical instruments and visualization platforms.

- Cardiopulmonary bypass machines will incorporate more digital monitoring, automation, and AI-driven perfusion management.

- Hospitals will upgrade operating suites to hybrid OR configurations, increasing procurement of advanced CABG device systems.

- Emerging markets will experience strong growth as cardiac care infrastructure improves and procedure accessibility widens.

- Manufacturers will expand training programs to support surgeon proficiency in minimally invasive and robotic CABG techniques.

- Competitive differentiation will rely increasingly on device ergonomics, safety features, and clinical outcome evidence.Top of FormBottom of Form