Market Overview

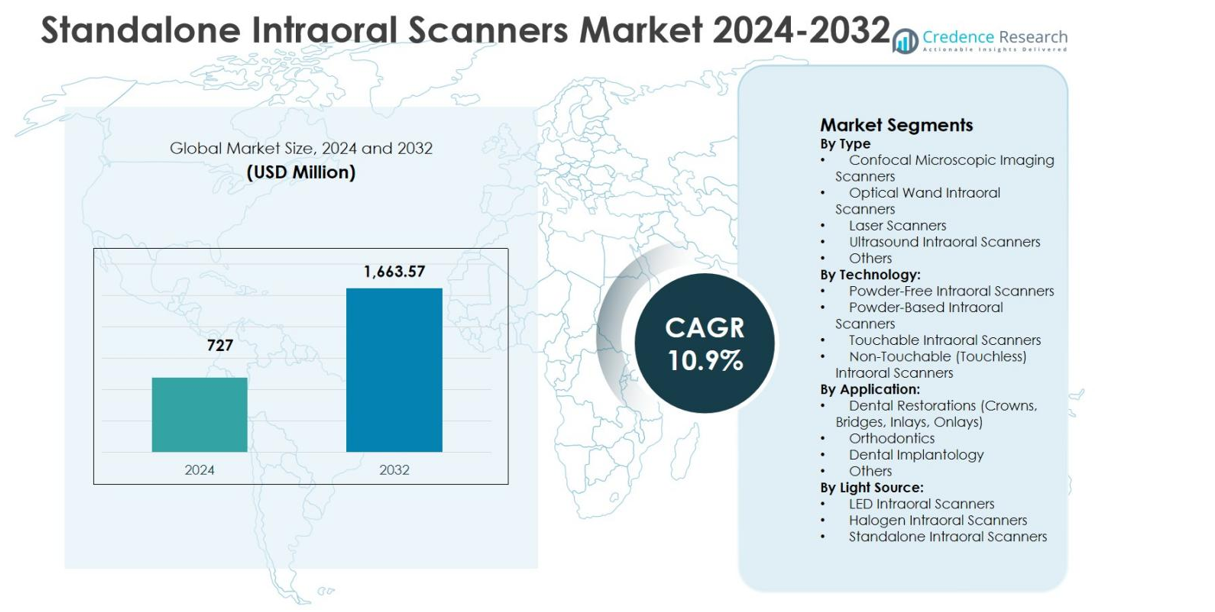

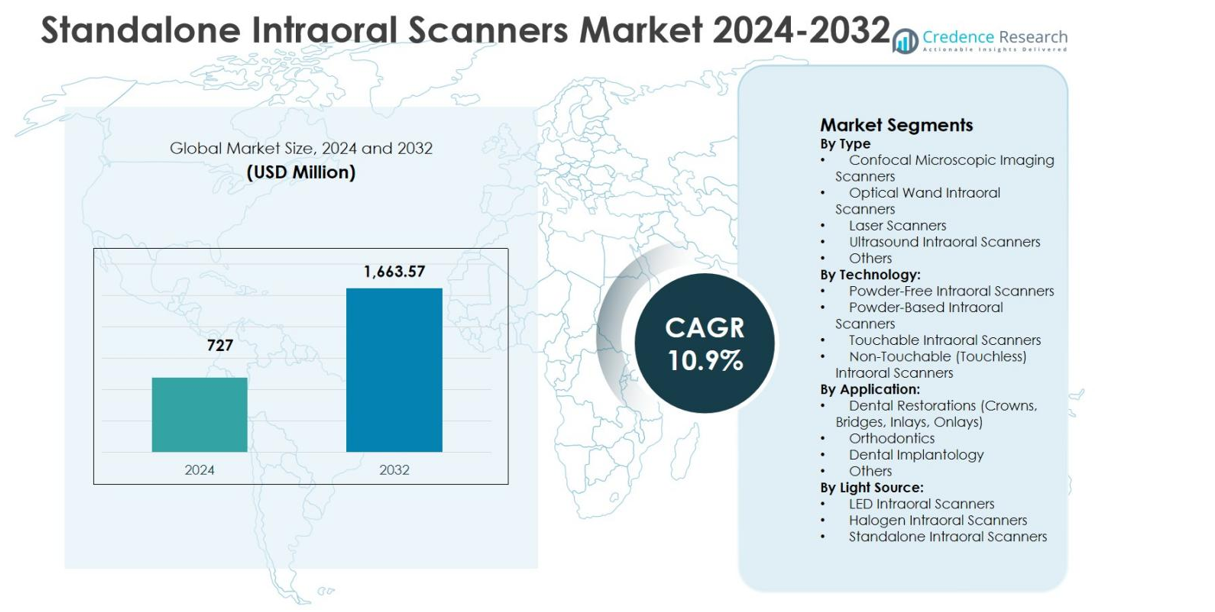

Standalone Intraoral Scanners Market size was valued at USD 727 Million in 2024 and is anticipated to reach USD 1,663.57 Million by 2032, expanding at a CAGR of 10.9% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Standalone Intraoral Scanners Market Size 2024 |

USD 727 Million |

| Standalone Intraoral Scanners Market, CAGR |

10.9% |

| Standalone Intraoral Scanners Market Size 2032 |

USD 1,663.57 Million |

Standalone Intraoral Scanners Market is shaped by the strong presence of leading manufacturers such as Align Technology, Inc., Dentsply Sirona Inc., 3Shape A/S, Carestream Dental, Inc., Planmeca Group, Medit Corp., Shining 3D, and 3M ESPE, all of which focus on innovation, software integration, and workflow efficiency. These companies continuously enhance scan accuracy, speed, and powder-free capabilities to meet evolving clinical demands. Regionally, North America leads the Standalone Intraoral Scanners Market with 38.6% market share in 2024, supported by advanced dental infrastructure and high adoption of digital dentistry. Europe follows with 29.4% share, driven by strong regulatory standards and orthodontic demand, while Asia Pacific holds 21.7% share, fueled by rapid clinic expansion and dental tourism growth.

Market Insights

- Standalone Intraoral Scanners Market was valued at USD 727 Million in 2024 and is projected to reach USD 1,663.57 Million by 2032, growing at a CAGR of 10.9% during the forecast period.

- Market growth is driven by rapid adoption of digital dentistry, increasing demand for restorative and orthodontic procedures, and widespread integration of CAD/CAM workflows across dental clinics and laboratories.

- Optical Wand Intraoral Scanners dominated the market with a 6% segment share in 2024, supported by high scanning accuracy, real-time visualization, and ergonomic designs, while powder-free technology led with a 58.9% share due to improved efficiency and patient comfort.

- Key players focus on innovation, AI-enabled software integration, powder-free scanning, and cloud connectivity, while expanding product portfolios to address both premium and cost-sensitive dental practices.

- Regionally, North America led with 6% market share in 2024, followed by Europe at 29.4%, Asia Pacific at 21.7%, Latin America at 6.2%, and Middle East & Africa at 4.1%, reflecting varied adoption levels and infrastructure maturity.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Type:

The By Type segment of the Standalone Intraoral Scanners Market is led by Optical Wand Intraoral Scanners, which accounted for 41.6% market share in 2024. This dominance is driven by their high scanning accuracy, real-time image rendering, ergonomic handheld design, and compatibility with chairside CAD/CAM systems. Confocal Microscopic Imaging Scanners follow due to their precision in subgingival scanning, while Laser and Ultrasound Intraoral Scanners maintain niche adoption in advanced diagnostics. Growing demand for minimally invasive digital impressions and faster clinical workflows continues to reinforce the leadership of optical wand-based systems.

- For instance, Dentsply Sirona’s Primescan captures 1,500,000 3D data points per second with dynamic depth scanning up to 20 mm, enabling full-arch impressions in under one minute.

By Technology:

Within the By Technology segment, Powder-Free Intraoral Scanners held the dominant position with a 58.9% market share in 2024. Their leadership stems from improved patient comfort, reduced preparation time, and enhanced scanning efficiency compared to powder-based systems. Dental clinics increasingly prefer powder-free technology due to lower consumable dependency and consistent scan quality. Non-touchable intraoral scanners are gaining traction in infection control-sensitive environments, while touchable scanners support precision-based applications. Continuous technological advancements in optical sensors and AI-driven image processing are strengthening adoption of powder-free platforms across dental practices.

- For instance, DEXIS launched the Imprevo scanner in October 2025, featuring a 40 FPS engine for smoother processing and dual sensors with a 25 mm depth of field for clearer details in tight spaces. Its slimmer autoclavable tip and gesture controls improve clinical usability and patient comfort without powder.

By Application:

The By Application segment is primarily driven by Dental Restorations, which accounted for 47.3% market share in 2024. High utilization in crowns, bridges, inlays, and onlays supports this dominance, as intraoral scanners significantly improve accuracy, turnaround time, and lab-to-clinic coordination. Orthodontics represents the second-largest segment due to rising aligner-based treatments, while Dental Implantology benefits from precise digital impressions for implant planning. The growing shift toward digital dentistry, coupled with increasing restorative procedures globally, continues to propel demand for intraoral scanners in restorative-focused applications.

Key Growth Driver

Rapid Adoption of Digital Dentistry

The Standalone Intraoral Scanners Market is strongly driven by the accelerating adoption of digital dentistry across dental clinics and laboratories. Dentists increasingly replace conventional impression methods with digital scanning to improve accuracy, reduce chairside time, and enhance patient comfort. Integration with CAD/CAM systems enables faster design and fabrication of restorations, improving clinical productivity. The growing preference for digital workflows in prosthodontics, orthodontics, and implantology supports sustained scanner adoption. Rising awareness among dental professionals about efficiency gains and error reduction continues to expand scanner penetration globally.

- For instance, Align Technology’s iTero intraoral scanners integrate with CAD/CAM for restorative workflows, capturing detailed 3D images that support crowns, bridges, implants, and dentures.

Rising Demand for Cosmetic and Restorative Dental Procedures

Increasing demand for cosmetic and restorative dental treatments is a major growth driver for the Standalone Intraoral Scanners Market. Procedures such as crowns, bridges, veneers, and aligner-based orthodontics rely heavily on precise digital impressions. Intraoral scanners provide high-resolution imaging that improves treatment outcomes and aesthetic accuracy. Growing disposable income, higher focus on dental aesthetics, and expanding geriatric populations with restorative needs further stimulate demand. As patient expectations for precision and faster treatment timelines increase, dental practices continue investing in advanced scanning technologies.

- For instance, 3Shape’s TRIOS intraoral scanner, for example, facilitated a screw-retained implant-supported crown on the lower right first premolar by capturing a fast, accurate digital fixture-level impression using compatible scan bodies.

Technological Advancements in Scanner Performance

Continuous technological advancements significantly fuel growth in the Standalone Intraoral Scanners Market. Improvements in optical imaging, AI-driven scan correction, real-time visualization, and enhanced ergonomics have expanded clinical usability. Powder-free scanning, faster data capture, and improved interoperability with dental software platforms increase adoption across small and large practices. Compact designs and wireless connectivity further improve workflow flexibility. These innovations reduce learning curves and operational complexity, enabling broader acceptance among general dentists and specialists, thereby strengthening long-term market expansion.

Key Trend & Opportunity

Integration with AI and Cloud-Based Dental Platforms

The integration of intraoral scanners with AI and cloud-based dental platforms represents a key trend and opportunity in the Standalone Intraoral Scanners Market. AI-enabled features support automated margin detection, scan validation, and treatment simulation, improving diagnostic confidence. Cloud connectivity enables seamless data sharing between clinics and laboratories, accelerating turnaround times. This trend creates opportunities for subscription-based software models and value-added services. As digital ecosystems expand, manufacturers offering integrated hardware–software solutions gain stronger differentiation and recurring revenue potential.

- For instance, Planmeca’s Romexis Ortho Simulator uses AI to generate orthodontic treatment simulations from intraoral scans within minutes, visualizing clear aligner outcomes for patient discussions. The tool supports common orthodontic cases with adjustable proposals.

Expansion in Emerging Dental Markets

Emerging economies present significant growth opportunities for the Standalone Intraoral Scanners Market as dental infrastructure continues to modernize. Increasing investments in private dental clinics, rising dental tourism, and expanding middle-class populations support scanner adoption. Governments and dental associations promoting digital healthcare further encourage technology uptake. Manufacturers are introducing cost-optimized and portable scanner models tailored for price-sensitive markets. This trend enables wider penetration beyond developed regions and creates long-term volume growth opportunities for market participants.

- For instance, Medit introduced the i700 in 2021 as a compact, high-speed intraoral scanner with 70 frames per second capture, now available wirelessly. Its affordability and open-system compatibility have driven strong uptake in emerging markets like India, enhancing efficiency in small practices.

Key Challenge

High Initial Cost and Budget Constraints

High initial investment remains a key challenge in the Standalone Intraoral Scanners Market, particularly for small and independent dental practices. Scanner systems involve significant upfront costs, along with software licensing, training, and maintenance expenses. Budget constraints limit adoption in cost-sensitive regions and delay replacement cycles. Although long-term efficiency benefits exist, return on investment concerns persist among practitioners. This challenge pressures manufacturers to offer flexible pricing models, financing options, and entry-level systems to sustain market growth.

Training Requirements and Workflow Integration Issues

The need for specialized training and workflow integration poses another challenge for the Standalone Intraoral Scanners Market. Dentists and staff require time to adapt to scanning techniques, software interfaces, and digital treatment planning processes. Integration with existing practice management and laboratory systems can create operational disruptions during transition phases. Resistance to change among traditionally trained professionals further slows adoption. Addressing this challenge requires comprehensive training programs, user-friendly interfaces, and strong technical support to ensure smooth implementation.

Regional Analysis

North America

North America accounted for 38.6% market share in 2024 in the Standalone Intraoral Scanners Market, driven by early adoption of digital dentistry and strong presence of leading dental technology manufacturers. High penetration of CAD/CAM workflows, advanced dental infrastructure, and favorable reimbursement for restorative and orthodontic procedures support sustained demand. The United States leads regional growth due to high procedural volumes in cosmetic dentistry and implantology. Continuous product innovation, strong clinician awareness, and rapid integration of AI-enabled dental solutions further reinforce North America’s leadership in intraoral scanner adoption.

Europe

Europe captured 29.4% market share in 2024 in the Standalone Intraoral Scanners Market, supported by widespread adoption of digital dental technologies across Germany, France, the UK, and Italy. Strong regulatory standards promoting precision dentistry and infection control accelerate scanner deployment. Growing demand for orthodontic aligners and prosthodontic restorations fuels consistent scanner usage. Dental laboratories and clinics increasingly adopt powder-free and touchless scanning technologies to improve workflow efficiency. Additionally, expanding dental tourism in Southern and Eastern Europe contributes to steady regional market expansion.

Asia Pacific

Asia Pacific held 21.7% market share in 2024 in the Standalone Intraoral Scanners Market and represents the fastest-growing regional market. Rising investments in private dental clinics, increasing dental tourism, and expanding middle-class populations in China, India, Japan, and South Korea drive adoption. Growing awareness of digital dentistry and cost-efficient scanner models support market penetration. Governments promoting healthcare digitization and increasing demand for orthodontic and restorative procedures further strengthen growth. Local manufacturing and competitive pricing strategies also enhance scanner accessibility across emerging economies.

Latin America

Latin America accounted for 6.2% market share in 2024 in the Standalone Intraoral Scanners Market, supported by gradual modernization of dental care infrastructure. Countries such as Brazil, Mexico, and Colombia lead adoption due to rising cosmetic dentistry demand and expanding private dental chains. Increasing dentist awareness of digital impressions and improved treatment accuracy supports market growth. However, cost sensitivity remains a limiting factor, encouraging demand for mid-range scanner systems. Growth in dental tourism and training initiatives continues to enhance regional adoption rates.

Middle East & Africa

The Middle East & Africa region represented 4.1% market share in 2024 in the Standalone Intraoral Scanners Market. Growth is driven by rising investments in premium dental clinics across the UAE, Saudi Arabia, and South Africa. Increasing focus on aesthetic dentistry, implant procedures, and digital healthcare transformation supports scanner adoption. Government-led healthcare infrastructure development and growing medical tourism strengthen demand in the Middle East. In Africa, adoption remains limited but is gradually increasing through urban dental centers and international partnerships improving access to digital dental technologies.

Market Segmentations:

By Type

- Confocal Microscopic Imaging Scanners

- Optical Wand Intraoral Scanners

- Laser Scanners

- Ultrasound Intraoral Scanners

- Others

By Technology:

- Powder-Free Intraoral Scanners

- Powder-Based Intraoral Scanners

- Touchable Intraoral Scanners

- Non-Touchable (Touchless) Intraoral Scanners

By Application:

- Dental Restorations (Crowns, Bridges, Inlays, Onlays)

- Orthodontics

- Dental Implantology

- Others

By Light Source:

- LED Intraoral Scanners

- Halogen Intraoral Scanners

- Standalone Intraoral Scanners

By Geography:

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

Competitive landscape analysis of the Standalone Intraoral Scanners Market includes key players such as Align Technology, Inc., Dentsply Sirona Inc., 3Shape A/S, Carestream Dental, Inc., 3M ESPE, Planmeca Group, Medit Corp., and Shining 3D. The market is characterized by strong emphasis on technological innovation, product differentiation, and software integration. Leading companies focus on improving scan accuracy, speed, and ergonomics while expanding powder-free and touchless scanning capabilities. Strategic partnerships with dental laboratories and software providers strengthen ecosystem integration and customer retention. Companies also invest in AI-enabled features, cloud-based data management, and enhanced interoperability to improve clinical workflows. Expansion into emerging markets through cost-optimized product offerings and localized distribution networks further intensifies competition. Ongoing investments in training, after-sales support, and digital education platforms enable key players to reinforce brand loyalty and maintain market positioning across global dental markets.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Condor

- 3Shape A/S

- Align Technology, Inc.

- Hint-Els GmbH

- Sirona Dental Systems, Inc.

- Densys3D Ltd.

- E4D Technologies, LLC.

- IOS Technologies, Inc.

- Carestream Dental, Inc.

- 3M ESPE

Recent Developments

- In March 2025, OMNIVISION and Biotech Dental entered into a partnership for Biotech Dental’s new Scan4All Iris intraoral scanners, integrating OMNIVISION’s multi-sensor camera modules to enhance 3D imaging accuracy and speed.

- In December 2025, Align Technology showcased its latest digital dentistry innovations including enhancements to the iTero Lumina™ scanner at the Greater New York Dental Meeting 2025, reinforcing its commitment to advancing intraoral scanning solutions.

- In November 2025, SHINING 3D Dental launched the Aoralscan Elf intraoral scanner, a lightweight 106 g device with AI-powered features such as IntelliBite occlusion optimization and Intelligent Plaque Management for improved digital dentistry workflows

Report Coverage

The research report offers an in-depth analysis based on Type, Technology, Application, Light Source and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The Standalone Intraoral Scanners Market will continue expanding as digital dentistry becomes standard practice across general and specialized dental clinics.

- Adoption of powder-free and touchless scanning technologies will accelerate due to improved patient comfort and workflow efficiency.

- Integration with AI-driven software will enhance scan accuracy, diagnostics, and automated treatment planning capabilities.

- Cloud-based connectivity will enable seamless data exchange between clinics and dental laboratories, reducing turnaround times.

- Demand from orthodontics and restorative dentistry applications will remain the primary growth catalyst.

- Manufacturers will increasingly focus on ergonomic, wireless, and compact scanner designs to improve usability.

- Cost-optimized models will support higher penetration in small practices and emerging markets.

- Strategic partnerships with dental software providers will strengthen digital ecosystem offerings.

- Training programs and digital education platforms will play a critical role in expanding user adoption.

- Regulatory emphasis on precision dentistry and infection control will further support long-term market growth.